Trinity Industries, Inc. Announces Pricing of Offering of $200.0 Million of Additional 7.750% Senior Notes Due 2028

22 Mai 2024 - 1:54AM

Business Wire

Trinity Industries, Inc. (“Trinity” or the “Company”) today

announced that it has finalized the terms of its offering (the

“Offering”) of an additional $200.0 million aggregate principal

amount of its 7.750% Senior Notes due 2028 (the “Additional

Notes”). Trinity anticipates that consummation of the offering will

occur on June 5, 2024, subject to customary closing conditions. The

Company intends to use the net proceeds from the Offering, together

with cash on hand and/or borrowings under its corporate revolving

credit facility, to (i) finance the repayment in full of its 4.550%

Senior Notes due 2024 and (ii) pay related fees, costs, premiums

and expenses in connection therewith and with the Offering. The

Additional Notes will be sold at a price of 102.50% of the

principal amount thereof plus accrued interest deemed to have

accrued from January 15, 2024.

The Additional Notes will constitute a further issuance of the

Company’s 7.750% Senior Notes due 2028 in the aggregate principal

amount of $400.0 million, which were issued on June 30, 2023 (the

“Existing Notes”). The Additional Notes will have identical terms

and conditions (other than the original issue date, issue price,

the first interest payment date and the first date from which

interest will accrue) as the Existing Notes. Upon the completion of

the Offering, the Company will have $600.0 million in aggregate

principal amount of 7.750% Senior Notes due 2028 outstanding.

Each of the Company’s existing and future domestic subsidiaries

that guarantees its existing corporate revolving credit facility

and the Existing Notes is expected to guarantee the Additional

Notes.

The Additional Notes and related guarantees being offered have

not been registered under the Securities Act of 1933, as amended

(the “Securities Act”), or any state securities laws. The

Additional Notes and related guarantees may not be offered or sold

in the United States except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and applicable state securities laws. The Additional

Notes and related guarantees are being offered only to persons

reasonably believed to be “qualified institutional buyers” in

reliance on the exemption from registration provided by Rule 144A

under the Securities Act and to certain non-U.S. persons in

offshore transactions in reliance on Regulation S under the

Securities Act.

This press release is being issued pursuant to and in accordance

with Rule 135c under the Securities Act and it is neither an offer

to sell nor a solicitation of an offer to buy any securities and

shall not constitute an offer to sell or a solicitation of an offer

to buy, or a sale of, the Additional Notes or any other securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful.

Forward-Looking Statements

Some statements in this press release, which are not historical

facts, are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Trinity’s estimates,

expectations, beliefs, intentions or strategies for the future, and

the assumptions underlying these forward-looking statements,

including, but not limited to, future financial and operating

performance, future opportunities, the Offering and the use of

proceeds therefrom, and any other statements regarding events or

developments that Trinity believes or anticipates will or may occur

in the future. Trinity uses the words “anticipates,” “assumes,”

“believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,”

“will,” “should,” “guidance,” “projected,” “outlook” and similar

expressions to identify these forward-looking statements.

Forward-looking statements speak only as of the date of this

release and Trinity expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein to reflect any change in

Trinity’s expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based,

except as required by federal securities laws. Forward-looking

statements involve risks and uncertainties that could cause actual

results to differ materially from historical experience or present

expectations, including, but not limited to, risks and

uncertainties regarding economic, competitive, governmental and

technological factors affecting Trinity’s operations, markets,

products, services and prices, and such forward-looking statements

are not guarantees of future performance. For a discussion of such

risks and uncertainties, which could cause actual results to differ

from those contained in the forward-looking statements, see “Risk

Factors” and “Forward-Looking Statements” in Trinity’s Annual

Report on Form 10-K for the most recent fiscal year, as may be

revised and updated by Trinity’s Quarterly Reports on Form 10-Q and

Trinity’s Current Reports on Form 8-K.

About Trinity

Trinity Industries, Inc., headquartered in Dallas, Texas, owns

businesses that are leading providers of rail transportation

products and services in North America. Our businesses market their

railcar products and services under the trade name TrinityRail®.

The TrinityRail platform provides railcar leasing and management

services; railcar manufacturing; railcar maintenance and

modifications; and other railcar logistics products and services.

Beginning January 1, 2024, Trinity reports its financial results in

two reportable business segments: (1) Railcar Leasing and Services

Group, formerly the Railcar Leasing and Management Services Group,

and (2) Rail Products Group.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240521737205/en/

Investor Contact Leigh Anne Mann Vice President, Investor

Relations Trinity Industries, Inc. Investors: (214) 631-4420

Media Contact Jack L. Todd Vice President, Public Affairs

Trinity Industries, Inc. Media Line: (214) 589-8909

Trinity Industries (NYSE:TRN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

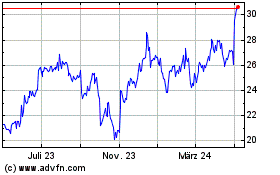

Trinity Industries (NYSE:TRN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025