McGraw-Hill Intent to Boost Value - Analyst Blog

13 September 2011 - 2:34PM

Zacks

With intent of boosting the shareholders value The

McGraw-Hill Companies Inc (MHP), recently announced

extensive growth and value measures, including the separation of

the company into two independent companies, McGraw-Hill

Markets and McGraw-Hill Education.

Since last year, the company has been reviewing its business

segments and the call was obvious as the company lost a substantial

market value in last 5 years and its rating agency was under fire

for its latest U.S. downgrade.

Moreover, the New York-based hedge fund Jana Partners and the

Ontario Teachers' Pension Plan, holding approximately 5.2% joint

stake in the company, were pushing it to split into four separate

firms.

Going with its plan, the company aims to create two "focused

companies” with optimal-size capital and cost arrangement for

amplifying client commitment and improving strategic and economic

suppleness while increasing management’s focus and

responsibility.

Further, the company added that it will focus on abridging costs

drastically to ensure competent operating channels and will also

accelerate the pace of share buybacks to a total of $1 billion for

the fiscal year 2011. Year-to-date, McGraw-Hill had repurchased

14.1 million shares for approximately $540.6 million.

McGraw-Hill added that it has engaged The Goldman Sachs

Group Inc. (GS) and Evercore Partners

Inc. (EVR) as the financial advisors to guide the company

during the evaluation period.

Getting to the Companies

McGraw-Hill Markets will be led by Terry McGraw as

Chairman, President and CEO and will focus on capital and

commodities markets and will include the iconic brands like

Standard & Poor's, S&P Indices, S&P Capital IQ and

Platts.

Moreover, McGraw-Hill Markets will also include the

businesses of J.D. Power and Associates and leading franchises in

the construction and aerospace industries.

The company added that it expects revenues of approximately $4

billion from McGraw-Hill Markets in fiscal 2011 with

approximately 40% of it coming from international avenues.

McGraw-Hill Education will be currently led by Robert

Bahash, existing President of the Education division as the company

is in the process of recruiting a new CEO for McGraw-Hill

Education.

McGraw-Hill Education will focus on education services

and digital learning and will speed up growth strategies and

supplement its growth through digital services and buyouts.

The company stated that it expects McGraw-Hill

Education to generate revenues of approximately $2.4 billion

in fiscal 2011.

Wrapping Up

McGraw-Hill expects to complete the transaction by the end of

2012 through a tax-free spin-off while the separation plan is

subject to the approval by the board of directors.

The McGraw-Hill Companies is a diversified publisher and

provider of financial information, and also offers media services

to customers in over 40 countries.

McGraw-Hill has regularly paid dividends since 1937. Since 1974,

the company has boosted its dividend at a compound annual dividend

growth rate of 9.8% and is now among those S&P 500 companies

(about 25), which have raised dividend annually for the

38th straight year.

Currently, we have a long-term Neutral rating on McGraw-Hill,

which competes with Pearson plc (PSO). Moreover,

the company holds a Zacks #3 Rank, which translates into a

short-term Hold recommendation.

EVERCORE PARTNR (EVR): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

PEARSON PLC-ADR (PSO): Free Stock Analysis Report

Zacks Investment Research

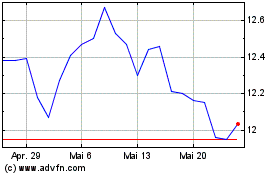

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2024 bis Aug 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Aug 2023 bis Aug 2024