Brookfield Asset Management Announces Results of Annual Meeting of Shareholders

07 Juni 2024 - 11:52PM

Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) today

announced that all six nominees proposed for election to the board

of directors by holders of Class A Limited Voting Shares

(“Class A Shares”) and all six nominees proposed for election to

the board of directors by the holder of Class B Limited Voting

Shares (“Class B Shares”) were elected at the company’s annual

meeting of shareholders held on June 7, 2024 in a virtual meeting

format. Detailed results of the vote for the election of directors

are set out below.

Management received the following proxies from

holders of Class A Shares in regard to the election of the six

directors nominated by this shareholder class:

|

Director Nominee |

Votes For |

% |

Votes Withheld |

% |

|

Marcel R. Coutu |

303,708,857 |

98.23 |

5,472,667 |

1.77 |

|

Oliva (Liv) Garfield |

288,094,494 |

93.18 |

21,087,030 |

6.82 |

|

Nili Gilbert |

307,246,251 |

99.37 |

1,935,273 |

0.63 |

|

Allison Kirkby |

308,722,149 |

99.85 |

459,375 |

0.15 |

|

Diana Noble |

307,294,268 |

99.39 |

1,887,256 |

0.61 |

|

Satish Rai |

307,201,140 |

99.36 |

1,980,384 |

0.64 |

Management received a proxy from the holder of

Class B Shares to vote all 21,280 Class B Shares for each of the

six directors nominated by this shareholder class:

|

Director Nominee |

Votes For % |

|

Mark Carney |

100.0 |

|

Bruce Flatt |

100.0 |

|

Brian W. Kingston |

100.0 |

|

Keith Johnson |

100.0 |

|

Cyrus Madon |

100.0 |

|

Samuel J.B. Pollock |

100.0 |

A summary of all votes cast by holders of the

Class A and Class B Shares represented at the company’s annual

meeting of shareholders is available on SEDAR+ at

www.sedarplus.ca.

About Brookfield Asset Management

Brookfield Asset Management Ltd. (NYSE: BAM,

TSX: BAM) is a leading global alternative asset manager with over

$925 billion of assets under management across renewable power and

transition, infrastructure, private equity, real estate, and

credit. We invest client capital for the long-term with a focus on

real assets and essential service businesses that form the backbone

of the global economy. We offer a range of alternative investment

products to investors around the world — including public and

private pension plans, endowments and foundations, sovereign wealth

funds, financial institutions, insurance companies and private

wealth investors. We draw on Brookfield’s heritage as an owner and

operator to invest for value and generate strong returns for our

clients, across economic cycles.

For more information, please visit our website

at bam.brookfield.com or contact:

|

Media:Kerrie McHugh HayesTel: (212) 618-3469Email:

kerrie.mchugh@brookfield.com |

Investor Relations: Jason FooksTel: (866)

989-0311Email: jason.fooks@brookfield.com |

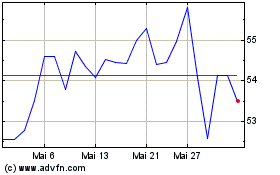

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

Von Dez 2023 bis Dez 2024