Regal to Replace Credit Facility - Analyst Blog

01 Juli 2011 - 6:36PM

Zacks

Regal Beloit Corporation (RBC) recently

completed its $500 million five-year unsecured revolving credit

facility for general corporate purposes.

This new facility will replace the previous credit facility of

$500 million, which is due to expire in April 2012.

Under the previous credit facility, the company had to pay

interest on the borrowed amount, based on LIBOR (London Interbank

Offered Rate) plus an applicable margin. The margin was derived

from the ratio of senior funded debt to EBITDA (Earnings before

interest, taxes, depreciation, and amortization). Additionally,

Regal Beloit paid a commitment

fee on the unused amount, contingent upon the ratio of senior

funded debt to EBITDA.

At the end of the first

quarter of fiscal 2011, the company was indebted to pay

$2.8 million under the revolving credit facility, whereas

there was no outstanding balance at the end of fiscal

2010.

As of April 2, 2011,

long-term debt was $430.8 million versus $428.3 million in the

prior quarter. Net debt-to-total capital ratio was

10.1%.

Regal Beloit is a

manufacturer and marketer of branded mechanical and

electrical motion control and power generation products serving

markets worldwide. The company has established manufacturing,

sales, and service facilities throughout the U.S., Canada, Mexico,

Europe and Asia.

We believe that Regal Beloit’s aggressive acquisition policy

leads to technological and geographical expansion. The company

completed nine acquisitions from fiscal 2008 to 2010. However, the

rise in raw material prices (copper and steel) could diminish

profits.

We currently have a Neutral recommendation on Regal Beloit. Our

recommendation is supported by a Zacks #3 Rank, which translates

into a Hold rating.

REGAL BELOIT (RBC): Free Stock Analysis Report

Zacks Investment Research

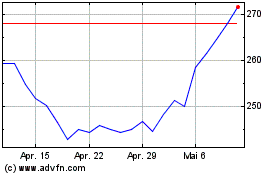

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

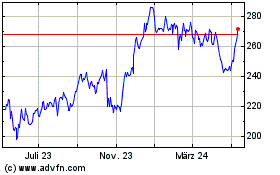

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024