0001757073FALSE00017570732024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 22, 2024

_____________________________________________

ENVISTA HOLDINGS CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

_____________________________________________

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | |

|

| |

| 001-39054 | 83-2206728 |

| (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

|

| | |

| 200 S. Kraemer Blvd., Building E | 92821 |

| Brea, | California |

| (Address of Principal Executive Offices) | (Zip Code) |

(714) 817-7000

(Registrant’s Telephone Number, Including Area Code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

|

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | NVST | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

Chief Executive Officer Transition

On February 22, 2024, Envista Holdings Corporation (the “Company”) and Amir Aghdaei, the President and Chief Executive Officer of the Company, entered into a transition letter agreement (the “Transition Agreement”), setting forth the terms of Mr. Aghdaei’s anticipated transition from his position as the Company’s President and Chief Executive Officer. Effective as of the Transition Date (as defined below), or such earlier date on which Mr. Aghdaei’s employment with the Company is terminated, Mr. Aghdaei’s employment with the Company, and his membership on the Board of Directors of the Company (the “Board”), will immediately cease.

Pursuant to the Transition Agreement, during the period beginning on the effective date of the Transition Agreement and ending on the date that a successor Chief Executive Officer of the Company is duly appointed by the Board (such date, the “Transition Date”, and such period, the “Transition Period”), Mr. Aghdaei will continue to serve as the President and Chief Executive Officer of the Company. During the Transition Period, Mr. Aghdaei will continue to be (i) paid his base salary at the rate in effect as of the date of the Transition Agreement, (ii) eligible for annual paid time off benefits, and (iii) eligible to participate in the Company’s applicable benefit plans and retirement plans. In addition, as of the effective date of the Transition Agreement, Mr. Aghdaei will not be eligible to receive any separation benefits under the Envista Holdings Corporation Severance and Change in Control Plan for Officers, as it may be amended from time to time (the “Severance Plan”). If the Transition Date does not occur prior to January 1, 2026 and Mr. Aghdaei remains an employee of the Company as of such date, the Transition Agreement will no longer have any force or effect.

Pursuant to the Transition Agreement, (i) in the event that the Transition Date occurs prior to January 1, 2026, or if Mr. Aghdaei’s employment is terminated by the Company without Cause (as defined in the Severance Plan), he will be eligible to receive his full target annual bonuses in respect of fiscal year 2023 and fiscal year 2024, in each case based on actual performance and payable in accordance with the Company’s Incentive Compensation Plan (the “ICP”); (ii) in the event that the Transition Date occurs in fiscal year 2024, or if his employment is terminated by the Company without Cause, he will continue to be paid his base salary through the end of fiscal year 2024; and/or (iii) in the event that the Transition Date occurs in fiscal year 2025, or if his employment is terminated by the Company without Cause in fiscal year 2025, he will be eligible to receive his prorated target annual bonus in respect of fiscal year 2025, based on actual performance and payable in accordance with the ICP.

Pursuant to the Transition Agreement, Mr. Aghdaei will receive his annual equity award in respect of fiscal year 2024 with an aggregate target award value of $5,500,000, subject to the requisite approval by the Compensation Committee of the Board and Mr. Aghdaei’s continued employment with the Company through the applicable grant date. In addition, Mr. Aghdaei’s termination of employment will constitute a Normal Retirement (as defined in the Envista Holdings Corporation 2019 Omnibus Incentive Plan, as it may be amended from time to time (the “Incentive Plan”)), and each of Mr. Aghdaei’s outstanding equity awards granted to him under the Incentive Plan will be treated in accordance with the applicable award agreement.

Mr. Aghdaei has agreed to provide consulting services to the Company for an eighteen-month period following the Transition Date, or such earlier date on which his employment is terminated by the Company without Cause. In consideration for these consulting services, Mr. Aghdaei will be paid a consulting fee equal to $1,500,000, payable in arrears in equal monthly installments during such eighteen-month period.

The payments and benefits provided to Mr. Aghdaei under the Transition Agreement are contingent upon Mr. Aghdaei’s execution and re-execution, as applicable, and non-revocation of the release of claims in favor of the Company group that is contained in the Transition Agreement. Further, the Transition Agreement provides that Mr. Aghdaei will continue to abide by his existing restrictive covenants.

The foregoing description of the Transition Agreement is qualified in its entirety by reference to the complete terms of the Transition Agreement, which is filed as Exhibit 10.1 to this Form 8-K.

ITEM 7.01 REGULATION FD

On February 26, 2024, the Company issued a press release announcing the planned CEO succession process. A copy of the release is furnished herewith as Exhibit 99.1 and incorporated by reference herein.

The information included or incorporated by reference in this Item 7.01 is being furnished to the SEC and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

|

| | |

| | ENVISTA HOLDINGS CORPORATION |

| | | |

| | | |

| Date: February 26, 2024 | By: | /s/ Stephen Keller |

| | | Stephen Keller |

| | | Principal Financial Officer |

Exhibit 10.1

EXECUTION VERSION

February 22, 2024

Amir Aghdaei Via Email

Re: Transition Agreement

Dear Amir:

This letter agreement (this “Agreement”) sets forth our mutual understanding concerning the transition of your employment as the President and Chief Executive Officer of Envista Holdings Corporation, a Delaware corporation (the “Company”), to your ongoing advisory role with the Company as a consultant providing critical transition services to the Company in connection with the appointment and integration of your successor, on the terms and subject to the conditions set forth below. This Agreement will be effective as of the Effective Date (as defined below).

1.Transition Period.

(a)General.

(i)During the Transition Period (as defined below), you will continue to serve as the President and Chief Executive Officer of the Company, pursuant to the terms and conditions set forth in that certain Offer Letter entered into by and between you and the Company, dated as of July 29, 2019 (the “Offer Letter”). For the avoidance of doubt, during the Transition Period, (i) you will continue to be paid your base salary at the rate in effect as of the date hereof (“Base Salary”); (ii) you will continue to be eligible to participate in any benefit plan that the Company Group (as defined below) has adopted or may adopt, maintain, or contribute to for the benefit of its regular employees generally or its senior executives in particular, subject to satisfying any applicable eligibility requirements; (iii) you will continue to be eligible for annual vacation and paid time off benefits pursuant to the Company’s applicable policies and California law; and (iv) you will continue to be eligible to participate in the Envista Holdings Executive Deferred Incentive Program (the “EDIP”), the Envista Holdings Corporation Excess Contribution Program (the “ECP”), and the Envista Holdings Corporation Deferred Compensation Plan (“DCP”). For purposes of this Agreement, (i) “Transition Period” means the period beginning on the Effective Date and ending on the Transition Date, and (ii) “Transition Date” means the date that a successor Chief Executive Officer of the Company is duly appointed by the Board of Directors of the Company (the “Board”).

(ii)You and the Company hereby acknowledge and agree that, as of the Effective Date and at all times thereafter, you will not be eligible to receive any separation benefits under the Envista Holdings Corporation Severance and Change in Control Plan for Officers, as it may be amended from time to time (the “Severance Plan”); provided, that prior to occurrence of the Transition Date, you shall be eligible to receive the change-in-control-related equity acceleration treatment with respect to your outstanding equity awards pursuant to Section 4.02(c) of the Severance Plan, the Envista Holdings Corporation 2019 Omnibus Incentive Plan, as it may be amended from time to time (the “Incentive Plan”), and the Award Agreements (as defined below), as applicable (the “CiC Acceleration Treatment”). For the avoidance of doubt, (i) as of the Effective Date and at all times thereafter, you will not be eligible to receive the separation benefits set forth in Sections 4.01 and 4.02(a), (b) and (d) of the Severance Plan, and (ii) upon the occurrence of the Transition Date and at all times thereafter (including, without limitation, during the Consulting Period (as defined below)), you will not be eligible to receive the CiC Acceleration Treatment.

(iii)Notwithstanding the foregoing or anything to the contrary set forth herein,

in the event that the Transition Date does not occur prior to January 1, 2026 and you remain an employee of the Company as of such date, (x) this Agreement will be immediately terminated and of no further force and effect, and you will immediately forfeit your rights to any future payments or benefits under this Agreement, (y) your employment relationship with the Company will continue to be governed by the Offer Letter, unless otherwise mutually agreed to in writing by the parties hereto, and (z) you will be eligible to receive, to the extent applicable, separation benefits under the Severance Plan, the Incentive Plan and/or any of the Award Agreements.

(b)Transition Date. Notwithstanding anything to the contrary set forth herein or in

the Offer Letter,

(i)Regardless of when the Transition Date occurs, or such earlier date on which your employment with the Company is terminated by the Company without Cause, you will be eligible to receive your (x) full target annual bonus in respect of fiscal year 2023 pursuant to the Company’s Incentive Compensation Plan (the “ICP”), with any such bonus based on actual performance and payable in accordance with the ICP (and in any event prior to March 15, 2024), and (y) full target annual bonus (without proration) in respect of fiscal year 2024 pursuant to the ICP, with any such bonus based on actual performance and payable in accordance with the ICP (and in any event prior to March 15, 2025).

(ii)In the event that the Transition Date occurs in fiscal year 2024, or such earlier date on which your employment with the Company is terminated by the Company without Cause, you will continue to be paid your Base Salary through the end of fiscal year 2024 as if such termination of employment had not occurred.

(iii)In the event that the Transition Date occurs in fiscal year 2025, or if your employment with the Company is terminated by the Company without Cause in fiscal year 2025, you will be eligible to receive a prorated target annual bonus in respect of fiscal year 2025 pursuant to the ICP, with any such bonus based on actual performance, prorated based on the number of days you are employed by the Company as its President and Chief Executive Officer during fiscal year 2025, and payable in accordance with the ICP (and in any event prior to March 15, 2026).

(iv)For purposes of this Agreement, “Cause” shall have the meaning set forth

in the Severance Plan.

(c)Indemnification; D&O Insurance. During the Transition Period (and thereafter, if applicable), the Company (i) shall continue to provide you with indemnification and advance of defense expenses, and (ii) agrees to maintain directors’ and officers’ liability insurance for your benefit, in each case, as provided for under, and in accordance with, the applicable (and then in effect) organizational documents of the applicable member of the Company Group.

(d)Communications. You and the Company will work collaboratively on communications regarding your transition under this Agreement. You understand and acknowledge, however, that the Company is solely responsible for the form, content, and dissemination of each such message, whether required by law or otherwise.

2.Separation From Employment.

(a)Separation From Employment. You and the Company agree that, effective as of the Transition Date, or such earlier date on which your employment with the Company is terminated (the actual date on which your employment terminates, the “Separation Date”), your employment with the Company will terminate and, subject to Section 4 below, you will automatically be deemed to have resigned

from your position as an officer of the Company and its parents, subsidiaries and affiliates (collectively, the “Company Group”) and from any and all other positions, roles, offices, or titles held by you with, at the direction of, or for the benefit of any member of the Company Group, including, but not limited to, your position as a director on the Board. You hereby agree to promptly execute such additional documentation as the Company may reasonably request to effectuate the foregoing. The Separation Date will be the termination date of your employment for purposes of participation in and coverage as an employee under all benefit plans and programs sponsored by or through any member of the Company Group.

(b)Accrued Benefits. The Company will pay you, within thirty (30) days following the Separation Date (or such earlier date as may be required by applicable law), the following: (i) any unpaid Base Salary earned by you through the Separation Date, (ii) any unreimbursed business expenses incurred by you through the Separation Date, and (iii) any amounts or benefits due to you under any benefit plan, program or arrangement of the Company Group, in accordance with the terms contained therein.

(c)Retirement Plan Benefits. Notwithstanding anything to the contrary set forth herein, the Separation Date will be the termination date of your service for purposes of your participation in the EDIP, the ECP and the DCP, and any of your contributions under any such plans that are vested as of the Separation Date will be treated in accordance with the applicable terms and conditions set forth in the applicable plan document.

(d)COBRA. You shall receive, under separate cover, information regarding your rights under the Consolidated Omnibus Budget Reconciliation Act and, if applicable, any state continuation coverage laws (collectively, “COBRA”). You acknowledge that you should review the COBRA notice and election forms carefully to understand your rights and obligations to make timely elections, provide timely notification and make timely premium payments.

(e)No Other Benefits or Payments Due. You agree that after the Separation Date, you are entitled to no compensation or benefits from the Company other than as expressly set forth in this Agreement, and that you will not be entitled to receive any other payment, benefit, or other form of compensation as a result of your employment or service or the cessation thereof, including, but not limited to, wages, deferred compensation, sick time, personal time, vacation, bonuses, expenses, equity interests, severance payments or benefits or payments in lieu of notice pursuant to the Offer Letter unless otherwise set forth in this Agreement or required by applicable law. You and the Company hereby acknowledge and agree that you will not be eligible to receive any separation benefits in connection with your termination of employment, including, without limitation, under the Severance Plan, except as expressly contemplated herein.

3.Incentive Equity.

(a)2024 Annual Grant. You will receive an annual equity award in respect of fiscal year 2024 (the “2024 Equity Award”) with an aggregate target award value of $5,500,000, to be granted to you promptly following the execution of this Agreement by the parties hereto (such actual date of grant, the “Grant Date”), subject to (i) the requisite approval by the Compensation Committee of the Board (the “Committee”), and (ii) your continued employment or service with the Company through the Grant Date. If the Committee does not approve the 2024 Equity Award within twenty-one (21) days after the Effective Date, then, notwithstanding anything to the contrary contained in this Agreement, (A) this Agreement will be immediately terminated and become null and void, effective with retroactive effect as of the Effective Date, (B) neither you nor the Company shall have any rights or obligations under this Agreement, and (C) effective from and after the Effective Date, your employment relationship with the Company will continue to be governed by the Offer Letter.

(b)Treatment of Outstanding Equity Awards. For purposes of this Section 3, you and the Company hereby acknowledge and agree that your termination of employment on the Separation Date will constitute a Normal Retirement (as defined in the Incentive Plan). Notwithstanding anything to the contrary set forth herein, the Incentive Plan or any of the award agreements entered into by and between you and the Company under the Incentive Plan (collectively, the “Award Agreements”), any Awards (as defined in the Incentive Plan) granted to you pursuant to the Award Agreements that remain outstanding as of the Separation Date will be treated in accordance with the applicable terms and conditions set forth in the applicable Award Agreement; provided, however, that if the Separation Date occurs within six (6) months of the grant date of the equity award referenced in Section 3(a) hereof, you will be deemed to have held such equity award for at least six (6) months for purposes of the Incentive Plan and the Award Agreements, including, without limitation, the Normal Retirement provisions thereof.

(c)No Further Equity Awards. For the avoidance of doubt, you acknowledge and agree that, except as otherwise provided in this Agreement, (i) following the earlier to occur of the Separation Date and the Transition Date, you will not be eligible to receive any additional Awards under the Incentive Plan, and (ii) you have no further rights, payments or benefits under the Incentive Plan, the Award Agreements or any other equity compensation plans or agreements with the Company Group.

4.Consulting Period.

(a)Consulting Services. During the Consulting Period, you agree to provide consultation services to the Company in the capacity of an independent contractor, at the direction of the Board or the Chief Executive Officer of the Company, with regard to the transitioning of your duties and responsibilities and the ongoing support of the business, including, but not limited to, advising on specific business initiatives and customer relationships based on your institutional knowledge (the “Consulting Services”).

(b)Consulting Period. You hereby agree to provide the Consulting Services for an eighteen (18)- month period commencing as of the Transition Date, or such earlier date on which your employment with the Company is terminated by the Company without Cause (the “Consulting Period”).

(c)Consulting Fee. In consideration of your providing the Consulting Services during the Consulting Period, you will be paid the total sum of $1,500,000 during the Consulting Period as a consulting fee (the “Consulting Fee”). The Consulting Fee shall be payable in arrears in equal monthly installments of $83,333 in the calendar month following the month in which the Consulting Services are performed. For the avoidance of doubt, in the event that your employment with the Company terminates prior to the Transition Date for any reason other than due to a termination of employment by the Company without Cause, you will not be eligible to receive the Consulting Fee.

5.Reimbursement of Expenses. The Company will reimburse you, subject to the Company’s expense reimbursement policies as in effect from time to time, for your reasonable and reasonably documented out-of-pocket expenses incurred in connection with your performance of the Consulting Services during the Consulting Period.

6.Independent Contractor Status. You acknowledge and agree that, in your capacity as a consultant of the Company during the Consulting Period, your status at all times will be that of an independent contractor. You and the Company hereby acknowledge and agree that the Consulting Fee will represent fees for services as an independent contractor and will therefore be paid without any deductions or withholdings taken therefrom for taxes or for any other purpose. You expressly agree to pay and be solely responsible for making all applicable tax filings and remittances with respect to the Consulting Fee and to hold harmless the Company Group for all claims, damages, costs and liabilities arising from your

failure to do so; provided, however, that the Company Group shall indemnify and hold you harmless from any claims, damages, costs and liabilities concerning the Consulting Fee arising from a determination by a state or federal agency or other entity of competent jurisdiction that you were not properly classified as an independent contractor. You also agree that, during the Consulting Period, you will not be eligible to participate in any of the employee benefit plans or arrangements of any member of the Company Group unless such benefits are made available to you by operation of law and due to your former employment status with the Company.

7.Restrictive Covenants. You acknowledge and agree that, as a material inducement for the Company to enter into this Agreement, you expressly reaffirm, acknowledge and agree to continue to abide by the restrictive covenants set forth in that certain Agreement Regarding Competition and Protection of Proprietary Interests entered into by and between you and the Company, dated as of July 29, 2019 and any other restrictive covenants to which you are subject to or otherwise bound (collectively, the “Restrictive Covenants”), the provisions of which are hereby fully incorporated herein by reference. You acknowledge that the Restrictive Covenants will remain in full force and effect following the termination of your employment or service with the Company Group and will not be superseded by the terms of this Agreement.

8.Return of Property. You confirm that, on the earlier of the Separation Date and the end of the Consulting Period, you will have returned to the Company all property of the Company Group in your possession and all property made available to you in connection with your employment or service with the Company Group, including, without limitation, any and all Company Group credit cards, keys, security access codes, records, manuals, customer lists, notebooks, computers, computer programs and files, papers, electronically stored information and documents kept or made by you in connection with your employment or service with the Company Group; provided, however, that you may retain documents relating to your compensation and any documents that would typically be included in a personnel record, together with any Company Group property necessary to fulfill your obligations under Section 4(a) hereof.

9.General Release.

(a)General Release. The payments and benefits provided to you hereunder are strictly contingent upon your execution and non-revocation of the release of claims set forth below. In consideration of the payments and benefits provided to you under this Agreement, you, and each of your heirs, executors, administrators, representatives, agents, successors and assigns (collectively, the “Releasors”) hereby irrevocably and unconditionally release and forever discharge each member of the Company Group and each of its directors, officers, employees, consultants, founders, shareholders, attorneys and agents (collectively, the “Releasees”) from any and all claims, actions, causes of action, rights, judgments, obligations, damages, demands, accountings or liabilities of whatever kind or character (collectively, “Claims”), including, without limitation, any Claims under Title VII of the Civil Rights Act, as amended, the Americans with Disabilities Act, as amended, the Family and Medical Leave Act, as amended, the Equal Pay Act, as amended, the Employee Retirement Income Security Act, as amended, the Civil Rights Act of 1991, as amended, the Worker Adjustment and Retraining Notification Act, as amended, the Age Discrimination in Employment Act of 1967, as amended by the Older Workers Benefit Protection Act of 1990, as amended, and the applicable rules and regulations promulgated thereunder, and any other Claims under any federal, state, local or foreign law, that the Releasors may have, arising out of (i) your employment or service with the Company Group and the termination of such employment or service or (ii) any event, condition, circumstance or obligation that occurred, existed or arose on or prior to the Effective Date; provided, however, that the release set forth in this Section 9(a) will not apply to (A) the obligations of the Company under this Agreement; (B) any rights that cannot be released as a matter of law; (C) rights to defense and indemnification under the Company Group’s organizational documents, directors & officers insurance or other insurance policies, applicable state law, or contract; or (D) claims for vested benefits. Each Releasee that is not a signatory hereto will be a third-party beneficiary of your covenants, warranties,

representations and release of claims set forth in this Agreement and entitled to enforce such provisions as if it was a party hereto.

(b)Civil Code § 1542 Waiver. You and the Company agree that the provisions of Section 1542 of the Civil Code of the State of California are hereby waived. Section 1542 provides as follows:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.

(c)Consideration Period; Revocation Period; Effective Date. You acknowledge and agree that (i) you are hereby entering into this waiver and release knowingly and voluntarily, (ii) the Company has advised you, and you are hereby advised in writing, that you should consult with an attorney prior to executing and re-executing this Agreement, as applicable, (iii) you have carefully read and fully understand all of the provisions of this Agreement, (iv) you are entering into this Agreement knowingly, freely and voluntarily in exchange for good and valuable consideration to which you would not be entitled in the absence of executing or re-executing, as applicable, and not revoking this Agreement, (v) you have been given at least twenty-one (21) days from receipt of this Agreement to consider the terms of this Agreement, and if you choose to execute this Agreement before this twenty-one (21) day consideration period has elapsed, you do so knowingly and voluntarily, (vi) no Releasee has provided any tax or legal advice regarding this Agreement and you have had an adequate opportunity to receive sufficient tax and legal advice from advisors of your own choosing such that you enter into this Agreement with full understanding of the tax and legal implications hereof, and (vii) you have been advised that you have the right to revoke your execution of this Agreement for a period of seven (7) days after executing this Agreement, and if you wish to revoke your execution of this Agreement, you must do so in a writing, signed by you and received by the Company, care of the General Counsel of the Company, no later than 5:00 p.m. eastern time on the seventh (7th) day of such revocation period. This Agreement will be effective as of the eighth (8th) day following the date you execute this Agreement (such date, the “Effective Date”), assuming you have not delivered revocation pursuant to this Section 9(c). If you do not execute this Agreement or if you revoke such execution, this Agreement will be null and void and neither the Company nor you will have any rights or obligations under it.

(d)Re-Execution of Agreement. The Company’s obligations set forth in this Agreement are strictly contingent upon your re-execution and non-revocation of this Agreement within twenty-one (21) days following the earlier to occur of the Separation Date and the Transition Date. Upon your re-execution of this Agreement (the “Re-Execution Date”), you advance to the Re-Execution Date your release of all Claims. You acknowledge and agree that you have been advised by the Company that you have the right to revoke your re-execution of this Agreement for a period of seven (7) days after the Re-Execution Date, and if you wish to revoke your re-execution of this Agreement, you must do so in a writing, signed by you and received by the Company, care of the General Counsel of the Company, no later than 5:00 p.m. eastern time on the seventh (7th) day of such revocation period. If no such revocation occurs, the re-execution of this Agreement shall become effective on the eighth (8th) day following the Re- Execution Date.

(e)Representation. You hereby represent that you have not instituted, assisted or otherwise participated in connection with, any action, complaint, claim, charge, grievance, arbitration, lawsuit, or administrative agency proceeding, or action at law or otherwise against any of the Releasees.

You understand that the release of Claims contained in this Agreement extends to all of the aforementioned Claims and potential Claims which arose on or before the Effective Date, whether now known or unknown, suspected or unsuspected, and that this constitutes an essential term of this Agreement. You further understand and acknowledge the significance and consequences of this Agreement and of each specific release and waiver, and expressly consent that this Agreement will be given full force and effect to each and all of its express terms and provisions, including those relating to unknown and uncompensated Claims, if any, as well as those relating to any other Claims specified herein. Except as otherwise set forth herein, you hereby waive any right or Claim that you may have to employment or service, reinstatement or re- employment with the Company Group.

10.Other Obligations. Notwithstanding anything to the contrary set forth herein, you acknowledge and agree that, to the extent permitted by applicable law, any amounts owed to you hereunder following the Transition Date will be offset by any amount of the Final Tax Equalization payment (as defined in that certain Tax Equalization Letter Agreement entered into by and between you and the Company, dated as of December 6, 2023) still owed to the Company as of the Transition Date.

11.Miscellaneous.

(a)Entire Agreement; Amendment. This Agreement, together with the Restrictive Covenants, sets forth the entire agreement and understanding of the parties hereto with respect to the subject matter hereof and supersedes and replaces any express or implied, written or oral, prior agreement, plan or arrangement with respect to the subject matter hereof. This Agreement may be amended only by a written document signed by an authorized officer of the Company and you.

(b)Section 409A. Notwithstanding any provision of this Agreement to the contrary, all provisions of this Agreement are intended to comply with Section 409A of the Internal Revenue Code of 1986, as amended, and the Treasury Regulations and guidance promulgated thereunder (collectively, “Section 409A”) or an exemption therefrom, and will be construed and administered in accordance with such intent. Any payments under this Agreement that may be excluded from Section 409A either as separation pay due to an involuntary separation from service or as a short-term deferral will be excluded from Section 409A to the maximum extent possible. For purposes of Section 409A, each installment payment provided under this Agreement will be treated as a separate payment. Notwithstanding any provision of this Agreement to the contrary, in no event shall any payment or benefit under this Agreement that constitutes “nonqualified deferred compensation” for purposes of Section 409A be subject to offset by any other amount, unless otherwise permitted by Section 409A. Notwithstanding the foregoing, the Company makes no representations that the payments and benefits provided under this Agreement are exempt from, or compliant with, Section 409A, and in no event will any member of the Company Group be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by you on account of non-compliance with Section 409A.

(c)Tax Consequences. During the Transition Period, the parties hereto agree that the Company will be entitled to withhold any amounts required to be withheld in respect of federal, state or local taxes with respect to any amounts payable to you hereunder. You expressly agree to pay and be solely responsible for making all applicable tax filings and remittances with respect to the Consulting Fee and to hold harmless the Company Group for all claims, damages, costs and liabilities arising from your failure to do so; provided, however, that the Company Group shall indemnify and hold you harmless from any claims, damages, costs and liabilities concerning the Consulting Fee arising from a determination by a state or federal agency or other entity of competent jurisdiction that you were not properly classified as an independent contractor. The Company Group makes no representations or warranties with respect to the tax consequences of the payments provided to you or made on your behalf under the terms of this Agreement.

(d)Waiver; Severability. The failure of either party to this Agreement to enforce any of its terms, provisions or covenants will not be construed as a waiver of the same or of the right of such party to enforce the same. Waiver by either party hereto of any breach or default by the other party of any term or provision of this Agreement will not operate as a waiver of any other breach or default. In the event that any provision of this Agreement (or portion thereof) is held to be invalid, illegal or unenforceable, the validity, legality and enforceability of the remainder of this Agreement will not in any way be affected or impaired thereby. If any provision of this Agreement (or portion thereof) is held to be excessively broad as to duration, activity or subject, such provision will be construed by limiting and reducing it so as to be enforceable to the maximum extent allowed by applicable law.

(e)Counterparts. This Agreement may be executed in one or more counterparts (including portable document format (.pdf) and facsimile counterparts), each of which will be deemed to be an original and all of which together will constitute one and the same agreement.

(f)Successors and Assigns. Except as otherwise provided herein, this Agreement will inure to the benefit of and be enforceable by you and by the Company and its successors and assigns. This Agreement is personal to you and may not be assigned by you. The Company may assign its rights and obligations under this Agreement without your consent, including to any other member of the Company Group and to any successor (whether by merger, purchase or otherwise) to all or substantially all of the equity, assets or businesses of the Company. This Agreement shall be binding upon any successor to the Company or its business following a Substantial Corporate Change within the meaning of Section 17(a) of the Incentive Plan.

(g)Governing Law. This Agreement will be governed by, and construed in accordance with, the laws of the State of Delaware, without giving effect to the conflicts of laws principles thereof.

* * *

IN WITNESS WHEREOF, the parties hereto have duly executed this Agreement as of the below- indicated date(s).

| | |

| ENVISTA HOLDINGS CORPORATION |

| By: /s/ Stephen Keller |

| Name: Stephen Keller |

| Title: Principal Financial Officer |

|

| Date: February 22, 2024 |

YOU HEREBY ACKNOWLEDGE THAT YOU HAVE READ THIS AGREEMENT, THAT YOU FULLY KNOW, UNDERSTAND AND APPRECIATE ITS CONTENTS, AND THAT YOU HEREBY ENTER INTO THIS AGREEMENT VOLUNTARILY AND OF YOUR OWN FREE WILL.

| | |

| ACCEPTED AND AGREED: |

| /s/ Amir Aghdaei |

| Amir Aghdaei |

|

| Date: February 20, 2024 |

NOT TO BE RE-EXECUTED PRIOR TO THE TRANSITION DATE

Signature Page to

Transition Agreement

Exhibit 99.1

Envista Holdings Announces Planned CEO

Succession Process

BREA, Calif., Feb. 26, 2024 -- Envista Holdings Corporation (NYSE: NVST) announced today that the Board of Directors and CEO Amir Aghdaei are formally launching a process to determine a successor for CEO. The Board of Directors has formed a search committee and retained an executive search firm to find qualified external candidates to lead the next phase of Envista. This process is expected be completed this year. Mr. Aghdaei will remain President and CEO until his successor is appointed.

“After nearly 10 years leading Danaher’s Dental Platform and the Envista team, it is now time to focus on the next phase of building a world-class dental company. Finding a strong successor will ensure that we continue our journey to digitize, personalize, and democratize the dental industry. After the appointment of a new leader, I will provide support to ensure a smooth transition, as needed.” said Mr. Aghdaei. “As we go through this process, I remain focused on driving our near-term transformation while ensuring we are positioned to achieve our long-term priorities of accelerating growth, expanding margins, and transforming the portfolio. I am incredibly proud of the Envista team and am committed to our long-term success.”

Board Chair Scott Huennekens said, “Amir has led the company during a pivotal time, including through the spinoff from Danaher and the challenges of the global pandemic. We are grateful for the many contributions he has made over the past 10 years. He was instrumental in the founding of Envista and has provided a platform for long-term value creation for our customers, employees, and shareholders. We share this announcement to ensure a smooth and orderly succession process as we identify the best possible leader for the future.”

The Envista board has appointed a special steering committee of independent directors to identify CEO candidates and prepare for the transition in leadership.

ABOUT ENVISTA

Envista is a global family of more than 30 trusted dental brands, including Nobel Biocare, Ormco, DEXIS, and Kerr, united by a shared purpose: to partner with professionals to improve lives. Envista helps its customers deliver the best possible patient care through industry-leading dental consumables, solutions, technology, and services. Its comprehensive portfolio, including dental implants and treatment options, orthodontics, and digital imaging technologies, covers a wide range of dentists' clinical needs for diagnosing, treating, and preventing dental conditions as well as improving the aesthetics of the human smile. With a foundation comprised of the proven Envista Business System (EBS) methodology, an experienced leadership team, and a strong culture grounded in continuous improvement, commitment to innovation, and deep customer focus, Envista is well equipped to meet the end-to-end needs of dental professionals worldwide. Envista is one of the largest global dental products companies, with significant market positions in some of the most attractive segments of the dental products industry. For more information, please visit www.envistaco.com.

FOR FURTHER INFORMATION

Melissa Morrison

VP Communication & Central Marketing

Envista Holdings Corporation

200 S. Kraemer Blvd., Building E

Brea, CA 92821

Telephone: (714) 817-7000

info@envistaco.com

SOURCE Envista Holdings Corporation

v3.24.0.1

Cover

|

Feb. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity Registrant Name |

ENVISTA HOLDINGS CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39054

|

| Entity Tax Identification Number |

83-2206728

|

| Entity Address, Address Line One |

200 S. Kraemer Blvd., Building E

|

| Entity Address, City or Town |

Brea,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92821

|

| City Area Code |

714

|

| Local Phone Number |

817-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

NVST

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001757073

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

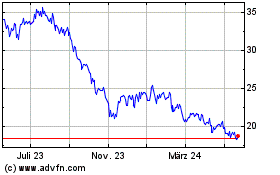

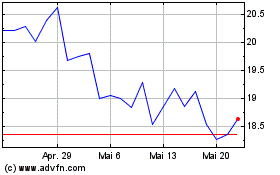

Envista (NYSE:NVST)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Envista (NYSE:NVST)

Historical Stock Chart

Von Mai 2023 bis Mai 2024