false000156490200015649022024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

United Parks & Resorts Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-35883 |

27-1220297 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

6240 Sea Harbor Drive Orlando, Florida |

32821 |

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (407) 226-5011

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

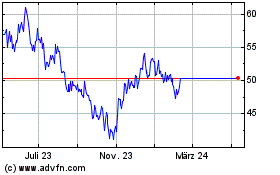

Common Stock, par value $0.01 per share |

PRKS |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 27, 2024, United Parks & Resorts Inc. (the “Company”) and Hill Path Capital LP (“Hill Path”) entered into the First Amendment (the “Amendment”) to the Stockholders Agreement, dated as of May 27, 2019 (as amended from time to time, the “Stockholders Agreement”), by and between the Company and Hill Path. The Amendment provides, among other things, that (A) any future amendment to or waiver by the Company of the Amendment will require approval of a majority of the directors of the Company’s Board of Directors who are not Hill Path affiliates and are disinterested from Hill Path (“Special Committee Approval”); (B) (i) any future acquisition of all or substantially all of the Company’s common stock not owned by Hill Path or its affiliates, whether by merger, consolidation, tender offer or otherwise or (ii) any material related party transaction with Hill Path or its affiliates will first require Special Committee Approval and approval by a majority of the Company’s voting shares not owned or controlled by Hill Path (“Disinterested Stockholder Approval”); and (C) for most matters put to a stockholder vote (including director elections, acquisition transactions and other routine matters) where the Stockholders Agreement currently provides that Hill Path may vote such shares either (x) affirmatively in accordance with the recommendation of the Board of Directors (or, in the case of director elections, in favor of each person nominated by the Board of Directors or the Nominating and Corporate Governance Committee) or (y) in the same proportion as the shares not owned or controlled by Hill Path, Hill Path may only vote such shares in the same proportion as the votes of the Company’s outstanding voting shares not owned or controlled by Hill Path.

The Board has entered into the Amendment in connection with the announced Share Repurchase Program. The Amendment provides that its terms will only become effective if Disinterested Stockholder Approval is obtained for both the Amendment and the Share Repurchase Program and any shares are purchased under such program. If the Amendment or the Share Repurchase Program proposal is not approved by the Company’s stockholders, the Amendment, in accordance with its terms, will automatically terminate and have no effect.

The Amendment will cease to have effect at any time if both the aggregate beneficial ownership and the aggregate economic ownership of the Hill Path Affiliates fall below their current levels. The Amendment will again become effective at any time thereafter if either the aggregate beneficial ownership or the aggregate economic ownership of the Hill Path Affiliates again equals or exceeds their current levels.

The information provided in this Item 1.01 is qualified in its entirety by reference to the terms of the Amendment, attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 2.02 Results of Operations and Financial Condition.

On February 28, 2024, the Company issued a press release announcing the results of the Company’s operations for the quarter and fiscal year ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference in this Item 2.02.

The information in this Current Report on Form 8-K and Exhibit 99.1 is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure

On February 28, 2024, the Company posted new written investor presentation materials on its investor relations website at http://www.unitedparksinvestors.com/events-and-presentations/default.aspx. The Company intends to use such materials from time to time in meetings with the investment community and for general marketing purposes.

The information set forth under this Item 7.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

UNITED PARKS & RESORTS INC. |

|

|

|

|

|

Date: February 28, 2024 |

|

By: |

|

/s/ G. Anthony (Tony) Taylor |

|

|

Name: |

|

G. Anthony (Tony) Taylor |

|

|

Title: |

|

Chief Legal Officer, General Counsel and Corporate Secretary |

Exhibit 10.1

EXECUTION VERSION

FIRST AMENDMENT TO

STOCKHOLDERS AGREEMENT

This First Amendment to the Stockholders Agreement (this “Amendment”), dated as of February 27, 2024, is by and between Hill Path Capital LP, a Delaware limited partnership (“Hill Path”), and United Parks & Resorts Inc., a Delaware corporation (formerly known as SeaWorld Entertainment, Inc.) (the “Company”). Capitalized terms used herein shall have the meanings set forth in the Stockholders Agreement by and between Hill Path and the Company dated as of May 27, 2019 (the “Original Agreement” and, as amended by this Amendment, the “Agreement”).

BACKGROUND:

WHEREAS, the Board has determined that it is in the best interests of the Company and its stockholders for the Company to authorize repurchases from time to time of up to $500 million of shares of Common Stock or such lesser amount as to ensure that the Beneficial Ownership Percentage of all Hill Path Affiliates (including James P. Chambers, who for the purpose of this Amendment and the Original Agreement, shall be deemed to be a Hill Path Affiliate), in the aggregate, does not equal or exceed 50% (the “Repurchase Program”);

WHEREAS, the Board has authorized the Repurchase Program, subject to Disinterested Stockholder Approval (as defined below);

WHEREAS, the Board has determined (i) to call a special meeting of the Company’s stockholders (the “Special Meeting”); (ii) to submit the Repurchase Program and this Amendment for approval by the holders of a majority of the outstanding shares of Common Stock not held by the Hill Path Affiliates (Nomura Global Financial Products Inc., as counterparty on the Derivatives (as defined below), and James P. Chambers, as a Partner at Hill Path, shall be deemed to be Hill Path Affiliates solely for purposes of this approval requirement) (such approval, the “Disinterested Stockholder Approval” and such stockholders, the “Disinterested Stockholders”); and (iii) to recommend that such stockholders vote in favor of the Disinterested Stockholder Approval;

WHEREAS, Hill Path Affiliates (i) currently have Beneficial Ownership of 27,314,264 shares of Common Stock, representing approximately 42.7% of the outstanding shares of Common Stock (the “Current Beneficial Ownership Percentage”); and (ii) have entered into cash-settled total return swap agreements (any such swap agreements or other derivative arrangements, collectively, the “Derivatives” and the economic ownership interest represented by such Derivatives taken together with those shares of Common Stock with respect to which there is Beneficial Ownership, “Economic Ownership Percentage”) that establish economic exposure to an aggregate of 4,421,431 additional shares of Common Stock, representing approximately 6.9% of the outstanding shares of Common Stock (the “Current Derivative Ownership Percentage,” together with the Current Beneficial Ownership Percentage, the “Current Economic Ownership Percentage”, which as of the date hereof is approximately 49.6%) that provide economic results comparable to ownership but do not provide the power to vote or direct the voting of or to dispose or direct the disposition of shares of Common Stock;

WHEREAS, in connection with its consideration of the Repurchase Program, a special committee of the Board, consisting of directors who are not Hill Path Affiliated Directors and who are disinterested from Hill Path, requested that Hill Path agree to certain amendments to the Original Agreement; and

WHEREAS, to facilitate the Repurchase Program and for the benefit of all the Company’s stockholders, Hill Path is willing to amend the Original Agreement as set forth herein, to become effective when the Company has acquired any shares under the Repurchase Program.

NOW, THEREFORE, in consideration of and in reliance upon the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Effectiveness of Amendments.

(a)Disinterested Stockholder Approval Not Obtained. If the Special Meeting occurs and the Disinterested Stockholder Approval is not obtained, this Amendment shall without further action automatically terminate and shall have no effect on the Original Agreement.

(b)Effectiveness. If the Special Meeting occurs and the Disinterested Stockholder Approval is obtained, this Amendment shall become effective when the Company has acquired any shares under the Repurchase Program, and Section 3 [Voting Agreement] of the Original Agreement shall without further action automatically be deemed to be amended to read in its entirety as follows in Section 2 below.

(c)Fallaway Event. Following the effectiveness of this Amendment, if at any time thereafter each of (i) the aggregate Beneficial Ownership of the Hill Path Affiliates is less than the Current Beneficial Ownership Percentage and (ii) the aggregate Economic Ownership Percentage of the Hill Path Affiliates, is less than the Current Economic Ownership Percentage (a “Fallaway Event”), the amendments set forth in Section 2 below shall cease to have any effect and Section 3 [Voting Agreement] of the Agreement shall without further action automatically be deemed to read in its entirety as it appeared in the Original Agreement.

(d)Reinstatement Event. Notwithstanding the previous sentence, if at any time subsequent to a Fallaway Event, either (i) the aggregate Beneficial Ownership of the Hill Path Affiliates again equals or exceeds the Current Beneficial Ownership Percentage or (ii) the aggregate Economic Ownership Percentage of the Hill Path Affiliates, again equals or exceeds the Current Economic Ownership Percentage, then Section 3 [Voting Agreement] shall again, without further action, automatically be deemed to be amended to read in its entirety as follows in Section 2 below (a “Reinstatement Event”). For the avoidance of doubt, there may be multiple Fallaway Events and/or Reinstatement Events.

(a)Voting in Elections. At any meeting of stockholders of the Company involving the election of Directors (or if action is taken by written consent of stockholders of the Company in lieu of a meeting in respect of an election of Directors), the Hill Path Affiliates shall vote, or cause to be voted (including, if applicable, by written consent), all Voting Securities Beneficially Owned by the Hill Path Affiliates in excess of the Voting Percentage Limit in the same proportion as the Voting Securities not Beneficially Owned by the Hill Path Affiliates are voted (including, if applicable, by written consent, or by voting by ballot or by submitting any alternative proxy card necessary to accomplish the proportionate voting contemplated by this section) affirmatively for or against, or to withhold authority with respect to, as applicable, the election of each Person nominated to serve as a Director (or, as applicable, the removal of any Director). The Hill Path Affiliates shall be free to vote or cause to be voted (including by abstaining or, if applicable, taking action by written consent), in their sole discretion, all Voting Securities Beneficially Owned by the Hill Path Affiliates up to and including the Voting Percentage Limit affirmatively for or against, or to withhold authority with respect to, as applicable, the election of each Person nominated to serve as a Director (or, as applicable, the removal of any Director).

(b)Voting with Respect to Acquisition Transactions. At any meeting of stockholders of the Company at which an Acquisition Transaction is submitted to a vote of the stockholders of the Company (or if action is taken with respect to such matter(s) by written consent of stockholders of the Company in lieu of a meeting), the Hill Path Affiliates shall vote or cause to be voted (including by abstaining or, if applicable, taking action by written consent) all Voting Securities Beneficially Owned by the Hill Path Affiliates in excess of the Voting Percentage Limit in the same proportion as the Voting Securities not Beneficially Owned by the Hill Path Affiliates are voted (including by written consent) for or against, or abstain with respect to, such Acquisition Transaction (and such related matter(s)). For the avoidance of doubt, in calculating the voting requirements of the Hill Path Affiliates under this Section 3(b), all broker non-votes and all Voting Securities that are not present or represented at the applicable stockholder meeting shall be considered as abstentions. The Hill Path Affiliates shall be free to vote or cause to be voted (including by abstaining or, if applicable, taking action by written consent), in their sole discretion, all Voting Securities Beneficially Owned by the Hill Path Affiliates up to and including the Voting Percentage Limit.

(c)Voting on Routine Matters. At any annual meeting of the Company’s stockholders, with respect to the annual stockholder vote regarding the selection of the Company’s auditor and the Company’s executive compensation (or if action is taken with respect to such matter(s) by written consent of stockholders of the Company in lieu of a meeting), the Hill Path Affiliates shall vote, or cause to be voted (including by abstaining or, if applicable, taking action by written consent), all Voting Securities Beneficially Owned by the Hill Path Affiliates in excess of the Voting Percentage Limit in the same proportion as the Voting Securities not Beneficially Owned by the Hill Path Affiliates are voted (including by written consent) for or against, or abstain with respect to, such matter. The Hill Path Affiliates shall be free to vote or cause to be voted (including by abstaining or, if applicable, taking action by written consent), in their sole discretion, all Voting Securities Beneficially Owned by the Hill Path Affiliates up to

and including the Voting Percentage Limit for or against, or to abstain from voting on, each such matter.

(d)Voting with Respect to Other Matters. At any meeting of stockholders of the Company at which any matter, other than an Other Specified Matter or a matter that is subject to Section 3(a), Section 3(b) or Section 3(c), is submitted to a vote of the stockholders of the Company (or if action is taken with respect to such matter(s) by written consent of stockholders of the Company in lieu of a meeting), the Hill Path Affiliates shall vote, or cause to be voted (including by abstaining or, if applicable, taking action by written consent), all Voting Securities Beneficially Owned by the Hill Path Affiliates in excess of the Voting Percentage Limit in the same proportion as the Voting Securities not Beneficially Owned by the Hill Path Affiliates are voted (including by written consent) for or against, or abstain with respect to such matter. The Hill Path Affiliates shall be free to vote or cause to be voted (including by abstaining or, if applicable, taking action by written consent), in their sole discretion, all Voting Securities Beneficially Owned by the Hill Path Affiliates up to and including the Voting Percentage Limit for or against, or to abstain from voting on, each such matter.

(e)Quorum. At each meeting of stockholders, Hill Path shall cause all of the Voting Securities Beneficially Owned by the Hill Path Affiliates to be present in person or by proxy for quorum purposes.

(f)Acquisition by Hill Path. Any Acquisition of the Company proposed by Hill Path or Hill Path Affiliated Directors shall, in each case, be subject to (i) approval of a special committee of the Board comprised solely of directors who are not Hill Path Affiliated Directors and are disinterested from Hill Path and (ii) approval by the holders of a majority of the outstanding shares of Common Stock not held by the Hill Path Affiliates. “Acquisition of the Company” means the acquisition by Hill Path Affiliates of all or substantially all of the Common Stock not owned by Hill Path Affiliates, whether by merger, consolidation, tender offer, or otherwise.

(g)Related Party Transactions with Hill Path Affiliates. Any material transaction between any Hill Path Affiliate, on the one hand, and the Company or any of its subsidiaries, on the other hand shall be subject to approval of a special committee of the Board comprised solely of directors who are not Hill Path Affiliated Directors and who are disinterested from Hill Path.

3.Expenses. The Company shall reimburse Hill Path, promptly upon request from time to time, for its reasonable, documented out-of-pocket fees and expenses (including legal expenses) incurred in connection with or related to the negotiation, execution and delivery of this Amendment and the Special Meeting, provided, that such reimbursement shall not exceed $750,000 in the aggregate.

4.Effect on Original Agreement. Except as otherwise set forth herein, the Original Agreement shall remain unaffected by the terms of this Amendment and shall continue in full force and effect.

5.Amendment; Waiver. Other than as provided in Section 1 above, any amendment to or waiver by the Company of this Amendment shall require the approval of a majority of the directors on the Board who are not Hill Path Affiliated Directors and are disinterested from Hill Path and any such amendment shall be an agreement specifically amending this Amendment in writing executed by the parties hereto.

6.Certain Provisions of Original Agreement. Sections 14 (Remedies; Jurisdiction and Venue; Governing Law), 20 (Counterparts) and 23 (Interpretation and Construction) of the Original Agreement shall apply to this Amendment mutatis mutandis.

[Signature Page Follows]

IN WITNESS WHEREOF, each of the parties hereto has executed this Amendment, or caused the same to be executed by its duly authorized representative as of the date first above written.

HILL PATH CAPITAL LP

By: /s/ Scott I. Ross_________________________

Name: Scott I. Ross

Title: Managing Partner

UNITED PARKS & RESORTS INC.

By: /s/ Marc G. Swanson_____________________

Name: Marc G. Swanson

Title: Chief Executive Officer

United Parks & Resorts Inc. Reports Fourth Quarter and Fiscal 2023 Results

ORLANDO, FL, February 28, 2024 - United Parks & Resorts Inc. (NYSE: PRKS), a leading theme park and entertainment company, today reported its financial results for the fourth quarter and fiscal year 2023.

Fourth Quarter 2023 Highlights

•Attendance was a record 5.0 million guests, an increase of approximately 23,000 guests from the fourth quarter of 2022.

•Total revenue was $389.0 million, a decrease of $1.6 million or 0.4% from the fourth quarter of 2022.

•Net income was $40.1 million, a decrease of $9.0 million from the fourth quarter of 2022.

•Adjusted EBITDA[1] was $150.4 million, a decrease of $3.2 million from the fourth quarter of 2022.

•Total revenue per capita[2] decreased 0.9% to $78.42 from the fourth quarter of 2022. Admission per capita[2] decreased 2.6% to $44.46 while in-park per capita spending[2] increased 1.5% to a record $33.96 from the fourth quarter of 2022.

Fiscal 2023 Highlights

•Attendance was 21.6 million guests, a decrease of 0.3 million guests or 1.5% from fiscal 2022.

•Total revenue was $1,726.6 million, a decrease of $4.7 million or 0.3% from fiscal 2022.

•Net income was $234.2 million, a decrease of $57.0 million or 19.6% from fiscal 2022.

•Adjusted EBITDA was $713.5 million, a decrease of $14.8 million or 2.0% from fiscal 2022.

•Total revenue per capita increased 1.3% to a record $79.91 from fiscal 2022. Admission per capita increased 0.4% to a record $44.16 while in-park per capita spending increased 2.4% to a record $35.75 from fiscal 2022.

Other Highlights

•The Board of Directors voted to recommend a new $500 million share buyback authorization, subject to approval by non-Hill Path shareholders.

•During fiscal 2023, the Company repurchased 313,750 shares for an aggregate total of approximately $17.9 million.

•During fiscal 2023, the Company came to the aid of 335 animals in need in the wild. The total number of animals the Company has helped over its history is more than 41,000.

“We are pleased to report another quarter and fiscal year of strong financial results,” said Marc Swanson, Chief Executive Officer of United Parks & Resorts Inc. “In the fourth quarter we delivered record attendance and record in park per capita spending despite adverse weather impacts, in particular across our Florida markets during peak visitation periods and an unfavorable calendar shift in the quarter. For the full year we delivered near record results and grew our total revenue per capita for the 6th year in a row despite significant adverse weather impacts throughout the year. We estimate that weather related and calendar shift impacts reduced attendance by approximately 75,000 visits in the fourth quarter and that weather related impacts reduced attendance by over 370,000 visits for the full year.”

“Weather aside, we continue to drive growth in total revenue per capita including growth in admissions per capita, and in-park per capita, which has increased for 15 consecutive quarters, demonstrating the effectiveness of our revenue strategies, our pricing power and the strength of consumer spending in our parks. Also, in 2023 along with our partners we successfully opened our first SeaWorld park outside of the United States in Abu Dhabi, which has been extremely well received and is performing ahead of expectations. In addition, we made meaningful investments across our parks and business that we are confident will deliver strong returns and will be a source of growth and profitability this year and into the future,” said Marc Swanson, Chief Executive Officer of United Parks & Resorts Inc. “I want to thank our ambassadors for all their dedicated efforts in 2023.”

"Our attendance levels for fiscal 2023 were still below levels achieved in 2019, primarily due to a decline in international and group attendance which we are confident will recover to and surpass pre-COVID levels. We are also still more than 3 million visitors below our historical high attendance of approximately 25 million guests achieved in 2008. Our clear opportunity to drive meaningfully more attendance to our parks combined with our demonstrated ability to continue to grow total per capita spending, manage and reduce costs and achieve strong returns on our investments give us high confidence in our ability to continue to deliver operational and financial improvements that will lead to meaningful increases in shareholder value” continued Swanson.

“We are excited about our plans for 2024, including an incredible line-up of new, one-of-a kind rides, attractions and events, improved in park venues and offerings across our parks. We are also really excited about celebrating SeaWorld Parks 60th anniversary this year which kicks off across our SeaWorld parks on March 21st and will run through the whole year. There will be even more reasons to visit our SeaWorld parks this year with special events, shows, attractions and a whole lot more. We are happy to report that our new rides and attractions are all currently scheduled to open before the peak summer season. We are also encouraged to see 2024 bookings trending ahead of prior year for both group sales and our Discovery Cove Property. We expect meaningful growth and new records in revenue and Adjusted EBITDA for 2024,” concluded Swanson.

[1] This earnings release includes Adjusted EBITDA, Covenant Adjusted EBITDA and Free Cash Flow which are financial measures that are not calculated in accordance with Generally Accepted Accounting Principles in the U.S. ("GAAP"). See "Statement Regarding Non-GAAP Financial Measures and Key Performance Metrics" section and the financial statement tables for the definitions of Adjusted EBITDA, Covenant Adjusted EBITDA and Free Cash Flow and the reconciliation of these measures for historical periods to their respective most comparable financial measures calculated in accordance with GAAP.

[2] This earnings release includes key performance metrics such as total revenue per capita, admissions per capita and in-park per capita spending. See “Statement Regarding Non-GAAP Financial Measures and Key Performance Metrics” section for definitions and further details.

For 2024, the Company has an exciting line-up of new rides, attractions, events and new and improved in park venues and offerings with something new and meaningful in every one of its parks. The Company’s new rides and attractions include the following:

•Penguin Trek (SeaWorld Orlando): An unforgettable multi-launch family coaster adventure, where guests will navigate the harsh Antarctic environment in search of a colony of penguins. Penguin Trek will be an indoor/outdoor coaster experience, as well as the eighth and most immersive addition to the Coaster Capital of Orlando.

•Jewels of the Sea (SeaWorld San Diego): A first of its kind at SeaWorld parks, the all-new "Jewels of the Sea: The Jellyfish Experience" offers an immersive and interactive view into the mysterious underwater world of glowing and graceful jellyfish. This aquarium features three unique galleries including one of the largest jelly cylinders in the country, as well as an immersive multi-media experience.

•Catapult Falls (SeaWorld San Antonio): Riders will experience the rush of the world's first launched flume coaster featuring the world's steepest flume drop. This family thrill experience will also feature the tallest flume drop in Texas.

•Loch Ness Monster: The Legend Lives On (Busch Gardens Williamsburg): The legendary Loch Ness Monster will resurface as a fully restored experience loaded with all-new thrills, dramatic storytelling and innovative effects, as it takes riders on “Nessie’s” newly refurbished signature track.

•Phoenix Rising (Busch Gardens Tampa Bay): Riders will experience a fiery blaze of immersive, family-friendly excitement as they soar above the Serengeti Plain and drop into an array of fun-filled twists and turns on the new Phoenix Rising. This family suspended coaster includes an on-board audio soundtrack and speeds up to 44 miles per hour.

•Tassie's Underwater Twist (Aquatica Orlando): Florida’s most immersive water slide takes riders on an exhilarating journey into a world of watery wonders set to an inspiring original musical score.

•Tikitapu Splash (Aquatica San Antonio): This all-new, multi-level interactive water-play structure provides countless ways to get wet and stay cool. Featuring 3 giant dumping buckets, 4 unique slides and over 100 new water-play elements including geysers, sprays, and spouts providing plenty of play for all ages.

•123 Playground and Sunny Day Carousel (Sesame Place Philadelphia): New furry fun is coming to Sesame Place with two experiences in 2024! The 123 Playground is the perfect place for adults to relax in the shade while their youngest ones run, climb, and play. The NEW Sunny Day Carousel will open in the Sesame Plaza and be colorfully renovated, providing a new way to experience one of the park’s most iconic attractions.

•Nitro Racer (Water Country USA): Challenge your friends to a bodysurfing battle across a six-lane superhighway and see who wins the bragging rights. An updated and enhanced 320-foot 6-person high-speed racing slide with new elements including a timer to race against friends and family.

•Castaway Falls (Adventure Island): This brand-new interactive splash and play area features multiple levels to explore with more than 100 spray elements, 4 slides, and three giant tipping buckets. It’s an ideal spot for kids of all ages to splash and play.

•Dine with Elmo and Friends (Sesame Place San Diego): Join your favorite furry friends at the Sunny Day Cafe for an interactive dining experience the whole family will enjoy! This indoor facility features a tasty family-style buffet meal while the Sesame Street friends join diners for an immersive experience with singing, dancing, and photo opportunities.

The Company's results of operations for fiscal 2023 and 2022 continued to be impacted by the global COVID-19 pandemic due in part to a decline in international attendance from historical levels.

Fourth Quarter 2023 Results

In the fourth quarter of 2023, the Company hosted approximately 5.0 million guests, generated total revenues of $389.0 million, net income of $40.1 million and Adjusted EBITDA of $150.4 million. Attendance increased approximately 23,000 guests when compared to the fourth quarter of 2022 primarily due to an increase in demand, partly from the Company's Halloween and Christmas events, partially offset by the impact of adverse weather during peak visitation periods, particularly across our Florida markets and the impact of a calendar shift in the quarter.

The decrease in total revenue of $1.6 million compared to the fourth quarter of 2022 was primarily a result of decreases in admission per capita (defined as admissions revenue divided by total attendance), partially offset by increased in-park per capita spending (defined as food, merchandise and other revenue divided by total attendance). Admission per capita decreased primarily due to the

impact of the admissions product mix when compared to the fourth quarter of 2022. In-park per capita spending improved due to pricing initiatives. The decrease in net income of $9.0 million compared to the fourth quarter of 2022 was primarily a result of the impact of higher operating expenses. Adjusted EBITDA was negatively impacted by a decrease in total revenue.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Variance |

|

|

|

2023 |

|

|

2022 |

|

|

% |

|

(Unaudited, in millions, except per share and per capita amounts) |

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

389.0 |

|

|

$ |

390.5 |

|

|

|

(0.4 |

%) |

Net income |

|

$ |

40.1 |

|

|

$ |

49.0 |

|

|

|

(18.3 |

%) |

Earnings per share, diluted |

|

$ |

0.62 |

|

|

$ |

0.76 |

|

|

|

(18.4 |

%) |

Adjusted EBITDA |

|

$ |

150.4 |

|

|

$ |

153.7 |

|

|

|

(2.1 |

%) |

Net cash provided by operating activities |

|

$ |

106.5 |

|

|

$ |

95.7 |

|

|

|

11.2 |

% |

Attendance |

|

|

4.96 |

|

|

|

4.94 |

|

|

|

0.5 |

% |

Total revenue per capita |

|

$ |

78.42 |

|

|

$ |

79.10 |

|

|

|

(0.9 |

%) |

Admission per capita |

|

$ |

44.46 |

|

|

$ |

45.63 |

|

|

|

(2.6 |

%) |

In-Park per capita spending |

|

$ |

33.96 |

|

|

$ |

33.47 |

|

|

|

1.5 |

% |

Fiscal 2023 Results

In fiscal 2022, the Company hosted approximately 21.6 million guests and generated total revenues of $1,726.6 million, net income of $234.2 million and Adjusted EBITDA of $713.5 million. Attendance decreased by 0.3 million guests when compared to 2022 primarily due to significantly adverse weather, including some combination of unusual heat, cold and/or rain, across most of our markets, including during peak visitation periods.

The decrease in total revenue of $4.7 million compared to 2022 was primarily a result of a decrease in attendance partially offset by increases in admission per capita and in-park per capita spending. Admission per capita increased primarily due to the realization of higher prices in our admission products resulting from our strategic pricing efforts and the impact of the park attendance mix, which was partially offset by the impact of the admissions product mix when compared to 2022. In-park per capita spending improved primarily due to pricing initiatives and an increase in revenue related to the Company's international services agreements when compared to 2022, partially offset by factors including weather, the admissions product mix, closures and disruption related to construction delays at certain in park locations.

Net income and Adjusted EBITDA were negatively impacted by a decrease in total revenue and increases in operating expense, selling, general and administrative expenses. Net income was also negatively impacted by higher interest expense.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended December 31, |

|

|

Variance |

|

|

|

2023 |

|

|

2022 |

|

|

% |

|

(Unaudited, in millions, except per share and per capita amounts) |

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

1,726.6 |

|

|

$ |

1,731.2 |

|

|

|

(0.3 |

%) |

Net income |

|

$ |

234.2 |

|

|

$ |

291.2 |

|

|

|

(19.6 |

%) |

Earnings per share, diluted |

|

$ |

3.63 |

|

|

$ |

4.14 |

|

|

|

(12.3 |

%) |

Adjusted EBITDA |

|

$ |

713.5 |

|

|

$ |

728.2 |

|

|

|

(2.0 |

%) |

Net cash provided by operating activities |

|

$ |

504.9 |

|

|

$ |

564.6 |

|

|

|

(10.6 |

%) |

Attendance |

|

|

21.61 |

|

|

|

21.94 |

|

|

|

(1.5 |

%) |

Total revenue per capita |

|

$ |

79.91 |

|

|

$ |

78.91 |

|

|

|

1.3 |

% |

Admission per capita |

|

$ |

44.16 |

|

|

$ |

44.00 |

|

|

|

0.4 |

% |

In-Park per capita spending |

|

$ |

35.75 |

|

|

$ |

34.91 |

|

|

|

2.4 |

% |

Share Repurchases

During the year ended December 31, 2023, the Company repurchased 313,750 shares for an aggregate total of approximately $17.9 million.

The Board of Directors voted to recommend a new $500 million share buyback authorization, subject to approval by non-Hill Path shareholders

Rescue Efforts

In the fourth quarter of 2023, the Company came to the aid of 98 animals in need in the wild. The total number of animals the Company has helped over its history is more than 41,000.

The Company is a leader in animal rescue. Working in partnership with state, local and federal agencies, the Company’s rescue teams are on call 24 hours a day, seven days a week, 365 days a year. Consistent with its mission to protect animals and their ecosystems, rescue teams mobilize and often travel hundreds of miles to help ill, injured, orphaned or abandoned wild animals in need of the Company’s expert care, with the goal of returning them to their natural habitat.

Conference Call

The Company will hold a conference call today, Wednesday, February 28, 2024, at 9 a.m. Eastern Time to discuss its fourth quarter and fiscal 2023 financial results. The conference call will be broadcast live on the Internet and the release and conference call can be accessed via the Company’s website at www.UnitedParksInvestors.com. For those unable to participate in the live webcast, a replay will be available beginning at approximately 12 p.m. Eastern Time on February 28, 2024, under the "Events & Presentations" tab of www.UnitedParksInvestors.com. A replay of the call can also be accessed telephonically from 12 p.m. Eastern Time on February 28, 2024, through 11:59 p.m. Eastern Time on March 6, 2024, by dialing (877) 344-7529 from anywhere in the U.S., (855) 669-9658 from anywhere in Canada, or (412) 317-0088 from international locations and entering the conference code 1368178.

Statement Regarding Non-GAAP Financial Measures

This earnings release and accompanying financial statement tables include several non-GAAP financial measures, including Adjusted EBITDA, Covenant Adjusted EBITDA and Free Cash Flow. Adjusted EBITDA, Covenant Adjusted EBITDA and Free Cash Flow are not recognized terms under GAAP, should not be considered in isolation or as a substitute for a measure of financial performance or liquidity prepared in accordance with GAAP and are not indicative of net income or loss or net cash provided by operating activities as determined under GAAP.

Adjusted EBITDA, Covenant Adjusted EBITDA, Free Cash Flow and other non-GAAP financial measures have limitations that should be considered before using these measures to evaluate a company’s financial performance or liquidity. Adjusted EBITDA, Covenant Adjusted EBITDA and Free Cash Flow as presented, may not be comparable to similarly titled measures of other companies due to varying methods of calculation.

Management believes the presentation of Adjusted EBITDA is appropriate as it eliminates the effect of certain non-cash and other items not necessarily indicative of the Company’s underlying operating performance. Management uses Adjusted EBITDA in connection with certain components of its executive compensation program. In addition, investors, lenders, financial analysts and rating agencies have historically used EBITDA-related measures in the Company’s industry, along with other measures, to estimate the value of a company, to make informed investment decisions and to evaluate companies in the industry.

Management believes the presentation of Covenant Adjusted EBITDA for the last twelve months is appropriate as it provides additional information to investors about the calculation of, and compliance with, certain financial covenants in the Company’s credit agreement governing its Senior Secured Credit Facilities and the indentures governing its Senior Notes and First-Priority Senior Secured Notes (collectively, the “Debt Agreements”). Covenant Adjusted EBITDA is a material component of these covenants.

Management believes that Free Cash Flow is useful to investors, equity analysts and rating agencies as a liquidity measure. The Company uses Free Cash Flow to evaluate its ability to generate cash flow from business operations. Free Cash Flow does not represent the residual cash flow available for discretionary expenditures, as it excludes certain expenditures such as mandatory debt service requirements, which are significant. Free Cash Flow is not defined by GAAP and should not be considered in isolation or as an alternative to net cash provided by (used in) operating, investing and financing activities or other financial data prepared in accordance with GAAP. Free Cash Flow as defined above may differ from similarly titled measures presented by other companies.

This earnings release includes several key performance metrics including total revenue per capita (defined as total revenue divided by attendance), admission per capita (defined as admissions revenue divided by attendance) and in-park per capita spending (defined as food, merchandise and other revenue divided by attendance). These performance metrics are used by management to assess the operating performance of its parks on a per attendee basis and to make strategic operating decisions. Management believes the presentation of these performance metrics is useful and relevant for investors as it provides investors the ability to review financial performance in the same manner as management and provides investors with a consistent methodology to analyze revenue between periods on a per attendee basis. In addition, investors, lenders, financial analysts and rating agencies have historically used similar per-capita related performance metrics to evaluate companies in the industry.

About United Parks & Resorts Inc.

United Parks & Resorts Inc. (NYSE: PRKS) is a global theme park and entertainment company that owns or licenses a diverse portfolio of award-winning park brands and experiences, including SeaWorld®, Busch Gardens®, Discovery Cove, Sesame Place®, Water Country USA, Adventure Island, and Aquatica®. The Company’s seven world-class brands span 13 parks in seven markets across the United States and Abu Dhabi, offering experiences that matter with exhilarating thrill and family-friendly rides, coasters, and experiences, inspiring up-close and educational presentations with wildlife, and other various special events throughout the year. In addition, the Company collectively cares for one of the largest zoological collections in the world, is a global leader in animal welfare, training, and veterinary care, and is one of the leading marine animal rescue organizations in the world with a legacy of rescuing and caring for animals that spans nearly 60 years, including coming to the aid of over 41,000 animals in need. To learn more, visit www.UnitedParks.com.

Copies of this and other news releases as well as additional information about United Parks & Resorts Inc. can be obtained online at www.unitedparks.com. Shareholders and prospective investors can also register to automatically receive the Company’s press releases, SEC filings and other notices by e-mail by registering at that website.

Forward-Looking Statements

In addition to historical information, this press release contains statements relating to future results (including certain projections and business trends) that are “forward-looking statements” within the meaning of the federal securities laws. The Company generally uses the words such as “might,” “will,” “may,” “should,” “estimates,” “expects,” “continues,” “contemplates,” “anticipates,” “projects,” “plans,” “potential,” “predicts,” “intends,” “believes,” “forecasts,” “future,” “guidance,” “targeted,” “goal” and variations of such words or similar expressions in this press release and any attachment to identify forward-looking statements. All statements, other than statements of historical facts included in this press release, including statements concerning plans, objectives, goals, expectations, beliefs, business strategies, future events, business conditions, results of operations, financial position, business outlook, earnings guidance, business trends and other information are forward-looking statements. The forward-looking statements are not historical facts, and are based upon current expectations, beliefs, estimates and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond management’s control. All expectations, beliefs, estimates and projections are expressed in good faith and the Company believes there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs, estimates and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and other important factors, many of which are beyond management’s control, that could cause actual results to differ materially from the forward-looking statements contained in this press release, including among others: various factors beyond the Company's control adversely affecting attendance and guest spending at the Company's theme parks, including, but not limited to, weather, natural disasters, labor shortages, inflationary pressures, supply chain delays or shortages, foreign exchange rates, consumer confidence, the potential spread of travel-related health concerns including pandemics and epidemics, travel related concerns, adverse general economic related factors including increasing interest rates, economic uncertainty, and recent geopolitical events outside of the United States, and governmental actions; failure to retain and/or hire employees; a decline in discretionary consumer spending or consumer confidence, including any unfavorable impacts from Federal Reserve interest rate actions and inflation which may influence discretionary spending, unemployment or the overall economy; the ability of Hill Path Capital LP and its affiliates to significantly influence the Company's decisions and their interests may conflict with ours or yours in the future; increased labor costs, including minimum wage increases, and employee health and welfare benefit costs; complex federal and state regulations governing the treatment of animals, which can change, and claims and lawsuits by activist groups before government regulators and in the courts; activist and other third-party groups and/or media can pressure governmental agencies, vendors, partners, guests and/or regulators, bring action in the courts or create negative publicity about us; incidents or adverse publicity concerning the Company's theme parks, the theme park industry and/or zoological facilities; a significant portion of the Company's revenues have historically been generated in the States of Florida, California and Virginia, and any risks affecting such markets, such as natural disasters, closures due to pandemics, severe weather and travel-related disruptions or incidents; technology interruptions or failures that impair access to the Company's websites and/or information technology systems; cyber security risks to us or the Company's third-party service providers, failure to maintain or protect the integrity of internal, employee or guest data, and/or failure to abide by the evolving cyber security regulatory environment; inability to compete effectively in the highly competitive theme park industry; interactions between animals and the Company's employees and the Company's guests at attractions at the Company's theme parks; animal exposure to infectious disease; high fixed cost structure of theme park operations; seasonal fluctuations in operating results; changing consumer tastes and preferences; inability to grow the Company's business or fund theme park capital expenditures; inability to realize the benefits of developments, restructurings, acquisitions or other strategic initiatives, and the impact of the costs associated with such activities; the effects of public health events on the Company's business and the economy in general; adverse litigation judgments or settlements; inability to protect the Company's intellectual property or the infringement on intellectual property rights of others; the loss of licenses and permits required to exhibit animals or the violation of laws and regulations; unionization activities and/or labor disputes; inability to maintain certain commercial licenses; restrictions in the Company's debt agreements limiting flexibility in operating the Company's business; inability to retain the Company's current credit ratings; the Company's leverage and interest rate risk; inadequate insurance coverage; inability to purchase or contract with third party manufacturers for rides and attractions, construction delays or impacts of supply chain disruptions on existing or new rides and attractions; environmental regulations, expenditures and liabilities; suspension or termination of any of the Company's business licenses, including by legislation at federal, state or local levels; delays, restrictions or inability to obtain or maintain permits; inability to remediate an identified material weakness; financial distress of strategic partners or other counterparties; tariffs or other trade restrictions; actions of activist stockholders; the policies of the U.S. President and his administration or any changes to tax laws; changes or declines in the Company's stock price, as well as the risk that securities analysts could downgrade the Company's stock or the Company's sector; risks associated with the Company's capital allocation plans and share repurchases, including the risk that the Company's share repurchase program could increase volatility and fail to enhance stockholder value, uncertainties and factors set forth in the section entitled “Risk Factors” in the Company’s most recently available Annual Report on Form 10-K, as such risks, uncertainties and factors may be updated in the Company’s periodic filings with the Securities and Exchange Commission (“SEC”). Although the Company believes that these statements are based upon reasonable assumptions, it cannot guarantee future results and readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date of this press release. There can be no assurance that (i) the Company has correctly measured or identified all of the factors affecting its business or the extent of these factors’ likely impact, (ii) the available information with respect to these factors on which such analysis is based is complete or accurate, (iii) such analysis is correct or (iv) the Company’s strategy, which is based in part on this analysis, will be successful. Except as required by law, the Company undertakes no obligation to update or revise forward-looking statements to reflect new information or events or circumstances that occur after the date of this press release or to reflect the occurrence of unanticipated events or otherwise. Readers are advised to review the

Company’s filings with the SEC (which are available from the SEC’s EDGAR database at www.sec.gov and via the Company’s website at www.unitedparks.com).

CONTACT:

Investor Relations:

Matthew Stroud

Investor Relations

(888) 410-1812

Investors@unitedparks.com

Media:

Libby Panke

FleishmanHillard

(314) 719-7521

Libby.Panke@fleishman.com

UNITED PARKS & RESORTS INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

December 31, |

|

|

Change |

|

|

For the Year Ended

December 31, |

|

|

Change |

|

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

Net revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Admissions |

|

$ |

220,541 |

|

|

$ |

225,291 |

|

|

$ |

(4,750 |

) |

|

|

(2.1 |

%) |

|

$ |

954,083 |

|

|

$ |

965,232 |

|

|

$ |

(11,149 |

) |

|

|

(1.2 |

%) |

Food, merchandise and other |

|

|

168,424 |

|

|

|

165,229 |

|

|

|

3,195 |

|

|

|

1.9 |

% |

|

|

772,504 |

|

|

|

766,005 |

|

|

|

6,499 |

|

|

|

0.8 |

% |

Total revenues |

|

|

388,965 |

|

|

|

390,520 |

|

|

|

(1,555 |

) |

|

|

(0.4 |

%) |

|

|

1,726,587 |

|

|

|

1,731,237 |

|

|

|

(4,650 |

) |

|

|

(0.3 |

%) |

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of food, merchandise and other revenues |

|

|

29,835 |

|

|

|

29,274 |

|

|

|

561 |

|

|

|

1.9 |

% |

|

|

131,697 |

|

|

|

135,217 |

|

|

|

(3,520 |

) |

|

|

(2.6 |

%) |

Operating expenses (exclusive of depreciation and amortization shown separately below) |

|

|

184,664 |

|

|

|

176,367 |

|

|

|

8,297 |

|

|

|

4.7 |

% |

|

|

758,874 |

|

|

|

735,687 |

|

|

|

23,187 |

|

|

|

3.2 |

% |

Selling, general and administrative expenses |

|

|

45,085 |

|

|

|

44,775 |

|

|

|

310 |

|

|

|

0.7 |

% |

|

|

221,237 |

|

|

|

200,074 |

|

|

|

21,163 |

|

|

|

10.6 |

% |

Severance and other separation costs (a) |

|

|

295 |

|

|

|

(5 |

) |

|

|

300 |

|

|

NM |

|

|

|

816 |

|

|

|

108 |

|

|

|

708 |

|

|

NM |

|

Depreciation and amortization |

|

|

39,812 |

|

|

|

38,241 |

|

|

|

1,571 |

|

|

|

4.1 |

% |

|

|

154,208 |

|

|

|

152,620 |

|

|

|

1,588 |

|

|

|

1.0 |

% |

Total costs and expenses |

|

|

299,691 |

|

|

|

288,652 |

|

|

|

11,039 |

|

|

|

3.8 |

% |

|

|

1,266,832 |

|

|

|

1,223,706 |

|

|

|

43,126 |

|

|

|

3.5 |

% |

Operating income |

|

|

89,274 |

|

|

|

101,868 |

|

|

|

(12,594 |

) |

|

|

(12.4 |

%) |

|

|

459,755 |

|

|

|

507,531 |

|

|

|

(47,776 |

) |

|

|

(9.4 |

%) |

Other (income) expense, net |

|

|

(38 |

) |

|

|

67 |

|

|

|

(105 |

) |

|

NM |

|

|

|

(18 |

) |

|

|

(43 |

) |

|

|

25 |

|

|

|

58.1 |

% |

Interest expense |

|

|

36,259 |

|

|

|

34,765 |

|

|

|

1,494 |

|

|

|

4.3 |

% |

|

|

146,666 |

|

|

|

117,501 |

|

|

|

29,165 |

|

|

|

24.8 |

% |

Income before income taxes |

|

|

53,053 |

|

|

|

67,036 |

|

|

|

(13,983 |

) |

|

|

(20.9 |

%) |

|

|

313,107 |

|

|

|

390,073 |

|

|

|

(76,966 |

) |

|

|

(19.7 |

%) |

Provision for income taxes |

|

|

13,000 |

|

|

|

18,026 |

|

|

|

(5,026 |

) |

|

|

(27.9 |

%) |

|

|

78,911 |

|

|

|

98,883 |

|

|

|

(19,972 |

) |

|

|

(20.2 |

%) |

Net income |

|

$ |

40,053 |

|

|

$ |

49,010 |

|

|

$ |

(8,957 |

) |

|

|

(18.3 |

%) |

|

$ |

234,196 |

|

|

$ |

291,190 |

|

|

$ |

(56,994 |

) |

|

|

(19.6 |

%) |

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share, basic |

|

$ |

0.63 |

|

|

$ |

0.76 |

|

|

|

|

|

|

|

|

$ |

3.66 |

|

|

$ |

4.18 |

|

|

|

|

|

|

|

Earnings per share, diluted |

|

$ |

0.62 |

|

|

$ |

0.76 |

|

|

|

|

|

|

|

|

$ |

3.63 |

|

|

$ |

4.14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

63,955 |

|

|

|

64,136 |

|

|

|

|

|

|

|

|

|

63,955 |

|

|

|

69,607 |

|

|

|

|

|

|

|

Diluted (b) |

|

|

64,699 |

|

|

|

64,789 |

|

|

|

|

|

|

|

|

|

64,494 |

|

|

|

70,280 |

|

|

|

|

|

|

|

UNITED PARKS & RESORTS INC. AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

December 31, |

|

|

Change |

|

|

For the Year Ended

December 31, |

|

|

Change |

|

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

Net income |

|

$ |

40,053 |

|

|

$ |

49,010 |

|

|

$ |

(8,957 |

) |

|

|

(18.3 |

%) |

|

$ |

234,196 |

|

|

$ |

291,190 |

|

|

$ |

(56,994 |

) |

|

|

(19.6 |

%) |

Provision for income taxes |

|

|

13,000 |

|

|

|

18,026 |

|

|

|

(5,026 |

) |

|

|

(27.9 |

%) |

|

|

78,911 |

|

|

|

98,883 |

|

|

|

(19,972 |

) |

|

|

(20.2 |

%) |

Interest expense |

|

|

36,259 |

|

|

|

34,765 |

|

|

|

1,494 |

|

|

|

4.3 |

% |

|

|

146,666 |

|

|

|

117,501 |

|

|

|

29,165 |

|

|

|

24.8 |

% |

Depreciation and amortization |

|

|

39,812 |

|

|

|

38,241 |

|

|

|

1,571 |

|

|

|

4.1 |

% |

|

|

154,208 |

|

|

|

152,620 |

|

|

|

1,588 |

|

|

|

1.0 |

% |

Equity-based compensation expense (c) |

|

|

4,246 |

|

|

|

4,203 |

|

|

|

43 |

|

|

|

1.0 |

% |

|

|

17,961 |

|

|

|

19,757 |

|

|

|

(1,796 |

) |

|

|

(9.1 |

%) |

Loss on impairment or disposal of assets and certain non-cash expenses (d) |

|

|

8,651 |

|

|

|

1,663 |

|

|

|

6,988 |

|

|

NM |

|

|

|

31,636 |

|

|

|

14,218 |

|

|

|

17,418 |

|

|

|

122.5 |

% |

Business optimization, development and strategic initiative costs (e) |

|

|

5,712 |

|

|

|

5,796 |

|

|

|

(84 |

) |

|

|

(1.4 |

%) |

|

|

33,903 |

|

|

|

19,846 |

|

|

|

14,057 |

|

|

|

70.8 |

% |

Certain transaction and investment costs and other taxes |

|

|

402 |

|

|

|

75 |

|

|

|

327 |

|

|

NM |

|

|

|

1,711 |

|

|

|

1,128 |

|

|

|

583 |

|

|

|

51.7 |

% |

COVID-19 related incremental costs (f) |

|

|

316 |

|

|

|

759 |

|

|

|

(443 |

) |

|

|

(58.4 |

%) |

|

|

9,076 |

|

|

|

6,689 |

|

|

|

2,387 |

|

|

|

35.7 |

% |

Other adjusting items (g) |

|

|

1,984 |

|

|

|

1,138 |

|

|

|

846 |

|

|

|

74.3 |

% |

|

|

5,223 |

|

|

|

6,413 |

|

|

|

(1,190 |

) |

|

|

(18.6 |

%) |

Adjusted EBITDA (h) |

|

$ |

150,435 |

|

|

$ |

153,676 |

|

|

$ |

(3,241 |

) |

|

|

(2.1 |

%) |

|

$ |

713,491 |

|

|

$ |

728,245 |

|

|

$ |

(14,754 |

) |

|

|

(2.0 |

%) |

Items added back to Covenant Adjusted EBITDA as defined in the Debt Agreements: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated cost savings (i) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,100 |

|

|

|

1,600 |

|

|

|

21,500 |

|

|

NM |

|

Other adjustments as defined in the Debt Agreements (j) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,350 |

|

|

|

10,877 |

|

|

|

(3,527 |

) |

|

|

(32.4 |

%) |

Covenant Adjusted EBITDA (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

743,941 |

|

|

$ |

740,722 |

|

|

$ |

3,219 |

|

|

|

0.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

December 31, |

|

|

Change |

|

|

For the Year Ended

December 31, |

|

|

Change |

|

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

Net cash provided by operating activities |

|

$ |

106,459 |

|

|

$ |

95,714 |

|

|

$ |

10,745 |

|

|

|

11.2 |

% |

|

$ |

504,916 |

|

|

$ |

564,588 |

|

|

$ |

(59,672 |

) |

|

|

(10.6 |

%) |

Capital expenditures |

|

|

70,618 |

|

|

|

49,976 |

|

|

|

20,642 |

|

|

|

41.3 |

% |

|

|

304,836 |

|

|

|

200,705 |

|

|

|

104,131 |

|

|

|

51.9 |

% |

Free Cash Flow (l) |

|

|

35,841 |

|

|

|

45,738 |

|

|

|

(9,897 |

) |

|

|

(21.6 |

%) |

|

|

200,080 |

|

|

|

363,883 |

|

|

|

(163,803 |

) |

|

|

(45.0 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

$ |

(71,389 |

) |

|

$ |

(49,976 |

) |

|

$ |

(21,413 |

) |

|

|

42.8 |

% |

|

$ |

(305,607 |

) |

|

$ |

(200,705 |

) |

|

$ |

(104,902 |

) |

|

|

52.3 |

% |

Net cash used in financing activities |

|

$ |

(3,374 |

) |

|

$ |

(78,910 |

) |

|

$ |

75,536 |

|

|

|

(95.7 |

%) |

|

$ |

(34,707 |

) |

|

$ |

(726,049 |

) |

|

$ |

691,342 |

|

|

|

(95.2 |

%) |

UNITED PARKS & RESORTS INC. AND SUBSIDIARIES

UNAUDITED BALANCE SHEET DATA

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

|

2023 |

|

|

2022 |

|

Cash and cash equivalents |

|

$ |

246,922 |

|

|

$ |

79,196 |

|

Total assets |

|

$ |

2,625,046 |

|

|

$ |

2,325,787 |

|

Deferred revenue |

|

$ |

155,614 |

|

|

$ |

169,535 |

|

Long-term debt, including current maturities: |

|

|

|

|

|

|

Term B Loans |

|

$ |

1,173,000 |

|

|

$ |

1,185,000 |

|

Senior Notes |

|

|

725,000 |

|

|

|

725,000 |

|

First-Priority Senior Secured Notes |

|

|

227,500 |

|

|

|

227,500 |

|

Total long-term debt, including current maturities |

|

$ |

2,125,500 |

|

|

$ |

2,137,500 |

|

Total stockholders' deficit |

|

$ |

(208,216 |

) |

|

$ |

(437,664 |

) |

UNITED PARKS & RESORTS INC. AND SUBSIDIARIES

UNAUDITED CAPITAL EXPENDITURES DATA

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended

December 31, |

|

|

Change |

|

|

|

|

2023 |

|

|

2022 |

|

|

# |

|

|

% |

|

|

Capital Expenditures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Core (m) |

|

$ |

181,850 |

|

|

$ |

131,940 |

|

|

$ |

49,910 |

|

|

|

37.8 |

% |

|

Expansion/ROI projects (n) |

|

|

122,986 |

|

|

|

68,765 |

|

|

|

54,221 |

|

|

|

78.8 |

% |

|

Capital expenditures, total |

|

$ |

304,836 |

|

|

$ |

200,705 |

|

|

$ |

104,131 |

|

|

|

51.9 |

% |

|

UNITED PARKS & RESORTS INC. AND SUBSIDIARIES

UNAUDITED OTHER DATA

(In thousands, except per capita amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

December 31, |

|

|

Change |

|

|

For the Year Ended

December 31, |

|

|

Change |

|

|

|

2023 |

|

|

2022 |

|

|

# |

|

|

% |

|

|

2023 |

|

|

2022 |

|

|

# |

|

|

% |

|

Attendance |

|

|

4,960 |

|

|

|

4,937 |

|

|

|

23 |

|

|

|

0.5 |

% |

|

|

21,606 |

|

|

|

21,939 |

|

|

|

(333 |

) |

|

|

(1.5 |

%) |

Total revenue per capita(o) |

|

$ |

78.42 |

|

|

$ |

79.10 |

|

|

$ |

(0.68 |

) |

|

|

(0.9 |

%) |

|

$ |

79.91 |

|

|

$ |

78.91 |

|

|

$ |

1.00 |

|

|

|

1.3 |

% |

Admission per capita(p) |

|

$ |

44.46 |

|

|

$ |

45.63 |

|

|

$ |

(1.17 |

) |

|

|

(2.6 |

%) |

|

$ |

44.16 |

|

|

$ |

44.00 |

|

|

$ |

0.16 |

|

|

|

0.4 |

% |

In-Park per capita spending(q) |

|

$ |

33.96 |

|

|

$ |

33.47 |

|

|

$ |

0.49 |

|

|

|

1.5 |

% |

|

$ |

35.75 |

|

|

$ |

34.91 |

|

|

$ |

0.84 |

|

|

|

2.4 |

% |

NM-Not meaningful.

ND-Not determinable

(a) Reflects restructuring and other separation costs and/or adjustments.

(b) During the three months and year ended December 31, 2023, there were approximately 474,000 and 437,000 anti-dilutive shares excluded from the computation of diluted earnings per share, respectively. During the three months and year ended December 31, 2022, there were approximately 368,000 and 277,000 anti-dilutive shares excluded from the computation of diluted earnings per share, respectively.

(c) Reflects non-cash equity compensation expenses and related payroll taxes associated with the grants of equity-based compensation.

(d) Reflects primarily non-cash expenses related to asset write-offs and costs related to certain rides and equipment which were removed from service. For the years ended December 31, 2023 and 2022 also includes approximately $11.8 million and $6.5 million, respectively, related to non-cash self-insurance reserve adjustments.

(e) For the year ended December 31, 2023, reflects business optimization, development and other strategic initiative costs primarily related to: (i) $16.9 million of third-party consulting costs; and (ii) $15.3 million of other business optimization costs and strategic

initiative costs. For the three months ended December 31, 2023, reflects business optimization, development and other strategic initiative costs primarily related to $5.5 million of other business optimization costs and strategic initiative costs.

For the three months and year ended December 31, 2022, reflects business optimization, development and other strategic initiative costs primarily related to: (i) $2.2 million and $9.9 million, respectively of third-party consulting costs; and (ii) $3.1 million and $8.8 million, respectively of other business optimization costs and strategic initiative costs.