Heineken N.V. reports on 2024 first-quarter trading

Amsterdam, 24 April 2024 – Heineken N.V. (EURONEXT:

HEIA; OTCQX: HEINY) publishes its trading update for the first

quarter of 2024.

- Revenue €8,184 million, up 7.2%

- Net revenue (beia)

organic growth 9.4%; per hectolitre 4.9%

- Beer volume organic

growth 4.7%

- Premium beer volume

organic growth 7.3%

- Heineken® volume

growth 12.9%

- Gross merchandise

value captured via eB2B platforms +17%

- Outlook for the

full year unchanged; operating profit (beia) expected to grow

organically low- to high-single-digit.

Dolf van den Brink, Chairman of the Executive Board /

CEO, commented:

"As we maintained focus on our EverGreen priorities, we had an

encouraging start to 2024. All regions grew volume and net revenue,

and we continued to see a sequential improvement in the performance

of the business, growing in line or ahead of the category in the

majority of our markets. This quarter was boosted by an earlier

Easter and cycling negative one-off effects from last year.

Top-line delivery was well-balanced between volume and value as

more markets returned to volume growth and our underlying

premiumisation trends remained strong.

Heineken® accelerated its growth to 12.9% in volume globally and

became the #1 brand by value in Brazil. Our Low & No-Alcohol

(LONO) portfolio grew volume in the mid-teens, led by the strong

growth of Heineken® 0.0, further strengthening our global

leadership position in the segment. Our eB2B platforms captured

€2.7 billion in gross merchandise value this quarter, 17% more than

last year. Continuing our journey to net zero, we opened a large

scale solar thermal plant in Spain featuring cutting-edge

technology.

We continue to see the economic environment as challenging and

uncertain, and will remain agile and focused. We will continue to

invest behind our brands, innovations, commercial capabilities and

route-to-consumer. Our full year expectations remain

unchanged."

Throughout this report figures refer to quarterly performance

unless otherwise indicated.

Revenue in the first quarter was €8.2 billion,

up 7.2%. Net revenue (beia) was €6.8 billion, up

9.4% organically. Total consolidated volume increased 4.3% and net

revenue (beia) per hectolitre was up 4.9%. Price mix on a constant

geographic basis increased by 6.0%, mainly driven by pricing and in

line with inflation.

Currency translation reduced net revenue (beia) by €294 million

or 4.6%, mainly driven by the devaluation of currencies in Africa,

particularly the Nigerian Naira, and partially offset by a stronger

Mexican Peso and Brazilian Real. Consolidation changes in net

revenue (beia) contributed €164 million, driven by the integration

of Distell and Namibia Breweries and partially offset by the sale

of Vrumona in the Netherlands and our exit from Russia.

|

IFRS Measures |

€ million |

Total growth |

|

BEIA Measures1 |

€ million |

Organic growth |

|

Revenue |

8,184 |

7.2% |

|

Revenue (beia) |

8,184 |

8.8% |

|

Net revenue |

6,847 |

7.3% |

|

Net revenue (beia) |

6,847 |

9.4% |

1. Consolidated figures are used throughout this report, unless

otherwise stated. Please refer to the Glossary for an explanation

of non-GAAP measures and other terms. Page 5 includes a

reconciliation versus IFRS metrics. These non-GAAP measures are

included in internal management reports that are reviewed by the

Executive Board of HEINEKEN, as management believes that this

measurement is the most relevant in evaluating the results and in

performance management.

Beer volume increased 4.7% organically with

growth in all regions, a sequential improvement in the performance

of the business, boosted by calendar and one-off effects. In

particular, the Americas and Europe regions benefitted from the

earlier timing of Easter and the Africa & Middle East and Asia

Pacific regions from a soft comparable base last year due to

one-off effects in Vietnam and Nigeria.

| Beer

volume |

|

|

|

|

|

|

(in mhl or %) |

1Q23 |

1Q24 |

|

Organic growth |

|

|

Heineken N.V. |

54.8 |

55.4 |

|

4.7% |

|

|

Africa & Middle East |

9.0 |

7.4 |

|

3.5% |

|

|

Americas |

20.3 |

21.4 |

|

5.0% |

|

|

Asia Pacific |

10.3 |

11.3 |

|

9.4% |

|

|

Europe |

15.2 |

15.3 |

|

1.6% |

|

Driving premiumisation at scale, led by

Heineken®

Premium beer volume grew by 7.3%, outperforming

the total beer portfolio. The strong momentum in premiumisation was

led by Heineken® and its line

extensions, complemented by our international and local premium

brands, including Tiger, Desperados, Birra Moretti and Kingfisher

Ultra.

Heineken® grew volume by

12.9%, with double-digit growth in more than 30 markets.

Heineken® 0.0

grew volume in the high-teens, with double-digit growth in all

regions, led by Brazil, Vietnam and China.

Heineken® Silver

grew volume by more than 50%, led by Vietnam and China.

|

Heineken®

volume |

|

|

|

|

|

(in mhl or %) |

1Q23 |

1Q24 |

|

Organic growth |

|

Heineken N.V. |

12.2 |

13.8 |

|

12.9% |

|

Africa & Middle East |

1.3 |

1.3 |

|

-0.3% |

|

Americas |

5.4 |

6.0 |

|

10.6% |

|

Asia Pacific |

2.3 |

3.2 |

|

38.8% |

|

Europe |

3.1 |

3.2 |

|

3.2% |

Build a future-fit digital

route-to-consumer

We continued to expand our business-to-business digital

(eB2B) platforms. In the first quarter our platforms

captured €2.7 billion in gross merchandise value (GMV), an increase

of 17% versus last year, connecting more than 640,000 active

customers in fragmented, traditional channels, up 28% compared to

last year. We continue to build capabilities to enable better

features at scale, resulting in an improved customer experience and

better performance, helping customers to grow their business.

We continue to see the economic environment as challenging and

uncertain, and will remain agile and focused on strengthening our

business in line with our EverGreen strategy. Despite the solid

start to the year, we cannot extrapolate the reported top-line

growth to the rest of the year. As planned, we will increase our

investment behind our brands, innovations, commercial capabilities

and route-to-consumer. All in all, we continue to expect operating

profit (beia) to grow organically by a low- to high-single-digit

and net profit (beia) organic growth lower than the operating

profit (beia) organic growth.

| Media |

|

Investors |

| Joris

Evers |

|

José

Federico Castillo Martinez |

| Director of

Global Communication |

|

Director of

Investor Relations |

| Michael

Fuchs |

|

Mark

Matthews / Chris Steyn |

| Corporate &

Financial Communication Manager |

|

Investor Relations

Manager / Senior Analyst |

| E-mail:

pressoffice@heineken.com |

|

E-mail:

investors@heineken.com |

| Tel:

+31-20-5239355 |

|

Tel:

+31-20-5239590 |

HEINEKEN will host an analyst and investor conference call with

Harold van den Broek, Chief Financial Officer, in relation to its

First Quarter 2024 Trading Update at 14:00 CET/13:00 GMT. The call

will be audio cast live via the company’s website:

www.theheinekencompany.com. An audio replay service will also be

made available after the conference call at the above web address.

Analysts and investors can dial-in using the following telephone

numbers:

United Kingdom: +44 203 936 2999

Netherlands: +31 85 888 7233

United States: +1 646 787 9445

All other locations: +44 203 936 2999

For the full list of dial in numbers, please refer to the

following link: Global Dial-In Numbers

Participation password for all countries: 655905

Editorial information HEINEKEN is the world's most international

brewer. It is the leading developer and marketer of premium and

non-alcoholic beer and cider brands. Led by the Heineken® brand,

the Group has a portfolio of more than 350 international, regional,

local and specialty beers and ciders. With HEINEKEN’s over 90,000

employees, we brew the joy of true togetherness to inspire a better

world. Our dream is to shape the future of beer and beyond to win

the hearts of consumers. We are committed to innovation, long-term

brand investment, disciplined sales execution and focused cost

management. Through "Brew a Better World", sustainability is

embedded in the business. HEINEKEN has a well-balanced geographic

footprint with leadership positions in both developed and

developing markets. We operate breweries, malteries, cider plants

and other production facilities in more than 70 countries. Most

recent information is available on our Company's website and follow

us on LinkedIn, Twitter and Instagram.

Market Abuse Regulation This press release may contain

price-sensitive information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Disclaimer This press release contains forward-looking

statements based on current expectations and assumptions with

regard to the financial position and results of HEINEKEN’s

activities, anticipated developments and other factors. All

statements other than statements of historical facts are, or may be

deemed to be, forward-looking statements. Forward-looking

statements also include, but are not limited to, statements and

information in HEINEKEN’s non-financial reporting, such as

HEINEKEN’s emissions reduction and other climate change related

matters (including actions, potential impacts and risks associated

therewith). These forward-looking statements are identified by

their use of terms and phrases such as “aim”, “ambition”,

“anticipate”, “believe”, “could”, “estimate”, “expect”, “goals”,

“intend”, “may”, “milestones”, “objectives”, “outlook”, “plan”,

“probably”, “project”, “risks”, “schedule”, “seek”, “should”,

“target”, “will” and similar terms and phrases. These

forward-looking statements, while based on management's current

expectations and assumptions, are not guarantees of future

performance since they are subject to numerous assumptions, known

and unknown risks and uncertainties, which may change over time,

that could cause actual results to differ materially from those

expressed or implied in the forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond

HEINEKEN’s ability to control or estimate precisely, such as but

not limited to future market and economic conditions, the behaviour

of other market participants, changes in consumer preferences, the

ability to successfully integrate acquired businesses and achieve

anticipated synergies, costs of raw materials and other goods and

services, interest-rate and exchange-rate fluctuations, changes in

tax rates, changes in law, environmental and physical risks, change

in pension costs, the actions of government regulators and weather

conditions. These and other risk factors are detailed in HEINEKEN’s

publicly filed annual reports. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only of

the date of this press release. HEINEKEN assumes no duty to and

does not undertake any obligation to update these forward-looking

statements contained in this press release. Market share estimates

contained in this press release are based on outside sources, such

as specialised research institutes, in combination with management

estimates.

- Please click here to download the full press release

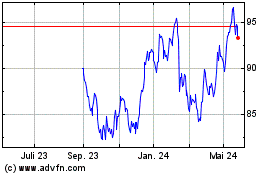

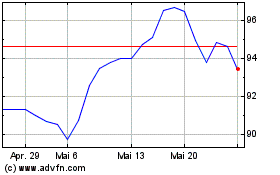

Heineken (TG:HNK1)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Heineken (TG:HNK1)

Historical Stock Chart

Von Dez 2023 bis Dez 2024