Statement of Changes in Beneficial Ownership (4)

29 März 2023 - 10:15PM

Edgar (US Regulatory)

FORM 4

☐

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

LYTTLE CATHERINE M |

2. Issuer Name and Ticker or Trading Symbol

WORTHINGTON INDUSTRIES INC

[

WOR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Sr VP & Chief HR Officer |

|

(Last)

(First)

(Middle)

200 OLD WILSON BRIDGE ROAD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/28/2023 |

|

(Street)

COLUMBUS, OH 43085 |

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

|

(City)

(State)

(Zip)

|

Rule 10b5-1(c) Transaction Indication

☐

Check this box to indicate that a transaction was made pursuant to a contract, instruction or written plan that is intended to

satisfy the affirmative defense conditions of Rule 10b5-1(c). See Instruction 10.

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Shares | 3/28/2023 | | M | | 2200 | A | $42.30 | 56184 | D | |

| Common Shares | 3/28/2023 | | M | | 1800 | A | $42.91 | 57984 | D | |

| Common Shares | 3/28/2023 | | M | | 1700 | A | $42.50 | 59684 | D | |

| Common Shares | 3/28/2023 | | M | | 4300 | A | $38.91 | 63984 | D | |

| Common Shares | 3/28/2023 | | S | | 9880 | D | $62.89 (1) | 54104 | D | |

| Common Shares | 3/28/2023 | | S | | 120 | D | $63.38 (2) | 53984 | D | |

| Common Shares | | | | | | | | 140.43 (3) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Non-qualified stock option (right to buy) | $42.30 | 3/28/2023 | | M | | | 2200 | 6/30/2017 (4) | 6/30/2026 | Common Shares | 2200 | $0.00 | 0 | D | |

| Non-qualified stock option (right to buy) | $42.91 | 3/28/2023 | | M | | | 1800 | 6/28/2019 (5) | 6/28/2028 | Common Shares | 1800 | $0.00 | 0 | D | |

| Non-qualified stock option (right to buy) | $42.50 | 3/28/2023 | | M | | | 1700 | 9/26/2019 (6) | 9/26/2028 | Common Shares | 1700 | $0.00 | 0 | D | |

| Non-qualified stock option (right to buy) | $38.91 | 3/28/2023 | | M | | | 4300 | 6/27/2020 (7) | 6/27/2029 | Common Shares | 4300 | $0.00 | 0 | D | |

| Phantom stock acquired under Deferred Compensation Plan | (8) | | | | | | | (9) | (9) | Common Shares | 6.43 (10) | | 343.43 | D | |

| Explanation of Responses: |

| (1) | The price reported is a weighted average price. These common shares were sold in multiple transactions at prices ranging from $62.37 to $62.89, inclusive. The reporting person undertakes to provide to the issuer, any security holder of the issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of common shares sold at each separate price within the range set forth. |

| (2) | The price reported is a weighted average price. These common shares were sold in multiple transactions at prices ranging from $63.37 to $63.39, inclusive. The reporting person undertakes to provide to the issuer, any security holder of the issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of common shares sold at each separate price within the range set forth. |

| (3) | Amount listed is the most up-to-date information available regarding holdings in the Company Plan Fund which invests in common shares of Worthington Industries, Inc. and is based on a plan statement dated as of December 31, 2022. |

| (4) | This non-qualified stock option was granted pursuant to the Worthington Industries, Inc. 2010 Stock Option Plan. Date listed is the first day any portion of the option vested. Additional portions of 33.33% of the option vested annually on 6/30/2018 and 6/30/2019. |

| (5) | This non-qualified stock option was granted pursuant to the Worthington Industries, Inc. 2010 Stock Option Plan. Date listed is the first day any portion of the option vested. Additional portions of 33.33% of the option vested annually on 6/28/2020 and 6/28/2021. |

| (6) | This non-qualified stock option was granted pursuant to the Worthington Industries, Inc. 2010 Stock Option Plan. Date listed is the first day any portion of the option vested. Additional portions of 33.33% of the option vested annually on 9/26/2020 and 9/26/2021. |

| (7) | This non-qualified stock option was granted pursuant to the Worthington Industries, Inc. 2010 Stock Option Plan. Date listed is the first day any portion of the option vested. Additional portions of 33.33% of the option vested annually on 6/27/2021 and 6/27/2022. |

| (8) | The account under the 2005 NQ Plan (as defined below) tracks Worthington Industries Inc. common shares on a one-for-one basis. |

| (9) | Prior to October 1, 2014, the account balances related to the theoretical Worthington Industries, Inc. common share deemed investment option could be immediately transferred to other deemed investment options under the terms of the Worthington Industries, Inc. Amended and Restated 2005 Deferred Compensation Plan, as amended (the "2005 NQ Plan"). The 2005 NQ Plan provides that effective October 1, 2014 and thereafter, any amount credited in a participant's account to the phantom stock fund (i.e. the theoretical Worthington Industries, Inc. common share deemed investment option) may not be transferred to an alternative deemed investment option under the 2005 NQ Plan until distribution from the 2005 NQ Plan. Distributions are made only in common shares of Worthington Industries, Inc. and generally commence upon leaving Worthington Industries, Inc. and its subsidiaries. |

| (10) | The amount shown reflects additional unfunded theoretical Worthington Industries, Inc. common shares (i.e. phantom stock) credited pursuant to the dividend reinvestment feature of the 2005 NQ Plan. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

LYTTLE CATHERINE M

200 OLD WILSON BRIDGE ROAD

COLUMBUS, OH 43085 |

|

| Sr VP & Chief HR Officer |

|

Signatures

|

| /s/Patrick J. Kennedy, as attorney-in-fact for Catherine M. Lyttle | | 3/29/2023 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

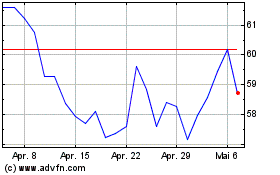

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024