- €99.9 million paid to minority interests, including a

purchase price adjustment of €1.5 million linked to Avanquest’s

level of cash during the completion of the transaction1

- Financing of the transaction:

- €47.7 million in cash

- €28.7 million through the issuance of 4,100,000 new shares

(representing 9.79%2 of the pre-transaction capital) at a price of

€7.00 per share as part of an in-kind contribution of

shares

- €23.6 million in the form of promissory notes

- Simplification of the Group's capital structure and

reintegration of 100% of the Avanquest division’s net

income

- Appointment of Eric Gareau as CEO of Avanquest

Regulatory News:

Claranova (Paris:CLA) (Euronext Paris: FR0013426004 - CLA) today

announced the completion of the buyout of all minority interests in

Avanquest, its software publishing division, as announced on August

11, for a total consideration of €99.9 million, including a

purchase price adjustment of €1.5 million based on Avanquest's cash

position1. On this basis, the total value of the division’s shares

amounted to €155.9 million3.

Pierre Cesarini, CEO of Claranova Group commented: "I am

particularly pleased to announce the completion of this transaction

which will contribute to simplifying the Group’s capital structure

in order to facilitate the market’s understanding of our business

portfolio organization. As owner of 100% of the share capital of

the entities comprising the Avanquest division, Claranova will reap

the full benefits of the efforts made over the last two years in

transitioning to a SaaS4 business model and the new prospects that

are now available to the division. This transaction also offers an

opportunity to officially announce the appointment of Eric Gareau

as Avanquest’s CEO. After having worked alongside Eric for more

than three years to reorganize and reposition the division, I am

very confident about the future of our software publishing

activities and look forward to this new chapter in Avanquest’s

development."

Avanquest: a successful strategic transformation

Since the announcement of Avanquest's acquisition of the

Upclick, Lulu Software, and Adaware businesses in March 2018, the

division has undergone a profound strategic transformation from a

third-party software reseller to a proprietary subscription-based

software publisher and distributor. While revenue and EBITDA5 have

remained stable since FY 2018-2019, the first year the acquired

businesses were fully integrated, FY 2020-2021 marked the

completion of Avanquest’s transition to a subscription-based

business model (SaaS). As a result, subscription sales now account

for 78% of the revenue provided by the three main products

developed and distributed by Avanquest (SodaPDF, inPixio, Adaware)

compared to 50% in FY 2018-2019. The percentage of recurring

revenue (including subscription sales) has accordingly continued to

grow and at year-end represented 58% of the division’s total sales

for FY 2020-2021, up from 35% in FY 2018-2019.

This has in turn strengthened Avanquest’s EBITDA which rose 54%

in FY 2020-2021 to €11 million or 12.4% as a percentage of revenue

compared to €7 million and 7.9% respectively in the prior fiscal

year.

Favorable financial terms and unique opportunities for the

Group

With a total value for Avanquest's shares of €155.9 million and

an enterprise value of €143.2 million6, this transaction has been

completed on the basis of terms which are close to the enterprise

value of €139.2 million7 referred to in connection with the aborted

acquisition in December 2019. In light of the improvement in

Avanquest's profitability, these terms result in a multiple of

approximately x13 last year's EBITDA, compared to a multiple of

approximately x208 proposed in December 2019 and more x43 for a

selection of comparable companies9.

This transaction will enable Claranova, as of November 1, 2021,

to integrate 100% of the Avanquest’s net income and reaffirms

Claranova’s strategic commitment to its software publishing

business.

In this context, Mr. Eric Gareau, until now CEO of Avanquest's

proprietary software publishing activities (Own IP), has been

appointed CEO of the entire division. Eric joined Claranova in 2018

when it acquired Lulu Software (PDF), where he was CEO. Since

joining the Group, he has successfully managed Avanquest's

transition to a subscription-based sales business model. He has

more than 25 years of experience in sales and marketing software

and Fast Moving Consumer Goods with large international

companies.

The transaction

In accordance with the terms of the agreements concluded with

Avanquest’s minority shareholders, the transaction is based on a

valuation of the shares of Avanquest Software SAS (“Avanquest

Software”) of €155.9 million for the entire division, excluding

Lastcard (10518590 Canada Inc.). This company includes Avanquest’s

fintech activities which will no longer be fully consolidated by

the Group after the transaction. Claranova will retain a minority

stake of 35.91% in Lastcard, which will be henceforth controlled by

Avanquest's minority shareholders and, on that basis, be accounted

for by the Group under the equity method after completion of the

transaction.

The transaction was completed on October 29, 2021. On that date,

Claranova acquired:

- through a sale, 32,872,938 Avanquest Software shares for a

price paid in cash of €47,648,356.62 by recognition of several

receivables resulting in the issuance of promissory notes for a

total principal of €23,591,833.42 with maturities ranging from 3

months to 10 years (the "Acquisition"), and

- through a contribution in kind of Avanquest Software 13,243,271

shares resulting in the issuance of 4,100,000 new shares of the

Company, or approximately 9.79% of the share capital before the

issue, at a unit price of €7.00 per share, i.e., a corresponding

value of €28,700,000.00 (the "Contribution").

Certain minority shareholders of Avanquest Software also signed

an investment agreement with the Company in conjunction with the

transaction’s completion designed to preserve the stability of

Claranova's capital (the "Minority Investment Agreement"). Under

the terms of this agreement, The Assouline Family Trust, 6673279

Canada Inc., The Dadoun Family Trust and Eric Gareau, who declare

that they are acting in concert, have agreed, among other things,

to a 12-month lock-up provision, subject to the usual

exceptions.

Main characteristics of the Acquisition

The Acquisition relates to 32,872,938 shares of Avanquest

Software. These shares were paid in cash for a consideration of €

47,648,356.62 and by recognition of receivables resulting in the

issuance of the following promissory notes:

- Four promissory notes for a total principal of € 15,594,007.90

with a 10-year maturity and a nominal annual interest rate of 4.5%

payable at maturity;

- Four promissory notes for a total principal of € 1,459,682.80

with a 12-month maturity and a nominal annual interest rate of 4.5%

payable at maturity;

- One promissory note for a principal of €6,538,142.73 with a

3-month maturity and a nominal annual interest rate of 4.5% payable

at maturity at the discretion of Claranova in cash or by set-off

against debt in new Claranova shares.

Main characteristics of the Contribution

- Main terms and conditions of contribution

a. Participating companies

Issuer - The Beneficiary

Company

Claranova S.E., a European company with a share capital of

€41,871,511.00, having its registered office at Immeuble Vision

Défense, 98-91 boulevard National 92250 La Garenne-Colombes,

registered in the Nanterre (RCS No. 329 764 625).

Contributors

- The Daniel Assouline Family Trust, a trust under Quebec law,

for the benefit of Daniel Assouline and his family;

- The Dadoun Family Trust, a trust under Quebec law, for the

benefit of Michael Dadoun and his family;

- 6673279 Canada Inc. a Canadian corporation for the benefit of

Michael Dadoun;

- Mr. Eric Gareau.

(the "Contributors")

The company whose shares are being

contributed

Avanquest Software, a simplified joint stock company (société

par actions simplifiée), having its registered office at Immeuble

Vision Défense, 98-91 boulevard National 92250 La Garenne-Colombes,

registered in the Nanterre (RCS No. 830 173 381), the head company

of the subgroup comprising the Group’s software publishing

division.

b. Contributed Shares

The Contributors contribute 13,243,271 shares of Avanquest

Software (the "Contributed Shares") with a total par value of

€1.00, representing 18.40% of the share capital and voting rights

of Avanquest Software, as follows:

- The Daniel Assouline Family Trust, 8,703,730 Contributed

Shares,

- The Dadoun Family Trust, 3,924,246 Contributed Shares,

- 6673279 Canada Inc. 280,373 Contributed Shares, and

- Eric Gareau, 334,922 Contributed Shares.

c. Legal regime

The Contribution is governed by the rules applicable to

contributions in kind as defined in Article L. 225-147 of the

French Commercial Code.

Using the delegation of authority granted by the 18th resolution

of the Company's Extraordinary General Meeting of December 17,

2020, having considered the report of the contribution auditor on

the value of the contributions, on October 29, 2021, the Company’s

Board of Directors approved the contribution of the Contributed

Shares, its valuation and remuneration, as well as all of the terms

and conditions of the Contribution Agreement.

The Board of Directors also decided, to increase the Company's

share capital by issuing 4,100,000 new shares with a par value of

€1.00 per share and delegated to the Chairman of the Board of

Directors of the Company the powers necessary to record the

satisfaction of the conditions precedent set forth in the

Contribution Agreement and, consequently, the issuance of the New

Shares, completion of the capital increase as consideration for the

Contributed Shares and the corresponding amendment of the articles

of association.

By a decision dated October 29, 2021, the Company’s Board of

Directors acknowledged the fulfillment of the conditions precedent

provided for in the Contribution Agreement, the final completion of

the increase in the Company's share capital by contribution in kind

to the Contributors of a total nominal amount of €4,100,000 divided

into 4,100,000.00 new shares with a par value of €1.00 each and

increased by a total contribution premium of €24,600,000.00, thus

increasing the share capital from €41,871,511.00 to €45,971,511.00

divided into 45,971,511 shares of €1.00 par value each. The Board

also amended the Articles of Association in consequence.

d. Valuation of the Contribution

The Contributed Shares have been valued at their actual value

that was set between the parties at €28,700,000.00 (the

"Contribution Value").

e. Consideration for the

Contribution

The Company and the Contributors have agreed to consideration

for the Contribution by the creation of 4,100,000 New Shares

distributed as follows:

- The Daniel Assouline Family Trust: 2,694,598 New Shares;

- The Dadoun Family Trust: 1,214,912 New Shares;

- 6673279. : 86,801 New Shares;

- Eric Gareau: 103,689 New Shares.

The New Shares, with a par value of €1.00 per share, were issued

at a price of €7.00. The issue price of the New Shares has been

determined by mutual agreement between the Parties.

The difference between the actual value of the Contributed

Shares (i.e. €28,700,000.00) and the par value of the New Shares

issued by the Company and allocated to the Contributors (i.e.

€4,100,000.00), or €24,600,000.00, is allocated to a “contribution

premium” account of the Company.

On that basis, the share capital of the Company is increased to

€45,971,511.00 New Shares representing approximately 8.92% of the

share capital of the Company after issue.

Changes in the Company's capital structure are presented in the

appendix to this press release.

f. Contribution closing date

The New Shares were issued on October 29, 2021, the date on

which the Company’s Board of Directors, acting under the delegation

of powers granted to it by the 18th resolution of the Company’s

Extraordinary General Meeting of December 17, 2020, acknowledged

the satisfaction of all conditions precedent provided for in the

Contribution Agreement and completion of the capital increase of

the Company.

The New Shares will carry dividend rights in the year of issue

and shall be fungible and rank pari passu with the Company’s

existing shares.

The New Shares will be admitted to trading on Euronext Paris on

the same line as the Company's existing shares.

g. Valuation of the Contribution

In accordance with the provisions of Articles L. 225-147 and R.

225-8 of the French Commercial Code, Saint-Honoré BK&A,

represented by Mr. Frédéric Burband, has been appointed as an

independent appraiser or “Commissaire aux Apports” (the

"Contribution Appraiser") by order of the President of the Nanterre

Commercial Court dated September 1, 2021, with responsibility for

the following tasks:

(i) assess the value of the Contributed

Shares;

(ii) prepare a report on the value of the

Contributed Shares containing the information required by Articles

L. 225-147 and R. 225-8 of the French Commercial Code,

including:

- describe the method of valuation adopted

for the Contributed Shares and the reasons why such method was

adopted;

- issuance of a statement that the value of

the Contributed Shares corresponds at least to the nominal value of

the shares to be issued, plus any contribution premium; and

(iii) if necessary, prepare a report on the

consideration for the contributions, in accordance with the AMF

Position-Recommendation No. 2011-11.

The report of the Contribution Auditor on the assessment of the

value of the Contributed Shares was filed with the Registrar of the

Commercial Court of Nanterre in accordance with applicable laws and

regulations and made available to the Company's shareholders at the

Company's registered office.

Contribution Appraiser's report on the

value of the Contributed Shares

In his report on the value of the Contributed Shares dated

October 20, 2021, the Contribution Appraiser states that: "The

value of the contribution set at €28,700,000.00 is not

overstated.”

Contribution Appraiser's report on the

consideration for the Contribution

In his report on the consideration for the Contributed Shares

dated October 20, 2021, the Contribution Appraiser states that: "On

the basis of our work, and with regard to the specific methods for

determining the exchange ratio (i.e. negotiation between

independent parties), at the date of this report, we are of the

opinion that the consideration proposed for the contribution

resulting in the issuance of 4,100,000 new Claranova shares, is

fair."

In accordance with the provisions of Article 1(5)(a) of

Regulation (EU) No. 2017/1129 of the European Parliament and of the

Council of June 14, 2017, a prospectus subject to prior approval by

the AMF is not required for admission of the New Shares to trading

on the regulated market of Euronext Paris.

Main provisions of the Minority Investment Agreement

The issuance of the New Shares entails the signature of a

Minority Investment Agreement with the Contributors. The main

provisions of this agreement would be as follows:

- continuing to hold shares in registered

form, with a switch to bearer shares to avoid triggering double

voting rights, for the duration of the agreement;

- a lock-up clause prohibiting the sale of

shares by minority shareholders for a period of 12 months, subject

to the usual exceptions;

- post lock-up period, orderly sale

arrangement;

- the Company's right of first refusal for

any sale by a minority shareholder of Claranova shares representing

2% or more of the share capital.

Information available to the public and risk factors

Detailed information regarding the Company, including its

business, financial information, results, prospects and related

risk factors are contained in the Company’s FY 2020-2021 Universal

Registration Document filed with the French Financial Market

Authority (Autorité des Marchés Financiers or “AMF”) on October 20,

2021 (No. D. 21-0869). This document, as well as other regulated

information and all of the Company's press releases, are available

on the Company's website (www.claranova.com).

The readers’ attention is drawn to the risk factors relating to

the Company and its activities presented in Chapter 4 of its FY

2020-2021 Universal Registration Document.

This press release does not constitute a prospectus within the

meaning of EU Regulation 2017/1129 (the "Prospectus Regulation")

nor an offer of securities to the public.

Expected timetable and legal information on the

transaction:

- November 3, 2021 - Settlement of the Contribution

Resignation of the Observer:

Mr. Marc Goldberg, non-voting observer (censor) on the Board of

Directors of the Company, informed the Company of his resignation

from this position effective on October 28, 2021, for personal

reasons.

Financial calendar: November 09, 2021:

Q1 2021-2022 revenue:

Telephone number for individual shareholders

available from Tuesday to Thursday between 2 p.m. and 4 p.m. for

calls within France: 0805 29 10 00 (local rate).

About Claranova:

As a diversified global technology company, Claranova manages

and coordinates a portfolio of majority interests in digital

companies with strong growth potential. Supported by a team

combining several decades of experience in the world of technology,

Claranova has acquired a unique know-how in successfully turning

around, creating and developing innovative companies.

With average annual growth of more than 40% over the last three

years and revenue of €472 million in FY 2020-2021, Claranova has

proven its capacity to turn a simple idea into a worldwide success

in just a few short years. Present in 15 countries and leveraging

the technology expertise of nearly 800 employees across North

America and Europe, Claranova is a truly international company,

with 95% of its revenue derived from international markets.

Claranova’s portfolio of companies is organized into three

unique technology platforms operating in all major digital sectors.

As a leader in personalized e-commerce, Claranova also stands out

for its technological expertise in software publishing and the

Internet of Things, through its businesses PlanetArt, Avanquest and

myDevices. These three technology platforms share a common vision:

empowering people through innovation by providing simple and

intuitive digital solutions that facilitate everyday access to the

very best of technology.

For more information on Claranova Group:

https://www.claranova.com or

https://twitter.com/claranova_group

*****

Disclaimer:

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements. This press release has been

produced in both French and English. In the event of a discrepancy

between the French and English versions, the French language

version shall prevail.

Appendix:

Changes in the Company's capital structure before and after the

closing of the Contribution:

- Pre-Contribution capital structure10:

Shareholders

Number of

shares on a

non-diluted

basis

Number of

shares on a

diluted basis11

Percentage of

capital on a

non-diluted

basis

Percentage of

capital on a

diluted basis

Number of

exercisable

voting rights

Percentage of

exercisable

voting rights

Directors and officers

3.103.722

3.291.332

7.41%

7.78%

3.992.810

9.14%

Institutional Funds

5.066.163

5.066.163

12.10%

11.98%

5,066.163

11.59%

Float

33.459.501

33.691.180

79.91%

79.67%

34,634.689

79.27%

Treasury shares

242.125

242.125

0.58%

0.57%

0.00%

Total

41.871.511

42.290.800

100.00%

100.00%

43.693.662

100.00%

- Post-Contribution capital structure:

Shareholders

Number of

shares on a

non-diluted

basis

Number of

shares on a

diluted basis10

Percentage of

capital on a

non-diluted

basis

Percentage of

capital on a

diluted basis

Number of

exercisable

voting rights

Percentage of

exercisable

voting rights

Directors and officers

3.103.722

3.291.332

6.75%

7.09%

3.992.810

8.35%

Institutional Funds

5.066.163

5.066.163

11.02%

10.92%

5.066.163

10.60%

Avanquest minority shareholders

4.100.000

4.100.000

8.92%

8.84%

4.100.000

8.58%

Float

33.459.501

33.691.180

72.78%

72.62%

34.634.689

72.47%

Treasury shares

242.125

242.125

0.53%

0.52%

0.00%

Total

45.971.511

46.390.800

100.00%

100.00%

47.793.662

100.00%

1 Purchase price adjustment negotiated in connection with the

binding agreement of August 2021, calculated on the basis of the

Avanquest division's cash level at the end of August 2021. 2 Before

completion of the issue based on 41,871,511 shares, including

treasury shares held by the Company. 3Or US$182.7 million converted

at a negotiated EUR/USD exchange rate of 1.1718. 4Software as a

Service 5 EBITDA (earnings before interest, taxes, depreciation and

amortization) is a non-GAAP aggregate used to measure the operating

performance of the businesses. It is equal to Recurring Operating

Income before depreciation, amortization and share-based payments

including related social security expenses and the IFRS 16 impact

on the recognition of leases.. 6 Based on a pre-IFRS 16

contribution to net financial debt of €12.4 million at June 30,

2021. 7 Based on the value of Avanquest shares of US$162.2 million,

or €146.0 million converted at a EUR/USD exchange rate of 1.1113,

and a pre-IFRS 16 contribution to net financial debt of €6.7

million at June 30, 2020. 8 Based on Avanquest's FY 2019-2020

results. 9 Source: Capital IQ, based on the EBITDA of a panel of

comparable listed companies including: Nitro Software (ASX: NTO),

Foxit Software (SHSE: 688095), Avast (LES: AVST), Kape Technologies

(AIM: KAPE) and Wondershare (SZSE: 300624). 10 Based on the TPI

(Identifiable Bearer Security) survey conducted on September 9,

2021 with Euroclear and the last census of voting rights. 11 The

number of shares on a diluted basis does not take into account the

ORNANE bond issue in June 2018, nor the OCEANE bond issue in August

2021, as the Company has not yet decided on the method of

redemption of these bonds.

CODES Ticker : CLA ISIN: FR0013426004

www.claranova.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211101005261/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 65

ir@claranova.com

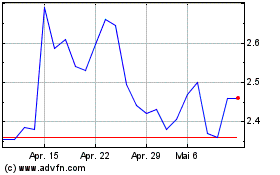

Claranova (EU:CLA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Claranova (EU:CLA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024