Current Report Filing (8-k)

03 Juni 2020 - 10:31PM

Edgar (US Regulatory)

0001374310

false

0001374310

2020-05-28

2020-05-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report

(Date of earliest event reported): May 29, 2020

Cboe Global

Markets, Inc.

(Exact

Name of Registrant As Specified In Charter)

|

Delaware

|

001-34774

|

20-5446972

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

400 South LaSalle Street

Chicago, Illinois 60605

(Address

of Principal Executive Offices, including Zip Code)

(312) 786-5600

(Registrant’s telephone number,

including area code)

Not applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common

Stock, par value $0.01 per share

|

|

CBOE

|

|

CboeBZX

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed, on December 10, 2019, Cboe Global Markets,

Inc. (the “Company”) announced that one of its wholly-owned subsidiaries has entered into a definitive

agreement to acquire all of the outstanding shares of stock of European Central Counterparty N.V. (“EuroCCP”),

other than the shares of EuroCCP already owned by a subsidiary of the Company (the “Transaction”). The

consummation of the Transaction is subject to the satisfaction or waiver of conditions precedent including (i) the receipt of required

regulatory clearances and approvals and (ii) the successful implementation of a supporting liquidity facility at the EuroCCP clearing

entity level. To accommodate this facility at the EuroCCP level, certain amendments were necessary to the Company’s existing

Term Loan Agreement (as defined below) and Revolving Credit Agreement (as defined below). These amendments are described below.

On May 29, 2020, the Company, as borrower, entered into an amendment

(the “Term Loan Amendment”) to the Term Loan Credit Agreement dated as of March 22, 2018 (as amended,

the “Term Loan Agreement”) with Bank of America, N.A., as administrative agent and initial lender, and

certain other lenders named therein. Also on May 29, 2020, the Company, as borrower, entered into an amendment (the

“Revolving Credit Agreement Amendment”) to the Credit Agreement dated as of December 15, 2016, (as

amended, the “Revolving Credit Agreement”) among Bank of America, N.A., as administrative agent and as

swing line lender, certain other lenders named therein.

The Term Loan Amendment and the Revolving Credit Agreement Amendment,

among other items:

|

|

·

|

Modified the negative covenants to permit liens on assets of the EuroCCP settlement and clearing business that secures indebtedness

incurred in support of its settlement and clearing activities, and permit the Company’s subsidiaries to incur such indebtedness,

provided that such amounts are repaid within 35 days;

|

|

|

·

|

Added provisions to provide that the London Interbank Offered Rate (LIBOR), as used in the Term Loan Agreement and Revolving

Credit Agreement, may be succeeded by one or more secured overnight financing rates (SOFR) published by the Federal Reserve Bank

of New York or another alternate benchmark rate giving due consideration to any evolving or then-existing convention for similar

agreements; and

|

|

|

·

|

Modified certain other provisions to reflect current market practice.

|

Certain of the lenders under the Term Loan Agreement and the

Revolving Credit Agreement and their affiliates (1) have provided, and may in the future provide, investment banking, underwriting,

trust or other advisory or commercial services to the Company and its subsidiaries and affiliates or (2) are our customers,

including trading permit holders, trading privilege holders, participants and members, and engage in trading activities on Company

markets.

The foregoing description does not purport to be complete and

is qualified in its entirety by reference to the Term Loan Amendment and the Revolving Credit Agreement Amendment, which are attached

as Exhibit 10.1 and 10.2 to this Current Report on Form 8-K, respectively, and are incorporated herein by reference.

Item 9.01. Financial Statements

and Exhibits.

(d) Exhibits.

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Amendment No. 1 to Term Loan Credit Agreement, dated as of May 29, 2020, by and among Cboe Global Markets, Inc., Bank of America, N.A., as administrative agent, and the lender parties thereto

|

|

|

|

|

|

10.2

|

|

Amendment No. 1 to Credit Agreement, dated as of May 29, 2020, by and among CBOE Holdings, Inc., Bank of America, N.A., as Administrative Agent and as Swing Line Lender, the lender parties thereto

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Cboe Global Markets, Inc.

|

|

|

|

|

Date: June 3, 2020

|

By:

|

/s/ Brian N. Schell

|

|

|

|

Brian

N. Schell

Executive Vice President,

Chief Financial Officer

and Treasurer

|

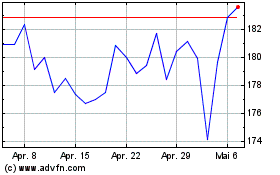

Cboe Global Markets (AMEX:CBOE)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

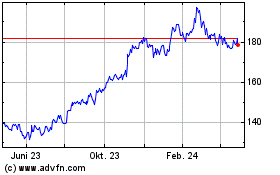

Cboe Global Markets (AMEX:CBOE)

Historical Stock Chart

Von Jul 2023 bis Jul 2024