Report of Foreign Issuer (6-k)

14 Februar 2020 - 12:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or

15d-16 under

the Securities Exchange Act of 1934

For the month of February 2020

Commission File No. 000-54189

MITSUBISHI UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form

40-F.

Form

20-F X Form

40-F

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY

REFERENCE IN THE REGISTRATION STATEMENT ON FORM F-3 (NO. 333-229697) OF MITSUBISHI UFJ FINANCIAL GROUP, INC. AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT

IS FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED WITH OR FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: February 14, 2020

|

|

|

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

By:

|

|

/s/ Zenta Morokawa

|

|

Name:

|

|

Zenta Morokawa

|

|

Title:

|

|

Managing Director, Head of

Documentation & Corporate

Secretary Department,

|

|

|

|

Corporate Administration Division

|

Mitsubishi UFJ Financial Group, Inc.(MUFG)

Risk-Adjusted Capital Ratio Based on the Basel 3 Standards for the Third Quarter Ended December 31, 2019

Tokyo, February 14, 2020 — MUFG hereby announces the risk-adjusted capital ratio based on the Basel 3 standards for the third quarter ended

December 31, 2019 as stated below.

Mitsubishi UFJ Financial Group, Inc. (Consolidated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of

December 31, 2019

(A)

|

|

|

Increase

(Decrease)

(A) - (B)

|

|

|

As of

March 31, 2019

(B)

|

|

|

As of

September 30,

2019

|

|

|

(1) Total capital ratio (4) / (7)

|

|

|

16.84

|

%

|

|

|

0.81

|

%

|

|

|

16.03

|

%

|

|

|

16.64

|

%

|

|

(2) Tier 1 capital ratio (5) / (7)

|

|

|

14.55

|

%

|

|

|

0.65

|

%

|

|

|

13.90

|

%

|

|

|

14.33

|

%

|

|

(3) Common Equity Tier 1 capital ratio (6) / (7)

|

|

|

12.69

|

%

|

|

|

0.46

|

%

|

|

|

12.23

|

%

|

|

|

12.68

|

%

|

|

(4) Total capital

|

|

|

19,393.9

|

|

|

|

624.1

|

|

|

|

18,769.7

|

|

|

|

18,822.1

|

|

|

(5) Tier 1 capital

|

|

|

16,760.9

|

|

|

|

484.6

|

|

|

|

16,276.3

|

|

|

|

16,208.4

|

|

|

(6) Common Equity Tier 1 capital

|

|

|

14,613.2

|

|

|

|

290.8

|

|

|

|

14,322.4

|

|

|

|

14,337.6

|

|

|

(7) Risk weighted assets

|

|

|

115,124.2

|

|

|

|

(1,966.8

|

)

|

|

|

117,091.1

|

|

|

|

113,066.6

|

|

|

(8) Required Capital (7)×8%

|

|

|

9,209.9

|

|

|

|

(157.3

|

)

|

|

|

9,367.2

|

|

|

|

9,045.3

|

|

MUFG Bank, Ltd. (Consolidated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of

December 31, 2019

(A)

|

|

|

Increase

(Decrease)

(A) - (B)

|

|

|

As of

March 31, 2019

(B)

|

|

|

As of

September 30,

2019

|

|

|

(1) Total capital ratio (4) / (7)

|

|

|

15.27

|

%

|

|

|

0.84

|

%

|

|

|

14.42

|

%

|

|

|

15.13

|

%

|

|

(2) Tier 1 capital ratio (5) / (7)

|

|

|

13.18

|

%

|

|

|

0.72

|

%

|

|

|

12.46

|

%

|

|

|

13.01

|

%

|

|

(3) Common Equity Tier 1 capital ratio (6) / (7)

|

|

|

11.34

|

%

|

|

|

0.51

|

%

|

|

|

10.83

|

%

|

|

|

11.39

|

%

|

|

(4) Total capital

|

|

|

15,056.2

|

|

|

|

423.6

|

|

|

|

14,632.6

|

|

|

|

14,606.2

|

|

|

(5) Tier 1 capital

|

|

|

12,994.7

|

|

|

|

355.2

|

|

|

|

12,639.4

|

|

|

|

12,562.6

|

|

|

(6) Common Equity Tier 1 capital

|

|

|

11,183.8

|

|

|

|

193.0

|

|

|

|

10,990.8

|

|

|

|

10,996.3

|

|

|

(7) Risk weighted assets

|

|

|

98,562.4

|

|

|

|

(2,863.8

|

)

|

|

|

101,426.3

|

|

|

|

96,538.5

|

|

|

(8) Required Capital (7)×8%

|

|

|

7,884.9

|

|

|

|

(229.1

|

)

|

|

|

8,114.1

|

|

|

|

7,723.0

|

|

1

Mitsubishi UFJ Trust and Banking Corporation (Consolidated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of

December 31, 2019

(A)

|

|

|

Increase

(Decrease)

(A) - (B)

|

|

|

As of

March 31, 2019

(B)

|

|

|

As of

September 30,

2019

|

|

|

(1) Total capital ratio (4) / (7)

|

|

|

23.99

|

%

|

|

|

(0.40

|

%)

|

|

|

24.40

|

%

|

|

|

24.35

|

%

|

|

(2) Tier 1 capital ratio (5) / (7)

|

|

|

20.78

|

%

|

|

|

(0.47

|

%)

|

|

|

21.26

|

%

|

|

|

20.91

|

%

|

|

(3) Common Equity Tier 1 capital ratio (6) / (7)

|

|

|

18.70

|

%

|

|

|

(0.87

|

%)

|

|

|

19.57

|

%

|

|

|

19.09

|

%

|

|

(4) Total capital

|

|

|

2,085.2

|

|

|

|

(127.9

|

)

|

|

|

2,213.1

|

|

|

|

2,050.0

|

|

|

(5) Tier 1 capital

|

|

|

1,806.3

|

|

|

|

(122.6

|

)

|

|

|

1,928.9

|

|

|

|

1,760.6

|

|

|

(6) Common Equity Tier 1 capital

|

|

|

1,624.9

|

|

|

|

(150.6

|

)

|

|

|

1,775.5

|

|

|

|

1,607.2

|

|

|

(7) Risk weighted assets

|

|

|

8,688.5

|

|

|

|

(380.7

|

)

|

|

|

9,069.2

|

|

|

|

8,416.2

|

|

|

(8) Required Capital (7)×8%

|

|

|

695.0

|

|

|

|

(30.4

|

)

|

|

|

725.5

|

|

|

|

673.3

|

|

MUFG Bank, Ltd. (Non-Consolidated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of

December 31, 2019

(A)

|

|

|

Increase

(Decrease)

(A) - (B)

|

|

|

As of

March 31, 2019

(B)

|

|

|

As of

September 30,

2019

|

|

|

(1) Total capital ratio (4) / (7)

|

|

|

16.26

|

%

|

|

|

0.67

|

%

|

|

|

15.58

|

%

|

|

|

16.49

|

%

|

|

(2) Tier 1 capital ratio (5) / (7)

|

|

|

14.09

|

%

|

|

|

0.55

|

%

|

|

|

13.53

|

%

|

|

|

14.31

|

%

|

|

(3) Common Equity Tier 1 capital ratio (6) / (7)

|

|

|

11.99

|

%

|

|

|

0.30

|

%

|

|

|

11.69

|

%

|

|

|

12.48

|

%

|

|

(4) Total capital

|

|

|

13,608.6

|

|

|

|

48.1

|

|

|

|

13,560.5

|

|

|

|

13,653.1

|

|

|

(5) Tier 1 capital

|

|

|

11,792.1

|

|

|

|

18.3

|

|

|

|

11,773.8

|

|

|

|

11,849.6

|

|

|

(6) Common Equity Tier 1 capital

|

|

|

10,036.5

|

|

|

|

(135.6

|

)

|

|

|

10,172.2

|

|

|

|

10,338.0

|

|

|

(7) Risk weighted assets

|

|

|

83,677.7

|

|

|

|

(3,312.3

|

)

|

|

|

86,990.0

|

|

|

|

82,776.8

|

|

|

(8) Required Capital (7)×8%

|

|

|

6,694.2

|

|

|

|

(264.9

|

)

|

|

|

6,959.2

|

|

|

|

6,622.1

|

|

Mitsubishi UFJ Trust and Banking Corporation (Non-Consolidated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of

December 31, 2019

(A)

|

|

|

Increase

(Decrease)

(A) - (B)

|

|

|

As of

March 31, 2019

(B)

|

|

|

As of

September 30,

2019

|

|

|

(1) Total capital ratio (4) / (7)

|

|

|

23.67

|

%

|

|

|

(0.58

|

%)

|

|

|

24.25

|

%

|

|

|

23.91

|

%

|

|

(2) Tier 1 capital ratio (5) / (7)

|

|

|

20.85

|

%

|

|

|

(0.26

|

%)

|

|

|

21.12

|

%

|

|

|

20.89

|

%

|

|

(3) Common Equity Tier 1 capital ratio (6) / (7)

|

|

|

19.01

|

%

|

|

|

(0.41

|

%)

|

|

|

19.42

|

%

|

|

|

19.29

|

%

|

|

(4) Total capital

|

|

|

2,337.9

|

|

|

|

142.8

|

|

|

|

2,195.0

|

|

|

|

2,287.8

|

|

|

(5) Tier 1 capital

|

|

|

2,059.5

|

|

|

|

148.3

|

|

|

|

1,911.2

|

|

|

|

1,998.9

|

|

|

(6) Common Equity Tier 1 capital

|

|

|

1,878.5

|

|

|

|

120.3

|

|

|

|

1,758.2

|

|

|

|

1,845.9

|

|

|

(7) Risk weighted assets

|

|

|

9,877.4

|

|

|

|

827.9

|

|

|

|

9,049.4

|

|

|

|

9,566.1

|

|

|

(8) Required Capital (7)×8%

|

|

|

790.1

|

|

|

|

66.2

|

|

|

|

723.9

|

|

|

|

765.2

|

|

2

Notes:

Risk-adjusted capital ratio of Mitsubishi UFJ Financial Group, Inc. is computed in accordance with the Notification of the

Financial Services Agency No.20, 2006.

Risk-adjusted capital ratio of MUFG Bank, Ltd. and Mitsubishi UFJ Trust and

Banking Corporation are computed in accordance with the Notification of the Financial Services Agency No.19, 2006.

-End-

About MUFG

Mitsubishi UFJ Financial Group, Inc. (MUFG)

is one of the world’s leading financial groups. Headquartered in Tokyo and with over 360 years of history, MUFG has a global network with over 2,700 locations in more than 50 countries. The Group has over 180,000 employees and offers services

including commercial banking, trust banking, securities, credit cards, consumer finance, asset management, and leasing. The Group aims to “be the world’s most trusted financial group” through close collaboration among our operating

companies and flexibly respond to all of the financial needs of our customers, serving society, and fostering shared and sustainable growth for a better world. MUFG’s shares trade on the Tokyo, Nagoya, and New York stock exchanges. For more

information, visit https://www.mufg.jp/english.

Press contact:

Naokazu Matsuda

Public Relations Division

Tokyo/Head Office

Mitsubishi UFJ Financial Group, Inc.

T +81-3-5218-1815

E naokazu_matsuda@mufg.jp

3

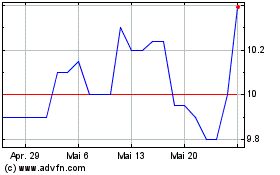

Mitsubishi UFJ Financial (PK) (USOTC:MBFJF)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Mitsubishi UFJ Financial (PK) (USOTC:MBFJF)

Historical Stock Chart

Von Mai 2023 bis Mai 2024

Echtzeit-Nachrichten über Mitsubishi UFJ Financial Group Inc (PK) (OTCMarkets): 0 Nachrichtenartikel

Weitere Mitsubishi Ufj Financial Group Inc News-Artikel