Deveron Reports Continued Revenue Growth in Q2

24 August 2020 - 1:18PM

Deveron UAS Corp. (CSE: DVR) (

“Deveron” or the

“Company”) a leading agriculture digital services

and insights provider in North America, is pleased to announce

revenue growth of 54% year over year to $1,123,867 in Q2 2020.

This marks a major milestone for the Company, as it has

successfully sold over $1 million in products and services for the

first time in one quarter since the Company’s founding.

Second Quarter 2020 Financial and Operational

Highlights

The Company’s financial performance improved

over the previous year’s quarter, driven by higher margin data

insight solutions, led by the Company’s acquisition of Texas based

Better Harvest, and the doubling of farm acres serviced from its

data collection division. For the three-month financial

results ended June 30, 2020 (and comparable period ended June 30,

2019):

- Revenue grew 54% year over year to $1,123,867 in Q2 2020, from

$727,973 in Q2 2019

- Revenue from US operations grew 361% to $595,696 in Q2

2020

- Total comprehensive income for the period was $76,223

“Our second quarter results illustrate the

success of our growth strategy which is underpinned by three key

focus areas: organic growth, productization of our offerings and

acquisitions,” commented David MacMillan, Deveron’s President and

CEO. “In the quarter, we were able to successfully integrate

our Texas acquisition, Better Harvest, which doubled the acres we

influence in the US and increased our US revenue by 361%.

This year we have made investments in our sales team and marketing

efforts which significantly impacted our sales funnel and activity

ahead. Additionally, investment in our data collection

network earlier this year has help secure nearly double the volume

in both drone and soil sampling orders compared to this time last

year. Looking forward to the next 6 months, our goal is to

continue accelerating the success of this strategy while also

focusing on some new digital tools and offerings that we believe

will continue to leverage our ability to scale and service more and

more customers throughout North America’s farm sector.”

Summary of Financial Results

|

Results of Operations |

For the three months ended |

For the six months ended |

|

|

June 30, 2020 |

June 30, 2019 |

June 30, 2020 |

June 30, 2019 |

|

Total Revenue |

$ |

1,123,867 |

|

$ |

727,973 |

|

$ |

1,407,287 |

|

$ |

828,537 |

|

|

Gross Profit |

$ |

925,631 |

|

$ |

508,058 |

|

$ |

1,105,287 |

|

$ |

577,891 |

|

|

Gross Profit Margin % |

|

82 |

% |

|

69 |

% |

|

79 |

% |

|

70 |

% |

|

Operating Expenses |

$ |

849,408 |

|

$ |

609,725 |

|

$ |

1,598,403 |

|

$ |

1,562,477 |

|

|

Total Comprehensive Income (Loss) |

$ |

76,223 |

|

$ |

(101,667 |

) |

$ |

(492,560 |

) |

$ |

(984,586 |

) |

|

Weighted Average Common Shares Outstanding |

|

49.8 |

M |

|

37.9 |

M |

|

44.1 |

M |

|

37.9 |

M |

|

Per Share: |

|

|

|

|

|

Comprehensive Net Gain (Loss) |

$ |

0.00 |

|

$ |

(0.00 |

) |

$ |

(0.01 |

) |

$ |

(0.03 |

) |

Operational Highlights for Q2:

In the second quarter, Deveron was able to

achieve key objectives and successes that had a positive impact on

the Company’s trajectory:

- On April 7, Deveron closed a private placement for $655,000 by

a group of strategic investors led by Bill Linton. Mr. Linton

was appointed as a Director and non-executive Chairman of the

Board. Mr. Linton is an experienced director and private

investor and currently serves on the Boards of TMX Group (TSE: X),

Empire Company (TSE: EMP.A) and CSL Group. He has invested in

several successful private companies and retired in 2012 as the CFO

of Rogers Communications.

- On April 17, Deveron closed the 2nd tranche of a private

placement for $700,000, which combined with the first tranche,

Deveron issued 13,550,000 Units for aggregate gross proceeds of

$1,355,000.

- On May 11, Deveron acquired Better Harvest, a Texas based

agronomy solutions firm further expanding its US footprint by over

100,000 customer acres. Better Harvest had unaudited reported

revenue of $471,769 USD in 2019.

- On June 18, Deveron announced the national launch of a plant

tissue testing service in collaboration with A & L Canada

Laboratories to continue to build on the Company’s turn-key data

collection offering. Tissue sampling complements other

progressive precision agriculture programs and is a value-add to

traditional soil sampling.

Subsequent to Q2

- On July 7, Deveron announced that it is providing a turnkey

data service program to Terramera, a global ag-tech leader fusing

science, nature and artificial intelligence to transform how food

is grown. The collaboration allows Terramerra access to

Deveron’s drone data network to provide high fidelity insight on

numerous sites across Canada and the United States.

Business Outlook

“The second quarter affirmed our beliefs about

the value that our products and services provide our customers,”

commented David MacMillan, Deveron’s President and CEO. “As

engagement within our sales pipeline continues to grow and our team

continues to push efficient turn around from the field to the

creation of tangible data that helps leaders in agriculture make

better decisions, we only see our success accelerating. With

a quarter under our belt of our integration of Better Harvest and

increased activity in the United States, we see a lot of

opportunities to consolidate a fragmented service market and align

great businesses toward a common goal of providing better, unbiased

information to improve efficiencies on farms. We are looking

forward to a busy fall and have already seen increased demand as

the soil sampling season gets underway following wheat harvest

across a number of our operating nodes. Finally, although

COVID-19 has challenged our ability as a company to deliver our

services, to date we have not experienced any major impact on our

business activity.”

The Management’s Discussion and Analysis for the

period and the accompanying Financial Statements and notes are

available under the Company’s profile on SEDAR at

www.sedar.com. This news release is not in any way a

substitute for reading those financial statements, including the

notes to the financial statements.

About Deveron UAS: Deveron is a

leading agriculture technology company focused on providing data

acquisition services and data insights in North America.

Through its on-demand network of drone pilots and soil sampling

technicians, the Company is providing scalable data acquisition

solutions in the imagery and soil space. Additionally,

through its wholly owned subsidiary Veritas Farm Management, the

company provides growers in North America with independent data

analytics and insights on the massive amount of data being

generated on farms today.

For more information and to join our community,

please visit www.deveronuas.com/register or reach us on Twitter

@DeveronUAS or @MyVeritas_HQ

David MacMillanPresident & CEO Deveron UAS

Corp.416-367-4571 ext. 221dmacmillan@deveronuas.com

This news release includes certain

“forward-looking statements” within the meaning of that phrase

under Canadian securities laws. Without limitation, statements

regarding future plans and objectives of the Company are forward

looking statements that involve various degrees of risk.

Forward-looking statements reflect management's current views with

respect to possible future events and conditions and, by their

nature, are based on management's beliefs and assumptions and

subject to known and unknown risks and uncertainties, both general

and specific to the Company. Although the Company believes the

expectations expressed in such forward-looking statements are

reasonable, such statements are not guarantees of future

performance and actual results or developments may differ

materially from those in our forward-looking statements. The

following are important factors that could cause the Company’s

actual results to differ materially from those expressed or implied

by such forward looking statements: changes in the world-wide price

of agricultural commodities, general market conditions, risks

inherent in agriculture, the uncertainty of future profitability

and the uncertainty of access to additional capital. Additional

information regarding the material factors and assumptions that

were applied in making these forward looking statements as well as

the various risks and uncertainties we face are described in

greater detail in the "Risk Factors" section of our annual and

interim Management's Discussion and Analysis of our financial

results and other continuous disclosure documents and financial

statements we file with the Canadian securities regulatory

authorities which are available at www.sedar.com. The Company

undertakes no obligation to update this forward-looking information

except as required by applicable law. The Company relies on

litigation protection for forward looking

statements.

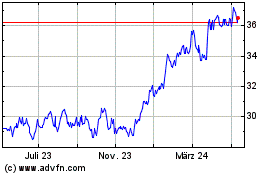

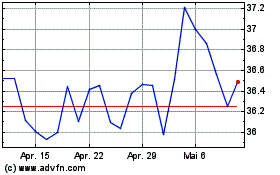

TMX (TSX:X)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

TMX (TSX:X)

Historical Stock Chart

Von Dez 2023 bis Dez 2024