0001108426false00011084262024-01-022024-01-02

| | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM | 8-K |

| |

| CURRENT REPORT |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

| |

| | | | | | | | |

| Date of Report (Date of earliest event reported) | January 2, 2024 | |

| (December 31, 2023) | |

| | | | | | | | | | | | | | |

Name of Registrant, State of Incorporation, Address Of Principal Executive Offices, Telephone Number, Commission File No., IRS Employer Identification No. |

PNM Resources, Inc.

(A New Mexico Corporation)

414 Silver Ave. SW

Albuquerque, New Mexico 87102-3289

Telephone Number - (505) 241-2700

Commission File No. - 001-32462

IRS Employer Identification No. - 85-0468296

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | |

| | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 40.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 40.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

Registrant | Title of each class | Trading Symbol(s) | Name of exchange on which registered |

PNM Resources, Inc. | Common Stock, no par value | PNM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement.

As previously disclosed, on October 20, 2020, PNM Resources, Inc., a New Mexico corporation (“PNMR”), Avangrid, Inc. (“Avangrid”), a New York corporation, and NM Green Holdings, Inc., a New Mexico corporation and wholly-owned subsidiary of Avangrid (“Merger Sub”), entered into an Agreement and Plan of Merger (as amended by the Amendment to Merger Agreement dated as of January 3, 2022, Amendment No. 2 to the Merger Agreement dated as of April 12, 2023 and Amendment No. 3 to the Merger Agreement dated as of June 19, 2023, the “Merger Agreement”) pursuant to which Merger Sub would merge with and into PNMR (the “Merger”), with PNMR surviving the Merger as a direct wholly-owned subsidiary of Avangrid. The Merger Agreement provides that it may be terminated by either party if the Effective Time shall not have occurred by December 31, 2023 (the “End Date”).

On December 31, 2023, Avangrid informed PNMR that it was terminating the Merger Agreement (the “Termination”), effective as of December 31, 2023.

Item 8.01. Other Events.

On January 2, 2024, PNMR issued a press release announcing the Termination. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover page in Inline XBRL format |

Forward-Looking Statements

Statements made in this Current Report on Form 8-K for PNMR that relate to future events or expectations, projections, estimates, intentions, goals, targets, and strategies are made pursuant to the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally include statements regarding the potential transaction between PNMR and Avangrid, including any statements regarding the expected outcome of the appeal, the timetable for completing the potential Merger, the ability to complete the potential Merger, the expected benefits of the potential Merger, and any other statements regarding PNMR’s and Avangrid’s future expectations, beliefs, plans, objectives, results of operations, financial condition and cash flows, or future events or performance. Readers are cautioned that all forward-looking statements are based upon current expectations and estimates and apply only as of the date of this report. Neither Avangrid nor PNMR assumes any obligation to update this information. Because actual results may differ materially from those expressed or implied by these forward-looking statements, Avangrid and PNMR caution readers not to place undue reliance on these statements. Avangrid’s and PNMR’s business, financial condition, cash flow, and operating results are influenced by many factors, which are often beyond its control, that can cause actual results to differ from those expressed or implied by the forward-looking statements. For a discussion of risk factors and other important factors affecting forward-looking statements, please see PNMR’s Form 10-K and Form 10-Q filings and the information filed on PNMR’s Forms 8-K with the Securities and Exchange Commission (the “SEC”), which factors are specifically incorporated by reference herein and the risks and uncertainties related to the proposed Merger with Avangrid, including, but not limited to: (i) the expected timing and likelihood of completion of the pending Merger, including the timing, receipt and terms and conditions of any remaining required governmental and regulatory approvals of the pending Merger that could reduce anticipated benefits or cause the parties to abandon the transaction, (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (iii) the risk that the parties may not be able to satisfy the conditions to the proposed Merger in a timely manner or at all, and (iv) the risk that the proposed transaction could have an adverse effect on the ability of PNMR to retain and hire key personnel and maintain relationships with its customers and suppliers, and on its operating results and businesses generally. Other unpredictable or unknown factors not discussed in this communication could also have material adverse effects on forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| PNM RESOURCES, INC. |

| |

| (Registrant) |

| |

| |

| Date: January 2, 2024 | /s/ Gerald R. Bischoff |

| Gerald R. Bischoff |

| Vice President and Corporate Controller |

| (Officer duly authorized to sign this report) |

Exhibit 99.1

For Immediate Release

January 2, 2024

PNM Resources Announces Avangrid Termination of Merger Agreement, Schedules Financial Update

(ALBUQUERQUE, N.M.) – PNM Resources (NYSE: PNM) announces the termination of its merger agreement with Avangrid. While the PNM Resources Board of Directors approved an extension, it was not accepted by Avangrid and Avangrid terminated the merger.

“We are greatly disappointed with Avangrid’s decision to terminate the merger agreement and its proposed benefits to our customers, communities and shareholders,” said Pat Vincent-Collawn, PNM Resources Chairman and CEO. “As we move forward, our strategic plans remain focused on the infrastructure investments necessary to meet the future energy needs of our customers and communities. We look to build upon our strong track record of delivering financial results and continue to target long-term earnings growth of 5%.”

The companies’ merger agreement, announced in October 2020, had been extended through December 31, 2023, while awaiting a decision from the New Mexico Supreme Court on the January 2022 appeal of the New Mexico Public Regulation Commission decision denying the transaction. All other federal and state approvals had been received in 2021.

FINANCIAL UPDATE CONFERENCE CALL: 11 A.M. EASTERN TUESDAY, FEBRUARY 6

On February 6th, 2024, PNM Resources will provide a financial update including preliminary 2023 results, 2024 guidance and the continued 5% long-term earnings growth target. A press release will be issued prior to market open and management will host a live conference call at 11 a.m. Eastern to discuss these items along other company updates. The press release and accompanying presentation materials for the conference call will be posted on the company website at www.PNMResources.com.

Investors and analysts can participate in the live conference call by pre-registering using the following link to receive a special dial-in number and PIN: https://dpregister.com/sreg/10185268/fb4a373624. Telephone participants who are unable to pre-register may participate in the live conference call by dialing (877) 276-8648 or (412) 317-5474 fifteen minutes prior to the event and referencing “the PNM Resources financial update.” Listeners are encouraged to visit the website at least 30 minutes before the event to register, download and install any necessary audio software. A live webcast of the call will be available at

http://www.pnmresources.com/investors/events.cfm.

Background:

PNM Resources (NYSE: PNM) is an energy holding company based in Albuquerque, N.M., with 2022 consolidated operating revenues of $2.2 billion. Through its regulated utilities, PNM and TNMP, PNM Resources provides electricity to more than 800,000 homes and businesses in New Mexico and Texas. PNM serves its customers with a diverse mix of generation and purchased power resources totaling 2.7 gigawatts of capacity, with a goal to achieve 100% emissions-free energy by 2040. For more information, visit the company's website at www.PNMResources.com.

Contacts:

Analysts Media

Lisa Goodman Raymond Sandoval

(505) 241-2160 (505) 241-2782

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Statements made in this news release for PNM Resources, Inc. (“PNMR”), Public Service Company of New Mexico (“PNM”), or Texas-New Mexico Power Company (“TNMP”) (collectively, the “Company”) that relate to future events or expectations, projections, estimates, intentions, goals, targets, and strategies, including the unaudited financial results and earnings guidance, are made pursuant to the Private Securities Litigation Reform Act of 1995. Readers are cautioned that all forward-looking statements are based upon current expectations and estimates and apply only as of the date of this report. PNMR, PNM, and TNMP assume no obligation to update this information. Because actual results may differ materially from those expressed or implied by these forward-looking statements, PNMR, PNM, and TNMP caution readers not to place undue reliance on these statements. PNMR's, PNM's, and TNMP's business, financial condition, cash flow, and operating results are influenced by many factors, which are often beyond their control, that can cause actual results to differ from those expressed or implied by the forward-looking statements. Additionally, there are risks and uncertainties in connection with the proposed acquisition of the Company by Avangrid, Inc. (the “Merger”) which may adversely affect the Company’s business, future opportunities, employees and common stock, including without limitation, (i) the expected timing and likelihood of completion of the pending Merger, including the timing, receipt and terms and conditions of any remaining required governmental and regulatory approvals of the pending Merger that could reduce anticipated benefits or cause the parties to abandon the transaction, (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (iii) the risk that the parties may not be able to satisfy the conditions to the proposed Merger in a timely manner or at all, and (iv) the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the Company to retain and hire key personnel and maintain relationships with its customers and suppliers, and on its operating results and businesses generally. For a discussion of risk factors and other important factors affecting forward-looking statements, please see the Company’s Form 10-K, Form 10-Q filings and the information included in the Company’s Forms 8-K with the Securities and Exchange Commission, which factors are specifically incorporated by reference herein.

(END)

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

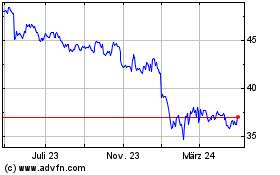

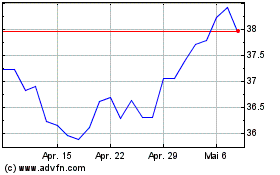

PNM Resources (NYSE:PNM)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

PNM Resources (NYSE:PNM)

Historical Stock Chart

Von Mai 2023 bis Mai 2024