As filed with the Securities and Exchange Commission on May 5, 2023

Registration No. 333-270579

| | |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

AMENDMENT NO. 1 TO

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PERIMETER SOLUTIONS, SA

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Grand Duchy of Luxembourg | | 98-1632942 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

12E rue Guillaume Kroll, L-1882 Luxembourg Grand Duchy of Luxembourg 352 2668 62-1 (314) 396-7343 |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

| | |

Haitham Khouri 8000 Maryland Avenue Suite 350 Clayton, Missouri 63105 (314) 396-7343 |

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | | | | | |

| Flora R. Perez, Esq. Greenberg Traurig, P.A. 401 East Las Olas Boulevard Suite 2000 Fort Lauderdale, FL 33301 (954) 765-0500 | |

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.☐ The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine. |

EXPLANATORY NOTE

This registration statement is being filed by the registrant to register, among other things, the (i) issuance of 8,460,860 of the registrant’s ordinary shares that may be issued upon exercise of warrants to purchase the registrant’s ordinary shares and (ii) resale of up to 76,527,200 of the registrant’s ordinary shares issued pursuant to subscription agreements with certain institutional investors, certain individual accredited investors, and certain members of management and directors of the registrant, which were registered for resale and remain unsold under the registrant’s Registration Statement on Form S-1 (File No. 333-260798), which was initially declared effective by the U.S. Securities and Exchange Commission on November 12, 2021.

SUBJECT TO COMPLETION, DATED MAY 5, 2023

PRELIMINARY PROSPECTUS

Perimeter Solutions, SA

8,460,860 Ordinary Shares and

126,097,150 Ordinary Shares Offered by Selling Securityholders

This prospectus relates to (i) the issuance by us of 8,460,860 of our ordinary shares having a nominal value of $1.00 per share (the “Ordinary Shares”) that may be issued upon the exercise of warrants to purchase Ordinary Shares at an exercise price of $12.00 (the “Warrants”) and (ii) the offer and sale from time to time by certain selling securityholders named herein (the “Selling Securityholders”), or their permitted transferees, of 126,097,150 Ordinary Shares, consisting of (a) up to 76,527,200 Ordinary Shares issued in a private placement pursuant to subscription agreements with certain institutional investors, investors affiliated with SK Invictus Holdings S.à.r.l. (“SK Holdings”), certain individual accredited investors, and certain members of our management and our directors in connection with the business combination among us, EverArc Holdings Limited (“EverArc”), SK Invictus Intermediate S.à r.l., EverArc (BVI) Merger Sub Limited and SK Holdings (the “Business Combination”) completed on November 9, 2021, (b) up to 15,036,731 Ordinary Shares issued or issuable to EverArc Founders, LLC (“Founder”) as payment for all or a portion of the fixed annual advisory fees payable to Founder pursuant to the terms of the Advisory Services Agreement dated December 12, 2019, by and between EverArc and Founder, assumed by us on November 9, 2021 (the “Founder Advisory Agreement”), and (c) up to 34,533,219 Ordinary Shares issued or issuable to Founder as payment for all or a portion of the variable annual advisory fees payable to Founder pursuant to the terms of the Founder Advisory Agreement. The Business Combination is described in greater detail in this prospectus. See “Prospectus Summary – Business Combination.”

If any Warrants are exercised, we will receive proceeds from the exercise of such Warrants. We will not receive any proceeds from the sale of Ordinary Shares by the Selling Securityholders pursuant to this prospectus. However, we will pay the expenses associated with the sale of Ordinary Shares pursuant to this prospectus, other than underwriting discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities.

Our registration of the Ordinary Shares covered by this prospectus does not mean that either we or the Selling Securityholders will issue, offer or sell, as applicable, any of the Ordinary Shares. The Selling Securityholders may offer and sell the Ordinary Shares covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell the Ordinary Shares in the section entitled “Plan of Distribution.”

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

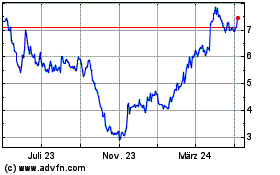

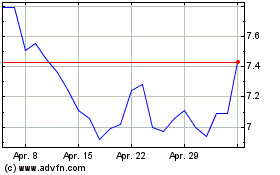

Our Ordinary Shares are listed on the New York Stock Exchange under the symbol “PRM”. On May 4, 2023, the closing price of our Ordinary Shares was $7.18 per share.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 6 of this prospectus. You should carefully read and consider these risk factors and the risk factors included in the reports that we file under the Securities Exchange Act of 1934, as amended, in any prospectus supplement relating to specific offerings of securities and in other documents that we file with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 5, 2023

Table of Contents

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we are filing with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, the selling securityholders named in this prospectus (the “Selling Securityholders”) may, from time to time, issue, offer and sell, as applicable, the securities described in this prospectus in one or more offerings. The Selling Securityholders may, from time to time, use the shelf registration statement to sell up to an aggregate of 126,097,150 Ordinary Shares, through any means described in the section entitled “Plan of Distribution.”

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the Selling Securityholders take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

Unless otherwise indicated or the context otherwise requires, when used in this prospectus, the term “Perimeter”, “we,” “our” and “us” refer to Perimeter Solutions, SA and our subsidiaries.

| | |

PROSPECTUS SUMMARY Overview We are a public company limited by shares (société anonyme) under the laws of the Grand Duchy of Luxembourg and registered with the Luxembourg trade and companies register (Registre de Commerce et des Sociétés, Luxembourg) under number B 256.548. We are organized and managed in two reporting segments: Fire Safety and Specialty Products (formerly Oil Additives). Approximately 74% of our 2022 annual revenues were derived in the United States, approximately 15% in Europe, approximately 5% in Canada and approximately 2% in Mexico. The approximately 4% of remaining revenues in 2022 was spread across various other countries. The Fire Safety segment is a formulator and manufacturer of fire management products that help our customers combat various types of fires, including wildland, structural, flammable liquids and other types of fires. Our Fire Safety segment also offers specialized equipment and services, typically in conjunction with its fire management products, to support its customers’ firefighting operations. Our specialized equipment includes air base retardant storage, mixing, and delivery equipment; mobile retardant bases; retardant ground application units; mobile foam equipment; and equipment that we custom design and manufacture to meet specific customer needs. Our service network can meet the emergency resupply needs of over 150 air tanker bases in North America, as well as many other customer locations globally. The segment is built on the premise of superior technology, exceptional responsiveness to our customers’ needs, and a “never-fail” service network. Significant end markets primarily include government-related entities and are dependent on approvals, qualifications, and permits granted by the respective governments and commercial customers around the world. In June 2022, the Oil Additives segment, which produces and sells Phosphorus Pentasulfide (“P2S5”), was renamed the Specialty Products segment to better reflect the current and expanding applications for P2S5 in several end markets and applications, including lubricant additives, various agricultural applications, various mining applications, and emerging electric battery technologies. Within the lubricant additive end market, our largest end market application as of September 30, 2022, P2S5, is primarily used in the production of a family of compounds called Zinc Dialkyldithiophosphates (“ZDDP”), which is considered an essential component in the formulation of engine oils with its main function to provide anti-wear protection to engine components. Our registered office is 12E rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg. Our investor relations website is located at www.perimeter-solutions.com. Information contained in, or accessible through, our website is not a part of, and is not incorporated into, this prospectus. The Business Combination On November 9, 2021, we consummated a business combination by and among us, EverArc Holdings Limited, a company limited by shares incorporated with limited liability in the British Virgin Islands (“EverArc”), SK Invictus Intermediate S.à r.l., a limited liability company (société à responsabilité limitée) governed by the laws of the Grand Duchy of Luxembourg (“SK”), EverArc (BVI) Merger Sub, a company limited by shares incorporated with limited liability under the laws of the British Virgin Islands (“Merger Sub”), and SK Invictus Intermediate S.à r.l., a limited liability company (société à responsabilité limitée) governed by the laws of the Grand Duchy of Luxembourg (“SK Holdings”) (the “Business Combination”). In connection with the Business Combination, (a) Merger Sub merged with and into EverArc, with EverArc surviving such merger as a direct wholly-owned subsidiary of Perimeter (the “Merger”), (b) in the context of such Merger, all Ordinary Shares of EverArc outstanding immediately prior to the Merger were exchanged for Ordinary Shares of Perimeter, (c) SK Holdings (i) contributed a portion of its Ordinary Shares in SK to Perimeter in exchange for 10,000,000 preferred shares of Perimeter valued at $100 million and (ii) sold its remaining Ordinary Shares in SK to Perimeter for approximately $1.9 billion in cash subject to certain customary adjustments for working capital, transaction expenses, cash and indebtedness (which amounted to approximately $600 million in the aggregate), and (d) all of the outstanding EverArc warrants, in each case, entitling the holder thereof to purchase one-fourth of an EverArc ordinary share at an exercise price of $12.00 per whole EverArc ordinary share, were converted into the right to purchase one-fourth of an Ordinary Share of Perimeter on substantially the same terms as the EverArc warrants.

|

| | |

In connection with the execution of the Business Combination Agreement, EverArc, SK Holdings and Perimeter entered into separate subscription agreements with a number of institutional investors, investors affiliated with SK Holdings and individual accredited investors (collectively, the “EverArc Subscribers”), pursuant to which the EverArc Subscribers agreed to purchase an aggregate of 115,000,000 EverArc ordinary shares at $10.00 per share which were converted into Ordinary Shares in connection with the closing of the Business Combination. In addition, members of management of SK (collectively, the “Management Subscribers”) purchased an aggregate of 1,104,810 Ordinary Shares at $10.00 per share in connection with the closing of the Business Combination and certain directors of Perimeter, together with the EverArc Subscribers and Management Subscribers, purchased an aggregate of 200,000 Ordinary Shares at $10.00 per share in connection with the closing of the Business Combination. Pursuant to the subscription agreements, we agreed to register the Ordinary Shares issued thereunder for resale. The Founder Advisory Agreement On December 12, 2019, EverArc entered into the Founder Advisory Agreement (the “Founder Advisory Agreement”) with EverArc Founders, LLC, a Delaware limited liability company (the “Founder”), which is owned and operated by William N. Thorndike, Jr., W. Nicholas Howley, Tracy Britt Cool, Vivek Raj and Haitham Khouri. Under the Founder Advisory Agreement, the Founder agreed (i) to assist with identifying target opportunities, due diligence, negation, documentation and investor relations with respect to the Business Combination, and (ii) to provide strategic and capital allocation advice and such services as may from time to time be agreed following the Business Combination. The rights and obligations of EverArc under the Founder Advisory Agreement were assigned to, and assumed by, Perimeter in connection with the closing of the Business Combination. In exchange for the services provided thereunder, the Founder is entitled to receive both a fixed amount (“Fixed Annual Advisory Amount”) and a variable amount (the “Variable Annual Advisory Amount”) until the years ending December 31, 2027, and 2031, respectively. The Fixed Annual Advisory Amount will be equal to 2,357,061 Ordinary Shares (1.5% of 157,137,410 Ordinary Shares outstanding as of November 9, 2021) for each year through December 31, 2027. The Variable Annual Advisory Amount for each year through December 31, 2031 is based on the appreciation of the market price of Ordinary Shares if such market price exceeds certain trading price minimums at the end of each reporting period and is valued using a Monte Carlo simulation model. For 2021, the average market price used to calculate the Variable Annual Advisory Amount and Fixed Annual Advisory Amount pursuant to the terms of the Founder Advisory Agreement was $13.63 per Ordinary Share, resulting in a (i) Variable Annual Advisory Amount for 2021 of 7,525,906 Ordinary Shares (the “2021 Variable Amount”) and (ii) Fixed Annual Advisory Amount of 2,357,061 Ordinary Shares (the “2021 Fixed Amount” and together with the 2021 Variable Amount, the “2021 Advisory Amounts”). Per the Founder Advisory Agreement, the Founder elected to receive approximately 60% of the 2021 Advisory Amounts in Ordinary Shares (5,952,992 Ordinary Shares). On February 15, 2022, Perimeter issued 5,952,992 Ordinary Shares and paid $53.5 million in cash in satisfaction of 2021 Advisory Amounts. For 2022, the Founder was entitled to a Fixed Annual Advisory Amount equal to 2,357,061 Ordinary Shares (the "2022 Advisory Amount"). Per the Founder Advisory Agreement, the Founder elected to receive approximately 78% of the 2022 Advisory Amount in Ordinary Shares (1,831,653 Ordinary Shares). On February 15, 2023, Perimeter issued 1,831,653 Ordinary Shares and paid $4.7 million in cash in satisfaction of 2022 Advisory Amounts. The Founder did not receive any Variable Annual Advisory Amount for 2022. |

THE OFFERING

| | | | | |

| Issuance of Ordinary Shares | |

| Ordinary Shares Offered Hereunder | 8,460,860 Ordinary Shares issuable upon the exercise of Warrants. |

Resale of Ordinary Shares | |

| Ordinary Shares Offered by the Selling Securityholders | Up to 76,527,200 Ordinary Shares issued pursuant to subscription agreements with institutional and accredited investors, members of management of SK and directors of Perimeter. Up to 15,036,731 Ordinary Shares issued or issuable to Founder as payment for all or a portion of the Fixed Annual Advisory Amount payable to Founder pursuant to the terms of the Founder Advisory Agreement. Up to 34,533,219 Ordinary Shares issued or issuable to Founder as payment for all or a portion of the Variable Annual Advisory Amount payable to Founder pursuant to the terms of the Founder Advisory Agreement. |

| Use of proceeds | We will receive up to an aggregate of $101,530,320 if all of the Warrants are exercised, to the extent such Warrants are exercised for cash. If the market price for our Ordinary Shares does not increase from current levels ($7.18 as of May 4, 2023), there is a small likelihood that any of the Warrants will be exercised. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes and to implement our business plan, although we believe we can fund our operations and business plan with cash on hand. We will not receive any proceeds from the sale of the Ordinary Shares to be offered by the Selling Securityholders under this prospectus. |

| Ticker symbols | Our Ordinary Shares trade on the NYSE under the ticker symbols “PRM”. |

| Risk Factors | Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 6. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements about:

•the benefits from the Business Combination;

•our ability to maintain the listing of the Ordinary Shares on the NYSE;

•Perimeter’s future financial performance, including any expansion plans and opportunities;

•Perimeter’s success in retaining or recruiting, or changes required in, its officers, key employees or directors;

•expectations concerning sources of revenue;

•expectations about demand for fire retardant products, equipment and services;

•the size of the markets in which we compete and potential opportunities in such markets;

•our ability to foster highly responsive and collaborative relationships with existing and potential customers and stakeholders;

•expectations concerning certain of our products’ ability to protect life and property as population settlement locations change;

•expectations concerning the markets in which we will operate in the coming years;

•our ability to maintain a leadership position in any market;

•the expected outcome of litigation matters and the effect of such claims on business, financial condition, results of operations or cash flows;

•our ability to increase the size of our selling, general and administrative functions to support the growth of our business and whether administrative expenses will decrease as a percentage of revenue over time; and

•expectations about our compensation policies.

These forward-looking statements are based on information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

You should not place undue reliance on these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause our actual results to differ include:

•the direct and indirect adverse impact of the novel strain of coronavirus, SARS-CoV-2, which causes COVID-19 (“COVID-19”) on the global economy and the related governmental regulations and restrictions;

•the impact of the conflict in Ukraine on the global economy and our business;

•negative or uncertain worldwide economic conditions;

•volatility, seasonality and cyclicality in the industries in which we operate;

•our ability to realize the strategic and financial benefits of the Business Combination;

•our substantial dependence on sales to the U.S. Department of Agriculture Forest Service and the state of California and the risk of decreased sales to these customers;

•changes in the regulation of the petrochemical industry, a downturn in the lubricant additives and/or fire retardant end markets or our failure to accurately predict the frequency, duration, timing, and severity of changes in demand in such markets;

•changes in customer relations or service levels;

•a small number of our customers represent a significant portion of our revenue;

•failure to continuously innovate and to provide products that gain market acceptance, which may cause us to be unable to attract new customers or retain existing customers;

•improper conduct of, or use of our products, by employees, agents, government contractors or collaborators;

•changes in the availability of products from our suppliers on a long-term basis;

•production interruptions or shutdowns, which could increase our operating or capital expenditures or negatively impact the supply of our products resulting in reduced sales;

•changes in the availability of third-party logistics suppliers for distribution, storage and transportation;

•increases in supply and raw material costs, supply shortages, long lead times for components or supply changes;

•adverse effects on the demand for our products or services due to the seasonal or cyclical nature of our business or severe weather events;

•introduction of new products, which are considered preferable, which could cause demand for some of our products to be reduced or eliminated;

•current ongoing and future litigation, including multi-district litigation and other legal proceedings;

•heightened liability and reputational risks due to certain of our products being provided to emergency services personnel and their use to protect lives and property;

•future products liabilities claims where indemnity and insurance coverage could be inadequate or unavailable to cover these claims due to the fact that some of the products we produce may cause adverse health consequences;

•compliance with export control or economic sanctions laws and regulations;

•environmental impacts and side effects of our products, which could have adverse consequences for our business;

•compliance with environmental laws and regulations;

•our ability to protect our intellectual property rights and know-how;

•our ability to generate the funds required to service our debt and finance our operations;

•fluctuations in foreign currency exchange;

•potential impairments or write-offs of certain assets;

•the adequacy of our insurance coverage; and

•challenges to our decisions and assumptions in assessing and complying with our tax obligations.

RISK FACTORS

An investment in our securities involves risks and uncertainties. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K for the year ended December 31, 2022 and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement before making an investment decision. The risks described in these documents are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially adversely affected. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment.

USE OF PROCEEDS

We will receive up to an aggregate of $101,530,320 if all the Warrants are exercised, to the extent such Warrants are exercised for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes and to implement our business plan, although we believe we can fund our operations and business plan with cash on hand. However, we will only receive such proceeds if and when the Warrant holders exercise the Warrants. Each Warrant is exercisable in multiples of four to purchase one Ordinary Share and only whole warrants are exercisable. The exercise price of the Warrants is $12.00 per share, subject to certain adjustments. On May 4, 2023, the closing price of our Ordinary Shares on the NYSE was $7.18 per share, which was $4.82 below the exercise price of the Warrants. If the market price for our Ordinary Shares does not increase from current levels, there is a small likelihood that any of the Warrants will be exercised.

All Ordinary Shares offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders or their permitted transferees. We will not receive any of the proceeds from the sale of the Ordinary Shares offered by the Selling Securityholders. However, we will pay the expenses associated with the sale of Ordinary Shares pursuant to this prospectus, other than underwriting discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities.

DESCRIPTION OF SECURITIES

Ordinary Shares

Share Capital

Perimeter was incorporated on June 21, 2021, by EverArc, with an initial share capital of $40,000, represented by 40,000 Ordinary Shares with a nominal value of $1.00 per share.

Perimeter’s authorised share capital is set at $3,734,933,805, to allow the board of directors to issue Ordinary Shares with a nominal value of $1.00 per share and/or preferred shares with a nominal value of $10.00 per share (the “Preferred Shares”) up to the maximum amount of the authorised capital. A shareholder in a Luxembourg société anonyme holding fully paid up shares is not liable, solely because of his, her or its shareholder status, for additional payments to Perimeter or its creditors. As of April 24, 2023, there were 157,630,816 Ordinary Shares outstanding and 10,000,000 Preferred Shares outstanding (excluding any shares held in treasury by Perimeter).

Share Issuances

Pursuant to Luxembourg law, the issuance of Ordinary Shares requires approval by the shareholders at the time of an extraordinary general meeting of the shareholders to be held before a notary in the Grand Duchy of Luxembourg (subject to necessary quorum and majority requirements). The shareholders may approve an authorized capital and authorize the board of directors, for a period up to 5 years, to increase the share capital in one or several tranches with or without share premium, against payment in cash or in kind, by conversion of claims on Perimeter or in any other manner for any reason whatsoever including (i) issue subscription and/or conversion rights in relation to new shares or instruments within the limits of the authorized capital under the terms and conditions of warrants (which may be separate or linked to shares, bonds, notes or similar instruments issued by Perimeter), convertible bonds, notes or similar instruments; (ii) determine the place and date of the issue or successive issues, the issue price, the terms and conditions of the subscription of and paying up on the new shares and instruments and (iii) remove or limit the statutory preferential subscription right of the shareholders in case of issue against payment in cash or shares, warrants (which may be separate or attached to shares, bonds, notes or similar instruments), convertible bonds, notes or similar instruments up to the maximum amount of such authorized capital for a maximum period of five years after the date that the minutes of the relevant general meeting approving such authorization are published in the Luxembourg official gazette (Recueil Electronique des Sociétés, “RESA”). The shareholders may amend, renew (each time for a period up to 5 years) or extend such authorized capital and such authorization to the board of directors to increase the share capital and issue ordinary shares.

In addition, the general meeting of shareholders may authorize the board of directors to make an allotment of existing or newly issued shares without consideration to (a) employees of Perimeter or certain categories amongst those; (b) employees of companies or economic interest grouping in which Perimeter holds directly or indirectly at least ten per cent (10%) of the share capital or voting rights; (c) employees of companies or economic interest grouping which holds directly or indirectly at least ten per cent (10%) of the share capital or voting rights of Perimeter; (d) employees of companies or economic interest grouping in which at least fifty per cent (50%) of the share capital or voting rights is held directly or indirectly by a company which holds directly or indirectly at least fifty per cent (50%) of the share capital of Perimeter; and (e) members of the corporate bodies of Perimeter or of the companies or economic interest grouping listed in point (b) to (d) above or certain categories amongst those, for a maximum period of five years after the date that the minutes of the relevant general meeting approving such authorization are published in the Luxembourg RESA.

Perimeter recognizes only one holder per ordinary share. In case an ordinary share is owned by several persons, they shall appoint a single representative who shall represent them in respect of Perimeter. Perimeter has the right to suspend the exercise of all rights attached to that share, except for relevant information rights, until such representative has been appointed.

Upon the consummation of the Business Combination, the board of directors will resolve on the issuance of Ordinary Shares out of the authorized capital (capital autorisé) in accordance with applicable law. The board of directors also resolves on the applicable procedures and timelines to which such issuance will be subjected. If the proposal of the board of directors to issue new Ordinary Shares exceeds the limits of Perimeter’s authorized share capital, the board of directors must then convene the shareholders to an extraordinary general meeting to be held in front of a Luxembourg notary for the purpose of increasing the issued share capital. Such meeting will be subject to the quorum and majority requirements required for amending the articles of association. If the capital call proposed by the board of directors consists of an increase in the shareholders’ commitments, the board of directors must convene the shareholders to an extraordinary general meeting to be held in front of a Luxembourg notary for such purpose. Such meeting will be subject to the unanimous consent of the shareholders.

Preemptive Rights

Under Luxembourg law, existing shareholders benefit from a preemptive subscription right on the issuance of ordinary shares for cash consideration. However, Perimeter’s shareholders have, in accordance with Luxembourg law, authorized the board of directors to suppress, waive, or limit any preemptive subscription rights of shareholders provided by law to the extent that the board of directors deems such suppression, waiver, or limitation advisable for any issuance or issuances of ordinary shares within the scope of Perimeter’s authorized share capital. The general meeting of shareholders duly convened to consider an amendment to the articles of association also may, by two-thirds majority vote, limit, waive, or cancel such preemptive rights or renew, amend or extend them, in each case for a period not to exceed five years. Such ordinary shares may be issued above, at, or below market value, and, following a certain procedure, even below the nominal value or below the accounting par value per ordinary share. The ordinary shares also may be issued by way of incorporation of available reserves, including share premium.

Share Repurchases

Perimeter cannot subscribe for its own ordinary shares. Perimeter may, however, repurchase issued ordinary shares or have another person repurchase issued ordinary shares for its account, subject to the following conditions:

•prior authorization by a simple majority vote at an ordinary general meeting of shareholders, which authorization sets forth;

•the terms and conditions of the proposed repurchase and in particular the maximum number of ordinary shares to be repurchased;

•the duration of the period for which the authorization is given, which may not exceed five years;

•in the case of repurchase for consideration, the minimum and maximum consideration per share, provided that the prior authorization shall not apply in the case of ordinary shares acquired by either Perimeter, or by a person acting in his or her own name on its behalf, for the distribution thereof to its staff or to the staff of a company with which it is in a control relationship;

•only fully paid-up ordinary shares may be repurchased; and

•the voting and dividend rights attached to the repurchased shares will be suspended as long as the repurchased ordinary shares are held by Perimeter; and the acquisition offer must be made on the same terms and conditions to all the shareholders who are in the same position, except for acquisitions which were unanimously decided by a general meeting at which all the shareholders were present or represented. In addition, listed companies may repurchase their own shares on the stock exchange without an acquisition offer having to be made to Perimeter’s shareholders.

The authorization will be valid for a period ending on the earlier of five years from the date of such shareholder authorization and the date of its renewal by a subsequent general meeting of shareholders. Pursuant to such authorization, the board of directors is authorized to acquire and sell Perimeter’s ordinary shares under the conditions set forth in article 430-15 of the Luxembourg law of August 10, 1915 on commercial companies, as amended (the “1915 Law”). Such purchases and sales may be carried out for any authorized purpose or any purpose that is authorized by the laws and regulations in force. The purchase price per ordinary share to be determined by the board of directors or its delegate shall represent not more than the fair market value of such ordinary share.

In addition, pursuant to Luxembourg law, Perimeter may directly or indirectly repurchase ordinary shares by resolution of its board of directors without the prior approval of the general meeting of shareholders if such repurchase is deemed by the board of directors to be necessary to prevent serious and imminent harm to Perimeter, or if the acquisition of ordinary shares has been made with the intent of distribution to its employees and/or the employees of any entity having a controlling relationship with it (i.e., its subsidiaries or controlling shareholder) or in any of the circumstances listed in article 430-16 of the 1915 Law.

On December 7, 2021, subject to the approval of the shareholders of Perimeter, the Perimeter’s board of directors authorized a share repurchase plan (the “Share Repurchase Plan”). Under the Share Repurchase Plan, Perimeter is authorized to repurchase up to $100.0 million of its issued and outstanding Ordinary Shares at any time during the next 24 months or, if different, such other timeframe as approved by the shareholders of Perimeter. Until such time as the Share Repurchase Plan was approved by the shareholders of Perimeter, the board of directors authorized any subsidiary of Perimeter to take such actions necessary to purchase Ordinary Shares of Perimeter. Repurchases under the Share Repurchase Plan may be made, from time to time, in such quantities, in such manner and on such terms

and conditions and at prices Perimeter deems appropriate. On July 21, 2022, subject to certain limits, the shareholders of Perimeter approved a proposal authorizing the board of directors to repurchase up to 25% of the Ordinary Shares outstanding as of the date of the shareholders’ approval, being 40,659,257 Ordinary Shares, at any time during the next five years. On November 3, 2022, the board of directors approved the repurchase of up to $100.0 million of Ordinary Shares during the next 24 months.

Preferred Shares

As of December 31, 2022, Perimeter had 10.0 million Preferred Shares outstanding with a nominal value of $10.00 per share. As long as the Preferred Shares are in issue and outstanding, no shares ranking pari passu or senior to the Preferred Shares shall be issued by Perimeter, other than additional Preferred Shares or other equity securities interest issued with the consent of a majority of holders of the Preferred Shares.

Each Preferred Share is entitled to a Preferential Dividend (as defined in Perimeter’s articles of association (the “Articles”)) amounting to the applicable Regular Dividend Rate (as defined in the Articles) of its nominal value (i.e., $10.00 per share). The Preferential Dividend shall be paid each year within 3 business days following each Preferential Dividend Payment Date (as defined in the Articles). On each Preferential Dividend Payment Date, 40% of the Preferential Dividend for such year (or 50% of the Preferential Dividend for such year if Perimeter paid a dividend on the Ordinary Shares during period since the payment of the last Preferential Dividend Payment Date) shall be paid in cash and the remainder of the Preferential Dividend shall be paid in kind, unless Perimeter elects to pay any additional portion of the Preferential Dividend in cash; provided, that, (x) Perimeter shall not be required to pay any portion of such annual Preferential Dividends in cash on a Preferential Dividend Payment Date to the extent that Perimeter or its subsidiaries are prohibited from paying such portion of the annual Preferential Dividend in cash under either (i) the Senior Credit Agreement (as defined in the Articles) or (ii) the Bridge Loan/Secured Notes (as defined in the Articles), and (y) in the event that Perimeter or its subsidiaries are so prohibited from paying all or a portion of such Preferential Dividends in cash as described in the foregoing clause (x), Perimeter shall pay the maximum amount not prohibited by the Senior Credit Agreement or the Bridge Loan/Secured Notes in cash. If Perimeter fails to pay any portion of the cash portion of the Preferential Dividend for any reason in a given year by the Preferential Dividend Payment Date (including due to clause (x) of the immediately preceding sentence), then (i) the Preferential Dividend rate for such year (i.e. the year in which Perimeter fails to pay any portion of the cash portion of the Preferential Dividend Payment (as defined in the Articles)), but not necessarily the subsequent year, will increase to the Increased Dividend Rate (as defined in the Articles) and (ii) the Preferential Dividend rate for the following year will be reset at the Regular Dividend Rate and will be subject to increase to the Increased Dividend Rate for such year (but not necessarily the subsequent year) if Perimeter fails to pay any portion of the cash portion of the Preferential Dividend Payment by the Preferential Dividend Payment Date for such year.

Perimeter may redeem the Preferred Shares at any time prior to the earliest of (i) six months following the latest maturity date of the Senior Credit Agreement and Bridge Loan/Secured Notes, (ii) nine years after the date of issuance of the Preferred Shares or (iii) upon the occurrence of a Change of Control (as defined in the Articles) (the “Defined Maturity Date”) at Perimeter’s sole option. The redemption price per share would be equal to the nominal value of the Preferred Shares plus any accrued and unpaid Preferential Dividend, if any. If Perimeter fails to redeem the Preferred Shares at the Defined Maturity Date, the Preferential Dividend rate will permanently increase to the interest rate currently being paid (whether default or not) under the Senior Credit Agreement plus 10%.

As long as Preferred Shares are issued and outstanding, Perimeter and its subsidiaries shall not (a) enter into a credit agreement (except to the extent related to the issuance of senior secured notes as contemplated by the Bridge Loan/Secured Notes) or (b) amend the Senior Credit Agreement, in each case, in a manner that would adversely affect the redemption rights of the Preferred Shares by extending the maturity date under such credit facility beyond the defined maturity date or increase the restrictions on Perimeter’s ability to pay the cash portion of Preferential Dividends without the consent of holders owning a majority of the Preferred Shares. If, in any year, Perimeter fails to make any portion of the cash portion of any Preferential Dividend by the Preferential Dividend Payment Date, then, during the following year, Perimeter may not, without the consent of the holders of a majority of the outstanding Preferred Shares, pay a cash dividend on the Ordinary Shares until such time as Perimeter has paid the cash portion of the Preferential Dividend Payment for such following year (which cash portion of the Preferential Dividend Payment may be paid by Perimeter in advance of the Preferential Dividend Payment Date for, and at any time during, such following year); for the avoidance of doubt, the restrictions set forth in this sentence shall not apply to any non-pro rata purchase, repurchase or redemption of any equity securities of Perimeter or any of its subsidiaries. As long as Preferred Shares are issued and outstanding, during the occurrence and continuance of a default by Perimeter to pay any Preferential Dividend (for the avoidance of doubt, the payment of any cash portion of the Preferential Dividend in kind in accordance with the terms of the Articles shall not constitute a default by Perimeter), the approval of holders owning a majority of the outstanding Preferred Shares shall be required (i) for the declaration of dividends to the benefit of all other categories of Perimeter shares issued and outstanding and (ii)

for the purchase, repurchase or redemption of any equity securities of Perimeter or any of its subsidiaries (other than pursuant to equity incentive agreements with employees).

The Preferred Shares are not entitled to vote, save for the matters provided for by Luxembourg law, including any amendment, alteration or change to the rights attached to the Preferred Shares in a manner adverse to the Preferred Shares for which the consent of holders owning a majority of the Preferred Shares will be required.

The Preferred Shares, being non-voting shares, shall not be included for the calculation of the quorum and majority at each general meeting of Perimeter, save for the matters provided for by Luxembourg law and in the relevant provisions of the Articles.

In case of liquidation of Perimeter, after payment of all the debts of and charges against Perimeter and of the expenses of liquidation, the holders of Preferred Shares, if any, shall be entitled to a preferential right to repayment of the nominal value of the Preferred Shares plus any accrued but unpaid Preferential Dividends before repayment of the nominal value of the Ordinary Shares.

The rights attached to the Preferred Shares under the Articles shall not be amended in a manner adverse to the Preferred Shares without the consent of holders owning a majority of the Preferred Shares.

Voting Rights

Each Ordinary Share entitles the holder thereof to one vote. Neither Luxembourg law nor the Articles contain any restrictions as to the voting of Ordinary Shares by non-Luxembourg residents. The 1915 Law distinguishes general meetings of shareholders and extraordinary general meetings of shareholders with respect to quorum and majority requirements.

Meetings

Ordinary General Meeting

At an ordinary general meeting, there is no quorum requirement and resolutions are adopted by a simple majority of validly cast votes. Abstentions are not considered “votes.”

Extraordinary General Meeting

Extraordinary resolutions are required for any of the following matters, among others: (i) an increase or decrease of the authorized or issued capital, (ii) a limitation or exclusion of preemptive rights, (iii) approval of a statutory merger or de-merger (scission), (iv) Perimeter’s dissolution and liquidation opening, (v) any and all amendments to the Articles and (vi) change of nationality. Pursuant to the Articles, for any resolutions to be considered at an extraordinary general meeting of shareholders, the quorum shall be at least one half of Perimeter’s issued share capital unless otherwise mandatorily required by law. If the said quorum is not present, a second meeting may be convened, for which the 1915 Law does not prescribe a quorum. Any extraordinary resolution shall be adopted at a quorate general meeting, except otherwise provided by law, by at least a two-thirds majority of the votes validly cast on such resolution by shareholders. Abstentions are not considered “votes.”

Annual Shareholders Meetings

An annual general meeting of shareholders shall be held in the Grand Duchy of Luxembourg within six months of the end of the preceding financial year, except for the first annual general meeting of shareholders which may be held within 18 months from incorporation.

Warrants

Pursuant to the EverArc Warrant Amendment attached to the Business Combination Agreement, EverArc assigned to Perimeter all of EverArc’s right, title and interest in and to the EverArc Warrant Instrument and Perimeter assumed, and agreed to pay, perform, satisfy and discharge in full, all of EverArc’s liabilities and obligations under the EverArc Warrant Instrument that arose after the consummation of the Business Combination.

Each Warrant is exercisable in multiples of four to purchase one Ordinary Share and only whole warrants are exercisable. The exercise price of the Warrants is $12.00 per share, subject to adjustment as described in the EverArc Warrant Instrument. A Warrant may be exercised only during the period beginning 30 days after the

consummation of the transactions contemplated by the Business Combination Agreement, and terminating at 5:00 p.m., New York City time on the date that is three years after the date on which the Business Combination was consummated, provided that if such day is not a trading day, the trading day immediately following such day, unless earlier redeemed in accordance with the EverArc Warrant Instrument as described below.

Redemptions of Warrants

Pursuant to the EverArc Warrant Instrument, once the warrants become exercisable, they may be redeemed (i) in whole and not in part, (ii) at a price of $0.01 per warrant, (iii) upon not less than 30 days’ prior written notice of redemption to each warrant holder, and (iv) if, and only if, the reported last sale price of the Ordinary Shares equals or exceeds $18.00 per share for any 10 consecutive trading days.

Dividends

From the annual net profits of Perimeter, at least 5% shall each year be allocated to the reserve required by applicable laws (the “Legal Reserve”). That allocation to the Legal Reserve will cease to be required as soon and as long as the Legal Reserve amounts to 10% of the amount of the share capital of Perimeter. The general meeting of shareholders shall resolve how the remainder of the annual net profits, after allocation to the Legal Reserve, will be disposed of by allocating the whole or part of the remainder to a reserve or to a provision, by carrying it forward to the next following financial year or by distributing it, together with carried forward profits, distributable reserves or share premium to the shareholders, each Ordinary Share entitling to the same proportion in such distributions.

The board of directors may resolve that Perimeter pays out an interim dividend to the shareholders, subject to the conditions of article 461-3 of the 1915 Law and the Articles, which includes, inter alia, a supervisory/statutory auditor report (as applicable). The board of directors shall set the amount and the date of payment of the interim dividend.

Any share premium assimilated premium or other distributable reserve may be freely distributed to the shareholders subject to the provisions of the 1915 Law and the Articles. In case of a dividend payment, each shareholder is entitled to receive a dividend right pro rata according to his, her or its respective shareholding. The dividend entitlement lapses upon the expiration of a five-year prescription period from the date of the dividend distribution. The unclaimed dividends return to Perimeter’s accounts.

Exclusive Forum

The Articles provide that unless Perimeter consents in writing to the selection of an alternative forum, the federal district courts of the United States will, to the fullest extent permitted by applicable law, be the sole and exclusive forum for any action asserting a claim arising under the Securities Act. The Securities Act forum provision is not intended by Perimeter to limit the forum available to its shareholders for actions or proceedings asserting claims arising under the Exchange Act. The validity and enforceability of such exclusive forum clause cannot be confirmed under Luxembourg law. If a court were to find the exclusive forum clause to be inapplicable or unenforceable in an action, Perimeter may incur additional costs associated with resolving such action in other jurisdictions, which could harm its business, operating results and financial condition.

SELLING SECURITYHOLDERS

This prospectus relates to the resale by the Selling Securityholders from time to time of up to 126,097,150 Ordinary Shares. The Selling Securityholders may from time to time offer and sell any or all of the Ordinary Shares set forth below pursuant to this prospectus and any accompanying prospectus supplement. When we refer to the “Selling Securityholders” in this prospectus, we mean the persons listed in the table below, and the pledgees, donees, transferees, assignees, successors, designees and others who later come to hold any of the Selling Securityholders’ interest in the Ordinary Shares other than through a public sale.

The following table sets forth, as of April 24, 2023, the names of the Selling Securityholders, the aggregate number of Ordinary Shares owned by each Selling Securityholder immediately prior to the sale of Ordinary Shares in this offering, the number of Ordinary Shares that may be sold by each Selling Securityholder under this prospectus and that each Selling Securityholder will beneficially own after this offering.

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the Selling Securityholders have sole voting and investment power with respect to all Ordinary Shares that they beneficially own, subject to applicable community property laws. Except as otherwise described below, based on the information provided to us by the Selling Securityholders, no Selling Securityholder is a broker-dealer or an affiliate of a broker-dealer.

For purposes of the table below, we have assumed that the Selling Securityholders will not acquire beneficial ownership of any additional securities during the offering. In addition, we assume that the Selling Securityholders have not sold, transferred or otherwise disposed of, our securities in transactions exempt from the registration requirements of the Securities Act.

| | | | | | | | | | | | | | | | | |

| Securities Beneficially Owned prior to this Offering | Maximum Number of Securities to be Sold in this Offering | Securities Beneficially Owned after this Offering |

| Name of Selling Securityholder | Perimeter Ordinary Shares | Percentage(1) | Perimeter Ordinary Shares | Perimeter Ordinary Shares | Percentage(1) |

Edward Goldberg(2) | 222,957 | * | 222,957 | — | — |

Barry Lederman(3) | 196,416 | * | 196,416 | — | — |

Noriko Yokozuka(4) | 47,157 | * | 47,157 | — | — |

Stephen Cornwall(5) | 42,087 | * | 42,087 | — | * |

Ernest Kremling(6) | 150,498 | * | 150,498 | — | — |

Shannon Horn(7) | 445,695 | * | 445,695 | — | — |

Sean Hennessy(8) | 100,000 | * | 100,000 | — | — |

Kevin Stein(9) | 115,000 | * | 115,000 | — | — |

BV Texas Partners LLC(10) | 200,000 | * | 200,000 | — | — |

Alyeska Master Fund, LP(11) | 5,906,259 | 3.75% | 4,434,347 | 1,471,912 | * |

Aperture Endeavour Equity Fund(12) | 300,000 | * | 300,000 | — | — |

BCP – 2021 Series LLC – Series EH(13) | 101,000 | * | 101,000 | — | — |

Cooper Square Fund II, L.P.(14) | 875,785 | * | 589,911 | 285,874 | * |

Cooper Square Fund, L.P.(14) | 2,271,618 | 1.44% | 1,710,308 | 561,310 | * |

Cooper Square Offshore Master Fund, Ltd.(14) | 512,246 | * | 403,396 | 108,850 | * |

CPG Cooper Square International Equity, LLC(14) | 167,415 | * | 111,385 | 56,030 | * |

| | | | | | | | | | | | | | | | | |

| Securities Beneficially Owned prior to this Offering | Maximum Number of Securities to be Sold in this Offering | Securities Beneficially Owned after this Offering |

| Name of Selling Securityholder | Perimeter Ordinary Shares | Percentage(1) | Perimeter Ordinary Shares | Perimeter Ordinary Shares | Percentage(1) |

CRMC – SMALL CAP World Fund, Inc.(15) | 6,513,000 | 4.13% | 6,513,000 | — | — |

Darlington Partners, L.P.(16) | 1,723,918 | 1.11% | 1,723,918 | — | — |

Darlington Partners II, L.P.(16) | 276,082 | * | 276,082 | — | — |

EC Longhorn LLC(17) | 1,250,373 | * | 1,250,373 | — | — |

Eminence Holdings LLC(17) | 5,749,627 | 3.65% | 5,749,627 | — | — |

Ghisallo Master Fund LP(18) | 800,000 | * | 800,000 | — | — |

Janus Henderson Capital Funds PLC(19) | 218,539 | * | 75,194 | 143,345 | * |

Janus Henderson Venture Fund(19) | 3,722,475 | 2.36% | 1,164,806 | 2,557,669 | 1.62% |

Matrix Capital Management Master Fund, LP(20) | 8,587,500 | 5.45% | 2,500,000 | 6,087,500 | 3.86% |

Meritage Fund LLC(21) | 8,000,000 | 5.08% | 8,000,000 | — | — |

Petrus Securities, L.P.(22) | 700,000 | * | 700,000 | — | — |

Principal Funds, Inc. – MidCap Fund(23) | 8,103,363 | 5.14% | 2,660,760 | 5,442,603 | 3.45% |

Principal Global Investors Collective Investment Trust – Mid-Cap Equity Fund(23) | 194,807 | * | 47,088 | 147,719 | * |

Principal Life Insurance Company – Principal MidCap Separate Account(23) | 790,280 | * | 224,859 | 565,421 | * |

Principal Variable Contracts Funds, Inc. – MidCap Account(23) | 281,317 | * | 67,293 | 214,024 | * |

SEG Partners Offshore Master Fund, Ltd.(14) | 4,486,639 | 2.85% | 1,851,876 | 2,634,763 | 1.67% |

Senator Global Opportunity Master Fund LP(24) | 2,450,000 | 1.55% | 1,700,000 | 750,000 | * |

Slate Path Capital GP LLC(25) | 6,000,000 | 3.81% | 6,000,000 | — | — |

The WindAcre Partnership Master Fund LP(26) | 21,600,000 | 13.70% | 20,000,000 | 1,600,000 | 1.02% |

Tiger Eye Master Fund Ltd.(27) | 11,968,087 | 7.59% | 9,500,000 | 2,468,087 | 1.57% |

Tiger Eye Opportunity Fund II LLC(27) | 500,000 | * | 500,000 | — | — |

Aaron Davenport(28)(29) | 100,000 | * | 100,000 | — | — |

Amber Shook(28) | 2,500 | * | 2,500 | — | — |

Jamshid Keynejad(28)(30) | 100,000 | * | 100,000 | — | — |

Jayesh Taunk(28)(31) | 4,000 | * | 4,000 | — | — |

| | | | | | | | | | | | | | | | | |

| Securities Beneficially Owned prior to this Offering | Maximum Number of Securities to be Sold in this Offering | Securities Beneficially Owned after this Offering |

| Name of Selling Securityholder | Perimeter Ordinary Shares | Percentage(1) | Perimeter Ordinary Shares | Perimeter Ordinary Shares | Percentage(1) |

John Norris(28) | 100,000 | * | 100,000 | — | — |

Joshua and Lauren Lieberman(28) | 2,500 | * | 2,500 | — | — |

Michael Anagnos(28) | 5,000 | * | 5,000 | — | — |

Robert Abrams(28) | 2,500 | * | 2,500 | — | — |

Simon Dowker(32) | 2,500 | * | 2,500 | — | — |

Stephen d’Incelli(28) | 10,000 | * | 10,000 | — | — |

Mike Lisman | 15,000 | * | 15,000 | — | — |

EverArc Founders LLC(33) | 42,103,588 | 26.71% | 42,103,488 | 100 | * |

Tracy Britt Cool(34) | 189,282 | * | 153,082 | 36,200 | * |

Haitham Khouri(35) | 1,475,385 | * | 1,293,859 | 181,526 | * |

Vivek Raj(36) | 584,406 | * | 484,406 | 100,000 | * |

William N. Thorndike, Jr.(37) | 2,737,546 | 1.74% | 2,237,546 | 500,000 | * |

W. Nicholas Howley (38) | 1,291,685 | * | 696,446 | 595,239 | * |

The Cleveland Foundation(39) | 2,601,123 | 1.65% | 2,601,123 | — | — |

* Less than one percent of outstanding Ordinary Shares. |

___________________________(1) Percentages are based on 157,630,816 Ordinary Shares outstanding as of April 24, 2023 (excluding any shares held in treasury by Perimeter).

(2) Edward Goldberg serves as the Vice Chairman of Perimeter and as a Director of Perimeter.

(3) Barry Lederman served as the Chief Financial Officer of Perimeter from November 2021 until May 2022.

(4) Noriko Yokozuka serves as General Counsel of Perimeter.

(5) Stephen Cornwall serves as the President, Specialty Products of Perimeter.

(6) Ernest Kremling served as the Chief Operations Officer of Perimeter from November 2021 until January 2023.

(7) Shannon Horn serves as the Business Director of Perimeter.

(8) Sean Hennessy serves as a Director of Perimeter.

(9) Kevin Stein served as a Director of Perimeter from November 2021 until April 2022.

(10) BV Texas Partners LLC is managed by Akard Partners LLC. Scout Management Partners LLC and MDS Akard Partners I, LLC are the managing members of Akard Partners LLC and may be deemed to have voting and dispositive power with respect to such shares. Cody Donnan and Michael Starcher control Scout Management Partners LLC and MDS Akard I, LLC, and, accordingly, may be deemed to have voting and dispositive power with respect to the shares held by BV Texas Partners LLC. Messrs. Donnan and Starcher disclaim beneficial ownership of the shares held by BV Texas Partners LLC. The business address for BV Texas Partners is 2121 North Akard Street, Dallas, TX, 75201.

(11) Alyeska Investment Group, L.P., the investment manager of Alyeska Master Fund, L.P. (“Alyeska Fund”), has voting and investment control of the shares held by Alyeska Fund. Anand Parekh is the Chief Executive Officer of Alyeska Investment Group, L.P. and may be deemed to be the beneficial owner of such shares. Mr. Parekh, however, disclaims any beneficial ownership of the shares held by Alyeska Fund. The registered address of Alyeska Master Fund, L.P. is at c/o Maples Corporate Services Limited, P.O. Box 309, Ugland House, South Church Street George Town, Grand Cayman, KY1-1104, Cayman Islands. Alyeska Investment Group, L.P. is located at 77 W. Wacker, Suite 700, Chicago IL 60601.

(12) Aperture Endeavour Equity Fund (the “Aperture Fund”) is a series within the Advisors’ Inner Circle Fund III, a Delaware statutory trust, and has appointed Aperture Investors, LLC (“Aperture Investors”) as its Investment Adviser. Thomas Tully, an employee of Aperture Investors, has been appointed the sole Portfolio Manager of the Aperture Fund and may therefore be deemed to have voting and dispositive power over the Aperture Fund’s assets but disclaims all beneficial ownership of such assets.

(13) BCP – 2021 Series LLC – Series EH (“BCP”) is managed by Bratenahl Capital Partners, LTD. Michael C. Howley, manager of Bratenahl Capital Partners, LTD. has voting and dispositive power over the shares. BCP is located at 600 Superior Ave. E. Suite 1701 Cleveland, OH 44114.

(14) Consists of (i) 2,271,618 Ordinary Shares (including 306,351 Ordinary Shares that may be acquired pursuant to the exercise of 1,225,404 Warrants) held by Cooper Square Fund, L.P., (ii) 875,785 Ordinary Shares (including 39,580 Ordinary Shares that may be acquired pursuant to the exercise of 158,320 Warrants) held by Cooper Square Fund II, L.P., (iii) 512,246 Ordinary Shares (including 29,069 Ordinary Shares that may be acquired pursuant to the exercise of 116,276 Warrants) held by Cooper Square Offshore Master Fund, Ltd., (iv) 167,415 Ordinary Shares held by CPG Cooper Square International Equity, LLC and (v) 4,486,639 Ordinary Shares (including 400,943 Ordinary Shares that may be acquired pursuant to the

exercise of 1,603,771 Warrants) held by SEG Partners Offshore Master Fund, Ltd. Select Equity, a limited partnership controlled by George S. Loening, has the power to vote or direct the vote of, and dispose or direct the disposition of, the shares beneficially owned by Cooper Square Fund, L.P., Cooper Square Fund II, L.P., Cooper Square Offshore Master Fund, Ltd., CPG Cooper Square International Equity, LLC and SEG Partners Offshore Master Fund, Ltd. Select Equity is an investment adviser and possesses the power to vote or direct the vote of, and dispose or direct the disposition of such shares. George S. Loening is a control person of Select Equity and possesses the power to vote or direct the vote of, and dispose or direct the disposition of, such shares.

(15) Consists of 2,221,167 Ordinary Shares held by Capital Research Global Investors (“CRGI”), a division of Capital Research and Management Company ("CRMC"). For purposes of the reporting requirements of the Exchange Act, CRMC, CRGI or Capital World Investors (“CWI”) may be deemed to be the beneficial owner of the Ordinary Shares held by CRGI; however, each of CRMC, CRGI and CWI expressly disclaims that it is, in fact, the beneficial owner of such securities. Brady L. Enright, Julian N. Abdey, Jonathan Knowles, Gregory W. Wendt, Peter Eliot, Bradford F. Freer, Leo Hee, Roz Hongsaranagon, Harold H. La, Dimitrije Mitrinovic, Aidan O’Connell, Samir Parekh, Andraz Razen, Renaud H. Samyn, Arun Swaminathan, Thatcher Thompson, Michael Beckwith, and Shlok Melwani, as portfolio managers, have voting and investment powers over the shares held by CRGI. The address for CRGI is c/o Capital Research and Management Company, 333 S. Hope St., 55th Floor, Los Angeles, California 90071. CRGI acquired the securities being registered hereby in the ordinary course of its business.

(16) These securities are held of record by Darlington Partners, L.P. and Darlington Partners II, L.P. (together, the “Darlington Funds”). Such shares include (i) 1,723,918 Ordinary Shares held of record by Darlington Partners, L.P. and (ii) 276,082 Ordinary Shares held of record by Darlington Partners II, L.P. Ultimate voting and dispositive power with respect to the shares held by the foregoing entities is exercised by Darlington Partners GP, LLC, the general partner of the Darlington Funds. The business address for each of the entities identified herein is 300 Drakes Landing Road, Suite 290, Greenbrae, CA 94904.

(17) Eminence Capital, LP serves as the investment adviser to, and may be deemed to have shared voting and dispositive power over the shares held by, EC Longhorn LLC and Eminence Holdings LLC (collectively “Eminence”). Ricky C. Sandler is the Chief Executive Officer of Eminence Capital, LP and may be deemed to have shared voting and dispositive power over the shares held by Eminence. Each of Mr. Sandler and Eminence Capital, LP expressly disclaims beneficial ownership of such securities. The business address for Eminence is c/o Eminence Capital, LP 399 Park Avenue, 25th Floor, New York, NY 10022.

(18) Ghisallo Master Fund LP. (“Ghisallo Fund”) is the beneficial owner of the shares. Ghisallo Capital Management LLC (“Ghisallo Capital”) is the investment manager of Ghisallo Fund and has voting control over the shares. Michael Germino is the managing member of Ghisallo Capital. Ghisallo Fund is located at c/o Walkers Corporate, 190 Elgin Avenue, George Town Grand Cayman, CI KY 1-9008.

(19) Such shares may be deemed to be beneficially owned by Janus Capital Management LLC (“Janus”), an investment adviser registered under the Investment Advisers Act of 1940, who acts as investment adviser for Janus Henderson Venture Fund (the “Janus Fund”) and has the ability to make decisions with respect to the voting and disposition of the shares subject to the oversight of the board of directors of the Janus Fund. Under the terms of its management contract with the Janus Fund, Janus has overall responsibility for directing the investments of the Janus Fund in accordance with the Janus Fund’s investment objective, policies and limitations. Jonathan Coleman and Scott Stutzman are the portfolio managers appointed by and serving at the pleasure of Janus who makes decisions with respect to the disposition of the shares. The address for Janus is 151 Detroit Street, Denver, CO 80206.

(20) David Goel is the Managing General Partner of Matrix Capital Management Master Fund, LP (“Matrix”) and may be deemed to have voting and dispositive power over the shares held by Matrix. The mailing address for Matrix is 1000 Winter Street, Suite 4500, Waltham, Massachusetts 02451.

(21) Meritage Group LP, investment manager of Meritage Fund LLC, has all voting and dispositive power over the shares. The business address of Meritage Fund LLC is 66 Field Point Road, Greenwich, CT 06830.

(22) Includes 700,000 shares held by Petrus Securities, L.P. Petrus Trust Company, LTA is the investment manager of Petrus Securities, L.P. and Petrus Capital Management, LLC is the general partner of Petrus Securities L.P. As such, each of Petrus Trust Company, LTA and Petrus Capital Management, LLC has voting and investment control of the shares held by Petrus Securities, L.P. Each of Petrus Trust Company, LTA and Petrus Capital Management, LLC may be deemed to be the beneficial owner of such shares; provided, however, each of Petrus Trust Company, LTA and Petrus Capital Management, LLC disclaims any beneficial ownership of the shares held by Petrus Securities, L.P. The business address of Petrus Securities, L.P., Petrus Trust Company, LTA and Petrus Capital Management, LLC is 3000 Turtle Creek Boulevard, Dallas, Texas 75219 USA.

(23) Principal Global Investors, LLC is the investment manager and has authority to vote the shares. Bill Nolin, CIO and Portfolio Manager of Principal Global Investors, LLC is the natural person with such authority. The business address of Principal Global Investors, LLC is 711 High Street, Des Moines IA 50392.

(24) Consists of (i) 1,700,000 Ordinary Shares held by Senator Global Opportunity Master Fund L.P. (“Senator Global Fund”) and (ii) 750,000 Ordinary Shares that may be acquired pursuant to the exercise of 3,000,000 Warrants. Senator Investment Group LP, or (“Senator”), is investment manager of Senator Global Fund and may be deemed to have voting and dispositive power with respect to the shares. The general partner of Senator is Senator Management LLC (the “Senator GP”). Douglas Silverman controls Senator GP, and, accordingly, may be deemed to have voting and dispositive power with respect to the shares held by Senator Global Fund. Mr. Silverman disclaims beneficial ownership of the shares held by Senator Global Fund. The business address for Senator Global Fund is 510 Madison Avenue, 28th Floor, New York, NY 10022.

(25) Slate Path Capital GP LLC (“Slate Path GP”) is the General Partner of Slate Path Master Fund LP (“Slate Path LP”). David Greenspan, Managing Member, Slate Path GP, has control over the voting and dispositive power of shares beneficially owned. The business address for Slate Path LP is 717 Fifth Avenue, 16th Floor, New York, NY 10022.

(26) Consists of 20,000,000 Ordinary Shares owned of record by The WindAcre Partnership Master Fund LP, an exempted limited partnership established in the Cayman Islands (“Master Fund”). The WindAcre Partnership LLC, a Delaware limited liability company (“WindAcre”) serves as the investment manager of the Master Fund. Snehal Rajnikant Amin is the principal beneficial owner and managing member of WindAcre and the only beneficial owner holding more than 5% (“Mr. Amin”). Mr. Amin disclaims beneficial ownership of the securities owned by the Master Fund except to the extent of

his pecuniary interest therein. The principal business address of the Master Fund is Elian Fiduciary Services (Cayman) LTD, 190 Elgin Avenue, George Town, Grand Cayman KY1-9007, Cayman Islands.

(27) Consists of (i) 11,965,649 Ordinary Shares held by Tiger Eye Master Fund Ltd (“TEM”), (ii) 500,000 Ordinary Shares held by Tiger Eye Opportunity Fund II LLC (“TEO”), (iii) 516,500 Ordinary Shares held by Tiger Eye Opportunity Fund I LLC (“TEOF”) and (iv) 2,438 Ordinary Shares that may be acquired pursuant to the exercise of 9,750 Warrants held by TEM. TEM, TEO and TEOF are managed by Tiger Eye Capital LLC (“TEC”). Benjamin S. Gambill III, as portfolio manager of TEC, will make decisions as to voting and disposition of securities. The business address for TEM, TEO and TEOF is 101 Park Avenue, 48th Floor, New York, NY 10178.

(28) At the time of the consummation of the Business Combination, the Selling Securityholder was an employee of an affiliate of SK Holdings, the owner of Perimeter prior to consummation of the Business Combination.

(29) At the time of the consummation of the Business Combination, Aaron Davenport served as Co-Invest Supervisor and Chairman on the board of SK Invictus Holdings, L.P., a parent entity of SK and SK Holdings (“Parent”).

(30) At the time of the consummation of the Business Combination. Jamshid Keynejad served as a Class A Supervisor on the board of Parent, and also served on the board of SK Capital Investment IV, Ltd., the ultimate general partner of Parent.

(31) At the time of the consummation of the Business Combination, Jayesh Taunk served as an Additional Supervisor on the board of Parent.

(32) At the time of the consummation of the Business Combination, Simon Dowker was a consultant to an affiliate of SK Holdings, the owner of Perimeter prior to consummation of the Business Combination.

(33) EverArc Founders LLC is managed by its board of managers, consisting of W. Nicholas Howley, William N. Thorndike, Jr. and Haitham Khouri, which has voting and dispositive power over the shares held by EverArc Founders LLC. EverArc Founders LLC may make a pro rata in-kind distribution of Ordinary Shares to its members. The mailing address of EverArc Founders LLC is c/o Greenberg Traurig, 401 East Las Olas Boulevard, Suite 2000, Fort Lauderdale, FL 33301.

(34) Tracy Britt Cool serves as a Director of Perimeter.

(35) Haitham Khouri serves as Chief Executive Officer of Perimeter and as a Director of Perimeter.

(36) Vivek Raj serves as a Director of Perimeter.

(37) William N. Thorndike, Jr. serves as Co-Chairman of the board of directors of Perimeter.

(38) W. Nicholas Howley serves as Co-Chairman of the board of directors of Perimeter.

(39) On December 6, 2022, W. Nicholas Howley gifted 2,601,123 Ordinary Shares to The Cleveland Foundation, a 501(c)(3) nonprofit organization. The Cleveland Foundation is managed by a board of directors, which is comprised of 15 board members. The mailing address of The Cleveland Foundation is 1422 Euclid Avenue, Suite 1300, Cleveland, OH 44115.

U.S. FEDERAL INCOME TAX CONSIDERATIONS