0001835681FALSE00018356812024-02-262024-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): February 26, 2024

PowerSchool Holdings, Inc.

(Exact name of Registrant, as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-04321 | | 85-4166024 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | |

150 Parkshore Drive Folsom, California | | 95630 |

| (Address of principal executive offices) | | (Zip Code) |

(877) 873-1550

(Registrant's telephone number, including area code)

Not Applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, par value $0.0001 per share | PWSC | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 26, 2024, PowerSchool Holdings, Inc. issued a press release announcing its financial results for the quarter and year ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1.

This information contained in this Item 2.02 and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description of Exhibit |

| 99.1 | |

| 104 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | POWERSCHOOL HOLDINGS, INC. |

| | | |

Date: February 26, 2024 | By: | /s/ Eric Shander |

| | Name: | Eric Shander |

| | Title: | President and Chief Financial Officer |

PowerSchool Announces Fourth Quarter and Full Year 2023 Financial Results

•Fourth quarter total revenue increased 13% year-over-year to $182.1 million, meeting outlook

•Full year total revenue increased 11% year-over-year to $697.7 million, meeting outlook

•Fourth quarter GAAP net loss was $18.7 million and Adjusted EBITDA increased 12% year-over-year to $59.4 million, exceeding outlook and representing 33% of total revenue

•Full year GAAP net loss was $39.1 million and Adjusted EBITDA increased 18% to $231.9 million, exceeding outlook and representing 33% of total revenue

•ARR* increased 18% over the prior year to $701.5 million as of December 31, 2023

FOLSOM, CA – February 26, 2023: PowerSchool Holdings, Inc. (NYSE: PWSC) ("PowerSchool" or the “Company”), the leading provider of cloud-based software for K-12 education in North America, today announced financial results for its fourth quarter and full fiscal year ended December 31, 2023.

“These fourth quarter results showcase the momentum we’ve seen throughout 2023. For the year, we surpassed $700 million in ARR, grew revenue double digits, increased our Adjusted EBITDA margin by over 200 basis points, and reached a new record in Free Cash Flow margin," said Hardeep Gulati, PowerSchool CEO. “Our differentiated platform of data-rich solutions continues to grow through the introduction of several game changing AI-driven innovations. We are the partner-of-choice in the K-12 ecosystem as schools, districts, and states increasingly leverage technology to improve their operational efficiencies, teacher effectiveness, and student outcomes.”

Fourth Quarter 2023 Financial Highlights

•Revenue: Total revenue was $182.1 million for the three months ended December 31, 2023, up 13% year-over-year.

•S&S Revenue: Subscriptions and support revenue was $163.6 million, up 16% year-over-year.

•Gross Profit: GAAP gross profit was $108.6 million, representing 60% of total revenue, and Adjusted Gross Profit* was $128.9 million, representing 71% of total revenue.

•Net Income/Loss: GAAP net loss was $18.7 million, representing 10% of total revenue, and Non-GAAP Net Income* was $34.4 million, representing 19% of total revenue.

•Adjusted EBITDA: Adjusted EBITDA* was $59.4 million, up 12% year-over-year and representing 33% of total revenue.

•Earnings/Loss Per Share: GAAP net loss per diluted share was $0.10 on 202.1 million shares outstanding. Non-GAAP Net Income per diluted share* was $0.17 on 204.0 million shares outstanding.

•Cash Flow: Net cash provided by operating activities was $42.9 million, representing 24% of total revenue, and Free Cash Flow* was $32.3 million, representing 18% of total revenue.

•ARR: Annual Recurring Revenue (ARR)* was $701.5 million, up 18% year-over-year, and Net Revenue Retention Rate* was 106.7%.

Full Year 2023 Financial Highlights

•Revenue: Total revenue was $697.7 million for the year ended December 31, 2023, up 11% year-over-year.

•S&S Revenue: Subscriptions and support revenue was $600.2 million, up 10% year-over-year.

•Gross Profit: GAAP gross profit was $413.8 million, representing 59% of total revenue, and Adjusted Gross Profit* was $490.9 million, representing 70% of total revenue.

•Net Income/Loss: GAAP net loss was $39.1 million, representing 6% of total revenue, and Non-GAAP Net Income* was $165.7 million, representing 24% of total revenue.

•Adjusted EBITDA: Adjusted EBITDA* was $231.9 million, up 18% year-over-year and representing 33% of total revenue.

•Earnings/Loss Per Share: GAAP net loss per diluted share was $0.19 on 163.0 million shares outstanding. Non-GAAP Net Income per diluted share* was $0.82 on 201.5 million shares outstanding.

•Cash Flow: Net cash provided by operating activities was $170.6 million, representing 24% of total revenue, and Free Cash Flow* was $129.9 million, representing 19% of total revenue.

* Definitions of the key business metrics and the non-GAAP financial measures used in this press release and reconciliations of such measures to the most closely comparable GAAP measures are included below under the headings “Definitions of Certain Key Business Metrics” and “Use and Reconciliation of Non-GAAP Financial Measures.”

Recent Business Highlights

•Delivering Customer Growth at Scale: Completed nearly 2,000 cross-sell and new logo transactions in 2023, including notable wins at Los Angeles Unified School District, Miami Dade Public Schools, and the Newark Board of Education. Gained 5 new state-and territory-wide contracts, including Puerto Rico, Florida, and Montana.

•Platform Expansion: Acquired Allovue, a leading provider of K-12 financial planning, budgeting, and analytics software in the U.S. A member of PowerSchool's technology partner program, Allovue provides intuitive and flexible budgeting tools to help school districts and state education leaders allocate and manage budgets and resources, including real-time access to all budgeting information, budget collaboration, equitable funding formulas, and analytics and dashboards to track and manage spending.

•AI-Driven Innovation: Announced the next evolution of its AI-driven solutions suite with the launch of PowerSchool PowerBuddy™, a persona-specific AI-powered virtual assistant for everyone in education, providing each student, parent, educator, counselor, and administrator with safe and secure access to individualized guidance, information, and resources. PowerBuddy™ will initially be incorporated into Schoology Learning to offer students on-demand, one-on-one assistance with their assignments, and PowerBuddy™ will eventually be expanded across the entire PowerSchool ecosystem. For example, teachers will be able to leverage PowerBuddy™ to generate lesson plans, automate the creation of quizzes and assessments, and personalize homework at scale, and parents will be able to leverage PowerBuddy™ in the My PowerSchool portal to inquire about their child's academic performance, schedule, attendance, and receive proactive alerts if their child is falling behind, fostering transparency and empowering parents to participate in their child’s education.

•International Expansion: Finished 2023 with 14 new strategic channel partnerships in targeted regions across the globe, adding 4 new partners in the Latin America region in fourth quarter: The American International Schools in the Americas (AMISA), Edutech, SICOM, and Educatek.

•UNESCO Global Education Coalition: Announced the joining of UNESCO’s Global Education Coalition, which brings together 200 members to provide expertise, strategic direction, resources, and leadership around education connectivity, instruction, and equality. In alignment with PowerSchool's mission of supporting the digital transformation of education, PowerSchool will support the Coalition’s objective to provide sustainable, scalable digital transformation in education through offering our expertise, training, and technology.

Commenting on the Company’s results, Eric Shander, PowerSchool President and CFO, added, “I am particularly happy with our teams' ability to hit our goals for growth while delivering significant operating leverage in the business. We are in the early innings of revolutionizing education through our data-centric technologies, which will provide us a durable and sustainable path for generating long-term student, family, customer, employee, and shareholder value.”

Financial Outlook

The Company currently expects the following results:

First quarter ending March 31, 2024 (in millions)

| | | | | | | | | | | |

| Total revenue | $183 | to | $186 |

| Adjusted EBITDA * | $56.5 | to | $58.5 |

Year ending December 31, 2024 (in millions)

| | | | | | | | | | | |

| Total revenue | $786 | to | $792 |

| Adjusted EBITDA * | $267 | to | $272 |

* Adjusted EBITDA, a non-GAAP financial measure was not reconciled to net income (loss), the most closely comparable GAAP financial measure because net income (loss) is not accessible on a forward-looking basis. The Company is unable to reconcile Adjusted EBITDA to net loss without unreasonable efforts because the Company is currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact net income (loss) for these periods but would not impact Adjusted EBITDA. Such items include stock-based compensation charges, depreciation and amortization of capitalized software costs and acquired intangible assets, severance, and other items. The unavailable information could have a significant impact on net income (loss). The foregoing financial outlook reflects the Company’s expectations as of today's date. Given the number of risk factors, uncertainties, and assumptions discussed below, actual results may differ materially. The Company does not intend to update its financial outlook until its next quarterly results announcement.

Important disclosures in this earnings release about and reconciliations of historical non-GAAP financial measures to the most closely comparable GAAP measures are provided below under “Use and Reconciliation of Non-GAAP Financial Measures.”

Conference Call Details

PowerSchool will host a conference call to discuss the fourth quarter and full year 2023 financial results on February 26, 2024, at 2:00 p.m. Pacific Time. Those wishing to participate via webcast should access the call through PowerSchool’s Investor Relations website (https://investors.powerschool.com/events-and-presentations/default.aspx). An archived webcast will be made available shortly after the conference call ends.

Those wishing to participate via telephone may dial 1-877-407-0792 (USA) or 1-201-689-8263 (International) by referencing conference ID 13743820. The telephone replay will be available from 5:00 p.m. Pacific Time (8:00 p.m. Eastern Time) on February 26, 2024, through March 4, 2024, by dialing 1-844-512-2921 (USA) or 1-412-317-6671 (International) and referencing the replay passcode 13743820.

About PowerSchool

PowerSchool (NYSE: PWSC) is the leading provider of cloud-based software for K-12 education in North America. Its mission is to power the education ecosystem with unified technology that helps educators and students realize their full potential, in their way. PowerSchool connects students, teachers, administrators, and parents, with the shared goal of improving student outcomes. From the office to the classroom to the home, it helps schools and districts efficiently manage state reporting and related compliance, special education, finance, human resources, talent, registration, attendance, funding, learning, instruction, grading, assessments, and analytics in one unified platform. PowerSchool supports over 50 million students globally and more than 17,000 customers, including over 90 of the top 100 districts by student enrollment in the United States, and sells solutions in over 95 countries. Visit www.powerschool.com to learn more.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harder provisions of the U.S. Private Securities Litigation Reform Act of 1995. Any statements made in this press release that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements and should be evaluated as such. Forward-looking statements are not assurances of future performance and may include information concerning possible or assumed future results of operations, including our financial outlook and descriptions of our business plan and strategies. Forward-looking statements are based on PowerSchool management’s beliefs, as well as

assumptions made by, and information currently available to, them. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Factors which may cause actual results to differ materially from current expectations include, but are not limited to: potential effects on our business of the COVID-19 pandemic; our history of cumulative losses; competition; our ability to attract new customers on a cost-effective basis and the extent to which existing customers renew and upgrade their subscriptions; our ability to sustain and expand revenues, maintain profitability, and to effectively manage our anticipated growth; our ability to retain, hire, and integrate skilled personnel including our senior management team; our ability to identify acquisition targets and to successfully integrate and operate acquired businesses; our ability to maintain and expand our strategic relationships with third parties, including with state and local government entities; the seasonality of our sales and customer growth; our reliance on third-party software and intellectual property licenses; our ability to obtain, maintain, protect, and enforce intellectual property protection for our current and future solutions; the impact of potential information technology or data security breaches or other cyber-attacks or other disruptions; and the other factors described under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the "Annual Report"), filed with the Securities Exchange Commission (“SEC”). Copies of the Annual Report may be obtained from the Company or the SEC.

We caution you that the factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. All forward-looking statements reflect our beliefs and assumptions only as of the date of this press release. We undertake no obligation to publicly update forward-looking statements, whether written or oral, to reflect future events, future developments or circumstances, or new information.

Definitions of Certain Key Business Metrics

Annualized Recurring Revenue (“ARR”)

ARR represents the annualized value of all recurring contracts as of the end of the period. ARR mitigates fluctuations due to seasonality, contract term, one-time discounts given to help customers meet their budgetary and cash flow needs, and the sales mix for recurring and non-recurring revenue. We record ARR at the time a customer purchases a new product or renews an existing product, and at a value that represents the contracted annual recurring revenue value excluding any granted one-time discounts. ARR does not have any standardized meaning and is therefore unlikely to be comparable to similarly titled measures presented by other companies. ARR should be viewed independently of revenue and deferred revenue and is not intended to be combined with or to replace either of those items. ARR is not a forecast, and the active contracts at the end of a reporting period used in calculating ARR may or may not be extended or renewed by our customers.

Net Revenue Retention Rate (“NRR”)

We believe that our ability to retain and grow recurring revenues from our existing customers over time strengthens the stability and predictability of our revenue base and is reflective of the value we deliver to them through upselling and cross selling our solution portfolio. Typically, our customer agreements are sold on a three-year basis with one-year rolling renewals and annual price escalators. These annual renewal processes provide us an additional opportunity to upsell and cross sell additional products. We assess our performance in this area using a metric we refer to as Net Revenue Retention Rate (“NRR”). For the purposes of calculating NRR, we exclude from our calculation of NRR any changes in ARR attributable to Intersect customers, as this product is sold through our channel partnership with EAB Global, Inc. and is pursuant to annual revenue minimums, therefore the business will not be managed based on NRR. We calculate our dollar-based NRR as of the end of a reporting period as follows:

•Numerator. We measure ARR from renewed and new sale opportunities booked as of the last day of the current reporting period from customers with associated ARR as of the last day of the prior year comparative reporting period.

•Denominator. We measure, as of the last day of the current reporting period, the last twelve months of ARR that was scheduled for renewal.

The quotient obtained from this calculation is our dollar-based net revenue retention rate. Our NRR provides insight into the impact on current year recurring revenues of expanding adoption of our solutions by our existing customers during the current period. Our NRR is subject to adjustments for acquisitions, consolidations, spin-offs, and other market activity.

Use and Reconciliation of Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP, we believe the following non-GAAP measures are useful in evaluating our operating performance. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance and assists in comparisons with other companies, some of which use similar non-GAAP financial information to supplement their GAAP results. The non-GAAP financial information is presented for analytical and supplemental informational purposes only, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP, and may be different from similarly-titled non-GAAP measures used by other companies. A reconciliation is provided below for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

Adjusted Gross Profit: Adjusted Gross Profit is a supplemental measure of operating performance that is not made under GAAP and that does not represent, and should not be considered as, an alternative to gross profit, as determined in accordance with GAAP. We define Adjusted Gross Profit as gross profit, adjusted for depreciation, share-based compensation expense and the related employer payroll tax, restructuring and acquisition-related expenses, and amortization of acquired intangible assets and capitalized product development costs. We use Adjusted Gross Profit to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget, and to develop short-term and long-term operating plans. We believe that Adjusted Gross Profit is a useful measure to us and to our investors because it provides consistency and comparability with our past financial performance and between fiscal periods, as the metric generally eliminates the effects of the variability of depreciation, share-based compensation, restructuring expense, acquisition-related expenses, and amortization of acquired intangibles and capitalized product development costs from period to period, which may fluctuate for reasons unrelated to overall operating performance. We believe that the use of this measure enables us to more effectively evaluate our performance period-over-period and relative to our competitors.

Non-GAAP Net Income (Loss), Non-GAAP Cost of Revenue and Operating Expenses, and Adjusted EBITDA: Non-GAAP Net Income (Loss), Non-GAAP Cost of Revenue, Non-GAAP Operating Expenses, and Adjusted EBITDA are supplemental measures of operating performance that are not made under GAAP and that do not represent, and should not be considered as, an alternative to net income (loss), GAAP cost of revenue, and GAAP operating expenses, as applicable. We define Non-GAAP Net Income (Loss) as net income (loss) adjusted for depreciation and amortization, share-based compensation expense and the related employer payroll tax, management fees, restructuring expense, and acquisition-related expenses. We define Non-GAAP Cost of Revenue and Operating Expenses as their respective GAAP measures adjusted for share-based compensation expense and the related employer payroll tax, management fees, restructuring expense, and acquisition-related expense. We define Adjusted EBITDA as net income (loss) adjusted for all of the above items, net interest expense, nonrecurring litigation expense, and provision for (benefit from) income tax. We use Non-GAAP Net Income, Non-GAAP Cost of Revenue, Non-GAAP Operating Expenses, and Adjusted EBITDA to understand and evaluate our core operating performance and trends and to develop short-term and long-term operating plans. We believe that Non-GAAP Net Income and Adjusted EBITDA facilitate comparison of our operating performance on a consistent basis between periods and, when viewed in combination with our results prepared in accordance with GAAP, help provide a broader picture of factors and trends affecting our results of operations.

Free Cash Flow and Unlevered Free Cash Flow: Free Cash Flow and Unlevered Free Cash Flow are supplemental measures of liquidity that are not made under GAAP and that do not represent, and should not be considered as, an alternative to cash flow from operations, as determined by GAAP. We define Free Cash Flow as net cash provided by operating activities less cash used for purchases of property and equipment and capitalized product development costs. We define Unlevered Free Cash Flow as Free Cash Flow plus cash paid for interest on outstanding debt. We believe that Free Cash Flow and Unlevered Free Cash Flow are useful indicators of liquidity that provide information to management and investors about the amount of cash generated by our operations inclusive of that used for investments in property and equipment and capitalized product development costs as well as cash paid for interest on outstanding debt.

These non-GAAP financial measures have their limitations as an analytical tool, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under GAAP. Because of these limitations, these non-GAAP financial measures should not be considered as a replacement for their respective comparable financial measures, as determined by GAAP, or as a measure of our profitability or liquidity. We compensate for these limitations by relying primarily on our GAAP results and using non-GAAP measures only for supplemental purposes.

For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure, please see “Reconciliation of GAAP to Non-GAAP Financial Measures” below.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

(in thousands except per share data) | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Subscriptions and support | 163,623 | | | 141,574 | | | $ | 600,189 | | | $ | 543,444 | |

| Service | 15,403 | | | 15,288 | | | 72,555 | | | 70,402 | |

| License and other | 3,110 | | | 4,204 | | | 24,907 | | | 16,837 | |

| Total revenue | 182,136 | | | 161,066 | | | 697,651 | | | 630,683 | |

| Cost of revenue: | | | | | | | |

| Subscriptions and support | 42,451 | | | 37,070 | | | 154,021 | | | 151,374 | |

| Service | 12,280 | | | 13,442 | | | 55,866 | | | 59,027 | |

| License and other | 1,213 | | | 904 | | | 7,788 | | | 3,694 | |

| Depreciation and amortization | 17,561 | | | 15,183 | | | 66,198 | | | 58,252 | |

| Total cost of revenue | 73,505 | | | 66,599 | | | 283,873 | | | 272,347 | |

| Gross profit | 108,631 | | | 94,467 | | | 413,778 | | | 358,336 | |

| Operating expenses: | | | | | | | |

| Research and development | 27,867 | | | 26,970 | | | 105,901 | | | 107,498 | |

| Selling, general, and administrative | 58,513 | | | 45,221 | | | 214,807 | | | 178,337 | |

| Acquisition costs | 1,819 | | | — | | | 4,280 | | | 2,630 | |

| Depreciation and amortization | 17,100 | | | 15,917 | | | 64,470 | | | 63,967 | |

| Total operating expenses | 105,299 | | | 88,108 | | | 389,458 | | | 352,432 | |

Income (loss) from operations | 3,332 | | | 6,359 | | | 24,320 | | | 5,904 | |

| Interest expense—net | 20,183 | | | 13,090 | | | 66,722 | | | 40,013 | |

| Change in Tax Receivable Agreement liability | (3,264) | | | 10,130 | | | (3,264) | | | 7,788 | |

| Loss on modification and extinguishment of debt | 96 | | | — | | | 96 | | | — | |

| Other (income) expenses—net | 207 | | | (6) | | | 314 | | | (1,341) | |

Loss before income taxes | (13,890) | | | (16,855) | | | (39,548) | | | (40,556) | |

Income tax expense (benefit) | 4,767 | | | (13,610) | | | (476) | | | (12,815) | |

Net loss | $ | (18,657) | | | $ | (3,245) | | | $ | (39,072) | | | $ | (27,741) | |

| Less: Net loss attributable to non-controlling interest | (3,042) | | | (1,625) | | | (7,935) | | | (6,954) | |

| Net loss attributable to PowerSchool Holdings, Inc. | (15,615) | | | (1,620) | | | (31,137) | | | (20,787) | |

| Net loss attributable to PowerSchool Holdings, Inc. Class A common stock: | | | | | | | |

| Basic | (15,615) | | | (1,620) | | | (31,137) | | | (20,787) | |

| Diluted | (19,452) | | | (3,063) | | | (31,137) | | | (26,807) | |

| Net loss attributable to PowerSchool Holdings, Inc. per share of Class A common stock, basic | $ | (0.09) | | | $ | (0.01) | | | $ | (0.19) | | | $ | (0.13) | |

| Net loss attributable to PowerSchool Holdings, Inc. per share of Class A common stock, diluted | $ | (0.10) | | | $ | (0.02) | | | $ | (0.19) | | | $ | (0.13) | |

| Weighted average shares of Class A common stock: | | | | | | | |

| Basic | 164,417,080 | | | 159,485,931 | | | 162,957,390 | | | 158,664,189 | |

| Diluted | 202,071,139 | | | 199,414,403 | | | 162,957,390 | | | 198,592,661 | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation | 91 | | | (160) | | | 25 | | | (1,903) | |

| Change in unrealized loss on investments | — | | | (3) | | | 3 | | | (3) | |

| Total other comprehensive income (loss) | 91 | | | (163) | | | 28 | | | (1,906) | |

| Less: Other comprehensive income (loss) attributable to non-controlling interest | $ | 17 | | | $ | (33) | | | $ | 5 | | | $ | (382) | |

| Comprehensive loss attributable to PowerSchool Holdings, Inc. | $ | (15,541) | | | $ | (1,750) | | | $ | (31,114) | | | $ | (22,311) | |

CONSOLIDATED BALANCE SHEETS

(unaudited)

| | | | | | | | | | | |

(in thousands) | December 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 39,054 | | | $ | 137,471 | |

| Accounts receivable—net of allowance of $7,930 and $4,712 respectively | 76,618 | | | 54,296 | |

| Prepaid expenses and other current assets | 40,449 | | | 36,886 | |

| Total current assets | 156,121 | | | 228,653 | |

| Property and equipment - net | 5,003 | | | 6,173 | |

| Operating lease right-of-use assets | 15,998 | | | 8,877 | |

| Capitalized product development costs - net | 112,089 | | | 100,861 | |

| Goodwill | 2,740,725 | | | 2,487,007 | |

| Intangible assets - net | 710,635 | | | 722,147 | |

| Other assets | 36,311 | | | 29,677 | |

| Total assets | $ | 3,776,882 | | | $ | 3,583,395 | |

| Liabilities and Stockholders’ Equity | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 13,629 | | | $ | 5,878 | |

| Accrued expenses | 116,271 | | | 84,270 | |

| Operating lease liabilities, current | 4,958 | | | 5,263 | |

| Deferred revenue, current | 373,672 | | | 310,536 | |

| | | |

| Current portion of long-term debt | 8,379 | | | 7,750 | |

| Total current liabilities | 516,909 | | | 413,697 | |

| Noncurrent Liabilities: | | | |

| Other liabilities | 2,178 | | | 2,099 | |

| Operating lease liabilities—net of current | 13,359 | | | 8,053 | |

| Deferred taxes | 275,316 | | | 281,314 | |

| Tax Receivable Agreement liability | 396,397 | | | 410,361 | |

| Deferred revenue—net of current | 6,111 | | | 5,303 | |

| Long-term debt, net | 811,325 | | | 728,624 | |

| Total liabilities | 2,021,595 | | | 1,849,451 | |

| Stockholders' Equity: | | | |

| | | |

| Class A common stock, $0.0001 par value per share, 500,000,000 shares authorized, 164,796,626 and 159,596,001 shares issued and outstanding as of December 31, 2023 and December 31, 2022, respectively. | 16 | | | 16 | |

| Class B common stock, $0.0001 par value per share, 300,000,000 shares authorized, 37,654,059 and 39,928,472 shares issued and outstanding as of December 31, 2023 and December 31, 2022, respectively. | 4 | | | 4 | |

| Additional paid-in capital | 1,520,288 | | | 1,438,019 | |

| Accumulated other comprehensive loss | (2,094) | | | (2,122) | |

| Accumulated deficit | (218,387) | | | (187,250) | |

| Total stockholders'/members’ equity attributable to PowerSchool Holdings, Inc. | 1,299,827 | | | 1,248,667 | |

| Non-controlling interest | 455,460 | | | 485,277 | |

| Total stockholders'/members’ equity | 1,755,287 | | | 1,733,944 | |

| Total liabilities and stockholders'/members' equity | $ | 3,776,882 | | | $ | 3,583,395 | |

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

(in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | |

| Net loss | $ | (18,657) | | | $ | (3,245) | | | $ | (39,072) | | | $ | (27,741) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | |

| Loss on modification and extinguishment of debt | 96 | | | — | | | 96 | | | — | |

| Depreciation and amortization | 34,660 | | | 31,100 | | | 130,667 | | | 122,219 | |

| Share-based compensation | 14,244 | | | 12,166 | | | 61,147 | | | 50,267 | |

| Amortization of operating lease right-of-use assets | 974 | | | 7,239 | | | 3,584 | | | 6,050 | |

| Change in fair value of acquisition-related contingent consideration | — | | | 700 | | | (273) | | | (4,886) | |

| Amortization of debt issuance costs | 1,470 | | | 895 | | | 4,215 | | | 3,552 | |

| Provision for allowance for doubtful accounts | 1,831 | | | 1,427 | | | 4,537 | | | 1,098 | |

| Gain on lease modification | — | | | — | | | (455) | | | — | |

| Write off of right-of-use assets and disposal of property and equipment | 77 | | | 162 | | | 129 | | | 8,837 | |

| Changes in operating assets and liabilities — net of effects of acquisitions: | | | | | | | |

| Accounts receivables | 70,150 | | | 46,676 | | | (12,318) | | | (5,975) | |

| Prepaid expenses and other current assets | (1,448) | | | 30 | | | (2,353) | | | 1,664 | |

| Other assets | (2,183) | | | (1,266) | | | (5,079) | | | (2,792) | |

| Accounts payable | 1,594 | | | (431) | | | 4,581 | | | (6,052) | |

| Accrued expenses | 5,388 | | | 10,459 | | | (711) | | | 9,938 | |

| Other liabilities | (1,429) | | | (6,188) | | | (5,591) | | | (12,137) | |

| Deferred taxes | 3,250 | | | (14,762) | | | (3,297) | | | (15,269) | |

| Tax receivable agreement liability | (3,015) | | | 10,130 | | | (2,338) | | | 7,788 | |

| Deferred revenue | (64,061) | | | (52,865) | | | 33,125 | | | 12,448 | |

| Net cash provided by operating activities | 42,941 | | | 42,227 | | | 170,594 | | | 149,009 | |

| Cash flows from investing activities: | | | | | | | |

| Purchases of property and equipment | (837) | | | (808) | | | (2,168) | | | (3,651) | |

| Proceeds from sale of property and equipment | 16 | | | — | | | 39 | | | — | |

| Investment in capitalized product development costs | (9,807) | | | (8,175) | | | (38,521) | | | (41,460) | |

| Purchase of internal use software | — | | | — | | | (259) | | | — | |

| Acquisitions—net of cash acquired | (290,293) | | | 13 | | | (300,046) | | | (31,143) | |

| Payment of acquisition-related contingent consideration | — | | | — | | | (3,528) | | | (1,392) | |

| Net cash used in investing activities | (300,921) | | | (8,970) | | | (344,483) | | | (77,646) | |

| Cash flows from financing activities: | | | | | | | |

| Taxes paid related to the net share settlement of equity awards | (66) | | | (2,363) | | | (1,604) | | | (11,187) | |

| Proceeds from Revolving Credit Agreement | 20,000 | | | — | | | 40,000 | | | 70,000 | |

| Proceeds from First Lien Debt amendment | — | | | — | | | 99,256 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Repayment of Revolving Credit Agreement | (30,000) | | | — | | | (40,000) | | | (70,000) | |

| | | | | | | |

| Repayment of First Lien Debt | — | | | (1,938) | | | (6,074) | | | (7,750) | |

| | | | | | | |

| Payments of deferred offering costs | — | | | — | | | — | | | (295) | |

| Payment of debt issuance costs | (15,399) | | | — | | | (15,708) | | | — | |

| | | | | | | |

| | | | | | | |

Net cash (used in) provided by financing activities | (25,465) | | | (4,301) | | | 75,870 | | | (19,232) | |

| Effect of foreign exchange rate changes on cash | $ | (332) | | | $ | (358) | | | $ | (408) | | | $ | (1,141) | |

| Net increase in cash, cash equivalents, and restricted cash | (283,777) | | | 28,598 | | | (98,427) | | | 50,990 | |

| Cash, cash equivalents, and restricted cash—Beginning of period | 323,331 | | | 109,383 | | | 137,981 | | | 86,991 | |

| Cash, cash equivalents, and restricted cash—End of period | $ | 39,554 | | | $ | 137,981 | | | $ | 39,554 | | | $ | 137,981 | |

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(unaudited)

Reconciliation of gross profit to Adjusted Gross Profit

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Gross profit | $ | 108,631 | | | $ | 94,467 | | | $ | 413,778 | | | $ | 358,336 | |

| Depreciation | 152 | | 253 | | 720 | | 1,056 |

Share-based compensation (1) | 2,422 | | 2,099 | | 10,029 | | 8,557 |

Restructuring (2) | — | | 155 | | 524 | | 3,480 |

Acquisition-related expense (3) | 261 | | 105 | | 394 | | 663 |

| Amortization | 17,409 | | 14,930 | | 65,478 | | 57,196 |

| Adjusted Gross Profit | $ | 128,875 | | | $ | 112,009 | | | $ | 490,923 | | | $ | 429,288 | |

Gross Profit Margin (4) | 59.6 | % | | 58.7 | % | | 59.3 | % | | 56.8 | % |

Adjusted Gross Profit Margin (5) | 70.8 | % | | 69.5 | % | | 70.4 | % | | 68.1 | % |

(1) Refers to expenses in cost of revenue associated with share-based compensation.

(2) Refers to expenses in cost of revenue related to migration of customers from legacy to core products, and severance expense related to offshoring activities and executive departures.

(3) Refers to expenses in cost of revenue incurred to execute and integrate acquisitions, including retention awards, and severance for acquired employees.

(4) Represents gross profit as a percentage of revenue.

(5) Represents Adjusted Gross Profit as a percentage of revenue.

Reconciliation of net loss to Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Net loss | $ | (18,657) | | | $ | (3,245) | | | $ | (39,072) | | | $ | (27,741) | |

| Add: | | | | | | | |

| Amortization | 33,845 | | 30,035 | | 127,292 | | 117,444 |

| Depreciation | 815 | | 1,065 | | 3,375 | | 4,775 |

Interest expense - net (1) | 20,183 | | 13,090 | | 66,722 | | 40,013 |

| Income tax benefit | 4,767 | | (13,610) | | (476) | | (12,815) |

Share-based compensation | 14,528 | | 12,360 | | 63,216 | | 50,219 |

Management fees (2) | 80 | | 128 | | 318 | | 390 |

Restructuring (3) | 3,062 | | 607 | | 5,653 | | 12,312 |

Acquisition-related expense (4) | 4,006 | | 2,236 | | 8,174 | | 4,005 |

| | | | | | | |

Change in Tax Receivable Agreement liability (5) | (3,264) | | 10,130 | | (3,264) | | | 7,788 |

| Adjusted EBITDA | $ | 59,365 | | | $ | 52,796 | | | $ | 231,938 | | | $ | 196,390 | |

| | | | | | | |

| Net loss margin | (10.2) | % | | (2.0) | % | | (5.6) | % | | (4.4) | % |

Adjusted EBITDA Margin (6) | 32.6 | % | | 32.8 | % | | 33.2 | % | | 31.1 | % |

(1) Interest expense, net of interest income.

(2) Refers to expense associated with collaboration with our principal stockholders and their internal consulting groups.

(3) Refers to costs incurred related to migration of customers from legacy to core products, remaining lease obligations for abandoned facilities, severance expense related to offshoring activities, facility closures, loss on modification of debt, nonrecurring litigation expense, and executive departures.

(4) Refers to direct transaction and debt-related fees reflected in our acquisition costs line item of our income statement and incremental acquisition-related costs that are incurred to perform diligence, execute and integrate acquisitions, including retention awards and severance for acquired employees, and other transaction and integration expenses. Also, refers to the fair value adjustments recorded to the contingent consideration liability related to the acquisitions of Kinvolved, Inc. ("Kinvolved") and Chalk.com Education ULC ("Chalk"). These incremental costs are embedded in our research and development, selling, general and administrative, and cost of revenue line items.

(5) Refers to impact of the remeasurement of the Tax Receivable Agreement liability.

(6) Represents Adjusted EBITDA as a percentage of revenue.

Reconciliation of net loss to Non-GAAP Net Income

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands, except per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Net loss | $ | (18,657) | | | $ | (3,245) | | | $ | (39,072) | | | $ | (27,741) | |

| Add: | | | | | | | |

| Amortization | 33,845 | | 30,035 | | 127,292 | | 117,444 |

| Depreciation | 815 | | 1,065 | | 3,375 | | 4,775 |

Share-based compensation | 14,528 | | | 12,360 | | 63,216 | | 50,219 |

Management fees (1) | 80 | | 128 | | 318 | | 390 |

Restructuring (2) | 3,062 | | 607 | | 5,653 | | 12,312 |

Acquisition-related expense (3) | 4,006 | | 2,236 | | 8,174 | | 4,005 |

| | | | | | | |

Change in Tax Receivable Agreement liability (4) | (3,264) | | 10,130 | | (3,264) | | 7,788 |

| Non-GAAP Net Income | $ | 34,415 | | $ | 53,316 | | $ | 165,693 | | $ | 169,192 |

| | | | | | | |

| Weighted-average Class A common stock used in computing GAAP net loss per share, basic | 164,417,080 | | 159,485,931 | | 162,957,390 | | 158,664,189 |

| Weighted-average Class A common stock used in computing GAAP net loss per share, diluted | 202,071,139 | | 199,414,403 | | 162,957,390 | | 198,592,661 |

| | | | | | | |

| Weighted-average shares Class A common stock used in computing Non-GAAP net income, basic | 164,417,080 | | 159,485,931 | | 162,957,390 | | 158,664,189 |

| Dilutive impact of LLC Units | 37,654,059 | | 39,928,472 | | 37,654,059 | | 39,928,472 |

| Dilutive impact of Restricted Shares and RSUs | 1,317,236 | | 1,282,178 | | 463,730 | | 225,386 |

| Dilutive impact of Market-share units | 572,594 | — | — | | 398,785 | | — |

| Weighted-average shares Class A common stock used in computing Non-GAAP net income per share - diluted | 203,960,969 | | 200,696,581 | | 201,473,964 | | 198,818,047 |

| | | | | | | |

| GAAP net loss attributable to the PowerSchool Holdings, Inc. per share of Class A common stock - basic | $ | (0.09) | | $ | (0.01) | | $ | (0.19) | | $ | (0.13) |

| Non-GAAP net income attributable to the PowerSchool Holdings, Inc. per share of Class A common stock - basic | $ | 0.21 | | $ | 0.33 | | $ | 1.02 | | $ | 1.07 |

| GAAP net loss attributable to the PowerSchool Holdings, Inc. per share of Class A common stock - diluted | $ | (0.10) | | $ | (0.02) | | $ | (0.19) | | $ | (0.13) |

| Non-GAAP net income attributable to the PowerSchool Holdings, Inc. per share of Class A common stock - diluted | $ | 0.17 | | $ | 0.27 | | $ | 0.82 | | $ | 0.85 |

(1) Refers to expense associated with collaboration with our principal stockholders and their internal consulting groups.

(2) Refers to costs incurred related to migration of customers from legacy to core products, remaining lease obligations for abandoned facilities, severance expense related to offshoring activities, facility closures,

executive departures, loss on modification of debt, nonrecurring litigation expense, and event cancellation fees related to the COVID-19 pandemic.

(3) Refers to direct transaction and debt-related fees reflected in our acquisition costs line item of our income statement and incremental acquisition-related costs that are incurred to perform diligence, execute and integrate acquisitions, including retention awards and severance for acquired employees, and other transaction and integration expenses. Also, refers to the fair value adjustments recorded to the contingent consideration liability related to the acquisitions of Kinvolved and Chalk. These incremental costs are embedded in our research and development, selling, general and administrative, and cost of revenue line items.

(4) Refers to impact of the remeasurement of the Tax Receivable Agreement liability.

Reconciliation of GAAP to Non-GAAP Cost of Revenue and Operating Expenses

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| GAAP Cost of Revenue - Subscription and Support | $ | 42,451 | | | $ | 37,070 | | | $ | 154,021 | | | $ | 151,374 | |

| Less: | | | | | | | |

| Share-based compensation | 1,615 | | 1,439 | | 6,508 | | 5,102 |

| Restructuring | — | | 18 | | 509 | | 106 |

| Acquisition-related expense | 176 | | 30 | | 236 | | 438 |

| Non-GAAP Cost of Revenue - Subscription and Support | $ | 40,660 | | $ | 35,583 | | $ | 146,768 | | $ | 145,728 |

| | | | | | | |

| GAAP Cost of Revenue - Services | $ | 12,280 | | | $ | 13,442 | | | $ | 55,866 | | | $ | 59,027 | |

| Less: | | | | | | | |

| Share-based compensation | 808 | | 660 | | 3,521 | | 3,454 |

| Restructuring | — | | 138 | | 15 | | 3,374 |

| Acquisition-related expense | 85 | | 75 | | 158 | | 225 |

| Non-GAAP Cost of Revenue - Services | $ | 11,387 | | $ | 12,569 | | $ | 52,172 | | $ | 51,974 |

| | | | | | | |

| GAAP Research & Development | $ | 27,867 | | | $ | 26,970 | | | $ | 105,901 | | | $ | 107,498 | |

| Less: | | | | | | | |

| Share-based compensation | 3,207 | | 3,277 | | 16,070 | | 13,114 |

| Restructuring | — | | 395 | | 197 | | 659 |

| Acquisition-related expense | 657 | | 1,075 | | 2,179 | | 3,221 |

| Non-GAAP Research & Development | $ | 24,003 | | $ | 22,223 | | $ | 87,455 | | $ | 90,504 |

| | | | | | | |

| GAAP Selling, General and Administrative | $ | 58,513 | | | $ | 45,221 | | | $ | 214,807 | | | $ | 178,337 | |

| Less: | | | | | | | |

| Share-based compensation | 8,898 | | 6,984 | | 37,117 | | 28,548 |

| Management fees | 80 | | 128 | | 318 | | 390 |

| Restructuring | 2,965 | | 57 | | 4,836 | | 8,173 |

| Acquisition-related expense | 1,270 | | 1,056 | | 1,321 | | (2,509) |

| Non-GAAP Selling, General and Administrative | $ | 45,300 | | $ | 36,996 | | $ | 171,215 | | $ | 143,735 |

| | | | | | | |

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow and Unlevered Free Cash Flow

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by operating activities | $ | 42,941 | | | $ | 42,227 | | | $ | 170,594 | | | $ | 149,009 | |

| Purchases of property and equipment | (837) | | | (808) | | | (2,168) | | | (3,651) | |

| Capitalized product development costs | (9,807) | | | (8,175) | | | (38,521) | | | (41,460) | |

| Free Cash Flow | $ | 32,297 | | $ | 33,244 | | $ | 129,905 | | $ | 103,898 |

| Add: | | | | | | | |

| Cash paid for interest on outstanding debt | 18,138 | | 4,247 | | 61,660 | | 28,948 |

| Unlevered Free Cash Flow | $ | 50,435 | | $ | 37,491 | | $ | 191,565 | | $ | 132,846 |

© PowerSchool. PowerSchool and other PowerSchool marks are trademarks of PowerSchool Holdings, Inc., or its subsidiaries. Other names and brands may be claimed as the property of others.

PWSC-F

Investor Contact:

Shane Harrison

investor.relations@PowerSchool.com

855-707-5100

Media Contact:

Beth Keebler

publicrelations@powerschool.com

503-702-4230

Source: PowerSchool Holdings, Inc.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

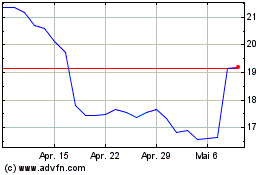

PowerSchool (NYSE:PWSC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

PowerSchool (NYSE:PWSC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024