Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240813278456/en/

Key highlights (Graphic: UBS Group

AG)

UBS (NYSE:UBS) (SWX:UBSN):

Key highlights

- 2Q24 PBT of USD 1.5bn and underlying1 PBT of USD

2.1bn reflecting client franchise strength and disciplined

execution of our strategy and integration plans; net profit of

USD 1.1bn

- 1H24 PBT of USD 3.8bn and underlying1 PBT of USD 4.7bn; net

profit of USD 2.9bn, RoCET1 7.5% and underlying RoCET1 of

9.2%

- Continued client momentum with net new assets of USD 27bn in

Global Wealth Management and strong transactional activity in

the Investment Bank; best second quarter Global Markets revenues on

record2 and underlying Global Banking revenues up 55% YoY,

significantly outperforming the fee pools across all products

- Non-core and Legacy RWA reduced 42% since 2Q23,

including USD 8bn decline QoQ mainly from active unwinds;

underlying operating expenses excluding litigation declined 17%

QoQ; revenues of USD 0.4bn

- Achieved USD 0.9bn of additional gross cost savings,

reaching ~45% of our total cumulative annualized gross cost save

ambition

- Completed key legal entity mergers in line with plan,

enabling execution of the next critical phase of client migrations

to unlock further cost, capital, funding and tax benefits

- Maintained a balance sheet for all seasons with a strong

CET1 capital ratio of 14.9% and CET1 leverage ratio of 4.9%,

supporting the execution of our 2024 capital return targets;

commenced share repurchases in June with USD 467m of shares

repurchased as of 9 August 2024; total loss absorbing capacity of

USD 198bn

- Named "World's Best Bank" and “Switzerland’s Best Bank” at

Euromoney Awards for Excellence 2024, a testament to the

effectiveness of our global strategy, reach and capabilities in

serving our clients domestically and around the world

“Our first-half results reflect the significant progress we have

made since the closing of the acquisition as we deliver on all of

our commitments to stakeholders. We are well positioned to meet our

financial targets and return to the levels of profitability we

delivered before being asked to step in and stabilize Credit

Suisse. We are now entering the next phase of our integration,

which will be critical to realize further substantial cost,

capital, funding and tax benefits. As we execute on our plans, we

will continue to invest to position UBS for sustainable growth

while staying close to clients, providing even better outcomes for

them and the communities where we live and work.” Sergio P.

Ermotti, Group CEO

Selected financials for

2Q24

Profit before tax

1.5

USD bn

Cost/income ratio

86.9

%

RoCET1 capital

5.9

%

Net profit

1.1

USD bn

CET1 capital ratio

14.9

%

Underlying1 profit before tax

2.1

USD bn

Underlying1 cost/income ratio

80.6

%

Underlying1 RoCET1 capital

8.4

%

Diluted EPS

0.34

USD

CET1 leverage ratio

4.9

%

Information in this news release is

presented for UBS Group AG on a consolidated basis unless otherwise

specified.

1 Underlying results exclude items

of profit or loss that management believes are not representative

of the underlying performance. Underlying results are a non-GAAP

financial measure and alternative performance measure (APM). Refer

to “Group Performance” and “Appendix-Alternative Performance

Measures” in the financial report for the second quarter of 2024

for a reconciliation of underlying to reported results and

definitions of the APMs. 2 Since 2013.

Group summary

Delivered strong performance in a complex market

environment

In 2Q24, we reported PBT of USD 1,469m and underlying PBT of USD

2,060m. Net profit attributable to shareholders was USD 1,136m and

return on CET1 capital was 5.9%, or 8.4% on an underlying

basis.

Reported revenues were USD 11.9bn. Underlying revenues were USD

11.1bn, 7% lower sequentially against a strong 1Q24, largely driven

by NCL and with strong capital markets activity partially

offsetting anticipated net interest income headwinds. Reported

Group operating expenses increased 1% QoQ to USD 10,340m and

included litigation-related releases of USD 150m. On an underlying

basis, operating expenses decreased 3% QoQ to USD 8,969m as we

continued to execute our cost reduction initiatives. Excluding the

aforementioned litigation-related releases, the sequential

underlying decrease was 1%.

Demonstrating continued franchise strength

Clients continue to place trust and value in UBS’s strength,

stability and advice as evidenced by USD 27bn in net new assets in

GWM with positive inflows across all regions, and after absorbing

headwinds from around USD 6bn of seasonal tax outflows in the US as

well as outflows related to our ongoing balance sheet optimization

efforts. Net new fee generating assets were USD 16bn. Net new

assets in 1H24 were USD 54bn, on track to deliver on our guidance

of USD ~100bn of NNA per annum through 2025.

Transactional activity was strong in the quarter, especially

among institutional clients. In GWM we delivered transaction-based

revenues of more than USD 1bn, with strong momentum in APAC and the

Americas, as we continue to provide our wealth management clients

with best-in-class access to our Investment Bank’s advice, products

and execution capabilities. In Global Markets, we delivered our

best second quarter results on record since 2013 with revenues up

18% YoY. Underlying Global Banking revenues were up 55% YoY as we

significantly outperformed the fee pools across all products

without compromising on our risk and capital discipline.

In July, UBS was awarded “World’s Best Bank” in the Euromoney

Awards for Excellence 2024, affirming the effectiveness of our

longstanding strategy centered around our truly global wealth

management franchise and leading Swiss universal bank, which

enabled the successful rescue and ongoing integration of Credit

Suisse while we continue to deliver best-in-class services and

advice to our clients. We were also proud to be named

“Switzerland’s Best Bank” for the tenth time since 2012, reflecting

our global reach and capabilities to support our Swiss clients and

economy. Since the acquisition, clients have entrusted us with

around CHF 30bn in net new deposits and with around CHF 85bn3 of

loans granted or renewed since the acquisition, we currently extend

around CHF 350bn of loans to Swiss clients.

Steady progress on balance sheet and cost reductions with

delivery of key integration milestones

We are executing our integration plan, and continue to deliver

on all of our commitments.

We reduced Group RWA by USD 15bn QoQ, of which over USD 8bn from

across the core business divisions, primarily as a result of the

financial resource optimization work in GWM and P&C. We have

also continued to run down the NCL portfolio at pace, with an RWA

decrease of USD 8bn QoQ largely driven by active unwinds across a

majority of portfolios, bringing the total RWA reduction in NCL to

42% compared to a year ago.

Group LRD decreased by USD 35bn QoQ, largely driven by the full

repayment of the Emergency Liquidity Assistance central bank

liquidity facility, in addition to lower lending volumes mainly

from our financial resource management efforts and the active

run-down of the NCL portfolio.

In 2Q24, we realized an additional USD 0.9bn in gross cost

savings, for a total of USD ~6bn in annualized exit rate gross cost

savings vs. FY22 combined. We now expect to achieve around USD 7bn

of gross cost savings by end-2024, or around 55% of our ambition of

USD ~13bn by end-2026.

We completed the merger of UBS AG and Credit Suisse AG on 31 May

2024, the transition to a single US intermediate holding company on

7 June 2024, and the merger of UBS Switzerland AG and Credit Suisse

(Schweiz) AG on 1 July 2024. These crucial milestones have begun to

support a more normalized tax rate and will facilitate the

migration of clients onto UBS platforms, beginning in Singapore,

Hong Kong and Luxembourg in the fourth quarter of 2024, which are

critical steps to unlock the next phase of the cost, capital,

funding and tax benefits we expect to realize by the end of

2026.

3 Loans to privates, corporates and

public institutions in P&C and GWM Switzerland, from 1.6.23 to

30.6.24

Maintained capital strength and a balance sheet for all

seasons

The CET1 capital ratio was 14.9% and the CET1 leverage ratio was

4.9%, supporting the execution of our 2024 capital return targets.

We continue to target up to USD 1bn of share repurchases in 2024,

which we commenced in June with USD 467m of shares repurchased as

of 9 August 2024. We also maintained healthy liquidity buffers with

an LCR of 212% and an NSFR of 128%.

Following the merger of UBS AG and Credit Suisse AG, UBS AG’s

standalone CET1 capital ratio as of 30 June 2024 is expected to be

around 13.5% on a fully applied basis, and around 100 basis points

above our current fully applied requirement by 2030. Final capital

figures for UBS AG standalone will be published with our Pillar 3

report, which will be available as of 23 August 2024.

Outlook

The macroeconomic outlook continues to be clouded by ongoing

conflicts, other geopolitical tensions and the upcoming US

elections. We expect these uncertainties to persist for the

foreseeable future, and they will likely lead to higher market

volatility compared with the first half of the year.

Entering the third quarter, we are seeing positive investor

sentiment and continued momentum in client and transactional

activity. Also visible are moderate net interest income headwinds

from ongoing mix shifts in Global Wealth Management and the effects

of the second Swiss National Bank rate cut, not yet captured in our

deposit pricing in Personal & Corporate Banking.

As we execute our integration plans, we expect to incur in the

third quarter of 2024 around USD 1.1bn of integration-related

expenses, while the pace of gross cost savings will decline

modestly sequentially. Integration-related expenses should be

partly offset by around USD 0.6bn accretion of purchase accounting

effects.

For the second half of 2024, we estimate Non-core and Legacy

will record an underlying pre-tax loss of around USD 1bn as

revenues are expected to reflect moderate short-term upside to

current book values and continued sequential progress on costs. In

the absence of a better-than-expected reported Non-core and Legacy

performance, we continue to expect our effective tax rate for the

second half of 2024 to be around 35%.

Our diversified business model positions us well to deliver

sustainable long-term value for shareholders across various market

conditions. We remain focused on supporting our clients while

positioning the Group for future growth.

Second quarter 2024 performance

overview – Group

This discussion and analysis of results compares the second

quarter of 2024, which covers three full months of post-acquisition

results, with the second quarter of 2023, which included only one

month of post-acquisition results.

Group PBT USD 1,469m, underlying PBT USD 2,060m

PBT of USD 1,469m included PPA effects and other integration

items of USD 780m and integration-related expenses and PPA effects

of USD 1,372m. Underlying PBT was USD 2,060m, including net credit

loss expenses of USD 95m. The cost/income ratio was 86.9% and the

underlying cost/income ratio was 80.6%. Net profit attributable to

shareholders was USD 1,136m, with diluted earnings per share of USD

0.34. Return on CET1 capital was 5.9%, and 8.4% on an underlying

basis.

Global Wealth Management (GWM) PBT USD 871m, underlying PBT

USD 1,161m

Total revenues increased by 15% to USD 6,053m, largely driven by

the consolidation of Credit Suisse revenues for the full quarter.

Excluding PPA effects and other integration items of USD 233m,

underlying total revenues were USD 5,820m. Net credit loss releases

were USD 1m, compared with net expenses of USD 149m in the second

quarter of 2023. Operating expenses increased by 27% to USD 5,183m,

largely due to the consolidation of Credit Suisse expenses for the

full quarter and an increase in financial advisor compensation

reflecting higher compensable revenues. Excluding

integration-related expenses and PPA effects of USD 523m,

underlying operating expenses were USD 4,660m. The cost/income

ratio was 85.6%, and 80.1% on an underlying basis. Invested assets

increased by USD 15bn sequentially to USD 4,038bn. Net new assets

were USD 26.9bn.

Personal & Corporate Banking (P&C) PBT CHF 703m,

underlying PBT CHF 645m

Total revenues increased by 27% to CHF 2,061m, mainly due to the

consolidation of Credit Suisse revenues for the full quarter.

Excluding PPA effects and other integration items of CHF 223m,

underlying total revenues were CHF 1,838m. Net credit loss expenses

were CHF 92m, compared with net expenses of CHF 198m in the second

quarter of 2023. Operating expenses increased by 51% to CHF 1,266m,

largely due to the consolidation of Credit Suisse expenses for the

full quarter. Excluding integration-related expenses and PPA

effects of CHF 165m, underlying operating expenses were CHF 1,101m.

The cost/income ratio was 61.4%, and 59.9% on an underlying

basis.

Asset Management (AM) PBT USD 130m, underlying PBT USD

228m

Total revenues increased by 32% to USD 768m, mainly reflecting

the consolidation of Credit Suisse revenues for the full quarter

and included a USD 28m net gain from the initial portion of the

sale of our Brazilian real estate fund management business.

Operating expenses increased by 27% to USD 638m, mainly reflecting

the consolidation of Credit Suisse expenses for the full quarter.

Excluding integration-related expenses of USD 98m, underlying

operating expenses were USD 540m. The cost/income ratio was 83.0%,

and 70.3% on an underlying basis. Invested assets increased by USD

10bn sequentially to USD 1,701bn. Net new money was USD (11.8bn),

and USD (14.6bn) excluding money market flows and associates.

Investment Bank (IB) PBT USD 477m, underlying PBT USD

412m

Total revenues increased by 38% to USD 2,803m, due to higher

Global Banking and Global Markets revenues. Excluding PPA effects

of USD 310m, underlying total revenues were USD 2,493m. Net credit

loss releases were USD 6m, compared with net expenses of USD 132m

in the second quarter of 2023. Operating expenses increased by 15%

to USD 2,332m, largely due to an increase in variable compensation

relating to higher revenues. Excluding integration-related expenses

of USD 245m, underlying operating expenses were USD 2,087m. The

cost/income ratio was 83.2%, and 83.7% on an underlying basis.

Return on attributed equity was 11.3%, and 9.7% on an underlying

basis.

Non-core and Legacy (NCL) PBT USD (405m), underlying PBT USD

(80m)

Total revenues were USD 401m, and reflected net gains from

position exits, along with net interest income from securitized

products and credit products. Net credit loss releases were USD 1m,

compared with net expenses of USD 119m in the second quarter of

2023. Operating expenses were USD 807m. Excluding

integration-related expenses of USD 325m, underlying operating

expenses were USD 481m.

Group Items PBT USD (377m), underlying PBT USD (371m)

UBS’s sustainability

highlights

Support for Swiss communities affected by the recent

storms

Earlier this summer the cantons of Ticino, Valais and Graubünden

were hit hard by severe storms. Thousands of people had to evacuate

their homes, some even lost their lives, and communities are facing

significant and costly damage.

UBS supported the dedicated Unwetter-Fond (severe weather fund)

launched by the Schweizer Patenschaft für Berggemeinden which

provides support and resources for clean-up and reconstruction as

well as vital capital for preventive measures. Thanks to the

generosity of clients and employees approximately CHF 800,000 were

raised for the fund, including a CHF 400,000 UBS donation and match

funding.

Developing the next generation of talent

Our commitment to attract, develop and retain top talents is a

key component of our sustainable performance. Importantly, we have

maintained our structured job entry training programs (e.g.,

apprenticeships, interns and graduates) at the same level as UBS

and Credit Suisse combined before the integration. Across UBS, we

have around 4,000 junior talents including around 2,300 in

Switzerland, and many of them are starting their career this

summer. We continue to be fully dedicated to our development

programs and are constantly evaluating new ways to prepare the next

generation of talent.

UBS donates USD 25m to celebrate the UBS Optimus Foundation

25th anniversary

We are proud of the work done by the UBS Optimus network of

foundations and the difference they make to millions of lives every

year. Over the past 25 years, the UBS Optimus Foundation has grown

from a small grant-making organization to a network of foundations

that drive transformative, scalable impact change for marginalized

communities globally and locally. During this time, Optimus has

raised over USD 1.5bn in donations together with our clients and

employees, and in the last year alone our current Optimus programs

reached 6.7m people.

To recognize this important milestone, UBS has donated USD 25m

to provide a 25% match for donations made to the UBS Optimus

Foundation Anniversary Impact Appeal. The funds raised will be used

to accelerate the work of four transformative initiatives in the

areas of education, health and the environment across Africa, Asia

and South America.

A growing focus on Nature Finance

Nature Finance is a topic of growing interest for our clients

and we recently held our first Nature Finance Conference to share

insights on the key trends and discuss how to drive much-needed

action. The event brought together leaders from academia, NGOs and

intergovernmental organizations, as well as UBS experts and

clients, to discuss the critical role nature plays in our economy

and how to unlock greater pools of capital to benefit the natural

world.

UBS Asset Management and Planet Tracker launched a guide for

investors aimed at maximizing investment in new energy solutions

while minimizing their impacts on nature. The guide sets out

strategies to support decision makers at every stage of planning,

financing and implementation.

UBS Global Wealth Management has joined forces with Rockefeller

Asset Management (RAM) to provide clients with exposure to

multiyear growth prospects in areas such as wastewater treatment,

waste management and plastic recycling, and sustainable

aquaculture. The fund focuses on around 50 high conviction small-

and mid-cap “improver” stocks, building on GWM’s award-winning CIO

research and the ocean expertise of RAM.

Selected financial information of the

business divisions and Group Items

For the quarter ended

30.6.24

USD m

Global Wealth

Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core and Legacy

Group Items

Total

Total revenues as reported

6,053

2,272

768

2,803

401

(392)

11,904

of which: PPA effects and other

integration items1

233

246

310

(8)

780

Total revenues (underlying)

5,820

2,026

768

2,493

401

(384)

11,124

Credit loss expense / (release)

(1)

103

0

(6)

(1)

0

95

Operating expenses as reported

5,183

1,396

638

2,332

807

(15)

10,340

of which: integration-related expenses and

PPA effects2

523

182

98

245

325

(2)

1,372

Operating expenses (underlying)

4,660

1,213

540

2,087

481

(13)

8,969

Operating profit / (loss) before tax as

reported

871

773

130

477

(405)

(377)

1,469

Operating profit / (loss) before tax

(underlying)

1,161

710

228

412

(80)

(371)

2,060

For the quarter ended 31.3.24

USD m

Global Wealth Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core and Legacy

Group Items

Total

Total revenues as reported

6,143

2,423

776

2,751

1,001

(355)

12,739

of which: PPA effects and other

integration items1

234

256

293

(4)

779

Total revenues (underlying)

5,909

2,166

776

2,458

1,001

(351)

11,960

Credit loss expense / (release)

(3)

44

0

32

36

(2)

106

Operating expenses as reported

5,044

1,404

665

2,164

1,011

(33)

10,257

of which: integration-related expenses and

PPA effects2

404

160

71

143

242

1

1,021

Operating expenses (underlying)

4,640

1,245

594

2,022

769

(34)

9,236

Operating profit / (loss) before tax as

reported

1,102

975

111

555

(46)

(320)

2,376

Operating profit / (loss) before tax

(underlying)

1,272

878

182

404

197

(315)

2,617

For the quarter ended

30.6.233

USD m

Global Wealth Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core and Legacy

Group Items

Negative goodwill4

Total

Total revenues as reported

5,261

1,810

583

2,036

162

(313)

9,540

of which: PPA effects and other

integration items1

186

143

55

(6)

378

Total revenues (underlying)

5,075

1,667

583

1,981

162

(306)

9,162

Negative goodwill

27,264

27,264

Credit loss expense / (release)

149

221

1

132

119

2

623

Operating expenses as reported

4,085

933

503

2,025

536

403

8,486

of which: integration-related expenses and

PPA effects2

68

37

14

161

105

348

732

of which: acquisition-related costs

106

106

Operating expenses (underlying)

4,017

896

489

1,864

432

(51)

7,648

Operating profit / (loss) before tax as

reported

1,028

655

79

(121)

(493)

(717)

27,264

27,695

Operating profit / (loss) before tax

(underlying)

909

549

93

(14)

(388)

(257)

891

1 Includes accretion of PPA adjustments on

financial instruments and other PPA effects, as well as temporary

and incremental items directly related to the integration. 2

Includes temporary, incremental operating expenses directly related

to the integration, as well as amortization of newly recognized

intangibles resulting from the acquisition of the Credit Suisse

Group. 3 Comparative-period information has been restated for

changes in business division perimeters, Group Treasury allocations

and Non-core and Legacy cost allocations. Refer to “Note 3 Segment

reporting” in the “Consolidated financial statements” section of

the UBS Group second quarter 2024 report and to “Changes to segment

reporting in 2024” in the “UBS business divisions and Group Items”

section and the “Equity attribution” section of the UBS Group first

quarter 2024 report, available under “Quarterly reporting” at

ubs.com/investors, for more information. 4 Comparative-period

information has been revised. Refer to “Note 2 Accounting for the

acquisition of the Credit Suisse Group” in the “Consolidated

financial statements” section of the UBS Group second quarter 2024

report, available under “Quarterly reporting” at ubs.com/investors,

for more information.

Selected financial information of the

business divisions and Group Items (continued)

Year-to-date 30.6.24

USD m

Global Wealth

Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core and Legacy

Group Items

Total

Total revenues as reported

12,196

4,695

1,543

5,554

1,402

(747)

24,642

of which: PPA effects and other

integration items1

467

502

603

(12)

1,559

Total revenues (underlying)

11,729

4,193

1,543

4,951

1,402

(735)

23,083

Credit loss expense / (release)

(4)

146

0

26

35

(2)

201

Operating expenses as reported

10,228

2,800

1,303

4,496

1,818

(48)

20,597

of which: integration-related expenses and

PPA effects2

928

342

169

387

568

(1)

2,392

Operating expenses (underlying)

9,300

2,458

1,134

4,109

1,250

(47)

18,205

Operating profit / (loss) before tax as

reported

1,972

1,748

241

1,032

(451)

(698)

3,844

Operating profit / (loss) before tax

(underlying)

2,433

1,588

410

816

117

(687)

4,677

Year-to-date 30.6.233

USD m

Global Wealth Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core and Legacy

Group Items

Negative goodwill4

Total

Total revenues as reported

10,049

3,087

1,086

4,401

185

(524)

18,284

of which: PPA effects and other

integration items1

186

143

55

(6)

378

Total revenues (underlying)

9,863

2,943

1,086

4,346

185

(517)

17,906

Negative goodwill

27,264

27,264

Credit loss expense / (release)

164

237

1

139

119

2

662

Operating expenses as reported

7,646

1,597

911

3,891

1,235

416

15,696

of which: integration-related expenses and

PPA effects2

68

37

14

161

105

348

732

of which: acquisition-related costs

176

176

Operating expenses (underlying)

7,578

1,560

897

3,730

1,130

(108)

14,787

Operating profit / (loss) before tax as

reported

2,239

1,253

174

372

(1,169)

(942)

27,264

29,191

Operating profit / (loss) before tax

(underlying)

2,121

1,147

188

478

(1,064)

(412)

2,457

1 Includes accretion of PPA adjustments on

financial instruments and other PPA effects, as well as temporary

and incremental items directly related to the integration. 2

Includes temporary, incremental operating expenses directly related

to the integration, as well as amortization of newly recognized

intangibles resulting from the acquisition of the Credit Suisse

Group. 3 Comparative-period information has been restated for

changes in business division perimeters, Group Treasury allocations

and Non-core and Legacy cost allocations. Refer to “Note 3 Segment

reporting” in the “Consolidated financial statements” section of

the UBS Group second quarter 2024 report and to “Changes to segment

reporting in 2024” in the “UBS business divisions and Group Items”

section and the “Equity attribution” section of the UBS Group first

quarter 2024 report, available under “Quarterly reporting” at

ubs.com/investors, for more information. 4 Comparative-period

information has been revised. Refer to “Note 2 Accounting for the

acquisition of the Credit Suisse Group” in the “Consolidated

financial statements” section of the UBS Group second quarter 2024

report, available under “Quarterly reporting” at ubs.com/investors,

for more information.

Our key figures

As of or for the quarter

ended

As of or year-to-date

USD m, except where indicated

30.6.24

31.3.241

31.12.231

30.6.231

30.6.24

30.6.231

Group results

Total revenues

11,904

12,739

10,855

9,540

24,642

18,284

Negative goodwill

27,264

27,264

Credit loss expense / (release)

95

106

136

623

201

662

Operating expenses

10,340

10,257

11,470

8,486

20,597

15,696

Operating profit / (loss) before tax

1,469

2,376

(751)

27,695

3,844

29,191

Net profit / (loss) attributable to

shareholders

1,136

1,755

(279)

27,331

2,890

28,360

Diluted earnings per share (USD)2

0.34

0.52

(0.09)

8.51

0.86

8.82

Profitability and growth3,4,5

Return on equity (%)

5.4

8.2

(1.3)

153.8

6.8

88.7

Return on tangible equity (%)

5.9

9.0

(1.4)

170.3

7.5

98.9

Underlying return on tangible equity

(%)6,7

8.4

9.9

4.8

2.8

9.2

5.4

Return on common equity tier 1 capital

(%)

5.9

9.0

(1.4)

177.5

7.5

106.4

Underlying return on common equity tier 1

capital (%)6,7

8.4

9.9

4.8

2.9

9.2

5.8

Return on leverage ratio denominator,

gross (%)

3.0

3.1

2.6

2.8

3.1

3.1

Cost / income ratio (%)8

86.9

80.5

105.7

88.9

83.6

85.8

Underlying cost / income ratio (%)6,8

80.6

77.2

93.0

83.5

78.9

82.6

Effective tax rate (%)

20.0

25.8

n.m.9

1.3

23.6

2.8

Net profit growth (%)

(95.8)

70.6

n.m.

n.m.

(89.8)

568.2

Resources3

Total assets

1,560,976

1,606,798

1,716,924

1,677,953

1,560,976

1,677,953

Equity attributable to shareholders

83,683

84,777

85,624

85,455

83,683

85,455

Common equity tier 1 capital10

76,104

77,663

78,002

78,597

76,104

78,597

Risk-weighted assets10

511,376

526,437

546,505

556,603

511,376

556,603

Common equity tier 1 capital ratio

(%)10

14.9

14.8

14.3

14.1

14.9

14.1

Going concern capital ratio (%)10

18.0

17.7

16.8

16.5

18.0

16.5

Total loss-absorbing capacity ratio

(%)10

38.7

37.4

36.4

34.9

38.7

34.9

Leverage ratio denominator10

1,564,201

1,599,646

1,695,403

1,677,877

1,564,201

1,677,877

Common equity tier 1 leverage ratio

(%)10

4.9

4.9

4.6

4.7

4.9

4.7

Liquidity coverage ratio (%)11

212.0

220.2

215.7

175.2

212.0

175.2

Net stable funding ratio (%)

128.0

126.4

124.7

117.6

128.0

117.6

Other

Invested assets (USD bn)4,12,13

5,873

5,848

5,714

5,530

5,873

5,530

Personnel (full-time equivalents)

109,991

111,549

112,842

119,100

109,991

119,100

Market capitalization2,14

101,903

106,440

107,355

69,932

101,903

69,932

Total book value per share (USD)2

26.13

26.44

26.68

26.48

26.13

26.48

Tangible book value per share (USD)2

23.85

24.14

24.34

24.13

23.85

24.13

1 Comparative-period information has been

revised. Refer to “Note 2 Accounting for the acquisition of the

Credit Suisse Group” in the “Consolidated financial statements”

section of the UBS Group second quarter 2024 report, available

under “Quarterly reporting” at ubs.com/investors, for more

information. 2 Refer to the “Share information and earnings per

share” section of the UBS Group second quarter 2024 report,

available under “Quarterly reporting” at ubs.com/investors, for

more information. 3 Refer to the “Targets, capital guidance and

ambitions” section of the UBS Group Annual Report 2023, available

under “Annual reporting” at ubs.com/investors, for more information

about our performance targets. 4 Refer to “Alternative performance

measures” in the appendix to the UBS Group second quarter 2024

report, available under “Quarterly reporting” at ubs.com/investors,

for the definition and calculation method. 5 Profit or loss

information for each of the second quarter of 2024, the first

quarter of 2024 and the fourth quarter of 2023 is presented on a

consolidated basis, including for each quarter Credit Suisse data

for three months, and for the purpose of the calculation of return

measures has been annualized multiplying such by four. Profit or

loss information for the second quarter of 2023 is presented on a

consolidated basis, including Credit Suisse data for one month

(June 2023), and for the purpose of the calculation of return

measures has been annualized multiplying such by four. Profit or

loss information for the first six months of 2024 is presented on a

consolidated basis, including Credit Suisse data for six months,

and for the purpose of the calculation of return measures has been

annualized by multiplying such by two. Profit or loss information

for the first six months of 2023 is presented on a consolidated

basis, including Credit Suisse data for one month, and for the

purpose of the calculation of return measures has been annualized

by multiplying such by two. 6 Refer to the “Group performance”

section of the UBS Group second quarter 2024 report, available

under “Quarterly reporting” at ubs.com/investors, for more

information about underlying results. 7 Comparative-period

information for the first quarter of 2024 has been restated to

reflect the updated underlying tax impact. 8 Negative goodwill is

not used in the calculation as it is presented in a separate

reporting line and is not part of total revenues. 9 The effective

tax rate for the fourth quarter of 2023 is not a meaningful

measure, due to the distortive effect of current unbenefited tax

losses at the former Credit Suisse entities. 10 Based on the Swiss

systemically relevant bank framework as of 1 January 2020. Refer to

the “Capital management” section of the UBS Group second quarter

2024 report, available under “Quarterly reporting” at

ubs.com/investors, for more information. 11 The disclosed ratios

represent quarterly averages for the quarters presented and are

calculated based on an average of 61 data points in the second

quarter of 2024, 61 data points in the first quarter of 2024, 63

data points in the fourth quarter of 2023 and 64 data points in the

second quarter of 2023. Refer to the “Liquidity and funding

management” section of the UBS Group second quarter 2024 report,

available under “Quarterly reporting” at ubs.com/investors, for

more information. 12 Consists of invested assets for Global Wealth

Management, Asset Management and Personal & Corporate Banking.

Refer to “Note 32 Invested assets and net new money” in the

“Consolidated financial statements” section of the UBS Group Annual

Report 2023, available under “Annual reporting” at

ubs.com/investors, for more information. 13 Include invested assets

from associates in the Asset Management business division. 14 The

calculation of market capitalization reflects total shares issued

multiplied by the share price at the end of the period.

Income statement

For the quarter ended

% change from

Year-to-date

USD m

30.6.24

31.3.24

30.6.231

1Q24

2Q23

30.6.24

30.6.231

Net interest income

1,535

1,940

1,707

(21)

(10)

3,475

3,095

Other net income from financial

instruments measured at fair value through profit or loss

3,684

4,182

2,517

(12)

46

7,866

5,198

Net fee and commission income

6,531

6,492

5,128

1

27

13,023

9,734

Other income

154

124

188

24

(18)

278

258

Total revenues

11,904

12,739

9,540

(7)

25

24,642

18,284

Negative goodwill

27,264

(100)

27,264

Credit loss expense / (release)

95

106

623

(11)

(85)

201

662

Personnel expenses

7,119

6,949

5,651

2

26

14,068

10,271

General and administrative expenses

2,318

2,413

1,968

(4)

18

4,731

4,033

Depreciation, amortization and impairment

of non-financial assets

903

895

866

1

4

1,798

1,391

Operating expenses

10,340

10,257

8,486

1

22

20,597

15,696

Operating profit / (loss) before

tax

1,469

2,376

27,695

(38)

(95)

3,844

29,191

Tax expense / (benefit)

293

612

361

(52)

(19)

905

820

Net profit / (loss)

1,175

1,764

27,334

(33)

(96)

2,939

28,371

Net profit / (loss) attributable to

non-controlling interests

40

9

3

352

48

11

Net profit / (loss) attributable to

shareholders

1,136

1,755

27,331

(35)

(96)

2,890

28,360

Comprehensive income

Total comprehensive income

1,614

(245)

26,467

(94)

1,369

28,300

Total comprehensive income attributable to

non-controlling interests

18

(5)

(2)

13

11

Total comprehensive income attributable

to shareholders

1,596

(240)

26,469

(94)

1,356

28,289

1 Comparative-period information has been

revised. Refer to “Note 2 Accounting for the acquisition of the

Credit Suisse Group” in the “Consolidated financial statements”

section of the UBS Group second quarter 2024 report, available

under “Quarterly reporting” at ubs.com/investors, for more

information.

Information about results materials and

the earnings call

UBS’s second quarter 2024 report, news release and slide

presentation are available from 06:45 CEST on Wednesday, 14 August

2024, at ubs.com/quarterlyreporting.

UBS will hold a presentation of its second quarter 2024 results

on Wednesday, 14 August 2024. The results will be presented by

Sergio P. Ermotti (Group Chief Executive Officer), Todd Tuckner

(Group Chief Financial Officer) and Sarah Mackey (Head of Investor

Relations).

Time

09:00 CEST 08:00 BST 03:00 US EDT

Audio webcast

The presentation for analysts can be followed live on

ubs.com/quarterlyreporting with a simultaneous slide show.

Webcast playback

An audio playback of the results presentation will be made

available at ubs.com/investors later in the day.

Cautionary statement regarding forward-looking

statements

This news release contains statements that constitute

“forward-looking statements,” including but not limited to

management’s outlook for UBS’s financial performance, statements

relating to the anticipated effect of transactions and strategic

initiatives on UBS’s business and future development and goals or

intentions to achieve climate, sustainability and other social

objectives. While these forward-looking statements represent UBS’s

judgments, expectations and objectives concerning the matters

described, a number of risks, uncertainties and other important

factors could cause actual developments and results to differ

materially from UBS’s expectations. In particular, terrorist

activity and conflicts in the Middle East, as well as the

continuing Russia–Ukraine war, may have significant impacts on

global markets, exacerbate global inflationary pressures, and slow

global growth. In addition, the ongoing conflicts may continue to

cause significant population displacement, and lead to shortages of

vital commodities, including energy shortages and food insecurity

outside the areas immediately involved in armed conflict.

Governmental responses to the armed conflicts, including, with

respect to the Russia–Ukraine war, coordinated successive sets of

sanctions on Russia and Belarus, and Russian and Belarusian

entities and nationals, and the uncertainty as to whether the

ongoing conflicts will widen and intensify, may continue to have

significant adverse effects on the market and macroeconomic

conditions, including in ways that cannot be anticipated. UBS’s

acquisition of the Credit Suisse Group has materially changed its

outlook and strategic direction and introduced new operational

challenges. The integration of the Credit Suisse entities into the

UBS structure is expected to take between three and five years and

presents significant risks, including the risks that UBS Group AG

may be unable to achieve the cost reductions and other benefits

contemplated by the transaction. This creates significantly greater

uncertainty about forward-looking statements. Other factors that

may affect UBS’s performance and ability to achieve its plans,

outlook and other objectives also include, but are not limited to:

(i) the degree to which UBS is successful in the execution of its

strategic plans, including its cost reduction and efficiency

initiatives and its ability to manage its levels of risk-weighted

assets (RWA) and leverage ratio denominator (LRD), liquidity

coverage ratio and other financial resources, including changes in

RWA assets and liabilities arising from higher market volatility

and the size of the combined Group; (ii) the degree to which UBS is

successful in implementing changes to its businesses to meet

changing market, regulatory and other conditions, including as a

result of the acquisition of the Credit Suisse Group; (iii)

increased inflation and interest rate volatility in major markets;

(iv) developments in the macroeconomic climate and in the markets

in which UBS operates or to which it is exposed, including

movements in securities prices or liquidity, credit spreads,

currency exchange rates, deterioration or slow recovery in

residential and commercial real estate markets, the effects of

economic conditions, including elevated inflationary pressures,

market developments, increasing geopolitical tensions, and changes

to national trade policies on the financial position or

creditworthiness of UBS’s clients and counterparties, as well as on

client sentiment and levels of activity; (v) changes in the

availability of capital and funding, including any adverse changes

in UBS’s credit spreads and credit ratings of UBS, Credit Suisse,

sovereign issuers, structured credit products or credit-related

exposures, as well as availability and cost of funding to meet

requirements for debt eligible for total loss-absorbing capacity

(TLAC), in particular in light of the acquisition of the Credit

Suisse Group; (vi) changes in central bank policies or the

implementation of financial legislation and regulation in

Switzerland, the US, the UK, the EU and other financial centers

that have imposed, or resulted in, or may do so in the future, more

stringent or entity-specific capital, TLAC, leverage ratio, net

stable funding ratio, liquidity and funding requirements,

heightened operational resilience requirements, incremental tax

requirements, additional levies, limitations on permitted

activities, constraints on remuneration, constraints on transfers

of capital and liquidity and sharing of operational costs across

the Group or other measures, and the effect these will or would

have on UBS’s business activities; (vii) UBS’s ability to

successfully implement resolvability and related regulatory

requirements and the potential need to make further changes to the

legal structure or booking model of UBS in response to legal and

regulatory requirements and any additional requirements due to its

acquisition of the Credit Suisse Group, or other developments;

(viii) UBS’s ability to maintain and improve its systems and

controls for complying with sanctions in a timely manner and for

the detection and prevention of money laundering to meet evolving

regulatory requirements and expectations, in particular in current

geopolitical turmoil; (ix) the uncertainty arising from domestic

stresses in certain major economies; (x) changes in UBS’s

competitive position, including whether differences in regulatory

capital and other requirements among the major financial centers

adversely affect UBS’s ability to compete in certain lines of

business; (xi) changes in the standards of conduct applicable to

its businesses that may result from new regulations or new

enforcement of existing standards, including measures to impose new

and enhanced duties when interacting with customers and in the

execution and handling of customer transactions; (xii) the

liability to which UBS may be exposed, or possible constraints or

sanctions that regulatory authorities might impose on UBS, due to

litigation, contractual claims and regulatory investigations,

including the potential for disqualification from certain

businesses, potentially large fines or monetary penalties, or the

loss of licenses or privileges as a result of regulatory or other

governmental sanctions, as well as the effect that litigation,

regulatory and similar matters have on the operational risk

component of its RWA, including as a result of its acquisition of

the Credit Suisse Group, as well as the amount of capital available

for return to shareholders; (xiii) the effects on UBS’s business,

in particular cross-border banking, of sanctions, tax or regulatory

developments and of possible changes in UBS’s policies and

practices; (xiv) UBS’s ability to retain and attract the employees

necessary to generate revenues and to manage, support and control

its businesses, which may be affected by competitive factors; (xv)

changes in accounting or tax standards or policies, and

determinations or interpretations affecting the recognition of gain

or loss, the valuation of goodwill, the recognition of deferred tax

assets and other matters; (xvi) UBS’s ability to implement new

technologies and business methods, including digital services and

technologies, and ability to successfully compete with both

existing and new financial service providers, some of which may not

be regulated to the same extent; (xvii) limitations on the

effectiveness of UBS’s internal processes for risk management, risk

control, measurement and modeling, and of financial models

generally; (xviii) the occurrence of operational failures, such as

fraud, misconduct, unauthorized trading, financial crime,

cyberattacks, data leakage and systems failures, the risk of which

is increased with cyberattack threats from both nation states and

non-nation-state actors targeting financial institutions; (xix)

restrictions on the ability of UBS Group AG and UBS AG to make

payments or distributions, including due to restrictions on the

ability of its subsidiaries to make loans or distributions,

directly or indirectly, or, in the case of financial difficulties,

due to the exercise by FINMA or the regulators of UBS’s operations

in other countries of their broad statutory powers in relation to

protective measures, restructuring and liquidation proceedings;

(xx) the degree to which changes in regulation, capital or legal

structure, financial results or other factors may affect UBS’s

ability to maintain its stated capital return objective; (xxi)

uncertainty over the scope of actions that may be required by UBS,

governments and others for UBS to achieve goals relating to

climate, environmental and social matters, as well as the evolving

nature of underlying science and industry and the possibility of

conflict between different governmental standards and regulatory

regimes; (xxii) the ability of UBS to access capital markets;

(xxiii) the ability of UBS to successfully recover from a disaster

or other business continuity problem due to a hurricane, flood,

earthquake, terrorist attack, war, conflict (e.g., the

Russia–Ukraine war), pandemic, security breach, cyberattack, power

loss, telecommunications failure or other natural or man-made

event, including the ability to function remotely during long-term

disruptions such as the COVID-19 (coronavirus) pandemic; (xxiv) the

level of success in the absorption of Credit Suisse, in the

integration of the two groups and their businesses, and in the

execution of the planned strategy regarding cost reduction and

divestment of any non-core assets, the existing assets and

liabilities of Credit Suisse, the level of resulting impairments

and write-downs, the effect of the consummation of the integration

on the operational results, share price and credit rating of UBS –

delays, difficulties, or failure in closing the transaction may

cause market disruption and challenges for UBS to maintain

business, contractual and operational relationships; and (xxv) the

effect that these or other factors or unanticipated events,

including media reports and speculations, may have on its

reputation and the additional consequences that this may have on

its business and performance. The sequence in which the factors

above are presented is not indicative of their likelihood of

occurrence or the potential magnitude of their consequences. UBS’s

business and financial performance could be affected by other

factors identified in its past and future filings and reports,

including those filed with the US Securities and Exchange

Commission (the SEC). More detailed information about those factors

is set forth in documents furnished by UBS and filings made by UBS

with the SEC, including the UBS Group AG and UBS AG Annual Reports

on Form 20- F for the year ended 31 December 2023. UBS is not under

any obligation to (and expressly disclaims any obligation to)

update or alter its forward-looking statements, whether as a result

of new information, future events, or otherwise.

Rounding

Numbers presented throughout this news release may not add up

precisely to the totals provided in the tables and text.

Percentages and percent changes disclosed in text and tables are

calculated on the basis of unrounded figures. Absolute changes

between reporting periods disclosed in the text, which can be

derived from numbers presented in related tables, are calculated on

a rounded basis.

Tables

Within tables, blank fields generally indicate non-applicability

or that presentation of any content would not be meaningful, or

that information is not available as of the relevant date or for

the relevant period. Zero values generally indicate that the

respective figure is zero on an actual or rounded basis. Values

that are zero on a rounded basis can be either negative or positive

on an actual basis.

Websites

In this news release, any website addresses are provided solely

for information and are not intended to be active links. UBS is not

incorporating the contents of any such websites into this

report.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813278456/en/

UBS Group AG Investor contact Switzerland: +41-44-234 41

00 Americas: +1-212-882 57 34 Media contact Switzerland: +41-44-234

85 00 UK: +44-207-567 47 14 Americas: +1-212-882 58 58 APAC:

+852-297-1 82 00 ubs.com

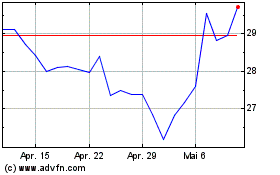

UBS (NYSE:UBS)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

UBS (NYSE:UBS)

Historical Stock Chart

Von Jan 2024 bis Jan 2025