Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

22 Juni 2022 - 11:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 Or 15d-16 Of

The Securities Exchange Act Of 1934

For the month of June 2022

Commission File Number: 001-14950

ULTRAPAR HOLDINGS INC.

(Translation of Registrant’s Name into English)

Brigadeiro Luis Antonio Avenue, 1343, 9th Floor

São Paulo, SP, Brazil 01317-910

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ____X____ Form 40-F ________

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ________ No ____X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ________ No ____X____

ULTRAPAR HOLDINGS INC.

TABLE OF CONTENTS

ITEM

ULTRAPAR PARTICIPAÇÕES S.A.

Approval by the Administrative Tribunal of CADE of Extrafarma’s sale

São Paulo, June 22, 2022 – In addition to the material notice of May 18, 2021, and the market announcements of February 11, 2022, and May 9, 2022, Ultrapar Participações S.A. (B3: UGPA3; NYSE: UGP, “Ultrapar”) hereby informs that the Administrative Tribunal of the Administrative Council of Economic Defense (“CADE”) approved the sale of Extrafarma to Pague Menos S.A. (“Transaction”), through the execution of a Merger Control Agreement, providing for the divestment of 8 Extrafarma stores, which will not change the total enterprise value of the Transaction of R$ 700 million, which remains, however, subject to adjustments due mainly to changes in working capital and of Extrafarma's net debt position on the closing date of the transaction.

As provided for in the Merger Control Agreement, the closing of the Transaction was authorized by CADE due to the execution of a binding contract covering the sale of the aforementioned stores. Once the other conditions precedent set out in the sale agreement of Extrafarma are fulfilled, the parties will implement the closing of the Transaction, scheduled to take place on August 1, 2022.

Ultrapar will keep the market and its shareholders duly informed of any relevant updates related to this announcement.

Rodrigo de Almeida Pizzinatto

Chief Financial and Investor Relations Officer

Ultrapar Participações S.A.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: June 22, 2022

|

ULTRAPAR HOLDING INC. |

|

By: /s/ Rodrigo de Almeida Pizzinatto

|

|

Name: Rodrigo de Almeida Pizzinatto

|

|

Title: Chief Financial and Investor Relations Officer

|

(Market announcement)

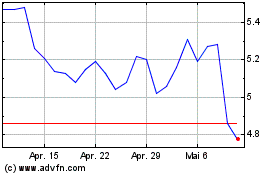

Ultrapar Participacoes (NYSE:UGP)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Ultrapar Participacoes (NYSE:UGP)

Historical Stock Chart

Von Jun 2023 bis Jun 2024