Not for distribution to U.S. newswire services or for dissemination in the

United States or its possessions. Any failure to comply with this restriction

may constitute a violation of U.S. securities law.

Northland Power Inc. ("Northland" or the "Company") (TSX:NPI) (TSX:NPI.PR.A)

(TSX:NPI.PR.C) (TSX:NPI.DB.A)

Highlights

-- Strong financial results for quarter:

-- Quarterly adjusted EBITDA increased by 101% from $37.6 million in

2012 to $75.7 million in 2013, primarily due to contributions from

newly operating North Battleford and ground-mounted solar

facilities;

-- Quarterly free cash flow increased by 550% over same period 2012;

from $6 million to $39 million, commensurate with the higher

adjusted EBITDA;

-- The quarterly payout ratio was 63% of free cash flow (84% excluding

the effect of dividends re-invested through the Dividend

Reinvestment Plan);

-- Announced project Gemini, a 600 MW offshore wind power generation

project currently in advanced development, for which Northland has the

rights to acquire a majority (55%) equity stake. The project has already

achieved significant development milestones;

-- Completed construction on two more ground-mounted solar facilities; and

-- Successfully completed approximately $900 million of project financings.

Northland reported its financial results today for the quarter ended September

30, 2013. The complete third quarter report for 2013, including management's

discussion and analysis and unaudited interim condensed consolidated financial

statements, is available at www.sedar.com under Northland's profile and

www.northlandpower.ca.

"We are continuing to deliver on our commitments by generating strong results

across our increasingly diverse operating portfolio, which now includes six

ground-mounted solar projects in Ontario," said John Brace, President and CEO.

"We are seeing the positive results from our development and construction

pipelines. Our third quarter results demonstrate that we are well-positioned to

deliver a stable dividend to our shareholders while continuing our growth

trajectory. Our projects under construction and in advanced development are

progressing as expected and we are making progress towards finalizing

development of the Gemini offshore wind project."

Summary of Financial Results

----------------------------------------------------------------------------

3 Months Ended 9 Months Ended

Sept. 30 Sept. 30

2013 2012 2013 2012

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FINANCIAL (in thousands of dollars,

except per share and energy unit

amounts)

Sales 152,373 82,689 382,907 268,505

Gross profit 99,632 49,971 241,395 170,206

Adjusted EBITDA(1) 75,681 37,575 180,310 135,158

Operating income 51,240 21,181 121,365 85,881

Net income (loss) 41,265 (22,158) 145,011 (7,375)

Free cash flow(1) 39,654 5,709 92,049 45,990

Cash Dividends paid to Common and

Class A Shareholders (2) 25,087 22,613 71,523 66,276

Total Dividends declared to Common

and Class A Shareholders(2) 34,241 31,074 97,442 92,602

Per Share

Free cash flow 0.320 0.050 0.768 0.402

Dividends declared to

Shareholders(2) 0.270 0.270 0.810 0.810

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Energy Volumes

Electricity sales volume (megawatt

hours) 1,075,512 755,058 2,786,5532,361,588

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) See "Non-IFRS measures" for a detailed description. Adjusted EBITDA was

previously reported as EBITDA.

(2) Total dividends to Common and Class A Shareholders represent cash

dividends plus share dividends issued as part of Northland's dividend

reinvestment plan.

Significant Events

On August 1, 2013, Northland announced that it had entered into agreements for

the rights to acquire a majority equity stake in a consortium which owns Gemini,

a 600 MW offshore wind project currently in advanced development located 85

kilometres off the coast of the Netherlands in the North Sea.

Gemini's total cost is projected to be approximately EUR2.8 billion and is

expected to be funded from a combination of non-recourse project debt, mezzanine

financing and equity from the consortium. Northland, and Gemini's other equity

investors, including Siemens (20%), Van Oord (10%), NV HVC (10%) and Typhoon

Offshore (5%), are working to obtain financing terms from major international

lenders, export credit and other governmental agencies, and pension funds.

Northland's investment in Gemini will consist of funding its pro-rata share of

the equity and possibly an investment in the project's mezzanine financing.

Northland's total investment is expected to be between $350 and $460 million,

depending on the amount of the project's mezzanine financing supplied by

Northland. After deducting net proceeds from revenues during construction and

term loans for parts of the project that will be settled at commercial

operations, Northland's net equity investment is expected to be in the range of

$180 to $290 million, depending on the amount of mezzanine financing supplied by

Northland. As previously stated, approximately $55 million has already been

raised by the financing of the company's North Battleford project in September.

Potential sources for the remaining amount are Northland's corporate line of

credit, the issuance of preferred shares, convertible debentures and/or common

shares. Management's objective is to minimize the amount of dilutive equity

raised while prudently maintaining healthy credit metrics. Additional

information regarding Northland's investment and the sources of capital are

further enumerated in Northland's September 2013 Investor Day materials.

Development on Gemini is progressing well and according to schedule.

Approximately thirty commercial banks have expressed serious interest and are

expected to seek credit approval for the senior debt financing. Project Gemini

remains on track to close financing in the first half of 2014.

On August 22, 2013, Northland announced that as a result of the successful

completion of the North Battleford project and the majority of the

Ground-mounted solar Phase I projects, all of the remaining 4,289,808 Class C

Convertible Shares ("Class C Shares") and all of the 8,067,723 Class B

Convertible Shares ("Class B Shares") were converted to Class A Shares and were

subsequently converted into the equivalent number of common shares of Northland.

Additionally, all of Northland's remaining Replacement Rights were converted

into common shares pursuant to the terms of those securities.

On September 20, 2013, Northland's wholly owned subsidiary, North Battleford

Power L.P., issued $667.3 million of 4.958% senior secured amortizing Series A

bonds. The bonds were rated A (low) by Dominion Bond Rating Service and will be

fully amortized by their maturity in December 2032. The net proceeds were

predominately used to repay North Battleford's existing bank debt and settle the

associated interest rate swaps, with the remainder used for general corporate

purposes.

During the quarter, two more of Northland's 13 ground-mounted solar projects

achieved commercial operations within budget; one on July 27, 2013 and the other

on September 23, 2013, completing phase I of Northland's ground-mounted solar

portfolio. Northland now has six ground-mounted solar projects in operations. On

September 24, 2013, Northland completed $84 million of non-recourse project

financing with a syndicate of banks for two of the three projects in phase II.

The third project in phase II is expected to be financed in the near future. The

all-in rate including interest rate swaps and credit spreads is 5.735%.

On September 21, 2013, Northland, with deep regret, announced the sudden passing

of Pierre R. Gloutney, a member of Northland's Board of Directors and Chairman

of the Audit Committee. Mr. Gloutney had served on the Board since the inception

of the Northland Power Income Fund in 1997. He worked extensively in the stock

and commodity sectors for 40 years, retiring as CEO from MF Global Canada in

2008. After his retirement, Pierre continued to provide significant wisdom and

valuable contributions to the Board of Directors.

V. Peter Harder, a member of the Audit Committee since 2010, has assumed

Pierre's position as Chairman of the Audit Committee.

Subsequent Events

On October 1, 2013, Northland's subsidiary, McLean's Mountain Wind Limited

Partnership, entered into a non-recourse credit facility with a syndicate of

institutional lenders for a $135 million senior secured construction and term

loan. The senior debt will be repaid through quarterly blended payments of

principal and interest starting on March 31, 2017 until maturity on March 31,

2034, with the principal payments fully amortizing the loan over this period.

Concurrent with the financing, Northland transferred 50% of the McLean's

Mountain Wind Limited Partnership ownership to the United Chiefs and Councils of

Mnidoo Mnising First Nations.

Financial Highlights

Northland's consolidated financials for the third quarter include the results

for Kirkland Lake, Cochrane and Canadian Environmental Energy Corporation (CEEC)

following Northland's April 1, 2013 acquisition of the controlling interest in

CEEC. Kirkland Lake and Cochrane fees and dividends earned by Northland

following the acquisition are considered intercompany amounts and eliminate on

consolidation. However, in the calculation of adjusted earnings before interest,

taxes, depreciation and amortization ("adjusted EBITDA") and free cash flow,

Northland includes the fees and dividends earned rather than all adjusted EBITDA

and free cash flow generated by these entities.

Third Quarter Results

Net income for the third quarter of 2013 at $41.3 million was $63.4 million

higher than the same period last year. The following section describes

significant factors contributing to this change:

Total Sales, cost of sales and plant operating costs all increased largely due

to the inclusion of North Battleford, the Ground-mounted Solar Phase I projects,

and consolidation of results from the Kirkland Lake and Cochrane facilities.

Other sales, which include management and incentive fees earned from services

provided to Cochrane and Kirkland Lake, decreased $2.9 million from the third

quarter of 2012, as they are now considered intercompany and eliminated on

consolidation.

Corporate management and administration expenditures increased $0.7 million from

the prior year largely due to expanded development activities.

Finance lease income was in line with the same period of 2012. As described in

Northland's 2012 Annual Report, Spy Hill's long-term power purchase agreement

(PPA) with SaskPower is considered a finance lease for accounting purposes. As a

result, the monthly availability payments from SaskPower are treated as lease

income, while electricity sales are recognized in sales revenue. The accounting

treatment of Spy Hill's PPA as a finance lease has no impact on Northland's

adjusted EBITDA or free cash flow.

Net finance costs, primarily interest expense, increased by $11.2 million from

the prior year due to the inclusion of interest on North Battleford and

Ground-mounted Solar Phase I project debt, partially offset by the replacement

of Spy Hill's bank debt with project bonds and repayment of Kingston's term loan

in late January 2013, and lower convertible debenture interest due to

conversions of debentures into common shares.

Amortization of contracts and other intangible assets of $5.1 million were

higher than the same period last year due to the CEEC acquisition on April 1,

2013.

Non-cash fair value gains of $29.7 million (compared to a $24.6 million loss in

2012) comprised: (i) a $13.2 million gain in the fair value of Northland's

financial derivative contracts; (ii) a $17.3 million decrease in the liability

associated with the fair value of Northland's Class B Shares; and (iii) $0.8

million in unrealized foreign exchange losses. Northland's policy is to hedge

interest rate and foreign exchange exposures where material. Changes in market

rates give rise to non-cash mark-to-market adjustments each quarter as a result

of Northland's accounting election to forego the application of hedge

accounting. These fair value adjustments are non-cash items that will reverse

over time, and have no impact on the cash obligations of Northland or its

projects.

The factors described above, combined with an $8.8 million provision for current

taxes and future income taxes, resulted in net income for the quarter of $41.3

million.

Adjusted earnings before interest, taxes, depreciation and amortization

Third quarter adjusted EBITDA was higher than the prior year largely due to the

inclusion of North Battleford and the operational Ground-mounted Solar Phase I

projects, overall favourable results from Northland's operating facilities,

partially offset by increased corporate management and administration costs, and

lower performance incentive fees earned from Kirkland Lake (which are not

eliminated for adjusted EBITDA and free cash flow purposes).

Year to Date

Sales and cost of sales were higher in the first nine months of 2013 compared to

the prior year and primarily reflect the inclusion of the financial results for

North Battleford, the Ground-mounted Solar Phase I facilities, Kirkland Lake and

Cochrane. Plant operating expenses were up largely due to the inclusion of the

entities described above. Management and administration costs increased from the

prior year largely due to additional development activities as previously

described.

For the year to date, Northland recorded $133.5 million in non-cash fair value

gains (compared to a $27.4 million loss in 2012) comprised of: (i) $103.8

million gain in the fair valued financial derivative contracts; (ii) a $27.8

million reduction in the liability associated with the fair value of Northland's

Class B Shares; and (iii) a $1.9 million unrealized foreign exchange gain on

Northland's foreign exchange contracts.

Dividends to Shareholders and Payout Ratio and Free Cash Flow

Free cash flow for the third quarter exceeded management's expectations and the

prior year by $33.9 million. Favourable changes from the same period for 2012

included: (i) a $38.1 million increase in adjusted EBITDA; (ii) a $2.9 million

favourable change in other liabilities associated with contracted gas turbine

maintenance milestone payments to General Electric and its subsidiaries; (iii) a

$5.6 million decrease in scheduled debt repayments as a result of the full

repayment of Kingston's debt in January 2013; and (iv) a $0.2 million decrease

in non-expansionary capital expenditures. Partially offsetting these favourable

increases were (i) a $11.1 million net interest expense increase primarily due

to the inclusion of North Battleford and Ground-mounted Solar Phase I; (ii) a

$1.7 million increase in funds set aside for future major maintenance and (iii)

$0.1 million increase in other miscellaneous items.

For 2013, Northland's dividend payout ratio in the third quarter was 63% of free

cash flow (84% excluding the effect of dividends re-invested through the

Dividend Reinvestment Plan (DRIP)) compared to 396% and 546%, respectively in

the third quarter of 2012.

Outlook

Northland actively pursues new power development opportunities that encompass a

range of clean technologies, including natural gas, wind, solar and hydro, to

provide a sustainable source of energy in various geographic regions and

political jurisdictions. Northland believes this diversified strategy will

mitigate the risk of adverse changes to local demographics or governmental

policies.

In the first nine months of 2013 and through the date of this report, Northland

continued to execute on its strategy of expanding its earlier-stage development

pipeline in its targeted traditional Canadian market as well as moving into the

US and other jurisdictions that meet the Company's investment criteria. A number

of opportunities have been identified and are being developed across all

technologies in Canada, the US and other markets. These new opportunities are in

addition to several projects Northland already has under development, such as

the Marmora pumped storage project in Ontario and the Queen's Quay combined heat

and power project in the GTA, wind and hydro projects in BC and wind projects in

Quebec. Northland's approach continues to be one of ensuring the balance between

progressing development opportunities which meet the Company's investment

criteria, while prudently managing the Company's cost exposure to earlier stage

projects.

In 2013, management continues to expect Northland to generate adjusted EBITDA of

approximately $245 to $255 million for the year. Management continues to expect

adjusted EBITDA of $380 to $400 million in 2015 based on all current

construction projects, the remaining solar projects and the Grand Bend project

being completed on the current schedules.

Northland's board and management are committed to maintaining the current

dividend of $1.08 per common share and Class A Share on an annual basis, payable

monthly. Excluding the effect of dividends re-invested through the DRIP,

Northland's 2013 dividend payments are expected to exceed free cash flow due

largely to the level of spending on growth initiatives and payments of dividends

on equity capital already raised for construction projects for which

corresponding cash flows will not be received until future years. Management

continues to expect the dividend payout ratio for the full fiscal 2013 year to

be 80-90% of free cash flow, and 105-115% excluding the effect of dividends

re-invested through the DRIP. Excluding the effect of dividends re-invested

through Northland's DRIP, management continues to expect the 2014 dividend

payout ratio to drop below 100%, however, dividend payments could exceed free

cash flow if significant additional equity investments are made as a result of

future development successes, such as the recently announced Gemini off-shore

wind development project. Northland's management has anticipated this and has

put in place various measures, including the DRIP and the $250 million credit

facility, to ensure there is sufficient liquidity to maintain the annual $1.08

dividend on common shares and Class A Shares.

Non-IFRS Measures

This press release includes references to Northland's free cash flow and

adjusted EBITDA (previously reported as EBITDA) which are not measures

prescribed by International Financial Reporting Standards (IFRS). Free cash flow

and adjusted EBITDA, as presented, may not be comparable to similar measures

presented by other companies. These measures should not be considered

alternatives to net income, cash flow from operating activities or other

measures of financial performance calculated in accordance with IFRS. Rather,

these measures are provided to complement IFRS measures in the analysis of

Northland's results of operations from management's perspective. Management

believes that free cash flow and adjusted EBITDA are widely accepted financial

indicators used by investors to assess the performance of a company and its

ability to generate cash through operations.

Earnings Conference Call

Northland will hold an earnings conference call on November 11 at 10:00 am EST

to discuss its third quarter financial results. John Brace, Northland's

President and Chief Executive Officer and Paul Bradley, Northland's Chief

Financial Officer will discuss the financial results and company developments

before opening the call to questions from analysts and members of the media.

Conference call details are as follows:

Date: Monday, November 11, 2013

Start Time: 10:00 a.m. EST

Phone Number: Toll free within North America: 1-800-709-0218 or Local: 416-641-6202

For those unable to attend the live call, an audio recording will be available

on Northland's website at (www.northlandpower.ca) from the afternoon of November

11 until November 26, 2013.

ABOUT NORTHLAND

Northland is an independent power producer founded in 1987, and publicly traded

since 1997. Northland produces 'clean' (natural gas) and 'green' (wind, solar,

and hydro) energy, providing sustainable long-term value to shareholders,

stakeholders, and host communities. The company owns or has a net economic

interest in 1,329 MW of operating generating capacity, with an additional 90 MW

(60 MW net to Northland) of generating capacity currently in construction, and

another 190 MW (119 MW net to Northland) of wind, solar and run-of-river hydro

projects with awarded power contracts. In addition, Northland has acquired the

rights to a majority equity stake in Gemini, a 600 MW offshore wind project

located 85 km off the coast of the Netherlands in the North Sea. Northland's

cash flows are diversified over five geographically separate regions and

regulatory jurisdictions in Canada, Europe and the United States.

Northland's common shares, Series 1 and Series 3 preferred shares and

convertible debentures trade on the Toronto Stock Exchange under the symbols

NPI, NPI.PR.A, NPI.PR.C and NPI.DB.A, respectively.

FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements which are provided for

the purpose of presenting information about management's current expectations

and plans. Readers are cautioned that such statements may not be appropriate for

other purposes. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or conditions, or

include words such as "expects," "anticipates," "plans," "believes,"

"estimates," "intends," "targets," "projects," "forecasts" or negative versions

thereof and other similar expressions, or future or conditional verbs such as

"may," "will," "should," "would" and "could." These statements may include,

without limitation, statements regarding future adjusted EBITDA, cash flows and

dividend payments, the construction, completion, attainment of commercial

operations, cost and output of development projects, plans for raising capital,

and the future operations, business, financial condition, financial results,

priorities, ongoing objectives, strategies and outlook of Northland and its

subsidiaries. These statements are based upon certain material factors or

assumptions that were applied in developing the forward-looking statements,

including the design specifications of development projects, the provisions of

contracts to which Northland or a subsidiary is a party, management's current

plans, its perception of historical trends, current conditions and expected

future developments, as well as other factors that are believed to be

appropriate in the circumstances. Although these forward-looking statements are

based upon management's current reasonable expectations and assumptions, they

are subject to numerous risks and uncertainties. Some of the factors that could

cause results or events to differ from current expectations include, but are not

limited to, construction risks, counterparty risks, operational risks, the

variability of revenues from generating facilities powered by intermittent

renewable resources and the other factors described in the "Risks and

Uncertainties" section of Northland's 2012 Annual Report and Annual Information

Form, both of which can be found at www.sedar.com under Northland's profile and

on Northland's website www.northlandpower.ca. Northland's actual results could

differ materially from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurances can be given that any of the events

anticipated by the forward-looking statements will transpire or occur.

The forward-looking statements contained in this release are based on

assumptions that were considered reasonable on November 8, 2013. Other than as

specifically required by law, Northland undertakes no obligation to update any

forward-looking statements to reflect events or circumstances after such date or

to reflect the occurrence of unanticipated events, whether as a result of new

information, future events or results, or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Northland Power Inc.

Barb Bokla

Manager, Investor Relations

647-288-1438

(416) 962-6266 (FAX)

investorrelations@northlandpower.ca

Northland Power Inc.

Adam Beaumont

Director of Finance

647-288-1929

(416) 962-6266 (FAX)

investorrelations@northlandpower.ca

www.northlandpower.ca

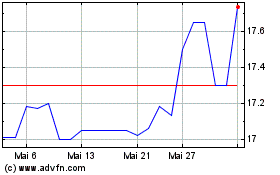

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024