Gold Bull Resources Corp. (TSX-V: GBRC) (“

Gold

Bull” or the “

Company”) is pleased to

announce it has executed a Purchase and Sales Agreement to acquire

100% of the Sandman Gold Project (“Sandman” or the “Project”) from

Newmont for USD $4 million in cash.

HIGHLIGHTS:

- Proven gold

mineralization comprising a total Resource of

309,900 oz Au (comprising of Measured &

Indicated Resource of 271,900 oz Au plus an

Inferred Resource of 38,000 oz Au as per 2007,

43-101 Resource Estimate)

- Located on renowned gold

trend in #1 Mining Jurisdiction in the World (~24km from

Sleeper mine that produced 1.7M oz Au @ 7 g/t average head grade,

1986-1996)

- Extensive &

consolidated land package (117km2 Sale Boundary)

- Expansion

potential with significant drilling and

exploration conducted post-resource estimate & massive gaps in

exploration under cover

- Permits In-Hand

from BLM and NDEP across land package in mining friendly

jurisdiction with no known environmental sensitives

PROPERTY DETAILS

Sandman is located in Townships 36 and 37 North,

Ranges 35 and 36 East, Mount Diablo Meridian, Humboldt County,

Nevada, USA. The property is situated south of the Slumbering Hills

and west of the Tenmile Hills, circa 24 km northwest of the town of

Winnemucca, Nevada. The property lies 23 km south of the successful

Sleeper gold mine1 which historically produced 1.7M oz Au with

M&I Resources in excess of ~3M oz Au2 (Figure 1). Sandman is

accessed by driving west from the town of Winnemucca on Jungo Road

for 15 km, and then an additional eight km to the north on dirt

roads that lie largely within the property boundaries.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8490bc1a-cab4-4e08-95b6-7ce8a562ebee

Figure 1. General Location map

The Sandman property (117 km2; Sale Boundary;

Figure 2) is located on checkerboard mix of public and private

lands. The project consists of 445 unpatented lode mining claims

and ~6 km2 (1,480 acres) of surface ownership. The existing net

smelter return production royalty obligations will transfer from

Newmont to Gold Bull.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/10a596b4-4fc1-4496-b956-c0e917df4225

Figure 2. Location map indicating sale boundary

via the white polygon.

Significant gold mineralization at Sandman has

been identified at the Southeast Pediment, Silica Ridge, North

Hill, and Abel Knoll deposits (Figure 3) for which NI 43-101

mineral resources have been estimated (see section on Mineral

Resource Estimate).

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/31a3c9eb-fb31-4086-a034-df9a630be430

Figure 3. Sandman project area with underlying geology and main

prospects

HISTORY

No significant historic mining activities have

taken place within the Sandman project limits. Modern exploration

of the Sandman project began in 1987 when Kennecott Exploration

Company (“Kennecott”) discovered gold in outcrop at North Hill.

Kennecott and Santa Fe Pacific Gold Corporation (“Santa Fe”) formed

a joint venture and conducted geologic mapping, surface sampling,

geophysical surveying, trenching, drilling, and metallurgical

testing through 1994. The joint venture drilled 275

reverse-circulation (“RC”) holes and three diamond-drill core

(“core”) holes in this period, as well as 4,000 shallow auger holes

to sample bedrock beneath the extensive sand cover. A block of

claims staked by U.S. Borax was acquired by the joint venture in

1989. U.S. Borax had drilled 37 RC holes within these claims. The

work of these companies led to the discoveries and partial

definitions of the Southeast Pediment, Silica Ridge, and North Hill

gold deposits, as well as the identification of the Adularia Hill,

Basalt Hills, Basalt Fields, and Abel Flat exploration target areas

(Figure 3).

Kennecott and Santa Fe terminated their joint

venture and conveyed their individual holdings at Sandman to

Western States Mining (“WSMC”) in 1997. WSMC and NewWest Gold

Corporation subsequently conducted extensive exploration of the

property, including rock chip and soil sampling, geophysical

surveying, trenching, drilling, and metallurgical testing. WSMC

also excavated a test pit at Southeast Pediment measuring 200-ft

long by 50-ft wide by 15-ft deep. A 1,067-ton bulk sample of

relatively high-grade mineralization was mined and shipped to the

Twin Creeks mine of Newmont for milling and leaching.

In 2005 NewWest acquired the property from WSMC

and employed Mine Development Associates to prepare a 43-101

report. In 2007 Fronteer acquired the Sandman property from NewWest

Gold and then in 2008, formed a joint venture with Newmont. In

2011, Newmont acquired Fronteer and initiated Stage 2 studies and

reporting, including drilling 364 holes within the Sandman AOI. In

addition, Newmont began Stage 3 initial permitting, including waste

characterization, aquifer testing, water rights acquisition, and

metallurgical studies. The project was put largely on hold by

Newmont between 2012 and 2016 due primarily to low gold prices.

The property boasts an extensive geological,

geochemical and geophysical database with significant drilling and

geological advancement post the 2007 resource estimate. The

historical databases, in addition to 974 drill holes, includes

4,293 soil samples from 6 surveys, 3,519 rock chip samples from 23

surveys and an abundance of geophysical datasets including one

airborne EM survey, three airborne magnetic surveys, one airborne

radiometric survey, two CSMAT surveys at Silica Ridge and Southeast

Pediment (2011, 2012), one IPRES survey, 576 gravity stations from

one survey, and a basin model3.

Post the 2007 resource estimate, significant

additional permitting, exploration and infill drilling has been

conducted that has not been incorporated in an updated 43-101

Resource Estimate. Gold Bull intends to commission this update

immediately post acquisition.

GEOLOGY &

MINERALIZATION

Sandman lies along the north-northwest-trending

eastern margin of the Sleeper or Kings River Rift, which is

regionally part of the Western Northern Nevada Rift (NNR). The

Sleeper Rift consists of a regional aeromagnetic and gravity linear

high that extends from the Idaho border to the Sleeper gold mine,

(located 23 km N-NW of Sandman; Figure 1), through Sandman, and

through the Goldbanks gold deposit (located 48 km S-SE of Sandman).

Much of the property area is covered by windblown sand deposits and

Late Tertiary to Quaternary basalt. Mapping, exploration drilling,

and extensive shallow auger drilling through the sand indicate that

most of the sand and basalt in the project area are underlain by a

section of Tertiary tuffaceous rocks and andesite, which in turn

overlie Late Triassic to early Jurassic metasedimentary clastic and

subordinate carbonate rocks.

The Southeast Pediment, Silica Ridge, North

Hill, and Abel Knoll Au+Ag mineralization at Sandman are classified

as low-sulfidation, quartz-adularia, epithermal deposits. The

mineralization is hosted by Tertiary volcanic rocks, primarily in

tuffaceous units, andesite porphyry, tuffaceous sedimentary units,

and basalt. Northwestern Nevada contains a number of similar middle

Miocene Au-Ag deposits that occur in silicic volcanic or

subvolcanic rocks, including the Sleeper, Tenmile, National, and

Hog Ranch deposits (Conrad et al., 1993). The abundance of adularia

and relative paucity of silicification associated with much of the

Sandman mineralization compares more closely to the mineralization

type at the Round Mountain mine located to the south in Nye County,

Nevada.

In general, higher-grade gold mineralization at

Sandman can be stratigraphically controlled along contacts between

basalt flows, interbedded fluvial conglomerates and tuffaceous

rocks (e.g., North Hill Deposit), or structurally controlled as

lens-shaped pods, with high-continuity, lower-grade disseminated

gold in sediments and volcanics (e.g., Silica Ridge and SE

Pediments Deposits). Quartz-adularia alteration dominates the ore

zones, whereas propylitic, argillic, and sericitic alteration are

associated with the known resource areas more distally.

2007 43-101 MINERAL RESOURCE

ESTIMATE

The Sandman drill-hole database includes at

least partial records of 974 drill holes, including 175 core holes.

Drilling was concentrated at the Southeast Pediment, Silica Ridge,

North Hill, and Abel Knoll deposits; other holes were drilled

within various exploration target areas throughout the property. An

additional 4,000 auger holes, totaling >30,000 m, were also

drilled at Sandman. The drill holes used in the 2007 mineral

resource estimations are listed in Table 1.

Table 1.

Drill-Hole Data used in Resource Estimations by Deposit and

Drill Type

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e6252416-faff-428a-803b-b4cb0540794e

The mineral resource reported in 2007 for the

Sandman project was modeled and estimated in accordance with

Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”)

definitions. Gold resources at Southeast Pediment, Silica Ridge,

North Hill, and Abel Knoll are summarized in Table 2.

Table 2. Sandman Gold Resource

Estimate4

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cfb2b8c6-f385-444b-8204-6ae1f1a57cac

A Measured & Indicated Resource of

271,900 oz Au plus an Inferred Resource of

38,000 oz Au result in a total Resource of

309,900 oz Au at Sandman from four of the known

five deposits. A cut-off of 0.34 g/t was chosen to reflect

mineralization potentially available to open-pit extraction and

heap-leach processing, and MDA believes that this cut-off is

reasonable for the reporting of the Southeast Pediment mineral

resources above an elevation of 4,200 ft, as well as all of the

Silica Ridge, North Hill, and Abel Knoll resources. Southeast

Pediment mineral resources may be subject to higher extraction

costs, or lower recoveries, and therefore were reported at a more

conservative cut-off of 0.69 g/t.

MINERAL PROCESSESING & METALLURGICAL

TESTING

Bottle roll, column leach, and some gravity

concentration tests have been undertaken on trench and drill- hole

samples from the Southeast Pediment, Silica Ridge, and North Hill

deposits. The bottle roll and column data indicate that the gold

mineralization tested is amenable to direct cyanidation. The data

consistently show that cyanide extractions increase with decreasing

particle size for the samples tested. Samples that were pulverized

to -100 mesh yielded an average gold extraction of 94.3%, while RC

chip samples tested at the ‘as-received’ size and samples crushed

to -0.25-inch yielded an average gold extraction of 77.8%. There is

no clear relationship between the cyanide extractions and gold

grades of the head samples, although there is some evidence that

samples with higher head grades require a longer leach time to

achieve comparable extractions. Cyanide consumptions and lime

requirements are low to moderate.

The bulk sample extracted from the test pit at

Southeast Pediment was sent to Newmont’s Twin Creeks mine for

milling and cyanide leaching. Over 95% of the gold in the 1,067-ton

sample was recovered, which is consistent with the bottle roll

results generated from samples pulverized to -100 mesh.

EXPLORATION POTENTIAL

Exploration work completed at Sandman to date

has resulted in the discovery of four gold deposits and the

identification of other target areas that remain to be explored.

Sandman provides the potential for near-term production from one or

more of the known deposits. There is also excellent potential for

the discovery of new precious-metal mineralization beyond the

limits of the deposits, as demonstrated by the discovery of the

Abel Knoll deposit in 2006.

Gold Bull believes that Sandman is a property of

merit that warrants significant additional expenditures. Programs

aimed at increasing the size of the Sandman mineral resources and

defining new areas of mineralization are justified in a Phase I

work program. Drilling at the four deposit areas in 2006 and 2007

concluded with open-ended mineralization in a number of drill

holes, and step-out RC drilling in these areas should continue.

Sandman is a large property that is extensively

covered by alluvial gravels and wind-blown sand. Four discrete gold

deposits have been discovered at Sandman, which proves the

existence of multiple hydrothermal systems and suggests that the

potential for the discovery of additional deposits is excellent.

Geophysical, geochemical, and geological data have led to the

identification of a number of quality exploration targets that are

not fully explored. The Phase I program recommends first-pass or

follow-up drill testing of these targets. Further work aimed at

developing new exploration targets is also warranted. Geophysical

and geochemical surveys should be completed with the goal of

defining new targets. Additionally, scoping-level economic studies

should be completed as deposit resources continue to be

refined.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/65096b03-92f0-49c0-b8c6-d1f47b0b12bd

Figure 4. Photo of the bulk sample pits at SE Pediment

Resource

DEAL TERMS SUMMARY

On 12 October 2020, Gold Bull, via its 100%

owned Nevadan subsidiary, Sandman Resources Inc., executed a

Purchase and Sales Agreement with Newmont USA Limited (Newmont) and

Fronteer Development LLC to purchase 100% of the Sandman Project,

located in Humboldt County, circa 23km from the town Winnemucca,

Nevada. Gold Bull will pay Newmont four million dollars

(USD$4,000,000) for 100% interest in the Sandman Project, to be

paid within forty five days. Upon payment, Gold Bull will assume

ownership of Sandman. The acquisition includes all mineral rights,

transferable permits, data and drill core relating to the project.

Existing royalty obligations transfer with the project.

Closing of the acquisition is subject to Gold

Bull’s routine filing requirements with the TSX Venture Exchange

and subject to financing.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d3d0e995-1bde-4723-b55c-1562a102a0e7

Figure 5. Photo of Project Geologist Dr. Stephanie Grocke

(left), and Proposed CEO Cherie Leeden (right)

Qualified Person

Cherie Leeden, B.Sc Applied Geology (Honours),

MAIG, a “Qualified Person” as defined by National Instrument

43-101, has read and approved all technical and scientific

information contained in this news release. Ms. Leeden will become

the Company’s Chief Executive Officer, following the closing of the

acquisition of the Big Balds gold project, previously announced on

August 17, 2020.

Cherie Leeden relied on information contained

within the Technical Report on the Sandman Gold Project, prepared

by Mine Development Associates for NewWest Gold Corporation, dated

May 31, 2007. Authored by Michael M Gustin, R.P. Geo. And James

Ashton, both Qualified Persons as qualified by the National

Instrument NI 43-101.

About Gold Bull Resources

Corp.

Gold Bull Resources Corp. is a gold focused

mineral exploration and development company that strives to

generate and advance high-reward project acquisitions in regions

with proven mineral wealth. The company’s exploration hub is

located in Nevada, USA and is focused on precious metal projects

located in top-tier mineral districts that contain significant

historical production, existing mining infrastructure and an

established mining culture. The Company’s primary focus is on

project generation and evaluation in Nevada and its secondary focus

is in Utah, USA. Gold Bull is led by a Board and Management team

with a track record of exploration success. Gold Bull’s objective

is to generate stakeholder value and superior investment returns

through the discovery and responsible development of mineral

resources.

Vince SoracePresident and CEO, Gold Bull Resources Corp.

For further information regarding Gold Bull

Resources Corp., please visit our website at www.goldbull.ca

Cautionary Note Regarding Forward-Looking

StatementsNeither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain statements

that may be deemed “forward-looking statements” with respect to the

Company within the meaning of applicable securities laws.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “indicates”, “opportunity”,

“possible” and similar expressions, or that events or conditions

“will”, “would”, “may”, “could” or “should” occur. Although Gold

Bull believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, are subject to risks and

uncertainties, and actual results or realities may differ

materially from those in the forward-looking statements. Such

material risks and uncertainties include, but are not limited to,

the Company’s ability to raise sufficient capital to fund its

obligations under its property agreements going forward, to

maintain its mineral tenures and concessions in good standing, to

explore and develop its projects, to repay its debt and for general

working capital purposes; changes in economic conditions or

financial markets; the inherent hazards associates with mineral

exploration and mining operations, future prices of copper and

other metals, changes in general economic conditions, accuracy of

mineral resource and reserve estimates, the potential for new

discoveries, the ability of the Company to obtain the necessary

permits and consents required to explore, drill and develop the

projects and if obtained, to obtain such permits and consents in a

timely fashion relative to the Company’s plans and business

objectives for the projects; the general ability of the Company to

monetize its mineral resources; and changes in environmental and

other laws or regulations that could have an impact on the

Company’s operations, compliance with environmental laws and

regulations, dependence on key management personnel and general

competition in the mining industry. Forward-looking statements are

based on the reasonable beliefs, estimates and opinions of the

Company’s management on the date the statements are made. Except as

required by law, the Company undertakes no obligation to update

these forward-looking statements in the event that management’s

beliefs, estimates or opinions, or other factors, should

change.

_______________________________

1 Reference to a nearby property is for information purposes

only and there are no assurances that the Sandman property will

achieve similar results.

2 Paramount Gold, Corporate Presentation September 2020

3 Newmont Management Presentation, March 2019

4 Mine Development Associates; Mine Engineering Services,

Updated Technical 43-101 Report, Sandman Gold Project, Humboldt

County, NV USA; Prepared for NewWest Gold Corporation, May 31,

2007

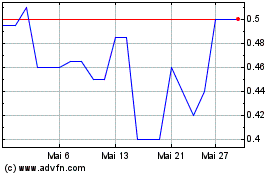

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024