As filed with the Securities and Exchange Commission on August 2, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PORTLAND GENERAL ELECTRIC COMPANY

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| Oregon | 93-0256820 |

(State or Other Jurisdiction of

Incorporation or Organization) | (I.R.S. Employer

Identification No.) |

121 SW Salmon Street

Portland, Oregon 97204

(503) 464-8000

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Angelica Espinosa, Esq.

Vice President General Counsel

121 SW Salmon Street

Portland, Oregon 97204

(503) 464-8000

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Copies to:

Michael J. Hong, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

One Manhattan West

New York, NY 10001-8602

(212) 735-3000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement as determined by the registrant.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

| | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

PROSPECTUS

Portland General Electric Company

Common Stock

Debt Securities

Stock Purchase Contracts

Stock Purchase Units

and

First Mortgage Bonds

______________________________________________________________

Portland General Electric Company may offer and sell from time to time, in one or more offerings, shares of our common stock, debt securities, stock purchase contracts, stock purchase units and first mortgage bonds.

This prospectus describes some of the general terms that may apply to these securities. The specific terms of any securities to be offered will be described in a supplement to this prospectus. A prospectus supplement may also add, update or change information contained in this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you make your investment decision.

We may offer and sell these securities through one or more underwriters, dealers and agents, underwriting syndicates managed or co-managed by one or more underwriters, or directly to purchasers, on a continuous or delayed basis. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering. For general information about the distribution of securities offered, please see “Plan of Distribution” on page 15 of this prospectus.

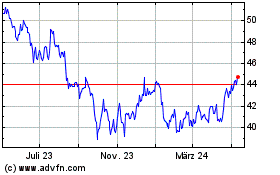

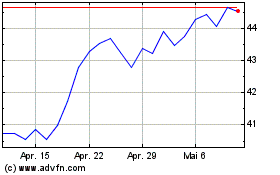

Our common stock is listed on the New York Stock Exchange under the trading symbol “POR.” On August 1, 2022, the last reported sale price of our common stock on the New York Stock Exchange was $52.15 per share. The prospectus supplement will indicate if the securities offered thereby will be listed on any securities exchange.

Investing in these securities involves certain risks. Please read carefully the information included and incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities, including the discussion of risks incorporated as described under “Risk Factors” on page 5 of this prospectus. ______________________________________________________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

______________________________________________________________

The date of this prospectus is August 2, 2022.

______________________________________________________________

PROSPECTUS

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of an "automatic shelf" registration statement that we filed with the Securities and Exchange Commission (the SEC), as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the "Securities Act"). Under this shelf registration process, we may, from time to time, sell an indeterminate amount of any combination of the securities described in this prospectus in one or more offerings.

This prospectus may not be used to sell securities unless accompanied by a prospectus supplement. This prospectus provides you with a general description of the common stock, debt securities, stock purchase contracts, stock purchase units and first mortgage bonds that we may offer. Each time that securities are sold, a prospectus supplement containing specific information about the terms of that offering will be provided, including the specific amounts, prices and terms of the securities offered. The prospectus supplements may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement and any other offering material prepared by or on behalf of us for a specific offering of securities, together with the additional information described under the heading “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

This prospectus and any accompanying prospectus supplement do not contain all of the information included in the registration statement as permitted by the rules and regulations of the SEC. For further information, we refer you to the registration statement on Form S-3, including its exhibits.

We are subject to the informational requirements of the Securities Exchange Act of 1934, and, therefore, file reports and other information with the SEC. Our SEC filings are available free of charge to the public on the SEC’s Internet site at www.sec.gov. Our file number with the SEC is 001-5532-99. Information about us, including our SEC filings, is also available through our website at www.portlandgeneral.com. However, information on our website is not incorporated into this prospectus supplement or our other SEC filings and is not a part of this prospectus supplement or those filings.

Statements contained in this prospectus and any accompanying prospectus supplement or other offering material about the provisions or contents of any agreement or other document are only summaries. If SEC rules require that any agreement or document be filed as an exhibit to the registration statement, you should refer to that agreement or document for its complete contents.

You should rely only on the information contained or incorporated by reference in this prospectus and the applicable prospectus supplement. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information provided in this prospectus, any prospectus supplement or any other offering material is accurate as of any date other than the date on the front of those documents, as applicable. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless otherwise stated or the context otherwise requires, references in this prospectus to “PGE,” “we,” “our,” “us” or the “Company” refer to Portland General Electric Company and its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus and the other public filings incorporated by reference herein include statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements that relate to expectations, beliefs, plans, assumptions, and objectives concerning future results of operations, business prospects, loads, outcome of litigation and regulatory proceedings, capital expenditures, market conditions, future events or performance, and other matters. Words or phrases such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will likely result,” “will continue,” “should,” or similar expressions are intended to identify forward-looking statements.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those risks discussed in this prospectus or otherwise incorporated by reference, that could cause actual results or outcomes to differ materially from those expressed. PGE’s expectations, beliefs and projections are expressed in good faith and are believed by the Company to have a reasonable basis including, but not limited to, management’s examination of historical operating trends and data contained either in internal records or available from third parties, but there can be no assurance that PGE’s expectations, beliefs or projections will be achieved or accomplished.

In addition to any assumptions and other factors and matters discussed elsewhere in this prospectus or incorporated by reference herein, some important factors that could cause actual results or outcomes for PGE to differ materially from those discussed in such forward-looking statements include:

•governmental policies, legislative action, and regulatory audits, investigations and actions, including those of the Federal Energy Regulatory Commission and the Public Utility Commission of Oregon with respect to allowed rates of return, financings, electricity pricing and price structures, acquisition and disposal of facilities and other assets, construction and operation of plant facilities, transmission of electricity, recovery of power costs, operating expenses, deferrals, timely recovery of costs, and capital investments, and current or prospective wholesale and retail competition;

•economic conditions that result in decreased demand for electricity, reduced revenue from sales of excess energy during periods of low wholesale market prices, impaired financial stability of vendors and service providers, and elevated levels of uncollectible customer accounts;

•inflation and interest rates;

•changing customer expectations and choices that may reduce customer demand for its services may impact PGE’s ability to make and recover its investments through rates and earn its authorized return on equity, including the impact of growing distributed and renewable generation resources, changing customer demand for enhanced electric services, and an increasing risk that customers procure electricity from registered Electricity Service Suppliers (ESSs) or community choice aggregators;

•the outcome of legal and regulatory proceedings and issues;

•natural or human-caused disasters and other risks, including, but not limited to, earthquake, flood, ice, drought, extreme heat, lightning, wind, fire, accidents, equipment failure, acts of terrorism, computer system outages and other events that disrupt PGE operations, damage PGE facilities and systems, cause the release of harmful materials, cause fires, and subject the Company to liability;

•unseasonable or extreme weather and other natural phenomena, such as the greater size and prevalence of wildfires in Oregon in recent years, which could affect public safety, customers’ demand for power and PGE’s ability and cost to procure adequate power and fuel supplies to serve its customers, PGE’s ability to access the wholesale energy market, PGE’s ability to operate its generating facilities and transmission and distribution systems, the Company’s costs to maintain, repair, and replace such facilities and systems, and recovery of costs;

•PGE’s ability to effectively implement a public safety power shutoff (PSPS) and de-energize its system in the event of heightened wildfire risk, which could cause damage to the Company’s own facilities or lead to potential liability if energized systems are involved in wildfires that cause harm;

•operational factors affecting PGE’s power generating facilities and battery storage facilities, including forced outages, unscheduled delays, hydro and wind conditions, and disruption of fuel supply, any of which may cause the Company to incur repair costs or purchase replacement power at increased costs;

•default or nonperformance on the part of any parties from whom PGE purchases capacity or energy, which may cause the Company to incur costs to purchase replacement power and related renewable attributes at increased costs;

•complications arising from PGE’s jointly-owned plant, including changes in ownership, adverse regulatory outcomes or legislative actions, or operational failures that result in legal or environmental liabilities or unanticipated costs related to replacement power or repair costs;

•delays in the supply chain and increased supply costs, failure to complete capital projects on schedule or within budget, failure of counterparties to perform under agreements, or the abandonment of capital projects, any of which could result in the Company’s inability to recover project costs;

•volatility in wholesale power and natural gas prices that could require PGE to post additional collateral or issue additional letters of credit pursuant to power and natural gas purchase agreements;

•changes in the availability and price of wholesale power and fuels, including natural gas and coal, and the impact of such changes on the Company’s power costs;

•capital market conditions, including availability of capital, volatility of interest rates, reductions in demand for investment-grade commercial paper, as well as changes in PGE’s credit ratings, any of which could have an impact on the Company’s cost of capital and its ability to access the capital markets to support requirements for working capital, construction of capital projects, and the repayments of maturing debt;

•future laws, regulations, and proceedings that could increase the Company’s costs of operating its thermal generating plants, or affect the operations of such plants by imposing requirements for additional emissions controls or significant emissions fees or taxes, particularly with respect to coal-fired generating facilities, in order to mitigate carbon dioxide, mercury, and other gas emissions;

•changes in, and compliance with, environmental laws and policies, including those related to threatened and endangered species, fish, and wildlife;

•the effects of climate change, whether global or local in nature, including unseasonable or extreme weather and other natural phenomena that may affect energy costs or consumption, increase the Company’s costs, cause damage to PGE facilities and system, or adversely affect its operations;

•changes in residential, commercial, or industrial customer demand, or demographic patterns, in PGE’s service territory;

•the effectiveness of PGE’s risk management policies and procedures;

•cybersecurity attacks, data security breaches, physical security breaches, or other malicious acts that cause damage to the Company’s generation, transmission, or distribution facilities, information technology systems, inhibit the capability of equipment or systems to function as designed or expected, or result in the release of confidential customer, employee, or Company information;

•employee workforce factors, including potential strikes, work stoppages, transitions in senior management, the ability to recruit and retain key employees and other talent, and turnover due to macroeconomic trends such as voluntary resignation of large numbers of employees similar to that experienced by other employers and industries since the beginning of the coronavirus (COVID-19) pandemic;

•new federal, state, and local laws that could have adverse effects on operating results;

•failure to achieve the Company’s greenhouse gas emission goals or being perceived to have either failed to act responsibly with respect to the environment or effectively responded to legislative requirements concerning greenhouse gas emission reductions, any of which can lead to adverse publicity and have adverse effects on the Company's operations and/or damage the Company's reputation;

•political and economic conditions;

•the impact of widespread health developments, including the global COVID–19 pandemic, and responses to such developments (such as voluntary and mandatory quarantines, including government stay at home orders, as well as shut downs and other restrictions on travel, commercial, social and other activities), which could materially and adversely affect, among other things, demand for electric services, customers’ ability to pay, supply chains, personnel, contract counterparties, liquidity and financial markets;

•changes in financial or regulatory accounting principles or policies imposed by governing bodies;

•acts of war or terrorism; and

•risks and uncertainties related to RFP final shortlist projects, including, but not limited to regulatory processes, inflationary impacts, supply chain constraints, supply cost increases (including application tariffs impacting solar module imports), and legislative uncertainty.

While we believe that the assumptions underlying such forward–looking statements are reasonable, there can be no assurance that future events or developments will not cause such statements to be inaccurate. Any forward-looking statement speaks only as of the date on which such statement is made and, except as required by law, PGE undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time and it is not possible for management to predict all such factors or assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. All forward-looking statements contained in this prospectus and the documents we incorporate by reference in this prospectus are qualified in their entirety by this cautionary statement. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statements to reflect any changes in events or circumstances or in our expectations or results.

PORTLAND GENERAL ELECTRIC COMPANY

Portland General Electric Company (PGE or the Company), a vertically integrated electric utility with corporate headquarters located in Portland, Oregon, is engaged in the generation, purchase, transmission, distribution, and retail sale of electricity. The

Company operates as a cost-based, regulated electric utility with revenue requirements and customer prices determined based upon the forecasted cost to serve retail customers, and a reasonable rate of return as determined by the Public Utility Commission of Oregon. PGE meets its retail load requirement with both Company-owned generation and power purchased in the wholesale market. The Company participates in the wholesale market through the purchase and sale of electricity and natural gas, as well as buying and selling transmission products and services, in an effort to obtain reasonably-priced power to serve its retail customers. In addition, PGE offers wholesale electricity transmission service pursuant to its Open Access Transmission Tariff, which contains rates, terms, and conditions of service, as filed with, and approved by, the Federal Energy Regulatory Commission. PGE, incorporated in 1930, is publicly-owned, with its common stock listed on the New York Stock Exchange under the ticker symbol “POR.” The Company operates as a single business segment, with revenues and costs related to its business activities maintained and analyzed on a total electric operations basis.

PGE’s state-approved service area allocation of approximately 4,000 square miles is located entirely within Oregon and includes 51 incorporated cities, of which Portland and Salem are the largest. The Company estimates that at the end of 2021 its service area population was 1.9 million.

Our principal executive offices are located at 121 SW Salmon Street, Portland, Oregon 97204. Our telephone number is (503) 464-8000. Our website is www.portlandgeneral.com. Information contained on our website does not constitute a part of this prospectus.

The foregoing information about us is only a general summary and is not intended to be comprehensive. For additional information about PGE, you should refer to the information described under the heading “Where You Can Find More Information.”

RISK FACTORS

You should consider the specific risks described in our Annual Report on Form 10-K for the year ended December 31, 2021, (together with any material changes thereto contained in subsequently filed Quarterly reports on Form 10-Q), the risk factors described under the caption “Risk Factors” in any applicable prospectus supplement and any risk factors set forth in our other filings with the SEC, pursuant to Sections 13(a), 14 or 15(d) of the Securities Exchange Act of 1934, before making an investment decision. Each of the risks described in these documents could materially and adversely affect our business, financial condition, results of operations and prospects, and could result in a partial or complete loss of your investment. See “Where You Can Find More Information” in this prospectus. You should also carefully review the cautionary statement in this prospectus referred to above under “Cautionary Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

Unless otherwise indicated in the applicable prospectus supplement with respect to the proceeds from the sale of the particular securities to which such prospectus supplement relates, we intend to use the net proceeds from the sale of the offered securities for general corporate purposes, including financing capital projects and refinancing existing indebtedness.

DESCRIPTION OF SECURITIES

This prospectus contains a summary of our common stock, debt securities, stock purchase contracts, stock purchase units and first mortgage bonds. These summaries are not meant to be a complete description of each security. The particular terms of any security to be issued pursuant hereto will be set forth in a related prospectus supplement. This prospectus and the accompanying prospectus supplement will contain the material terms and conditions for each security.

DESCRIPTION OF COMMON STOCK

The following description of our common stock is a summary and is subject to our Third Amended and Restated Articles of Incorporation (“Articles of Incorporation”) and our Eleventh Amended and Restated Bylaws (“Bylaws”) and to the applicable provisions of Oregon corporate law. You should refer to our Articles of Incorporation and our Bylaws and to Oregon corporate law for a complete understanding of the terms and rights of our common stock.

General

Our Articles of Incorporation provide that we have authority to issue up to 160,000,000 shares of common stock, no par value. Our common stock is listed and traded on the New York Stock Exchange under the ticker symbol “POR.” The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company.

Voting Rights

Except as otherwise provided by law or our Articles of Incorporation, and subject to the rights of holders of any outstanding shares of our preferred stock, all of the voting power of our shareholders is vested in the holders of our common stock, and each holder of common stock has one vote for each share on all matters voted upon by our shareholders. Our Articles of Incorporation do not provide for cumulative voting for the election of directors.

Dividend Rights

Except as otherwise provided by law, regulatory restriction or the Articles of Incorporation, and subject to the rights of holders of any outstanding shares of our preferred stock, holders of our common stock are entitled to receive dividends when and as declared by the Board of Directors out of any funds legally available for the payment of dividends.

Other Rights

Holders of our common stock do not have any preemptive or other rights to subscribe for, purchase or receive any proportionate or other amount of our common stock or any securities of the Company convertible into our common stock upon the issuance of our common stock or any such convertible securities. There are also no redemption or sinking fund provisions applicable to our common stock.

Liquidation Rights

If we were voluntarily or involuntarily liquidated, dissolved or wound up, the holders of our outstanding shares of common stock would be entitled to share in the distribution of all assets remaining after payment of all of our liabilities and after satisfaction of prior distribution rights and payment of any distributions owing to holders of any outstanding shares of our preferred stock.

Liability for Calls and Assessments

The outstanding shares of our common stock are validly issued, fully paid and non-assessable.

Shareholder Action

Except as otherwise required by law, a majority of the shares of our common stock entitled to be voted at a meeting constitutes a quorum for the transaction of business at a meeting. Except as otherwise required by law, each matter, other than the election of directors, is decided by a majority of votes cast. Directors are elected annually by a majority of votes cast by the shares entitled to vote in an election at a meeting at which a quorum is present, except in the case of a contested election. In the case of a contested election, directors are elected by a plurality of votes cast by the shares entitled to vote in an election at a meeting at which a quorum is present. Special meetings of our shareholders may be called by our Chairman of the Board, our Chief Executive Officer, our President or by our Board of Directors.

Except as otherwise provided by law or in our Articles of Incorporation, and subject to restrictions on the taking of shareholder action without a meeting under applicable law or the rules of a national securities association or exchange, action required or permitted by law to be taken at a shareholders’ meeting may be taken without a meeting if the action is taken by shareholders having not less than the minimum number of votes that would be required to take such action at a meeting at which all shareholders entitled to vote on the action were present and voted.

Vacancies and Removal of Directors

Any vacancy, including a vacancy resulting from an increase in the number of directors, occurring on our Board of Directors may be filled by our shareholders, the Board of Directors or the affirmative vote of a majority of the remaining directors if less than a quorum of the Board of Directors or by a sole remaining director. A vacancy that will occur at a specific later date, by reason of a resignation or otherwise, may be filled before the vacancy occurs, and the new director shall take office when the vacancy occurs.

Shareholders may remove one or more directors with or without cause at a meeting called expressly for that purpose. A director may be removed only if the number of votes cast to remove a director exceeds the number cast not to remove the director. If a director is elected by a voting group of shareholders, only those shareholders may participate in the vote to remove the director.

Provisions with Possible Anti-Takeover Effects

An Oregon company may provide in its articles of incorporation or bylaws that certain control share and business combination provisions in the Oregon Business Corporation Act do not apply to its shares. We have not opted out of these provisions.

Oregon Control Share Act. We are subject to Sections 60.801 through 60.816 of the Oregon Business Corporation Act, known as the “Oregon Control Share Act.” The Oregon Control Share Act generally provides that a person who acquires voting stock of an Oregon corporation, in a transaction that results in the acquiror holding more than 20%, 33 1/3% or 50% of the total voting power of the corporation, cannot vote the shares it acquires in the acquisition. An acquiror is broadly defined to include companies or persons acting as a group to acquire the shares of the Oregon corporation. This restriction does not apply if voting rights are given to the control shares by:

•a majority of the outstanding voting shares, including shares held by the company’s officers and employee directors; and

•a majority of the outstanding voting shares, excluding the control shares held by the acquiror and shares held by the company’s officers and employee directors.

In order to retain the voting rights attached to acquired shares, this vote would be required when an acquiror’s holdings exceed 20% of the total voting power, and again at the time the acquiror’s holdings exceed 33 1/3% and 50%, respectively.

The acquiror may, but is not required to, submit to the target company an “acquiring person statement” that includes specific information about the acquiror and its plans for the company. The acquiring person statement may also request that the company call a special meeting of shareholders to determine whether the control shares will be allowed to have voting rights. If the acquiror requests a special meeting and undertakes to pay the target company's expenses of the meeting, the directors of the target company must, within 10 days after receiving the acquiring person statement, call a special meeting for the purpose of considering the voting rights of the control shares. If the acquiror does not request a special meeting of shareholders, the issue of voting rights of control shares will be considered at the next annual or special meeting of shareholders that is held more than 60 days after the date of the acquisition of control shares. If the acquiror’s control shares are allowed to have voting rights and represent a majority or more of all voting power, shareholders who do not vote in favor of voting rights for the control shares will have the right to receive the appraised fair value of their shares, which may not be less than the highest price paid per share by the acquiror for the control shares.

Shares are not deemed to be acquired in a control share acquisition if, among other things, they are acquired from the issuing corporation, or are issued pursuant to a plan of merger or exchange effected in compliance with the Oregon Business Corporation Act and the issuing corporation is a party to the merger or exchange agreement.

Oregon Business Combination Act. We are also subject to Sections 60.825 through 60.845 of the Oregon Business Corporation Act, known as the “Oregon Business Combination Act.” The Oregon Business Combination Act governs business combinations between Oregon corporations and a person or entity that acquires 15% or more of the outstanding voting stock of the corporation, thereby becoming an “interested shareholder.” The Oregon Business Combination Act generally provides that the corporation and the interested shareholder, or any affiliated entity of the interested shareholder, may not engage in business combination transactions for three years following the date the person acquired the shares. Business combination transactions for this purpose include:

•a merger or plan of exchange;

•any sale, lease, mortgage or other disposition of the assets of the corporation where the assets have an aggregate market value equal to 10% or more of the aggregate market value of the corporation’s assets or outstanding capital stock; and

•transactions that result in the issuance or transfer of capital stock of the corporation to the interested shareholder.

These business combination restrictions do not apply if:

•the board of directors approves the business combination or the transaction that resulted in the shareholder acquiring the shares before the acquiring shareholder acquires 15% or more of the corporation’s voting stock;

•as a result of the transaction in which the person acquired the shares, the acquiring shareholder became an interested shareholder and owner of at least 85% of the outstanding voting stock of the corporation, disregarding shares owned by employee directors and shares owned by certain employee benefits plans; or

•the board of directors and the holders of at least two-thirds of the outstanding voting stock of the corporation at an annual or special meeting of shareholders, disregarding shares owned by the interested shareholder, approve the business combination after the acquiring shareholder acquires 15% or more of the corporation’s voting stock.

DESCRIPTION OF DEBT SECURITIES

We may offer debt securities in one or more series, which may be senior debt securities or subordinated debt securities and which may be convertible into another security.

The following description briefly sets forth certain general terms and provisions of the debt securities other than the first mortgage bonds that we may offer by this prospectus in one or more distinct offerings. The particular terms of the debt securities offered by any prospectus supplement and the extent, if any, to which the following general terms and provisions may

apply to the debt securities, will be described in an accompanying prospectus supplement. Unless otherwise specified in an

accompanying prospectus supplement, our debt securities will be issued in one or more series under an indenture to be entered

into between us and trustee named therein. A form of the indenture is attached as an exhibit to the registration statement of which this prospectus forms a part. The terms of the debt securities will include those set forth in the indenture and those made a part of the indenture by the Trust Indenture Act of 1939 (“TIA”). You should read the summary below, any accompanying prospectus supplement and the provisions of the indenture in their entirety before investing in our debt securities.

The aggregate principal amount of debt securities that may be issued under the indenture is unlimited. The prospectus

supplement relating to any series of debt securities that we may offer will contain the specific terms of the debt securities. These

terms may include, among others, the following:

•the title and aggregate principal amount of the debt securities and any limit on the aggregate principal amount of such series;

•any applicable subordination provisions for any subordinated debt securities;

•the maturity date(s) or method for determining same;

•the interest rate(s) or the method for determining same;

•the dates on which interest will accrue or the method for determining dates on which interest will accrue and dates on which interest will be payable and whether interest will be payable in cash, additional securities or some combination thereof;

•whether the debt securities are convertible or exchangeable into other securities and any related terms and conditions;

•redemption or early repayment provisions;

•authorized denominations;

•if other than the principal amount, the principal amount of debt securities payable upon acceleration;

•place(s) where payment of principal and interest may be made, where debt securities may be presented and where notices or demands upon the Company may be made;

•the form or forms of the debt securities of the series including such legends as may be required by applicable law;

•whether the debt securities will be issued in whole or in part in the form of one or more global securities and the date as of which the securities are dated if other than the date of original issuance;

•whether the debt securities are secured and the terms of such security;

•the amount of discount or premium, if any, with which the debt securities will be issued;

•any covenants applicable to the particular debt securities being issued;

•any additions or changes in the defaults and events of default applicable to the particular debt securities being issued;

•the guarantors of each series, if any, and the extent of the guarantees (including provisions relating to seniority, subordination and release of the guarantees), if any;

•the currency, currencies or currency units in which the purchase price for, the principal of and any premium and any interest on, the debt securities will be payable;

•the time period within which, the manner in which and the terms and conditions upon which we or the holders of the debt securities can select the payment currency;

•our obligation or right to redeem, purchase or repay debt securities under a sinking fund, amortization or analogous provision;

•any restriction or conditions on the transferability of the debt securities;

•provisions granting special rights to holders of the debt securities upon occurrence of specified events;

•additions or changes relating to compensation or reimbursement of the trustee of the series of debt securities;

•provisions relating to the modification of the indenture both with and without the consent of holders of debt securities issued under the indenture and the execution of supplemental indentures for such series; and

•any other terms of the debt securities (which terms shall not be inconsistent with the provisions of the TIA, but may modify, amend, supplement or delete any of the terms of the indenture with respect to such series of debt securities).

General

We may sell the debt securities, including original issue discount securities, at par or at a substantial discount below their stated

principal amount. Unless we inform you otherwise in a prospectus supplement, we may issue additional debt securities of a

particular series without the consent of the holders of the debt securities of such series or any other series outstanding at the

time of issuance. Any such additional debt securities, together with all other outstanding debt securities of that series, will

constitute a single series of securities under the indenture.

We will describe in an accompanying prospectus supplement any other special considerations for any debt securities we sell

that are denominated in a currency or currency unit other than U.S. dollars. In addition, debt securities may be issued where the

amount of principal and/or interest payable is determined by reference to one or more currency exchange rates, commodity

prices, equity indices or other factors. Holders of such securities may receive a principal amount or a payment of interest that is

greater than or less than the amount of principal or interest otherwise payable on such dates, depending upon the value of the

applicable currencies, commodities, equity indices or other factors. Information as to the methods for determining the amount of principal or interest, if any, payable on any date, and the currencies, commodities, equity indices or other factors to which the

amount payable on such date is linked will be described in an accompanying prospectus supplement.

United States federal income tax consequences and special considerations, if any, applicable to any such series will be

described in an accompanying prospectus supplement.

We expect most debt securities to be issued in fully registered form in denominations of $2,000 and any integral multiple of $1,000 in excess thereof. Subject to the limitations provided in the indenture and in an accompanying prospectus supplement, debt securities that are issued in registered form may be transferred or exchanged at the designated corporate trust office of the trustee, without the payment of any service charge, other than any tax or other governmental charge payable in connection therewith.

Global Securities

Unless we inform you otherwise in an accompanying prospectus supplement, the debt securities of a series may be issued in

whole or in part in the form of one or more global securities that will be deposited with, or on behalf of, a depositary identified

in an accompanying prospectus supplement. Unless and until a global security is exchanged in whole or in part for the

individual debt securities, a global security may not be transferred except as a whole by the depositary for such global security to a nominee of such depositary or by a nominee of such depositary to such depositary or another nominee of such depositary or

by such depositary or any such nominee to a successor of such depositary or a nominee of such successor.

Governing Law

The indenture and the debt securities shall be construed in accordance with and governed by the laws of the State of New York, except to the extent the Trust Indenture Act of 1939 otherwise applies.

DESCRIPTION OF STOCK PURCHASE CONTRACTS AND STOCK PURCHASE UNITS

We may issue stock purchase contracts, including contracts obligating holders to purchase from us, and obligating us to sell to

the holders, a specified number of shares of our common stock or our debt securities at a future date or dates, which we refer to

in this prospectus as stock purchase contracts. The price of the securities and the number of securities may be fixed at the time

the stock purchase contracts are issued or may be determined by reference to a specific formula set forth in the stock purchase

contracts, and may be subject to adjustment under anti-dilution formulas. The stock purchase contracts may be issued separately

or as part of units consisting of a stock purchase contract and our debt securities or preferred securities or debt obligations of

third parties, including U.S. treasury securities, or any combination of the foregoing, securing the holders’ obligations to

purchase the securities under the stock purchase contracts, which we refer to herein as stock purchase units. The stock purchase

contracts may require holders to secure their obligations under the stock purchase contracts in a specified manner. The stock

purchase contracts also may require us to make periodic payments to the holders of the stock purchase contracts or the stock

purchase units, as the case may be, or vice versa, and those payments may be unsecured or pre-funded in whole or in part.

The description in an accompanying prospectus supplement of any stock purchase contract or stock purchase unit we offer will

not necessarily be complete and will be qualified in its entirety by reference to the applicable stock purchase contract or stock

purchase unit, which will be filed with the SEC if we offer stock purchase contracts or stock purchase units. For more

information on how you can obtain copies of any purchase contract or purchase unit we may offer, see “Where You Can Find

More Information.” We urge you to read the applicable purchase contract or applicable purchase unit and any accompanying

prospectus supplement in their entirety.

DESCRIPTION OF FIRST MORTGAGE BONDS

We may issue the first mortgage bonds under our Indenture of Mortgage and Deed of Trust dated July 1, 1945, between us and Wells Fargo Bank, National Association as trustee (the “Trustee”), as supplemented and amended. The original mortgage, as so supplemented and amended, is referred to as the “Mortgage.” The first mortgage bonds that we may issue under the Mortgage are referred to as the "bonds."

The following summary of material provisions of the Mortgage is not complete and may not contain all of the information that is important to you. This summary is subject to, and is qualified in its entirety by reference to, all of the provisions of the Mortgage, including the defined terms contained therein. We have filed the original mortgage and certain of the supplemental indentures amending the mortgage as exhibits to the registration statement of which this prospectus is a part. In addition, prior to issuing bonds, we will file a form of supplemental indenture describing the terms of the new bonds in a post-effective amendment to the registration statement. You should read the Mortgage and any applicable form of new supplemental indenture because those documents, and not this description, will define your rights as a holder of the bonds. The Mortgage has been qualified under the Trust Indenture Act of 1939, and you should also refer to the Trust Indenture Act of 1939 for provisions that apply to the bonds.

Secured Obligations

The bonds, when issued, will be our senior secured obligations and will be secured equally and ratably with all of our other first mortgage bonds now outstanding or hereafter issued under the Mortgage, by a first lien on substantially all of our now owned or hereafter acquired tangible utility property (except cash, securities, accounts receivable, motor vehicles, materials and supplies, fuel, certain minerals and mineral rights, property located outside of the states of Oregon, Washington, California, Arizona, New Mexico, Idaho, Montana, Wyoming, Utah, Nevada and Alaska, and certain other property specified in the Mortgage), subject, however, to certain permitted encumbrances and various exceptions, reservations, limitations, and minor irregularities and deficiencies in title which will not interfere with the proper operation and development of the mortgaged property. We refer to this collateral security as “bondable public utility property.”

The term “permitted encumbrances” means as of any particular time any of the following:

•liens for taxes, assessments, or governmental charges for the then current year and taxes, assessments, or governmental charges not then delinquent; and liens for taxes, assessments, or governmental charges already delinquent, but whose validity is being contested at the time by us in good faith by appropriate proceedings;

•liens and charges incidental to construction or current operation which have not at such time been filed or asserted or the payment of which has been adequately secured or which, in the opinion of counsel, are insignificant in amount;

•liens, securing obligations neither assumed by us nor on account of which we customarily pay interest directly or indirectly, existing, either at July 1, 1945, or as to property thereafter acquired, at the time of acquisition by us, upon real estate or rights in or relating to real estate acquired by us for substation, measuring station, regulating station, or transmission, distribution, or other right-of-way purposes;

•any right which any municipal or governmental body or agency may have by virtue of any franchise, license, contract, or statute to purchase, or designate a purchaser of, or order the sale of, any of our property upon payment of reasonable compensation therefor or to terminate any franchise, license, or other rights or to regulate our property and business;

•the lien of judgments covered by insurance or if not so covered, not exceeding at any one time $100,000 in aggregate amount;

•easements or reservations in respect of any of our property for the purpose of rights-of-way and similar purposes, reservations, restrictions, covenants, party wall agreements, conditions of record, and other encumbrances (other than to secure the payment of money) and minor irregularities or deficiencies in the record evidence of title, which in the opinion of counsel (at the time of the acquisition of the property affected or subsequently) will not interfere with the proper operation and development of the property affected thereby;

•any lien or encumbrance, moneys sufficient for the discharge of which have been deposited in trust with the Trustee or with the trustee or mortgagee under the instrument evidencing such lien or encumbrance, with irrevocable authority to the Trustee or to such other trustee or mortgagee to apply such moneys to the discharge of such lien or encumbrance to the extent required for such purposes; and

•

•the lien reserved for rent and for compliance with the terms of the lease in the case of leasehold estates.

The Mortgage permits the acquisition of property subject to prior liens. However, no property subject to prior liens (other than purchase money liens) may be acquired (i) if at the date the property is acquired, the principal amount of indebtedness secured by prior liens, together with all of our other prior lien indebtedness, is greater than 10% of the aggregate principal amount of debt securities outstanding under the Mortgage, (ii) if at the date the property is acquired, the principal amount of indebtedness secured by prior liens is greater than 60% of the cost of such property to us, or (iii) in certain cases if the property had been used by another entity in a business similar to ours, unless the net earnings of such property meet certain tests.

We have covenanted, among other things,

•to not issue debt securities under the Mortgage in any manner other than in accordance with the Mortgage;

•except as permitted by the Mortgage, to keep the Mortgage a first priority lien on the property subject to it;

•except as permitted by the Mortgage, to not suffer any act or thing whereby all of the properties subject to it might or could be impaired; and

•in the event that we are no longer required to file reports with the SEC, and so long as the bonds are outstanding, to furnish to the Trustee the financial and other information that would be required to be contained in the reports filed with the SEC on Forms 10-Q, 10-K, and 8-K if we were required to file such reports.

Redemption and Purchase of Bonds

A prospectus supplement will disclose any provisions for the redemption or purchase of any particular series of bonds. Cash deposited under any provision of the Mortgage (with certain exceptions) may be applied to the purchase of the bonds.

Sinking Fund Provisions

We may establish a sinking fund for the benefit of a particular series of bonds. If a sinking fund is established, we will be required to deposit with the Trustee at certain specified times sufficient cash to redeem a percentage of the series or the whole series. The prospectus supplement with respect to that series will state the price or prices at which, and the terms and conditions upon which, the bonds will be redeemed. The prospectus supplement will also set forth the percentage of securities of the series to be redeemed.

Replacement Fund

If the amount of the minimum provision for depreciation upon bondable public utility property (as defined above) exceeds the balance of property additions credits available in any year, we will pay the excess to the Trustee on May 1 of the following year by either payments in cash or by delivery of first mortgage bonds. The balance of property additions available for credit is the net of the aggregate property additions acquired or constructed by us from March 31, 1945, to the end of the calendar year for which the payment is due, less property additions that (i) have been previously made the basis for action or credit under the Mortgage or (ii) have been used as a credit on all previous replacement fund certificates. We may, at our election, credit against any deficiency in the replacement fund amount (i) available retirements of first mortgage bonds, (ii) certain expenditures on bondable public utility property subject to prior lien, and (iii) certain retirements of prior lien indebtedness. If those credits at any time exceed the replacement fund requirement, we may withdraw cash or first mortgage bonds held by the Trustee in the replacement fund. We may also reinstate available retirements of first mortgage bonds that we previously took as credit against any replacement fund requirement. Cash deposited in the replacement fund may, at our option, be applied to the redemption or purchase of bonds or, in certain circumstances, to the redemption or purchase of other first mortgage bonds. The redemptions of the bonds would be at the then applicable regular redemption prices.

Minimum Provision for Depreciation

Under the Mortgage, there is a “minimum provision for depreciation” of bondable public utility property. The aggregate amount of the minimum provision for depreciation of bondable public utility property for any period after March 31, 1945, is $35,023,487.50 plus an amount for each calendar year or fraction of a year after December 31, 1966, equal to the greater of (i) 2% of depreciable bondable public utility property, as shown by our books as of January 1 of that year, as to which we were required to make appropriations to a reserve for depreciation or obsolescence or (ii) the amount we actually appropriated in respect of the depreciable bondable public utility property to a reserve for depreciation or obsolescence, in either case less an amount equal to the aggregate of (a) the amount of any property additions which we made as the basis for a sinking fund credit during the calendar year, and (b) 166 2/3% of the principal amount of any first mortgage bonds of any series which we credited against any sinking fund payment or which we redeemed in anticipation of, or out of moneys paid to the Trustee on account of, any sinking fund payment due during the calendar year. The property additions and first mortgage bonds referred to in (a) and (b) above become disqualified from being made the basis of the authentication and delivery of first mortgage bonds or any other further action or credit under the Mortgage. In addition, the minimum provision for depreciation shall also include (1) the amount of any property additions referred to in (a) above which after December 31, 1966, were made the basis for a sinking fund credit pursuant to the provisions of a sinking fund for first mortgage bonds of any series, and thereafter became “available additions” as a result of the fact that all first mortgage bonds of such series ceased to be outstanding, and (2) 166 2/3% of the principal amount of first mortgage bonds referred to in (b) above, which after December 31, 1966, were credited against any sinking fund payment, or were redeemed in anticipation of, or out of moneys paid to the Trustee on account of, any sinking fund payment for first mortgage bonds of any series, and thereafter became available retirements of first mortgage bonds as a result of the fact that all first mortgage bonds of such series ceased to be outstanding.

Issuance of Additional Bonds

Subject to the issuance restrictions described below, we may issue an unlimited amount of first mortgage bonds under the Mortgage. First mortgage bonds may be issued from time to time on the basis of, and in an aggregate principal amount not exceeding, the following: (i) 60% of the amount of available additions; (ii) an amount of cash deposited with the Trustee; and/or (iii) the aggregate principal amount of available retirements of first mortgage bonds.

With certain exceptions in the case of (iii) above, the issuance of first mortgage bonds is subject to the amount of net earnings available for interest for 12 consecutive months within the preceding 15 months being at least twice the annual interest requirements on all first mortgage bonds to be outstanding and all prior lien indebtedness. Cash deposited with the Trustee pursuant to (ii) above may be (a) withdrawn in an amount equal to 60% of available additions, (b) withdrawn in an amount equal to the aggregate principal amount of available retirements of first mortgage bonds, or (c) applied to the purchase or redemption of first mortgage bonds.

Available additions are determined, at any time, by deducting from the aggregate amount of property additions since March 31, 1945, (i) the greater of the aggregate amount of retirements of bondable public utility property not subject to a prior lien, or the aggregate amount of the minimum provision for depreciation upon bondable public utility property not subject to a prior lien since March 31, 1945, and (ii) the aggregate amount of available additions theretofore made the basis for action or credit under the Mortgage. Property additions taken as a credit against the replacement fund requirement are not deemed to be “made the basis for action or credit.”

Dividend Restrictions

So long as any of the bonds, or any of the first mortgage bonds authenticated under the Mortgage are outstanding, we will be subject to the following restrictions:

•we may not pay or declare dividends (other than stock dividends) or other distributions on our common stock, and

•we may not purchase any shares of our capital stock (other than in exchange for or from the proceeds of other shares of our capital stock),

in either case if the aggregate amount distributed or expended after December 31, 1944, would exceed the aggregate amount of our net income, as adjusted, available for dividends on our common stock accumulated after December 31, 1944.

Release and Substitution of Property

Property subject to the lien of the Mortgage may (subject to certain exceptions and limitations) be released only upon the substitution of cash, purchase money obligations, or certain other property or upon the basis of available additions or available retirements of bonds.

Subject to the terms and conditions contained in the Mortgage, we:

•may, at any time, without the consent of the Trustee, sell, exchange, or otherwise dispose of, free from the lien of the Mortgage, any property subject to the lien of the Mortgage, which has become worn out, unserviceable, undesirable, or unnecessary for use in the conduct of our business; upon replacing or modifying such property, such replacement or modified property shall without further action become subject to the lien of the Mortgage;

•may, at any time, sell, exchange, or dispose of any property (except cash, securities, or other personal property pledged or deposited with or required to be pledged or deposited with the Trustee), and the Trustee shall release such property from the operation and lien of the Mortgage upon receipt by the Trustee of certain documents and, subject to certain exceptions, cash in an amount equal to the fair value of such property;

•shall, in the event any property is taken by the exercise of the power of eminent domain or otherwise purchased or ordered to be sold by any governmental body, deposit with the Trustee the award for or proceeds of any property so taken, purchased or sold, and such property shall be released from the lien of the Mortgage;

•may, at any time, without the consent of the Trustee, sell, exchange, or otherwise dispose of any property (except cash, securities, or other personal property pledged or deposited with or required to be pledged or deposited with the Trustee) subject to the lien of the Mortgage which is no longer used or useful in the conduct of our business, provided the fair values of the property so sold, exchanged, or otherwise disposed of in any one calendar year shall not exceed $50,000 and cash in an amount equal to the fair value of the property is deposited with the Trustee; and

•may, in lieu of depositing cash with the Trustee as required above, deliver to the Trustee purchase money obligations secured by a mortgage on the property to be released or disposed of, a certificate of the Trustee or other holder of a prior lien on any part of the property to be released stating that a specified amount of cash or purchase money obligations have been deposited with such Trustee or other holder, or certain other certificates from us.

Subject to certain conditions specified in the Mortgage, moneys deposited with the Trustee may be:

•withdrawn by us to the extent of available additions and available first mortgage bond retirements;

•withdrawn by us in amount equal to the lower of cost or fair value of property additions acquired or constructed by us; and

•used to purchase or redeem first mortgage bonds of any series.

Notwithstanding the foregoing, proceeds received by the Trustee from a sale or disposition of substantially all of our electric properties at Portland, Oregon, may be applied only to the retirement of first mortgage bonds outstanding under the Mortgage.

Modification of the Mortgage

Under the Mortgage, our rights and obligations and the rights of the holders of the bonds may be modified with the consent of the holders of 75% in aggregate principal amount of the outstanding first mortgage bonds, including the consent of holders of 60% in aggregate principal amount of the first mortgage bonds of each series affected by the modification. No modification of the principal or interest payment terms, no modification permitting the creation of any lien not otherwise permitted under the Mortgage, and no modification reducing the percentage required for modifications, will be effective without the consent of the holders of all first mortgage bonds then outstanding. The Mortgage may also be modified in various other respects not inconsistent with the Mortgage and which do not adversely affect the interests of the holders of bonds.

Consolidation, Merger, and Conveyance of Assets

The terms of the Mortgage do not preclude us from merging or consolidating with, or from transferring all of the trust estate substantially as an entirety to, a corporation lawfully entitled to acquire and operate our utility assets (a “successor corporation”), provided that the lien and security of the Mortgage and the rights and powers of the Trustee and the holders of the bonds continue unimpaired. Any such merger, consolidation, or transfer, if it involves a successor corporation owning property subject to existing liens, must comply with the requirements of the Mortgage relating to the acquisition of property subject to a prior lien, which requirements are described in the third paragraph under “Secured Obligations” above. At or before the time of any such merger, consolidation, or transfer permitted by the Mortgage, the successor corporation must execute and record a supplemental indenture with the Trustee pursuant to which the successor corporation assumes all of our obligations under the Mortgage and agrees to pay the bonds in accordance with their terms. Thereafter, the successor corporation will have the right to issue additional first mortgage bonds under the Mortgage in accordance with its terms, and all such first mortgage bonds shall have the same legal rank and security as the bonds and the other first mortgage bonds issued under the Mortgage. Property acquired by the successor corporation after a merger, consolidation, or transfer described above shall not be subject to the lien of the Mortgage unless expressly made a part of the trust estate pursuant to a supplemental indenture.

The Mortgage does not contain any provisions that afford holders of bonds special protection in the event that we consummate a highly leveraged transaction; however, the bonds would continue to be entitled to the benefit of a first priority lien on the property subject to the Mortgage (other than property acquired by us subject to a prior lien) as described above.

Defaults and Notice

Each of the following will constitute a default:

•failure to pay the principal when due;

•failure to pay interest for 60 days after it is due;

•failure to deposit any sinking or replacement fund payment for 60 days after it is due;

•certain events in bankruptcy, insolvency, or reorganization of us; and

•failure to perform any other covenant in the Mortgage that continues for 60 days after being given written notice, including the failure to pay any of our other indebtedness.

The Trustee may withhold notice to the holders of first mortgage bonds of any default (except in payment of principal, interest, or any sinking or purchase fund installment) if it in good faith determines that withholding notice is in the interest of the holders of the first mortgage bonds issued under the Mortgage.

If an event of default occurs and continues, the Trustee or the holders of at least 25% in aggregate principal amount of the first mortgage bonds may declare the entire principal and accrued interest due and payable immediately. If this happens, subject to certain conditions, the holders of a majority of the aggregate principal amount of the first mortgage bonds can annul the declaration and its consequences.

No holder of first mortgage bonds may enforce the lien of the Mortgage, unless (i) it has given the Trustee written notice of default, (ii) the holders of 25% of the first mortgage bonds have requested the Trustee to act and have offered the Trustee reasonable indemnity, and (iii) the Trustee has failed to act within 60 days. The holders of a majority in principal amount of the first mortgage bonds may direct the time, method, and place of conducting any proceeding or any remedy available to the Trustee, or exercising any power conferred upon the Trustee.

Evidence to be Furnished to the Trustee

Compliance with Mortgage provisions is evidenced by the written statements of our officers or persons we selected and paid. In certain cases, opinions of counsel and certificates of an engineer, accountant, appraiser, or other expert (who in some instances must be independent) must be furnished. Various certificates and other papers are required to be filed annually and upon the occurrence of certain events, including an annual certificate with respect to compliance with the terms of the Mortgage and the absence of defaults.

Interest and Payment

The prospectus supplement will set forth:

•the interest rate or rates or the method of determination of the interest rate or rates of the bonds;

•the date or dates on which the interest is payable; and

•the office or agency in the Borough of Manhattan, City and State of New York at which interest will be payable.

Concerning the Trustee

Wells Fargo Bank, National Association is the Trustee under the Mortgage. We maintain ordinary banking relationships and credit facilities with Wells Fargo Bank, National Association. The holders of a majority in principal amount of the outstanding first mortgage bonds issued under the Mortgage may direct the time, method, and place of conducting any proceeding for exercising any remedy available to the Trustee, subject to certain exceptions. The Mortgage provides that if default occurs (and it is not cured), the Trustee will be required, in the exercise of its power, to use the degree of care of a prudent person in the conduct of such person’s own affairs. Subject to these provisions, the Trustee will be under no obligation to exercise any of its rights or powers under the Mortgage at the request of any holder of securities issued under the Mortgage, unless that holder has offered to the Trustee security and indemnity satisfactory to it against any loss, liability, or expense, and then only to the extent required by the terms of the Mortgage. The Trustee may resign from its duties with respect to the Mortgage at any time or may be removed by us. If the Trustee resigns, is removed, or becomes incapable of acting as Trustee or a vacancy occurs in the office of the Trustee for any reason, a successor Trustee shall be appointed in accordance with the provisions of the Mortgage.

Governing Law

The Mortgage provides that it and any bonds issued thereunder are governed by, and construed in accordance with, the laws of the state of New York, except to the extent the Trust Indenture Act of 1939 otherwise applies.

PLAN OF DISTRIBUTION

We may sell the offered securities from time to time:

•through underwriters or dealers;

•through agents;

•directly to one or more purchasers; or

•through a combination of any of these methods of sale.

The Company may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by the Company or borrowed from the Company or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from the Company in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be identified in the applicable prospectus supplement (or a post-effective amendment).

We will identify the specific plan of distribution, including any underwriters, dealers, agents or direct purchasers and their compensation in the applicable prospectus supplement.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from the SEC's website at www.sec.gov. Information about us, including our SEC filings, is also available through our website at www.portlandgeneral.com. However, information on our website is not incorporated into this prospectus or our other SEC filings and is not a part of this prospectus or those filings.

This prospectus is part of a registration statement filed by us with the SEC. The exhibits to our registration statement contain the full text of certain contracts and other important documents we have summarized in this prospectus. Since these summaries may not contain all the information that you may find important in deciding whether to purchase the securities we may offer, you should review the full text of these documents. The registration statement and the exhibits can be obtained from the SEC as indicated above, or from us.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to "incorporate by reference" the information we file with the SEC. This means that we can disclose important information to you by referring you to another filed document. Any information referred to in this way is considered part of this prospectus, except for any information that is modified or superseded by information contained in this prospectus or any other subsequently filed document. Any reports filed by us with the SEC after the date of this prospectus and before the date that the offering of the securities by means of this prospectus is terminated will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference in this prospectus. Accordingly, we incorporate by reference the following documents or information filed with the SEC:

•Those portions of our Definitive Proxy Statement on Schedule 14A, which we filed with the SEC on March 8, 2022 and March 16, 2022 that are incorporated by reference into Part III of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021;

•Annual Report on Form 10-K for the fiscal year ended December 31, 2021, which we filed with the SEC on February 17, 2022;

•Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022 and June 30, 2022, which we filed with the SEC on April 28, 2022 and July 28, 2022, respectively;

•Current Reports on Form 8-K, which we filed with the SEC on January 18, 2022 and May 11, 2022; and

•The description of our common stock contained in Item 1 of our Form 8-A filed with the SEC on March 31, 2006 pursuant to Section 12(b) of the Securities Exchange Act of 1934, including any amendment filed for the purpose of updating such description.

We also incorporate by reference all documents we may subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the initial filing date of the registration statement of which this prospectus is a part and prior to the termination of the offering (other than documents or information deemed to have been furnished and not filed in accordance with SEC rules). The most recent information that we file with the SEC automatically updates and supersedes older information. The information contained in any such filing will be deemed to be a part of this prospectus, commencing on the date on which the document is filed.

We will provide to each person, including any beneficial owner, to whom a copy of this prospectus has been delivered, without charge, upon the written or oral request of such person, a copy of any or all of the documents which are incorporated by reference into this prospectus, other than exhibits to such documents, unless such exhibits are specifically incorporated by reference into the information that this prospectus incorporates. You should direct requests for such copies to:

Portland General Electric Company

121 SW Salmon Street

Portland, Oregon 97204

Attention: Jardon Jaramillo, Senior Director, Investor Relations & Risk Management

Telephone: (503) 464-7458

LEGAL MATTERS

Unless otherwise specified in a prospectus supplement accompanying this prospectus, Angelica Espinosa, our General Counsel, and Skadden, Arps, Slate, Meagher & Flom LLP, will pass upon certain legal matters for us in connection with the securities offered by this prospectus. As of August 1, 2022, Angelica Espinosa beneficially owned no shares of our common stock.

EXPERTS

The financial statements of the Company incorporated by reference in this Prospectus, and the effectiveness of the Company's internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm, given their authority as experts in accounting and auditing.

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the estimated expenses (all of which will be borne by the registrant unless otherwise provided in the applicable prospectus supplement) incurred in connection with the issuance and distribution of the securities being registered, other than underwriting discounts and commissions (if any). All of the amounts shown are estimates, except the SEC registration fee:

| | | | | |

| Securities and Exchange Commission Registration Fee | $- * |

| Trustee and Transfer Agent Fees | ** |

| Rating Agency Fees | ** |

| Printing and Engraving Fees and Expenses | ** |

| Accounting Fees and Expenses | ** |

| Legal Fees and Expenses | ** |

| Miscellaneous | ** |

| Total | ** |

* Deferred in reliance on Rule 456(b) and 457(r).

** As an indeterminate amount of securities is covered by this registration statement, the expenses in connection with the issuance and distribution of the securities are not currently determinable.

Item 15. Indemnification of Directors and Officers.

Section 60.394 of the Oregon Business Corporation Act provides that unless limited by its articles of incorporation, a corporation shall indemnify a director who was wholly successful, on the merits or otherwise, in the defense of any proceeding to which the director was a party because of being a director of the corporation against reasonable expenses incurred by the director in connection with the proceeding. Section 60.407 of the Oregon Business Corporation Act provides that unless limited by its articles of incorporation an officer of the corporation is entitled to the same mandatory indemnification under Section 60.394 as a director. Our Articles of Incorporation do not limit the indemnification provided under Section 60.394 or Section 60.407 of the Oregon Business Corporation Act. Article VII of our Articles of Incorporation provides that, to the fullest extent permitted by law, no director of the Company shall be personally liable to the Company or its shareholders for monetary damages for conduct as a director.