Intermap Technologies (TSX: IMP; OTCQB: ITMSF) (“Intermap” or the

“Company”), a global leader in 3D geospatial products and

intelligence solutions, today announced 42% revenue growth in the

first quarter of 2024. For the period ending March 31, 2024, the

Company reported revenue of $1.7 million, compared with $1.2

million for the fourth quarter of 2023. Additionally, deferred

revenue increased by $2.6 million, driven primarily by the receipt

of initial payments from the Indonesian government. Adjusted for

upfront payments, which were invested to upgrade Intermap’s sensor,

processing and airborne platforms, revenue and incremental deferred

revenue of $2.6 million (totaling $4.3 million) was up 154%

compared with the first quarter of 2023. For IFRS reporting,

deferred revenue represents cash payments from customers that are

recognized in the P&L over time as program costs are incurred.

Intermap will be building world-class geospatial foundation data

for Indonesia, built to unprecedented specifications for

country-scale mapping, including a 3D elevation model posted at

0.50 meters CE95, orthorectified ground-true imagery collected at

up to 10 cm resolution, a seamless mosaic for the Island of

Sulawesi, supported by high-resolution, bare-earth foundation data,

collected through triple canopy jungle foliage with Intermap’s

proprietary, Lear-jet mounted, IFSAR and FOPEN sensors and patented

convergence models. Following a successful capital upgrade and

certification of its sensor payload and airborne platform to meet

stringent geospatial data specifications in Indonesia, total assets

increased by $1.7 million to $6.2 million.

Cash and accounts receivable improved to $2.6 million.

Intermap’s adjusted net working capital improved to $0.7 million

from a deficit of $0.8 million at December 31, 2023, excluding

longer-term, restructuring-related, non-operating liabilities. Cash

milestone payments for Indonesia are heavily weighted towards

finished product deliveries during the second half of 2024. The

Company expects to recognize approximately 60% of its Indonesian

revenue while its airborne platform is deployed to collect data,

during the second and third quarters of 2024. Accordingly, Intermap

expects to draw $1.9 million of incremental working capital to fund

airborne and field operations and data processing. Liquidity will

be provided through a combination of funds from operations,

milestone acceleration, partner advances or equity issuance, as

needed.

Acquisition Services revenue in the first quarter totaled $0.5

million, compared with NIL last year, as the Company started to

perform pre-deployment activities for its program in Indonesia.

Last year, Intermap experienced a delay in the award of key

government contracts, reducing its revenue from government

customers. With this initial Sulawesi contract, representing

approximately 10% of Indonesia’s land mass, Intermap is

establishing the foundation for a successful execution and seamless

transition to mapping the entire country of Indonesia through 2028,

building a strategic national digital infrastructure that supports

economic growth and commercial applications. In addition to

Indonesia, the Company’s government segment is off to a strong

start in 2024. Subsequent to the quarter end, Intermap

has secured major new contracts in Malaysia, Malawi, India and

Greece. This rapid growth reflects strong demand for precise 3D

geospatial elevation data in the region and signals promising

opportunities for new government contracts and the expansion of

existing contracts. Intermap anticipates further wins during 2024

throughout Southeast Asia to fulfill government strategic data

infrastructure requirements.

In the first quarter, software and solutions revenue totaled

$0.9 million, an 8% increase over the previous quarter. The

recurring revenue in this segment represented 56% of total revenue.

In the U.S., InsitePro® software subscription revenue represented

68% of total software and solutions revenue. The Company projects

its insurance business to continue growing at a CAGR of more than

20% over the next few years. Other first quarter highlights

include:

- Winning a $20 million contract to map the Island of Sulawesi,

Indonesia

- Winning a $1 million contract in Malaysia for water resources

management

- Winning more than $1 million in U.S. and European insurance

business

- Winning two new infrastructure projects leveraging AI/ML

capabilities in Greece and Malawi

Intermap affirms its 2024 guidance for revenue in the range of

$16-18 million and adjusted EBITDA margin of approximately 25%. The

primary risk factor to this guidance is the Indonesian government’s

ability to secure necessary permits on schedule and in a timely

manner. Permitting remains on track and Intermap has completed its

pre-deployment mobilization and sensor upgrades and expects to

deploy its airborne platform and commence field operations by the

end of May 2024.

“Intermap is focused on leveraging our unique data and

infrastructure to win and execute large, multiyear government and

commercial contracts, then provide our customers with multiyear

subscription opportunities that further extend their own

capabilities and increase the value of their strategic geospatial

data investments,” said Patrick A. Blott, Intermap Chairman and

CEO. “Our commercial software and data subscription revenue

continue to demonstrate the value of this business model and grow

with renewals and upsells. We have created a solid foundation in

key markets for sustainable growth with high margins. Our advanced

AI/ML technology and processing infrastructure, which run on top of

the world’s largest multi-sensor elevation data archive to train

algorithms, enable us to deliver unique insights with unprecedented

resolution, scale, quality and speed.”

The Company’s consolidated financial statements for the quarter

ended March 31, 2024, along with management’s discussion and

analysis for the corresponding period and related management

certifications for first quarter financial results will be filed on

SEDAR+ at www.sedarplus.ca on May 15, 2024.

Reconciliation of Non-GAAP measuresAdjusted

working capital is not a recognized performance measure under IFRS

and does not have a standardized meaning prescribed by IFRS. The

term working capital is defined as current assets less current

liabilities. Adjusted working capital is included as a supplemental

disclosure because management believes that such measurement

provides a better assessment of the Company’s operations on a

continuing basis by eliminating certain non-operating liabilities

that are nonrecurring. A reconciliation to Adjusted working capital

is provided in the table below.

|

|

|

|

|

|

|

| US$s in

millions |

March 31, 2024 |

|

December 31, 2023 |

|

| Current assets |

3.0 |

|

|

1.3 |

|

| Current liabilities |

9.7 |

|

|

7.0 |

|

|

Working capital |

(6.7 |

) |

|

(5.7 |

) |

| |

|

|

|

|

|

| Adjustments for

non-operating items |

|

|

|

|

|

|

Longer-term, restructuring-related, non-operating payables |

1.0 |

|

|

1.0 |

|

| Employee bonus accrual from

2018 |

0.6 |

|

|

0.7 |

|

| Accrued directors

compensation |

0.6 |

|

|

0.6 |

|

|

Unearned revenue |

5.2 |

|

|

2.6 |

|

|

|

|

|

|

|

|

|

Adjusted working capital |

0.7 |

|

|

(0.8 |

) |

| |

|

|

|

|

|

Intermap Reader AdvisoryCertain

information provided in this news release, including reference to

revenue projections or revenue growth, constitutes forward-looking

statements. The words "anticipate", "expect", "project",

"estimate", "forecast", “will be”, “will consider”, “intends” and

similar expressions are intended to identify such forward-looking

statements. Although Intermap believes that these statements are

based on information and assumptions which are current, reasonable

and complete, these statements are necessarily subject to a variety

of known and unknown risks and uncertainties. Intermap’s

forward-looking statements are subject to risks and uncertainties

pertaining to, among other things, cash available to fund

operations, availability of capital, revenue fluctuations, nature

of government contracts, economic conditions, loss of key

customers, retention and availability of executive talent,

competing technologies, common share price volatility, loss of

proprietary information, software functionality, internet and

system infrastructure functionality, information technology

security, breakdown of strategic alliances, and international and

political considerations, as well as those risks and uncertainties

discussed Intermap’s Annual Information Form and other securities

filings. While the Company makes these forward-looking statements

in good faith, should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary significantly from those expected.

Accordingly, no assurances can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do so, what benefits that the Company will

derive therefrom. All subsequent forward-looking statements,

whether written or oral, attributable to Intermap or persons acting

on its behalf are expressly qualified in their entirety by these

cautionary statements. The forward-looking statements contained in

this news release are made as at the date of this news release and

the Company does not undertake any obligation to update publicly or

to revise any of the forward-looking statements made herein,

whether as a result of new information, future events or otherwise,

except as may be required by applicable securities law.

About Intermap

TechnologiesFounded in 1997 and headquartered in Denver,

Colorado, Intermap (TSX: IMP; OTCQB: ITMSF) is a global leader in

geospatial intelligence solutions, focusing on the creation and

analysis of 3D terrain data to produce high-resolution thematic

models. Through scientific analysis of geospatial information and

patented sensors and processing technology, the Company provisions

diverse, complementary, multi-source datasets to enable customers

to seamlessly integrate geospatial intelligence into their

workflows. Intermap’s 3D elevation data and software analytic

capabilities enable global geospatial analysis through artificial

intelligence and machine learning, providing customers with

critical information to understand their terrain environment. By

leveraging its proprietary archive of the world’s largest

collection of multi-sensor global elevation data, the Company’s

collection and processing capabilities provide multi-source 3D

datasets and analytics at mission speed, enabling governments and

companies to build and integrate geospatial foundation data with

actionable insights. Applications for Intermap’s products and

solutions include defense, aviation and UAV flight planning, flood

and wildfire insurance, disaster mitigation, base mapping,

environmental and renewable energy planning, telecommunications,

engineering, critical infrastructure monitoring, hydrology, land

management, oil and gas and transportation.

For more information, please visit www.intermap.com or contact:

Patrick Blott

Chairman and CEO

CEO@intermap.com

+1 (303) 708-0955

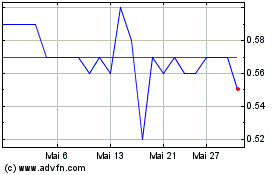

Intermap Technologies (TSX:IMP)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Intermap Technologies (TSX:IMP)

Historical Stock Chart

Von Dez 2023 bis Dez 2024