NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES OR ITS POSSESSIONS. ANY FAILURE TO COMPLY WITH THIS RESTRICTION

MAY CONSTITUTE A VIOLATION OF U.S. SECURITIES LAW.

Northland Power Inc. ("Northland" or "the Company")

(TSX:NPI)(TSX:NPI.PR.A)(TSX:NPI.PR.C)(TSX:NPI.DB.A)(TSX:NPI.DB.B)

First Quarter Highlights:

-- 87% increase in quarterly adjusted EBITDA from 2013;

-- 87% increase in quarterly free cash flow from 2013;

-- Began commercial operations on two additional 10 MW ground-mounted solar

projects, bringing the total solar operations to 80 MW;

-- Decreased quarterly payout ratio to 49% of free cash flow (63% excluding

the effect of dividends reinvested through the Dividend Reinvestment

Plan), compared to 75% in the first quarter of 2013;

-- Successfully completed offering and placement of $286.3 million to be

used to fund Project Gemini; and

-- Announced the addition of Sean Durfy, former CEO of WestJet, to its

executive team as President and Chief Development Officer.

Northland reported its financial results today for the quarter ended March 31,

2014.

"2014 is off to a very strong start," said John Brace, Chief Executive Officer.

"Our performance this quarter again demonstrates our proficiency in delivering

robust financial results while achieving substantial growth targets. Our

adjusted EBITDA and free cash flow have grown by 87% over last year following

the commissioning of North Battleford and the first two phases of our

ground-mounted solar facilities. Our portfolio of long-term contracted renewable

energy assets continues to expand with the completion of two additional

ground-mounted solar projects and the McLean's Mountain wind project. As we move

forward on Gemini, our biggest project yet, the addition of Sean Durfy to our

executive team positions us well for the significant growth ahead. We remain

focused on delivering value to our shareholders now and into the future through

a business strategy that is both measured and progressive."

Subsequent Events

McLean's Mountain Achieves Commercial Operations

On May 1, 2014, Northland's 60 MW (30 MW net interest) McLean's Mountain wind

project located on Manitoulin Island, Ontario, declared commercial operations.

The project was completed on time and on budget and has a 20-year power purchase

agreement (PPA) with the Ontario Power Authority (OPA) under Ontario's renewable

energy Feed-In-Tariff Program.

$240 million Solar Financing

On April 24, 2013, Northland completed $240 million of non-recourse project

financing for the five remaining ground-mounted solar projects ("Cluster 4")

with a syndicate of banks based on an 18-year amortization period.

Sale of Wood Chipping Facility

Northland sold its wood chipping facility in British Columbia for $0.8 million

on April 23, 2014.

Gemini

Project Gemini, the 600 MW offshore wind project in the North Sea, with a

estimated capital cost of EUR2.8 billion continued to make significant progress;

in April 2014, Northland received final board approval to proceed with its

equity investment, sub-debt investment, its share purchase for its 60% interest

in the project, and for certain early capital expenditures for longer lead time

items on the project. As of the date hereof, $167 million has been funded by

Northland for the share purchase and advancement of capital expenditures and

EUR24 million in letters of credit have been provided that will be returned upon

the project reaching financial close. All amounts funded or expected to be

funded for Project Gemini will be sourced from previous capital raises, the term

facility and cash on hand.

The project is also nearing completion of its approximately EUR2 billion

non-recourse project financing with a consortium of creditors including major

international lenders, export credit and other governmental agencies, and

subordinated debt. Management expects full financial close to be finalized

before the end of May 2014.

Northland entered into foreign exchange contracts with several members of its

corporate banking syndicate to effectively fix the foreign exchange conversion

rate at an average of $1.65 CAD:EURO on a portion of its projected

EURO-denominated cash inflows from Project Gemini.

Short Form Prospectus

On April 21, 2014, Northland renewed its existing short form base shelf

prospectus that was set to expire at the end of April. This will enable

Northland to offer an aggregate of up to $500 million of securities to assist in

maintaining financial flexibility and providing an efficient access to the

Canadian capital markets when capital is required.

Summary of Financial Results

----------------------------------------------------------------------------

Three Months Ended March 31

2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FINANCIAL (in thousands of dollars, except per share and

energy unit amounts)

Sales 229,424 106,134

Gross profit 133,438 67,984

Adjusted EBITDA(1) 102,097 54,565

Operating income 84,009 37,370

Net income 28,576 23,617

Free cash flow(1) 56,752 30,418

Cash dividends paid to Common and Class A

Shareholders 27,617 22,682

Total dividends declared to Common and Class A

Shareholders(2) 37,182 31,483

Per Share

Free cash flow 0.413 0.261

Dividends declared to Shareholders(2) 0.270 0.270

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Energy Volumes

Electricity sales volume (megawatt hours) 1,490,615 978,036

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) See "Non-IFRS measures" for a detailed description.

(2) Total dividends to Common and Class A Shareholders represent cash

dividends plus share dividends issued as part of Northland's dividend

reinvestment plan.

First Quarter Results

Northland's consolidated sales, adjusted earnings before interest, taxes,

depreciation and amortization ("adjusted EBITDA") and operating income for the

three months ending March 31, 2014 were significantly higher than the same

period of 2013. Major variances at Northland facilities compared to the first

quarter of 2013 are discussed below.

Adjusted EBITDA

Northland's consolidated adjusted EBITDA for the first quarter of 2014 of $102.1

million was $47.5 million or 87% higher than the prior year primarily due to:

(i) a $36.1 million contribution from North Battleford and the Ground-mounted

Solar Phase I and II projects, which were not operational at this time last

year; (ii) $11.7 million from Northland's existing thermal and wind facilities,

largely due to favourable wind conditions and $9.5 million of natural gas resale

profits; and (iii) $5.3 million of additional performance and management fees

from Kirkland Lake and Cochrane (Northland was not entitled to performance fees

from Cochrane at this time last year). Offsetting these favourable variances

were: (i) a $5.2 million write- off of deferred development costs; and (ii) $0.4

million of higher corporate costs.

Free Cash Flow, Payout Ratio and Dividends to Shareholders

Free cash flow for the quarter of $56.8 million was $26.3 million (87%) higher

than the same period in 2013; significant factors increasing and decreasing free

cash flow in 2014 are described below.

Factors increasing free cash flow in the first quarter of 2014 over the same

quarter of 2013:

-- $47.9 million higher adjusted EBITDA from Northland's operating

facilities;

-- $6 million increase in adjusted EBITDA generated from Northland's

managed and other facilities;

-- $0.3 million positive variance associated with Kingston and North

Battleford payments to General Electric related to their gas turbine

maintenance contracts; and

-- $0.7 million favourable increase in non-cash items.

Factors decreasing free cash flow in the first quarter of 2014 over the same

quarter of 2013 were:

-- $13.8 million net interest expense increase primarily due to the

inclusion of North Battleford and Ground-mounted Solar Phase I and II

debt;

-- $6.7 million increase in scheduled debt repayments as a result of

including North Battleford and Ground-mounted Solar Phase I projects;

-- $5.2 million write-off of deferred development costs related to

Northland's Kabinakagami project;

-- $1 million increase in funds set aside for future major maintenance;

-- $0.7 million decrease in other income;

-- $0.4 million increase in corporate general and administration costs;

-- $0.6 million negative variance related to funds that were set aside in

2012 pending the closing of the British Columbia wind development

assets; and

-- $0.2 million increase in current income taxes and other miscellaneous

items.

For the three months ending March 31, 2014, Northland's dividend payout ratio

was 49% of free cash flow or 63% if all dividends were paid out in cash (i.e.

excluding the effect of dividends reinvested through the Dividend Reinvestment

Plan (DRIP)) compared to 75% and 103%, respectively in 2013.

Net income

Net income for the first quarter of 2014 at $28.6 million exceeded the prior

year due to higher adjusted EBITDA, partially offset by higher finance costs, a

fair value loss on derivative contracts and higher current and deferred income

taxes.

Outlook

During the first three months of 2014 and through the date of this release,

Northland continued to execute its strategy of expanding its earlier-stage

development pipeline in its targeted traditional Canadian market, as well as

increased activity in other jurisdictions that meet the Company's investment

criteria. A number of opportunities in these jurisdictions have been identified

and are in addition to several projects Northland already has under development.

Northland's approach continues to be one of ensuring a balance between advancing

development opportunities that meet the Company's investment criteria, while

prudently managing the Company's cost exposure to earlier-stage projects.

In 2014, management continues to expect Northland to generate adjusted EBITDA of

approximately $345 to $355 million.

Management continues to expect adjusted EBITDA of $380 to $400 million in 2015

based on the current completion schedules for Northland's projects with power

contracts.

Northland's 2014 dividend payments, on a total dividend basis, are expected to

exceed free cash flow due largely to the level of spending on growth initiatives

and payments of dividends and interest on capital raised for construction

projects for which corresponding cash flows will not be received until the

projects for which the capital is raised are completed. For 2014, management

continues to expect cash dividends to be 75-85% of free cash flow, including the

impact of reinvested dividends through the DRIP, and 105-120% of free cash flow

excluding the impact of reinvested dividends through the DRIP. Prior to its

investment in Project Gemini, management expected the dividend payout ratio to

drop below 100% in 2014 on a total dividend basis, based on the successful

conclusion of a period of significant growth and capital expenditures for

Northland. Due to the significant capital costs for Northland's investment in

Project Gemini, additional corporate capital has been raised in 2014 to fund the

project, and as a result the payout ratio may exceed 100% until Project Gemini

is completed in 2017. Northland has sufficient liquidity to bridge the payout of

the current dividend in excess of free cash flow during this period. Management

expects the payout ratio during Project Gemini's construction to be

significantly lower than during the growth period experienced by Northland from

2009 to 2013.

Northland's Board and management are committed to maintaining the current

monthly dividend of $0.09 per share ($1.08 per share on an annual basis).

Northland's management and Board have anticipated the impact of growth on the

payout ratio and are confident that Northland has adequate access to funds to

meet its dividend commitment, including operating cash flows, cash and cash

equivalents on hand and, if necessary, use of its line of credit or external

financing. Management expects to continue its DRIP to provide an additional

source of liquidity.

Non-IFRS Measures

This press release includes references to Northland's free cash flow and

adjusted EBITDA which are not measures prescribed by International Financial

Reporting Standards (IFRS). Free cash flow and adjusted EBITDA, as presented,

may not be comparable to similar measures presented by other companies. These

measures should not be considered alternatives to net income, cash flow from

operating activities or other measures of financial performance calculated in

accordance with IFRS. Rather, these measures are provided to complement IFRS

measures in the analysis of Northland's results of operations from management's

perspective. Management believes that free cash flow and adjusted EBITDA are

widely accepted financial indicators used by investors to assess the performance

of a company and its ability to generate cash through operations.

Earnings Conference Call

Northland will hold an earnings conference call on May 13th at 10:00 a.m. EDT to

discuss its first quarter financial results. John Brace, Northland's Chief

Executive Officer and Paul Bradley, Northland's Chief Financial Officer will

discuss the financial results and company developments before opening the call

to questions from analysts and members of the media.

Conference call details are as follows:

Date: Tuesday, May 13, 2014

Start Time: 10:00 a.m. EDT

Phone Number: Toll free within North America: 1-800-732-6870 or Local: 416-

981-9007

For those unable to attend the live call, an audio recording will be available

on Northland's website at (www.northlandpower.ca) from the afternoon of May 13

until May 27, 2014.

ABOUT NORTHLAND

Northland is an independent power producer founded in 1987, and publicly traded

since 1997. Northland develops, builds, owns and operates facilities that

produce 'clean' (natural gas) and 'green' (wind, solar, and hydro) energy,

providing sustainable long-term value to shareholders, stakeholders, and host

communities.

The company owns or has a net economic interest in 1,379 MW of operating

generating capacity, with an additional 50 MW of generating capacity currently

in construction, and another 750 MW (439 MW net to Northland) of wind and solar

projects with awarded power contracts. The above includes Northland's majority

equity stake in Gemini, a 600 MW (360 MW net to Northland) of offshore wind

project in the North Sea. Northland's cash flows are diversified over five

geographically separate regions and regulatory jurisdictions in Canada, Europe

and the United States.

Northland's common shares, Series 1 and Series 3 preferred shares and

convertible debentures trade on the Toronto Stock Exchange under the symbols

NPI, NPI.PR.A, NPI.PR.C, NPI.DB.A and NPI.DB.B, respectively.

FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements which are provided for

the purpose of presenting information about management's current expectations

and plans. Readers are cautioned that such statements may not be appropriate for

other purposes. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or conditions, or

include words such as "expects," "anticipates," "plans," "believes,"

"estimates," "intends," "targets," "projects," "forecasts" or negative versions

thereof and other similar expressions, or future or conditional verbs such as

"may," "will," "should," "would" and "could." These statements may include,

without limitation, statements regarding plans for raising capital. These

statements are based upon certain material factors or assumptions that were

applied in developing the forward-looking statements, including management's

current plans, its perception of historical trends, current conditions and

expected future developments, as well as other factors that are believed to be

appropriate in the circumstances. Although these forward-looking statements are

based upon management's current reasonable expectations and assumptions, they

are subject to numerous risks and uncertainties. Some of the factors that could

cause results or events to differ from current expectations include, but are not

limited to, operational risks, foreign exchange rates, regulatory risks, and the

variability of revenues from generating facilities powered by intermittent

renewable resources and the other factors described in the "Risks and

Uncertainties" section of Northland's 2013 Annual Report and Annual Information

Form, both of which can be found at www.sedar.com under Northland's profile and

on Northland's website www.northlandpower.ca. Northland's actual results could

differ materially from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurances can be given that any of the events

anticipated by the forward-looking statements will transpire or occur.

The forward-looking statements contained in this release are based on

assumptions that were considered reasonable on May 12, 2014. Other than as

specifically required by law, Northland undertakes no obligation to update any

forward-looking statements to reflect events or circumstances after such date or

to reflect the occurrence of unanticipated events, whether as a result of new

information, future events or results, or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Northland Power Inc.

Barb Bokla

Manager, Investor Relations

647-288-1438

investorrelations@northlandpower.ca

Northland Power Inc.

Adam Beaumont

Director of Finance

647-288-1929

(416) 962-6266 (FAX)

www.northlandpower.ca

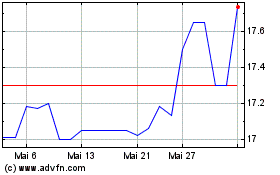

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024