False000080133700008013372024-01-302024-01-300000801337us-gaap:CommonClassAMember2024-01-302024-01-300000801337exch:XNYS2024-01-302024-01-300000801337us-gaap:SeriesFPreferredStockMember2024-01-302024-01-300000801337us-gaap:SeriesGPreferredStockMember2024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 30, 2024

_________________________

WEBSTER FINANCIAL CORPORATION

_________________________________________

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-31486 | | 06-1187536 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

200 Elm Street, Stamford, Connecticut 06902

(Address and zip code of principal executive offices)

203-578-2202

(Registrant’s telephone number, including area code)

______________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | WBS | New York Stock Exchange |

| Depositary Shares, each representing 1/1000th interest in a share of 5.25% Series F Non-Cumulative Perpetual Preferred Stock | WBS-PrF | New York Stock Exchange |

| Depositary Shares, each representing 1/40th interest in a share of 6.50% Series G Non-Cumulative Perpetual Preferred Stock | WBS-PrG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Officer Appointments

On January 24, 2024, Webster Financial Corporation (the “Company”) appointed Luis Massiani, currently President and Chief Operating Officer of Webster Bank, N.A. (the “Bank”), as the Company’s President and Chief Operating Officer, effective as of February 1, 2024, to serve in such capacity until his successor is duly appointed, or his earlier termination, resignation, death or removal from office. Mr. Massiani will continue to serve as Chief Operating Officer and Senior Executive Vice President of the Bank. Also effective February 1, 2024, John Ciulla, currently President and Chief Executive Officer of the Company and Chief Executive Officer of the Bank, will assume the role of President of the Bank. Mr. Cuilla will continue to serve as Chief Executive Officer of both the Company and the Bank.

The full biographical information and business experience of both Mr. Ciulla and Mr. Massiani, ages 58 and 46, respectively, are described under the headings “Election of Directors” and “Executive Officers”, respectively, in the Company’s Definitive Proxy Statement on Schedule 14A (the “Proxy Statement”) filed with the U.S. Securities and Exchange Commission on March 15, 2023.

Effective February 12, 2024, Mr. Massiani’s annual base salary will be increased to $900,000. The Company will also enter into a new Change in Control and Non-Competition Agreement with Mr. Massiani in connection with the pending expiration of his existing Retention Agreement, as described below. There were no new compensatory arrangements or modifications to existing compensatory arrangements entered into with Mr. Ciulla in connection with his appointment.

There are no arrangements or understandings between either Mr. Ciulla or Mr. Massiani and any other persons pursuant to which they were appointed to their respective positions. Neither Mr. Ciulla nor Mr. Massiani has a family relationship with any director or executive officer of the Company, and neither has any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Chairman Transition

As previously disclosed, in connection with Webster’s merger with Sterling Bancorp (the “Merger”), on January 31, 2022, Jack L. Kopnisky was appointed Executive Chairman of the Company’s and the Bank’s Boards of Directors (together, the “Boards”) and was a named executive officer in the Proxy Statement. Pursuant to the Company’s Bylaws, as amended, effective as of January 31, 2024 (the 24-month anniversary of the effective time of Merger), Mr. Kopnisky will cease to serve as a member of both Boards and will instead serve as a strategic consultant to the Company and the Bank. Following Mr. Kopnisky’s departure, Mr. Ciulla will succeed Mr. Kopnisky as Chairman of both Boards and the size of the Company’s Board of Directors will be decreased by one member to 14 directors.

Compensatory Arrangements

On February 1, 2024, the Company is expected to enter into a Change in Control Agreement (the “CIC Agreement”) and a Non-Competition Agreement (the “Non-Competition Agreement”) with Mr. Massiani upon the expiration of, and as contemplated by, the term of Mr. Massiani’s Retention Agreement, dated as of April 18, 2021, originally entered into in connection with the Merger. The Non-Competition Agreement and CIC Agreement are generally consistent with the terms of such agreements with the Company’s other executive officers and previously filed by the Company. The Non-Competition Agreement contains provisions that obligate Mr. Massiani to comply with non-competition and employee and client non-solicitation covenants while employed by the Company and for one year following his termination of employment, as well as perpetual confidentiality and non-disparagement covenants (in each case prior to a change in control), and provides that if his employment is terminated by the Company other than for cause, death or disability, or he resigns due to a material adverse change in his title or position or due to a material reduction in his annual target compensation opportunity, he will, subject to an effective release of claims in favor of the Company, be entitled to a lump sum payment equal to one year of his annual base salary, a pro rata annual incentive payment based on actual performance, and up to one year of medical and dental coverage at active employee rates. Upon the protections of the CIC Agreement with Mr. Massiani becoming effective in connection with a change in control, the Non-Competition Agreement will be superseded by the CIC Agreement, which provides that if his employment is terminated by the Company other than for cause, death or disability or by him for good reason, subject to an effective release of claims in favor of the Company, he will be entitled to: (i) an amount equal to three times the sum of his annual base salary and target annual cash incentive; (ii) a prorated target annual bonus for the portion of the Company’s fiscal year elapsed prior to the date of termination; (iii) an amount equal to the cost of the monthly COBRA premiums for group health care plan coverage for a period of 36 months; (iv) a payment equal to the sum of all Company contributions under the Company’s qualified defined contribution plans and any excess or supplemental defined contribution plans for three years, (v) vesting of all account balances under the Company’s defined contribution plans, and (vi) outplacement services up to a maximum cost of $50,000. The payments and benefits provided under the CIC Agreement are “double trigger” and are not payable upon a termination of Mr.

Massiani’s employment for cause, by his resignation without good reason or any termination of his employment prior to a change in control and will be reduced to the extent that they would be subject to an excise tax under Sections 280G and 4999 of the Internal Revenue Code of 1986, as amended, unless he would be better off on an after-tax basis receiving all such payments and benefits and paying his own excise tax.

In addition, in connection with Christopher Motl’s promotion to Senior Executive Vice President of Webster Bank, National Association as previously disclosed in the Company’s Current Report on Form 8-K filed on April 5, 2023, on February 1, 2024, the Company is expected to enter into an amendment (the “Motl Agreement Amendment”) to Mr. Motl’s Change in Control Agreement, dated as of January 1, 2017 (which provides for severance benefits upon a qualifying termination following a change in control comparable to those described above), providing that the applicable severance multiple and benefit continuation periods thereunder will be increased from two to three.

The foregoing summary is qualified in its entirety by reference to the full text of the Non-Competition Agreement, the CIC Agreement and the Motl Agreement Amendment, copies of which will be filed with the Company’s Annual Report on 10-K for the fiscal year ended December 31, 2023.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | WEBSTER FINANCIAL CORPORATION |

| | | (Registrant) |

| | |

| Date: January 30, 2024 | | | /s/ Albert J. Wang |

| | | | Albert J. Wang |

| | | | Executive Vice President and Chief Accounting Officer |

Document and Entity Information Statement

|

Jan. 30, 2024 |

| Entity Information [Line Items] |

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 30, 2024

|

| Entity Registrant Name |

WEBSTER FINANCIAL CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-31486

|

| Entity Tax Identification Number |

06-1187536

|

| Entity Address, Address Line One |

200 Elm Street

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06902

|

| City Area Code |

203

|

| Local Phone Number |

578-2202

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000801337

|

| NEW YORK STOCK EXCHANGE, INC. [Member] |

|

| Entity Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Common Class A [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

WBS

|

| Series F Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, each representing 1/1000th interest in a share of 5.25% Series F Non-Cumulative Perpetual Preferred Stock

|

| Trading Symbol |

WBS-PrF

|

| Series G Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, each representing 1/40th interest in a share of 6.50% Series G Non-Cumulative Perpetual Preferred Stock

|

| Trading Symbol |

WBS-PrG

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

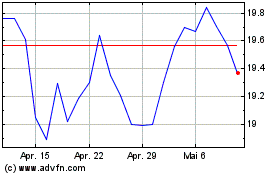

Webster Financial (NYSE:WBS-F)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

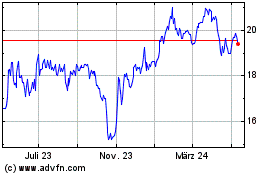

Webster Financial (NYSE:WBS-F)

Historical Stock Chart

Von Mai 2023 bis Mai 2024