Pebblebrook Hotel Trust Extends $787 Million in Debt Maturities, Enhancing Financial Flexibility

04 November 2024 - 1:00PM

Business Wire

Company Strengthens Balance Sheet with No

Significant Debt Maturities Until December 2026

Pebblebrook Hotel Trust (NYSE: PEB) (the “Company” or

“Pebblebrook”) today announced the successful extension of $787

million in debt maturities, significantly bolstering its financial

flexibility and liquidity position.

The Company has extended the maturity of $185.2 million of its

recently reduced $200 million 2025 term loan to 2029. Additionally,

Pebblebrook extended the maturity of $602 million of its $650

million senior unsecured revolving credit facility to 2029,

inclusive of two optional six-month extensions. The revolving

credit facility remains undrawn and fully available, providing the

Company with substantial liquidity.

Importantly, the pricing on both the term loan and the credit

facility remains unchanged and is based on a competitive pricing

grid of 140 to 250 basis points over the applicable adjusted term

SOFR.

“By securing these strategic extensions and completing our

recent $400 million five-year senior notes offering, we have

executed approximately $1.2 billion in debt financings and

extensions,” said Raymond D. Martz, Co-President and Chief

Financial Officer of Pebblebrook Hotel Trust. “These significant

transactions greatly enhance our financial flexibility, allowing us

to focus on reducing debt, increasing liquidity, strengthening our

balance sheet, and ultimately delivering greater shareholder value.

We deeply appreciate the continued strong support and partnership

of our bank group in facilitating this strategic refinancing.”

Balance Sheet Financial Highlights:

- No Significant Debt Maturities Until December 2026:

These refinancing efforts provide Pebblebrook with enhanced

flexibility to execute its strategic initiatives.

- Attractive Interest Rates and Debt Maturities: The

weighted average interest rate on the Company’s approximately $2.3

billion of outstanding debt and convertible notes is 4.3%, with a

weighted average maturity of approximately 3.2 years.

- Fixed-Rate and Unsecured Debt Profile: After factoring

in swap agreements, approximately 91% of the Company’s total

outstanding debt and convertible notes effectively bear interest at

fixed rates, and approximately 91% is unsecured, reducing exposure

to interest rate volatility and enhancing financial stability.

BofA Securities Inc. led the Company’s debt maturity extensions,

serving as Joint Lead Arranger and Sole Bookrunner. U.S. Bank

National Association serves as the Syndication Agent and Joint Lead

Arranger. Capital One, National Association; PNC Capital Markets

LLC; TD Bank, N.A.; Truist Securities, Inc.; and Wells Fargo Bank,

National Association serve as Documentation Agents and Joint Lead

Arrangers. Raymond James Bank and Regions Bank serve as Senior

Managing Agents.

About Pebblebrook Hotel

Trust

Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real

estate investment trust (“REIT”) and the largest owner of urban and

resort lifestyle hotels in the United States. The Company owns 46

hotels, totaling approximately 12,000 guest rooms across 13 urban

and resort markets. For more information, visit

www.pebblebrookhotels.com and follow @PebblebrookPEB.

For further information about the Company’s business and

financial results, please refer to the “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of the Company’s SEC filings, including,

but not limited to, its Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q, copies of which may be obtained at the

Investor Relations section of the Company’s website at

www.pebblebrookhotels.com.

All information in this press release is as of November 4, 2024.

The Company undertakes no duty to update the statements in this

press release to conform the statements to actual results or

changes in the Company’s expectations.

For additional information or to receive press

releases via email, please visit www.pebblebrookhotels.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104450511/en/

Raymond D. Martz Co-President and Chief Financial Officer

Pebblebrook Hotel Trust (240) 507-1330

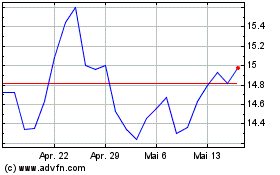

Pebblebrook Hotel (NYSE:PEB)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Pebblebrook Hotel (NYSE:PEB)

Historical Stock Chart

Von Apr 2024 bis Apr 2025