Report of Foreign Issuer (6-k)

02 April 2014 - 12:41PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2014

PEARSON plc

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant's name into English)

80 Strand

London, England WC2R 0RL

44-20-7010-2000

(Address of principal executive office)

Indicate by check mark whether the Registrant files or will file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark whether the Registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

Yes No X

Pearson plc - (the "Company")

Notification of PDMRs' Interests

Long-Term Incentive Plan ("LTIP") - 2014 Release

In 2001, the Company established the Pearson Long-Term Incentive Plan (the "LTIP"

).

Its purpose is to link management's long-term reward with Pearson's financial performance and returns to shareholders. Since 2006, the annual LTIP awards have been based around three performance measures: relative total shareholder return, return on invested capital and earnings per share growth.

Restricted Share Awards Granted in 2009

Under the terms of the LTIP, three-quarters of any shares that vest are released to participants three years after an award is granted. The remaining quarter is released two years later, providing that the executive has retained the released shares and is still employed by the Company.

The following table sets out the number of shares released to PDMRs on 1 April 2014 under the 2009 LTIP awards. The LTIP rules require that sufficient shares are sold to discharge the PAYE income tax liability on the shares released. The shares set out in the third column below were sold on 1 April 2014 at an average price of 1038p per share, leaving the after-tax number of shares set out in the final column below.

|

Name of PDMR

|

Shares Released

|

Shares sold to discharge tax liabilities

|

Shares/ADRs Retained

|

|

John Fallon

|

36,941

|

17,363

|

19,578 ordinary shares

|

|

Robin Freestone

|

31,663

|

14,882

|

16,781 ordinary shares

|

|

Philip Hoffman

|

26,385

|

9,755

|

16,630 ADRs

|

|

Luke Swanson

|

26,385

|

12,401

|

13,984 ordinary shares

|

Interests of the PDMRs

As a result of the above transactions, the PDMRs are interested in the following shares (excluding shares to which they are notionally entitled or may become entitled, subject to the satisfaction of any relevant conditions, under the Company's employee share plans):

|

Name of PDMR

|

Number of Shares/ADRs

|

% of Capital

|

|

John Fallon

|

282,147

|

0.03445%

|

|

Robin Freestone

|

495,288

|

0.06047%

|

|

Philip Hoffman

|

105,622

|

0.01290%

|

|

Luke Swanson

|

235,833

|

0.02879%

|

PEARSON plc

Date: 02 April 2014

By: /s/ STEPHEN JONES

-----------------------

Stephen Jones

Deputy Secretary

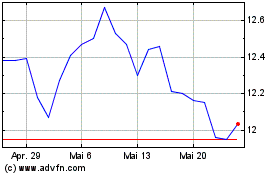

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024