Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

05 Februar 2024 - 4:53PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

February 2024

Commission File Number 1-15182

DR.

REDDY’S LABORATORIES LIMITED

(Translation of registrant’s name into English)

8-2-337, Road No. 3, Banjara Hills

Hyderabad, Telangana 500 034, India

+91-40-49002900

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ______

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

Indicate by check mark whether by furnishing the

information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

¨

No x

If “Yes” is marked, indicate below the file number assigned

to registrant in connection with Rule 12g3-2(b): 82-________.

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

DR. REDDY’S LABORATORIES LIMITED

(Registrant) |

| |

|

|

|

| Date: February 5, 2024 |

By: |

/s/ K Randhir Singh |

| |

|

Name: |

K Randhir Singh |

| |

|

Title: |

Company Secretary |

Exhibit 99.1

|

Dr. Reddy’s Laboratories Ltd.

8-2-337, Road No. 3, Banjara Hills,

Hyderabad - 500 034, Telangana,

India.

CIN : L85195TG1984PLC004507

Tel : +91 40

4900 2900

Fax : +91 40 4900

2999

Email : mail@drreddys.com

www.drreddys.com |

February 5, 2024

National Stock Exchange of India Ltd. (Stock Code: DRREDDY-EQ)

BSE Limited (Stock Code: 500124)

New York Stock Exchange Inc. (Stock Code: RDY)

NSE IFSC Ltd. (Stock Code: DRREDDY)

Dear Sir/ Madam,

Sub: Transcript of the Earnings call conducted on January 30, 2024

Pursuant to Regulation 30 of the Securities and

Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, please find enclosed the transcript of the

Earnings call for the quarter and nine months ended December 31, 2023, conducted on January 30, 2024. Also please note that this transcript

of the call has been uploaded on our website.

Weblink:https://www.drreddys.com/cms/sites/default/files/2024-

02/DRL_Q3FY24%20Earnings%20Call%20Transcript_30Jan2024_final.pdf

This is for your information and records.

Thanking you.

Yours faithfully,

For Dr. Reddy’s Laboratories Limited

K Randhir Singh

Company Secretary, Compliance Officer &

Head-CSR

Dr. Reddy's Laboratories Limited's

Q3FY24 Earnings Conference Call

January 30, 2024

| Management: |

Mr. Erez ISRAELI: Chief Executive Officer |

| |

Mr. Parag AGARWAL: Chief Financial Officer |

| |

Ms.

Richa PERIWAL: head - investor relations & corporate analytics |

|

Q3FY24

Earnings Conference Call Transcript

January

30, 2024 |

| Moderator: |

Ladies and gentlemen, good day, and welcome to the Dr. Reddy's Q3FY24 Earnings Conference Call. |

| |

|

| |

As a reminder, all participant lines will be in the ‘listen-only’ mode and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing ‘*’ then ‘0’ on your touchtone phone. Please note that this conference is being recorded. |

| |

|

| |

I now hand the conference over to Ms. Richa Periwal. Thank you, and over to you, ma'am. |

| |

|

| Richa Periwal: |

Thank you. A very good morning and good evening to all of you and thank you for joining us today for the Dr. Reddy's Earnings Conference Call for the quarter ended December 31, 2023. |

| |

|

| |

Earlier during the day, we have released our results, and the same is also posted on our website. This call is being recorded, and the playback and transcripts shall be made available on our website soon. |

| |

|

| |

All the discussions and analysis of this call will be based on the IFRS consolidated financial statements. The discussion today contains certain non-GAAP financial measures or a reconciliation of GAAP to non-GAAP measures, please refer to our press release. |

| |

|

| |

To discuss the business performance and outlook, we have our CEO, Mr. Erez Israeli, and our CFO, Mr. Parag Agarwal, and the entire Investor Relations team. |

| |

|

| |

Please note that today's call is a copyrighted material of Dr. Reddy's and cannot be rebroadcasted or attributed in press or media outlets, without the company's expressed written consent. |

| |

|

| |

Before I proceed with the call, I'd like to remind everyone that the safe harbor contained in today's press release also pertains to this conference call. |

| |

|

| |

Now, I hand over the call to Mr. Parag Agarwal. Over to you, Parag. |

| |

|

| Parag Agarwal: |

Thank you, Richa, and greetings to everyone. A warm welcome to our Q3FY24 earnings call. Thanks for joining. |

| |

|

| |

I am pleased to take you through our financial performance for the quarter. For this section, all amounts have been translated into U.S. dollar at a convenience translation rate of Rs.83.19, which is the rate as of December 31st, 2023. |

| |

|

| |

We continued our growth trajectory in the third quarter and delivered another quarter of financial results with highest ever sales and robust operating profit. |

| |

|

| |

Consolidated revenues for the quarter stood at Rs. 7,215 crores, which is $867 million and grew by 7% on YoY basis and by 5% on a sequential basis. The growth is led by the generics business in U.S. & Europe, with contribution from both base business and new product launches. |

|

Q3FY24

Earnings Conference Call Transcript

January

30, 2024 |

| |

Consolidated gross profit margin stood at 58.5% for the quarter, a decrease of 73 bps over previous year and 18 bps sequentially. The decrease was on account of price erosion for certain of our existing products, partly offset by improvement in product mix and productivity. Gross margin for the Global generics and PSAI businesses were at 61.9% and 29.4% respectively. |

| |

|

| |

The SG&A spend for the quarter is Rs. 2,023 crores, which is $ 243 million, an increase of 12% YoY and 8% QoQ. The YoY increase is primarily on account of investment in sales & marketing activities, digitalization capabilities, and new business & innovation initiatives. The SG&A cost as percentage to sales were 28.0% and is higher by 148 bps YoY and 72 bps QoQ. |

| |

|

| |

The R&D spend for the quarter is Rs. 557 crores, which is $ 67 million, an increase of 15% YoY and 2% QoQ. The R&D spend is at 7.7% of sales and is higher by 60 bps YoY and lower by 20 bps QoQ. The investments are driven by ongoing clinical trials on differentiated assets, as well as other developmental efforts to build a healthy pipeline of new products across our markets, for both small molecules and biosimilars. |

| |

|

| |

The other operating income for the quarter is Rs. 97 crores as compared to operating expense of Rs. 73 crores for the same quarter last year. The other income was higher on account of sale of non-current assets. |

| |

|

| |

The EBITDA for the quarter

is Rs. 2,111 crores, which is $ 254 million, posting a growth of 7% YoY. The EBITDA margin stood at 29.3%. |

| |

|

| |

Our profit before tax for the quarter stood at Rs. 1,826 crores, which is $219 million, posting a growth of ~12% YoY and a decline of 4.6% over previous quarter. |

| |

|

| |

The net finance income for the quarter is Rs. 96 crores as compared to net finance expense of Rs. 14 crores for the same quarter last year. |

| |

|

| |

Effective tax rate has been at 24.5% for the quarter. The effective tax rate was marginally higher in comparison to the same period last year, mainly due to an increase in the proportion of the Company's profits coming from higher tax jurisdictions, partly offset by adoption of corporate tax rate under section 115BAA of the Income Tax Act of India. We expect our normalized ETR for the year to be in the range of 24% to 25%. |

| |

|

| |

Profit after tax for the quarter stood at Rs. 1,379 crores, which is $ 166 million, posting a growth of 11% YoY and a decline of 7% over previous quarter. Reported EPS for the quarter is Rs. 82.7. |

| |

|

| |

Operating working capital increased by Rs. 1,227 crores, which is $148 million, against that on September 30th, 2023, mainly due to increase in inventory and receivables. Our capital investment stood at Rs. 307 crores, which is $ 37 million in this quarter. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| |

The free cash flow generated, before acquisition related payout, during this quarter was at Rs. 22 crores, which is $ 2.6 million. |

| |

|

| |

Consequently, we now have a net surplus cash of Rs. 5,907 crores, which is $ 710 million as on December 31st, 2023. |

| |

|

| |

Foreign currency cash flow hedges in the form of derivatives for the U.S. dollar are approximately $672 million, hedged around the range of Rs. 83.4 to Rs. 84.6 to the dollar & AUD 1.1 million at the rate of Rs. 58.3 to Australian dollar maturing in the next 15 months. |

| |

|

| |

With this, I now request Erez to take us through the key business highlights. |

| |

|

| Erez Israeli: |

Thank you, Parag, and a very warm welcome to everyone joining us today. |

| |

|

| |

I am delighted to report yet another quarter with highest ever revenues and robust operational performance. We made progress during the quarter on strategic collaborations to bring novel therapies to India and to improve our position in new avenues of growth globally. We are also humbled by the recognitions received for the progress we have made on our sustainability agenda. |

| |

|

| |

Let me take you through some of the key highlights of the quarter: |

| |

|

| |

Sales and EBITDA grew by 7% each. The sales growth was primarily driven by improved market share for our existing products in US, continued momentum in our Europe business, contribution from new products, partially offset by price erosion in certain existing products due to competitive landscape. We generated healthy EBITDA margin at 29% and annualized RoCE at 37%. Net cash surplus was $ 710 mn at the end of quarter. |

| |

|

| |

We entered an exclusive development and commercialization deal with U.S. based Coya Therapeutics for their product COYA 302. It is an investigational combination biologic for treatment of the neuro-degenerative disease, ALS. |

| |

|

| |

We received an approval from UK MHRA for our proposed bevacizumab biosimilar. |

| |

|

| |

We acquired a leading women’s health and dietary supplements portfolio of brands called MenoLabs in the US. With this and our recent entry into the UK consumer health space through the launch of anti-hay fever medicine, Histallay, as an OTC, we are taking steps to strengthen our OTC business globally. |

| |

|

| |

The USFDA completed a routine cGMP inspection at our formulations manufacturing facility (FTO-3) in October 2023 as well as a GMP and Pre-Approval Inspection (PAI) at our R&D facility in December 2023. We were issued Form 483s with 10 observations at FTO-3 and 3 observations at our R&D facility. We have submitted our response within the stipulated timeline. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| |

Our efforts in sustainability and ESG continue to gain momentum, and external recognition. We became the 1st Indian pharma company to be featured in the Dow Jones Sustainability World Index for 2023 and retained our place in the Emerging Markets Index for the 8th year in a row. We were awarded ‘Gold Medal’ status by EcoVadis. We were upgraded in MSCI ESG ratings from BB to BBB. We were awarded Golden Peacock for Corporate Social Responsibility, 2023. Further, we are the first Indian pharma company to pledge towards a plantation initiative covering 2,900 hectares by 2028, as part of the World Economic Forum’s 1t.org. |

| |

|

| |

Now, let me take you through the key business highlights for the quarter. Please note that all references to the numbers in this section are in respective local currencies. |

| |

|

| |

Our North America generics business recorded sales of $401 million for the quarter with a growth of 7% on YoY and a sequential increase of 4%. The benefit of market share expansion in certain existing key products, revenues from new launches and integration of acquired portfolio was partly offset by price erosion due to competitive environment. We launched 4 new products during the quarter. We recently acquired MenoLabs portfolio of women’s health and dietary supplements brands in the U.S., which complements well with our U.S. self-care and wellness business portfolio. |

| |

|

| |

Our European generics business recorded sales of €55 million this quarter, with a YoY growth of 8% and a sequential decline of 6%. The contribution from new product launches and improvement in base business volumes helped offset price erosion. During the quarter, we launched a total of 6 products across markets. Earlier this month, we entered the UK OTC/consumer health market with the launch of branded allergy medication, Histallay. |

| |

|

| |

Our Emerging Markets business recorded sales of Rs. 1,283 crores, a marginal YoY decline of 2% and a sequential increase of 6%. The benefit of new products and price increases in certain markets was more than offset by unfavourable forex. We are on track to deliver double digit growth for the year. We launched 30 new products during the quarter across various countries of the Emerging Markets. Within the Emerging Markets segment, the Russia business grew by 3% on YoY basis and 7% on a sequential basis in constant currency. |

| |

|

| |

Our India business recorded sales of Rs. 1,180 crores and reported a YoY growth of 5% and a marginal sequential decline. We anticipate the base business to deliver double digit growth in the coming quarters. We are focusing on licensing and collaborations to bring innovation to India. Roll out of Nerivio marked our entry into digital therapeutics. We are seeing adoption by doctors and repeat purchases indicate high patient satisfaction scores. India remains our priority market and we will continue to reinforce our presence in core generics business, while investing and building the innovation spaces, in line with our strategy. |

| |

|

| |

Our PSAI business recorded sales of $94 million with a strong sequential growth of 11% and a marginal YoY decline of 1%. Excluding sales of COVID products in the same period last year, sales growth was in high single digit. We expect sales to improve on the back of strategic collaborations with regional and global players. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| |

Last quarter, we invested 7.7% of our revenue to strengthen our R&D capabilities. Our efforts are focused on developing complex value-accretive products, including several generic injectables and biosimilars, in line with our patient-centric strategy to enable access and affordability. We also continue to invest in innovative solutions through strategic partnerships, such as the recent collaboration with Coya Therapeutics on investigational therapy. We have done 9 global generic filings, including 2 ANDAs in U.S. during Q3FY24. |

| |

|

| |

We have been recently ramping up our inventory to reduce the risk of supply chain disruptions and building inventory for our pipeline products. We are also strengthening our position by building best in class capabilities and commercial infrastructure to leverage our portfolio to expand further. We continue to develop our pipeline and scale up our biosimilars business, being our ‘pivot to growth’ strategy. Our ability to source external innovation through strategic business development and collaboration will enable us to address unmet needs of patients and support the overall growth ambitions of the company. |

| |

|

| |

With this, I would like to open the floor for questions and answers. |

| |

|

| Moderator: |

Thank you very much. We will now begin the ‘Question & Answer’ session. Anyone who wishes to ask a question may press * and 1 on their touch-tone telephone. If you wish to remove yourself from the question queue, you may press * and 2. Participants are requested to use handsets only, while asking a question. Ladies and gentlemen, we will wait for a moment while the question queue assembles. The first question is from the line of Balaji Prasad from Barclays. Please go ahead. |

| |

|

| Mikela: |

This is Mikela, on for Balaji. Thanks for taking our questions. Just two from us. First one is, what is your latest thinking on generic pricing trends, particularly in the U.S.? And could you provide a bit more color on how you see this trending going forward? And second one, what are your thoughts around the Chinese pharma market in 2024? Thanks so much. |

| |

|

| Erez Israeli: |

So, the first question is just continuation of the pricing environment that we saw in the last couple of quarters. So, we are, give or take, in the same environment, meaning that relatively to other years, it is less than it used to be. More focused on service, sustainability of supply. But obviously, the business model did not change. And, in every place that competitors are coming, we see price erosion in the same neighbourhood like we have discussed in previous quarters. As for China, we do see very good tracking for approvals. We got nine approvals since the beginning of this fiscal and 3 in the last quarter. So, for us, the momentum continues in China. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Moderator: |

Thank you.

The next question is from the line of Kunal Dhamesha from Macquarie. Please go ahead. |

| |

|

| Kunal Dhamesha: |

Hi, thank you for taking

my question and congratulations on a good set of numbers. First one, on the U.S. product launch and filing momentum. So, if I look

at the first nine-months data, we have launched twelve products in the U.S., and we have just made eight new filings and our total

pending ANDAs also have come down from 90 in Q4FY22 to now 79. So, is it because we are focusing on a few therapy areas, more complex?

If you can provide some color there, would be helpful. |

| |

|

| Erez Israeli: |

So, yes, we do have less

filings, let us say, overall, because we are now focused on products that we believe is meaningful. But it is still a healthy number

of files. I believe that you'll see in the next coming months more filings that are coming, just timing of those files. On the launch

piece, we will have more than 20 this year. So, it looks like a healthy number. But, obviously in the U.S., what is important is

the type of product launches, not the number of launches, but so far it looks healthy for us. |

| |

|

| Kunal Dhamesha: |

Sure, and then just a follow

up on that. Now, we have acquired this MenoLabs, if you can provide some clarity as to how does this fit into our strategy? What

was, probably, the last 12 months sales for these brands? And what is the acquisition value that we have paid, and does the increase

in borrowing quarter-on-quarter relate to this? |

| |

|

Erez Israelī: |

So, at the start, at that

time of what we call Horizon-2, we decided to focus, in general, as a company, on three type of segments - NCE & NBE, I'm talking

primarily collaborations or BD/acquisitions; OTC and nutraceuticals; and digital therapeutics. Specifically, for the U.S., we decided

to focus on OTC in several areas, including working on digital aisle on our private label as well as brands in women’s health.

So, we acquired Premama in the past and now, we have complementary products, brands that were added to it. The idea is to create

franchise in women health supplements. So, that is the kind of, if you wish, diversified U.S. business, to areas that have different

patterns of demand and supply and the brand awareness. I don't recall exactly the sales of MenoLabs, because we are talking about

the range of millions of dollars there. So, it is relatively small. We believe that we can take it from there. |

| |

|

| Kunal Dhamesha: |

And, after this what would

be our U.S. revenue contribution from the wellness products or OTC products? I think earlier we used to provide it in 20F or the

quarterly filing. I'm not sure now do you provide that? |

| |

|

| Erez Israeli: |

So, the OTC, if I may,

on an annual basis, should be about 10%, give or take, of the overall U.S. business. |

| |

|

| Kunal Dhamesha: |

Thank you. I have more

questions. I will join back the queue. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Moderator: |

Thank you. The next question is from the line of Tushar Manudhane from Motilal Oswal Financial Services. Please go ahead. |

| |

|

| Tushar Manudhane: |

Ya, thanks for the opportunity. Sir, firstly, on the receivables which have increased on a quarter-on-quarter basis - is this on certain select products or is it across the portfolio? And for which markets? |

| |

|

| Parag Agarwal: |

No, receivables increase is primarily in line with the top-line increase. So, it's nothing unusual. It's across the market, but largely concentrated in the U.S. So, it's in line with the normal top-line increase. |

| |

|

| Tushar Manudhane: |

Ok. Secondly, gross margin for PSAI segment has been higher for the quarter, compared to the previous quarters. So, anything in specific you'd like to comment? |

| |

|

| Erez Israeli: |

Yeah, we are growing. And, because of the nature of the business that has normally a high level of fixed costs. So, when you are increasing the sales, you normally will have better margins. So, it's just a reflection of the growth. I'm happy that we are back to growth. It took us quite some time to achieve that. I think now we are, it looks like, in the right direction. |

| |

|

| Tushar Manudhane: |

Ok. Because, second quarter, the PSAI revenue was Rs. 960 crores with 13% gross margin and now, it is Rs. 1,040 and the gross margin has improved to almost 22%. |

| |

|

| Erez Israeli: |

Yes, so it's a combination, again, of the mix and the combination of more sales. And there was nothing unusual in that. It's just a type of growth. |

| |

|

| Tushar Manudhane: |

And just lastly, considering the launches and the filings and the market share gain for the existing products, if you would like to share outlook for the U.S. business for FY25, we are approaching now at the end of FY24. So, if you could share some color on that? |

| |

|

| Erez Israeli: |

You know that we are not giving guidance, but we are supposed to continue to do well in all the levers. So far it looks healthy for both commercial products, service to the customers, and price environment. Lenalidomide is going to continue to be meaningful. So, all the levers should continue to work well also in the next coming quarters. |

| |

|

| Moderator: |

Thank you. The next question is from the line of Neha Manpuria from Bank of America. Please go ahead. |

| |

|

| Neha Manpuria: |

Thank you so much for taking my questions. If I were to look at the SG&A spend increase that we have seen in the quarter or even if I were to look at it over a three-year period, I know you’ve mentioned that we've been investing in Horizon-2 projects that you talk about. But from a monetization point of view, when should we start seeing this contributing to revenue? I'm just trying to understand, when should we start seeing operating leverage in the higher spend? And do you think this number continues to trend up from where we are? |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Erez Israeli: |

Yes, so part of it which is related to the investment we put now in certain brands in India, will give results already in FY25, because that's the nature of the game. So, we are creating demand. Some of it is related to investment that will take more time as we are putting money into building products that will be launched in FY25-26 and even 27. So, likely that, this level, at least value wise, will continue to be a bit higher, but I do see more growth in revenue. So, overall, it should be in the same environment that it used to be in the past, meaning before that. But let's say to your questions, part of it will be already in FY25 and part of it will be in FY26 instead. |

| |

|

| Neha Manpuria: |

And, you know, if I were to dig a little deeper on the points on the launches. I know in your analyst meet; you've mentioned certain areas that you're working on. But, out of the 20-25 launches that you talk about in the U.S., can we try to understand as to how many of these could be the ‘bread and butter’ launches that we need, to offset the base business and how many of these could be meaningful products? Some color there would be helpful. |

| |

|

| Erez Israeli: |

Yes, so we have overall about 26 products that can be launched, if it will get approval. We will know then when and only how in the market that can be launched. And I'm talking about products that can be meaningful. What meaningful means, probably in tens and millions and more than that. This is what is, let's say, for the second discussion, meaningful. The question is what combination of that will get to the market and what will be the sale that? Of course, I don't know, but we are building on that to offset the period after lenalidomide. In addition to that, we are planning to have a growth in the other levers as well as potential business that will come. So, the combination of those is supposed to lead & address to that. |

| |

|

| Neha Manpuria: |

And, you know, just to follow up on that, the 26 products would be over the next 2 years, 3 years, how should I look at the timeline for that? |

| |

|

| Erez Israeli: |

So, potentially, with all the cautions about this kind of products, I refer to product that are supposed to be in the next two years, 25 and 26. If it's going to 27, we have more products, of course, subject to approval, subject to winning court cases, subject to all the normal challenges that go into bringing products to the market. But, let's say, it's a healthy list of ‘tough to make’, ‘tough to develop’ products. |

| |

|

| Neha Manpuria: |

Understood. And my last question on the biosimilar pipeline. Could we talk about how many products we are developing for the U.S. and European market? And when should we start expecting, some sort of a timeline, or let's say a progress update on the pipeline that we're looking at for biosimilars? |

| |

|

| Erez Israeli: |

We are talking about 6 products by FY30. And again, subject to receiving approval in those timelines and subject to winning the patent cases. But this is what we are aiming for. If you recall, at the time when we had the change that we made, after the arrangement that we had, at the time, with Merck Serono, we decided to skip a couple of years and to move to products that we have a chance to be ‘first-to-market.’ This is the strategy. The first product should come in the beginning of calendar 2027 and then, the rest of the products by FY30. Then, of course, we have a bunch of products that will come later between FY31 and FY35 and ongoing. So, that's right now the pace for which we are planning. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Moderator: |

Thank you. The next question is from the line of Damayanti Kerai from HSBC Securities and Capital Markets. Please go ahead. |

| |

|

| Damayanti Kerai: |

Hi, thank you for the opportunity. My first question is for your India business. So, you obviously mentioned you're working on some innovative products, digital therapeutics etc. to improve market offering. But I just want to understand like how far these opportunities are right now for you because it appears that this kind of product uptake might take some time and meanwhile, your India business is, I'll say, growing slowly than the market. So, how do you bridge your growth versus market growth till the time those innovative products start delivering results? |

| |

|

| Erez Israeli: |

Sure. First, just to calibrate, a part of the reason that people see single digits is that for Cidmus, the brand that we acquired, the price erosion that we had, which we anticipated is part of the business plan that we took into account when we acquired this brand, contributed about 2% for that decline. Plus, in the base of last quarter last year, we had also products that we divested. So, if we are taking those, we are already in the place of double digits. But going forward, what's more important, we identify brands that should grow even faster than the market. So, I'm talking about brands that will grow at the pace of 1.5x the market for those specific brands, so we are building behind them. And in addition to your point, indeed, those pick up may take time, but it's a very significant pipeline that we are building now. All the products that we are bringing in innovation are better than the current standard of care, so it will be meaningful growth, more in the medium term. In April 25, I'm expecting to see double digit growth of India business from the big ones. |

| |

|

| Damayanti Kerai: |

Okay, that's comforting to hear. My second question is on your U.S. business. So, obviously you delivered a very good set of numbers. So, a few reasons you mentioned - pickup in market share for some key products etc. So, just want to understand, was the Revlimid contribution for the third quarter even much higher than what we saw in the first and second quarter? And have you seen like what kind of pickup you have seen on the Mayne portfolio? |

| |

|

| Erez Israeli: |

So, you know that I cannot speak unfortunately on quantities on lenalidomide. I can also say that it's absolutely within our expectations. And I'm expecting it to be meaningful also in the future. As for Mayne, we see pick up. We see that it is growing. So far it is within our expectation. I'm happy for this acquisition. |

| |

|

| Damayanti Kerai: |

Ok, thank you. And my last question is, can you talk about your progress in some of GLP-1 products, specifically for anti-obesity indications, which you might be targeting for, say, U.S. or other export markets? |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Erez Israeli: |

So, we decided, like many others, to be in this segment. It's a very important segment for us. It's in our interest from both areas. First, we are very much into anti-diabetics, not just in India, but also actually globally and we build ourselves. And the second is the peptides, as a family, we believe that it's a core strength for us, both on the API as well as on the sterile facilities that we have. So, the combination of that, we want to play in these markets very much, and to address some of the needs. So, we are planning to launch globally, we mean in all the countries that we have a reach, these products when the relevant patent situation will allow us to do that. |

| |

|

| Moderator: |

The next question is from the line of Surya Patra from Phillip Capital. Please go ahead. |

| |

|

| Surya Patra: |

Thanks for this opportunity. So, my first question is on the U.S. business. In fact, the base U.S. business excluding, let's say, Revlimid and the recently acquired Mayne’s portfolio, it looks like that Y-o-Y we are kind of seeing is flattish performance, despite the improved pricing scenario in the U.S. So, could you qualify that whether that is the kind of trend what we have also seen and what is the kind of growth that we are anticipating for the base business? |

| |

|

| Erez Israeli: |

So, I can confirm that the base business is growing, and this is attributing to our ability to and the efforts that we put on both inventories and service, and obviously relationships with customers. I anticipate that these trends will continue, also, in the future. And naturally, with the geopolitical situation in certain areas, concern about sustainability of supply is an important topic for customers. And we see ourselves as a partner to help them with that challenge. And, wherever we are successful, we also see more sales. |

| |

|

| Surya Patra: |

Ok. Regards the recent M&As what we have seen, let's say, leveraging the cash flow generation from Revlimid, I think we have done a couple of acquisitions and already announced 3-4 odd kind of in-licensing arrangements. So, cumulatively, all these initiatives should have also contributed to the growth in the base business. So, in fact, could you share that, what is the kind of incremental growth that such M&A initiatives would have added to the base business? And going ahead over a period of, let's say, next 3-4 years, I mean, beyond Revlimid opportunity, so what base business growth that you are anticipating out of the M&A activities? |

| |

|

| Erez Israeli: |

So, I'm not calling M&As as base business. It’s by design, new stuff that we are adding to the company. It's not just M&As - we have all kinds of collaborations - licensing in, JVs, also M&As. All of that is primarily to strengthen the future portfolio as per the strategy, whether it’s in, like I mentioned, it can be on the base products like Mayne, but mostly, it is about what we call Horizon-2 - again NCEs & NBEs, OTC & nutraceuticals and digital therapeutics. So, actually most of the efforts are coming from that. In addition to that, we are always looking for opportunity. By the way, it’s not the money from gRevlimid. It’s the money that we make ‘also’ from gRevlimid, but also from the other activities of the company. How much it will contribute? As much as we'll be able to buy. We potentially have a significant financial capacity, and we are very active in the market. At the same time, we are not buying for the sake of buying or for the sake of any other reason. We buy, because we feel it’s a good deal for us and its meaningful for our strategy. So, like I said, in the past we are not on a shopping spree. We are buying what we believe is good for us and strategic for us. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Surya Patra: |

Regards the inspection outcomes for the Bachupally facility. So, what risk that one should assign to it or what is your practical assessment here, sir? Do you find any risk to the existing business, given the kind of number of observations that has been issued to you? And the nature of the observation that has been highlighted? |

| |

|

| Erez Israeli: |

Yes, so you're talking about the FTO-3, I'm assuming. |

| |

|

| Surya Patra: |

Correct. |

| |

|

| Erez Israeli: |

So, first, what is the risk? The risk is we get an OAI. Is there a possibility for that? Yes, there is a possibility. There is always a possibility, but there is a possibility that it will happen. What I can update is that first, we addressed all the observations in stipulated time. After that, we gave, twice, to the FDA, with the blessing also of external consultants, data that shows that the CAPA that we put in place is working. This is happening in two instalments, one in December and one in January. And I believe that it's a robust answer, but, of course, we will wait for the FDA response for that. |

| |

|

| Surya Patra: |

So, just one last clarification from my side. Whether you have commented on the MenoLabs size and potential contribution to our U.S. business? |

| |

|

| Erez Israeli: |

No, I did not, because I don't remember the numbers. I apologize for this. |

| |

|

| Richa Periwal: |

And we’ve not disclosed the number, but as Erez had mentioned, couple of millions is what is there. And as the business progresses, we'll keep updating you all. |

| |

|

| Moderator: |

Thank you. The next question is from the line of Bino Pathiparampil from Elara Capital. Please go ahead. |

| |

|

| Bino Pathiparampil: |

Hi, good morning, good evening. Just a couple of quick questions. One, you have this product, gLumify, which you have been licensed in the U.S. So, is there any timeline we can get regarding the approval of the same? |

| |

|

| Erez Israeli: |

I don't have any information about this one. |

| |

|

| Richa Periwal: |

That is there actually in the pipeline product, and we'll keep updating once, when the approval is in place. |

| |

|

| Bino Pathiparampil: |

Second on biosimilar Rituxan. Could you give some color on what sort of timelines you have in mind for the launch? Also, given the recent inspection of U.S. FDA and the outcome, etc.? |

| |

|

| Erez Israeli: |

So, we submitted in April. We got the FDA inspection on time in October. We addressed the FDA observations. We did not receive any additional information. So, if everything will be without any CRL or any query that will come from the U.S. FDA, the earliest that we can get approval is the end of April, but of course, it may be late, if we will get any query or CRL. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Bino Pathiparampil: |

Understood. Okay. And Erez, you mentioned about this biosimilar pipeline, which kind of starts from CY, calendar year 27, and going into the 30s. Do you have some products which could be among the first wave or the first biosimilar to some of the products within that? |

| |

|

| Erez Israeli: |

This is the intent. All the products that we are developing, we are developing with the intent to be either first or in the first wave. |

| |

|

| Moderator: |

Thank you. The next question is from the line of Shyam Srinivasan from Goldman Sachs. Please go ahead. |

| |

|

| Shyam Srinivasan: |

Ya, thank you. Good evening and thank you for taking my question. Erez, just the first one is on the overall CDMO kind of space, I know you have a subsidiary. But just want to understand, are you able to see more demand coming from global innovators towards India based companies, including companies like yourself or your subsidiary? So, that's the first question. And are you investing in capacities, either on the small molecules side or the biologics side for manufacturing for CDMO? |

| |

|

| Erez Israeli: |

So, its ‘yes’ for both. The caveat is that still our business is not that big, so I cannot say that it’s an overall global trend, but the trend that we see is the growth. And indeed, we do invest in capacity, both in the labs as well as for production, for products that we have contracts and we know that the capacity will be, of course, be paid by those contracts. |

| |

|

| Shyam Srinivasan: |

So, Erez, I'm just trying to understand from a capital allocation standpoint, will this be significant for you or you think we have enough other projects in the pipeline for us to be, you know, or do you think this will be a small part and will not be ramping up? |

| |

|

| Erez Israeli: |

The CDMO is not in the overall scheme of things, capital allocation will not be big. But it’s a business that should go from tens of millions of dollars to hundreds of millions of dollars, that's the expectation. But, in the overall scheme of things of the whole size of the company, it's a relatively small business. |

| |

|

| Shyam Srinivasan: |

Just a second, a financial question to Parag. I'm just looking at your disclosure around net cash generated after removing taxes and looking at FCF. So, the conversion has been low. So, just want to understand, I know there has been an acquisition you paid out for in the quarter one, but just want to understand, either in terms of CAPEX or in terms of intangible build-up, is there something that we need to keep in mind? |

| |

|

| Parag Agarwal: |

So, I think the only thing I would point out is what Erez mentioned, which is we are investing in strategic inventory build-up. So, we are investing in new product pipeline build-up. Also, because of the supply chain, the sea routes disruption, we don't want to lose any sales. So, we are also increasing inventory in our front-end markets. So, it’s primarily the working capital impact, apart from the receivables increase, which is in line with normal sales. So, that’s the key reason. Otherwise, our cash flows on various fronts continue to be healthy. The conversion is healthy. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Moderator: |

Thank you. The next follow up question is from the line of Kunal Dhamesha from Macquarie. Please go ahead. |

| |

|

| Kunal Dhamesha: |

Thank you for the opportunity again. Just continuing the last question on the inventory build-up. So, how much of our product would probably be going through sea route now and anything going through Red Sea route as of now? |

| |

|

| Erez Israeli: |

So, the majority of the products are going for the sea route. The situation creates an opportunity to move something by air, in a strange way, certain products are even better to do by air now. But of course, this is a volatile situation and may change. But in general, we are trying to address the majority. The majority means that for us it should be 80% plus. The second one is that we are trying to have as much inventory in the U.S., very close to the customers, part of our service to address customer need. We see that as an advantage for us, as we can give the customer a service that they may not get from others. So, this strategy, of course, leveraging the fact that we have a healthy balance sheet helped us a lot to grow. |

| |

|

| Kunal Dhamesha: |

Sure, sure. And just one related question in U.S. Over, let’s say, the last three to four quarters, how has the one-time or short-term supply opportunities behaved for you? Are those supply opportunities increasingly coming to you or decreasing in the last three, four quarters? |

| |

|

| Erez Israeli: |

I would say that the one-time situation is not big. And there is no, let’s say, tangible trends on that. For me, it's more of the fact that if we are gaining share, we are gaining it for the long term. This is more something that we are focused on. And most of the growth that we have in our base products is more longer term in nature, rather than a one-time buy. |

| |

|

| Kunal Dhamesha: |

So, is it fair to say that now the agreements that are being done are for a little longer period of time versus what it used to be, let's say, two years back? |

| |

|

| Erez Israeli: |

Every customer has its own pattern of procurement. I don't want to go into details, but in general, we do see appreciation of the approaches we are taking. So, we are trying to position as a partner for customers in certain areas. |

| |

|

| Kunal Dhamesha: |

Sure, sure. And one on the India business. So, we have said that we want to focus on our key brands. We have identified in India where we want to grow 1.5 times the market rate. Could you provide some ballpark number as to how much of these key brands will be contributing to our India business? |

| |

|

| Erez Israeli: |

So, most of the contributions to the overall growth that India is supposed to do, will come from those brands. So, when they will grow at the pace we mentioned, the overall India business will grow by double digits. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Kunal Dhamesha: |

Sure. And the last one, because you are focusing on the GLP-1 opportunities, can you provide some color on how much is our peptide manufacturing capacity? And are we manufacturing anything currently for regulated or semi-regulated markets? |

| |

|

| Erez Israeli: |

We are focusing not just on GLP-1. We are focusing beyond that, like other peptides, etc. But to your point, yes, we are making, but most of the volumes is yet to be launched, because the products are still under patents or are still under approval process, by either ourselves or by partners, external partners. |

| |

|

| Kunal Dhamesha: |

But any capacity that you want to put out? Like some of the other global players have put out that they can manufacture 32,000 litre capacity to manufacture GLP-1. |

| |

|

| Erez Israeli: |

Let's say that we invested a lot in our capacity, both on the API as well as on the finished products. I will not tell out the numbers of the capacity. |

| |

|

| Moderator: |

Thank you. The next follow-up question is from the line of Neha Manpuria from Bank of America. Please go ahead. |

| |

|

| Neha Manpuria: |

Ya, thanks again for taking my question. Just to confirm, out of the 26 products that you mentioned, Erez, in the U.S. pipeline which are meaningful, none of these would be from Bachupally? Would that be a fair assumption? Bachupally, FTO-3? |

| |

|

| Erez Israeli: |

In FTO-3, we do have, I think, two products that are part of that. And, so in the case that we have an issue, we will have to move it to another site that we have, if it will come into that situation. |

| |

|

| Neha Manpuria: |

From a pipeline dependence, upcoming launches, how important would FTO-3 be? Just to understand the risk in case of an adverse outcome? |

| |

|

| Erez Israeli: |

Not significant. Most of the products are oral solid, most of them commercial, so not significant. Obviously, we don't want it, it’s not nice to our reputation, et cetera, but it’s not significant. Most of the growth will come from Vizag and not from Bachupally. |

| |

|

| Neha Manpuria: |

Got it. And Parag, on the moderation in the gross margins that we have seen in the generics business - how much of that would be, I mean, the quarter-on-quarter moderation, would all of that be because of pricing pressure or is there any other big factor there? I think FX would be the other one, I'm assuming. |

|

Q3FY24 Earnings Conference Call Transcript

January 30, 2024 |

| Parag Agarwal: |

It's more of a mix issue, Neha. I mean, pricing is obviously there, but it's very stable. So, pricing doesn't stand out, but it is just that the offset from new product launches from the product mix has been a bit lower, that's all. So, it's not that the price erosion is higher, price erosion still remains at the same level. It's the upside from the other things that we see in terms of productivity, in terms of product mix. There is some timing issue I would say there. So, overall, well within the normal range. So, I shouldn't assume that the incremental business that we've seen in U.S., et cetera, is a lower margin business, and hence, that's reflective in my gross margin. |

| |

|

| Parag Agarwal: |

No, no, that's not right. Yes, you should not assume that. |

| |

|

| Moderator: |

Thank you. Ladies and gentlemen, that was our last question for today. As there are no further questions, I would now like to hand the conference over to Ms. Richa Periwal for closing comments. |

| |

|

| Richa Periwal: |

Thank you all for joining us for today's evening call. In case of any further queries, please contact the Investor Relations team. Thank you once again on behalf of Dr. Reddy’s Laboratories Limited. That concludes this conference. You may now disconnect your lines. Thank you. |

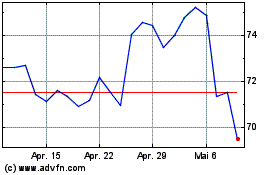

Dr Reddys Laboratories (NYSE:RDY)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Dr Reddys Laboratories (NYSE:RDY)

Historical Stock Chart

Von Mai 2023 bis Mai 2024