UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE

ACT OF 1934

For the month of August,

2023

(Commission File

No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of

incorporation or organization)

Maipú 1

C1084ABA

City of Buenos Aires

Argentina

(Address of principal

executive offices)

(Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate

by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes"

is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

This Form 6-K

for Pampa Energía S.A. (“Pampa” or the “Company”) contains:

Exhibit

1: Earnings Release Q2 23

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: August 9, 2023

| Pampa Energía S.A. |

| |

|

|

| |

|

|

| By: |

/s/ Gustavo Mariani

|

|

| |

Name: Gustavo Mariani

Title: Chief Executive Officer |

|

FORWARD-LOOKING

STATEMENTS

This press release may contain

forward-looking statements. These statements are statements that are not historical facts, and are based on management's current

view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates",

"believes", "estimates", "expects", "plans" and similar expressions, as they relate to

the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

|

Pampa Energía, an independent company with active participation

in Argentina’s electricity and gas value chain, announces the results for the six-month period and quarter ended on June 30, 2023. |

Buenos Aires, August 9, 2023

|

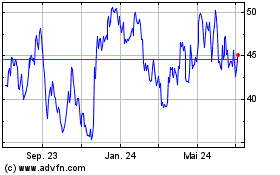

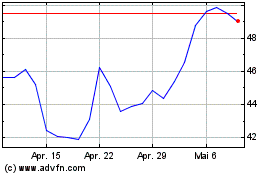

Stock information

Share capital net of repurchases and reductions

as of August 8, 2023

1,363.5 million common shares/

54.5 million ADS

Market capitalization

AR$1,336.7 million/

US$2,245 million

Information about the videoconference

Date and time: Thursday

Aug-10

10 AM Eastern Standard Time

11 AM Buenos Aires Time

Access link: bit.ly/Pampa2Q2023VC

For further information about Pampa

·

Email:

investor@pampaenergia.com

·

Website for investors:

ri.pampaenergia.com

·

Argentina’s Securities and Exchange Commission

www.argentina.gob.ar/cnv

·

Securities and

Exchange Commission:

sec.gov |

|

Basis of presentation

Pampa’s financial information adopts US$ as functional currency, which is then translated into AR$ at transactional FX. However, for our affiliates Transener and TGS, their figures are adjusted for inflation as of June 30, 2023, and then translated into US$ at the period’s closing FX. The reported figures in US$ from previous periods remain unchanged.

Q2 23 main results1

Sales amounted to US$464 million2, similar to Q2 22, explained by improved natural gas prices and sold volumes, the incorporation of PEMC and PEA3 and higher sales of reforming volumes, offset by lower petrochemical and crude oil prices and lesser legacy energy income.

Operating performance highlighted by reforming and CTEB’s CCGT:

|

| |

|

|

|

|

| |

Pampa's main operational KPIs |

Q2 23 |

Q2 22 |

Variation |

| |

Power |

Generation (GWh) |

5,218 |

4,477 |

+17% |

| |

|

Gross margin (US$/MWh) |

22.6 |

22.1 |

+2% |

| |

|

|

|

|

|

| |

Oil and gas |

Production (k boe/day) |

67.3 |

64.6 |

+4% |

| |

|

Gas over total production |

92% |

92% |

+0% |

| |

|

Average gas price (US$/MBTU) |

4.7 |

4.4 |

+7% |

| |

|

Average oil price (US$/bbl) |

65.1 |

72.6 |

-10% |

| |

|

|

|

|

|

| |

Petrochemicals |

Volume sold (k ton) |

106 |

91 |

+17% |

| |

|

Average price (US$/ton) |

1,240 |

1,738 |

-29% |

| |

|

|

|

|

|

| |

Adjusted EBITDA4

reached US$222 million, 13% lower than Q2 22, explained by reductions of 53% in holding and others,

48% in petrochemicals, 4% in oil and gas, and 1% in power generation.

The profit attributable to

the Company’s shareholders rose 156%, reaching US$166 million, mainly due to gains from holding financial securities and, to

a lesser extent, depreciation over the monetary liability net position in AR$, partially offset by increased financial interests due

to higher stock of AR$-debt and higher income tax charges.

Net debt continued decreasing,

reaching US$787 million, resulting in a net leverage ratio of 1.1x.

|

1 The information is based

on FS prepared according to IFRS in force in Argentina.

2 It does not include sales

from the affiliates CTBSA, Transener and TGS, which at our ownership account for US$97 million. Under IFRS, affiliates are not consolidated

in Pampa, thus shown as ‘Results for participation in joint businesses and associates’.

3 PEMC is consolidated since

Pampa holds full ownership on August 2022; in process of divestment. PEA was acquired on December 2022.

4 Consolidated

adjusted EBITDA represents the results before financial results, income tax, depreciations and amortizations, extraordinary and non-cash

income and expense, equity income and other adjustments from the IFRS implementation, and includes affiliates’ EBITDA at our ownership.

For further information, see section 3.1 of this Earnings release.

| |

| Pampa Energía ● Earnings release Q2 23 ● 1 |

Table of contents

| |

| Pampa Energía ● Earnings release Q2 23 ● 2 |

Asset swap with Total Austral and

the beginning of shale oil development

On June 23, 2023, Pampa

agreed with Total Austral S.A. (Argentine Branch) to acquire a 45% stake in the Rincón de Aranda block. In exchange, Pampa will

transfer its 100% equity stake in Greenwind, which solely owns the PEMC. As a result, Pampa will become the sole owner of Rincón

de Aranda.

Rincón de Aranda

is a 59,154-acre exploratory block located in the Neuquina Basin, at the heart of the Vaca Muerta’s shale oil window in the Province

of Neuquén. It currently has one shut-in productive well and another uncompleted well, both drilled in 2019. Although the block

is not currently producing, its proximity to important productive blocks of the Vaca Muerta formation makes it highly promising from

a technical standpoint.

The closing of this swap

is subject to fulfilling certain precedent conditions, including granting the CENCH to Rincón de Aranda, which will extend its

exploitation rights for 35 years. On July 31, 2023, the Province of Neuquén approved the stake transfer and granted the CENCH to

Pampa (Executive Order No. 1,435/23). The transfer of the block’s rights and the CENCH will take effect upon closing the swap, which

is still pending.

PEMC, inaugurated by Pampa

in May 2018, is a 100 MW wind farm located in Bahía Blanca, Province of Buenos Aires. It was Pampa’s first wind project and

the largest within the RenovAr 1 program. The annual average EBITDA amounts to US$21 million. The swap also includes the transfer of Greenwind’s

debt, amounting to US$79 million as of June 30, 2023.

While this swap represents a significant milestone,

Pampa remains fully committed to renewable energy, which is essential to our mission of being a leading and efficient energy supplier.

Since 2018, Pampa has actively developed wind energy, establishing itself as one of Argentina’s leading renewable energy companies.

Recently, we successfully commissioned PEPE IV, and we began building PEPE VI.

It is worth highlighting that this project’s total expansion amounts to 300 MW, with an estimated total investment of US$500 million.

With the full incorporation

of Rincón de Aranda into Pampa, we are diversifying our presence in the energy sector and reinforcing our commitment to developing

Vaca Muerta reserves, in a shale oil block with significant upside potential. Pampa is currently the third-largest gas producer in the

Neuquina Basin and holds an interest in 8% of Vaca Muerta’s acreage. Over the period from 2020 to 2023, Pampa will complete over

US$1.1 billion in investments to enhance its gas production.

New record of peak gas production

Aligned with

our production commitment under Plan Gas.Ar, on June 30, 2023, we achieved a record production of 13.5 million m3/day, representing

a 18% increase vs. 2022 record.

Unlike previous

years, this remarkable growth is primarily attributed to Vaca Muerta’s shale gas production, which drilling began in the 2022-2023

campaign. Moreover, El Mangrullo contributed 60% of the 13.5 million m3/day production, and 25% came from Sierra Chata, both

ranked among the best gas-producing blocks in the Neuquina Basin.

| |

| Pampa Energía ● Earnings release Q2 23 ● 3 |

Permits to export gas

The SE approved additional

gas export volumes to Chile on a take-or-pay basis for 0.9 million m3/day, delivering during the winter months of July to September

2023. This volume will increase to 1.5 million m3/day from October 2023 to April 2024.

| 1.2 | Power generation segment |

Commissioning of PEPE IV and commencement

of works at PEPE VI

Between May 11 and June

17, 2023, the last 8 Vestas wind turbines were commissioned in Coronel Rosales, Province of Buenos Aires, completing the commissioning

of PEPE IV. Hence, the 18 wind turbines of 4.5 MW each at PEPE IV will contribute 81 MW of renewable energy to the national grid. The

construction of PEPE IV required an investment of over US$120 million. The energy produced will be sold in the MAT ER segment through

PPAs with private parties.

Moreover, the works at

PEPE VI have already started. The first stage will add 94.5 MW, and the second stage will increase the total capacity to 140 MW, fully

operational by 2H2024. By then, we expect to reach a total renewable capacity of 427 MW, further strengthening Pampa’s position

as one of Argentina’s leading wind power generators.

Tender to install thermal power

capacity

On July 27, 2023, the

SE called a tender for installing 2,250-3,000 MW of thermal or co-generation power capacity to replace or enhance existing capacity, and

improve the reliability and sustainability of the Wholesale Electricity Market (Res. SE No. 621/23).

Awarded projects will

obtain a PPA with CAMMESA for up to 15 years, with commissioning scheduled between 2025 and 2028. Remuneration will mainly consist of

a base capacity payment ranging from US$9,000 to US$19,800/MW-month (depending on the tender’s category) and an operation and maintenance

charge, comprising a fixed payment in US$/MW-month and a variable price per used fuel in US$/MWh.

The SE will evaluate the

efficiency, capacity payment and location of the tendered projects, prioritizing the critical nodes defined in the auction. The submission

deadline is August 31, 2023, with the awarding scheduled for October 10, 2023. Pampa is currently evaluating its participation in the

tender.

| 1.3 | TGS: award of GPNK’s operation

and midstream service expansion |

On June 5, 2023, ENARSA awarded TGS the operation and maintenance

of the GPNK’s Tratayén – Salliqueló tranche, signing a 5-year contract, extendable for 12 months. The GPNK,

which was inaugurated on July 9, 2023, and commissioning began on August 3, 2023, has a length of 573 km and an initial transportation

capacity of 11 million m3/day, passing through the Provinces of Neuquén, Río Negro, La Pampa and Buenos Aires.

The license encompasses surface and underground facilities, as well as compressor stations in Tratayén and Salliqueló.

In response to the increasing gas output from the Neuquina

Basin, TGS has been developing its midstream business since 2018. This includes the construction of an 182 km gathering gas pipeline that

passes through the Vaca Muerta formation, with a transportation capacity of up to 60 million m3/day. In August 2023, TGS is

set to commission a 32 km extension to the pipeline’s north tranche (Los Toldos I Sur – El Trapial), with a 17 million m3/day

transportation capacity and a US$49 million investment. Additionally, TGS has installed a gas conditioning plant in Tratayén, with

a 14.8 million m3/day capacity. Moreover, two conditioning plants with a capacity of 6.6 million m3/day each are

expected to be commissioned by 1H2024, with an estimated total investment of US$270 million.

| |

| Pampa Energía ● Earnings release Q2 23 ● 4 |

| 1.4 | Share capital reduction |

On July 18, 2023, 20 million shares (equivalent to 0.8 million ADR)

were canceled, which was previously approved by the shareholders’ meeting on April 26, 2023. Currently, Pampa’s outstanding

capital stock amounts to 1,363,520,380 common shares or 54,540,815 ADRs equivalent.

| |

| Pampa Energía ● Earnings release Q2 23 ● 5 |

| 2.1 | Consolidated balance sheet |

| Figures in million |

|

As of 06.30.2023 |

|

As of 12.31.2022 |

| |

AR$ |

US$ FX 256.7 |

|

AR$ |

US$ FX 177.16 |

| ASSETS |

|

|

|

|

|

|

| Property, plant and equipment |

|

585,004 |

2,279 |

|

383,464 |

2,165 |

| Intangible assets |

|

25,252 |

98 |

|

24,364 |

138 |

| Right-of-use assets |

|

1,982 |

8 |

|

1,521 |

9 |

| Deferred tax asset |

|

8,491 |

33 |

|

6,326 |

36 |

| Investments in joint ventures and associates |

|

240,004 |

935 |

|

159,833 |

902 |

| Financial assets at amortized cost |

|

25,853 |

101 |

|

18,000 |

102 |

| Financial assets at fair value through profit and loss |

|

7,053 |

27 |

|

4,867 |

27 |

| Other assets |

|

121 |

0 |

|

91 |

1 |

| Trade and other receivables |

|

6,660 |

26 |

|

3,415 |

19 |

| Total non-current assets |

|

900,420 |

3,508 |

|

601,881 |

3,397 |

| |

|

|

|

|

|

|

| Inventories |

|

47,714 |

186 |

|

30,724 |

173 |

| Financial assets at amortized cost |

|

3,006 |

12 |

|

1,357 |

8 |

| Financial assets at fair value through profit and loss |

|

169,968 |

662 |

|

103,856 |

586 |

| Derivative financial instruments |

|

146 |

1 |

|

161 |

1 |

| Trade and other receivables |

|

116,646 |

454 |

|

83,328 |

470 |

| Cash and cash equivalents |

|

50,749 |

198 |

|

18,757 |

106 |

| Total current assets |

|

388,229 |

1,512 |

|

238,183 |

1,344 |

| |

|

|

|

|

|

|

| Assets classified as held for sale |

|

46,631 |

182 |

|

- |

- |

| |

|

|

|

|

|

|

| Total assets |

|

1,335,280 |

5,202 |

|

840,064 |

4,742 |

| |

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

| Equity attributable to owners of the company |

|

669,365 |

2,608 |

|

403,463 |

2,277 |

| |

|

|

|

|

|

|

| Non-controlling interest |

|

1,684 |

7 |

|

1,157 |

7 |

| |

|

|

|

|

|

|

| Total equity |

|

671,049 |

2,614 |

|

404,620 |

2,284 |

| |

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

| Provisions |

|

38,250 |

149 |

|

26,062 |

147 |

| Income tax and presumed minimum income tax liabilities |

|

37,356 |

146 |

|

31,728 |

179 |

| Deferred tax liabilities |

|

17,596 |

69 |

|

19,854 |

112 |

| Defined benefit plans |

|

8,362 |

33 |

|

4,908 |

28 |

| Borrowings |

|

333,830 |

1,300 |

|

237,437 |

1,340 |

| Trade and other payables |

|

8,485 |

33 |

|

3,757 |

21 |

| Total non-current liabilities |

|

443,879 |

1,729 |

|

323,746 |

1,827 |

| |

|

|

|

|

|

|

| Provisions |

|

1,003 |

4 |

|

779 |

4 |

| Income tax liabilities |

|

4,493 |

18 |

|

927 |

5 |

| Taxes payables |

|

7,398 |

29 |

|

4,966 |

28 |

| Defined benefit plans |

|

928 |

4 |

|

1,021 |

6 |

| Salaries and social security payable |

|

5,404 |

21 |

|

5,627 |

32 |

| Derivative financial instruments |

|

133 |

1 |

|

318 |

2 |

| Borrowings |

|

91,688 |

357 |

|

48,329 |

273 |

| Trade and other payables |

|

74,368 |

290 |

|

49,731 |

281 |

| Total current liabilities |

|

185,415 |

722 |

|

111,698 |

630 |

| |

|

|

|

|

|

|

| Liabilities associated to assets classified as held for sale |

|

34,937 |

136 |

|

- |

- |

| |

|

|

|

|

|

|

| Total liabilities |

|

664,231 |

2,588 |

|

435,444 |

2,458 |

| |

|

|

|

|

|

|

| Total liabilities and equity |

|

1,335,280 |

5,202 |

|

840,064 |

4,742 |

| |

| Pampa Energía ● Earnings release Q2 23 ● 6 |

| 2.2 | Consolidated income statement |

| |

|

First half |

|

Second quarter |

| Figures in million |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

AR$ |

US$ |

|

AR$ |

US$ |

|

AR$ |

US$ |

|

AR$ |

US$ |

| Sales revenue |

|

194,256 |

895 |

|

99,523 |

874 |

|

110,341 |

464 |

|

55,512 |

462 |

| Local market sales |

|

154,309 |

708 |

|

78,708 |

688 |

|

86,900 |

363 |

|

44,999 |

372 |

| Foreign market sales |

|

39,947 |

187 |

|

20,815 |

186 |

|

23,441 |

101 |

|

10,513 |

90 |

| Cost of sales |

|

(117,939) |

(555) |

|

(60,896) |

(540) |

|

(67,401) |

(290) |

|

(34,652) |

(294) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

76,317 |

340 |

|

38,627 |

334 |

|

42,940 |

174 |

|

20,860 |

168 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling expenses |

|

(7,723) |

(34) |

|

(3,721) |

(33) |

|

(4,530) |

(18) |

|

(1,658) |

(12) |

| Administrative expenses |

|

(19,564) |

(89) |

|

(7,326) |

(63) |

|

(11,254) |

(48) |

|

(3,797) |

(31) |

| Exploration expenses |

|

(1,750) |

(7) |

|

(15) |

- |

|

(1,702) |

(7) |

|

(7) |

- |

| Other operating income |

|

14,289 |

61 |

|

4,357 |

36 |

|

9,430 |

45 |

|

3,057 |

25 |

| Other operating expenses |

|

(7,375) |

(35) |

|

(2,632) |

(23) |

|

(3,530) |

(22) |

|

(964) |

(8) |

| Impairment of financial assets |

|

(937) |

(3) |

|

(519) |

(4) |

|

(646) |

(3) |

|

(392) |

(3) |

| Rec. of imp. (impairm.) of int. assets & inventories |

|

(323) |

(1) |

|

(4,384) |

(35) |

|

(734) |

(3) |

|

(4,375) |

(35) |

| Results for part. in joint businesses & associates |

|

8,570 |

34 |

|

6,861 |

57 |

|

5,370 |

19 |

|

4,179 |

32 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

61,504 |

266 |

|

31,248 |

269 |

|

35,344 |

137 |

|

16,903 |

136 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Financial income |

|

428 |

2 |

|

450 |

5 |

|

235 |

2 |

|

204 |

2 |

| Financial costs |

|

(41,078) |

(188) |

|

(8,794) |

(78) |

|

(26,367) |

(112) |

|

(4,599) |

(39) |

| Other financial results |

|

55,461 |

254 |

|

(4,170) |

(35) |

|

40,818 |

170 |

|

(3,881) |

(33) |

| Financial results, net |

|

14,811 |

68 |

|

(12,514) |

(108) |

|

14,686 |

60 |

|

(8,276) |

(70) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Profit before tax |

|

76,315 |

334 |

|

18,734 |

161 |

|

50,030 |

197 |

|

8,627 |

66 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax |

|

(7,087) |

(29) |

|

(29) |

6 |

|

(7,730) |

(33) |

|

(376) |

1 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income for the period |

|

69,228 |

305 |

|

18,705 |

167 |

|

42,300 |

164 |

|

8,251 |

67 |

| Attributable to the owners of the Company |

|

69,097 |

305 |

|

18,469 |

165 |

|

42,179 |

164 |

|

8,165 |

66 |

| Attributable to the non-controlling interests |

|

131 |

- |

|

236 |

2 |

|

121 |

0.1 |

|

86 |

1 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share to shareholders |

|

50.36 |

0.22 |

|

13.37 |

0.12 |

|

31.01 |

0.12 |

|

5.92 |

0.05 |

| Net income per ADR to shareholders |

|

1,259.06 |

5.56 |

|

334.34 |

2.99 |

|

775.35 |

3.01 |

|

147.92 |

1.20 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average outstanding common shares1 |

|

1,372 |

|

|

1,381 |

|

|

1,360 |

|

|

1,380 |

|

| Outstanding shares by the end of period1 |

|

1,360 |

|

|

1,380 |

|

|

1,360 |

|

|

1,380 |

|

Note: 1 It considers

the shares from the Employee stock-based compensation plan, which as of June 30, 2022 and 2023 amounted to 3.9 million common shares.

| |

| Pampa Energía ● Earnings release Q2 23 ● 7 |

| 2.3 | Cash and financial borrowings |

As of June 30, 2023,

in US$ million |

|

Cash1 |

|

Financial debt |

|

Net debt |

| |

Consolidated

in FS |

Ownership adjusted |

|

Consolidated

in FS |

Ownership adjusted |

|

Consolidated

in FS |

Ownership adjusted |

| Power generation |

|

714 |

710 |

|

631 |

631 |

|

(83) |

(80) |

| Petrochemicals |

|

- |

- |

|

- |

- |

|

- |

- |

| Holding and others |

|

0 |

0 |

|

- |

- |

|

(0) |

(0) |

| Oil and gas |

|

157 |

157 |

|

1,027 |

1,027 |

|

870 |

870 |

| Total under IFRS/Restricted Group |

|

872 |

868 |

|

1,658 |

1,658 |

|

786 |

790 |

| Affiliates at O/S2 |

|

141 |

141 |

|

306 |

306 |

|

164 |

164 |

| Total with affiliates |

|

1,013 |

1,009 |

|

1,963 |

1,963 |

|

951 |

954 |

Note: Financial debt includes

accrued interest. 1 It includes cash and cash equivalents, financial assets at fair value with changing results, and investments

at amortized cost. 2 Under IFRS, the affiliates CTBSA, Transener and TGS are not consolidated in Pampa.

Debt transactions

As of

June 30, 2023, Pampa’s financial debt at the consolidated level under IFRS amounted to US$1,658 million, which is slightly higher

than at the end of 2022, mainly explained by debt issuances, partially offset by the de-consolidation of PEMC’s associated financial

debt due to the pending divestment. However, the net debt decreased by 14%, reaching US$786 million. The total US$ debt accounted for

79% of the Company’s gross debt, with an average interest rate of 8.3%, primarily at a fixed rate, and no coupon for US$-link debt,

while the US$-MEP indebtedness rate was 4.99%. The average interest rate for AR$ debt was 87%. The financial debt had an average life

of 3.2 years. The chart below shows the principal maturity profile, net of repurchases, in US$ million by the end of Q2 23:

|

Note: The chart only considers Pampa consolidated under IFRS;

it does not include affiliates TGS, Transener, and CTBSA. |

During Q2 23, Pampa

redeemed the outstanding 2023 Notes (US$92.9 million) and issued the Series XVI CB in US$-MEP for US$55.7 million at a 4.99% rate maturing

on November 2025 and the second Green Bond (Series XVII CB) for AR$5,980 million at a Private Badlar plus 2% floating rate maturing in

May 2025, and received in-kind AR$852 million from the first Green Bond (Series VIII CB) at a 1.0336 ratio. Moreover, Pampa obtained short-term

bank debt for AR$36,168 million and paid borrowings for US$9 million and import financing for US$5 million.

After Q2 23, Pampa paid net import financing facilities for US$2

million and the outstanding AR$2,283 million of the first Green Bond (Series VIII CB), and took short-term loans for AR$2 billion.

Regarding

our affiliates, CTEB issued Series IX

US$-link CB in Q2 23 for US$50 million at a 0% coupon, maturing in April 2026, of which US$2 million was

exchanged with Series I CB at a 1.0033 ratio.

| |

| Pampa Energía ● Earnings release Q2 23 ● 8 |

The

remaining US$30 million from Series I CB was redeemed in

May. Additionally, TGS paid import financing in foreign currency for the equivalent of US$2 million, while Transener paid borrowings

for AR$702 million. After the quarter’s closing, TGS obtained import financing for the equivalent of US$17 million and refinanced

loans for US$4 million, while Transener paid borrowings for AR$56

million.

As of this Earnings

Release issuance, the Company complies with the covenants established in its debt agreements.

Summary of debt securities

Company

In million |

Security |

Maturity |

Amount issued |

Amount

net of repurchases |

Coupon |

| In US$ |

|

|

|

|

|

| Pampa |

CB Series IX at par & fixed rate |

2026 |

293 |

179 |

9.5% |

| CB Series I at discount & fixed rate |

2027 |

750 |

597 |

7.5% |

| CB Series III at discount & fixed rate |

2029 |

300 |

293 |

9.125% |

| TGS1 |

CB at discount at fixed rate |

2025 |

500 |

470 |

6.75% |

| |

|

|

|

|

|

| In US$-link |

|

|

|

|

|

| Pampa |

CB Series XIII |

2027 |

98 |

98 |

0% |

| CTEB1 |

CB Series IV |

2024 |

96 |

96 |

0% |

| CB Series VI |

2025 |

84 |

84 |

0% |

| CB Series IX |

2026 |

50 |

50 |

0% |

| |

|

|

|

|

|

| In US$-MEP |

|

|

|

|

|

| Pampa |

CB Series XVI |

2025 |

56 |

56 |

4.99% |

| |

|

|

|

|

|

| In AR$ |

|

|

|

|

|

| Pampa |

CB Series VIII (Green Bond)2 |

2023 |

2,283 |

2,283 |

Badlar Privada +2% |

| CB Series XI |

2024 |

21,655 |

21,655 |

Badlar Privada +0% |

| CB Series XV |

2024 |

18,264 |

18,264 |

Badlar Privada +2% |

| CB Series XVII (Green Bond) |

2024 |

5,980 |

5,980 |

Badlar Privada +2% |

| CTEB1 |

CB Series VII |

2023 |

1,754 |

1,754 |

Badlar Privada +2.98% |

| CB Series VIII |

2024 |

4,236 |

4,236 |

Badlar Privada +1% |

| |

|

|

|

|

|

| In UVA |

|

|

|

|

|

| CTEB1 |

CB Series II |

2024 |

65 |

65 |

4% |

Note: 1 According

to IFRS, affiliates are not consolidated in Pampa’s FS. 2 Settled post-Q2 23.

| |

| Pampa Energía ● Earnings release Q2 23 ● 9 |

Credit rating of Pampa and subsidiaries

| Company |

Agency |

Rating |

| Global |

Local |

| Pampa |

S&P |

b-1 |

na |

| Moody's |

Caa3 |

na |

| FitchRatings2 |

B- |

AA+ (long-term)

A1+ (short-term) |

| TGS |

S&P |

CCC- |

na |

| Moody's |

Caa3 |

na |

| Transener |

FitchRatings2 |

na |

A+ (long-term) |

| CTEB |

FitchRatings2 |

na |

A+ |

Note: 1 Stand-alone.

2 Local ratings issued by FIX SCR.

| |

| Pampa Energía ● Earnings release Q2 23 ● 10 |

| 3. | Analysis of the Q2 23 results |

Breakdown by segment

Figures in US$ million |

Q2 23 |

Q2 22 |

Variation |

| Sales |

Adjusted EBITDA |

Net Income |

Sales |

Adjusted EBITDA |

Net Income |

Sales |

Adjusted EBITDA |

Net Income |

| |

|

|

|

|

|

|

|

|

|

| Power generation |

171 |

98 |

104 |

165 |

99 |

(18) |

+4% |

-1% |

NA |

| Oil and Gas |

187 |

97 |

15 |

165 |

102 |

52 |

+13% |

-4% |

-71% |

| Petrochemicals |

132 |

10 |

6 |

158 |

19 |

14 |

-16% |

-48% |

-57% |

| Holding and Others |

4 |

16 |

39 |

5 |

35 |

19 |

-20% |

-53% |

+105% |

| Eliminations |

(30) |

- |

- |

(31) |

(1) |

(1) |

-3% |

-100% |

-100% |

| |

|

|

|

|

|

|

|

|

|

| Total |

464 |

222 |

164 |

462 |

253 |

66 |

+0% |

-13% |

+148% |

Note: Net income attributable

to the Company’s shareholders.

| 3.1 | Reconciliation of consolidated adjusted

EBITDA |

Reconciliation of adjusted EBITDA,

in US$ million |

|

First half |

|

Second quarter |

| |

2023 |

2022 |

|

2023 |

2022 |

| Consolidated operating income |

|

266 |

269 |

|

137 |

136 |

| Consolidated depreciations and amortizations |

|

126 |

106 |

|

67 |

56 |

| EBITDA |

|

392 |

375 |

|

204 |

192 |

| |

|

|

|

|

|

|

| Adjustments from generation segment |

|

(6) |

11 |

|

(4) |

9 |

| Deletion of equity income |

|

(5) |

(34) |

|

(3) |

(12) |

| Deletion of gain from commercial interests |

|

(29) |

(7) |

|

(17) |

(3) |

| Deletion of provision in outages |

|

- |

6 |

|

- |

6 |

| Deletion of PPE activation in operating expenses |

|

3 |

11 |

|

1 |

7 |

| Deletion of provision in hydros |

|

5 |

- |

|

1 |

- |

| Greenwind's EBITDA adjusted by ownership |

|

- |

6 |

|

- |

3 |

| CTBSA's EBITDA adjusted by ownership |

|

21 |

29 |

|

14 |

8 |

| Adjustments from oil and gas segment |

|

1 |

29 |

|

3 |

29 |

| Deletion of PPE & inventories' impairment |

|

- |

29 |

|

- |

29 |

| Deletion of gain from commercial interests |

|

(6) |

(0) |

|

(4) |

(0) |

| Deletion of Río Atuel's reversal losses |

|

7 |

- |

|

7 |

- |

| Adjustments from petrochemicals segment |

|

3 |

(0) |

|

3 |

(0) |

| Deletion of inventory impairment |

|

3 |

- |

|

3 |

- |

| Adjustments from holding & others segment |

|

38 |

63 |

|

15 |

24 |

| Deletion of equity income |

|

(29) |

(23) |

|

(16) |

(20) |

| Deletion of gain from commercial interests |

|

(0) |

(1) |

|

(0) |

(1) |

| Deletion of intang. assets' impairment/(recovery) |

|

(2) |

6 |

|

- |

6 |

| TGS's EBITDA adjusted by ownership |

|

52 |

71 |

|

24 |

31 |

| Transener's EBITDA adjusted by ownership |

|

17 |

9 |

|

7 |

7 |

| |

|

|

|

|

|

|

| Consolidated adjusted EBITDA |

|

428 |

478 |

|

222 |

253 |

| At our ownership |

|

419 |

477 |

|

226 |

253 |

| |

| Pampa Energía ● Earnings release Q2 23 ● 11 |

| 3.2 | Analysis of the power generation segment |

Power generation segment, consolidated

Figures in US$ million |

|

First half |

|

Second quarter |

| |

2023 |

2022 |

∆% |

|

2023 |

2022 |

∆% |

| Sales revenue |

|

344 |

331 |

+4% |

|

171 |

165 |

+4% |

| Local market sales |

|

344 |

331 |

+4% |

|

171 |

165 |

+4% |

| Cost of sales |

|

(181) |

(184) |

-2% |

|

(97) |

(100) |

-3% |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

163 |

147 |

+11% |

|

74 |

65 |

+14% |

| |

|

|

|

|

|

|

|

|

| Selling expenses |

|

(1) |

(1) |

- |

|

- |

- |

NA |

| Administrative expenses |

|

(26) |

(19) |

+37% |

|

(14) |

(10) |

+40% |

| Other operating income |

|

35 |

7 |

NA |

|

24 |

3 |

NA |

| Other operating expenses |

|

(14) |

(2) |

NA |

|

(9) |

(1) |

NA |

| Results for participation in joint businesses |

|

5 |

34 |

-85% |

|

3 |

12 |

-75% |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

162 |

166 |

-2% |

|

78 |

69 |

+13% |

| |

|

|

|

|

|

|

|

|

| Finance income |

|

1 |

1 |

- |

|

1 |

- |

NA |

| Finance costs |

|

(66) |

(27) |

+144% |

|

(41) |

(14) |

+193% |

| Other financial results |

|

124 |

(42) |

NA |

|

90 |

(51) |

NA |

| Financial results, net |

|

59 |

(68) |

NA |

|

50 |

(65) |

NA |

| |

|

|

|

|

|

|

|

|

| Profit before tax |

|

221 |

98 |

+126% |

|

128 |

4 |

NA |

| |

|

|

|

|

|

|

|

|

| Income tax |

|

(21) |

(17) |

+24% |

|

(24) |

(21) |

+14% |

| |

|

|

|

|

|

|

|

|

| Net income for the period |

|

200 |

81 |

+147% |

|

104 |

(17) |

NA |

| Attributable to owners of the Company |

|

200 |

79 |

+153% |

|

104 |

(18) |

NA |

| Attributable to non-controlling interests |

|

- |

2 |

-100% |

|

0 |

1 |

-90% |

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

206 |

220 |

-6% |

|

98 |

99 |

-1% |

| Adjusted EBITDA at our share ownership |

|

198 |

219 |

-10% |

|

103 |

98 |

+4% |

| |

|

|

|

|

|

|

|

|

| Increases in PPE |

|

146 |

30 |

NA |

|

53 |

20 |

+165% |

| Depreciation and amortization |

|

50 |

43 |

+16% |

|

24 |

21 |

+14% |

The

slight increase in power generation sales during Q2 23

is mainly explained by renewable PPAs: the consolidation of PEMC, the acquisition of PEA and the commissioning of PEPE IV. Additionally,

despite a 2% drop in national industrial electricity consumption, we recorded a 21% increase in Energía Plus demand, reaching 530

GWh during Q2 23.

These effects

were partially offset by lower legacy energy prices and, to a lesser extent, Energia Plus prices. For legacy energy, in spite of

price increases, devaluation affected the mainly AR$-traded prices. Legacy energy represented 68% of the 5,432 MW operated by

Pampa[5], but comprised only 27% of the Q2 23 segment’s sales. The capacity remuneration for our thermal legacy

units was US$4.0 thousand/MW-month (-8% vs. Q2 22), but it would have been -30% without the differential remuneration for CCGTs

(Res. No. 59/23). Hydros recorded US$1.9 thousand/MW-month (-14% vs. Q2 22). Moreover, sales were affected by a programmed overhaul

in CTGEBA’s legacy CCGT and a minor incident at CTG; both outages ended in June 2023.

In operating

terms, Pampa’s operated power generation grew 17% vs. Q2 22. This was explained by the higher

dispatch from the most efficient units, mainly CTEB’s CCGT, commissioned in February 2023 (+936 GWh), new wind farms PEA and PEPE

IV (+117 GWh) and CTLL due to more gas availability in the area (+56 GWh). On the other hand, Argentine power generation decreased by

7% year-on-year due to

5 Under IFRS, we do not consolidate

CTEB (848 MW) in our financial statements since it is an affiliate. However, it is an asset operated by Pampa and its EBITDA to our shareholding

is considered in our total adjusted EBITDA.

| |

| Pampa Energía ● Earnings release Q2 23 ● 12 |

lower demand, affecting

CPB’s dispatch (-218 GWh) and Mendoza hydros (-19 GWh). Moreover, CTGEBA’s TV01 had a programmed overhaul (-137 GWh),

and wind farms experienced lower wind speeds (-27 GWh).

The availability

of Pampa’s operated units reached 95.0% in Q2 23 (-279 basis points vs. Q2 22’s 97.8%), mainly

due to CTG’s outage and the programmed maintenance at CTGEBA, both mentioned above, in addition to the commissioning testing with

GO of CTEB’s CCGT. Therefore, a 93.6% thermal availability rate was registered in Q2 23 (-374 basis points vs. 97.3% from Q2 22).

Power generation's

key performance indicators |

|

2023 |

|

2022 |

|

Variation |

| Hydro |

Wind |

Thermal |

Total |

Hydro |

Wind |

Thermal |

Total |

Hydro |

Wind |

Thermal |

Total |

| Installed capacity (MW) |

|

938 |

387 |

4,107 |

5,432 |

|

938 |

206 |

3,826 |

4,970 |

|

- |

+88% |

+7% |

+9% |

| New capacity (%) |

|

- |

100% |

33% |

32% |

|

- |

100% |

28% |

26% |

|

- |

- |

+5% |

+6% |

| Market share (%) |

|

2.2% |

0.9% |

9.5% |

12.5% |

|

2.2% |

0.5% |

8.9% |

11.6% |

|

-0% |

+0% |

+1% |

+1% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Semester |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net generation (GWh) |

|

653 |

598 |

9,728 |

10,978 |

|

596 |

442 |

8,331 |

9,369 |

|

+9% |

+35% |

+17% |

+17% |

| Volume sold (GWh) |

|

653 |

592 |

10,315 |

11,561 |

|

596 |

456 |

8,905 |

9,956 |

|

+10% |

+30% |

+16% |

+16% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average price (US$/MWh) |

|

24 |

73 |

33 |

34 |

|

28 |

69 |

41 |

41 |

|

-13% |

+6% |

-19% |

-16% |

| Average gross margin (US$/MWh) |

7 |

64 |

20 |

22 |

|

10 |

58 |

25 |

26 |

|

-28% |

+9% |

-19% |

-16% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Second quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net generation (GWh) |

|

205 |

306 |

4,707 |

5,218 |

|

224 |

215 |

4,038 |

4,477 |

|

-8% |

+42% |

+17% |

+17% |

| Volume sold (GWh) |

|

205 |

301 |

5,017 |

5,523 |

|

224 |

221 |

4,302 |

4,747 |

|

-8% |

+36% |

+17% |

+16% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average price (US$/MWh) |

|

33 |

74 |

35 |

37 |

|

33 |

70 |

39 |

40 |

|

-1% |

+6% |

-10% |

-7% |

| Average gross margin (US$/MWh) |

5 |

64 |

21 |

23 |

|

8 |

60 |

21 |

22 |

|

-29% |

+7% |

-1% |

+2% |

Note: Gross margin before amortization

and depreciation. It includes CTEB, operated by Pampa (50% equity stake), and PEMC, in the process of divestment.

Without

depreciation and amortizations, net operating costs decreased

17% vs. Q2 22, mainly due to increased commercial interests from CAMMESA’s collection delays, both in rate and days. Without considering

this income, costs rose only 3% year-on-year, explained by higher labor costs and, to a lesser extent, increased power purchases to cover

contracts, partially offset by lower repairment charges due to the CTLL’s outage in Q2 22.

Financial

results from Q2 23 reached a net profit of US$50 million, while a net

loss of US$65 million was recorded in Q2 22, mainly due to profits from holding financial instruments, partially offset by higher financial

interest due to increased stock of AR$-debt and, to a lesser extent, by higher FX losses due to the segment’s asset monetary position.

Adjusted

EBITDA from the power generation segment reached US$98 million,

similar to Q2 22, mainly due to lower legacy energy prices and, to a lesser extent, Energía Plus prices, certain thermal outages

at CTG and programmed at CTGEBA, lower dispatch at less efficient units as required by CAMMESA, and higher labor costs. These variations

were partially offset by renewable PPAs at PEMC, PEA and PEPE IV, the commissioning of CTEB’s CCGT and the differential remuneration

in US$ for legacy CCGTs. In addition, adjusted EBITDA considers CTEB (CTBSA)’s 50% ownership (US$14 million in Q2 23 vs. US$8 million

in Q2 22) and PEMC (Greenwind)’s 50% share capital when it was Pampa’s affiliate for US$3 million in Q2 22. Adjusted EBITDA

excludes items such as the commercial interests for delayed collections, repair expenses from CTLL’s outage in Q2 22, accrual of

PPE’s expenses as operating costs and contingency provisions for the concession’s termination at Mendoza hydros in Q2 23.

Finally,

without including CTEB, capital expenditures registered

US$53 million in Q2 23 (vs. US$20 million in Q2 22), explained by the PEPE VI project, offset by the commissioning of PEPE IV.

| |

| Pampa Energía ● Earnings release Q2 23 ● 13 |

The following table shows the expansion projects

in power generation:

| Project |

MW |

Marketing |

Currency |

Awarded price |

|

Estimated capex in

US$ million1 |

Date of

commissioning |

Capacity per

MW-month |

Variable

per MWh |

Total

per MWh |

|

Budget |

% Executed

@6/30/23 |

| Thermal |

|

|

|

|

|

|

|

|

|

|

| Closing to CC Ensenada2 |

279 |

PPA for 10 years |

US$ |

23,962 |

10.5 |

43 |

|

253 |

99% |

22-Feb-23 |

| |

|

|

|

|

|

|

|

|

|

|

| Renewable |

|

|

|

|

|

|

|

|

|

|

| Pampa Energía IV3 |

81 |

MAT ER |

US$ |

na |

na |

58(4) |

|

128 |

94% |

17-Jun-23 |

| Pampa Energía VI |

139.5 |

MAT ER |

US$ |

na |

na |

62(4) |

|

261 |

1% |

Q4 2024 (est.) |

Note: 1 Without value-added tax. 2 The ST capacity increased from

272 MW to 279 MW in April 2023, and both GTs from 567 MW to 569 MW. 3 Progressive commissioning from December 2022,

completing in June 2023. 4 Estimated average.

| 3.3 | Analysis of the oil and gas segment |

Oil & gas segment, consolidated

Figures in US$ million |

|

First half |

|

Second quarter |

| |

2023 |

2022 |

∆% |

|

2023 |

2022 |

∆% |

| Sales revenue |

|

341 |

302 |

+13% |

|

187 |

165 |

+13% |

| Local market sales |

|

230 |

216 |

+6% |

|

126 |

135 |

-6% |

| Foreign market sales |

|

111 |

86 |

+29% |

|

61 |

30 |

+100% |

| Cost of sales |

|

(198) |

(160) |

+24% |

|

(106) |

(90) |

+18% |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

143 |

142 |

+1% |

|

81 |

75 |

+8% |

| |

|

|

|

|

|

|

|

|

| Selling expenses |

|

(25) |

(24) |

+4% |

|

(13) |

(8) |

+63% |

| Administrative expenses |

|

(38) |

(28) |

+36% |

|

(20) |

(14) |

+43% |

| Other operating income |

|

25 |

24 |

+4% |

|

20 |

20 |

- |

| Other operating expenses |

|

(13) |

(16) |

-19% |

|

(8) |

(4) |

+100% |

| Impairment of financial assets |

|

- |

(1) |

-100% |

|

- |

(1) |

-100% |

| Impairment of PPE and inventories |

|

- |

(29) |

-100% |

|

- |

(29) |

-100% |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

85 |

68 |

+25% |

|

53 |

39 |

+36% |

| |

|

|

|

|

|

|

|

|

| Finance income |

|

1 |

1 |

- |

|

1 |

- |

NA |

| Finance costs |

|

(97) |

(43) |

+126% |

|

(59) |

(19) |

+211% |

| Other financial results |

|

25 |

(5) |

NA |

|

20 |

7 |

+186% |

| Financial results, net |

|

(71) |

(47) |

+51% |

|

(38) |

(12) |

+217% |

| |

|

|

|

|

|

|

|

|

| Loss before tax |

|

14 |

21 |

-33% |

|

15 |

27 |

-44% |

| |

|

|

|

|

|

|

|

|

| Income tax |

|

- |

27 |

-100% |

|

- |

25 |

-100% |

| |

|

|

|

|

|

|

|

|

| Net loss for the period |

|

14 |

48 |

-71% |

|

15 |

52 |

-71% |

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

159 |

158 |

+1% |

|

97 |

102 |

-4% |

| |

|

|

|

|

|

|

|

|

| Increases in PPE and right-of-use assets |

|

217 |

148 |

+47% |

|

129 |

85 |

+52% |

| Depreciation and amortization |

|

73 |

61 |

+20% |

|

41 |

34 |

+21% |

In Q2

23, sales from the oil and gas segment grew 13% vs.

Q2 22, mainly due to higher gas income from exports to Chile and deliveries to CAMMESA and, to a lesser extent, an increase in

foreign oil demand. However, these effects were partially offset by a lower gas retail demand due to mild weather, although it

increased during the winter season that began in May. Moreover, crude oil exports were affected by lower internationall

prices.

| |

| Pampa Energía ● Earnings release Q2 23 ● 14 |

Oil and gas'

key performance indicators |

|

2023 |

|

2022 |

|

Variation |

| Oil |

Gas |

Total |

Oil |

Gas |

Total |

Oil |

Gas |

Total |

| Semester |

|

|

|

|

|

|

|

|

|

|

|

|

| Volume |

|

|

|

|

|

|

|

|

|

|

|

|

| Production |

|

|

|

|

|

|

|

|

|

|

|

|

| In thousand m3/day |

|

0.8 |

9,745 |

|

|

0.8 |

9,519 |

|

|

+0% |

+2% |

+2% |

| In million cubic feet/day |

|

|

344 |

|

|

|

336 |

|

|

| In thousand boe/day |

|

5.1 |

57.4 |

62.4 |

|

5.1 |

56.0 |

61.1 |

|

| Sales |

|

|

|

|

|

|

|

|

|

|

|

|

| In thousand m3/day |

|

0.9 |

9,781 |

|

|

0.8 |

9,606 |

|

|

+14% |

+2% |

+3% |

| In million cubic feet/day |

|

|

345 |

|

|

|

339 |

|

|

| In thousand boe/day |

|

5.7 |

57.6 |

63.2 |

|

4.9 |

56.5 |

61.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average Price |

|

|

|

|

|

|

|

|

|

|

|

|

| In US$/bbl |

|

66.4 |

|

|

|

70.7 |

|

|

|

-6% |

+9% |

|

| In US$/MBTU |

|

|

4.4 |

|

|

|

4.0 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Second quarter |

|

|

|

|

|

|

|

|

|

|

|

|

| Volume |

|

|

|

|

|

|

|

|

|

|

|

|

| Production |

|

|

|

|

|

|

|

|

|

|

|

|

| In thousand m3/day |

|

0.8 |

10,577 |

|

|

0.8 |

10,118 |

|

|

+0% |

+5% |

+4% |

| In million cubic feet/day |

|

|

374 |

|

|

|

357 |

|

|

| In thousand boe/day |

|

5.1 |

62.3 |

67.3 |

|

5.1 |

59.6 |

64.6 |

|

| Sales |

|

|

|

|

|

|

|

|

|

|

|

|

| In thousand m3/day |

|

0.9 |

10,585 |

|

|

0.7 |

10,227 |

|

|

+15% |

+4% |

+4% |

| In million cubic feet/day |

|

|

374 |

|

|

|

361 |

|

|

| In thousand boe/day |

|

5.4 |

62.3 |

67.7 |

|

4.7 |

60.2 |

64.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average Price |

|

|

|

|

|

|

|

|

|

|

|

|

| In US$/bbl |

|

65.1 |

|

|

|

72.6 |

|

|

|

-10% |

+7% |

|

| In US$/MBTU |

|

|

4.7 |

|

|

|

4.4 |

|

|

|

Note: The net production in Argentina.

The gas volume is standardized at 9,300 kilocalories (kCal).

In operating

terms, total production reached 67.3 kboe/day

in Q2 23 (+4% vs. Q2 22 and +17% vs. Q1 23). Gas production recorded

10.6 million m3/day (+5% vs. Q2 22 and +19% vs. Q1 23), explained by the beginning of the winter season, higher volumes exported

to Chile and increased demand for thermal generation by CAMMESA. However, lower retail demand was observed compared to the maximum volumes

contracted under Plan Gas.Ar due to mild weather. Still, Pampa reached a new all-time high gas production in June, recording 13.5 million

m3/day.

Analyzing

the gas output by block, 60% of our total gas output in Q2 23 came from El Mangrullo,

which recorded 6.3 million m3/day (-13% vs. Q2 22 but +10% vs. Q1 23 due to seasonality). The lower activity at El Mangrullo

is explained by the soft retail demand mentioned above. On the other hand, due to shale activity, Sierra Chata reached 2.2 million m3/day

(+209% vs. Q2 22 and +83% vs. Q1 23). At non-operated blocks, Río Neuquén remained at 1.6 million m3/day (+4%

vs. Q2 22 and +6% vs. Q1 23), while Rincón del Mangrullo continues the natural depletion, contributing 0.2 million m3/day

(-33% vs. Q2 22 and -8% vs. Q1 23).

Our gas

price in Q2 23 was US$4.7/MBTU (+7% vs. Q2 22 and +19% vs. Q1 23), mainly driven by better export

prices to Chile, which were higher than the local market, partially offset by lower prices in the industrial segment due to lower domestic

demand.

In Q2

23, 39% of our gas deliveries were destined for the retail

segment due to the winter period priority under Plan Gas.Ar. 22% was sold to CAMMESA as fuel for our thermal power units, also under Plan

Gas.Ar6, 20% was sold to the industrial/spot market, 15% was exported, and the remaining was sold as raw

6 Energía Plus and SEE

Res. No. 287/17.

| |

| Pampa Energía ● Earnings release Q2 23 ● 15 |

material to our petchem plants. In contrast, in Q2 22, 48%

was sold to the retail segment, 21% to the industrial/spot market, 17% to our thermal power units, 10% was exported, and 3% was sold to

our petchem plants.

Oil

production reached 5.1 kbbl/day in Q2 23, similar to Q2 22, explained by higher output at Río

Neuquén, Gobernador Ayala and Los Blancos (+0.4 kbbl/day vs. Q2 22), partially offset by a drop of 0.3 kbbl/day at El Tordillo.

However, the volume sold was higher thanks to the oil stock during Q2 23 to respond to the increasing foreign demand. 67% of the volume

traded was destined for the local market vs. 78% in Q2 22.

Our oil

price in Q2 23 was 10% lower than in Q2 22, reaching US$65.1/barrel,

explained by lower export prices due to the decrease in Brent, while domestic prices remained similar, recording US$65/barrel.

By the

end of Q2 23, we accounted for 815 productive wells vs.

895 as of the end of 2022. The sharp decrease is explained by the exit agreements in Estación Fernández Oro and Anticlinal

Campamento gas blocks, and the production curtailment at El Tordillo oil block due to cost efficiency.

Net operating

costs in Q2 23, excluding depreciation, amortization, Plan Gas.Ar

compensation and interests for delayed collections charged to CAMMESA grew 37%, reaching US$112 million vs. Q2 22 and 19% vs. Q1 23, mainly

due to a US$7 million loss for wells write-off because of Río Atuel’s oil exploratory area reversal, in addition to higher

transportation costs for gas exports as tariffs increased, operation and maintenance of wells and treatment plants at operated blocks,

labor expenses, royalties and levies - all linked to higher oil and gas sales.

New wells’

productivity positively impacted the lifting cost per boe,

which increased at a lower speed than total operating costs. Lifting cost increased by only 11% year-on-year to US$6.5/boe produced in

Q2 23 and decreased by 9% vs. Q1 23.

Financial

results in Q2 23 recorded increased losses of US$38 million, mainly due to a rise in interests

from the higher stock of AR$-debt and devaluation losses over certain receivables, partially offset by higher gains from holding financial

securities.

Our oil

and gas adjusted EBITDA amounted to US$97 million in Q2

23, 4% lower than in Q2 22, mainly explained by soft retail demand and higher operation costs due to increased activity, partially offset

by gas and oil exports. In addition, the adjusted EBITDA of Q2 23 excludes the impairment of PPE and inventories, costs linked to Río

Atuel reversal and commercial interests for late collection, mainly charged to CAMMESA.

Finally,

in Q2 23, capital expenditures amounted to US$129 million,

52% higher vs. Q2 22, mainly driven by the shale gas wells drilling and completion campaign to comply with the additional commitments

under Plan Gas.Ar.

| |

| Pampa Energía ● Earnings release Q2 23 ● 16 |

| 3.4 | Analysis of the petrochemicals segment |

Petrochemicals segment, consolidated

Figures in US$ million |

|

First half |

|

Second quarter |

| |

2023 |

2022 |

∆% |

|

2023 |

2022 |

∆% |

| Sales revenue |

|

257 |

284 |

-10% |

|

132 |

158 |

-16% |

| Local market sales |

|

181 |

184 |

-2% |

|

92 |

99 |

-8% |

| Foreign market sales |

|

76 |

100 |

-24% |

|

40 |

59 |

-32% |

| Cost of sales |

|

(231) |

(250) |

-8% |

|

(117) |

(134) |

-13% |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

26 |

34 |

-24% |

|

15 |

24 |

-38% |

| |

|

|

|

|

|

|

|

|

| Selling expenses |

|

(8) |

(8) |

- |

|

(5) |

(4) |

+25% |

| Administrative expenses |

|

(3) |

(2) |

+50% |

|

(1) |

(1) |

- |

| Other operating expenses |

|

(1) |

(1) |

- |

|

(1) |

(1) |

- |

| Impairment of inventories |

|

(3) |

- |

NA |

|

(3) |

- |

NA |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

11 |

23 |

-52% |

|

5 |

18 |

-72% |

| |

|

|

|

|

|

|

|

|

| Finance costs |

|

(1) |

(1) |

- |

|

- |

- |

NA |

| Other financial results |

|

3 |

- |

NA |

|

3 |

(1) |

NA |

| Financial results, net |

|

2 |

(1) |

NA |

|

3 |

(1) |

NA |

| |

|

|

|

|

|

|

|

|

| Profit before tax |

|

13 |

22 |

-41% |

|

8 |

17 |

-53% |

| |

|

|

|

|

|

|

|

|

| Income tax |

|

(2) |

(3) |

-33% |

|

(2) |

(3) |

-33% |

| |

|

|

|

|

|

|

|

|

| Net income for the period |

|

11 |

19 |

-42% |

|

6 |

14 |

-57% |

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

17 |

25 |

-32% |

|

10 |

19 |

-48% |

| |

|

|

|

|

|

|

|

|

| Increases in PPE |

|

3 |

2 |

+50% |

|

1 |

2 |

-50% |

| Depreciation and amortization |

|

3 |

2 |

+50% |

|

2 |

1 |

+100% |

The petrochemicals

segment’s adjusted EBITDA reached US$10 million in Q2 23, which is 48% lower vs.

Q2 22, mainly explained by the significant drop in international reference prices and lower styrene, polystyrene and SBR exported volumes.

These effects were partially offset by higher reforming volumes sold. On the other hand, the adjusted EBITDA increased by US$3 million

quarter-on-quarter, mainly due to an improvement in reforming international reference prices and higher SBR volumes sold, partially offset

by lower styrene and polystyrene sales.

Total

volume sold

grew 17% vs. Q2 22, reaching 106 thousand tons, mainly explained by increased dispatch of reforming products due to higher virgin naphtha

processing and a programmed shutdown in Q2 22. This increase was partially offset by lower exports of the rest of the products,

in addition to the 3 thousand tons of gasoline dispatched as toll processing, which was not recorded as volume sold in Q2 22.

| |

| Pampa Energía ● Earnings release Q2 23 ● 17 |

Petrochemicals'

key performance indicators |

|

Products |

|

Total |

| |

Styrene & polystyrene1 |

SBR |

Reforming & others |

|

| Semester |

|

|

|

|

|

|

| Volume sold 1H23 (thousand ton) |

|

54 |

20 |

136 |

|

209 |

| Volume sold 1H22 (thousand ton) |

|

56 |

24 |

103 |

|

182 |

| Variation 1H23 vs. 1H22 |

|

-4% |

-17% |

+32% |

|

+15% |

| |

|

|

|

|

|

|

| Average price 1H23 (US$/ton) |

|

1,889 |

1,924 |

869 |

|

1,230 |

| Average price 1H22 (US$/ton) |

|

2,106 |

2,197 |

1,119 |

|

1,561 |

| Variation 1H23 vs. 1H22 |

|

-10% |

-12% |

-22% |

|

-21% |

| |

|

|

|

|

|

|

| Second quarter |

|

|

|

|

|

|

| Volume sold Q2 23 (thousand ton) |

|

25 |

11 |

70 |

|

106 |

| Volume sold Q2 22 (thousand ton) |

|

28 |

13 |

50 |

|

91 |

| Variation Q2 23 vs. Q2 22 |

|

-12% |

-14% |

+41% |

|

+17% |

| |

|

|

|

|

|

|

| Average price Q2 23 (US$/ton) |

|

1,926 |

1,913 |

891 |

|

1,240 |

| Average price Q2 22 (US$/ton) |

|

2,296 |

2,322 |

1,270 |

|

1,738 |

| Variation Q2 23 vs. Q2 22 |

|

-16% |

-18% |

-30% |

|

-29% |

Note: 1 Includes Propylene.

In Q2 23,

financial results reached a net profit of US$3 million, while in Q2 22, a

net loss of US$1 million was recorded, explained by higher FX gains over payables and lower losses from commodities

hedge.

Capital

expenditures reached US$1 million in Q2 23 vs. US$2 million in Q2 22.

| |

| Pampa Energía ● Earnings release Q2 23 ● 18 |

| 3.5 | Analysis of the holding and others segment |

Holding and others segment, consolidated

Figures in US$ million |

|

First half |

|

Second quarter |

| |

2023 |

2022 |

∆% |

|

2023 |

2022 |

∆% |

| Sales revenue |

|

8 |

12 |

-33% |

|

4 |

5 |

-20% |

| Local market sales |

|

8 |

12 |

-33% |

|

4 |

5 |

-20% |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

8 |

12 |

-33% |

|

4 |

5 |

-20% |

| |

|

|

|

|

|

|

|

|

| Administrative expenses |

|

(22) |

(14) |

+57% |

|

(13) |

(6) |

+117% |

| Other operating income |

|

1 |

5 |

-80% |

|

1 |

2 |

-50% |

| Other operating expenses |

|

(7) |

(4) |

+75% |

|

(4) |

(2) |

+100% |

| Impairment of financial assets |

|

(3) |

(3) |

- |

|

(3) |

(2) |

+50% |

| Recovery from impair. (Impairment) of intangible assets |

|

2 |

(6) |

NA |

|

- |

(6) |

-100% |

| Results for participation in joint businesses |

|

29 |

23 |

+26% |

|

16 |

20 |

-20% |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

8 |

13 |

-38% |

|

1 |

11 |

-91% |

| |

|

|

|

|

|

|

|

|

| Finance income |

|

3 |

6 |

-50% |

|

1 |

3 |

-67% |

| Finance costs |

|

(27) |

(10) |

+170% |

|

(13) |

(7) |

+86% |

| Other financial results |

|

102 |

12 |

NA |

|

57 |

12 |

NA |

| Financial results, net |

|

78 |

8 |

NA |

|

45 |

8 |

NA |

| |

|

|

|

|

|

|

|

|

| Profit before tax |

|

86 |

21 |

NA |

|

46 |

19 |

+142% |

| |

|

|

|

|

|

|

|

|

| Income tax |

|

(6) |

(1) |

NA |

|

(7) |

- |

NA |

| |

|

|

|

|

|

|

|

|

| Net income for the period |

|

80 |

20 |

+300% |

|

39 |

19 |

+105% |

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

46 |

76 |

-40% |

|

16 |

35 |

-53% |

| |

|

|

|

|

|

|

|

|

| Increases in PPE |

|

3 |

2 |

+84% |

|

1 |

1 |

- |

| Depreciation and amortization |

|

- |

- |

NA |

|

- |

- |

NA |

The holding

and others segment, without considering the affiliates’ equity income (Transener and TGS), posted a US$15 million operating

loss in Q2 23, while in Q2 22, it was a US$9 million loss, mainly explained by the share price

performance impacting the executive compensation plan and lower accrued fees, partially offset by lower third-party expenses.

In Q2

23, financial results reached a net gain of US$45 million vs. US$8 million in

Q2 22, mainly due to higher profits from the devaluation on liability monetary position in AR$, partially offset by higher tax interests.

The adjusted

EBITDA of our holding and others segment decreased by 53%, recording

US$16 million in Q2 23. The adjusted EBITDA excludes the equity income from our participation in TGS and Transener. In turn, it adds the

EBITDA adjusted by equity ownership in these businesses. Besides, it excludes the impairment of intangible assets in Q2 22.

In TGS,

the EBITDA adjusted by our stake was US$24 million in Q2

23 vs. US$31 million in Q2 22. The decline was mainly due to lower international reference prices and the lagged tariff increase over

regulated income that failed to offset inflation and AR$ devaluation. However, these effects were partially offset by higher propane and

butane exports, increased dispatch of ethane (and the award for achievement) and midstream revenues.

In Transener,

the EBITDA adjusted by our stake recorded US$7 million in Q2 23 (similar to Q2 22), mainly due to the tariff increase of approximately

155% as of January 2023, partially offset by the AR$ devaluation.

| |

| Pampa Energía ● Earnings release Q2 23 ● 19 |

| 3.6 | Analysis of the six-month period, by

subsidiary and segment |

Subsidiary

In US$ million |

First half 2023 |

|

First half 2022 |

| % Pampa |

Adjusted EBITDA |

Net debt2 |

Net income (loss)3 |

|

% Pampa |

Adjusted EBITDA |

Net debt2 |

Net income (loss)3 |

| |

| Power generation segment |