- Consolidated Revenues of $21.8B, Compared to $22.1B Last

Year

- Consolidated Operating Margin of 8.9%; Adjusted*

Consolidated Operating Margin of 9.5%

- Diluted EPS of $1.65; Adj. Diluted EPS of $1.79, Compared to

$2.54 Last Year

- Updates Full-Year 2024 Financial Guidance; Restarts Share

Repurchase Program, Targeting $1B Annually

UPS (NYSE:UPS) today announced second-quarter 2024 consolidated

revenues of $21.8 billion, a 1.1% decrease from the second quarter

of 2023. Consolidated operating profit was $1.9 billion, down 30.1%

compared to the second quarter of 2023, and down 29.3% on an

adjusted basis. Diluted earnings per share were $1.65 for the

quarter; adjusted diluted earnings per share of $1.79 were 29.5%

below the same period in 2023.

For the second quarter of 2024, GAAP results include an

after-tax charge of $120 million, or $0.14 per diluted share,

comprised of a one-time payment of $94 million to settle an

international regulatory matter, and transformation and other

charges of $26 million.

“I want to thank all UPSers for their hard work and efforts in

the second quarter,” said Carol Tomé, UPS chief executive officer.

“This quarter was a significant turning point for our company as we

returned to volume growth in the U.S., the first time in nine

quarters. As expected, our operating profit declined in the first

half of 2024 from what we reported last year. Going forward we

expect to return to operating profit growth.”

U.S. Domestic Segment

2Q

2024

Adjusted

2Q

2024

2Q

2023

Adjusted

2Q

2023

Revenue

$14,119 M

$14,396 M

Operating profit

$989 M

$997 M

$1,602 M

$1,681 M

- Revenue decreased 1.9%, driven by a 2.6% decrease in revenue

per piece due primarily to changes in product mix.

- Operating margin was 7.0%; adjusted operating margin was

7.1%.

International Segment

2Q

2024

Adjusted

2Q

2024

2Q

2023

Adjusted

2Q

2023

Revenue

$4,370 M

$4,415 M

Operating profit

$718 M

$824 M

$883 M

$902 M

- Revenue decreased 1.0%, driven primarily by a 2.9% decrease in

average daily volume.

- Operating margin was 16.4%; adjusted operating margin was

18.9%.

Supply Chain Solutions1

2Q

2024

Adjusted

2Q

2024

2Q

2023

Adjusted

2Q

2023

Revenue

$3,329 M

$3,244 M

Operating profit

$237 M

$243 M

$295 M

$336 M

1 Consists of operating segments that do

not meet the criteria of a reportable segment under ASC Topic 280 –

Segment Reporting.

- Revenue increased 2.6% due primarily to growth in logistics,

including healthcare.

- Operating margin was 7.1%; adjusted operating margin was

7.3%.

2024 Outlook

The company provides certain guidance on an adjusted (non-GAAP)

basis because it is not possible to predict or provide a

reconciliation reflecting the impact of future pension adjustments

or other unanticipated events, which would be included in reported

(GAAP) results and could be material.

For 2024, UPS updates its full-year, consolidated financial

targets**:

- Consolidated revenue expected to be approximately $93.0

billion

- Consolidated adjusted operating margin expected to be

approximately 9.4%

- Capital expenditures of approximately $4.0 billion

- Targeting around $500 million in share repurchases

* “Adjusted” or “Adj.” amounts are

non-GAAP financial measures. See the appendix to this release for a

discussion of non-GAAP financial measures, including a

reconciliation to the most closely correlated GAAP measure.

**Excludes the impacts of pending

disposition of Coyote and announced acquisition.

Conference Call

Information

UPS CEO Carol Tomé and CFO Brian Dykes will discuss

second-quarter results with investors and analysts during a

conference call at 8:30 a.m. ET, July 23, 2024. That call will be

open to others through a live Webcast. To access the call, go to

www.investors.ups.com and click on “Earnings Conference Call.”

Additional financial information is included in the detailed

financial schedules being posted on www.investors.ups.com under

“Quarterly Earnings and Financials” and as furnished to the SEC as

an exhibit to our Current Report on Form 8-K.

About UPS

UPS (NYSE: UPS) is one of the world’s largest companies, with

2023 revenue of $91.0 billion, and provides a broad range of

integrated logistics solutions for customers in more than 200

countries and territories. Focused on its purpose statement,

“Moving our world forward by delivering what matters,” the

company’s approximately 500,000 employees embrace a strategy that

is simply stated and powerfully executed: Customer First. People

Led. Innovation Driven. UPS is committed to reducing its impact on

the environment and supporting the communities we serve around the

world. UPS also takes an unwavering stance in support of diversity,

equity and inclusion. More information can be found at www.ups.com,

about.ups.com and www.investors.ups.com.

Forward-Looking

Statements

This release, our Annual Report on Form 10-K for the year ended

December 31, 2023 and our other filings with the Securities and

Exchange Commission contain and in the future may contain

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Statements other than

those of current or historical fact, and all statements accompanied

by terms such as “will,” “believe,” “project,” “expect,”

“estimate,” “assume,” “intend,” “anticipate,” “target,” “plan,” and

similar terms, are intended to be forward-looking statements.

Forward-looking statements are made subject to the safe harbor

provisions of the federal securities laws pursuant to Section 27A

of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934.

From time to time, we also include written or oral

forward-looking statements in other publicly disclosed materials.

Forward-looking statements may relate to our intent, belief,

forecasts of, or current expectations about our strategic

direction, prospects, future results, or future events; they do not

relate strictly to historical or current facts. Management believes

that these forward-looking statements are reasonable as and when

made. However, caution should be taken not to place undue reliance

on any forward-looking statements because such statements speak

only as of the date when made and the future, by its very nature,

cannot be predicted with certainty.

Forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ materially

from our historical experience and our present expectations or

anticipated results. These risks and uncertainties include, but are

not limited to: changes in general economic conditions in the U.S.

or internationally; significant competition on a local, regional,

national and international basis; changes in our relationships with

our significant customers; our ability to attract and retain

qualified employees; strikes, work stoppages or slowdowns by our

employees; increased or more complex physical or operational

security requirements; a significant cybersecurity incident, or

increased data protection regulations; our ability to maintain our

brand image and corporate reputation; impacts from global climate

change; interruptions in or impacts on our business from natural or

man-made events or disasters including terrorist attacks, epidemics

or pandemics; exposure to changing economic, political, regulatory

and social developments in international and emerging markets; our

ability to realize the anticipated benefits from acquisitions,

dispositions, joint ventures or strategic alliances; the effects of

changing prices of energy, including gasoline, diesel, jet fuel,

other fuels and interruptions in supplies of these commodities;

changes in exchange rates or interest rates; our ability to

accurately forecast our future capital investment needs; increases

in our expenses or funding obligations relating to employee health,

retiree health and/or pension benefits; our ability to manage

insurance and claims expenses; changes in business strategy,

government regulations or economic or market conditions that may

result in impairments of our assets; potential additional U.S. or

international tax liabilities; increasingly stringent regulations

related to climate change; potential claims or litigation related

to labor and employment, personal injury, property damage, business

practices, environmental liability and other matters; and other

risks discussed in our filings with the Securities and Exchange

Commission from time to time, including our Annual Report on Form

10-K for the year ended December 31, 2023, and subsequently filed

reports. You should consider the limitations on, and risks

associated with, forward-looking statements and not unduly rely on

the accuracy of predictions contained in such forward-looking

statements. We do not undertake any obligation to update

forward-looking statements to reflect events, circumstances,

changes in expectations, or the occurrence of unanticipated events

after the date of those statements, except as required by law.

From time to time, we expect to participate in analyst and

investor conferences. Materials provided or displayed at those

conferences, such as slides and presentations, may be posted on our

investor relations website at www.investors.ups.com under the

heading "Presentations" when made available. These presentations

may contain new material nonpublic information about our company

and you are encouraged to monitor this site for any new posts, as

we may use this mechanism as a public announcement.

Reconciliation of GAAP and Non-GAAP

Financial Measures

We supplement the reporting of our financial information

determined under generally accepted accounting principles ("GAAP")

with certain non-GAAP financial measures.

Adjusted financial measures should be considered in addition to,

and not as an alternative for, our reported results prepared in

accordance with GAAP. Our adjusted financial measures do not

represent a comprehensive basis of accounting and therefore may not

be comparable to similarly titled measures reported by other

companies.

Forward-Looking Non-GAAP Metrics

From time to time when presenting forward-looking non-GAAP

metrics, we are unable to provide quantitative reconciliations to

the most closely correlated GAAP measure due to the uncertainty in

the timing, amount or nature of any adjustments, which could be

material in any period.

One-Time Payment for International Regulatory Matter

In the second quarter of 2024, we made a one-time payment of $94

million of previously restricted cash to settle a

previously-disclosed challenge by Italian tax authorities to the

deductibility of Value Added Tax payments by UPS to certain

third-party service providers, a review of which was launched in

the fourth quarter of 2023. We supplement the presentation of our

operating profit, operating margin, interest expense, total other

income (expense), income before income taxes, net income and

earnings per share with non-GAAP measures that exclude the impact

of this payment. We believe excluding the impact of this payment,

which we do not believe is a component of our ongoing operations

and we do not expect to recur, better enables users of our

financial statements to view and evaluate underlying business

performance from the same perspective as management.

Transformation and Other Costs, and Asset Impairment Charges

We supplement the presentation of our operating profit,

operating margin, income before income taxes, net income and

earnings per share with non-GAAP measures that exclude the impact

of charges related to transformation activities, asset impairments

and other charges. We believe excluding the impact of these charges

better enables users of our financial statements to view and

evaluate underlying business performance from the perspective of

management. We do not consider these costs when evaluating the

operating performance of our business units, making decisions to

allocate resources or in determining incentive compensation

awards.

One-Time Compensation Payment

We supplement the presentation of our operating profit,

operating margin, income before income taxes, net income and

earnings per share with non-GAAP measures that exclude the impact

of a one-time payment made to certain U.S.-based, non-union

part-time supervisors following the ratification of our labor

agreement with the Teamsters. We do not expect this or similar

payments to recur. We believe excluding the impact of this one-time

payment better enables users of our financial statements to view

and evaluate underlying business performance from the same

perspective as management.

Defined Benefit Pension and Postretirement Medical Plan Gains

and Losses

We recognize changes in the fair value of plan assets and net

actuarial gains and losses in excess of a 10% corridor (defined as

10% of the greater of the fair value of plan assets or the plan's

projected benefit obligation), as well as gains and losses

resulting from plan curtailments and settlements, for our pension

and postretirement defined benefit plans immediately as part of

Investment income (expense) and other in the statements of

consolidated income. We supplement the presentation of our income

before income taxes, net income and earnings per share with

adjusted measures that exclude the impact of these gains and losses

and the related income tax effects. We believe excluding these

defined benefit pension and postretirement plan gains and losses

provides important supplemental information by removing the

volatility associated with plan amendments and short-term changes

in market interest rates, equity values and similar factors.

Free Cash Flow

We calculate free cash flow as cash flows from operating

activities less capital expenditures, proceeds from disposals of

property, plant and equipment, and plus or minus the net changes in

other investing activities. We believe free cash flow is an

important indicator of how much cash is generated by our ongoing

business operations and we use this as a measure of incremental

cash available to invest in our business, meet our debt obligations

and return cash to shareowners.

Adjusted Return on Invested Capital

Adjusted ROIC is calculated as the trailing twelve months

(“TTM”) of adjusted operating income divided by the average of

total debt, non-current pension and postretirement benefit

obligations and shareowners’ equity, at the current period end and

the corresponding period end of the prior year. Because adjusted

ROIC is not a measure defined by GAAP, we calculate it, in part,

using non-GAAP financial measures that we believe are most

indicative of our ongoing business performance. We consider

adjusted ROIC to be a useful measure for evaluating the

effectiveness and efficiency of our long-term capital

investments.

Adjusted Total Debt / Adjusted EBITDA

Adjusted total debt is defined as our long-term debt and finance

leases, including current maturities, plus non-current pension and

postretirement benefit obligations. Adjusted EBITDA is defined as

earnings before interest, taxes, depreciation and amortization

adjusted for the impacts of incentive compensation program

redesign, one-time compensation, goodwill & asset impairment

charges, transformation and other costs, a one-time international

regulatory matter, defined benefit plan gains and losses and other

income. We believe the ratio of adjusted total debt to adjusted

EBITDA is an important indicator of our financial strength, and is

a ratio used by third parties when evaluating the level of our

indebtedness.

Adjusted Cost per Piece

We evaluate the efficiency of our operations using various

metrics, including adjusted cost per piece. Adjusted cost per piece

is calculated as adjusted operating expenses in a period divided by

total volume for that period. Because adjusted operating expenses

exclude costs or charges that we do not consider a part of

underlying business performance when monitoring and evaluating the

operating performance of our business units, making decisions to

allocate resources or in determining incentive compensation awards,

we believe this is the appropriate metric on which to base reviews

and evaluations of the efficiency of our operational

performance.

Reconciliation of GAAP and

Non-GAAP Income Statement Items

(in millions, except per share

data):

Three Months Ended June 30,

2024

As Reported (GAAP)

One-Time Int'l Regulatory

Matter(1)

Transformation & Other

Adj.(2)

As Adjusted

(Non-GAAP)

U.S. Domestic Package

$

13,130

$

—

$

8

$

13,122

International Package

3,652

88

18

3,546

Supply Chain Solutions

3,092

—

6

3,086

Operating Expense

19,874

88

32

19,754

U.S. Domestic Package

989

—

8

997

International Package

718

88

18

824

Supply Chain Solutions

237

—

6

243

Operating Profit

1,944

88

32

2,064

Other Income and (Expense):

Other pension income (expense)

67

—

—

67

Investment income (expense) and other

70

—

—

70

Interest expense

(212

)

6

—

(206

)

Total Other Income (Expense)

(75

)

6

—

(69

)

Income Before Income Taxes

1,869

94

32

1,995

Income Tax Expense

460

—

6

466

Net Income

$

1,409

$

94

$

26

$

1,529

Basic Earnings Per Share

$

1.65

$

0.11

$

0.03

$

1.79

Diluted Earnings Per Share

$

1.65

$

0.11

$

0.03

$

1.79

(1) Reflects a one-time payment for an

international regulatory matter and related interest of $94

million.

(2) Reflects other employee benefits costs

of $20 million and $12 million of other costs.

Reconciliation of GAAP and

Non-GAAP Income Statement Items

(in millions, except per share

data):

Six Months Ended June 30,

2024

As Reported (GAAP)

One-Time Int'l Regulatory

Matter(1)

Asset Impairment

Charges(2)

Transformation & Other

Adj.(3)

As Adjusted

(Non-GAAP)

U.S. Domestic Package

$

26,539

$

—

$

5

$

17

$

26,517

International Package

7,252

88

2

42

7,120

Supply Chain Solutions

6,176

—

41

59

6,076

Operating Expense

39,967

88

48

118

39,713

U.S. Domestic Package

1,814

—

5

17

1,836

International Package

1,374

88

2

42

1,506

Supply Chain Solutions

369

—

41

59

469

Operating Profit

3,557

88

48

118

3,811

Other Income and (Expense):

Other pension income (expense)

134

—

—

—

134

Investment income (expense) and other

121

—

—

—

121

Interest expense

(407

)

6

—

—

(401

)

Total Other Income (Expense)

(152

)

6

—

—

(146

)

Income Before Income Taxes

3,405

94

48

118

3,665

Income Tax Expense

883

—

13

17

913

Net Income

$

2,522

$

94

$

35

$

101

$

2,752

Basic Earnings Per Share

$

2.95

$

0.11

$

0.04

$

0.11

$

3.21

Diluted Earnings Per Share

$

2.94

$

0.11

$

0.04

$

0.12

$

3.21

(1) Reflects a one-time payment for an

international regulatory matter and related interest of $94

million.

(2) Reflects impairment charges of $41

million for acquired trade names within Supply Chain Solutions and

$7 million for software licenses.

(3) Reflects other employee benefits costs

of $51 million and $67 million of other costs, including a one-time

expense related to a regulatory matter.

Reconciliation of Free Cash

Flow (Non-GAAP measure)

(in millions):

Six Months Ended June

30,

2024

Cash flows from operating activities

$

5,309

Capital expenditures

(1,968

)

Proceeds from disposals of property, plant

and equipment

28

Other investing activities

(4

)

Free Cash Flow (Non-GAAP measure)

$

3,365

Reconciliation of Adjusted

Debt to Adjusted EBITDA (Non-GAAP measure)

(in millions):

TTM(1) Ended

June 30,

2024

Net income

$

5,254

Add back:

Income tax expense

1,482

Interest expense

815

Depreciation & amortization

3,489

EBITDA

11,040

Add back (deduct):

Incentive compensation program

redesign

—

One-time compensation

61

Asset impairment charges

276

Transformation and other

411

Defined benefit plan (gains) and

losses

359

Investment income and other pension

income

(533

)

One-time international regulatory

matter

88

Adjusted EBITDA

$

11,702

Debt and finance leases, including current

maturities

$

22,205

Add back:

Non-current pension and postretirement

benefit obligations

6,449

Adjusted total debt

$

28,654

Adjusted total debt/Net income

5.45

Adjusted total debt/adjusted EBITDA

(Non-GAAP)

2.45

(1) Trailing twelve months.

Reconciliation of Adjusted

Return on Invested Capital (Non-GAAP measure)

(in millions):

TTM(1) Ended

June 30,

2024

Net income

$

5,254

Add back (deduct):

Income tax expense

1,482

Interest expense

815

Other pension (income) expense

93

Investment (income) expense and other

(267

)

Operating profit

$

7,377

Incentive compensation program

redesign

—

Long-lived asset estimated residual value

changes

—

One-time compensation

61

Asset impairment charges

276

Transformation and other

411

One-time international regulatory

matter

88

Adjusted operating profit

$

8,213

Average debt and finance leases, including

current maturities

$

21,484

Average pension and postretirement benefit

obligations

5,542

Average shareowners' equity

18,545

Average invested capital

$

45,571

Net income to average invested capital

11.5

%

Adjusted Return on Invested Capital

(Non-GAAP)

18.0

%

(1) Trailing twelve months.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723590067/en/

UPS Media Relations: 404-828-7123 or pr@ups.com UPS Investor

Relations: 404-828-6059 (option 4) or investor@ups.com

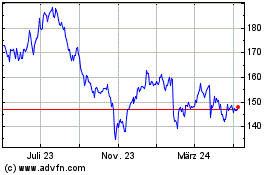

United Parcel Service (NYSE:UPS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

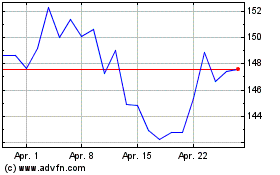

United Parcel Service (NYSE:UPS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024