Deveron Reports Q1 Revenue Growth of 181%

28 Mai 2020 - 1:30PM

Deveron UAS Corp. (CSE: DVR) (

“Deveron” or the

“Company”), a leading agriculture digital services

and insights provider in North America, is pleased to announce

revenue growth of 181% year over year to $283,420 in Q1 2020.

For the fourth quarter in a row, Deveron achieved sales growth of

over 100%.

First Quarter 2020 Financial and Operational

Highlights

The Company’s financial performance improved

over the previous year’s quarter, driven by the continued customer

uptake of Deveron’s soil sampling service. For the

three-month financial results ended March 31, 2020 (and comparable

period ended March 31, 2019):

- Revenue grew 181% year over year to $283,420 in Q1 2020, from

$100,564 in Q1 2019.

- Gross profit grew 160% year over year to $180,212 in Q1 2020,

from $69,833 in Q1 2019.

“Our first quarter results are highlighted by

continued growth in acres serviced for our data collection group,”

commented David MacMillan, Deveron’s President and CEO.

“Building upon our successful launch in 2019, we saw increased

usage of our collection network reflecting trust from our customers

and our team’s ability to quickly turn around orders, helping our

farm partners prepare for the spring planting season.

Considering that Q1 is typically slow for our business, I think

these results continue to illustrate our growing market

penetration, the value we provide as a low cost, reliable service

provider and that we are on track for another year of substantial

growth. We are starting to see our organic sales channels

deliver and coupled with our recent acquisition of Better Harvest

in Texas, we believe we have a solid foundation on which we can

continue to grow our farm acres under management and ultimately,

average revenue per acre. Finally, as was the case in 2019,

we have already seen net bookings in April and May outpace all of

Q1.”

Summary of Financial Results

|

Results of operations |

For the three months ended |

|

|

March 31, 2020 |

March 31, 2019 |

|

Total Revenue |

$ |

283,420 |

|

$ |

100,564 |

|

|

Gross Profit |

$ |

180,212 |

|

$ |

69,833 |

|

|

Gross Profit Margin % |

|

63 |

% |

|

69 |

% |

|

Operating Expenses |

$ |

748,995 |

|

$ |

952,919 |

|

|

Total Comprehensive Loss |

$ |

(568,783 |

) |

$ |

(882,919 |

) |

|

Weighted Average Common Shares Outstanding |

|

38.1 M |

|

|

37.8 M |

|

|

Per Share: |

|

|

Comprehensive Net Loss |

$ |

(0.01 |

) |

|

(0.02 |

) |

| |

|

|

|

|

|

|

Operational Highlights for Q1:

- On January 7, Deveron announced

further collaboration with Huron Tractor, a leading John Deere

dealer, to offer data insights and collection products to help

deliver increased value to agriculture data while offering

additional support to help farmers leverage raw data into value add

solutions.

- Increased data collection revenue

to $139,786 in 2020 versus $3,332 in 2019.

- Increased data insights revenue of

47% to $143,634 in 2020 versus $97,232 in 2019.

Business Outlook“Our goal was to achieve

significant revenue growth in both our data collections and

analytics business. We achieved this in Q1 with revenue

growth of 181% over Q1 2019, in what is typically our lowest

activity quarter. We moved our strategy forward in Q1 by

growing our customer base and increasing the acres under management

that we service. This will directly impact the remainder of

the year and set us up for solid growth again in 2020.

Secondly, with our acquisition of Better Harvest in Texas finalized

subsequent to the quarter end, we have initiated an agronomist

acquisition strategy which we think provides significant potential

to accelerate revenue growth and acres under management.

Finally, with a new round of investment completed, our team has

ample runway to execute our 2020 plan.”

Subsequent to Quarter End

- On May 11, Deveron acquired Better

Harvest, a Texas based agronomy solutions business. Better

Harvest provides unbiased agronomic advice, nitrogen management

solutions and optimization for irrigation to over 100,000 acres of

growers. Better Harvest had unaudited reported revenue of

$471,769 USD in 2019.

- The Company also completed a

private placement of $1.35 million (see press releases dated April

7, 2020 and April 17, 2020). In conjunction with this

financing, Bill Linton joined its Board of Directors, where he will

serve as non-executive Chairman. Bill Linton is an

experienced Director and private investor. He currently serves on

the Boards of TMX Group (TSE: X), Empire Company (TSE: EMP.A), and

CSL Group. He has invested in and served as an advisor to and/or

Board member of a number of successful technology companies

including UXP Systems (acquired by AmDocs), In The Chat (acquired

by Pegasystems) and Softchoice Corp. (acquired by Birch Hill Equity

Partners). Bill retired in 2012 as the CFO of Rogers Communications

Inc. and prior to that was the CEO of Call Net Enterprises.

The Management’s Discussion and Analysis for the

period and the accompanying financial statements and notes are

available under the Company’s profile on SEDAR at

www.sedar.com. This news release is not in any way a

substitute for reading those financial statements, including the

notes to the financial statements.

About Deveron UAS: Deveron is a

leading agriculture technology company focused on providing data

acquisition services and data analytics in North America.

Through its on-demand network of drone pilots and soil sampling

technicians, the Company is providing scalable data acquisition

solutions in the imagery and soil space. Additionally,

through its wholly owned subsidiary Veritas Farm Management, the

company provides growers in North America with independent data

analytics and insights on the massive amount of data being

generated on farms today.

For more information and to join our community,

please visit www.deveronuas.com/register or reach us on

Twitter @DeveronUAS or @MyVeritas_HQ

David MacMillanPresident & CEO Deveron UAS

Corp.416-367-4571 ext. 221dmacmillan@deveronuas.com

This news release includes certain

“forward-looking statements” within the meaning of that phrase

under Canadian securities laws. Without limitation, statements

regarding future plans and objectives of the Company are forward

looking statements that involve various degrees of risk.

Forward-looking statements reflect management's current views with

respect to possible future events and conditions and, by their

nature, are based on management's beliefs and assumptions and

subject to known and unknown risks and uncertainties, both general

and specific to the Company. Although the Company believes the

expectations expressed in such forward-looking statements are

reasonable, such statements are not guarantees of future

performance and actual results or developments may differ

materially from those in our forward-looking statements. The

following are important factors that could cause the Company’s

actual results to differ materially from those expressed or implied

by such forward looking statements: changes in the world-wide price

of agricultural commodities, general market conditions, risks

inherent in agriculture, the uncertainty of future profitability

and the uncertainty of access to additional capital. Additional

information regarding the material factors and assumptions that

were applied in making these forward looking statements as well as

the various risks and uncertainties we face are described in

greater detail in the "Risk Factors" section of our annual and

interim Management's Discussion and Analysis of our financial

results and other continuous disclosure documents and financial

statements we file with the Canadian securities regulatory

authorities which are available at www.sedar.com. The Company

undertakes no obligation to update this forward-looking information

except as required by applicable law. The Company relies on

litigation protection for forward looking

statements.

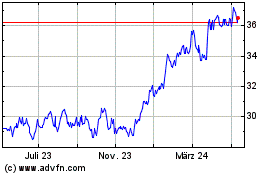

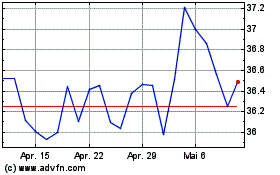

TMX (TSX:X)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

TMX (TSX:X)

Historical Stock Chart

Von Dez 2023 bis Dez 2024