0001043219false00010432192023-09-072023-09-070001043219us-gaap:CommonStockMember2023-09-072023-09-070001043219nly:A6.95SeriesFFixedtoFloatingRateCumulativeRedeemablePreferredStockMember2023-09-072023-09-070001043219nly:A6.50SeriesGFixedtoFloatingRateCumulativeRedeemablePreferredStockMember2023-09-072023-09-070001043219nly:A6.75SeriesIFixedtoFloatingRateCumulativeRedeemablePreferredStockMember2023-09-072023-09-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

September 7, 2023

Annaly Capital Management Inc

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | |

Maryland | 1-13447 | 22-3479661 |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | |

| 1211 Avenue of the Americas | | |

| New York, | New York | | 10036 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 696-0100

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| | |

| Common Stock, par value $0.01 per share | NLY | New York Stock Exchange |

| | |

| | |

| | |

| | |

| 6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock | NLY.F | New York Stock Exchange |

| 6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock | NLY.G | New York Stock Exchange |

| 6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock | NLY.I | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 7, 2023, the Board of Directors (the “Board”) of Annaly Capital Management, Inc. (the “Company”) elected Manon Laroche and Scott Wede as members of the Board, effective October 1, 2023. Ms. Laroche has been appointed to the Board’s Corporate Responsibility Committee and Risk Committee and Mr. Wede has been appointed to the Board’s Audit Committee and Risk Committee, and Ms. Laroche and Mr. Wede will stand for re-election to the Board at the Company’s 2024 Annual Meeting of Stockholders for a term of one year.

The Board determined that Ms. Laroche and Mr. Wede are independent directors within the meaning of the New York Stock Exchange listing standards. There are no arrangements or understandings between Ms. Laroche or Mr. Wede and any other person pursuant to which they were elected. There are also no family relationships between Ms. Laroche or Mr. Wede and any director or executive officer of the Company, and Ms. Laroche and Mr. Wede do not have any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with the election of Ms. Laroche and Mr. Wede, the Board increased its size from ten to twelve directors. The Company will enter into its standard form of indemnification agreement with Ms. Laroche and Mr. Wede, a copy of which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC on March 20, 2017. Ms. Laroche and Mr. Wede will also participate in the non-employee director compensation arrangements established by the Company for non-employee directors, as described under “Compensation of Directors” in the Company’s definitive proxy statement on Schedule 14A filed with the SEC on April 5, 2023.

Item 7.01 Regulation FD Disclosure.

On September 7, 2023, the Company issued a press release (the “Press Release”) announcing the expansion of the Board and the election of Ms. Laroche and Mr. Wede as members of the Board effective October 1, 2023. A copy of the Press Release is being furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The Press Release is being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| | |

| | |

| | |

| 101 | | Pursuant to Rule 406 of Regulation S-T, the cover page information is formatted in iXBRL (Inline eXtensible Business Reporting Language). |

| | |

| 104 | | Cover page interactive data file (formatted in iXBRL in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | ANNALY CAPITAL MANAGEMENT, INC. |

| | (REGISTRANT) |

| | | | |

| | By: | | /s/ Anthony C. Green |

| | | | Name: Anthony C. Green |

| | | | Title: Chief Corporate Officer & Chief Legal Officer |

Dated: September 7, 2023

Annaly Capital Management, Inc. Expands Board with Election of Manon Laroche and Scott Wede

NEW YORK -- (September 7, 2023) -- Annaly Capital Management, Inc. (NYSE: NLY) (“Annaly” or the “Company”) announced today that the Board of Directors of the Company (the “Board”) has elected Manon Laroche, former Head of Global Spread Products Securitized Sales, North America at Citigroup, and Scott Wede, former Global Head of Securitized Products and Municipal Finance at Barclays Capital, as independent members of the Board, effective October 1, 2023. Following their appointment, Annaly’s Board will be comprised of twelve members, ten of whom are independent and six of whom identify as women and/or racially/ethnically diverse.

“We are excited to welcome both Manon and Scott to our Board of Directors and look forward to benefiting from their deep experience in financial markets and securitized products,” said Michael Haylon, Chair of Annaly’s Board of Directors. “The expansion of our Board reflects Annaly’s commitment to bringing a diverse range of backgrounds and perspectives to strengthen our industry leading corporate governance and enhance the execution of our strategic initiatives as we continue to expand our housing finance footprint.”

Ms. Laroche served as Managing Director, Head of Global Spread Products Securitized Sales, North America at Citigroup, a global financial services company, from 2018 to February 2023. Prior to this, Ms. Laroche served as Head of Global Securitized Markets Sales, New York beginning in 2012. From 2002 to 2012, Ms. Laroche served as a Managing Director in Global Securitized Markets Sales at Citigroup. Ms. Laroche received a B.S. in Applied Math and Economics from Brown University.

Mr. Wede served as the Global Head of Securitized Products and Municipal Finance at Barclays Capital from 2004 to 2015. More recently, Mr. Wede served as the President and Chief Financial Officer of Conventus Holdings Corp., a provider of business purpose loans, from January 2022 to April 2022. Mr. Wede has served as a member of the Board of Directors of Rapid Applications Group LLC since 2016 and MPOWER Financing since 2021. He has served as an Advisory Board member of INFLO since 2020. Mr. Wede received a B.S. in Business Administration from Creighton University.

Ms. Laroche and Mr. Wede will stand for re-election to the Board at the Company’s 2024 Annual Meeting of Stockholders for a term of one year. Ms. Laroche has been appointed to the Board’s Corporate Responsibility and Risk Committees. Mr. Wede has been appointed to the Board’s Audit and Risk Committees.

About Annaly

Annaly is a leading diversified capital manager with investment strategies across mortgage finance. Annaly’s principal business objective is to generate net income for distribution to its stockholders and to optimize its returns through prudent management of its diversified investment strategies. Annaly is internally managed and has elected to be taxed as a real estate investment trust, or REIT, for federal income tax purposes. Additional information on the company can be found at www.annaly.com.

Forward-Looking Statements

This news release and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “should,” “estimate,” “project,” “believe,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Actual results could differ materially from

those set forth in forward-looking statements due to a variety of factors, including, but not limited to, changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of our assets; changes in business conditions and the general economy; our ability to grow our residential credit business; our ability to grow our mortgage servicing rights business; credit risks related to our investments in credit risk transfer securities and residential mortgage-backed securities and related residential mortgage credit assets; risks related to investments in mortgage servicing rights; the our ability to consummate any contemplated investment opportunities; changes in government regulations or policy affecting our business; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940; operational risks or risk management failures by us or critical third parties, including cybersecurity incidents; and risks and uncertainties related to the COVID-19 pandemic, including as related to adverse economic conditions on real estate-related assets and financing conditions. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law.

Contact

Annaly Capital Management, Inc.

Investor Relations

1-888-8Annaly

investor@annaly.com

v3.23.2

Cover Page

|

Sep. 07, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 07, 2023

|

| Entity Registrant Name |

Annaly Capital Management Inc

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

1-13447

|

| Entity Tax Identification Number |

22-3479661

|

| Entity Address, Address Line One |

1211 Avenue of the Americas

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

212

|

| Local Phone Number |

696-0100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001043219

|

| Amendment Flag |

false

|

| Common Stock, par value $0.01 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

NLY

|

| Security Exchange Name |

NYSE

|

| 6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

NLY.F

|

| Security Exchange Name |

NYSE

|

| 6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

NLY.G

|

| Security Exchange Name |

NYSE

|

| 6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

NLY.I

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nly_A6.95SeriesFFixedtoFloatingRateCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nly_A6.50SeriesGFixedtoFloatingRateCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nly_A6.75SeriesIFixedtoFloatingRateCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

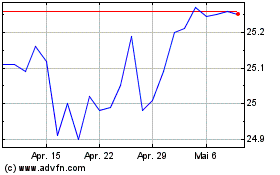

Annaly Capital Management (NYSE:NLY-I)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Annaly Capital Management (NYSE:NLY-I)

Historical Stock Chart

Von Mai 2023 bis Mai 2024