TC Energy completes the sale of Portland Natural Gas Transmission System

15 August 2024 - 11:00PM

News Release – TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or

the Company) and its partner Northern New England Investment

Company, Inc., a subsidiary of Énergir L.P. (Énergir), today

announced the successful completion of the sale of Portland Natural

Gas Transmission System (PNGTS). The gross purchase price of

US$1.14 billion includes US$250 million of outstanding Senior

Notes held at PNGTS and consolidated on TC Energy’s balance

sheet, assumed by the buyers.

“Completing this transaction demonstrates continued progress

towards delivering on $3 billion in asset divestitures and

enhancing our balance sheet strength,” said François Poirier, TC

Energy’s President and Chief Executive Officer. “We remain focused

on reaching our 4.75 times debt-to-EBITDA upper limit by year-end,

and today’s announcement takes us one step closer to achieving this

goal.”

Cash proceeds will be split pro-rata according to the PNGTS

ownership interests prior to the sale (TC Energy 61.7 per cent,

Énergir 38.3 per cent). TC Energy is providing customary transition

services and will continue to work jointly with the buyers to

ensure the safe and orderly transition of this critical natural gas

system.

About TC EnergyWe’re a team of 7,000+ energy

problem solvers working to safely move, generate and store the

energy North America relies on. Today, we’re delivering solutions

to the world’s toughest energy challenges – from innovating to

deliver the natural gas that feeds LNG to global markets, to

working to reduce emissions from our assets, to partnering with our

neighbours, customers and governments to build the energy system of

the future. It’s all part of how we continue to deliver sustainable

returns for our investors and create value for communities.

TC Energy’s common shares trade on the Toronto (TSX) and New

York (NYSE) stock exchanges under the symbol TRP. To learn more,

visit us at TCEnergy.com.

FORWARD-LOOKING INFORMATIONThis release

contains certain information that is forward-looking and is subject

to important risks and uncertainties (such statements are usually

accompanied by words such as "anticipate", "expect", "believe",

"may", "will", "should", "estimate", "intend" or other similar

words). Forward-looking statements in this document are intended to

provide TC Energy security holders and potential investors with

information regarding TC Energy and its subsidiaries, including

management's assessment of TC Energy's and its subsidiaries' future

plans and financial outlook. All forward-looking statements reflect

TC Energy's beliefs and assumptions based on information available

at the time the statements were made and as such are not guarantees

of future performance. As actual results could vary significantly

from the forward-looking information, you should not put undue

reliance on forward-looking information and should not use

future-oriented information or financial outlooks for anything

other than their intended purpose. We do not update our

forward-looking information due to new information or future

events, unless we are required to by law. For additional

information on the assumptions made, and the risks and

uncertainties which could cause actual results to differ from the

anticipated results, refer to the most recent Quarterly Report to

Shareholders and Annual Report filed under TC Energy’s profile on

SEDAR+ at www.sedarplus.ca and with the U.S. Securities and

Exchange Commission at www.sec.gov.

Non-GAAP Measures This release contains

references to debt-to-EBITDA which is a non-GAAP ratio which is

calculated using adjusted debt and adjusted comparable EBITDA, both

of which are non-GAAP measures. We believe debt-to-EBITDA ratios

provide investors with a useful credit measure as they reflect our

ability to service our debt and other long-term commitments. These

non-GAAP measures do not have any standardized meaning as

prescribed by GAAP and therefore may not be comparable to similar

measures presented by other entities. These non-GAAP measures are

calculated by adjusting certain GAAP measures for specific items we

believe are significant but not reflective of our underlying

operations in the period. These comparable measures are calculated

on a consistent basis from period to period and are adjusted for

specific items in each period, as applicable except as otherwise

described in the Condensed consolidated financial statements and

MD&A.

Comparable EBITDA for Portland Natural Gas Transmission System

for the years ended December 31, 2023 and 2022 was US$104 million

and US$101 million, respectively. Comparable EBITDA for our U.S.

Natural Gas Pipelines segment for the years ended December 31, 2023

and 2022 was US$3.248 billion and US$3.142 billion, respectively.

Segmented earnings for our U.S. Natural Gas Pipelines segment for

the years ended December 31, 2023 and 2022 were $3.531 billion and

$2.617 billion, respectively. For reconciliations of comparable

EBITDA to segmented earnings for our U.S. Natural Gas Pipelines

segment for the years ended December 31, 2023 and 2022, refer to

pages 21, 50 and the Non-GAAP measures section of our management’s

discussion and analysis for the year ended December 31, 2023 (the

MD&A), which sections of the MD&A are incorporated by

reference herein. The MD&A can be found on SEDAR+

(www.sedarplus.ca) under TC Energy's profile.

Adjusted debt is defined as the sum of Reported total debt,

including Notes payable, Long-Term Debt, Current portion of

long-term debt and Junior Subordinated Notes, as reported on our

Consolidated balance sheet as well as Operating lease liabilities

recognized on our Consolidated balance sheet and 50 per cent of

Preferred Shares as reported on our Consolidated balance sheet due

to the debt-like nature of their contractual and financial

obligations, less Cash and cash equivalents as reported on our

Consolidated balance sheet and 50 per cent of Junior Subordinated

Notes as reported on our Consolidated balance sheet due to the

equity-like nature of their contractual and financial

obligations.

Adjusted comparable EBITDA is calculated as comparable EBITDA

excluding Operating lease costs recorded in Plant operating costs

and other in our Consolidated statement of income and adjusted for

Distributions received in excess of income from equity investments

as reported in our Consolidated statement of cash flows which is

more reflective of the cash flows available to TC Energy to service

our debt and other long-term commitments.

See the following “Reconciliation” section for reconciliation of

adjusted debt and adjusted comparable EBITDA for the years ended

2023 and 2022.

ReconciliationThe following is a reconciliation

of adjusted debt and adjusted comparable EBITDAi.

|

|

Year endedDecember 31 |

|

(millions of Canadian $) |

2023 |

|

2022 |

|

|

Reported total debt |

63,201 |

|

58,300 |

|

|

Management adjustments: |

|

|

|

Debt treatment of preferred sharesii |

1,250 |

|

1,250 |

|

|

Equity treatment of junior subordinated notesiii |

(5,144 |

) |

(5,248 |

) |

|

Cash and cash equivalents |

(3,678 |

) |

(620 |

) |

|

Operating lease liabilities |

459 |

|

433 |

|

|

Adjusted debt |

56,088 |

|

54,115 |

|

|

|

|

|

|

Comparable EBITDAiv |

10,988 |

|

9,901 |

|

|

Operating lease cost |

118 |

|

106 |

|

|

Distributions received in excess of (income) loss from equity

investments |

(123 |

) |

(29 |

) |

|

Adjusted Comparable EBITDA |

10,983 |

|

9,978 |

|

|

|

|

|

|

Adjusted Debt-to-Adjusted Comparable

EBITDAi |

5.1 |

|

5.4 |

|

i Adjusted debt and adjusted comparable EBITDA are non-GAAP

financial measures. Management methodology. Individual rating

agency calculations will differ. ii 50 per cent debt treatment on

$2.5 billion of preferred shares as of December 31, 2023. iii 50

per cent equity treatment on $10.3 billion of junior subordinated

notes as of December 31, 2023. U.S. dollar-denominated notes

translated at December 31, 2023, U.S./Canada foreign exchange rate

of 1.32. iv Comparable EBITDA is a non-GAAP financial measure. See

the Forward-looking information and Non-GAAP measures sections for

more information.

-30-

Media Inquiries:Media

Relationsmedia@tcenergy.com 403-920-7859 or 800-608-7859

Investor & Analyst Inquiries:Gavin Wylie /

Hunter Mauinvestor_relations@tcenergy.com403-920-7911 or

800-361-6522

PDF

available: http://ml.globenewswire.com/Resource/Download/f350d8e7-7527-4888-ad54-5dd3a595bc8c

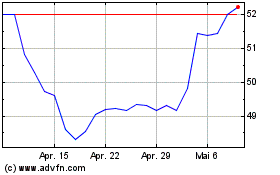

TC Energy (TSX:TRP)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

TC Energy (TSX:TRP)

Historical Stock Chart

Von Nov 2023 bis Nov 2024