Tidewater Midstream and Infrastructure Ltd. Announces Closing of Deep Basin and Montney Acquisition, Provides Update on BRC E...

22 Dezember 2017 - 1:34AM

THIS RELEASE IS INTENDED FOR

DISTRIBUTION OUTSIDE THE UNITED STATES ONLY AND IS NOT AUTHORIZED

FOR DISTRIBUTION WITHIN THE UNITED STATES

Closing of Deep Basin and Montney

Acquisition

Tidewater Midstream and Infrastructure Ltd.

(“Tidewater” or the “Corporation”) (TSX:TWM) is pleased to announce

that it has completed its previously announced acquisition of

certain assets in the Deep Basin and Montney region for net cash

consideration of $34 million. Together with Tidewater’s

previously announced acquisition of a pipeline in the Wapiti

region, Tidewater’s key pieces of infrastructure acquired under

these two transactions include: an 85% working interest in a rail

connected 600 MMcf/d gas plant; a 25% operated working interest in

400 MMcf/d and 200 MMcf/d dehydration and compression facilities at

Stolberg and Brazeau, respectively; and, an operated working

interest in greater than 600 km of pipelines running from Narraway

and Wapiti and interconnecting to Ansell, Brazeau, Stolberg and

Ferrier, providing connectivity between Tidewater’s core Montney

and Deep Basin areas. An immaterial portion of the Deep Basin

and Montney assets is being held in escrow pending resolution of a

right of first refusal challenge.

BRC Expansion

Tidewater is pleased to announce that its 50

MMcf/d expansion at the Brazeau River Complex (“BRC”) and the

construction of strategic pipelines from the BRC were completed

on-time and on-budget at a combined capital cost of approximately

$25 million. The pipelines provide access to a new core area

for the BRC which is supported by a 55,000 acre reserve dedication

and a three to four horizontal well drilling commitment.

Run-Rate Adjusted EBITDA

Guidance

Tidewater remains on-time and on-budget on its

previously announced 2017 capital program and the EBITDA generated

from these capital projects is expected to be in-line with previous

guidance. Tidewater reaffirms that it plans to exit 2017 with

annualized run-rate Adjusted EBITDA of approximately $80

million.

The Corporation's Business

Tidewater is traded on the TSX under the symbol

“TWM”. Tidewater’s business objective is to build a diversified

midstream and infrastructure company in the North American natural

gas and natural gas liquids (“NGL”) space. Its strategy is to

profitably grow and create shareholder value through the

acquisition and development of oil and gas infrastructure.

Tidewater plans to achieve its business objective by providing

customers with a full service, vertically integrated value chain

through the acquisition and development of oil and gas

infrastructure including: gas plants, pipelines, railcars, trucks,

export terminals and storage facilities.

Cautionary Notes

Advisory Regarding Forward-Looking

Statements

This news release contains forward-looking

statements within the meaning of applicable securities laws.

In particular, this news release contains forward-looking

statements with respect to Tidewater's anticipated 2017 exit

annualized run-rate Adjusted EBITDA. Although Tidewater

believes that the expectations reflected in such forward-looking

statements are reasonable, undue reliance should not be placed on

them because Tidewater can give no assurance that such expectations

will prove to be correct. Assumptions have been made with

respect to, among other things, general economic and market

conditions. Factors that could cause actual results to differ

materially from those set forth in the forward looking statements

include, among other things, general economic and market

conditions, industry conditions, market and commodity price

volatility and Tidewater's financial and operational performance

and results. Tidewater undertakes no obligation to update the

forward-looking statements herein except as required by applicable

laws.

Non-GAAP Financial Measures

This press release refers to “EBITDA” and

“Adjusted EBITDA” which do not have any standardized meaning

prescribed by generally accepted accounting principles in Canada

(“GAAP”). EBITDA is calculated as income or loss before

interest, taxes, depreciation and amortization. Adjusted

EBITDA is calculated as EBITDA adjusted for incentive compensation,

unrealized gains/losses, non-cash items, transaction costs and

items that are considered non-recurring in nature.

Tidewater Management believes that EBITDA and

Adjusted EBITDA provide useful information to investors as they

provide an indication of results generated from the Corporation’s

operating activities prior to financing, taxation and

non-recurring/non-cash impairment charges occurring outside the

normal course of business. Management utilizes Adjusted

EBITDA to set objectives and as a key performance indicator of the

Corporation’s success. In addition to its use by Management,

Tidewater also believes Adjusted EBITDA is a measure widely used by

security analysts, investors and others to evaluate the financial

performance of the Corporation and other companies in the midstream

industry. Investors should be cautioned that EBITDA and

Adjusted EBITDA should not be construed as alternatives to

earnings, cash flow from operating activities or other measures of

financial results determined in accordance with GAAP as an

indicator of the Corporation’s performance and may not be

comparable to companies with similar calculations.

For more information with respect to financial

measures which have not been defined by GAAP, including

reconciliations to the closest comparable GAAP measure, see the

“Non-GAAP and Additional Measures” section of Tidewater’s most

recent MD&A which is available on SEDAR.

Tidewater Midstream & Infrastructure Ltd.

Joel MacLeod

Chairman, President and CEO

587.475.0210

jmacleod@tidewatermidstream.com

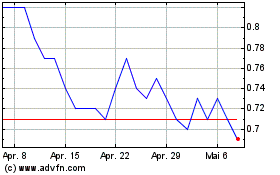

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

Von Feb 2024 bis Feb 2025