UBS AG announced today that it will redeem all of the

outstanding securities in each of the seven series of UBS-issued

exchange traded notes set forth in the following table

(collectively, the “ETNs”). UBS AG expects to deliver redemption

notices with respect to each of the ETNs to holders of the

applicable ETNs with Call Settlement Dates as set forth in the

table below.

Table-1

ETN Ticker

ETN Name and Prospectus

Supplement [1]

CUSIP

Call Settlement Date

DJCB

ETRACS Bloomberg Commodity Index Total

ReturnSM ETN Series B due October 31, 2039[2]

90269A450

12/12/2024

WUCT

ETRACS Whitney US Critical Technologies

ETN due March 13, 2053

90278V222

12/12/2024

AMNA

ETRACS Alerian Midstream Energy Index ETN

due June 21, 2050[3]

90269A351

12/12/2024

AMND

ETRACS Alerian Midstream Energy High

Dividend Index ETN due July 19, 2050[3]

90269A252

12/12/2024

AMTR

ETRACS Alerian Midstream Energy Total

Return Index ETN due October 20, 2050[3]

90269A245

12/12/2024

ESUS

ETRACS 2x Leveraged MSCI USA ESG Focus TR

ETN due September 15, 2061[4]

90278V743

12/12/2024

FEDL

ETRACS 2x Leveraged IFED Invest with the

FED TR Index ETN due September 15, 2061[4]

90278V750

12/12/2024

[1] The table above provides a hyperlink to the relevant

prospectus and supplements thereto for each of the ETNs, which are

identified by their names. Each of the above ETNs are part of the

UBS AG’s Medium Term Notes, Series B, on which UBS AG is sole

obligor. Capitalized terms used but not defined in this press

release shall have the meanings ascribed to such terms in the

relevant prospectus supplement (including, as applicable, any

product supplement and pricing supplement (each such supplement, a

“prospectus supplement”)) for the ETNs.

[2] The prospectus addendum with a link to the updated base

prospectus and the changes to the section entitled “Early

Redemption” on page S-3 of the prospectus supplement can be

accessed here.

[3] The prospectus addendum with a link to the updated base

prospectus can be accessed here.

[4] The prospectus addendum with a link to the updated base

prospectus can be accessed here.

With respect to the ETNs represented by tickers WUCT, AMNA,

AMND, AMTR, ESUS and FEDL, the Call Settlement Amount payable on

the Call Settlement Date will be calculated as specified in the

relevant prospectus supplement. UBS will pay the applicable Call

Settlement Amount to investors holding such ETNs on the applicable

Call Settlement Date.

With respect to the ETNs represented by ticker DJCB, the

Redemption Amount payable on the Call Settlement Date will be

calculated as specified in the relevant prospectus supplement. UBS

will pay the Redemption Amount to investors holding such ETNs on

the applicable Call Settlement Date.

We expect that the last day of trading for the ETNs will be

December 11, 2024.

Additional details regarding the redemption dates and valuation

dates are included in Table-2 below.

Table-2

ETN Ticker

Call Measurement

Period

Call Measurement Period Start

Date & Call Measurement Period End Date

Call Valuation Date

Call Settlement Date

DJCB*

1 Trading Day

12/09/2024

12/09/2024

12/12/2024

WUCT

1 Index Business Day

12/09/2024

12/09/2024

12/12/2024

AMNA

1 Index Business Day

12/09/2024

12/09/2024

12/12/2024

AMND

1 Index Business Day

12/09/2024

12/09/2024

12/12/2024

AMTR

1 Index Business Day

12/09/2024

12/09/2024

12/12/2024

ESUS

1 Index Business Day

12/09/2024

12/09/2024

12/12/2024

FEDL

1 Index Business Day

12/09/2024

12/09/2024

12/12/2024

* The Call Measurement Period and Call

Valuation Date in this table refers to the Valuation Date as

defined in the Securities represented by ticker DJCB.

As disclosed in more detail in the applicable prospectus

supplement(s) for the ETNs, the market value of the ETNs may be

influenced by, among other things, supply and demand for the ETNs.

It is possible that the discontinuance of further issuances of the

ETNs by UBS AG may influence the market value of the ETNs. The

suspension of new issuances of the ETNs could affect the liquidity

of the market for the ETNs, potentially leading to insufficient

supply and causing the ETNs to trade at a premium above their

closing or intraday indicative value. Any such premium may

subsequently decrease at any time and for any reason without

warning, resulting in financial loss to sellers who paid this

premium when they acquired their ETNs. In addition, on the

applicable Call Settlement Date, holders will receive the Call

Settlement Amount or Redemption Amount, as applicable, as described

in each applicable prospectus supplement but will not receive any

premium thereto. Accordingly, investors who purchase the ETNs at

any time prior to the Call Settlement Date for an amount that is

greater than the Call Settlement Amount or Redemption Amount, as

applicable (including paying any premium to the indicative value of

the ETNs), will suffer a loss on their investment if they hold

their ETNs until the Call Settlement Date.

If investors elect to redeem any such ETNs, any redemption will

be at the redemption value set forth in the applicable prospectus

supplement(s) and will not include any premium above that value.

Investors should always consult their financial advisors and

compare the intraday indicative value of the ETNs with the ETNs’

then-prevailing market price before purchasing or selling any such

ETNs, especially notes with premium characteristics. The applicable

prospectus supplement(s) for the ETNs can be accessed by clicking

on the name of the ETN identified in the table above as well as on

the SEC's website at sec.gov.

This announcement does not affect the terms of the outstanding

ETNs, including the right of holders to require UBS AG to redeem

their ETNs on the terms and at the redemption price set forth in

the applicable prospectus supplement(s). This news release shall

not constitute an offer to sell or the solicitation of an offer to

buy any securities nor will there be any sale of these ETNs in any

state or other jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or other jurisdiction.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains statements that constitute

“forward-looking statements” that are subject to risks and

uncertainties, and actual results may differ materially. These

statements could contain words such as “possible,” “intend,”

“will,” “may,” “intends,” “would,” “if,” “expect,” “potentially” or

other similar expressions. Forward-looking statements, including

those relating to UBS AG’s plans for the ETNs, are based on

management’s current expectations and assumptions, and are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict. While these forward-looking statements

represent UBS’s judgments, expectations and objectives concerning

the matters described, a number of risks, uncertainties and other

important factors, including whether UBS AG will actually complete

the redemption of the ETNs, could cause actual developments and

results to differ materially from UBS’s expectations. For a

discussion of the risks and uncertainties that may affect the ETNs

please refer to the "Risk Factors" in the applicable prospectus

supplement(s) relating to the ETNs referenced in Table-1. UBS is

not under any obligation to (and expressly disclaims any obligation

to) update or alter its forward-looking statements, whether as a

result of new information, future events, or otherwise.

About ETRACS ETNs

ETRACS ETNs are senior unsecured notes issued by UBS AG, are

traded on NYSE Arca, and can be bought and sold through a broker or

financial advisor. An investment in ETRACS ETNs is subject to a

number of risks, including the risk of loss of some or all of the

investor’s principal, and is subject to the creditworthiness of UBS

AG. Investors are not guaranteed any coupon or distribution amount

under the ETRACS ETNs. Prior to making an investment in the ETRACS

ETNs, investors should take into account whether or not the market

price is tracking the intraday indicative value of the ETRACS ETNs.

We urge you to read the more detailed explanation of risks

described under “Risk Factors” in the applicable prospectus

supplement for each ETRACS ETN.

UBS AG has filed a registration statement (including a

prospectus and supplements thereto) with the Securities and

Exchange Commission, or SEC, for the offerings of securities to

which this communication relates. Before you invest, you should

read the prospectus, along with the applicable prospectus

supplement(s) to understand fully the terms of the ETNs and other

considerations that are important in making a decision about

investing in the ETNs. The applicable offering document for each

ETN may be obtained by clicking on the name of each ETNs identified

above. You may also get these documents without cost by visiting

EDGAR on the SEC website at www.sec.gov. The securities related to

the offerings are not deposit liabilities and are not insured or

guaranteed by the Federal Deposit Insurance Corporation or any

other governmental agency of the United States, Switzerland or any

other jurisdiction.

About UBS

UBS is a leading and truly global wealth manager and the leading

universal bank in Switzerland. It also provides diversified asset

management solutions and focused investment banking capabilities.

With the acquisition of Credit Suisse, UBS manages $5.7 trillion of

invested assets as per fourth quarter 2023. UBS helps clients

achieve their financial goals through personalized advice,

solutions and products. Headquartered in Zurich, Switzerland, the

firm is operating in more than 50 markets around the globe. UBS

Group shares are listed on the SIX Swiss Exchange and the New York

Stock Exchange (NYSE).

In the US, securities underwriting, trading and brokerage

activities and M&A advisor activities are provided by UBS

Securities LLC, a registered broker/dealer that is a wholly owned

subsidiary of UBS AG, a member of the New York Stock Exchange and

other principal exchanges, and a member of SIPC

(http://www.sipc.org/). UBS Financial Services Inc. is a registered

broker/dealer and affiliate of UBS Securities LLC.

This material is issued by UBS AG and/or any of its subsidiaries

and/or any of its affiliates ("UBS"). This document was produced by

and the opinions expressed are those of UBS as of the date of

writing and are subject to change. It has been prepared solely for

information purposes and for the use of the recipient. It does not

constitute an offer or an invitation by or on behalf of UBS to any

person to buy or sell any security. The information and analysis

contained in this publication have been compiled or arrived at from

sources believed to be reliable but UBS does not make any

representation as to their accuracy or completeness and does not

accept liability for any loss arising from the use hereof. Products

and services mentioned in this material may not be available for

residents of certain jurisdictions. Past performance is not

necessarily indicative of future results. Please consult the

restrictions relating to the product or service in question for

further information.

Bloomberg is not affiliated with UBS. UBS assumes sole

responsibility for this press release, which has not been reviewed

by Bloomberg. None of Bloomberg, UBS AG, UBS Securities LLC or any

of their subsidiaries or affiliates (collectively, "Bloomberg or

UBS") guarantees the accuracy and/or the completeness of the

Bloomberg Commodity Indexsm or any data related thereto and neither

of Bloomberg or UBS shall have any liability for any errors,

omissions or interruptions therein. Neither of Bloomberg or UBS

makes any warranty, express or implied, as to results to be

obtained by owners of the securities or any other person or entity

from the use of the Bloomberg Commodity Index sm or any data

related thereto. Neither of Bloomberg or UBS makes any express or

implied warranties and expressly disclaims all warranties of

merchantability or fitness for a particular purpose or use with

respect to the Bloomberg Commodity Indexsm or any data related

thereto. Without limiting any of the foregoing, to the maximum

extent allowed by law, Bloomberg, its licensors (including UBS),

and its and their respective employees, contractors, agents,

suppliers and vendors shall have no liability or responsibility

whatsoever for any injury or damages— whether direct, indirect,

consequential, incidental, punitive or otherwise—arising in

connection with the Bloomberg Commodity Indexsm or any data or

values relating thereto—whether arising from their negligence or

otherwise, even if notified of the possibility thereof. There are

no third-party beneficiaries of any agreements or arrangements

among Bloomberg and UBS Securities LLC, other than UBS AG.

The securities referred to herein are not sponsored, endorsed,

issued, sold or promoted by MSCI, and MSCI bears no liability with

respect to any such securities or any index on which such

securities are based. The respective ETN prospectus contains a more

detailed description of the limited relationship MSCI has with

UBS.

Alerian Midstream Energy Index, Alerian Midstream Energy

Dividend Index, AMNA, AMNTR and AEDW are trademarks of VettaFi and

their use is granted under a license from VettaFi. VetttaFi owns

and administers the Alerian Index Series.

Solactive AG (“Solactive”) is the licensor of Solactive Whitney

U.S. Critical Technologies CNTR Index (the “Index”). The Index has

been developed in cooperation with J.H. Whitney Data Services, LLC

(“J.H. Whitney”). The financial instruments that are based on the

Index are not sponsored, endorsed, promoted or sold by Solactive or

J.H. Whitney in any way and Solactive or J.H. Whitney make no

express or implied representation, guarantee or assurance with

regard to: (a) the advisability of investing in the financial

instruments; (b) the quality, accuracy and/or completeness of the

Index; and/or (c) the results obtained or to be obtained by any

person or entity from the use of the Index. Solactive or J.H.

Whitney do not guarantee the accuracy and/or the completeness of

the Index and shall not have any liability for any errors or

omissions with respect thereto. The Index has not been designed to

achieve positive returns and neither Solactive nor J.H. Whitney is

acting as a fiduciary or investment adviser for any user of the

Index or investor in any financial instrument based on the Index.

Notwithstanding Solactive’s obligations to its licensees, Solactive

reserves the right to change the methods of calculation or

publication with respect to the Index and Solactive or J.H. Whitney

shall not be liable for any miscalculation of or any incorrect,

delayed or interrupted publication with respect to the Index.

Solactive or J.H. Whitney shall not be liable for any damages,

including, without limitation, any loss of profits or business, or

any special, incidental, punitive, indirect or consequential

damages suffered or incurred as a result of the use of (or

inability to use) the Index.

Economic Index Associates, LLC (“EIA”) outsources the end-of-day

and real-time calculation of its IFED™ indexes that serve as the

basis for investment products. Third party index calculators that

publish and distribute EIA indexes strive to the best of their

ability to ensure the correctness of the calculations. There is no

obligation for EIA—irrespective of possible obligations to

issuers—to advise third parties, including investors and/or

financial intermediaries, of any errors in any of the indexes that

are calculated on a real-time basis. The publication and

distribution of any IFED™ indexes that are calculated on a

real-time basis and that serve as the basis for products licensed

by EIA are not intended as a recommendation for capital investment

and does not contain any assurance or opinion of EIA regarding a

possible investment in a financial instrument based on an

Index.

UBS specifically prohibits the redistribution or reproduction of

this communication in whole or in part without the prior written

permission of UBS and UBS accepts no liability whatsoever for the

actions of third parties in this respect.

© UBS 2024. The key symbol, UBS and ETRACS are among the

registered and unregistered trademarks of UBS. Other marks may be

trademarks of their respective owners. All rights reserved.

1 Individual investors should instruct their

broker/advisor/custodian to call us or should call together with

their broker/advisor/custodian.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120988504/en/

Media contact Alison Keunen +1 212 713 2296

alison.keunen@ubs.com

Institutional Investor contact1 +1-877-387 2275

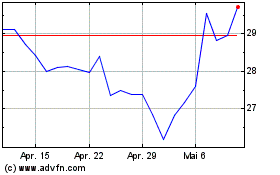

UBS (NYSE:UBS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

UBS (NYSE:UBS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024