Pearson Eyes Return to Sales Growth in 2020 -- Update

22 Februar 2019 - 5:42PM

Dow Jones News

(Refocuses headline and lede and adds details, CEO quote and

share price)

--Pearson anticipates a return to sales growth in 2020 and a

stable performance this year

--The company posted a 18% rise in pretax profit for 2018

despite a decline in revenue due to weakness at its U.S.

higher-education business

--In recent years, the company has tried to streamline its

operations and portfolio amid a digital transformation

By Adria Calatayud

Pearson PLC'S (PSON.LN) yearslong turnaround will start to pay

off in the form of sales growth next year, the company said Friday,

as it reported higher earnings for 2018 helped by cost cuts.

Challenges at its key U.S. higher-education business made 2018

Pearson's fourth consecutive year of falling underlying sales, but

the company expects a stabilization this year before a return to

growth in 2020.

Over the last few years, the FTSE 100 education company has

relied on asset sales and cost reductions to deal with tough

conditions in the U.S., where Pearson faces increased competition

from new digital rivals for a market in structural decline as

college enrolments fall.

Despite lower revenue, the company's pretax profit rose 18% to

498 million pounds ($649.7 million) for last year compared with

GBP421 million in 2017, it said. Net profit rose 45% to GBP588

million, boosted by a one-off tax benefit, Pearson said.

Adjusted operating profit--Pearson's preferred earnings

metric--fell to GBP546 million from GBP576 million, the company

said. Pearson had guided for adjusted operating profit to come in

at between GBP540 million and GBP545 million. On an underlying

basis, adjusted operating profit rose 8%, Pearson said.

Revenue fell to GBP4.13 billion in 2018 from GBP4.51 billion a

year earlier, Pearson said. Revenue on an underlying basis declined

1%, dragged by weakness at the company's U.S. higher education

unit, which posted a 5% drop in underlying revenue.

The company confirmed its guidance for this year and raised its

final dividend by 8.3% to 13 pence a share.

Pearson's results were met with a mixed market reaction, as its

stock rose sharply in London opening trade, but moved to the red

later in the session. At 1606 GMT, shares traded 1.7% higher at

989.20 pence.

The company's simplifications program is on track, while its

cost cuts are ahead of plan, it said. Pearson anticipates

annualized cost savings of more than GBP330 million by the end of

2019.

"We made good progress last year. We increased underlying

profits, outperformed our cost savings plan and invested in the

digital platforms that are making us a simpler, more efficient and

innovative company," Chief Executive John Fallon said.

Earlier this week, Pearson completed the sale of its U.S. K12

publishing unit for $250 million, which it regarded as a milestone

in its streamlining efforts. In 2018, Pearson also sold the

headquarters of U.K. business daily the Financial Times, having

sold the newspaper itself in 2015. This helped to reduce the

company's net debt to GBP143 million at the end of last year

compared with GBP432 million in 2017.

The company is investing in its digital transformation, as it

moves away from physical publishing. However, analysts at

investment bank Liberum said that shift is happening slowly given

that Pearson increased its digital revenue to 34% of the group's

total last year from 32% in 2017.

"Despite the claims that Pearson is ready to return to the sunny

uplands of growth in 2020, there is little in these numbers nor

indeed the 2019 guidance to suggest this is the case," Liberum

analysts said in a research note.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

February 22, 2019 11:27 ET (16:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

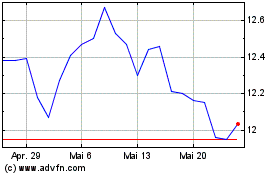

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024