High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) released its’ fourth quarter and year-end results

today. The audited consolidated financial statements, management

discussion & analysis (“MD&A”), and annual information form

for the year ended December 31, 2021 will be available on SEDAR at

www.sedar.com, and on High Arctic’s website at www.haes.ca.

Non-IFRS measures, such as EBITDA, Adjusted EBITDA, Adjusted Net

Earnings (Loss), Operating margin % and working capital are

included in this News Release. See Non-IFRS Measures section below.

All amounts are denominated in Canadian dollars (“CAD”), unless

otherwise indicated.

Mike Maguire, Chief Executive Officer

commented:

“High Arctic closed out the 2021 fiscal year in

excellent position. As underlying business fundamentals began to

improve, surplus pre-pandemic cash of $9.7 million was paid to

shareholders in the form of a special one-time dividend. We exited

the year with a net cash position of $4.0 million, strengthened

capital structure with fixed rate mortgage financing and an undrawn

revolving credit facility, and increasing revenue fueled by

positive pricing trends and the return to work in PNG.

Entering 2022, global events have propelled the

energy sector into significant supply constraint. Sanctions against

Russia combined with the actions of global energy and transport

corporations have removed substantial supply of both oil and gas,

stressing the market at a time of increasing energy demand as

Covid-19 restrictions are lifted.

As a result, commodity price strength coupled

with long-term security of supply assurances are expected to drive

further increases in service activity. More Canadian oil is needed

to supply foreign markets, and LNG is increasingly becoming the

mobile, low emissions energy source of choice through this period

of energy transition. The signing of the P’nyang gas agreement and

the progression of the Papua LNG project towards FID, positions

Papua New Guinea as a key source of new LNG supply to Asia and the

sub-continent. High Arctic is ideally placed to benefit in both of

these markets, and as a result we have undertaken to reinstate a

regular monthly dividend.”

Highlights

The following highlights the Corporations results for Q4-2021

and YTD-2021:

- High Arctic’s revenues increased

43% to $23.6 million in Q4-2021 relative to Q4-2020 and were 27%

higher than Q3-2021, buoyed by renewed activity in the Drilling

Services Segment during the quarter. In contrast, YTD-2021 revenues

of $76.4 million were lower by 16% primarily due to significantly

lower drilling services activity throughout 2021-year compared to

the 2020-year which included a full quarter of pre-pandemic

activity.

- High Arctic’s oilfield services

operating margin as a percentage of revenue was 19.9% in both

Q4-2021 and YTD-2021, compared to 23% and 23.5% in the

corresponding 2020-periods.

- High Arctic achieved positive

EBITDA of $1.2 million and $4.4 million for Q4-2021 and YTD-2021,

while the net loss in the respective 2021-periods was $4.6 million

and $18.6 million.

- High Arctic returned value to

shareholders through a $9.7 million special one-time cash dividend

in Q4-2021 while maintaining a strong working capital balance of

$29.7 million on December 31, 2021. At year end, High Arctic

carried a cash balance of $12.0 million.

- Cost reduction initiatives

delivered $2.5 million or 19.4% lower general and administrative

costs YTD-2021 over prior year, and $5.5 million lower than

pre-pandemic YTD-2019 costs.

- In December 2021, High Arctic

completed a $8.1 million mortgage financing of Corporation owned

and occupied land and buildings with an initial 5-year term and a

fixed interest rate of 4.30%.

Strategy

Our 2022 Strategic Priorities build on the

platform we created in 2021 and include:

- Safety excellence and quality service delivery,

- Actions aimed at generating free cash flow including:

- Increased utilization of the Corporation’s world-class fleet of

equipment,

- Improved efficiency and work force productivity, and

- Operating cost control,

- Development of new and existing employees to grow our workforce

to meet demand,

- Pursuit of opportunities that secure the Corporation’s future

as a lower emissions energy services provider,

- Pursuit of opportunities for growth and corporate transactions

in well understood markets that enhance shareholder value, and

- Disciplined capital stewardship to improve returns for

shareholders including dividends and common share buybacks.

The audited consolidated financial statements

(“Financial Statements”) and management discussion & analysis

(“MD&A”) for the year ended December 31, 2021 will be available

on SEDAR at www.sedar.com, and on High Arctic’s website at

www.haes.ca. Non-IFRS measures, such as EBITDA, Adjusted EBITDA,

EBITDA for purposes of long-term debt covenants, Adjusted net

earnings (loss), Oilfield services operating margin, Operating

margin %, Percent of revenue, Funds provided from operations,

Working capital and Net cash are included in this News Release. See

Non-IFRS Measures section, below. All amounts are denominated in

Canadian dollars (“CAD”), unless otherwise indicated.

Within this News Release, the three months ended

December 31, 2021 may be referred to as the

“Quarter” or “Q4-2021”, and

similarly the twelve months ended December 31, 2021 may be referred

to as “YTD-2021”. The comparative three months

ended December 31, 2020 may be referred to as

“Q4-2020”, and similarly the twelve months ended

December 31, 2020 may be referred to as

“YTD-2020”. References to other quarters may be

presented as “QX-20XX” with X being the

quarter/year to which the commentary relates. All amounts are

expressed in thousands of Canadian dollars, unless otherwise

noted.

RESULTS OVERVIEW

The following is a summary of select financial

information of the Corporation:

|

|

For the three months ended December

31 |

For the year ended December

31 |

|

($ thousands, except per share amounts) |

2021 |

2020 |

2021 |

2020 |

|

Revenue |

23,644 |

16,584 |

76,442 |

90,834 |

| Net loss |

(4,608) |

(11,468) |

(18,607) |

(25,985) |

|

Per share (basic and diluted) |

(0.09) |

(0.12) |

(0.38) |

(0.52) |

| Oilfield services operating

margin |

4,700 |

3,810 |

15,216 |

21,311 |

| Oilfield services operating

margin as a % of revenue |

19.9% |

23.0% |

19.9% |

23.5% |

| EBITDA |

1,175 |

644 |

4,429 |

10,404 |

| Adjusted EBITDA |

1,836 |

1,154 |

4,918 |

8,529 |

| Adjusted EBITDA as % of

revenue |

7.8% |

7.0% |

6.4 % |

9.4% |

| Operating loss |

(4,582) |

(11,613) |

(19,430) |

(27,510) |

| Cash provided by operating

activities |

(3,472) |

2,389 |

(1,797) |

20,152 |

|

Per share (basic and diluted) |

(0.07) |

0.05 |

(0.04) |

0.41 |

| Funds provided by operating

activities |

1,390 |

859 |

3,697 |

6,320 |

|

Per share (basic and diluted) |

0.03 |

0.02 |

0.08 |

0.13 |

| Dividends |

9,747 |

- |

9,747 |

1,638 |

|

Per share (basic and diluted) |

0.20 |

- |

0.20 |

0.03 |

| Capital expenditures |

3,134 |

1,050 |

7,242 |

4,874 |

|

|

|

|

As at |

|

| ($

thousands, except share amounts) |

|

|

December 31, 2021 |

December 31, 2020 |

|

Working capital |

|

|

29,724 |

44,577 |

| Cash, end of period |

|

|

12,037 |

32,598 |

| Total assets |

|

|

185,452 |

214,159 |

| Long-term debt |

|

|

7,779 |

10,000 |

| Total long-term financial

liabilities |

|

|

13,414 |

15,926 |

| Shareholders’ equity |

|

|

148,851 |

177,221 |

|

Per share (basic and diluted) |

|

|

3.05 |

3.58 |

| Common

shares outstanding, thousands |

|

|

48,733 |

48,760 |

Fourth Quarter 2021 Summary ($ thousands, except share

amounts):

- High Arctic’s consolidated revenue

and oilfield services operating margin rose in Q4-2021 to $23,644

and $4,700, respectively, as compared to $16,684 and $3,810 in

Q4-2020.

- Net loss of $4,608 in Q4-2021 was

lower as compared to net loss of $11,468 in Q4-2020, mainly due to

one-off $5,600 higher depreciation expense in Q4-2020 as a result

of a change in depreciation policy, specifically as it related to

salvage value estimates.

- Consolidated oilfield services

operating margin as a percentage of revenue for Q4-2021 was 19.9%

compared to 23% in Q4-2020, due to lower profitability in Canada’s

production services segment.

- Utilization for High Arctic’s 50

registered Concord Well Servicing rigs was 40% in the Quarter

versus industry utilization of 42% (source: Canadian Association of

Oilwell Energy Contractors “CAOEC”). Growth in rig utilization in

Q4-2021 was constrained by lower activity with a certain contracted

large customer and Covid-19 labour disruptions.

- Adjusted EBITDA of $1,836 in

Q4-2021, higher relative to $1,154 in Q4-2020.

- In November 2021, the Corporation

paid a one-time special $0.20 per share dividend to shareholders of

$9,747.

- In December 2021, the Corporation

strengthened its capital structure by securing fixed interest rate

mortgage financing of $8,100 of long-term debt. Current portion of

the long-term debt on December 31, 2021 is $296.

Year Ended December 31, 2021

Summary

- For the year ended December 31,

2021, consolidated revenue and oilfield services operating margin

fell to $76,442 and $15,216, respectively, as compared to $90,834

and $21,311 in 2020. High Arctic was actively drilling in PNG in

Q1-2020, and has since paused all drilling activity with drilling

preparation activities recommencing in Q4-2021.

- YTD-2021 oilfield services

operating margin as a percentage of revenue was lower at 19.9%

compared to 23.5% in 2020, due to lower activity in PNG and lower

wage subsidies received in Canada in 2021 versus 2020.

- Utilization for High Arctic’s 49

registered Concord Well Servicing rigs was 43% YTD-2021 versus

industry utilization of 37% (source: CAOEC).

- High Arctic continues to prioritize

cost controls and inflationary influences as part of initiatives

undertaken in the 2020-year, with YTD-2021 general &

administrative costs decreasing 19% to $10,298.

- Cash balance decreased by $20,561

YTD-2021 to $12,037 mainly due to $9,787 of dividend payment, a

$1,925 reduction to long term debt, and buildup of accounts

receivable in Q4-2021.

- All activities in the US ceased

during 2020 and Corporation owned property and equipment is in the

process of being relocated to Canada or disposed pending continuing

assessment of opportunities.

Drilling Services Segment

|

|

Three months endedDecember

31 |

Year endedDecember 31 |

|

($ thousands, unless otherwise noted) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Revenue |

6,291 |

|

1,447 |

|

10,653 |

|

25,357 |

|

|

Oilfield services expense |

4,831 |

|

1,221 |

|

8,990 |

|

18,827 |

|

|

Oilfield services operating margin |

1,460 |

|

226 |

|

1,663 |

|

6,530 |

|

|

Operating margin (%) |

23.2% |

|

15.6% |

|

15.6% |

|

25.8% |

|

Production Services Segment

|

|

Three months endedDecember

31 |

Year endedDecember 31 |

|

($ thousands, unless otherwise noted) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Revenue |

13,637 |

|

13,598 |

|

55,440 |

|

57,583 |

|

|

Oilfield services expense |

12,721 |

|

11,182 |

|

47,957 |

|

47,644 |

|

|

Oilfield services operating margin |

916 |

|

2,416 |

|

7,483 |

|

9,939 |

|

|

Operating margin (%) |

6.7% |

|

17.8% |

|

13.5% |

|

17.3% |

|

|

|

Three months endedDecember

31 |

Year endedDecember 31 |

|

Operating Statistics – Canada |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Service rigs: |

|

|

|

|

|

Average fleet |

50 |

|

50 |

|

49 |

|

50 |

|

|

Utilization |

40% |

|

44% |

|

43% |

|

43% |

|

|

Operating hours |

18,415 |

|

20,070 |

|

77,179 |

|

79,683 |

|

|

Revenue per hour ($) |

630 |

|

581 |

|

603 |

|

587 |

|

|

|

|

|

|

|

|

Snubbing packages: |

|

|

|

|

|

Average fleet |

8 |

|

8 |

|

8 |

|

8 |

|

|

Utilization |

20% |

|

23% |

|

22% |

|

21% |

|

|

Operating hours |

1,445 |

|

1,696 |

|

6,423 |

|

6,054 |

|

Ancillary Services Segment

|

|

Three months endedDecember

31 |

Year endedDecember 31 |

|

($ thousands, unless otherwise noted) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Revenue |

4,227 |

|

1,770 |

|

12,274 |

|

9,407 |

|

|

Oilfield services expense |

1,902 |

|

901 |

|

6,204 |

|

4,834 |

|

|

Oilfield services operating margin |

2,325 |

|

869 |

|

6,070 |

|

4,573 |

|

|

Operating margin (%) |

55.0% |

|

49.1% |

|

49.5% |

|

48.6% |

|

Liquidity and Capital

Resources

|

|

Three months endedDecember

31 |

Year endedDecember 31 |

|

($ thousands) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Cash (used in) provided by: |

|

|

|

|

|

Operating activities |

(3,472) |

|

2,389 |

|

(1,797) |

|

20,152 |

|

|

Investing activities |

(2,722) |

|

(853) |

|

(5,572) |

|

(1,100) |

|

|

Financing activities |

(2,088) |

|

(1,307) |

|

(13,389) |

|

4,600 |

|

|

Effect of exchange rate changes on cash |

109 |

|

(879) |

|

197 |

|

(363) |

|

|

(Decrease) increase in cash |

(8,173) |

|

(650) |

|

(20,561) |

|

23,289 |

|

|

|

|

As at |

|

($ thousands, unless otherwise noted) |

|

|

December 31 2021 |

December 31 2020 |

|

Current Assets |

|

|

45,132 |

55,589 |

|

Working capital |

|

|

29,724 |

44,577 |

|

Working capital ratio |

|

|

3.1:1 |

5.0:1 |

|

Cash |

|

|

12,037 |

32,598 |

|

Net cash |

|

|

3,962 |

22,598 |

|

Undrawn availability under revolving credit facility |

|

|

37,000 |

35,000 |

The Bank of PNG continues to encourage the use

of the local market currency, Kina or PGK. Due to High Arctic’s

requirement to transact with international suppliers and customers,

High Arctic has received approval from the Bank of PNG to maintain

its USD account within the conditions of the Bank of PNG currency

regulations. The Corporation continues to use PGK for local

transactions when practical. Included in the Bank of PNG’s

conditions is for PNG drilling contracts to be settled in PGK,

unless otherwise approved by the Bank of PNG for the contracts to

be settled in USD. The Corporation has historically received

such approval for its contracts with its key customers in PNG. The

Corporation will continue to seek Bank of PNG approval for future

customer contracts to be settled in USD on a contract-by-contract

basis, however, there is no assurance the Bank of PNG will continue

to grant these approvals.

If such approvals are not received in future,

the Corporation’s PNG drilling contracts will be settled in PGK

which would expose the Corporation to exchange rate fluctuations

related to the PGK. In addition, this may delay the Corporation’s

ability to receive USD which may impact the Corporation’s ability

to settle USD denominated liabilities and repatriate funds from PNG

on a timely basis. The Corporation also requires the approval

from the PNG Internal Revenue Commission (“IRC”)

to repatriate funds from PNG and make payments to non-resident PNG

suppliers and service providers. While delays can be experienced

for the IRC approvals, such approvals have been received in the

past.

Operating ActivitiesIn Q4-2021,

cash used in operating activities was $3,472 (Q4-2020: $2,389 cash

from operating activities), of which $1,390 are funds provided by

operations (Q4-2020: $859), and $4,862 cash outflow from working

capital changes (Q4-2020: $1,530 cash inflow) mainly due to

increase in accounts receivable during the Quarter.

YTD-2021, cash used in operating activities was

$1,797 (YTD-2020: $20,152 cash from operating activities), of which

$3,697 are funds provided by operations (YTD-2020: 6,320), and

$5,494 cash outflow from working capital changes (YTD-2020: $13,832

cash inflow) mainly due to increase in accounts receivable during

Q4-2021.

Investing ActivitiesDuring

Q4-2021, the Corporation’s cash used in investing activities was

$2,722 (Q4-2020: $853). Capital expenditures during the Quarter

were $3,134 (Q4-2020: $1,050) partially offset by $213 proceeds on

disposal of property and equipment (Q4-2020: $182), and $199 cash

inflow relating to working capital balance changes for capital

items (Q4-2020: $15 cash inflow).

YTD-2021, the Corporation’s cash used in

investing activities was $5,572 (YTD-2020: $1,100). Capital

expenditures during the period were $7,242 (YTD-2020: $4,874)

partially offset by $1,196 proceeds on disposal of property and

equipment (YTD-2020: $5,134), and $474 cash inflow relating to

working capital balance changes for capital items (YTD-2020: $1,360

cash outflow).

Financing ActivitiesIn Q4-2021,

the Corporation’s cash used in financing activities was $2,088

(Q4-2020: $1,307). During the quarter the Corporation paid $9,747

for a one-time special dividend, $416 lease liability payments

(Q4-2020: $576) and made no purchases of common shares for

cancellation (Q4-2020: $731). A total of $8,075 long-term debt

proceeds, net of transaction costs, were received during the

Quarter.

YTD-2021, the Corporation’s cash used in

financing activities was $13,389 (YTD-2020: $4,600 cash from

financing activities). During 2021-year the Corporation paid $9,747

for a one-time special dividend (YTD-2020: $1,638), paid $1,925 net

debt payments with $10,000 paid in Q1-2021 offset by $8,075 net

proceeds in Q4-2021 (YTD-2020: $10,000 proceeds), $1,615 lease

liability payments (YTD-2020: $2,121), and $102 purchases of common

shares for cancellation (YTD-2020: $822). No changes to working

capital balance changes for finance activities in 2021 (YTD-2020:

$819 cash inflow).

Credit FacilityIn December

2021, the Corporation amended its revolving credit facility from a

borrowing limit of $45,000 to $37,000 and site-specific assets held

as mortgage security for separate mortgage financing have been

carved out. In addition, up to $5,000 of the revolving loan shall

be available by way of account overdraft outside of covenant

requirements described below.

The Corporation’s revolving credit facility has

a maturity date of August 31, 2023, is renewable with the lender’s

consent, and is secured by a general security agreement over the

Corporation’s assets.

Interest on the facility, which is independent

of standby fees, is charged monthly at prime plus an applicable

margin which fluctuates based on the Funded Debt to Covenant EBITDA

ratio (defined below). The applicable margin can range between

0.75% – 1.75% depending on the level of principal outstanding; the

higher the ratio the higher the margin. Standby fees also fluctuate

based on the Funded Debt to Covenant EBITDA ratio and range between

0.40% and 0.60% of the undrawn balance; the higher the ratio the

higher the standby fee percentage.

The facility is subject to two financial

covenants which are reported to the lender on a quarterly basis.

The first covenant requires the Funded Debt to Covenant EBITDA

ratio to be less than 3.0 to 1 and the second covenant requires

Covenant EBITDA to Interest Expense ratio to be a minimum of 3.0 to

1. Both are calculated on the last day of each fiscal quarter on a

rolling four quarter basis. As at December 31, 2021, the

Corporation was in compliance with these two financial

covenants.

The financial covenant calculations at December

31, 2021 are:

|

Covenant |

As at |

|

Covenant |

December 31, 2021 |

|

Funded debt to Covenant EBITDA (1) |

< 3.0x |

- |

|

Covenant EBITDA to Interest expense (1) |

>3.0x |

11.1 |

(1) As at December 31, 2021 the

Corporation had access to $10,500 of the revolving facility.Funded

Debt to Covenant EBITDA is defined as the ratio of consolidated

Funded Debt to the aggregate Covenant EBITDA for the trailing four

quarters. Funded Debt is the amount of debt provided and

outstanding at the date of the covenant calculation. Interest

Expense excludes any impact related to lease liabilities. Covenant

EBITDA for the purposes of calculating the covenants is defined as

a trailing 12-month net income (loss) plus interest expense,

current tax expense, deferred income tax expense (recovery),

depreciation and amortization, share-based compensation expense,

and non-cash inventory write-downs, less gains from foreign

exchange and sale or purchase of assets and lease payments.

Mortgage Financing

|

($ thousands) |

As at |

|

|

December 31, 2021 |

|

|

Current |

$296 |

|

|

Non-current |

7,779 |

|

|

Total |

$8,075 |

|

In December 2021, the Corporation entered into a

mortgage arrangement with the Business Development Bank of Canada

(BDC) for $8,100, secured by lands and buildings owned and occupied

by High Arctic within Alberta. The mortgage financing provides the

Corporation with long term liquidity, and adds to existing cash

balances. The mortgage has an initial term of 5 years with a fixed

interest rate of 4.30% and an amortization period of 25 years with

payments occurring monthly. The mortgage liability and associated

financing costs are carved out of all revolving credit facility

financial covenant calculations.

The Corporation capitalized $25 in financing

fees incurred to set up the loan and applied this to the long-term

debt liability. Financing fees will be amortized over the expected

life of the mortgage financing.

OutlookThe rebound in global

energy demand continued the rally in oil and gas commodity prices,

which reached ten-year highs in the early months of 2022. A

continuation of the easing of government-imposed restrictions

related to the Covid-19 pandemic, periods of extreme cold in

Europe, Asia and North America, war in Ukraine, and the

underperformance of renewable energy supply in Europe reinforced

demand for oil and gas. Coupled with the discipline of OPEC members

in maintaining modest supply increases, a continued reduction in

drilled-and-uncompleted wells in the USA and several years of

underinvestment in upstream oil and gas sources, has set the table

for sustained high commodity prices.

Though the impact of Covid-19 cases amongst

crews remains unpredictable, and market volatility from global

events lingers, High Arctic anticipates continuous improvement in

profitability throughout 2022. On the backdrop of high commodity

prices, continued economic recovery and the improved balance sheets

of E&P companies, demand for energy services grows and High

Arctic anticipates continued utilization increases across its

service offerings. Improved fleet utilization in Canada, combined

with cost inflation, has led to improvements in pricing, as seen in

the rise of our hourly revenue during Q4-2021. This pricing trend

is continuing in Q1-2022, with further increases being agreed with

major customers.

Papua New Guinea continues to be key to High

Arctic’s long-term business strategy due to the significant LNG

investments made by large oil and gas companies in the country and

high barriers for entry due to the technical expertise required to

operate the heli-portable drilling rigs in remote locations. With

Rig 115 operations recently restarting, management is optimistic

2022 will be the start of an upward trend in revenue growth for

High Arctic in PNG.

High Arctic anticipates further investments in

LNG infrastructure in PNG in the coming years. The Shell LNG market

update published in February 2022 highlighted a large and growing

supply deficit through 2040 and the need for significant new

project investment for supply to meet demand. The PNG-LNG project,

commissioned in 2014, has demonstrably de-risked PNG as a source of

world-class, low-cost gas supply in a location well positioned for

the Asian market. LNG is ideal to both meet demand growth and

deliver long-term climate benefits by reducing coal consumption in

Asia. The Papua LNG project is underway again with personnel

recently remobilised into PNG with indications they are progressing

work towards a project FID in 2023. On February 22, 2022, the PNG

government and PNG-LNG partners announced the signing of the

P’nyang Gas Agreement. The development of P’nyang has been seen as

a possible catalyst to expand the existing LNG plant and these two

projects alone are anticipated to more than double LNG supply from

the country. With Arran Energy announcing intention to make an FID

for its Stanley Gas Condensate Development early this year, the

stage is set for a meaningful near term ramp up of activity. High

Arctic remains exceptionally well positioned to benefit.

NON - IFRS MEASURESThis News

Release contains references to certain financial measures that do

not have a standardized meaning prescribed by International

Financial Reporting Standards (“IFRS”) and may not be comparable to

the same or similar measures used by other companies. High Arctic

uses these financial measures to assess performance and believes

these measures provide useful supplemental information to

shareholders and investors. These financial measures are computed

on a consistent basis for each reporting period and include EBITDA,

Adjusted EBITDA, EBITDA for purposes of long-term debt covenants,

Adjusted net earnings (loss), Oilfield services operating margin,

Percent of revenue, Funds provided from operations, Working

capital, and Net cash, none of which have standardized meanings

prescribed under IFRS.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at www.sedar.com

and through High Arctic’s website at www.haes.ca.

FORWARD-LOOKING STATEMENTSThis

press release contains forward-looking statements. When used in

this document, the words “may”, “would”, “could”, “will”, “intend”,

“plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”,

“expect”, and similar expressions are intended to identify

forward-looking statements. Such statements reflect the

Corporation’s current views with respect to future events and are

subject to certain risks, uncertainties and assumptions. Many

factors could cause the Corporation’s actual results, performance

or achievements to vary from those described in this press

release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this MD&A as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this MD&A include, among others,

statements pertaining to the following: general economic and

business conditions which will include, among other things,

continued improvement in energy services outlook, impact of high

commodity prices on demand for and market prices for the

Corporation’s services; continued impact of the Covid-19; ability

to prioritize a strong balance sheet and liquidity position;

activity increases in the medium and long-term in PNG;

opportunities to invest and enhance shareholder value; improving

and stabilizing economic environment, climate and weather

predictions and their effect on energy demand; improving customer

pricing trends; the Corporation’s ability to maintain a USD bank

account and conduct its business in USD in PNG; market fluctuations

in interest rates, commodity prices, and foreign currency exchange

rates; restrictions to repatriate funds held in PGK; customer

activity to boost production; expectations regarding the

Corporation’s ability to raise capital and manage its debt

obligations; estimated capital expenditure programs; projections of

market prices and costs; expectations for improving customer demand

in the near-term, factors upon which the Corporation will decide

whether or not to undertake a specific course of operational action

or expansion; the Corporation’s ongoing relationship with major

customers; treatment under governmental regulatory regimes and

political uncertainty and civil unrest; a final Papua LNG

investment decision; expectations for the speed and efficacy of

distributions relating to Covid-19 vaccines; developments in

Ukraine; and estimated credit risks and tax losses.

With respect to forward-looking statements

contained in this news release, the Corporation has made

assumptions regarding, among other things, its ability to: obtain

equity and debt financing on satisfactory terms; market

successfully to current and new customers; the general continuance

of current or, where applicable, assumed industry conditions;

activity and pricing; assumptions regarding commodity prices, in

particular oil and gas; the Corporation’s primary objectives, and

the methods of achieving those objectives; obtain equipment from

suppliers; construct property and equipment according to

anticipated schedules and budgets; remain competitive in all of its

operations; and attract and retain skilled employees.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this press release, along with the risk factors set

out in the most recent Management Discussion and Analysis and

Annual Information Form filed on SEDAR at www.sedar.com.

The forward-looking statements contained in this

press release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this press release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy

ServicesHigh Arctic’s principal focus is to provide

drilling and specialized well completion services, equipment

rentals and other services to the oil and gas industry. High Arctic

is a market leader providing drilling and specialized well

completion services and supplies rig matting, camps and drilling

support equipment on a rental basis in Papua New Guinea. The

Western Canadian operation provides well servicing, well

abandonment, snubbing and nitrogen services and equipment on a

rental basis to a large number of oil and natural gas exploration

and production companies.

For further information contact:

Lance

Mierendorf Chief

Financial

Officer P:

+1 (587) 318 2218P: +1 (800) 688

7143 High

Arctic Energy Services Inc.Suite 2350, 330 – 5th Ave SWCalgary,

Alberta, Canada T2P 0L4

website: www.haes.caEmail: info@haes.ca

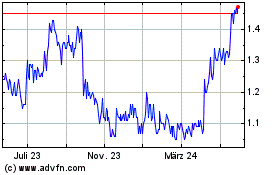

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

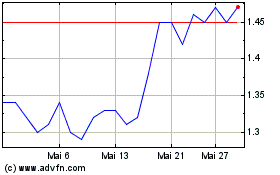

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025