As filed with the Securities and Exchange Commission on December 28, 2023.

Registration No. 333- __

_________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

OFG BANCORP

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Commonwealth of Puerto Rico | | 66-0538893 |

| (State or Other Jurisdiction of Incorporation) | | (I.R.S. Employer Identification No.) |

Oriental Center

254 Muñoz Rivera Avenue

San Juan, Puerto Rico 00918

(Address of Principal Executive Offices)

OFG BANCORP

2007 OMNIBUS PERFORMANCE INCENTIVE PLAN

(Full Title of the Plan)

Hugh González

General Counsel

Oriental Center

254 Muñoz Rivera Avenue

San Juan, Puerto Rico 00918

(787) 771-6800

(Name, Address and Telephone Number, including Area Code of Agent for Service)

Copies to:

Iván G. Marrero

Pietrantoni Mendez & Alvarez LLC

Popular Center, 19th Floor

208 Ponce de Leon Avenue

San Juan, Puerto Rico 00918

(787) 773-6001

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ X ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [ ]

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

EXPLANATORY NOTE AND INCORPORATION BY REFERENCE

This registration statement on Form S-8 is filed by OFG Bancorp (the “Company”) for the purpose of registering 974,384 additional shares of the Company’s common stock, par value $1.00 per share (the “Common Stock”), that may be issued in connection with the Company’s 2007 Omnibus Performance Incentive Plan, as amended and restated (the “Plan”). On March 16, 2023, the Company filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement that included a proposal to replenish and increase the total number of shares of Common Stock reserved for issuance under the Plan by 974,384 shares to 1,500,000. The proposal was approved by the Company’s shareholders at their annual meeting on April 26, 2023. In accordance with Instruction E of the General Instructions to Form S-8, the registration statements on Form S-8 previously filed by the Company with the SEC relating to the Plan (File Nos. 333-147727, 333-170064, 333-191603 and 333-262655) (collectively, the “Prior Registration Statements”) are incorporated herein by reference, including all periodic reports of the Company that were filed subsequent to the Prior Registration Statements and which are incorporated therein by reference.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 8. Exhibits

| | | | | |

Exhibit No. |

Description

|

4.1

| |

4.2

| |

4.3

| |

4.4

| |

| 5.0* | |

| 23.1* | |

| 23.2* | |

| 24* | |

| 107* | |

* Filed herewith. |

SIGNATURES

The Registrant. Pursuant to the requirements of the Securities Act, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the municipality of San Juan, Commonwealth of Puerto Rico, on the 28th day of December, 2023.

OFG BANCORP

By: /s/ José Rafael Fernández

José Rafael Fernández

President, Chief Executive Officer and

Vice Chairman of the Board

(Principal Executive Officer)

POWER OF ATTORNEY AND SIGNATURES

Each person whose signature appears below hereby constitutes and appoints José Rafael Fernández, Maritza Arizmendi, and Hugh González, each acting singly, his true and lawful attorneys‑in‑fact and agents, each with full power of substitution and re‑substitution for him and in his name, place and stead in any and all capacities, to sign any and all amendments (including post‑effective amendments) to this registration statement, and any registration statement relating to the same offering as this registration statement that is to be effective upon filing pursuant to Rule 462(a) under the Securities Act, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the SEC, granting unto said attorneys‑in‑fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys‑in‑fact and agents, or their substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and on the date indicated:

| | | | | | | | |

| SIGNATURES | TITLES | DATE |

/s/ Julian S. Inclán Julian S. Inclán

| Chairperson of the Board | December 28, 2023 |

/s/ José Rafael Fernández José Rafael Fernández

| President, Chief Executive Officer and Vice Chairman of the Board

(Principal Executive Officer)

| December 28, 2023 |

/s/ Jorge Colón-Gerena Jorge Colón-Gerena

| Director | December 28, 2023 |

/s/ Néstor de Jesús Néstor de Jesús

| Director | December 28, 2023 |

/s/ Annette Franqui Annette Franqui

| Director | December 28, 2023 |

/s/ Susan Harnett Susan Harnett

| Director | December 28, 2023 |

/s/ Angel Vázquez Angel Vázquez

| Director | December 28, 2023 |

/s/ Rafael Vélez Rafael Vélez

| Director | December 28, 2023 |

/s/ Maritza Arizmendi Maritza Arizmendi

| Chief Financial Officer (Principal Financial and Accounting Officer)

| December 28, 2023 |

Exhibit 107

Calculation of Filing Fee Tables

FORM S-8

Registration Statement Under the Securities Act of 1933

(Form Type)

OFG BANCORP

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Title of Each Class of Securities to be Registered1 | Fee Calculation Rule | Amount to be Registered1 | Proposed Maximum Offering Price per Share2 | Proposed Maximum Aggregate Offering Price 2 | Fee rate | Amount of

Registration Fee |

| Equity | Common Stock,

par value $1.00 per share | 457 (c) and 457 (h) |

974,384 shares | $37.32 | $36,364,010.88 | 0.0001476 | $5,367.33 |

| Total Offering Amounts | | $36,364,010.88 | | $5,367.33 |

| Total Fee Offsets | | | | $— |

| Net Fee Due | | | | $5,367.33 |

1 Represents additional shares of common stock, par value $1.00 per share (the “Common Stock”), reserved for issuance under the Registrant’s 2007 Omnibus Performance Incentive Plan, as amended and restated (the “Plan”). Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), the amount being registered also includes an indeterminate number of shares of Common Stock as may become issuable under the Plan as a result of stock splits, stock dividends or similar transactions.

2 Estimated solely for the purpose of calculating the registration fee pursuant to paragraphs (c) and (h)(1) of Rule 457 under the Securities Act. Based on the average of the high and low prices of the Company’s common stock as reported on the New York Stock Exchange on December 21, 2023.

EXHIBIT 5

December 28, 2023

OFG Bancorp

Oriental Center

254 Muñoz Rivera Avenue

San Juan, Puerto Rico 00918

Ladies and Gentlemen:

As counsel to OFG Bancorp, a Puerto Rico corporation (the “Company”), we have been requested to render this opinion for filing as an exhibit to the Company’s registration statement on Form S-8 (the “Registration Statement”), which is being filed with the Securities and Exchange Commission (the “Commission”) on the date hereof.

The Registration Statement covers 974,384 additional shares (the “Shares”) of the Company’s common stock, par value $1.00 per share, which may be issued by the Company pursuant to its 2007 Omnibus Performance Incentive Plan, as amended and restated (the “Plan”), filed as Exhibit 4.1 to the Registration Statement.

We have examined the Company’s certificate of incorporation, as amended, the Company’s by-laws, the Plan, and related minutes of actions taken by the Company’s Board of Directors, and such other documents and records as we have deemed appropriate. In the foregoing examination, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, and the conformity to originals of all documents submitted to us as certified or reproduced copies of originals.

Based on the foregoing, we are of the opinion that the Shares, when issued and sold pursuant to and in accordance with the terms and conditions of the Plan, will be legally issued, fully paid and non-assessable.

This opinion merely constitutes an expression of our reasoned professional judgment regarding the matters of law addressed herein and neither is intended nor should it be construed as a prediction or guarantee that any court or other public or governmental authority will reach any particular result or conclusion as to the matters of law addressed herein. This opinion is limited to the Puerto Rico General Corporations Act, as amended and in effect on the date hereof, and we assume no obligation to revise or supplement this opinion should such law be changed by legislative action, judicial decision or otherwise.

OFG Bancorp

Page 2

December 28, 2023

We hereby consent to the filing of this opinion as Exhibit 5.0 to the Registration Statement. This consent is not to be construed as an admission that we are within the category of persons whose consent is required under Section 7(a) of the Securities Act of 1933, as amended, or the rules and regulations promulgated thereunder by the Commission.

Very truly yours,

/s/ Pietrantoni Mendez & Alvarez LLC

EXHIBIT 23.2

Consent of Independent Registered Public Accounting Firm

We consent to the use of our reports dated February 24, 2023, with respect to the consolidated financial statements of OFG Bancorp, and the effectiveness of internal control over financial reporting, incorporated herein by reference.

/s/ KPMG LLP

San Juan, Puerto Rico

December 28, 2023

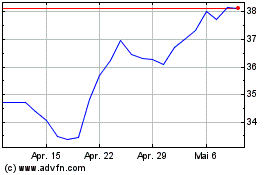

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

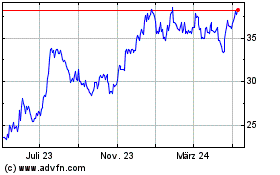

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

Von Mai 2023 bis Mai 2024