Firm Capital Property Trust Announces Normal Course Issuer Bid

15 Juli 2024 - 11:01PM

Firm Capital Property Trust ("FCPT" or the "Trust"), (TSX: FCD.UN)

announced today that the Toronto Stock Exchange (the “TSX”) has

accepted a notice filed by FCPT of its intention to make a normal

course issuer bid (the “NCIB”) with respect to its outstanding

trust units.

The notice provides that FCPT may, during the 12

month period commencing July 18, 2024 and ending no later than July

17, 2025, purchase through the facilities of the TSX and/or

alternative Canadian Trading Systems up to 3,281,995 trust units in

total, being 10% of the “public float” of trust units as of July 5,

2024. The price which FCPT will pay for any trust units will be the

market price at the time of acquisition. During the period of this

NCIB, FCPT may make purchases under the NCIB by means of open

market transactions. The actual number of trust units which may be

purchased pursuant to the NCIB and the timing of any such purchases

will be determined by senior management of FCPT. The average daily

trading volume on the TSX from January 1, 2024 to June 30, 2024 was

16,228 trust units. Daily purchases under the NCIB will be limited

to 4,057 trust units, other than block purchases. All trust units

purchased by FCPT under the NCIB will be cancelled.

As of July 15, 2024, there were 36,925,682 trust

units of FCPT outstanding, and the public float was 32,819,951

trust units.

FCPT believes that its trust units may from time

to time trade in a price range that does not adequately reflect the

value of such units in relation to the business of FCPT and its

future business prospects. As a result, depending upon future price

movements and other factors, FCPT believes that the outstanding

trust units may represent an attractive investment to FCPT.

Furthermore, purchases of trust units are expected to benefit all

persons who continue to hold trust units by increasing their equity

interest in FCPT.

Pursuant to a previous notice of intention to

conduct a NCIB, FCPT sought and received approval from the TSX to

purchase up to 3,324,528 trust units through open market purchases

on the TSX and alternative Canadian trading systems for the period

of July 18, 2023 to July 17, 2024. As of today, FCPT has not

purchased for cancellation any of its trust units under this prior

normal course issuer bid.

ABOUT FIRM CAPITAL PROPERTY TRUST (TSX :

FCD.UN)

Firm Capital Property Trust is focused on

creating long-term value for Unitholders, through capital

preservation and disciplined investing to achieve stable

distributable income. In partnership with management and industry

leaders, the Trust’s plan is to own as well as to co-own a

diversified property portfolio of multi-residential, flex

industrial, net lease convenience retail, and core service provider

professional space. In addition to stand alone accretive

acquisitions, the Trust will make joint acquisitions with strong

financial partners and acquisitions of partial interests from

existing ownership groups, in a manner that provides liquidity to

those selling owners and professional management for those

remaining as partners. Firm Capital Realty Partners Inc., through a

structure focused on an alignment of interests with the Trust

sources, syndicates and property and asset manages investments on

behalf of the Trust.

FORWARD LOOKING INFORMATION

This press release contains contain

forward-looking statements within the meaning of applicable

securities laws including, among others, statements relating to

future purchases of trust units under the NCIB. In some cases,

forward-looking statements can be identified by the use of words

such as "may", "will", "should", "expect", "plan", "anticipate",

"believe", "estimate", "predict", "potential", "continue", and by

discussions of strategies that involve risks and uncertainties. The

forward-looking statements are based on certain key expectations

and assumptions made by the Trust. By their nature, forward-looking

statements involve numerous assumptions, inherent risks and

uncertainties, both general and specific, that contribute to the

possibility that the predictions, forecasts, projections and

various future events will not occur. Although management of the

Trust believes that the expectations reflected in the

forward-looking statements are reasonable, there can be no

assurance that future results, levels of activity, performance or

achievements will occur as anticipated. These statements are not

guarantees and are based on our estimates and assumptions that are

subject to risks and uncertainties. These risks include, but are

not limited to, risks associated with the Trust's financial

condition and prospects; the stability of general economic and

market conditions; interest rates; the underlying value of the

Trust and its trust units; the ability of the Trust to complete

purchases under the NCIB; the availability of cash for repurchases

of outstanding trust units under the NCIB; the existence of

alternative uses for the Trust’s cash resources which may be

superior to effecting repurchases under the NCIB; compliance by

third parties with their contractual obligations; compliance with

applicable laws and regulations pertaining to the NCIB; and other

risks related to the Trust’s business, including those described in

the Trust’s Annual Information Form for the year ended December 31,

2023 under “Risks and Uncertainties” (a copy of which can be

obtained at www.sedar.com). Neither the Trust nor any other person

assumes responsibility for the accuracy and completeness of any

forward-looking statements, and no one has any obligation to update

or revise any forward-looking statement, whether as a result of new

information, future events or such other factors which affect this

information, except as required by law.

For further information, please contact:

| Robert

McKee |

Sandy

Poklar |

| President & Chief Executive Officer |

Chief Financial Officer |

| (416) 635-0221 |

(416) 635-0221 |

For Investor Relations information, please

contact:

Victoria Moayedi Director, Investor Relations

(416) 635-0221

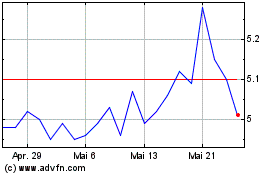

Firm Capital Property (TSX:FCD.UN)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Firm Capital Property (TSX:FCD.UN)

Historical Stock Chart

Von Apr 2024 bis Apr 2025