Standard Lithium Reports 2024 Full Year and Fourth Quarter Results

24 September 2024 - 2:19PM

Standard Lithium Ltd. (“Standard Lithium” or the

“Company”) (TSXV:SLI) (NYSE American:SLI) (FRA:S5L), a leading

near-commercial lithium company, today announced its financial and

operating results for the fiscal fourth quarter and year ended June

30, 2024.

“We delivered on our promises in fiscal 2024

with the advancement of our world-class lithium brine assets and by

securing a strategic partnership with global energy major,

Equinor,” said David Park, CEO and Director of Standard Lithium.

“Standard Lithium holds globally-significant lithium brine assets

in the Smackover with the potential to help meet the growing demand

for sustainable lithium production in the U.S. We are the most

advanced DLE play in North America, having proven direct lithium

extraction at a commercial scale. The Standard Lithium team has

done an outstanding job of differentiating itself from the pack by

systematically de-risking its business, including the consummation

of it’s partnerships with Equinor and Koch. Now, with the recent

announcement of the conditional DOE grant of US$225 million, is the

time for us to prioritize, focus and execute. We look forward to

working closely with our partners to advance our South West

Arkansas and East Texas projects.”

Highlights Subsequent to the Fourth

Quarter Ended June 30, 2024

All amounts are in US dollars unless otherwise

indicated.

- Received conditional $225

million grant from the U.S. Department of Energy (“DOE”) for the

South West Arkansas Project. The grant is expected to

support the construction of the Central Processing Facility for

Phase 1 of the SWA project and is dependent on successful

negotiations with the DOE. The grant is one of the largest ever

awarded to a U.S. critical minerals project.

- Appointed David Park as

Chief Executive Officer and Director of the Company. On

September 1, 2024, Mr. Park, a highly experienced executive with a

strong energy and industrial sector background, assumed the

position of Chief Executive Officer. Mr. Park joined the company as

a strategic advisor in July 2023 following his retirement from Koch

Industries after 28 years.

Fourth Quarter and Full Year 2024

Highlights

- Secured strategic

partnership with global energy major Equinor to advance the South

West Arkansas (“SWA”) and East Texas projects. Equinor ASA

(“Equinor”) acquired a 45% interest in two Standard Lithium

entities holding the SWA and East Texas projects for a gross

investment of up to $160 million. The transaction immediately

strengthened the Company’s financial position and resulted in no

dilution to existing shareholders.

- De-risked commercialization

of the direct lithium extraction (“DLE”) process. The

Company successfully installed, commissioned, and continues to

operate the Li-ProTM Lithium Selective Sorption commercial scale

unit at its Demonstration Plant in El Dorado, Arkansas. The

Company’s partner, Koch Technology Solutions, supplied the

commercial scale unit, which is believed to be the largest

commercial-scale column operating in a DLE facility globally. The

results to date have exceeded design parameters, including average

lithium recovery of 97.3%, key contaminant rejection of greater

than 99%, and boron rejection greater than 95%.

- Executed drilling programs

yielding the highest-ever reported lithium brine values in North

America. The South West Arkansas Project’s current

resource averages among the highest lithium concentrations in North

America. As part of its PFS for SWA, the Company reported an Upper

Smackover Indicated and Middle Smackover Inferred resource of 1.4

Mt and 0.4 Mt lithium carbonate equivalent, respectively, at an

average lithium concentration of 437 mg/L. In East Texas, the

Company delivered globally-significant results with confirmed

lithium concentrations up to 806 mg/L and an average concentration

of 644 mg/L in the drilled area. The drill results represent the

highest-ever reported and confirmed lithium brine concentrations in

North America.

- Advanced and de-risked the

South West Arkansas Project. The Company delivered a

Preliminary Feasibility Study (“PFS”) for the project in the first

half of the fiscal year, demonstrating robust economics assuming

average annual production of 30,000 tonnes per annum (“tpa”) of

lithium hydroxide beginning in 2027. Post publishing the PFS, the

Company secured brine production rights and purchased a 118-acre

parcel of land to further advance the project. Most recently, SWA

received a conditional $225 million grant from the U.S. Department

of Energy in support of its construction and development. The grant

was awarded based on an updated scope from the original PFS; the

Project’s design is being updated and now targets a larger total

output of 45,000 tpa of lithium carbonate to be developed in two

phases of 22,500 tpa each. SWA is being developed in partnership

with Equinor, with ownership shared 55% by Standard Lithium and 45%

by Equinor. Ausenco Engineering Canada ULC is leading the

Definitive Feasibility Study and Front-end Engineering and Design

currently underway to support the larger project scope.

- Strengthened the senior

management team with the appointment of key executives.

Michael Barman was appointed Chief Development Officer and Salah

Gamoudi joined as Chief Financial Officer. Mr. Barman most recently

served as Managing Director in Investment Banking at Stifel

Nicolaus Canada Inc. (formerly GMP Securities L.P.) and brings over

two decades of banking experience advising senior executives and

their boards. Mr. Gamoudi brings extensive experience from the oil

and gas sector. Prior to joining the Company, he served as Chief

Financial Officer of SandRidge Energy, Inc. where he successfully

generated significant value for its shareholders.

- Delivered the Definitive

Feasibility Study (“DFS”) for the Phase 1A project at LANXESS South

Plant. The DFS assumed an average annual production of

5,400 tpa of lithium carbonate over a 25-year operating life

beginning in 2026. Phase 1A represents a modest scale-up from the

Company’s existing Demonstration Plant that has been operating

since May 2020. Advancement of the Phase 1A project is dependent on

ongoing commercial discussions with LANXESS and the finalization of

the Arkansas lithium royalty.

- Established an at-the-market equity

program. Net proceeds to the Company for the fiscal year totaled

C$2.8 million and US$13.3 million from the issuance of 1.5 million

shares on the TSX Venture Exchange and 9.1 million shares on the

NYSE American LLC, respectively. No issuances have been completed

under the ATM Program since April 10, 2024.

- Cash and working capital of C$52.9

million and C$39.6 million, respectively, as of June 30, 2024.

- The Company has no term or

revolving debt obligations as of June 30, 2024.

Consolidated Financial

Statements

This news release should be read in conjunction

with the Company’s Consolidated Financial Statements and MD&A

for the year ended June 30, 2024, which are available on the

Company’s issuer profile on SEDAR+ at www.sedarplus.ca and on EDGAR

at www.sec.gov.

Q4 AND FISCAL YEAR 2024 RESULTS

CONFERENCE CALL AND WEBCAST

The Company will hold a conference call and

webcast to discuss its fourth quarter and fiscal year 2024 on

Tuesday, October 1st at 3:30 p.m. ET. Access to the call is

available via webcast or direct dial.

Conference Call and Webcast

DetailsStandard Lithium Fourth Quarter and Fiscal Year

2024 Results Call and WebcastOctober 1, 2024 3:30 p.m. Eastern Time

(US and Canada)

Participant Information:USA / International Toll

+1 (646) 307-1963USA - Toll-Free (800) 715-9871Canada - Toronto

(647) 932-3411Canada - Toll-Free (800) 715-9871

Attendee Webcast

Link:https://events.q4inc.com/attendee/719576289

About Standard Lithium Ltd.

Standard Lithium is a leading near-commercial

lithium development company focused on the sustainable development

of a portfolio of large, high-grade lithium-brine properties in the

United States. The Company prioritizes projects characterized by

the highest quality resources, robust infrastructure, skilled

labor, and streamlined permitting. Standard Lithium aims to achieve

sustainable, commercial-scale lithium production via the

application of a scalable and fully integrated Direct Lithium

Extraction (“DLE”) and purification process. The Company’s flagship

projects are located in the Smackover Formation, a world-class

lithium brine asset, focused in Arkansas and Texas. In partnership

with global energy leader Equinor ASA, Standard Lithium is

advancing the South West Arkansas project, a greenfield project

located in southern Arkansas, and actively exploring promising

lithium brine prospects in East Texas. Additionally, the Company is

advancing the Phase 1A project in partnership with LANXESS

Corporation, a brownfield development project located in southern

Arkansas. Standard Lithium also holds an interest in certain

mineral leases in the Mojave Desert in San Bernardino County,

California.

Standard Lithium trades on both the TSX Venture

Exchange and the NYSE American under the symbol “SLI”; and on the

Frankfurt Stock Exchange under the symbol “S5L”. Please visit the

Company’s website at www.standardlithium.com.

Qualified Person

Steve Ross, P.Geol., a qualified person as

defined by National Instrument 43-101, and Vice President Resource

Development for the Company, has reviewed and approved the relevant

scientific and technical information in this news release.

Twitter: @standardlithiumLinkedIn:

https://www.linkedin.com/company/standard-lithium/

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release. This news release may contain

certain “Forward-Looking Statements” within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities laws. When used in this news

release, the words “anticipate”, “believe”, “estimate”, “expect”,

“target”, “plan”, “forecast”, “may”, “schedule” and other similar

words or expressions identify forward-looking statements or

information. These forward-looking statements or information may

relate to intended development timelines, future prices of

commodities, accuracy of mineral or resource exploration activity,

reserves or resources, regulatory or government requirements or

approvals, the reliability of third party information, continued

access to mineral properties or infrastructure, fluctuations in the

market for lithium and its derivatives, changes in exploration

costs and government regulation in Canada and the United States,

and other factors or information. Such statements represent the

Company’s current views with respect to future events and are

necessarily based upon a number of assumptions and estimates that,

while considered reasonable by the Company, are inherently subject

to significant business, economic, competitive, political and

social risks, contingencies and uncertainties. Many factors, both

known and unknown, could cause results, performance or achievements

to be materially different from the results, performance or

achievements that are or may be expressed or implied by such

forward-looking statements. The Company does not intend, and does

not assume any obligation, to update these forward-looking

statements or information to reflect changes in assumptions or

changes in circumstances or any other events affecting such

statements and information other than as required by applicable

laws, rules and regulations.

Investor and Media Inquiries

Allysa Iverson

Vice President, IR & Corporate Communications

+1 720 484 1147

a.iverson@standardlithium.com

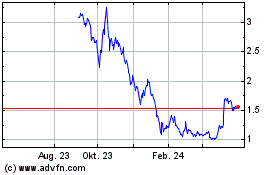

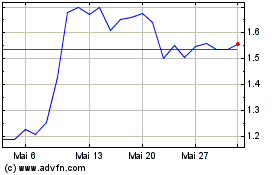

Standard Lithium (TG:S5L)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Standard Lithium (TG:S5L)

Historical Stock Chart

Von Dez 2023 bis Dez 2024