THOR Industries, Inc. Names Jeffrey D. Lorenger to Its Board of Directors

05 Februar 2024 - 12:30PM

THOR Industries, Inc. (NYSE: THO) announced today the appointment

of Jeffrey D. Lorenger to its Board of Directors, effective

February 1, 2024.

Mr. Lorenger, age 58, is the President, Chief

Executive Officer, and Chairman of the Board for HNI Corporation, a

leading manufacturer of workplace furnishings and residential

building products. Mr. Lorenger has served in his role of President

and CEO since June 2018 and has been Chairman of the HNI Board of

Directors since February 2020. Mr. Lorenger has a wide array of

experience during his 25 years at HNI including President of Office

Furniture, President of Allsteel, and General Counsel of HNI prior

to assuming his current role.

Mr. Lorenger fills the Board seat recently

vacated upon Wilson Jones’ retirement from the Board in December

2023. With his appointment, THOR’s Board of Directors has nine

members.

“We are very pleased to add Jeff to our Board of

Directors. Jeff brings a deep understanding of the complexities of

manufacturing and managing independent distribution, and has a

diverse background of leadership experience that will serve the

Company and its shareholders well in the years to come,” offered

Chairman Andy Graves.

“Jeff’s decades of experience and successful

track record in corporate leadership and manufacturing will provide

valuable insight as THOR continues to lead the recreational vehicle

industry,” added Bob Martin, THOR President and CEO.

Mr. Lorenger holds three degrees from the

University of Iowa, having received a BBA in Marketing, a Juris

Doctorate, and an MBA.

About THOR Industries, Inc.

THOR Industries is the sole owner of operating

companies which, combined, represent the world’s largest

manufacturer of recreational vehicles.

For more information on the Company and its

products, please go to www.thorindustries.com.

Forward-Looking StatementsThis

release includes certain statements that are "forward-looking"

statements within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. These forward-looking statements are made based

on management's current expectations and beliefs regarding future

and anticipated developments and their effects upon THOR, and

inherently involve uncertainties and risks. These forward-looking

statements are not a guarantee of future performance. We cannot

assure you that actual results will not differ materially from our

expectations. Factors which could cause materially different

results include, among others: the impact of inflation on the cost

of our products as well as on general consumer demand; the effect

of raw material and commodity price fluctuations, and/or raw

material, commodity or chassis supply constraints; the impact of

war, military conflict, terrorism and/or cyber-attacks, including

state-sponsored or ransom attacks; the impact of sudden or

significant adverse changes in the cost and/or availability of

energy or fuel, including those caused by geopolitical events, on

our costs of operation, on raw material prices, on our suppliers,

on our independent dealers or on retail customers; the dependence

on a small group of suppliers for certain components used in

production, including chassis; interest rate fluctuations and their

potential impact on the general economy and, specifically, on our

profitability and on our independent dealers and consumers; the

ability to ramp production up or down quickly in response to rapid

changes in demand while also managing costs and market share; the

level and magnitude of warranty and recall claims incurred; the

ability of our suppliers to financially support any defects in

their products; legislative, regulatory and tax law and/or policy

developments including their potential impact on our independent

dealers, retail customers or on our suppliers; the costs of

compliance with governmental regulation; the impact of an adverse

outcome or conclusion related to current or future litigation or

regulatory investigations; public perception of and the costs

related to environmental, social and governance matters; legal and

compliance issues including those that may arise in conjunction

with recently completed transactions; lower consumer confidence and

the level of discretionary consumer spending; the impact of

exchange rate fluctuations; restrictive lending practices which

could negatively impact our independent dealers and/or retail

consumers; management changes; the success of new and existing

products and services; the ability to maintain strong brands and

develop innovative products that meet consumer demands; the ability

to efficiently utilize existing production facilities; changes in

consumer preferences; the risks associated with acquisitions,

including: the pace and successful closing of an acquisition, the

integration and financial impact thereof, the level of achievement

of anticipated operating synergies from acquisitions, the potential

for unknown or understated liabilities related to acquisitions, the

potential loss of existing customers of acquisitions and our

ability to retain key management personnel of acquired companies; a

shortage of necessary personnel for production and increasing labor

costs and related employee benefits to attract and retain

production personnel in times of high demand; the loss or reduction

of sales to key independent dealers, and stocking level decisions

of our independent dealers; disruption of the delivery of units to

independent dealers or the disruption of delivery of raw materials,

including chassis, to our facilities; increasing costs for freight

and transportation; the ability to protect our information

technology systems from data breaches, cyber-attacks and/or network

disruptions; asset impairment charges; competition; the impact of

losses under repurchase agreements; the impact of the strength of

the U.S. dollar on international demand for products priced in U.S.

dollars; general economic, market, public health and political

conditions in the various countries in which our products are

produced and/or sold; the impact of changing emissions and other

related climate change regulations in the various jurisdictions in

which our products are produced, used and/or sold; changes to our

investment and capital allocation strategies or other facets of our

strategic plan; and changes in market liquidity conditions, credit

ratings and other factors that may impact our access to future

funding and the cost of debt.

These and other risks and uncertainties are discussed more fully

in our Quarterly Report on Form 10-Q for the quarter

ended October 31, 2023 and in Item 1A of our Annual

Report on Form 10-K for the year ended July 31, 2023.

We disclaim any obligation or undertaking to disseminate any

updates or revisions to any forward-looking statements contained in

this release or to reflect any change in our expectations

after the date hereof or any change in events, conditions or

circumstances on which any statement is based, except as required

by law.

Contact

Mike Cieslak, CFAmcieslak@thorindustries.com(574) 294-7724

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2f656274-9134-46ce-b173-96a61f0a86d0

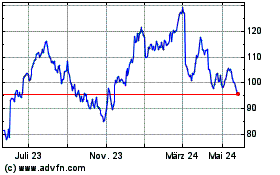

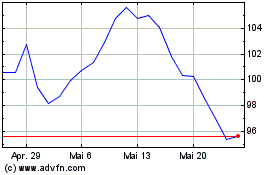

Thor Industries (NYSE:THO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Thor Industries (NYSE:THO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024