Allied Announces Offering of Series J Senior Unsecured Debentures

24 September 2024 - 11:50PM

Allied Properties Real Estate Investment Trust (“Allied”)

(TSX:AP.UN) announced today that it has agreed to offer, on a

private placement basis in each of the provinces and territories of

Canada (the “

Offering”), $250 million aggregate

principal amount of series J senior unsecured debentures that will

bear interest at a rate of 5.534% per annum and will mature on

September 26, 2028 (the “

Debentures”).

The Debentures will be sold at par with a yield

of 5.534% per annum, and are being offered on an agency basis by a

syndicate of agents co-led by Scotiabank and RBC Capital Markets

and including BMO Capital Markets, CIBC Capital Markets, Desjardins

Capital Markets and National Bank Financial Markets. Subject to

customary closing conditions, the Offering is expected to close on

September 26, 2024. Allied intends to use the net proceeds of the

Offering to repay short-term, variable-rate indebtedness.

The Debentures are expected to be rated “BBB”

with a Negative trend by Morningstar DBRS. The Debentures will rank

equally with all other unsecured indebtedness of Allied that has

not been subordinated.

The Debentures being offered have not been, and

will not be, registered under the United States Securities Act of

1933, as amended, or any state securities laws, and may not be

offered or sold in the United States absent registration or an

applicable exemption from such registration requirements. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy the Debentures in the United States

or in any jurisdiction in which such offer, sale or solicitation

would be unlawful.

About Allied

Allied is a leading owner-operator of

distinctive urban workspace in Canada’s major cities. Allied’s

mission is to provide knowledge-based organizations with workspace

that is sustainable and conducive to human wellness, creativity,

connectivity and diversity. Allied’s vision is to make a continuous

contribution to cities and culture that elevates and inspires the

humanity in all people.

CAUTIONARY STATEMENTS

This press release may contain forward-looking

statements with respect to Allied including the expected proceeds

of the Offering, the closing date of the Offering and the intended

use of the net proceeds thereof. These statements generally can be

identified by use of forward-looking words such as “may”, “will”,

“expect”, “estimate”, “anticipate”, “intends”, “believe” or

“continue” or the negative thereof or similar variations. The

actual results and performance of Allied discussed herein could

differ materially from those expressed or implied by such

statements. Such statements are qualified in their entirety by the

inherent risks and uncertainties surrounding future expectations.

Important factors that could cause actual results to differ

materially from expectations include, among other things, financing

and interest rates, general economic and market conditions and

other factors described under “Risks and Uncertainties” in Allied’s

Annual MD&A, which is available at www.sedarplus.ca. These

cautionary statements qualify all forward-looking statements

attributable to Allied and persons acting on Allied’s behalf.

Unless otherwise stated, all forward-looking statements speak only

as of the date of this press release and, except as required by

applicable law, Allied has no obligation to update such

statements.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Cecilia C. Williams, President & CEO(416)

977-9002cwilliams@alliedreit.com

Nanthini Mahalingam, Senior Vice President & CFO(416)

977-9002nmahalingam@alliedreit.com

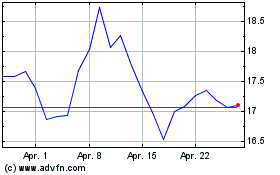

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

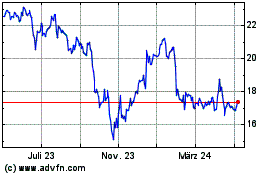

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024