- Legislation Continues to Support Energy Efficient Products

BELOIT, Wis., May 6 /PRNewswire-FirstCall/ -- Regal Beloit

Corporation (NYSE:RBC) today reported financial results for the

first quarter ended March 28, 2009. Net sales of $443.3 million

decreased 17.4% as compared to the $536.3 million reported for the

first quarter of 2008. Diluted earnings per share were $0.39 as

compared to $0.95 for the first quarter of 2008. (Note: prior year

financial results have been restated to reflect the impact of the

change in accounting for the Company's convertible senior

subordinated notes as prescribed in FASB Staff Position APB 14-1:

Accounting for Convertible Debt Instruments That May Be Settled in

Cash upon Conversion (Including Partial Cash Settlement.)) "While

the first quarter proved to be as challenging as we anticipated, I

am pleased with the response of our associates in delivering

results consistent with our expectations. We have and will continue

to take advantage of all available business opportunities and

reduce costs throughout our Company while continuing to invest in

high efficiency products and lean processes. We believe these

actions and our focus on strong fundamentals will position us well

to seize the opportunities that we expect will arise as the

business environment begins to improve," commented Henry Knueppel,

Chairman and Chief Executive Officer. Sales for the first quarter

of 2009 were $443.3 million, a 17.4% decrease over the $536.3

million reported for the first quarter of 2008. First quarter 2009

sales included $29.7 million of sales related to the Hwada and

Dutchi businesses acquired in 2008 and the Customer Power

Technology acquisition completed on January 2, 2009. In the

Electrical segment, sales decreased 17.4%, including the impact of

the acquisitions noted above. Exclusive of the acquired businesses,

Electrical segment sales decreased 23.7%, largely due to global

generator sales decreasing 12%, commercial and industrial motors

sales in North America decreasing 23% and residential HVAC motor

sales decreasing 22%. Sales in the Mechanical segment decreased 17%

from the prior year period. From a geographic perspective,

Asia-based sales decreased 24.2% as compared to the first quarter

of 2008. In total, sales to regions outside of the United States

were 26.7% of total sales for the first quarter of 2009 in

comparison to 25.6% for the comparable period of 2008. The negative

impact of foreign currency exchange rate changes decreased total

sales by 2.4%. From an energy efficiency standpoint, sales of high

efficiency products represented 12.9% of total sales for the

quarter. The gross profit margin for the first quarter was 20.4% as

compared to the 22.8% reported for the comparable period of 2008.

The decrease is driven by higher commodity costs and the fixed cost

absorption impact of lower sales volumes. In addition, costs

related to the ongoing plant rationalizations increased cost of

sales by approximately $2.4 million. Operating expenses were $62.4

million (14.1% of sales) in the three months ended March 28, 2009

versus $64.5 million (12.0% of sales) in 2008. Operating expenses

included approximately $5.1 million for the Dutchi and Hwada

businesses. Income from operations was $28.2 million versus $57.6

million in the comparable period of 2008. As a percent of sales,

income from operations was 6.4% for the first quarter versus 10.7%

in the comparable period of 2008. Net interest expense was $7.0

million versus $8.0 million in the comparable period of 2008. The

decrease was driven by lower interest rates in 2009 versus the

comparable period of 2008. The impact of the change in accounting

for the Company's convertible senior subordinated notes as

prescribed in APB 14-1 was a pretax non-cash interest charge in the

amount of $1.1 million. The comparable amount for 2008 is $1.2

million. The effective tax rate for the three months ended March

28, 2009 was 34.1% versus 35.4% for the first quarter of 2008. The

decrease in the effective tax rate results primarily from the

global distribution of income. Net income attributable to Regal

Beloit Corporation for the three months ended March 28, 2009 was

$12.8 million, a decrease of 59.3% versus the $31.4 million

reported in the first quarter of 2008. Fully diluted earnings per

share was $0.39 as compared to $0.95 per share reported in the

first quarter of 2008. The Company ended the first quarter with

total debt of $587.3 million as compared to $575.4 million at the

end of the fourth quarter of 2008. Cash and cash equivalents

increased $16.8 million during the first quarter to $82.1 million.

"As we move into the second quarter, the difficult sales

environment is expected to continue. We do not believe that the

normal seasonal pick up in sales will materialize and we believe

that inventory liquidation by our customers will continue well into

the second quarter," continued Henry Knueppel, Chairman and Chief

Executive Officer. "We also plan to continue to aggressively reduce

our inventory levels to maximize our cash position which we expect

will negatively impact our gross margin by approximately $7.5

million. Additionally, costs related to our plant rationalizations

will add an estimated $3.0 million to cost of sales for the second

quarter. Given these factors, we are estimating second quarter

earnings per share to be in the range of $0.38 to $0.46," concluded

Henry Knueppel, Chairman and Chief Executive Officer. Regal Beloit

will be holding a conference call pertaining to this news release

at 10:30 AM CT (11:30 AM ET) on Thursday, May 7. Interested parties

should call 866-394-7807, referencing Regal Beloit conference ID

96496426. International callers should call 763-488-9117 using the

same conference ID. A replay of the call will be available through

May 15, 2009 at 800-642-1687, conference ID 96496426. International

callers should call 706-645-9291 using the same conference ID.

Regal Beloit Corporation is a leading manufacturer of mechanical

and electrical motion control and power generation products serving

markets throughout the world. Regal Beloit Corporation is

headquartered in Beloit, Wisconsin, and has manufacturing, sales,

and service facilities throughout the United States, Canada,

Mexico, Europe and Asia. CAUTIONARY STATEMENT This Press Release

contains "forward-looking statements" as defined in the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements represent our management's judgment regarding future

events. In many cases, you can identify forward-looking statements

by terminology such as "may," "will," "plan," "expect,"

"anticipate," "estimate," "believe," or "continue" or the negative

of these terms or other similar words. Actual results and events

could differ materially and adversely from those contained in the

forward-looking statements due to a number of factors, including:

-- economic changes in global markets where we do business, such as

reduced demand for the products we sell, weakness in the housing

and commercial real estate markets, currency exchange rates,

inflation rates, interest rates, recession, foreign government

policies and other external factors that we cannot control; --

unanticipated fluctuations in commodity prices and raw material

costs; -- cyclical downturns affecting the global market for

capital goods; -- unexpected issues and costs arising from the

integration of acquired companies and businesses; -- marketplace

acceptance of new and existing products including the loss of, or a

decline in business from, any significant customers; -- the impact

of capital market transactions that we may effect; -- the

availability and effectiveness of our information technology

systems; -- unanticipated costs associated with litigation matters;

-- actions taken by our competitors, including new product

introductions or technological advances, and other events affecting

our industry and competitors; -- difficulties in staffing and

managing foreign operations; -- other domestic and international

economic and political factors unrelated to our performance, such

as the current substantial weakness in economic and business

conditions and the stock markets as a whole; and -- other risks and

uncertainties described from time to time in our reports filed with

the U.S. Securities and Exchange Commission, or SEC, which are

incorporated by reference. All subsequent written and oral

forward-looking statements attributable to us or to persons acting

on our behalf are expressly qualified in their entirety by the

applicable cautionary statements. The forward-looking statements

included in this press release are made only as of their respective

dates, and we undertake no obligation to update these statements to

reflect subsequent events or circumstances. See also Item 1A - Risk

Factors in the Company's Annual Report on Form 10-K filed on

February 25, 2009. STATEMENTS OF INCOME In Thousands of Dollars

(Unaudited) Three Months Ended (As Adjusted)* March 28, March 29,

2009 2008 Net Sales $443,274 $536,343 Cost of Sales 352,704 414,244

Gross Profit 90,570 122,099 Operating Expenses 62,378 64,487 Income

From Operations 28,192 57,612 Interest Expense 7,119 8,413 Interest

Income 133 384 Income Before Taxes & Noncontrolling Interests

21,206 49,583 Provision For Income Taxes 7,230 17,558 Net Income

13,976 32,025 Less: Net Income Attributable to Noncontrolling

Interests, net of tax 1,189 598 Net Income Attributable to Regal

Beloit Corporation $12,787 $31,427 Earnings Per Share of Common

Stock: Basic $0.41 $1.00 Assuming Dilution $0.39 $0.95 Cash

Dividends Declared $0.16 $0.15 Weighted Average Number of Shares

Outstanding: Basic 31,457,282 31,316,878 Assuming Dilution

32,594,802 33,117,034 *The Company adopted at the beginning of 2009

Financial Accounting Standards Board ("FASB") Staff Position

("FSP") No. APB 14-1, "Accounting for Convertible Debt Instruments

That May Be Settled in Cash upon Conversion (Including Partial Cash

Settlement)" ("FSP APB 14-1"). The adoption of FSP APB 14-1

required an adjustment of previously reported amounts assigned to

the debt portion of the Company's convertible debt and related

cumulative interest expense. CONDENSED BALANCE SHEETS In Thousands

of Dollars (As Adjusted From Audited (Unaudited) Statements)* March

28, December 27, ASSETS 2009 2008 Current Assets: Cash and Cash

Equivalents $82,078 $65,250 Trade Receivables and Other Current

Assets 410,187 436,094 Inventories 327,324 359,918 Total Current

Assets 819,589 861,262 Net Property, Plant and Equipment 352,685

358,372 Other Noncurrent Assets 797,607 803,862 Total Assets

$1,969,881 $2,023,496 LIABILITIES AND EQUITY Accounts Payable

$152,991 $202,456 Other Current Liabilities 180,463 228,546

Long-Term Debt 580,283 560,127 Deferred Income Taxes 71,302 72,119

Other Noncurrent Liabilities 111,686 122,807 Total Liabilities

$1,096,725 $1,186,055 Equity 873,156 837,641 Total Liabilities and

Equity $1,969,881 $2,023,696 *The Company adopted at the beginning

of 2009 Financial Accounting Standards Board ("FASB") Staff

Position ("FSP") No. APB 14-1, "Accounting for Convertible Debt

Instruments That May Be Settled in Cash upon Conversion (Including

Partial Cash Settlement)" ("FSP APB 14-1"). The adoption of FSP APB

14-1 required an adjustment of previously reported amounts assigned

to the debt portion of the Company's convertible debt and related

cumulative interest expense. SEGMENT INFORMATION In Thousands of

Dollars (Unaudited) Mechanical Segment Electrical Segment Three

Months Ending Three Months Ending March 28, March 29, March 28,

March 29, 2009 2008 2009 2008 Net Sales $51,912 $62,550 $391,362

$473,793 Income from Operations $6,286 $10,047 $21,906 $47,565

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW In Thousands of

Dollars (Unaudited) Three Months Ended (As Adjusted)* March 28,

March 29, 2009 2008 CASH FLOWS FROM OPERATING ACTIVITIES: Net

income $13,976 $32,025 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 15,277 14,152 Excess tax benefits from stock-based

compensation (1,675) (452) (Gain) loss on sale of assets, net (91)

70 Stock-based compensation expense 773 882 Non-cash convertible

debt deferred financing costs 1,063 1,194 Change in assets and

liabilities, net of acquisitions (10,725) (13,005) Net cash

provided by operating activities 18,598 34,866 CASH FLOWS FROM

INVESTING ACTIVITIES: Additions to property, plant and equipment

(8,143) (13,646) Business acquisitions, net of cash acquired

(1,500) 374 Sale of property, plant and equipment 306 1,149 Net

cash used in investing activities (9,337) (12,123) CASH FLOWS FROM

FINANCING ACTIVITIES: Net repayments of short-term borrowings

(8,265) - Payments of long-term debt (56) (113) Net borrowings

(repayments) under revolving credit facility 19,150 (8,200)

Dividends paid to shareholders (5,024) (4,700) Purchases of

treasury stock - (4,191) Proceeds from the exercise of stock

options 512 1,364 Excess tax benefits from stock-based compensation

1,675 452 Net cash provided by (used in) financing activities 7,992

(15,388) EFFECT OF EXCHANGE RATES ON CASH (425) 602 Net increase in

cash and cash equivalents 16,828 7,957 Cash and cash equivalents at

beginning of period 65,250 42,574 Cash and cash equivalents at end

of period $82,078 $50,531 *The Company adopted at the beginning of

2009 Financial Accounting Standards Board ("FASB") Staff Position

("FSP") No. APB 14-1, "Accounting for Convertible Debt Instruments

That May Be Settled in Cash upon Conversion (Including Partial Cash

Settlement)" ("FSP APB 14-1"). The adoption of FSP APB 14-1

required an adjustment of previously reported amounts assigned to

the debt portion of the Company's convertible debt and related

cumulative interest expense. DATASOURCE: Regal Beloit Corporation

CONTACT: David A. Barta, Vice President, Chief Financial Officer of

Regal Beloit Corporation, +1-608-361-7405 Web Site:

http://www.regal-beloit.com/

Copyright

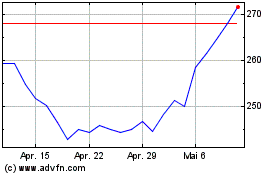

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

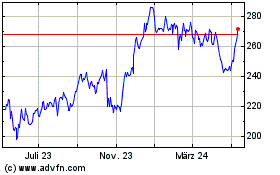

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024