Fennec Pharmaceuticals Inc. (NASDAQ:FENC; TSX: FRX), a specialty

pharmaceutical company, today reported its financial results for

the fiscal year ended December 31, 2022 and provided a business

update.

“It was an outstanding year for Fennec as we

achieved FDA approval of PEDMARK® in the fourth

quarter and evolved into a commercial-stage pharmaceutical company.

For 2023, we are focused on building upon our early commercial

launch momentum by continuing to execute on our strategic plans,

expand our prescriber base, and increase the utilization of

PEDMARK®,” said Rosty Raykov, chief executive

officer of Fennec Pharmaceuticals. “We are very proud of Fennec’s

patient-centric approach and the performance across the entire

organization, and we continue to be motivated by the positive

responses that we are receiving from the pediatric cancer patient

community, healthcare providers and payors. Fennec remains

dedicated to growing its revenues both in the U.S. and worldwide as

we seek to expand PEDMARK’s presence and availability to patients

globally.”

Recent Developments and

Highlights:

- Received U.S. Food and Drug

Administration (FDA) approval of the PEDMARK® New

Drug Application (NDA) on September 20, 2022.

PEDMARK® is the first and only FDA-approved

therapy indicated to reduce the risk of ototoxicity associated with

cisplatin in pediatric patients one month of age and older with

localized, non-metastatic solid tumors.

- Initiated U.S. commercial launch of

PEDMARK® on October 17, 2022. The Fennec HEARS™

program offers comprehensive patient services, including access to

care coordinators, financial and prescription drug support.

- The National Comprehensive Cancer

Network® (NCCN) updated its clinical practice

guidelines for Adolescent and Young Adult (AYA) Oncology to include

PEDMARK® (sodium thiosulfate injection) in

January 2023.

- The FDA granted Orphan Drug

Exclusivity to PEDMARK® (sodium thiosulfate

injection) in January 2023. The FDA’s Orphan Drug Designation

program is designed to advance the development of drugs that treat

a condition affecting 200,000 or fewer U.S. patients

annually. The seven-year market exclusivity for

PEDMARK® began on September 20, 2022, the

date of its FDA approval, and continues until September 20,

2029. Additionally, in the approved prescribing label, the FDA has

explicitly directed that PEDMARK® is not

substitutable with other sodium thiosulfate products.

Financial Results for the Fourth Quarter

and Fiscal Year Ended December 31, 2022

- Cash Position –

There was a $2.7 million increase in cash and cash equivalents

between December 31, 2022 and December 31, 2021. The net

increase was the result of cash operating expenses, offset by the

net $20.0 million received from the Petrichor note and $0.9 million

received from the exercise of 273,000 options. During the period

ended December 31, 2022, cash for operations was used mainly

on the pre-commercialization activities of PEDMARK® prior to FDA

approval and then commercialization activities post NDA

approval.

- Commercial launch of PEDMARK®

commenced in October 2022. The company recorded net product sales

of $1.54 million in fiscal 2022. The Company recorded discounts and

allowances against sales in the amount of $0.2 million and cost of

products sold of $0.1 million. The Company had gross profit of $1.4

million for fiscal year ended 2022. In fiscal 2021, the Company had

no revenues.

- Research and Development

(R&D) Expenses – R&D expense decreased by $1.5

million in fiscal 2022 as compared to fiscal 2021. The Company

reduced research and development costs when it received FDA

approval of PEDMARK®. The majority of traditional research and

development expenses associated with PEDMARK® are now recorded as

general and administrative expenses or capitalized into inventory

and eventually recorded to costs of product sales.

- Selling and Marketing

(S&M) Expenses – The Company began recording selling

and marketing expenses when it expanded its payroll to include an

internal salesforce. Selling and marketing expenses include

distribution costs, logistics, shipping and insurance, advertising,

wages commissions and out-of-pocket expenses. The Company recorded

$2.8 million in selling and marketing expenses in fiscal 2022.

- General and Administrative

(G&A) Expenses – There was a $5.5 million

increase of general and administrative expenses in fiscal 2022

compared to fiscal 2021. Payroll and benefits related expenses rose

by $4.0 million in fiscal 2022 compared to fiscal 2021 as our

headcount increased from 10 to 36 over the course of fiscal 2022.

There was an increase in legal costs of $1.4 million in fiscal 2022

over fiscal 2021. This net increase is comprised of an

increase in $0.2 million in class action suit defense, a

decrease in general legal expense of $0.2 million and an increase

of $1.4 million in intellectual property litigation.

Pre-commercialization activities rose by $0.2 million in fiscal

2022 over fiscal 2021. Non-cash expenses associated with equity

remuneration increased by $0.2 million.

- Net

Loss – Net losses for the

fourth quarter and year ended December 31, 2022 of $6.9 million

($0.26 per share) and $23.7 million ($0.90 per share),

respectively, compared to $4.4 million ($0.18 per share) and $17.3

million ($0.67 per share), respectively, for the same periods in

2021.

- Financial Guidance

– The Company believes its cash and cash equivalents on hand as of

December 31, 2022 will be sufficient to fund the Company's planned

commercial activities for 2023.

Financial Update

The selected financial data presented below is

derived from our audited, condensed consolidated financial

statements, which were prepared in accordance with U.S. generally

accepted accounting principles. The complete audited, condensed

consolidated financial statements for the period ended December 31,

2022, and management's discussion and analysis of financial

condition and results of operations, will be available via

www.sec.gov and www.sedar.com. All values are presented in

thousands unless otherwise noted.

|

Audited Condensed Consolidated |

|

Statement of Operations: |

|

(U.S. Dollars in thousands except per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Twelve months Ended |

| |

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

PEDMARK product sales, net |

$ |

1,535 |

|

|

$ |

— |

|

|

$ |

1,535 |

|

|

$ |

— |

|

| Cost of products sold |

|

(86 |

) |

|

|

— |

|

|

|

(86 |

) |

|

|

— |

|

| Gross

profit |

|

1,449 |

|

|

|

— |

|

|

|

1,449 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

117 |

|

|

|

523 |

|

|

|

3,531 |

|

|

|

4,981 |

|

|

Selling and marketing |

|

2,785 |

|

|

|

— |

|

|

|

2,785 |

|

|

|

— |

|

|

General and administrative |

|

4,682 |

|

|

|

3,703 |

|

|

|

17,722 |

|

|

|

12,242 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total operating

expenses |

|

7,584 |

|

|

|

4,226 |

|

|

|

24,038 |

|

|

|

17,223 |

|

| Loss from

operations |

|

(6,135 |

) |

|

|

(4,226 |

) |

|

|

(22,589 |

) |

|

|

(17,223 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Other

(expense)/income |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized foreign exchange loss |

|

(58 |

) |

|

|

(162 |

) |

|

|

(9 |

) |

|

|

(10 |

) |

|

Amortization expense |

|

(70 |

) |

|

|

(8 |

) |

|

|

(149 |

) |

|

|

(16 |

) |

|

Unrealized (loss)/gain on securities |

|

(3 |

) |

|

|

(1 |

) |

|

|

(184 |

) |

|

|

(25 |

) |

|

Interest income |

|

153 |

|

|

|

13 |

|

|

|

195 |

|

|

|

54 |

|

|

Interest expense |

|

(744 |

) |

|

|

(62 |

) |

|

|

(978 |

) |

|

|

(126 |

) |

|

Total other (expense)/income |

|

(722 |

) |

|

|

(220 |

) |

|

|

(1,125 |

) |

|

|

(123 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(6,857 |

) |

|

$ |

(4,446 |

) |

|

$ |

(23,714 |

) |

|

$ |

(17,346 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic net loss per

common share |

$ |

(0.26 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.90 |

) |

|

$ |

(0.67 |

) |

| Diluted net loss per

common share |

$ |

(0.26 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.90 |

) |

|

$ |

(0.67 |

) |

| Weighted-average

number of common shares outstanding basic |

|

26,275 |

|

|

|

26,006 |

|

|

|

26,275 |

|

|

|

26,006 |

|

| Weighted-average

number of common shares outstanding diluted |

|

26,275 |

|

|

|

26,006 |

|

|

|

26,275 |

|

|

|

26,006 |

|

|

Audited Condensed Consolidated Balance Sheets |

|

(U.S. Dollars in thousands) |

| |

|

|

|

|

|

|

| |

|

December 31, |

|

December 31, |

| |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

23,774 |

|

|

$ |

21,100 |

|

|

Accounts receivable, net |

|

|

1,545 |

|

|

|

— |

|

|

Prepaid expenses |

|

|

770 |

|

|

|

1,034 |

|

|

Inventory |

|

|

576 |

|

|

|

— |

|

|

Other current assets |

|

|

63 |

|

|

|

253 |

|

| Total current

assets |

|

|

26,728 |

|

|

|

22,387 |

|

|

|

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

|

Deferred issuance cost, net amortization |

|

|

211 |

|

|

|

27 |

|

| Total non-current

assets |

|

|

211 |

|

|

|

27 |

|

| Total

assets |

|

$ |

26,939 |

|

|

$ |

22,414 |

|

| |

|

|

|

|

|

|

| Liabilities and

shareholders’ deficit |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,390 |

|

|

$ |

777 |

|

|

Accrued liabilities |

|

|

2,219 |

|

|

|

877 |

|

| Total current

liabilities |

|

|

4,609 |

|

|

|

1,654 |

|

| |

|

|

|

|

|

|

| Long term

liabilities |

|

|

|

|

|

|

|

Term loan |

|

|

25,000 |

|

|

|

5,000 |

|

|

PIK interest |

|

|

260 |

|

|

|

— |

|

|

Debt discount |

|

|

(361 |

) |

|

|

(12 |

) |

| Total long term

liabilities |

|

|

24,899 |

|

|

|

4,988 |

|

| Total

liabilities |

|

|

29,508 |

|

|

|

6,642 |

|

| |

|

|

|

|

|

|

| Commitments and

Contingencies (Note 7) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Shareholders’

deficit: |

|

|

|

|

|

|

|

Common stock, no par value; unlimited shares authorized; 26,361

shares issued and outstanding (2021 ‑26,014) |

|

|

142,591 |

|

|

|

140,801 |

|

|

Additional paid-in capital |

|

|

56,797 |

|

|

|

53,214 |

|

|

Accumulated deficit |

|

|

(203,200 |

) |

|

|

(179,486 |

) |

|

Accumulated other comprehensive income |

|

|

1,243 |

|

|

|

1,243 |

|

| Total shareholders’

deficit |

|

|

(2,569 |

) |

|

|

15,772 |

|

| Total liabilities and

shareholders’ deficit |

|

$ |

26,939 |

|

|

$ |

22,414 |

|

| |

|

|

|

|

|

|

| Working

capital |

|

Fiscal Year Ended |

|

Selected Asset and Liability Data: |

|

December 31, 2022 |

|

December 31, 2021 |

| (U.S. Dollars in

thousands) |

|

|

|

|

|

|

|

Cash and equivalents |

|

$ |

23,774 |

|

|

$ |

21,100 |

|

| Other current assets |

|

|

2,954 |

|

|

|

1,287 |

|

| Current liabilities excluding

derivative liability |

|

|

(4,608 |

) |

|

|

(1,654 |

) |

| Working capital |

|

|

22,120 |

|

|

|

20,733 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Selected

Equity: |

|

|

|

|

|

|

| Common stock and additional

paid in capital |

|

|

199,388 |

|

|

|

194,015 |

|

| Accumulated deficit |

|

|

(203,200 |

) |

|

|

(179,486 |

) |

| Shareholders’ equity |

|

|

(2,569 |

) |

|

|

15,772 |

|

About Cisplatin-Induced

OtotoxicityCisplatin and other platinum compounds are

essential chemotherapeutic agents for the treatment of many

pediatric malignancies. Unfortunately, platinum-based therapies can

cause ototoxicity, or hearing loss, which is permanent,

irreversible, and particularly harmful to the survivors of

pediatric cancer.i

The incidence of ototoxicity depends upon the

dose and duration of chemotherapy, and many of these children

require lifelong hearing aids or cochlear implants, which can be

helpful for some, but do not reverse the hearing loss and can be

costly over time.ii Infants and young children that are affected by

ototoxicity at critical stages of development lack speech and

language development and literacy, and older children and

adolescents often lack social-emotional development and educational

achievement.iii

PEDMARK® (sodium thiosulfate

injection)PEDMARK® is the first and only U.S. Food and

Drug Administration (FDA) approved therapy indicated to reduce the

risk of ototoxicity associated with cisplatin treatment in

pediatric patients with localized, non-metastatic, solid tumors. It

is a unique formulation of sodium thiosulfate in single-dose,

ready-to-use vials for intravenous use in pediatric

patients. PEDMARK is also the only therapeutic agent with

proven efficacy and safety data with an established dosing

paradigm, across two open-label, randomized Phase 3 clinical

studies, the Clinical Oncology Group (COG) Protocol ACCL0431 and

SIOPEL 6.

In the U.S. and Europe, it is estimated that,

annually, more than 10,000 children may receive platinum-based

chemotherapy. The incidence of ototoxicity depends upon the dose

and duration of chemotherapy, and many of these children require

lifelong hearing aids. There is currently no established preventive

agent for this hearing loss and only expensive, technically

difficult, and sub-optimal cochlear (inner ear) implants have been

shown to provide some benefit. Infants and young children that

suffer ototoxicity at critical stages of development lack speech

language development and literacy, and older children and

adolescents lack social-emotional development and educational

achievement.

PEDMARK has been studied by co-operative groups

in two Phase 3 clinical studies of survival and reduction of

ototoxicity, COG ACCL0431 and SIOPEL 6. Both studies have been

completed. The COG ACCL0431 protocol enrolled childhood cancers

typically treated with intensive cisplatin therapy for localized

and disseminated disease, including newly diagnosed hepatoblastoma,

germ cell tumor, osteosarcoma, neuroblastoma, medulloblastoma, and

other solid tumors. SIOPEL 6 enrolled only hepatoblastoma patients

with localized tumors.

Indications and UsagePEDMARK®

(sodium thiosulfate injection) is indicated to reduce the risk of

ototoxicity associated with cisplatin in pediatric patients 1 month

of age and older with localized, non-metastatic solid tumors.

Limitations of UseThe safety

and efficacy of PEDMARK have not been established when administered

following cisplatin infusions longer than 6 hours. PEDMARK may not

reduce the risk of ototoxicity when administered following longer

cisplatin infusions, because irreversible ototoxicity may have

already occurred.

Important Safety Information

PEDMARK is contraindicated in patients with history of a severe

hypersensitivity to sodium thiosulfate or any of its

components.

Hypersensitivity reactions occurred in 8% to 13%

of patients in clinical trials. Monitor patients for

hypersensitivity reactions. Immediately discontinue PEDMARK and

institute appropriate care if a hypersensitivity reaction occurs.

Administer antihistamines or glucocorticoids (if appropriate)

before each subsequent administration of PEDMARK. PEDMARK may

contain sodium sulfite; patients with sulfite sensitivity may have

hypersensitivity reactions, including anaphylactic symptoms and

life-threatening or severe asthma episodes. Sulfite sensitivity is

seen more frequently in people with asthma.

PEDMARK is not indicated for use in pediatric

patients less than 1 month of age due to the increased risk of

hypernatremia or in pediatric patients with metastatic cancers.

Hypernatremia occurred in 12% to 26% of patients

in clinical trials, including a single Grade 3 case. Hypokalemia

occurred in 15% to 27% of patients in clinical trials, with Grade 3

or 4 occurring in 9% to 27% of patients. Monitor serum sodium and

potassium levels at baseline and as clinically indicated. Withhold

PEDMARK in patients with baseline serum sodium greater than 145

mmol/L.

Monitor for signs and symptoms of hypernatremia

and hypokalemia more closely if the glomerular filtration rate

(GFR) falls below 60 mL/min/1.73m2.

Administer antiemetics prior to each PEDMARK

administration. Provide additional antiemetics and supportive care

as appropriate.

The most common adverse reactions (≥25% with

difference between arms of >5% compared to cisplatin alone) in

SIOPEL 6 were vomiting, nausea, decreased hemoglobin, and

hypernatremia. The most common adverse reaction (≥25% with

difference between arms of >5% compared to cisplatin alone) in

COG ACCL0431 was hypokalemia.

Please see full Prescribing Information for

PEDMARK® at: www.PEDMARK.com.

About Fennec

PharmaceuticalsFennec Pharmaceuticals Inc. is a specialty

pharmaceutical company focused on the development and

commercialization of PEDMARK® to reduce the risk of

platinum-induced ototoxicity in pediatric patients. Further,

PEDMARK received FDA approval in September 2022 and has received

Orphan Drug Exclusivity in the U.S. Fennec has a license agreement

with Oregon Health and Science University (OHSU) for exclusive

worldwide license rights to intellectual property directed to

sodium thiosulfate and its use for chemoprotection, including the

reduction of risk of ototoxicity induced by platinum chemotherapy,

in humans. For more information, please visit

www.fennecpharma.com.

Forward Looking

StatementsExcept for historical information described in

this press release, all other statements are forward-looking. Words

such as “believe,” “anticipate,” “plan,” “expect,” “estimate,”

“intend,” “may,” “will,” or the negative of those terms, and

similar expressions, are intended to identify forward-looking

statements. These forward-looking statements include statements

about our business strategy, timeline and other goals, plans and

prospects, including our commercialization plans respecting

PEDMARK®, the market opportunity for and market impact of PEDMARK®,

its potential impact on patients and anticipated benefits

associated with its use, and potential access to further funding

after the date of this release. Forward-looking statements are

subject to certain risks and uncertainties inherent in the

Company’s business that could cause actual results to vary,

including the risks and uncertainties that regulatory and guideline

developments may change, scientific data and/or manufacturing

capabilities may not be sufficient to meet regulatory standards or

receipt of required regulatory clearances or approvals, clinical

results may not be replicated in actual patient settings,

unforeseen global instability, including political instability, or

instability from an outbreak of pandemic or contagious disease,

such as the novel coronavirus (COVID-19), or surrounding the

duration and severity of an outbreak, protection offered by the

Company’s patents and patent applications may be challenged,

invalidated or circumvented by its competitors, the available

market for the Company’s products will not be as large as expected,

the Company’s products will not be able to penetrate one or more

targeted markets, revenues will not be sufficient to fund further

development and clinical studies, our ability to obtain necessary

capital when needed on acceptable terms or at all, the Company may

not meet its future capital requirements in different countries and

municipalities, and other risks detailed from time to time in the

Company’s filings with the Securities and Exchange Commission

including its Annual Report on Form 10-K for the year ended

December 31, 2021. Fennec disclaims any obligation to update these

forward-looking statements except as required by law.

For a more detailed discussion of related risk

factors, please refer to our public filings available

at www.sec.gov and www.sedar.com.

PEDMARK® and Fennec® are registered trademarks

of Fennec Pharmaceuticals Inc.

©2023 Fennec Pharmaceuticals Inc. All rights

reserved. FEN-1604-v1

For further information, please

contact:

Investors:Robert AndradeChief Financial

OfficerFennec Pharmaceuticals Inc.+1 919-246-5299

Corporate and Media:Lindsay Rocco Elixir Health

Public Relations+1 862-596-1304lrocco@elixirhealthpr.com

i Rybak L. Mechanisms of Cisplatin Ototoxicity and Progress in

Otoprotection. Current Opinion in Otolaryngology & Head and

Neck Surgery. 2007, Vol. 15: 364-369.ii Landier W. Ototoxicity and

Cancer Therapy. Cancer. June 2016 Vol. 122, No.11: 1647-1658.iii

Bass JK, Knight KR, Yock TI, et al. Evaluation and Management of

Hearing Loss in Survivors of Childhood and Adolescent Cancers: A

Report from the Children's Oncology Group. Pediatric Blood &

Cancer. 2016 Jul;63(7):1152-1162.

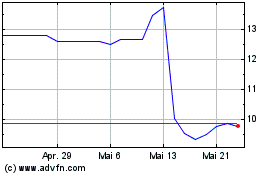

Fennec Pharmaceuticals (TSX:FRX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Fennec Pharmaceuticals (TSX:FRX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025