Goodfellow Inc. Renews its Normal Course Issuer Bid

15 November 2023 - 11:00PM

Goodfellow Inc. (TSX: GDL) (“Goodfellow” or the “Company”),

announced today that the Toronto Stock Exchange (the “TSX”) has

approved the notice filed by the Company to renew its normal course

issuer bid (“NCIB”) with respect to its common shares (the

“Shares”).

The notice provides that Goodfellow may, during

the 12-month period commencing November 20, 2023 and ending no

later than November 19, 2024, purchase up to 426,157 Shares,

representing approximately 5% of the 8,523,154 issued and

outstanding Shares of the Company as at November 9, 2023, through

the facilities of the TSX or other designated exchanges or Canadian

alternative trading systems, at times and in numbers to be

determined by the Company. All Shares purchased under the NCIB will

be acquired on the open market and in accordance with the rules and

policies of the TSX and applicable securities laws at the

prevailing market prices, plus applicable brokerage fees, and

cancelled. The Company may also seek issuer bid exemption orders

from securities regulators allowing for purchases under private

agreements, in which case purchases may also be made in accordance

with such exemptions, at a discount to the market price.

The average daily trading volume of the Shares

on the TSX for the most recently completed six calendar months is

2,935. Accordingly, pursuant to the rules and policies of the TSX,

daily purchases under the NCIB will be limited to 1,000 Shares,

except pursuant to certain prescribed exceptions, including a

weekly block purchase of Shares not owned by insiders of the

Company.

Goodfellow considers that the acquisition of

Shares for cancellation is a sound use of its funds. Decisions

regarding the actual number of Shares and timing of any purchases

or other actions in connection with the NCIB will be made by

Goodfellow based on various factors, including prevailing market

conditions and the Company’s capital and liquidity positions.

Goodfellow has also renewed its automatic share

purchase plan (“ASPP”) with a designated broker in connection with

the NCIB. The ASPP allows for the purchase for cancellation of

Shares, subject to certain trading parameters, by its designated

broker during times when Goodfellow would ordinarily not be active

in the market due to applicable regulatory restrictions or

self-imposed blackout periods. Outside these periods, Shares may be

repurchased by Goodfellow at its discretion under the NCIB.

There can be no assurances that Goodfellow will

purchase all or any of the number of Shares that are subject to the

NCIB referred to in this news release. Goodfellow may also suspend

or discontinue the NCIB at any time.

Under the Company’s current NCIB, which expired

on November 9, 2023, the Company had received approval from the TSX

to purchase up to 428,127 Shares. Goodfellow has repurchased 39,400

Shares under its current NCIB in the last twelve months at an

average weighted price of $12.4032 per Share.

About

Goodfellow

Goodfellow is a diversified manufacturer of

value-added lumber products, as well as a wholesale distributor of

building materials and floor coverings. Goodfellow has a

distribution footprint from coast-to-coast in Canada servicing

commercial and residential sectors through lumber yard retailer

networks, manufacturers, industrial and infrastructure project

partners, and floor covering specialists. Goodfellow also leverages

its value-added product capabilities to serve lumber markets

internationally. Goodfellow Inc. is a publicly traded company, and

its shares are listed on the Toronto Stock Exchange under the

symbol “GDL”.

Forward-Looking Statements

This press release contains implicit and/or

explicit forward-looking statements relating, inter alia, to

objectives, strategies, priorities, goals, plans, financial

position, operating results, trends and activities of the Company

and its markets and industries. Forward-looking statements can be

identified by words such as: “believe,” “estimate,” “expect,”

“strategy,” “future,” “likely,” “may,” “should,” “will” and similar

references to future periods. Examples of forward-looking

statements include, among others, statements relating to the

repurchase of Shares by the Company. Forward-looking statements are

neither historical facts nor assurances of future performance.

Instead, these statements are forward-looking to the extent that

they are based on expectations and on various assessments and

assumptions of the Company. Although we believe that the

expectations reflected in the forward-looking statements contained

in this press release, and the assumptions on which such

forward-looking statements are made, are reasonable, there can be

no assurance that such expectations and assumptions will prove to

be correct. Some of these expectations and assumptions relate to

the state of the global economy and the economies of the regions in

which the Company operates; the level of demand for the Company’s

products including from its recurring client base, including

bookings from customers; prices and margins for its products;

competitors; reliability of supply chains; inflation; interest

rates; foreign currency fluctuations; the COVID-19 pandemic;

overhead expenses; working capital requirements and access to

capital or funding to finance same; the collection of accounts

receivable; the availability and sufficiency insurance coverage;

the sufficiency and reliability of the Company’s workforce; the

successful management of environmental and health and safety risk;

the sufficiency, reliability and effectiveness of information

systems; the sufficiency, reliability and effectiveness of internal

and disclosure controls; and the absence of adverse change in the

Company’s regulatory environment and legal proceedings. Readers are

cautioned not to place undue reliance on forward-looking statements

included in this press release, as there can be no assurance that

the plans, intentions or expectations upon which the

forward-looking statements are based will occur or prove to be

accurate. Actual results could differ significantly from the

expectations of the management team if recognized or unrecognized

risks and uncertainties affect our results or if our assessments or

assumptions are inaccurate. These risks and uncertainties include,

among other things; the effects of general economic and business

conditions including the cyclical nature of our business; industry

competition; inflation, credit, currency and interest rate risks;

environmental risk; level of demand and financial performance of

the manufacturing industry; competition from vendors; changes in

customer demand; extent to which we are successful in gaining new

long-term relationships with customers or retaining existing ones

and the level of service failures that could lead customers to use

competitors' services; increased customer bankruptcies; dependence

on key personnel; impact of the COVID-19 pandemic and the related

climate of uncertainty; laws and regulation; information systems,

cost structure and working capital requirements; occurrence of

hostilities, political instability or catastrophic events and other

factors described in our public filings available at

www.sedarplus.ca. For these reasons, we cannot guarantee the

results of these forward-looking statements. The foregoing risks

and uncertainties are described in greater detail in our latest

annual and interim Management’s Discussion and Analysis and our

other public filings available at www.sedarplus.ca. The Company

disclaims any obligation to update or revise these forward-looking

statements, except as required by applicable law.

Goodfellow Inc.Patrick GoodfellowPresident and

CEOT: 450 635-6511F: 450 635-3730info@goodfellowinc.com

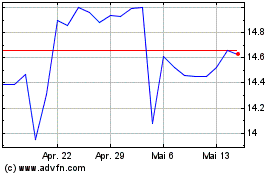

Goodfellow (TSX:GDL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Goodfellow (TSX:GDL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024