- Revenues: +15.0% to €893.1m

- Underlying operating income: +38% to €27.7m (+50

bps)

- Net income: more than doubled to €14.8 m

- Financial debt: limited to 0.7x EBITDA

Regulatory News:

ID Logistics, (ISIN: FR0010929125, Mnémo: IDL) (Paris:IDL) one

of the European leaders in contract logistics, announces its

results for the first half of 2021 with revenues up 15.0% to €893.1

million and underlying operating income up 38% to €27.7 million,

representing a margin gain of 50 bps.

Eric Hémar, Chairman and CEO of ID Logistics, commented:

« The growth of the first half of 2021 has accelerated with a

+17.7% increase on a like-for-like basis compared to the first half

of 2020, which had itself proven the strong resilience of ID

Logistics' model (+4.3% compared to 2019 despite the pandemic). The

Group's operating profitability is growing faster than its

activity: underlying operating income is up +38% due to the

increased productivity of the sites started up in the last two

years and the good control of start-up costs for new projects. The

Group continues to strengthen its position in e-commerce, which now

accounts for 27% of activity in the first half of the year, and

continues to manage its cash flow and investments carefully ».

In €m

H1 2021

H1 2020

Change

Revenues

893.1

776.6

+15.0%

EBITDA

117.9

97.5

+20.9%

As a % of revenues

13.2%

12.6%

+60 bps

Underlying operating income

27.7

20.1

+37.8%

As a % of revenues

3.1%

2.6%

+50 bps

Consolidated net income

14.8

6.5

x2.3

As a % of revenues

1.7%

0.8%

+90 bps

SUSTAINED ACTIVITY IN THE FIRST HALF OF 2021 WITH REVENUES

GROWTH OF +15.0%

ID Logistics' revenues stood at €893.1 million at June 30, 2021,

up +15.0% and +17.7% on a like-for-like basis compared to the first

half of 2020, which itself recorded growth of +4.3%:

- In France, revenues in the first half of

2021 amounted to €376.7 million, up +9.5% compared with the first

half of 2020. - Outside France, revenues for the first half of 2021

reached €516.4 million, up 19.4% compared with the first half of

2020. This performance includes a generally unfavorable exchange

rate effect, particularly in Latin America, and a scope effect

linked to the end of activities in China in 2020. Excluding these

items, revenues rose by 24.6% in the first half of the year.

UNDERLYING OPERATING INCOME UP 38% TO €27.7 MILLION

ID Logistics continues to improve its underlying operating

income, up 38% to €27.7 million for the first half of 2021 compared

to €20.1 million in 2020, and its underlying operating margin (up

50 basis points to 3.1%):

- In France, underlying operating income has

bounced back to €13.5 million at June 30, 2021, or 3.6% of

revenues, compared with €9.7 million and 2.8% in 2020. The first

half of 2020 was impacted by direct and indirect additional costs

related to the Covid-19 health crisis (masks, hydroalcoholic gel,

social distancing, loss of productivity), which are now more

limited and better managed. The increased productivity of the sites

started up in 2019 and 2020 and the good control of start-up costs

for new contracts since the beginning of the year have also

contributed to the improved results. - Outside France, underlying

operating income continued to rise to €14.2 million at June 30,

2021, representing a margin of 2.7%, compared with €10.4 million

and 2.4% in 2020. As in France, the Covid crisis effects on the

results of the first half of 2020, particularly in Spain, did not

reproduced to the same extent in the first half of 2021. Beyond

this specific effect, recent contracts are improving their overall

productivity compared to 2020 and offsetting the cost of start-ups

in early 2021.

NET INCOME DOUBLED TO €14.8M

In the first half of 2021, the Group did not recognize any

non-current expenses, which amounted to €1.5m in the first half of

2020, in relation to the closure of operations in China. At the

same time, the financial result improved and the tax charge

benefited from the reduction in the CVAE contribution rate, which

generated a saving of €1.2 million over the first 6 months of 2021.

Consolidated net profit thus amounted to €14.8 million at June 30,

2021, up 127% compared to H1 2020 (€6.5m).

GOOD CASH MANAGEMENT AND CONTINUED STRONG INVESTMENT

CAPACITY

Cash flow from operations after taking into account operating

investments amounted to €72.0 million in H1 2021 compared to €97.5

million in H1 2020:

- It benefited from the improvement in

results and in particular Ebitda, which rose by €20.4m over the

period. - The Group did not use the government measures authorizing

the deferral of payment of certain social security contributions

that it had activated as a precaution in the first half of 2020 for

an amount of €20.5 million, fully repaid in the second half of

2020. - The strict management of working capital, which during the

health crisis reduced the average customer collection time by 4

days in the first half of 2020, generating €18.7 million in current

cash, has continued and has enabled the working capital requirement

to remain stable since the beginning of the year 2021. - Since the

beginning of 2021, operating investments stood at €41.0 million and

consist mainly of new e-commerce projects currently being launched

( IT equipment, mechanized solutions, …) whereas during the first

half of 2020, ID Logistics and its customers have been selective

and gradual in investments, which were limited to €26.9

million.

At the beginning of 2020, ID Logistics had finalized the

refinancing of the remaining acquisition debts by a new 5-year €100

million loan with its historical banking syndicate, benefiting from

better financial conditions compared to the refinanced loans and

very progressive repayments. This transaction resulted in a net

cash inflow of €30.4 million in the first half of 2020. At the same

time, the Group had also concluded a 5-year €50 million revolving

credit facility, which has not been drawn down to date.

Taking into account these elements, and after payment of rental

debts (IFRS 16) and other changes, the Group had a net current cash

position of €139.6 million at June 30, 2021, and net financial debt

was limited to €66.9 million, or 0.7x EBITDA excluding IFRS 16.

OUTLOOK

In line with its roadmap, ID Logistics intends to rely on its

good performance in 2020 and early 2021 and its strong positioning

in e-commerce to continue its profitable development, while

remaining cautious of developments in the Covid-19 crisis. The

Group recalls that its results traditionally benefit from a more

favorable seasonality in the second half of the year. The company

remains attentive to external growth opportunities, particularly in

Northern Europe and the United States.

Additional note: Board of Directors have validated half-year

results on August, 25th and audit procedures on the consolidated

financial statements have been performed. The certification report

will be issued after completion of the procedures required for the

purpose of publishing the interim financial report.

Next Report Release of third-quarter 2021 revenues after

the market close on 25 October 2021.

ABOUT ID LOGISTICS

ID Logistics is an international contract logistics group, with

revenue of €1,643 million in 2020. ID Logistics has more than 340

sites across 17 countries, representing 6.0 million square meters

of warehousing facilities in Europe, America, Asia and Africa, with

21,500 employees. With a client portfolio balanced between retail,

industry, detail picking, healthcare and e-commerce sectors, ID

Logistics is characterized by offers involving a high level of

technology. Developing a social and environmental approach through

a number of original projects since its creation in 2001, the Group

is today resolutely committed to an ambitious CSR policy. ID

Logistics is listed on Compartment A of NYSE Euronext’s regulated

market in Paris (ISIN Code: FR0010929125, Ticker: IDL).

APPENDIX

- Simplified statement of income

(€m)

H1 2021

H1 2020

France

376.7

344.1

International

516.4

432.5

Revenues

893.1

776.6

France

13.5

9.7

International

14.2

10.4

Underlying operating income

27.7

20.1

Amortisation of customer relationships

(0.6)

(0.6)

Non-recurring expenses

-

(1.5)

Financial result

(5.8)

(6.9)

Income tax

(6.8)

(5.1)

Share in income of associates

0.3

0.5

Consolidated net income

14.8

6.5

o/w attributable to ID Logistics’

shareholders

12.9

5.3

- Simplified statement of cash flows

(€m)

H1 2021

H1 2020

EBITDA

117.9

97.5

Change in working capital

0.0

38.7

Other changes (non-recurring, tax,

etc.)

(4.9)

(11.8)

Net investments

(41.0)

(26.9)

Net cash generated/(used) by operating

activities

72.0

97.5

Net issuance (repayment) of debt

1.0

30.5

Reimbursement of lease liabilities (IFRS

16)

(75.0)

(65.9)

Others

(2.4)

(4.0)

Increase (decrease) in cash and cash

equivalents

(4.4)

58.1

Cash and cash equivalent – beginning of

period

144.0

90.5

Cash and cash equivalent – end of

period

139.6

148.6

Definitions

- Like-for-like change: change excluding the impact

of:

- acquisitions and disposals: the revenue

contribution of companies acquired during the period is excluded

from the same period, and the revenue contribution made by

companies sold during the previous period is also excluded from

that period - changes in the applicable accounting principles -

changes in exchange rates (revenues in the various periods

calculated based on identical exchange rates, so that the reported

figures for the previous period are translated using the exchange

rates for the current period).

- EBITDA: Underlying operating income before net

depreciation of property, plant and equipment and amortisation of

intangible assets

- Net financial debt: Gross debt plus bank overdrafts and

less cash and cash equivalents

- Net debt : Net financial debt plus rent liabilities

(IFRS 16)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210825005614/en/

ID Logistics Yann Perot CFO Tel.: + 33 (0)4 42 11 06 00

yperot@id-logistics.com

NewCap Emmanuel Huynh / Thomas Grojean Investor Relations &

Financial Communications Tel.: +33 (0)1 44 71 94 94

idlogistics@newcap.eu

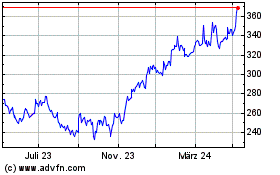

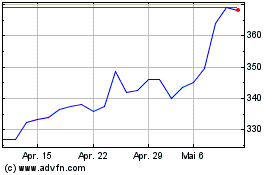

ID Logistics (EU:IDL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ID Logistics (EU:IDL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024