0000074046false00000740462023-12-112023-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported) | December 11, 2023 |

OIL-DRI CORPORATION OF AMERICA

(Exact name of the registrant as specified in its charter)

Delaware 001-12622 36-2048898

| | | | | | | | | | | | | | |

| (State or other jurisdiction of incorporation or organization) | | Commission File Number | | (I.R.S. Employer Identification No.) |

410 North Michigan Avenue, Suite 400 60611-4213

Chicago, Illinois (Zip Code)

(Address of principal executive offices)

Registrant's telephone number, including area code (312) 321-1515

| | |

| |

| (Former name or former address, if changed since last report.) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | ODC | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | | | | |

| | Item 2.02 | Results of Operations and Financial Condition. |

On December 11, 2023, Oil-Dri Corporation of America (the “Registrant”) issued a press release announcing its results of operations for its first quarter ended October 31, 2023. A copy of the press release is attached as Exhibit 99.1, and the information contained therein is incorporated herein by reference. The information contained in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), and it shall not be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| | | | | | | | |

| | Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits

| | | | | | | | |

| Exhibit | | |

| Number | | Description of Exhibits |

| | | |

| 99.1 | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | OIL-DRI CORPORATION OF AMERICA |

| | | |

| | By: | /s/ Laura G. Scheland | |

| | | Laura G. Scheland |

| | | Vice President, Strategic Partnerships and General Counsel & Secretary |

Date: December 11, 2023

410 N. Michigan Ave. Chicago, Illinois 60611, U.S.A

News Announcement

For Immediate Release

Exhibit 99.1

Oil-Dri Announces Record Results for First Quarter of Fiscal Year 2024

and Doubles its Net Income

CHICAGO-(December 11, 2023) - Oil-Dri Corporation of America (NYSE: ODC), producer and marketer of sorbent mineral products, today announced results for its first quarter of fiscal year 2024.

| | | | | | | | | | | | | | |

| | First Quarter |

| (in thousands, except per share amounts) | | Ended October 31, |

| | | | 2023 | 2022 | Change |

| Consolidated Results | | | | | | |

| Net Sales | | | | $ | 111,438 | | $ | 98,539 | | 13% |

| Net Income Attributable to Oil-Dri | | | | $ | 10,742 | | $ | 5,241 | | 105% |

| | | | | | |

| Diluted EPS - Common | | | | $ | 1.50 | | $ | 0.78 | | 92% |

| | | | | | |

| Business to Business | | | | | | |

| Net Sales | | | | $ | 39,161 | | $ | 33,687 | | 16% |

| Segment Operating Income | | | | $ | 11,123 | | $ | 7,257 | | 53% |

| Retail and Wholesale | | | | | | |

| Net Sales | | | | $ | 72,277 | | $ | 64,852 | | 11% |

| Segment Operating Income | | | | $ | 11,331 | | $ | 7,574 | | 50% |

| | | | | | |

Daniel S. Jaffee, President and Chief Executive Officer, stated, “I am very proud of our team’s efforts to successfully grow our top and bottom lines in the first quarter of fiscal 2024 compared to last year. These favorable results reflect our sixth consecutive quarter of record net sales and our eighth consecutive quarter of record gross profit. We also doubled our net income which reached an all-time high for the first quarter. While our gross margins were slightly lower than fourth quarter fiscal 2023 levels, we expanded year-over-year gross margins by 520 basis points. Moving forward, we hope to maintain this trajectory of success through further gross margin improvement and expanded distribution of our innovative products. At the same time, we will continue investing heavily in our manufacturing facilities to replace aging assets and support increased demand.”

Consolidated Results

Consolidated net sales in the first quarter of fiscal 2024 reached a record $111.4 million, a 13% increase over the prior year. This growth was primarily driven by elevated sales of cat litter and fluids purification products. While the Company also experienced revenue gains from its animal health, industrial & sports, and agricultural businesses, sales of its co-packaged coarse cat litter products declined in the first quarter compared to last year. Higher prices across all principal products helped contribute to the improvement in net sales, as well as increased volumes within our Business to Business (“B2B”) Products Group.

First quarter of fiscal 2024 consolidated gross profit was a record $31.0 million, an increase of $8.7 million, or 39%, over the first quarter of the prior year, with gross margin expansion to 27.8% in fiscal 2024 from 22.6% in fiscal 2023. During the three months ended October 31, 2023, domestic cost of goods sold per ton increased 11% compared to the prior year as a result of higher per ton non-fuel manufacturing, freight, and packaging costs, partially offset by lower natural gas costs. The implementation of several rounds of pricing actions over the last 12 months helped to mitigate these headwinds.

Selling, general and administrative (“SG&A”) expenses were $17.8 million during the first quarter of fiscal 2024 compared to $15.7 million for the same period last year. This 13% increase reflects higher advertising spending and an increase in compensation related expenses including salaries and corporate bonus accrual. Advertising expenses were significantly higher in the first quarter compared to the same period last year, as the majority of the prior year’s expenditures took place in the fourth quarter. Oil-Dri expects advertising costs for the full fiscal year 2024 to be higher than fiscal year 2023 and equally spread over four quarters

In the first quarter of fiscal 2024, the Company doubled its consolidated operating income to $13.2 million from $6.6 million in the first quarter of fiscal 2023. Higher sales offset inflationary impacts on cost of goods sold and an increase in SG&A expenditures.

Income tax expense increased to $2.1 million in the first quarter of fiscal year 2024 compared to $1.2 million in the same period last year due to higher taxable income. The Company set a record for the highest first quarter net income attributable to Oil-Dri of $10.7 million in fiscal 2024, more than double the prior year’s first quarter bottom line of $5.2 million.

Cash and cash equivalents for the three month period ending October 31, 2023, totaled $29.6 million compared to $10.5 million in the prior year. This $19.1 million increase was driven by higher earnings. Significant uses of cash during the first quarter of fiscal 2024 include capital investments for manufacturing infrastructure improvements and dividends.

Product Group Review

The Business to Business Products Group’s first quarter of fiscal 2024 revenues reached a record $39.2 million, a 16% increase over the prior year. All principal products achieved topline growth which was driven by higher prices and, to a lesser extent, by increased volumes. Sales of fluids purification products contributed to the majority of the increase with revenues of $22.4 million for the first quarter of fiscal 2024, a 23% increase over the prior year. This was primarily a result of elevated demand for renewable diesel and edible oil products within North America from both new and existing customers. Amlan International, the Company’s animal health business, demonstrated strong revenue growth with $6.4 million in sales during the first quarter of fiscal 2024, or an 18% increase over the prior year. These gains were primarily driven by customer demand, despite challenging global economic and market conditions impacting the poultry industry. Sales rose within North America due to higher prices and increased demand of Sorbiam products from existing customers. Amlan International’s topline growth can also be attributed to higher revenues within China, as a result of the sale of existing inventory to the Company’s master distributor in that country. Animal health products sales in Asia showed positive gains, while revenues from other regions remained soft. During the first quarter of fiscal

2024, agricultural products sales were $10.3 million, or a 3% increase over the prior year. Higher prices as well as a favorable mix of products contributed to the revenue improvement.

Operating income for the B2B Products Group was $11.1 million in the first quarter of fiscal 2024 compared to $7.3 million in fiscal 2023, reflecting a 53% increase. Higher sales coupled with a $300,000, or 7% decrease, in SG&A expenses drove the increase. This reduction in SG&A costs was primarily a result of a decrease in the allocation of technical support expenses.

The Retail and Wholesale (“R&W”) Products Group’s first quarter revenues reached an all-time high of $72.3 million, an 11% increase over the prior year. This was mainly driven by an $8.2 million, or 18%, increase in domestic cat litter sales, excluding the Company’s co-packaged coarse-cat litter business. Higher prices across the domestic cat litter product portfolio and increased volumes of lightweight scoopable and coarse litter offerings drove these sales gains. In addition, the Company expanded distribution with its newly launched Cat’s Pride Antibacterial Clumping Litter, the first and only EPA approved antibacterial cat litter in the United States. Revenues from combined domestic branded and private label lightweight litter items rose 24% in the first quarter of fiscal 2024 versus the prior year, exceeding the lightweight litter segment sales growth of 7% for the 13-week period ended November 4, 2023, according to third-party research data for retail sales1. First quarter of fiscal 2024 net sales from co-packaged coarse cat litter products decreased by $1.6 million, or 36%, compared to the same period in fiscal year 2023. This decline was primarily driven by a cyberattack on a significant customer rendering them unable to place and receive orders from the Company. Domestic industrial and sports product revenues were $10.7 million in the first quarter of fiscal 2024, or a 6% increase over last year. This gain was due to increased demand for Oil-Dri’s synthetic absorbents and higher prices across clay-based floor absorbent products. Net sales of our subsidiary in Canada increased in the first quarter of fiscal year 2024 compared to the prior year driven by higher demand and pricing of industrial floor absorbents.

Operating income for the R&W Products Group was $11.3 million in the first quarter of fiscal year 2024 compared to $7.6 million in the prior year, reflecting a 50% increase. Higher sales offset elevated costs of goods sold and higher SG&A spending. SG&A expenses for the first quarter of fiscal year 2024 increased by $1.2 million, or 32%, over last year. This increase was primarily driven by higher advertising expenditures to promote Cat’s Pride lightweight litter, including the newly launched Cat’s Pride Antibacterial Clumping Litter product.

Oil-Dri will host its first quarter fiscal 2024 earnings discussion and its fiscal 2023 Annual Meeting of Stockholders virtually via a live webcast on Wednesday, December 13, 2023 at 9:30 a.m. Central Time. Participation details are available on the Company’s website’s Events page.

###

1Based in part on data reported by NielsenIQ through its Scantrack Service for the Cat Litter Category in the 13-week period ended November 4, 2023, for the U.S. xAOC+Pet Supers market. Copyright © 2023 NielsenIQ.

Oil-Dri Corporation of America is a leading manufacturer and supplier of specialty sorbent products for the pet care, animal health and nutrition, fluids purification, agricultural ingredients, sports field, industrial and automotive markets. Oil-Dri is vertically integrated which enables the Company to efficiently oversee every step of the process from research and development to supply chain to marketing and sales. With over 80 years of experience, the Company continues to fulfill its mission to Create Value from Sorbent Minerals.

“Oil-Dri”, “Cat’s Pride”, “Sorbiam”, and “Amlan” are registered trademarks of Oil-Dri Corporation of America.

Certain statements in this press release may contain forward-looking statements that are based on our current expectations, estimates, forecasts and projections about our future performance, our business, our beliefs, and our management’s assumptions. In addition, we, or others on our behalf, may make forward-looking statements in other press releases or written statements, or in our communications and discussions with investors and analysts in the normal course of business through meetings, webcasts, phone calls, and conference calls. Words such as “expect,” “outlook,” “forecast,” “would,” “could,” “should,” “project,” “intend,” “plan,” “continue,” “believe,” “seek,” “estimate,” “anticipate,” “may,” “assume,” “potential,” and variations of such words and similar expressions are intended to identify such forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Such statements are subject to certain risks, uncertainties and assumptions that could cause actual results to differ materially including, but not limited to, the dependence of our future growth and financial performance on successful new product introductions, intense competition in our markets, volatility of our quarterly results, risks associated with acquisitions, our dependence on a limited number of customers for a large portion of our net sales and other risks, price fluctuations and pressures, increases in costs, disruptions to our and our counterparties’ businesses and operations and other uncertainties and assumptions that are described in Item 1A (Risk Factors) of our Quarterly Report on Form 10-Q for the quarter ended October 31, 2023 and our most recent Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission. Should one or more of these or other risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results may vary materially from those anticipated, intended, expected, believed, estimated, projected, planned or otherwise expressed in any forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Except to the extent required by law, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this press release, whether as a result of new information, future events, changes in assumptions, or otherwise.

Contact:

Leslie A. Garber

Director of Investor Relations

Oil-Dri Corporation of America

InvestorRelations@oildri.com

(312) 321-1515

| | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | | | | |

| (in thousands, except per share amounts) | |

| | | | | | | |

| Three Months Ended October 31, |

| 2023 | | % of Sales | | 2022 | | % of Sales |

| Net Sales | $ | 111,438 | | | 100.0 | % | | $ | 98,539 | | | 100.0 | % |

| Cost of Goods Sold | (80,447) | | | (72.2) | % | | (76,229) | | | (77.4) | % |

| Gross Profit | 30,991 | | | 27.8 | % | | 22,310 | | | 22.6 | % |

| | | | | | | |

| Selling, General and Administrative Expenses | (17,835) | | | (16.0) | % | | (15,741) | | | (16.0) | % |

| | | | | | | |

| Operating Income | 13,156 | | | 11.8 | % | | 6,569 | | | 6.7 | % |

| | | | | | | |

| Other Expense, Net | (326) | | | (0.3) | % | | (132) | | | (0.1) | % |

| | | | | | | |

| Income Before Income Taxes | 12,830 | | | 11.5 | % | | 6,437 | | | 6.5 | % |

| Income Taxes Expense | (2,088) | | | (1.9) | % | | (1,207) | | | (1.2) | % |

| Net Income | 10,742 | | | 9.6 | % | | 5,230 | | | 5.3 | % |

| Net Loss Attributable to Noncontrolling Interest | — | | | — | % | | (11) | | | — | % |

| Net Income Attributable to Oil-Dri | $ | 10,742 | | | 9.6 | % | | $ | 5,241 | | | 5.3 | % |

| | | | | | | |

| Net Income Per Share: Basic Common | $ | 1.61 | | | | | $ | 0.80 | | | |

| Basic Class B | $ | 1.21 | | | | | $ | 0.60 | | | |

| Diluted Common | $ | 1.50 | | | | | $ | 0.78 | | | |

| Diluted Class B | $ | 1.21 | | | | | $ | 0.59 | | | |

| Avg Shares Outstanding: Basic Common | 4,827 | | | | | 4,804 | | | |

| Basic Class B | 1,967 | | | | | 1,942 | | | |

| Diluted Common | 6,794 | | | | | 4,913 | | | |

| Diluted Class B | 1,967 | | | | | 1,963 | | | |

| | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEETS | | | | |

| (in thousands, except per share amounts) | | | | |

| | As of October 31, |

| | 2023 | | 2022 |

| Current Assets | | | | |

Cash and Cash Equivalents | | $ | 29,579 | | | $ | 10,470 | |

| | | | |

| | | | |

Accounts Receivable, Net | | 60,663 | | | 53,062 | |

Inventories | | 43,832 | | | 45,460 | |

| Prepaid Expenses and Other Assets | | 2,692 | | | 2,366 | |

Total Current Assets | | 136,766 | | | 111,358 | |

| Property, Plant and Equipment, Net | | 123,216 | | | 112,633 | |

| Other Noncurrent Assets | | 28,786 | | | 25,122 | |

| Total Assets | | $ | 288,768 | | | $ | 249,113 | |

| | | | |

| Current Liabilities | | | | |

Current Maturities of Notes Payable | | $ | 1,000 | | | $ | 1,000 | |

| | | | |

Accounts Payable | | 14,867 | | | 12,088 | |

Dividends Payable | | 1,953 | | | 1,860 | |

Other Current Liabilities | | 34,485 | | | 30,344 | |

Total Current Liabilities | | 52,305 | | | 45,292 | |

| Noncurrent Liabilities | | | | |

Notes Payable | | 30,842 | | | 31,800 | |

| Other Noncurrent Liabilities | | 19,705 | | | 17,993 | |

Total Noncurrent Liabilities | | 50,547 | | | 49,793 | |

| Stockholders' Equity | | 185,916 | | | 154,028 | |

| Total Liabilities and Stockholders' Equity | | $ | 288,768 | | | $ | 249,113 | |

| | | | |

| Book Value Per Share Outstanding | | $ | 27.36 | | | $ | 22.83 | |

| | | | |

| Acquisitions of: | | | | |

| Property, Plant and Equipment | | | | |

| First Quarter | | $ | 8,064 | | | $ | 6,737 | |

| Year To Date | | $ | 8,064 | | | $ | 6,737 | |

| Depreciation and Amortization Charges | | | | |

| First Quarter | | $ | 4,368 | | | $ | 3,523 | |

| Year To Date | | $ | 4,368 | | | $ | 3,523 | |

Certain amounts in the prior period financial statements have been reclassified to conform to the presentation of the current period financial statements.

| | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | | | |

| (in thousands) | | | |

| For the Three Months Ended |

| October 31, |

| 2023 | | 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net Income | $ | 10,742 | | | $ | 5,230 | |

| Adjustments to reconcile net income to net cash | | | |

| provided by operating activities: | | | |

| Depreciation and Amortization | 4,368 | | | 3,523 | |

| | | |

| | | |

| Increase in Accounts Receivable | (1,487) | | | (1,622) | |

| Increase in Inventories | (1,374) | | | (5,202) | |

| (Decrease) Increase in Accounts Payable | (1,289) | | | 1,854 | |

| Decrease in Accrued Expenses | (4,365) | | | (1,601) | |

| | | |

| Other | 1,969 | | | 632 | |

| Total Adjustments | (2,178) | | | (2,416) | |

| Net Cash Provided by Operating Activities | 8,564 | | | 2,814 | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Capital Expenditures | (8,064) | | | (6,737) | |

| | | |

| | | |

| | | |

| | | |

| Net Cash Used in Investing Activities | (8,064) | | | (6,737) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| | | |

| | | |

| | | |

| Dividends Paid | (1,927) | | | (1,851) | |

| Purchases of Treasury Stock | (872) | | | (92) | |

| | | |

| | | |

| Net Cash Used In Financing Activities | (2,799) | | | (1,943) | |

| | | |

| Effect of exchange rate changes on Cash and Cash Equivalents | 124 | | | 38 | |

| | | |

| Net Decrease in Cash and Cash Equivalents | (2,175) | | | (5,828) | |

| Cash and Cash Equivalents, Beginning of Period | 31,754 | | | 16,298 | |

| Cash and Cash Equivalents, End of Period | $ | 29,579 | | | $ | 10,470 | |

Certain amounts in the prior period financial statements have been reclassified to conform to the presentation of the current period financial statements.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

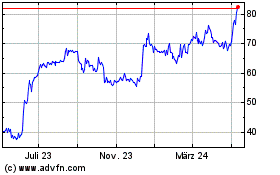

Oil Dri Corp of America (NYSE:ODC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

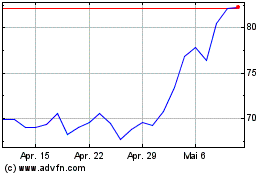

Oil Dri Corp of America (NYSE:ODC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024