The Perfect

Storm for

StarJets

International

Just Hit

-

StarJets

triple-digit

growth with $10 million reported

for

2020 and record bookings each month

-

StarJets

now accepting

bitcoin to attract very large market of

new wealthy

bitcoin

owners now being accepted by many

large companies including TSLA

-

OTC

Markets

reports unusually

large short position in StarJets with very small float

that could cause

short squeeze which may have just started

yesterday. Volume and price just started climbing on the

close

-

StarJets

CEO Ricky

Sitomer

previously led

Blue Star Jets to over $800 million in sales. He is determined to beat

those numbers with StarJets

-

StarJets

has

small float

of 21 million shares

with 10 million

closely held

April 9, 2021 -- InvestorsHub

NewsWire -- via BioResearch Alert -- Rarely do so many

forces all line up at the same time

that have the

potential to spike a company's share

value much higher such as what can be

considered a "Perfect Storm" for StarJets International, Inc. (JETR:

OTC).

StarJets

International

was founded in October 2016 by Ricky Sitomer,

foremost expert in Private Jet Charter, and the co-founder of Blue

Star Jets, one of the most recognized Jet Charter companies in the

Private Aviation space. While CEO and leading Blue Star Jets in its

16-year operating history, the company generated over $800M in

revenue and established "private Jet Brokerage and Charter" as the

most efficient model for accessing private jets. Blue Star Jets

pioneered the jet charter business and led the industry.

In its 16-year operating

history, Blue Star Jets become a brand name in the private aviation

business (featured in the movie Wall Street). The Company's client

list was a

Who's Who of corporate America, and included government officials,

athletes, entertainers, wealthy families, and business leaders

around the world.

Sitomer, while CEO of Blue Star Jets

appeared on CNN/FN as a safety and security expert regarding

private aviation and has been recognized for his leadership

position in the industry by The New York Times, ABC, CNBC, Fox

News, Bloomberg and many others. The Wall Street Journal has

described Blue Star Jets as one of the most competitively priced

jet providers in the country. Additionally, Blue Star was

recognized as the "Best

Private Jet Company" from the Board of Luxury

Travel Advisors, an award voted on by all travel agents that are

affiliated with all travel consortiums.

StarJets

International

("Star Jets") has moved that business model through innovation and

development into the most professional and reliable model for both

business and personal jet travel. Star Jets International's motto

is "Any Jet, Any Time, Anywhere."

Mr.

Sitomer,

at age 51, has committed to take his 20-years of experience and

knowledge and grow this three-year old company into the premier Jet

Charter company that will successfully compete and win in the

space. In the last decade, several business models have been tried

and failed, all seeking to promote access and cost efficiency for

jet travel, while achieving neither.

StarJets

is

looking to be the new "Priceline, Expedia, Kayak, Booking.com" of

private jets. By leveraging its relationships with private

jet owners and operators, directly targeting qualified customers,

and having a team of technology experts to market directly to our

customers through social media, online marketing efforts and

television, Star Jets plans

to grow

into one of the largest and most successful private jet brokers in

the world.

StarJets

has

launched

their

new real time "Booking Engine"

online and

through an Apple IOS app and an Android app, and

became

the premier Private Jet Brokerage firm in the entire

world.

Overview

StarJets will improve the traditional

business model that has proven to work for many years. Star

Jets plans

to grow

very quickly by targeting customers directly and

giving them the

ability to automatically book their private jet travel online or on

our customized app that has now been launched is in in

use.

StarJets offers its clients the

flexibility to fly on whatever their needs are for each specific

trip. We have access to 5000 aircraft in the USA and 15,000

aircraft worldwide. We also offer our clients three types

of Skycard, a 25-hour card in a

specific aircraft, our traditional Skycard (that works like a debit

card), and a customized Skycard program (20 trips from

Teterboro to West Palm Beach).

The points of differentiation

for Star Jets are its ability to secure customers for charters and

programs, its individualized customer service, its pricing

structure designed to be superior to anyone in the jet service

industry, and its access to a fleet of jets unrivaled by its

competitors.

Industry

The private jet

travel

market has

evolved and demonstrated strong

growth over the years

but has seen

explosive growth recently driven by first-class and business class

commercial passengers looking for a safer way to travel to protect

against the Coronavirus. After flying with StarJets for the first time and

experiencing not only a safer way to travel, many are discovering

a new

found luxurious experience and

convenience that they want to continue.

StarJets is focused on its core

business, wealthy families and businesses that want to fly private

on private jets, with the emphasis on direct marketing and access

to the "Best Planes at the Best Prices." Star Jets will develop

relationships and a quality of service that will drive loyalty and

growth. The sales team will have a concierge approach to

clients,

and will

know the preferred bottle of wine and the favorite snacks for

traveling families. The company will arrange for any catering or

restaurants on board, transportation, be the go-to resource for

tickets to entertainment and sports events, villa rentals, yacht

charters and anything else they need.

Many families and businesses

that were once on the fence are now flying private. Star Jet's

brokerage model reduces costs and opens the market to a broader

demographic. Innovative programs that Star Jets will deploy will

focus on making the private jet experience more affordable.

Improved affordability and accessibility, in addition to

the intrusive security measures at commercial airports, is fueling

private charter growth. The private jet industry is forecasted to

be a $20 billion per year industry. In this growing market,

Star Jets is poised to gain significant market share. Star Jets

expects to surpass industry growth based upon its proven strategy

and industry experience, relationships with the best aircraft and

operators, its understanding of digital marketing and direct

marketing, and by automating the booking process.

Target Markets

The Company is targeting all

users of private aviation including business, personal and leisure

travelers with the intent to broker all aspects of private air

travel. The business model is focused on selling a Bespoke product

for the experienced private aviation traveler at the best price

points, the Lending Tree model. In addition, and based on prior

success and experience, the Company will build specific sales teams

and pursue additional markets to include Air Cargo, Air Ambulance,

Private Jet Sales, and Private Jet Management.

International Expansion

The Jet Charter business

requires very little overhead to grow and expand and as part of the

long-term growth objectives StarJets will look to establish sales

and marketing satellite offices in strategic locations with the

highest priority being Eastern Europe, Latin America, Europe, Asia,

and the Middle East. The company seeks to establish relationships

in these regions, either through targeted broker acquisitions or by

opening small sales/marketing offices, allowing Star Jets

International to better serve these key markets (known private jet

corridors; Moscow – Paris).

Innovation and Acquisitions

The Company has developed a

specialty "Booking Engine" to

assist with the

real time online reservations process and the real time booking

app. A user-friendly solution that streamlines the initial customer

interaction and process and focuses on the customer booking

directly on the app. The Company will also look to immediately hire

in house technology experts to assist with social media and

internet

marketing. The Company may pursue acquisitions of worldwide charter

broker companies that will bring volume, revenue and performing

sales teams.

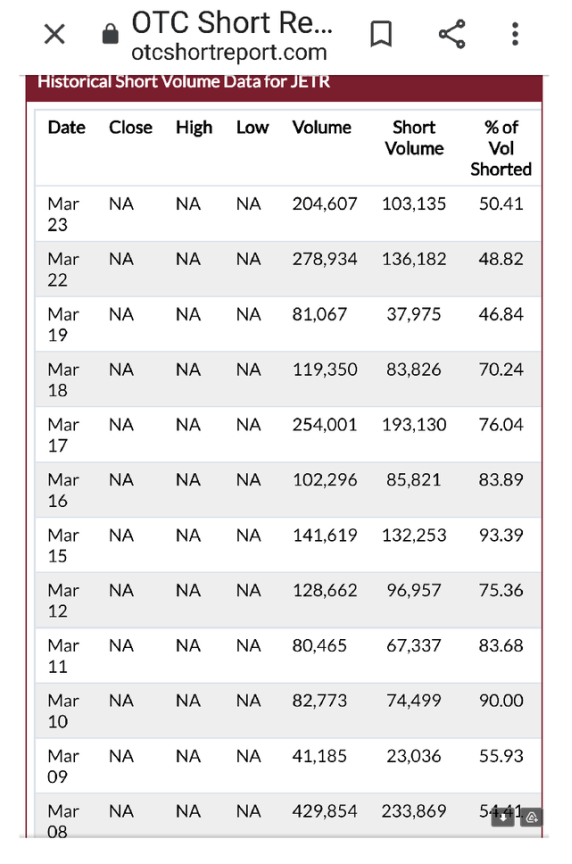

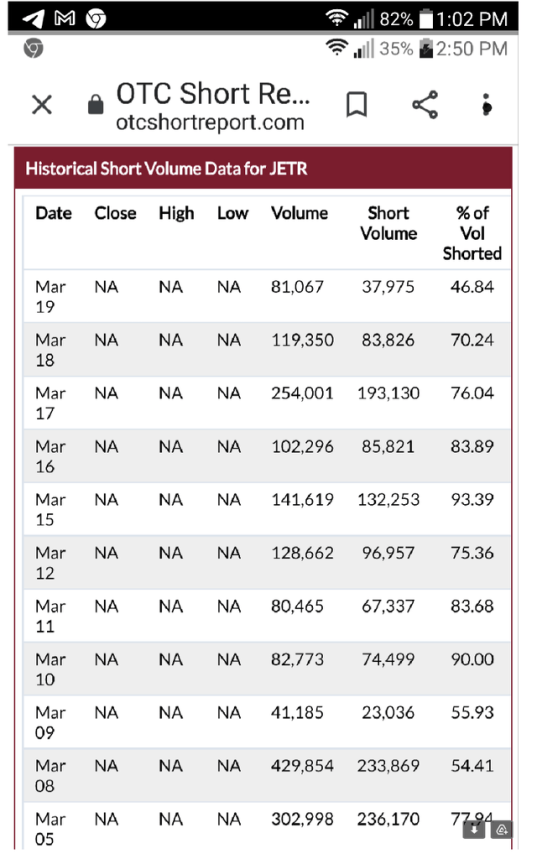

Unusually

Large Short Interest and Very Small Float Spell Impending Short

Squeeze

OTC reports large and growing

short interest in StarJets, International (JETR:

OTC) with extremely high levels of short sales ranging from 46%

to over 90% of total daily trading volume in the past

month.

Close to 2

million shares

have been reported as short sales in less than 30 days and if any

positive news hits the wires, shares have the potential to explode

in price overnight if the price rises enough to force margin calls

which would force buying back the losing short positions before the

loss gets worse. Short selling can be very profitable if covered at

lower prices but shares of JETR appear

destined for substantially higher prices in the near term because

sales are soaring at record triple digit growth rates and are

expected to accelerate even further as passengers discover this new

safer and more luxurious way to travel. Sales may be particularly

vulnerable to even sharper than expected projections because Star

Jets recently announced the company is now accepting bitcoin as

payment.

First Class

and Business Class Passengers Rapidly Switching to Private Jet

Travel

Covid-19 is reshaping the way

the world does business and the fallout is a distinct new group of

winners and losers. Commercial airlines like AAL, DAL and UAL have

been particularly hard hit as passengers fear being exposed to the

virus in crowded airports and in tightly packed airplanes. Forbes

published an article, "Are

Private Jets the New Business or First Class?" and the trend looks like it

is going to be here for a long time because once commercial

first-class passengers experience the luxury and convenience of

private jet travel, they never want to return to crowded airports

and airplanes.

Star Jets, International

(JETR:

OTC) a private jet company is emerging as a clear winner with

record sales that are about to explode again because word will soon

be getting out that they accept Bitcoin as payment. Elon Musk

recently let the world know that TSLA is not only accepting Bitcoin

but, recently purchased $1.5 billion.

In a recent interview

by BioResearchAlert,

CEO Ricky Sitomer said, "In

these trying Covid-19 times, Star Jets International tries to keep

ahead of the curve, continues to innovate and continues to advance

its technological platform. The company is proud to announce its

third consecutive triple digit quarter, year over year. We are

pleased to announce that we have hired an auditor for 2019 and 2020

in order to uplist

to OTCBB.

In addition, we are very proud and excited to take bitcoin as

payment for flights."

CEO of Star Jets

International, Inc. (OTCPK:JETR) Announces Record

2020 Revenue of $9,581,799.

Star Jets International,

Inc. (OTCPink: JETR),

a leading Private Jet Charter Company, announces an all-time

revenue record of $9,581,799 million for the year ended December

31, 2020, a year-over-year increase of 80%. JETR recorded $2.2

million in the fourth quarter of 2020, an increase of 100%

year-over-year. As predicted, the Company's tremendous growth

continues as the demand for private air travel increases, and not

showing any signs of slowing down.

The Company expects to

continue its growth pattern throughout the first quarter of 2021.

Health concerns related to COVID-19 remains a primary reason for

the uptick in private travel demand. As many first-time passengers

discovered and enjoyed their new-found benefits of private jet

travel, repeat customer bookings increased throughout

2020.

Ricky Sitomer, CEO of JETR stated, "We are

proud to announce our all-time-record revenue in 2020, and our

continued growth in the private jet industry. The demand for

private jets has been tremendous and we expect that the demand will

clearly continue. We look forward to working hard to grow our

client base and we are primed and ready to serve our clients with

all of their private travel needs."

The Company hired

a PCAOB

auditing firm to audit its 2019 and 2020

financial records. Upon completion, these audited financial

statements become a part of the Company's plan to file a

corporate registration

statement with the US SEC. Once the registration

statement becomes effective, the Company can pursue an up-listing

of the Company's stock to OTCQB.

Please

visit www.starjetsinternational.com for

more information, Company updates or to book travel with Star Jets

International, Inc.

Related

Stocks - Air Travel & Cryptocurrency

A few airline stocks are:

AAL,

DAL,

UAL, and LUV.

Conclusion

StarJets

growth

rate is already triple digit.

Ricky Sitomer,

the founder and CEO, has the experience and knowhow to bring this

new venture into the digital age of marketing and

sales. The Company has already avoided the mistakes and

miss-steps common with new ventures in the space and will focus on

service and ease of access for the universe of private jet

customers, leveraging relationships in the industry and contacts

worldwide. The current annual revenue run rate is

$10,000,000.

At Blue Star Jets, Mr.

Sitomer

raised $1.6

million and did $800 million in Revenue. Star Jets

International has a

growth strategy that will be executed with limited risk, and with

low capital requirements. The company is expecting to

grow its Revenue to $200 - $300 million per year in a $20 billion

per year industry.

After

deducting tightly held shares, StarJets

float

is estimated to be very small at about 10 million shares, earnings

are soaring every quarter, the company is now accepting bitcoin as

payment that opens up an entire new market of new wealthy bitcoin

users, and an unusually large short position that

must

buy their shares back could be accelerated into a short squeeze if

the share price starts moving up which just

started yesterday.

Forward-Looking

Statements Disclaimer and disclosure:

This press

release contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. In some

cases, you can identify forward-looking statements by the following

words: "anticipate," "believe," "continue,"

"could," "estimate," "expect," "intend," "may," "ongoing," "plan,"

"potential," "predict," "project," "should," "will," "would," or

the negative of these terms or other comparable terminology,

although not all forward-looking statements contain these words.

Forward-looking statements are not a guarantee of future

performance or results,

and will not

necessarily be accurate indications of the times at, or by, which

such performance or results will be achieved. Forward-looking

statements are based on information available at the time the

statements are made and involve known and unknown risks,

uncertainty and other factors that may cause our results, levels of

activity, performance or achievements to be materially different

from the information expressed or implied by the forward-looking

statements in this press release. BioResearch

Alert is

compensated for this article. This press release should be

considered in light of all filings of the Company that are

contained in the Edgar Archives of the Securities and Exchange

Commission at www.sec.gov.

SOURCE: BioResearch

Alert