Brookfield Asset Management (NYSE: BAM, TSX: BAM) (“Brookfield”)

today announced an initial closing of $2.4 billion for the

Catalytic Transition Fund (“CTF” or “the Fund”), marking a

significant milestone towards the target of raising up to $5

billion for deployment towards clean energy and transition assets

in emerging markets.

CTF was previously launched at COP28 with up to

$1 billion of catalytic capital provided by ALTÉRRA funds

(“ALTÉRRA”), the world’s largest private investment vehicle for

climate finance based in the United Arab Emirates with the purpose

of mobilizing investment at scale to finance a new climate economy.

As it looks towards innovative approaches to catalyze capital for

climate solutions in emerging markets, ALTÉRRA’s fund commitment

has been designed to receive a capped return, thereby improving

risk-adjusted returns for other investors in the Fund. Brookfield

has committed to provide 10% of the Fund’s target to align itself

with investment partners and investors.

Today, Brookfield is announcing four additional

investment partners for CTF: CDPQ, GIC, Prudential and Temasek,

among others. These leading institutional investors are important

global players in transition investing and will be valued partners

to Brookfield as CTF gets deployed in its target markets. CTF has

now raised approximately half of the $5 billion total capital

targeted for the Fund.

CTF is focused on deploying capital into clean

energy and transition assets in emerging markets in South and

Central America, South and Southeast Asia, the Middle East, and

Eastern Europe. This strategic partnership will help drive clean

energy investment into emerging markets, where investment needs to

increase sixfold over current levels to reach the $1.6 trillion

required annually by the early 2030s in line with global net zero

targets. The Fund benefits from ALTERRA’s push to significantly

expand private finance and fuel ambitious new climate strategies,

as well as Brookfield’s global leadership in clean energy and

transition investing, building on over three decades of operational

experience in renewable energy technologies and its track record as

the world’s largest transition investor among alternative asset

managers.

The Fund expects to announce its initial

investments later in 2024, and a traditional first close – with

additional capital from Brookfield’s ongoing fundraising efforts

through its extensive network of institutional investors – is

expected by early 2025.

H.E Majid

Al-Suwaidi, CEO of ALTÉRRA, said:

“CTF demonstrates ALTÉRRA’s catalytic capital as

a powerful multiplier of climate finance to the Global South. This

early momentum around CTF shows strong global demand not just for

climate strategies, but for opportunities to invest in climate

solutions in emerging markets. ALTÉRRA looks forward to working

with CDPQ, GIC, Prudential and Temasek and other partners who share

our ambitions to redefine how the world invests in climate

solutions and go beyond business-as-usual to deliver positive

impact for both people and planet.”

Mark Carney, Chair and Head of

Transition Investing at Brookfield Asset Management,

said:

“These anchor commitments from CDPQ, GIC,

Prudential and Temasek demonstrate significant momentum for the

Catalytic Transition Fund. The support from the world’s most

sophisticated investors for the CTF strategy underscores the unique

combination of the major commercial opportunity and the climate

imperative. We look forward to working with other like-minded

investment partners to accelerate the transition in these critical

and vastly underserved markets.”

Marc-André Blanchard, Executive

Vice-President and Head of CDPQ Global and Global Head of

Sustainability, said:

“Globally, around $6.5 trillion will be needed

yearly for the energy transition over the next 15 years. It’s a

staggering figure, and various partnerships and investments are

necessary to accelerate the path forward. For CDPQ, the energy

transition is key to creating lasting value. By investing in

Brookfield’s Catalytic Transition Fund, we are supporting

innovative approaches to mobilize capital for climate solutions in

emerging markets, where investments are critical to tackle the

global environmental challenge.”

Don Guo, Chief Investment Officer,

Prudential plc, said:

“We believe there is an opportunity to drive

scalable positive change in emerging markets through investing in

the climate transition. Prudential’s investment in Brookfield’s

Catalytic Transition Fund underscores our belief that responsible

investment is not only an environmental imperative but also a

significant opportunity for growth in emerging markets. By

supporting a just and inclusive transition, we enable the benefits

of sustainable development to be shared widely, contributing to

social equity and long-term prosperity.”

About Brookfield Asset

Management

Brookfield Asset Management (NYSE: BAM, TSX:

BAM) is a leading global alternative asset manager with

approximately $1 trillion of assets under management. We invest

client capital for the long-term with a focus on real assets and

essential service businesses that form the backbone of the global

economy. We offer a range of alternative investment products to

investors around the world — including public and private pension

plans, endowments and foundations, sovereign wealth funds,

financial institutions, insurance companies and private wealth

investors.

Brookfield operates one of the world’s largest

platforms for renewable power and sustainable solutions. Our

renewable power portfolio consists of hydroelectric, wind,

utility-scale solar and storage facilities in North America, South

America, Europe and Asia, and totals approximately 34,000 megawatts

of installed capacity and a development pipeline of approximately

200,000 megawatts. Our portfolio of sustainable solutions assets

includes our investments in Westinghouse, a leading global nuclear

services business, and a utility and independent power producer

with operations in the Caribbean and Latin America, as well as both

operating assets and a development pipeline of carbon capture and

storage capacity, agricultural renewable natural gas and materials

recycling.

As a signatory to the Net Zero Asset Managers

initiative, Brookfield is committed to supporting the goal of

achieving net-zero greenhouse gas emissions by 2050 or sooner—in

line with the Paris Agreement.

For more information, please visit our website

at www.brookfield.com.

About ALTÉRRA

ALTÉRRA is the world’s largest private

investment vehicle for climate finance. Launched at COP28 with a

US$30 billion commitment from the UAE, ALTÉRRA aims to build

innovative partnerships to mobilize US$250 billion globally by 2030

to finance the new climate economy and accelerate the climate

transition.

ALTERRA's dual-arm structure enhances its

impact: the US$25 billion Acceleration Fund directs capital towards

projects crucial for accelerating the global transition to a

net-zero and climate-resilient economy at scale. The US$5 billion

Transformation Fund incentivizes investment flows in high-growth

climate opportunities in underserved markets by providing catalytic

capital.

Alterra Management Limited is duly licensed and

authorised by the ADGM Financial Services Regulatory Authority

under the Financial Services Permission No. 200001.

Brookfield

|

Media:Simon MaineTel: +44 (0)7398 909 278Email:

simon.maine@brookfield.com |

Investor Relations:Jason FooksTel: +1 (866) 989

0311Email: jason.fooks@brookfield.com |

ALTÉRRA

|

Simon HailesManaging Director Middle

East Edelman SmithfieldM: +971 50 973 1173Email:

simon.hailes@edelmansmithfield.com |

|

|

Notice to Readers

This news release contains “forward-looking

information” within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of

the U.S. Securities Act of 1933,

the U.S. Securities Exchange Act of 1934, “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995 and in any applicable Canadian securities

regulations (collectively, “forward-looking statements”).

Forward-looking statements include statements that are predictive

in nature, depend upon or refer to future results, events or

conditions, and include, but are not limited to, statements which

reflect management’s current estimates, beliefs and assumptions and

which are in turn based on our experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors management believes are

appropriate in the circumstances. The estimates, beliefs and

assumptions of Brookfield are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and as such, are subject

to change. Forward-looking statements are typically identified by

words such as “expect”, “anticipate”, “believe”, “foresee”,

“could”, “estimate”, “goal”, “intend”, “plan”, “seek”, “strive”,

“will”, “may” and “should” and similar expressions. In particular,

the forward-looking statements contained in this news release

include statements referring to, among other things, CTF’s

fundraising target, the expected impact and returns of CTF and the

expected timing for announcing initial investments and the first

close of CTF.

Although Brookfield believes that such

forward-looking statements are based upon reasonable estimates,

beliefs and assumptions, certain factors, risks and uncertainties,

which are described from time to time in our documents filed with

the securities regulators in Canada and the United States, or that

are not presently known to Brookfield or that Brookfield currently

believes are not material, could cause actual results to differ

materially from those contemplated or implied by forward-looking

statements.

Readers are urged to consider these risks, as

well as other uncertainties, factors and assumptions carefully in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements, which are

based only on information available to us as of the date of this

news release. Except as required by

law, Brookfield undertakes no obligation to publicly

update or revise any forward-looking statements, whether written or

oral, that may be as a result of new information, future events or

otherwise.

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

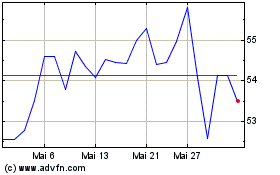

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

Von Dez 2023 bis Dez 2024