false000128263700012826372024-01-162024-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 16, 2024

NEWMARKET CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Virginia | | 1-32190 | | 20-0812170 |

(State or other jurisdiction of

incorporation or organization) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | |

| 330 South Fourth Street | | | | |

| Richmond, | Virginia | | | | 23219 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (804) 788-5000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

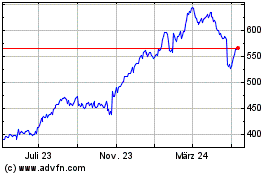

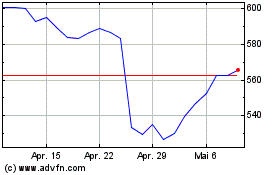

| Common Stock, with no par value | NEU | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On January 16, 2024, NewMarket Corporation, a Virginia corporation (the Company), filed a Current Report on Form 8-K (the Original Form 8-K) to announce the completion of its acquisition of all issued and outstanding ownership units of AMPAC Intermediate Holdings, LLC (AMPAC), the ultimate parent company of American Pacific Corporation, from Coyote Ultimate Holdings, LLC (Coyote) pursuant to the Securities Purchase Agreement entered into by the Company, Coyote and AMPAC on December 1, 2023 (the Transaction).

This amendment amends and supplements the Original Form 8-K solely to provide the financial statements and pro forma financial information relating to the Transaction required under Item 9.01 of Form 8-K, which were excluded from the Original Form 8-K in reliance on the instructions to such item. This amendment reports no other updates or amendments to the Original Form 8-K. The pro forma financial information included in this amendment has been presented for informational purposes only, as required by Form 8-K. It does not purport to represent the actual results of operations that the Company and AMPAC would have achieved had the companies been combined during the periods presented in the pro forma financial information and is not intended to project the future results of operations that the combined company may achieve after completion of the Transaction.

Item 9.01. Financial Statements and Exhibits

(a)Financial Statements of Business Acquired.

The audited consolidated financial statements of AMPAC, as of and for the year ended September 30, 2023, and the accompanying notes, are attached hereto as Exhibit 99.1 and incorporated herein by reference.

(b)Pro Forma Financial Information

The unaudited pro forma condensed combined financial information of the Company and its subsidiaries (including AMPAC) as of and for the year ended December 31, 2023 are attached hereto as Exhibit 99.2 and incorporated herein by reference.

(d)Exhibits

| | | | | |

| Consent of PricewaterhouseCoopers LLP |

| Audited consolidated financial statements of AMPAC, as of and for the year September 30, 2023, and the accompanying notes |

| Unaudited pro forma condensed combined financial information of the Company and its subsidiaries (including AMPAC) as of and for the year ended December 31, 2023 |

| Exhibit 104 | Cover Page Interactive Data File (Embedded within the Inline XBRL document) |

| |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 28, 2024

| | | | | | | | |

| NEWMARKET CORPORATION |

| |

| By: | | /s/ William J. Skrobacz |

| | William J. Skrobacz |

| | Vice President and Chief Financial Officer |

Exhibit 23

CONSENT OF INDEPENDENT AUDITORS

We hereby consent to the incorporation by reference in the Registration Statements on Form S-3 (Nos. 333-253774 and 333-277399) and S-8 (Nos. 333-120312 and 333-272771) of NewMarket Corporation of our report dated February 27, 2024 relating to the financial statements of AMPAC Intermediate Holdings, LLC, which appears in this Current Report on Form 8-K/A.

/s/ PricewaterhouseCoopers LLP

Salt Lake City, Utah

February 28, 2024

AMPAC Intermediate

Holdings, LLC

Consolidated Financial Statements

As of and for the year ended September 30, 2023

AMPAC Intermediate Holdings, LLC

Index

September 30, 2023

| | | | | |

| Page(s) |

| |

| Report of Independent Auditors | |

| Consolidated Financial Statements | |

| |

| Consolidated Balance Sheet | |

| Consolidated Statement of Operations | |

| Consolidated Statement of Comprehensive Income | |

| Consolidated Statement of Changes in Members' Equity | |

| Consolidated Statement of Cash Flows | |

| Notes to Consolidated Financial Statements | |

| |

| |

| |

Report of Independent Auditors

To the Management of AMPAC Intermediate Holdings, LLC

Opinion

We have audited the accompanying consolidated financial statements of AMPAC Intermediate Holdings, LLC and its subsidiaries (the "Company"), which comprise the consolidated balance sheet as of September 30, 2023, and the related consolidated statements of operations, of comprehensive income, of changes in members' equity and of cash flows for the year then ended, including the related notes (collectively referred to as the "consolidated financial statements").

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2023, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditors' Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for one year after the date the consolidated financial statements are available to be issued.

Auditors' Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors' report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a

substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements.

In performing an audit in accordance with US GAAS, we:

•Exercise professional judgment and maintain professional skepticism throughout the audit.

•Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly, no such opinion is expressed.

•Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements.

•Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/PricewaterhouseCoopers LLP

February 27, 2024

Salt Lake City, UT

AMPAC Intermediate Holdings, LLC

Consolidated Balance Sheet

September 30, 2023

| | | | | | | | |

| (dollars in thousands) | | |

| | 2023 |

| ASSETS | | |

| Current assets: | | |

| Cash and cash equivalents | | $ | 7,669 | |

| Accounts receivable | | 46,330 | |

| Inventories, net | | 12,649 | |

| Prepaid expenses and other current assets | | 2,000 | |

| Related party notes receivable | | 6,500 | |

| Total current assets | | 75,148 | |

| Property, plant and equipment, net | | 63,286 | |

| Other assets (note 6) | | 5,268 | |

| Intangible assets, net | | 166,439 | |

| Goodwill | | 207,777 | |

| TOTAL ASSETS | | $ | 517,918 | |

| | |

| LIABILITIES AND MEMBERS' EQUITY | | |

| Current liabilities: | | |

| Accounts payable | | $ | 4,469 | |

| Accrued expenses | | 12,355 | |

| Income taxes payable | | 5,044 | |

| Current portion of long-term debt | | 3,300 | |

| Other current liabilities | | 15,930 | |

| Total current liabilities | | 41,098 | |

| Long-term debt, net | | 310,200 | |

| Other noncurrent liabilities | | 52,200 | |

| Total liabilities | | $ | 403,498 | |

| Commitments and contingencies (note 13) | | |

| Members' equity | | |

| Members' capital | | 148,877 | |

| Accumulated deficit | | (54,160) | |

| Accumulated other comprehensive income | | 19,703 | |

| Total members' equity | | 114,420 | |

| TOTAL LIABILITIES AND MEMBERS' EQUITY | | $ | 517,918 | |

The accompanying notes are an integral part of these consolidated financial statements.

3

AMPAC Intermediate Holdings, LLC

Consolidated Statement of Operations

Year Ended September 30, 2023

| | | | | | | | |

| (dollars in thousands) | | |

| | 2023 |

| Revenues, net | | $ | 123,995 | |

| Cost of revenues | | 54,788 | |

| Gross profit | | 69,207 | |

| | |

| Selling, general, and administrative expenses | | 13,777 | |

| Amortization of intangible assets | | 10,695 | |

| Related party management fees | | 2,334 | |

| Operating income | | 42,401 | |

| Other income, net (note 3) | | 119 | |

| Interest expense | | (39,127) | |

| Income before income tax expense | | 3,393 | |

| Income tax expense | | (112) | |

| Net income | | $ | 3,281 | |

The accompanying notes are an integral part of these consolidated financial statements.

4

AMPAC Intermediate Holdings, LLC

Consolidated Statement of Comprehensive Income

Year Ended September 30, 2023

| | | | | | | | |

| (dollars in thousands) | | |

| | 2023 |

| Net income | | $ | 3,281 | |

| Other comprehensive income | | |

| Defined benefit pension plans | | |

| Actuarial income arising during period (net of tax expense of $950) | | 2,947 | |

| Comprehensive income | | $ | 6,228 | |

The accompanying notes are an integral part of these consolidated financial statements.

5

AMPAC Intermediate Holdings, LLC

Consolidated Statement of Changes in Members' Equity

Year Ended September 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | |

| | Members'

capital | | Accumulated

deficit | | Accumulated

other

comprehensive

income | | Total

members'

equity |

| Balances, September 30, 2022 | | $ | 148,877 | | | $ | (51,989) | | | $ | 16,756 | | | $ | 113,644 | |

| Net income | | — | | | 3,281 | | | — | | | 3,281 | |

| Other comprehensive income | | — | | | — | | | 2,947 | | | 2,947 | |

| Transfer of equity method investment | | — | | | (5,452) | | | — | | | (5,452) | |

| Balances, September 30, 2023 | | $ | 148,877 | | | $ | (54,160) | | | $ | 19,703 | | | $ | 114,420 | |

The accompanying notes are an integral part of these consolidated financial statements.

6

AMPAC Intermediate Holdings, LLC

Consolidated Statement of Cash Flows

Year Ended September 30, 2023

| | | | | | | | |

| (dollars in thousands) | | 2023 |

| Cash flows from operating activities: | | |

| Net income | | $ | 3,281 | |

| Adjustments to reconcile net income to net cash and cash equivalents used in operating activities: | | |

| Depreciation and amortization | | 18,168 | |

| Amortization of deferred financing fees | | 2,264 | |

| Inventory reserve | | 123 | |

| Deferred income taxes | | (8,827) | |

| Loss (gain) on disposal of assets | | 48 | |

| Changes in operating assets and liabilities: | | |

| Accounts receivable | | (37,394) | |

| Inventories, net | | 2,472 | |

| Prepaid expenses and other current assets | | (603) | |

| Related party notes receivable | | (6,500) | |

| Income taxes receivable/payable | | 1,780 | |

| Other assets | | (3,731) | |

| Accounts payable | | 250 | |

| Accrued expenses | | 2,514 | |

| Other noncurrent liabilities | | (4,749) | |

| Net cash and cash equivalents used in operating activities | | (30,904) | |

| Cash flows from investing activities: | | |

| Purchases of property, plant and equipment | | (3,155) | |

| Net cash and cash equivalents used in investing activities | | (3,155) | |

| Cash flows from financing activities: | | |

| Repayments of long-term debt | | (3,300) | |

| Proceeds from revolving facility | | 14,000 | |

| Proceeds from short-term debt | | 4,906 | |

| Repayments of short-term debt | | (3,747) | |

| Net cash and cash equivalents provided by financing activities | | 11,859 | |

| Net decrease in cash and cash equivalents | | (22,200) | |

| Cash and cash equivalents | | |

| Cash and cash equivalents, beginning of period | | 29,869 | |

| Cash and cash equivalents, end of period | | $ | 7,669 | |

| Supplemental disclosure of cash flow information | | |

| Cash paid for: | | |

| Interest | | $ | 36,863 | |

| Income taxes | | $ | 7,159 | |

| Supplemental disclosure of noncash investing and financing activities | | |

| Payables related to purchases of property and equipment | | $ | 386 | |

| Transfer of equity method investment | | $ | 5,451 | |

The accompanying notes are an integral part of these consolidated financial statements.

7

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

1.Basis of Presentation

Basis of Presentation

The consolidated financial statements include the operations of AMPAC Intermediate Holdings, LLC (“Parent” or “Company”) and its subsidiaries including American Pacific Corporation (“American Pacific”) which is a wholly owned subsidiary of Flamingo Parent Corp. Flamingo Parent Corp. is a wholly owned subsidiary of Coyote Buyer, LLC. Coyote Buyer, LLC is a wholly owned subsidiary of Coyote AMPAC Holdings, LLC. Coyote AMPAC Holdings, LLC is a wholly owned subsidiary of AMPAC Intermediate Holdings, LLC. All intercompany balances and transactions have been eliminated upon consolidation. Results are reported based on a fiscal year which ends on September 30.

The Company is principally engaged in the production of perchlorates, which include several grades of ammonium perchlorate (“AP”), sodium perchlorate, and potassium perchlorate. AP is a key component of solid propellant rockets, booster motors, and missiles used in national defense, space exploration, and commercial satellite launch programs. In addition, the Company produces and sells sodium azide, a chemical primarily used in pharmaceutical manufacturing and Halotron, a series of clean fire extinguishing agents used in fire extinguishing products ranging from portable fire extinguishers to total flooding systems. The Company’s customers and product distribution span much of the globe. Corporate headquarters and manufacturing facilities are located in Utah.

2. Summary of Significant Accounting Policies

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and the reported amounts of revenue and expenses. These estimates and assumptions are based on historical information and information currently available. Actual results may differ from estimates. Significant estimates include but are not limited to pension obligations, goodwill, and long lived asset and inventory impairment.

Cash and cash equivalents

The Company maintains cash balances that exceed federally insured limits; however, all such balances are maintained with high credit quality financial institutions and the Company has incurred no losses on such accounts. The Company recorded no restricted cash as of September 30, 2023. The Company considers all highly liquid investments with an original maturity or a remaining maturity at the time of purchase of three months or less to be cash equivalents.

Accounts Receivable

Accounts receivable represent the Company’s right to consideration that is unconditional, only the passage of time is required before the consideration is considered due. The Company assesses the collectability of its accounts receivable based on historical collection experience and records allowances for estimated credit losses when circumstances necessitate. As of September 30, 2023 no allowances were recorded. Typically, the Company’s customers consist of large corporations and government contractors procuring products on behalf of or for the benefit of government agencies.

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

Inventories

Inventories are stated at the lower of cost and net realizable value. Costs are removed from inventories using the average-cost method. Inventoried costs include materials, labor and manufacturing overhead. Inventoried costs also include certain overhead parts and supplies. General and administrative costs are expensed as incurred. Raw materials costs are determined on a moving average basis. The Company expenses the cost of inventories in the case that on-hand inventories exceed estimates of future demand. The Company records a reserve for maintenance, repair, and operating inventory items that may no longer be used. As of September 30, 2023 reserves of $649 were recorded.

Income Taxes

The Company accounts for income taxes under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the consolidated financial statement carrying amounts of assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured separately for each tax-paying entity in each tax jurisdiction, using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the period that includes the enactment date. The Company evaluates the probability of realizing the future benefits of its deferred tax assets and provides a valuation allowance for the portion of such deferred tax assets where the likelihood of realizing the related income tax benefit in the future does not meet the “more-likely-than-not” criteria for recognition.

The Company accounts for uncertain tax positions in accordance with an accounting standard which creates a single model to address uncertainty in income tax positions and prescribes the minimum recognition threshold a tax position is required to meet before being recognized in the consolidated financial statements. Under this standard, the Company may recognize tax benefits from an uncertain position only if it is more likely than not that the position will be sustained upon examination by taxing authorities based on the technical merits of the issue. The amount recognized is the largest benefit that the Company believes has greater than a 50% likelihood of being realized upon settlement.

The Company recognizes interest and penalties, if any, related to unrecognized tax positions in the Consolidated Statement of Operations. No interest or penalties were accrued as of September 30, 2023.

Property, Plant, and Equipment

Property, plant, and equipment are carried at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated productive lives of the assets, which do not exceed the lease term for leasehold improvements, as follows:

| | | | | | | | |

| Land improvements, buildings, and building improvements | | 7 to 30 years |

| Machinery and equipment | | 5 to 7 years |

| Computers and lab equipment | | 3 to 5 years |

Impairment of Long-Lived Assets and Intangibles

Intangible assets include trademarks and customer relationships and have established useful lives of 10 years and 20 years, respectively. The Company amortizes such assets on a straight-line basis over the established useful lives.

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

The Company tests property, plant and equipment and intangible assets for recoverability when events or changes in circumstances indicate that their carrying amounts may not be recoverable. Examples of such circumstances include, but are not limited to, operating or cash flow losses from the use of such assets or changes in the intended uses of such assets. To test for recovery, the Company groups assets (an “Asset Group”) in a manner that represents the lowest level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities. The carrying amount of an Asset Group is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the Asset Group. If the Company determines that an Asset Group is not recoverable, then an impairment charge is recorded if the carrying value of the Asset Group exceeds its fair value. Fair value is based on estimated discounted future cash flows expected to be generated by the Asset Group. The assumptions underlying cash flow projections would represent management’s best estimates at the time of the impairment review. Changes in key assumptions or actual conditions which differ from estimates could result in an impairment charge. The Company uses reasonable and supportable assumptions when performing impairment reviews but cannot predict the occurrence of future events and circumstances that could result in impairment charges.

Goodwill

Goodwill arises from the excess of cost over the net assets of businesses acquired. Goodwill represents the residual purchase price after allocation to all identifiable net assets. The Company assesses qualitative factors to determine whether it is more likely than not (that is, a likelihood of more than 50 percent) that the fair value of a reporting unit is less than its carrying amount, including goodwill. If the qualitative factors indicate an impairment is more likely than not, the Company will perform a quantitative impairment test. We test goodwill for impairment each year, as well as whenever a significant event or circumstance occurs which could reduce the fair value of the reporting unit based on the income method to which the goodwill applies below the carrying amount of the reporting unit.

Contract Liabilities

Contract liabilities (i.e. customer deposits) are recorded when a customer’s payment is received or due before all performance obligations have been met. Contract liabilities include customer deposits which consist of upfront payments received from customers. These amounts are recorded as other current liabilities and applied against the total consideration for an arrangement upon completion of the deliverable.

Leases

The Company has adopted ASC 842 for the period ended September 30, 2023. Prior to October 1, 2022 the company followed guidance previously in effect in ASC 840. The Company assesses contracts at inception to determine whether an arrangement is or includes a lease, which conveys the Company’s right to control the use of an identified asset for a period of time in exchange for consideration. The classification as finance or operating lease depends on the substance of the transaction rather than the form of the contract. A lease right of use asset and associated liability is recognized at the commencement date and initially measured based on the present value of lease payments over the defined lease term. The Company does not recognize leases with a contractual term of less than 12 months on its consolidated balance sheet. Lease expense for these short‑term leases is expensed on a straight-line basis over the lease term. The adoption of this ASU did not have an impact on the consolidated financial statements.

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

Fair Value of Financial Instruments

The current authoritative guidance on fair value clarifies the definition of fair value as the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. Applicable accounting guidance also establishes a hierarchy for inputs used to measure fair value in order to maximize the use of observable inputs and minimize the use of unobservable inputs in the measurement of fair value by requiring that the most observable inputs be used when available. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect internal market assumptions. These two types of inputs create the following fair value hierarchy:

| | | | | |

| Level 1 | Quoted prices for identical instruments in active markets. |

| |

| Level 2 | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable. |

| |

| Level 3 | Significant inputs to the valuation model are unobservable. |

The carrying value of financial instruments, including cash and cash equivalents, accounts receivable, notes receivable, accounts payable and revolving credit facility approximate fair value because of the relatively short maturity of these instruments. The carrying value of debt approximates fair value as the associated interest rate is variable based on current market conditions. Cash equivalents on the Consolidated Balance Sheet include money market funds with a carrying amount and fair value of $4,053 as of September 30, 2023. The fair value is categorized in Level 1 of the fair value hierarchy.

Revenue Recognition

Revenue is recognized to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. Revenue recognized by the Company is based on contracts with customers. Contracts, typically a purchase order, are approved by both parties evidencing commitment to perform obligations of the contract. The contract identifies each party’s rights, performance obligations, and payment terms. The Company typically satisfies performance obligations at the time of shipment of product from the Company plant site. Normal payment terms are Net 30 days. The Company records no warranties or obligations for returns or refunds of chemical products shipped to customers. American Pacific evaluates the probability of collection on each contract and only recognizes revenue when it is probable that substantially all of the consideration of the contract will be collected. Transaction price is defined in the contract with the customer. No adjustment to the transaction price is made as a result of significant financing components (if any), due to American Pacific’s expectation that payment will be received within one year. Typical contracts with customers include only one performance obligation and as such, the transaction price is not allocated. Revenue is recognized when the customer obtains control of the asset. Minimal judgement is involved with the recording of revenue as revenue is dictated by contracts and recorded at the time of physical shipment of goods. The Company has not recorded any impairment losses on receivables or contract assets. The Company’s primary products are often used by customers in government contracts. Such contracts may lead customers to purchase product on a schedule that would

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

lead to uneven revenues and cash flows in a fiscal year. At times, the Company receives payment in advance of customer acceptance, in which case a contract liability is recorded with revenue recognized upon delivery of the product. Revenue is reported net of any impact of variable consideration resulting from changes in actual and expected sales volume.

Related Party Transactions

Related party transactions generally consist of transactions with parent entity owners and the employee benefit trust established for the administration of the Company’s pension plan. Payments to owners consist of management fees totaling $2,334 for the period ended September 30, 2023 and notes receivable totaling $6,500 with accrued interest of $165 as of September 30, 2023. Payments to the employee benefit trust consist of funding contributions necessary to maintain adequate funding levels of the Company pension plan. All such contributions are prescribed by the plan’s independent actuary and totaled $885 for the period ended September 30, 2023. Pension plan contributions result in a reduction of the Pension Obligation reported on the balance sheet.

On December 30, 2022, the Company transferred its investment in a wholly owned subsidiary, Rocket Investco Holdings, LLC to Coyote Ultimate Holdings, LLC, an entity under common control. The only assets owned by Rocket Investco Holdings, LLC at the time of transfer was a long-term equity method investment. No proceeds were received by the Company as a result of the transfer and the difference in proceeds and book value was reported as an equity transaction.

Concentration Risk

Financial instruments that have potential concentrations of credit risk include cash, accounts receivable, and notes receivable. The Company places its cash with high quality credit institutions. There is concentration risk in the Company’s accounts receivable as significant amounts relate to a limited number of customers in the aerospace and defense industries. From time to time the Company makes sales to a customer that exceeds 10% of its then-outstanding accounts receivable balance.

As of September 30, 2023, two customers accounted for 81% of consolidated accounts receivable and 68% of consolidated sales.

Recent Accounting Pronouncements

In September 2022, the FASB issued ASU No. 2022-04, Liabilities – Supplier Finance Programs. The update specifies reporting requirements, including quantitative and qualitative information about its supplier finance programs. The standard becomes effective for the Company for fiscal year beginning October 1, 2023. The Company is evaluating the impact of adopting this new accounting standard on its consolidated financial statements.

In August 2018, the FASB issued ASU No. 2018-14, Compensation-Retirement Benefits-Defined Benefit Plans-General (Subtopic 715-20). The update provides guidance on disclosure requirements related to defined benefit pension plans including removal of disclosures that no longer are considered cost beneficial, clarifying specific requirements of disclosures, and adding relevant disclosures. The standard becomes effective for the Company for fiscal year beginning October 1, 2022. The Company evaluated the pronouncement which had no material impact on the Company’s financial statements.

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments and subsequent amendments which significantly changes the way entities recognize impairment of many financial assets by requiring immediate recognition of estimated credit losses expected to occur over their remaining life, instead of when incurred. The changes (as amended) are effective for the Company for annual and interim periods in fiscal years beginning after December 15, 2022. The Company is evaluating the impact of adopting this new accounting standard on its consolidated financial statements.

In February 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases (Topic 842) (“ASU No. 2016-02”). ASU No. 2016-02 is intended to improve financial reporting around leasing transactions. It affects all companies and other organizations that engage in lease transactions (both lessee and lessor) for assets such as real estate and manufacturing equipment. ASU No. 2016-02 applies a right-of-use (ROU) model that requires a lessee to record, for all leases with a lease term of more than 12 months, an asset representing its right to use the underlying asset and a liability to make lease payments. For leases with a term of 12 months or less, a practical expedient is available whereby a lessee may elect, by class of underlying asset, not to recognize an ROU asset or lease liability. At inception, lessees must classify all leases as either finance or operating based on five criteria. Balance sheet recognition of finance and operating leases is similar, but the pattern of expense recognition in the Consolidated Statement of Operations, as well as the effect on the Consolidated Statement of Cash Flows, differs depending on the lease classification. Lessors will be required to classify leases as either sales-type, direct financing or operating, similar to existing U.S. GAAP. Classification depends on the same five criteria used by lessees plus certain additional factors. The subsequent accounting treatment for all three lease types is substantially equivalent to existing U.S. GAAP for sales-type leases, direct financing leases, and operating leases. However, the new standard updates certain aspects of the lessor accounting model to align it with the new lessee accounting model, as well as with the new revenue standard under Topic 606. The standard becomes effective for the Company for the fiscal year beginning October 1, 2022. The Company has applied this standard herein which application did not have a material impact on results or reporting.

In December 2019, the FASB issued ASU 2019-12, “Simplifying the Accounting for Income Taxes,” which will simplify the accounting for income taxes by removing certain exceptions to the general principles in income tax accounting and improve consistent application of and simplify GAAP for other areas of income tax accounting by clarifying and amending existing guidance. The new guidance is effective for the fiscal year beginning October 1, 2022. The Company evaluated the pronouncement which had no material impact on the Company’s financial statements.

3. Other Income

Other income consists of the following items:

| | | | | | | | |

| | 2023 |

| Net periodic pension income | | $ | (48) | |

| Interest income | | 166 |

| Other | | 1 |

| Other income, net | | $ | 119 | |

| | |

| | |

| | |

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

4. Inventories

The following table provides additional disclosure for inventories:

| | | | | | | | | | | |

| | 2023 |

| | | |

| Finished goods | | $ | 2,588 | | |

| Work-in-progress | | 6,040 | | |

| Raw materials and supplies | | 4,021 | | |

| Total inventories | | $ | 12,649 | | |

5. Property, Plant and Equipment

The following table provides additional disclosure for property, plant and equipment:

| | | | | | | | | | | |

| | 2023 |

| | | |

| Land and improvements | | $ | 13,851 | | |

| Buildings and improvements | | 10,047 | | |

| Machinery and equipment | | 60,856 | | |

| Construction in progress | | 1,870 | | |

| Total cost | | 86,624 | | |

| Less: Accumulated depreciation | | (23,338) | | |

| Total property, plant and equipment | | $ | 63,286 | | |

Depreciation expense of $7,473 for the period ended September 30, 2023 is included in cost of revenues on the Consolidated Statement of Operations.

6. Other Assets

The following table provides additional disclosure for other assets:

| | | | | | | | | | | |

| | 2023 |

| Long-term prepaid insurance | | $ | 4,121 | | |

| Critical spare material | | 890 | | |

| Other | | 257 | | |

| Total other assets | | $ | 5,268 | | |

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

7. Goodwill and Intangible Assets

Goodwill and intangible assets consist of the following as of September 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Estimated Useful Life (in Years) | Gross Amount | | Accumulated Amortization | | Impairment | | Net Amount |

| September 30, 2023 | | | | | | | | |

| Goodwill | | $ | 207,777 | | | $ | — | | | $ | — | | | $ | 207,777 | |

| Intangible Assets: | | | | | | | | |

| Customer relationships | 20 | $ | 198,300 | | | $ | (36,033) | | | $ | (1,161) | | | $ | 161,106 | |

| Trademarks | 10 | 8,500 | | | (3,074) | | | (93) | | | 5,333 | |

| Total intangible assets | $ | 206,800 | | | $ | (39,107) | | | $ | (1,254) | | | $ | 166,439 | |

Intangible assets are amortized on a straight line basis over the determined useful lives. Amortization expense was $10,695 for the period ended September 30, 2023.

Estimated future amortization expense for Intangible Assets is as follows:

| | | | | | | | |

| Years ending September 30: | | Intangible Assets |

| | |

| 2024 | | $ | 10,695 | |

| 2025 | | 10,695 | |

| 2026 | | 10,695 | |

| 2027 | | 10,695 | |

| 2028 | | 10,695 | |

| Thereafter | | 112,964 | |

| | $ | 166,439 | |

8. Current Liabilities

Accrued expenses consists of the following:

| | | | | | | | | | | |

| | 2023 |

| Accrued liabilities | | $ | 370 | | |

| Accrued interest | | 6,190 | | |

| Employee related liabilities | | 5,795 | | |

| Accrued expenses | | $ | 12,355 | | |

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

Other current liabilities consists of the following:

| | | | | | | | |

| | 2023 |

| Revolving credit facility | | $ | 14,000 | |

| Other | | 1,930 | |

| Other current liabilities | | $ | 15,930 | |

Available borrowings under the Revolving Facility are computed as the $20,000 committed line less any outstanding revolving loans and outstanding letters of credits. As of September 30, 2023 Borrower had $14,000 outstanding borrowings or letters of credit under the Revolving Facility.

9. Debt

The Company's outstanding debt balances consist of the following:

| | | | | | | | |

| | 2023 |

| | |

| Term Loan, variable rate interest, due through February 6, 2026 | | $ | 270,200 | |

| Second Amendment Term Loan, variable rate interest, due through August 6, 2026 | | 48,625 | |

| Less: Current portion | | (3,300) | |

| Total long-term debt | | 315,525 | |

| Less: Unamortized debt issue costs | | (5,325) | |

| Long-term debt, net | | $ | 310,200 | |

To facilitate the acquisition of Carpenter Corp. by Coyote Buyer, LLC (“Borrower”), on February 6, 2020 (the “Transaction”), the Company obtained financing through a $280,000 senior secured credit agreement (the “Credit Facility”). Under the Credit Facility, the Borrower (i) obtained a term loan in the aggregate principal amount of $280,000 with an initial maturity of six years (the “Term Loan”), and (ii) access to revolving loans of up to $20,000 in aggregate principal amount which terminates February 6, 2025 (the “Revolving Facility”). On October 2, 2021, the Credit Facility was amended and an additional $50,000 was made available to Borrower (“Second Amendment Term Loan”). The borrower may make voluntary prepayments on Term Loans and Revolving Facility without premium or penalty. The Credit Facility contains certain mandatory prepayment provisions which are based upon incurrence of certain indebtedness, excess cash flow, and events of loss.

For all loans under the Credit Facility, the Company elects between two options to determine the annual interest rates applicable to such loans: SOFR Rate Loans and Base Rate Loans as described in the Credit Facility. These elections can be renewed or changed from time to time during the term of the Credit Facility. Interest payments are due at least quarterly and may be more frequent under certain loan elections. Term loan interest rate at September 30, 2023 was 11.5%. Second Amendment Term Loan interest rate at September 30, 2023 was 13.6%.

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

The Term Loan includes quarterly principal amortization payments which commenced on June 30, 2020. Scheduled amortization of the Term Loan is $700 per quarter, although such quarterly payments may be offset by voluntary prepayments by Borrower. The remaining balance of the Term Loan is due upon maturity.

The Second Amendment Term Loan includes quarterly principal amortization payments which commenced on March 31, 2021. Scheduled amortization of the Second Amendment Term Loan is $125 per quarter, although such quarterly payments may be offset by voluntary prepayments by Borrower. The remaining balance of the Second Amendment Term Loan is due upon maturity.

The Credit Facility is guaranteed by the current and future domestic restricted subsidiaries of the Borrower and is secured by substantially all of the Company’s assets and the assets of current and future domestic restricted subsidiaries, subject to certain exceptions as set forth in the Credit Facility.

The Credit Facility contains customary affirmative, negative, and financial covenants which are subject to customary and negotiated exceptions and exclusions. The financial covenant requires that the Company’s total net leverage ratio must remain below certain thresholds defined in the Credit Facility agreement. As of September 30, 2023 the Company was in compliance with all affirmative, negative, and financial covenants noted above.

Principal Maturities

Principal maturities for the Term Loan and Revolving Facility outstanding as of September 30, 2023 are as follows:

| | | | | | | | |

| | Principal Maturities |

| Years ending September 30 | | |

| 2024 | | $ | 3,300 | |

| 2025 | | 3,300 | |

| 2026 | | 312,225 | |

| | $ | 318,825 | |

Debt Issuance Costs

In connection with the issuance of the 2020 Credit Facility, the Company incurred debt issuance costs of $8,400 and $600 related to the term and revolving facilities, respectively. In addition, the Company incurred debt issuance costs of $4,356 in relation to the Second Amendment Term Loans. Debt issuance costs related to the term loan facility are recorded as a direct reduction to the long-term debt reported on the balance sheet. Debt issuance costs related to the revolving loan facility are recorded in Other Assets. Debt issuance costs are being amortized, using the effective interest rate method for the Term Loan and straight-line for the Revolving Facility, as additional noncash interest expense over the term of each, respectively. Unamortized term loan facility and revolver debt issue costs are $5,325 and $163, respectively, as of September 30, 2023.

Letters of Credit

The Company issues letters of credit principally to secure performance related to insurance and utilities. Letters of credit that are not issued under the Revolving Facility are collateralized by cash on deposit

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

with the issuing bank in the amount of 105% of the outstanding letters of credit. Collateral deposits are classified as other assets on the consolidated balance sheet. As of September 30, 2023 there were no such letters of credit outstanding.

10. Other noncurrent liabilities

Other noncurrent liabilities consist of the following:

| | | | | | | | |

| | 2023 |

| Pension obligations, net | | $ | 14,144 | |

| Deferred income taxes | | 38,056 | |

| Other noncurrent liabilities | | $ | 52,200 | |

11. Income Taxes

The components of the income tax expense are as follows:

| | | | | | | | |

| | 2023 |

| | |

| Current | | |

| Federal | | $ | (7,127) | |

| State | | (1,875) | |

| Total current | | (9,002) | |

| Deferred | | |

| Federal | | 7,027 | |

| State | | 1,863 | |

| Total deferred | | 8,890 | |

| Income tax expense | | $ | (112) | |

The reconciliation of the U.S. federal statutory rate to the effective income tax rate is as follows:

| | | | | | | | |

| | 2023 |

| | |

| Tax At Federal Statutory Rate | | 21.00 | % |

| State, Net Of Federal Benefit | | 3.91 | % |

| State Rate Change | | (3.79) | % |

| Permanent adjustments | | (8.84) | % |

| Return to provision adjustments | | (8.97) | % |

| Effective Tax Rate | | 3.31 | % |

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

Deferred Tax Assets and Liabilities

Deferred tax assets arise primarily because expenses have been recorded in historical consolidated financial statements periods which will not become deductible for income taxes until future tax years. Deferred tax assets and liabilities are comprised of the following:

| | | | | | | | |

| | 2023 |

| | |

| Deferred tax assets: | | |

| Inventory | | $ | 468 | |

| Pension obligations | | 3,731 | |

| Accrued expenses | | 508 | |

| Interest | | 11,064 | |

| Deferred tax assets | | 15,771 | |

| Deferred tax liabilities: | | |

| Intangible assets | | (39,152) | |

| Property, plant and equipment | | (14,178) | |

| Prepaid expenses | | (497) | |

| Deferred tax liabilities | | (53,827) | |

| Net deferred tax liabilities | | $ | (38,056) | |

Unrecognized Tax Benefits

The Company reviews its portfolio of uncertain tax positions and recorded liabilities based on the applicable recognition standards. In this regard, an uncertain tax position represents the expected treatment of a tax position taken in a filed tax return, or planned to be taken in a future tax return, that has not been reflected in measuring income tax expense for financial reporting purposes. Uncertain tax positions are classified as noncurrent income tax liabilities unless expected to be settled within one year.

As of September 30, 2023, the recorded liability for unrecognized tax benefits was $0.

The Company is no longer subject to examinations for years prior to 2020.

12. Employee Benefit Plans

American Pacific is self-insured for health care benefits. The estimated liability for claims incurred but not yet paid is included in employee related liabilities on the accompanying consolidated balance sheet.

Defined Benefit Plan and SERP Descriptions

The Company maintains a defined benefit pension plan, which covers substantially all of the Company’s employees: The Amended and Restated American Pacific Corporation Defined Benefit Pension Plan (the “AMPAC Plan”), as amended to date. Pension plan benefits are paid based on an average of earnings, retirement age, and length of service, among other factors. In May 2010, the board of directors approved amendments to the pension plan which effectively closed the pension plan to participation by any new employees. Retirement benefits for existing U.S. employees and retirees through June 30, 2010 were not affected by this change. Beginning July 1, 2010, new U.S. employees began participating solely in the

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

401(k) plan. On January 31, 2021, the plan was again amended by the board of directors to cease all future benefit accruals of plan participants. Benefits earned through January 31, 2021 were not affected by this amendment.

The Company also maintains the American Pacific Corporation Supplemental Executive Retirement Plan (the “SERP”). On February 27, 2014, the plan was frozen and benefit accrual ceased thereafter. In addition, on March 1, 2014, benefit payments commenced to the then three active participants. These changes had no impact on the then two retired participants. As of September 30, 2023, four participants, comprised of retired senior executives, continue to receive benefit payments.

Defined Contribution Plan Descriptions

The Company maintains a 401(k) plan in which participating employees may make contributions. Matching contributions are made for eligible U.S. employees. Total contributions of $670 were made to the 401(k) Plan during the period ended September 30, 2023.

Summary Defined Benefit Plan and SERP Results

The following tables provide financial information for the AMPAC Plan and SERP.

| | | | | | | | | | | | | | |

| | 2023 |

| | AMPAC

Plan | | SERP |

| Accumulated benefit obligation | | $ | 78,028 | | | $ | 7,537 | |

| Plan assets | | 70,541 | | | — | |

| Funded status | | $ | (7,487) | | | $ | (7,537) | |

| Amounts recognized in consolidated balance sheet | | | | |

| Employee related liabilities | | $ | — | | | $ | (880) | |

| Pension obligations and other long-term liabilities | | (7,487) | | | (6,657) | |

| Net amount recognized | | $ | (7,487) | | | $ | (7,537) | |

| | | | | | | | | | | | | | |

| | 2023 |

| | Pension | | SERP |

| Net periodic benefit (income) costs recognized | | $ | (366) | | | $ | 414 | |

| Employer contributions | | 885 | | | 909 | |

| Benefits paid | | (4,052) | | | (909) | |

Other components (excluding service costs) of net periodic benefit (income) expense are reported in Other Income on the Statement of Operations.

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

Unrecognized Benefit Plan Costs

The following tables summarize changes in the components of unrecognized benefit plan costs:

| | | | | | | | | | | | | | |

| | 2023 |

| | Pension | | SERP |

| Net actuarial (gain) loss | | $ | (3,942) | | | $ | 45 | |

| Prior service costs | | — | | | — | |

| Amortization from prior years: | | | | |

| Net actuarial loss | | — | | | — | |

| Prior service costs | | — | | | — | |

| Income tax effects | | 961 | | | (11) | |

| Changes in unrecognized benefit plan costs | | $ | (2,981) | | | $ | 34 | |

The following table sets forth the amounts recognized as components of accumulated other comprehensive loss:

| | | | | | | | | | | | | | |

| | 2023 |

| | Pension | | SERP |

| Unrecognized benefits plan costs, net of tax | | $ | (19,031) | | | $ | (672) | |

Assumptions

The following table summarizes the weighted average actuarial assumptions used to determine the benefit obligation as of the period end date and the net periodic benefit plan costs for the period then ended.

| | | | | | | | | | | | | | |

| | 2023 |

| | AMPAC Plan | | SERP |

| Benefit obligation | | | | |

| Discount rate | | 6.03 | % | | 5.93 | % |

| Rate of compensation increase | | — | | | — | |

| Net periodic benefit plan cost | | | | |

| Discount rate | | 5.71 | % | | 5.62 | % |

| Rate of compensation increase | | — | | | — | |

| Expected return on plan assets | | 6.50 | | | — | |

The discount rate is determined for the AMPAC Plan and SERP by projecting the expected future benefit payments of the AMPAC Plan and SERP, discounting those payments using a theoretical zero-coupon spot-yield curve derived from a universe of high-quality bonds as of the measurement date, and solving for a single equivalent discount rate that results in the same projected benefit obligation.

Through consultation with investment advisors and actuaries, the expected long-term returns for each of the AMPAC Plan’s strategic asset classes were developed. Several factors were considered, including survey of investment managers’ expectations, current market data and historical returns of long periods.

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

Using policy target allocation percentages and the asset class expected returns, a weighted average expected return was calculated.

Contributions and Benefit Payments

During the year ending September 30, 2024, the Company expects to contribute approximately $1,500 to the AMPAC Plan and approximately $909 to the SERP.

The table below sets forth expected future benefit payments for the years ending September 30:

| | | | | | | | | | | | | | |

| | AMPAC Plan | | SERP |

| Years ending September 30 | | | | |

| 2024 | | $ | 4,484 | | | $ | 906 | |

| 2025 | | 4,802 | | | 891 | |

| 2026 | | 5,031 | | | 872 | |

| 2027 | | 5,219 | | | 845 | |

| 2028 | | 5,331 | | | 812 | |

| 2029-2033 | | 28,317 | | | 3,361 | |

Plan Assets and Investment Policy

The AMPAC Plan’s assets include no shares of the Company’s common stock. Assumptions are developed for expected long-term returns for the targeted asset classes of the AMPAC Plan based on factors that include current market data such as yields/price-earnings ratios, and historical market returns over long periods. Using policy target allocation percentages and the asset class expected returns, a weighted average expected return was calculated. The actual and target asset allocation for the AMPAC Plan is as follows:

| | | | | | | | | | | | | | |

| | 2023 |

| | Target | | Actual |

| Fixed income & cash | | 26 | % | | 29 | % |

| Domestic equity | | 47 | % | | 51 | % |

| International equity | | 14 | % | | 13 | % |

| Real estate/alternatives | | 13 | % | | 7 | % |

| | 100 | % | | 100 | % |

The table below provides the fair values of the AMPAC Plan’s assets by asset category, and identifies the level of inputs used to determine the fair value of assets in each category (Note 2 for additional information regarding the level categories). Certain investments that were measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy.

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 |

| | Quoted Prices in Active Markets for Identical Assets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total |

| | | | | | | | |

| Cash and short term investments | | $ | 2,479 | | | $ | — | | | $ | — | | | $ | 2,479 | |

| Mutual funds - equity | | 41,751 | | | — | | | — | | | 41,751 | |

| Mutual funds - fixed income | | 17,723 | | | — | | | — | | | 17,723 | |

| US Treasury/Agency Securities | | 6,861 | | | — | | | — | | | 6,861 | |

| | $ | 68,814 | | | $ | — | | | $ | — | | | 68,814 | |

| Investments measured at net asset value | | | | | | |

| Alternative fixed income/real estate | | | | | | 1,727 | |

| | | | | | | | $ | 70,541 | |

Fair Value of Investments in Entities that Use NAV

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value | | Unfunded Commitments | | Redemption Frequency (If Currently Eligible) | | Redemption Notice Period |

| 2023 | | | | | | | | |

| Real estate | | $ | 1,727 | | | $ | 47 | | | N/A | | 90 Days |

| | $ | 1,727 | | | $ | 47 | | | | | |

13. Commitments and Contingencies

Although the Company is not currently party to any material pending legal proceedings, it is from time to time subject to claims and lawsuits related to the business operations. Loss contingencies are accrued when a loss is probable and the amount can be reasonably estimated. Legal fees, which can be material in any given period, are expensed as incurred. The Company believes that current claims or lawsuits against it, individually and in the aggregate, will not result in loss contingencies that will have a material adverse effect on the Company’s financial condition, cash flows, or results of operations.

14. Subsequent Events

Management evaluates events and transactions that occur after the balance sheet date, but before the consolidated financial statements are issued for possible recognition or disclosure. The Company entered into a definitive purchase agreement and was subsequently acquired by Newmarket Corporation (NYSE: NEU) on January 16, 2024. In connection with the closing of the acquisition, long-term debt, the

AMPAC Intermediate Holdings, LLC

Notes to Consolidated Financial Statements

September 30, 2023

(dollars in thousands)

associated revolving credit facility, and related party notes receivable, each along with all accrued interest, were settled and extinguished.

Subsequent events have been evaluated through February 27, 2024, the date the consolidated financial statements were available to be issued.

EXHIBIT 99.2

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

Acquisition

On December 1, 2023, NewMarket Corporation (the Company or NewMarket) entered into a Securities Purchase Agreement (the Purchase Agreement) with Coyote Ultimate Holdings, LLC (Coyote) and AMPAC Intermediate Holdings, LLC (AMPAC), the ultimate parent company of American Pacific Corporation. On January 16, 2024, the Company completed its acquisition (the Acquisition) of all issued and outstanding ownership units of AMPAC pursuant to the Purchase Agreement. The Company satisfied the approximately $700 million purchase price with cash on hand and borrowings of approximately $690 million under its former revolving credit facility (see Debt Agreements below).

The Acquisition is being accounted for using the acquisition method of accounting for business combinations under the provisions of Financial Accounting Standards Board (FASB) Accounting Standard Codification (ASC) Topic 805, Business Combinations (ASC 805). The unaudited pro forma condensed combined financial statements were prepared in accordance with Article 11 of Regulation S-X, as amended by SEC Final Rule Release No. 33-10786, Amendments to Financial Disclosures About Acquired and Disposed Businesses and are presented to illustrate the estimated effects of the Acquisition.

The unaudited pro forma condensed combined statement of income for the year ended December 31, 2023 was prepared as if the Acquisition had occurred on January 1, 2023. The unaudited pro forma condensed combined balance sheet was prepared as if the Acquisition had occurred on December 31, 2023.

The following unaudited pro forma condensed combined financial information is derived from the historical financial statements of NewMarket and AMPAC, and should be read in conjunction with:

•NewMarket Corporation's consolidated financial statements included in its Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC) on February 15, 2024.

•AMPAC's audited consolidated financial statements for the year ended September 30, 2023 that are included as Exhibit 99.1 in the Company's Report on Form 8-K/A filed with the SEC on February 28, 2024 to which this unaudited pro forma condensed combined financial information is being filed as an exhibit.

Debt Agreements

On January 22, 2024, NewMarket and certain foreign subsidiary borrowers entered into a credit agreement for a new $900 million revolving credit facility (the Revolving Credit Agreement). The revolving credit facility matures on January 22, 2029 and includes a $500 million sublimit for multicurrency borrowings, an initial letter of credit sublimit of $25 million and a $20 million sublimit for swingline loans. The Revolving Credit Agreement includes an expansion feature allowing the Company, subject to certain conditions, to request an increase in the aggregate amount of the revolving credit facility or obtain incremental term loans in an amount up to $450 million. The Company may also request an extension of the maturity date as provided for in the Revolving Credit Agreement.

Borrowings made under the revolving credit facility bear interest at a variable rate determined, at the Company's option, at an annual rate equal to (i) the Base Rate, (ii) Term SOFR, (iii) the Weekly Adjusted Term SOFR, (iv) the Alternative Currency Term Rate, or (v) the Alternative Currency Daily Rate, each plus the Applicable Rate and all as defined in the Revolving Credit Agreement. The Applicable Rate is based, at the Company's option, on either NewMarket's Leverage Ratio or Ratings Level. All capitalized terms are as defined in the Revolving Credit Agreement as filed on Form 8-K with the SEC on January 25, 2024.

Also on January 22, 2024, NewMarket entered into a credit agreement for a $250 million term loan (the Term Loan Credit Agreement). The term loan matures on January 22, 2026. NewMarket is required to repay the principal amount borrowed under the term loan in full at maturity. The Company may, in its sole discretion and subject to the conditions set forth in the Term Loan Credit Agreement, prepay amounts borrowed under the term loan, together with any accrued and unpaid interest, prior to maturity. Any amounts prepaid prior to maturity are not available for additional borrowings by NewMarket.

The principal amount borrowed under the term loan initially bears interest at a variable rate equal to Term SOFR plus the Applicable Rate. The Company may, at its option, elect for outstanding portions of the principal amount to instead bear interest at a variable rate equal to the Base Rate or Weekly Adjusted Term SOFR, plus, in each case, the Applicable Rate, subject to the conditions set forth in the Term Loan Credit Agreement. Similar to the revolving credit facility, the Applicable Rate is based, at the Company's option, on either its Leverage Ratio or Ratings Level. All capitalized terms are as defined in the Term Loan Credit Agreement as filed on Form 8-K with the SEC on January 25, 2024.

The obligations under the revolving credit facility and the term loan are unsecured and the obligations under the revolving credit facility are fully and unconditionally guaranteed by NewMarket.

Both the revolving credit facility and the term loan contain certain customary covenants, including financial covenants that require NewMarket to maintain a consolidated Leverage Ratio (as defined in each of the agreements) of no more than 3.75 to 1.00 except during an Increased Leverage Period (as defined in each of the agreements).

Concurrently with the Company's entry into the Revolving Credit Agreement and the Term Loan Credit Agreement described above, the former revolving credit facility dated as of March 5, 2020 was terminated. Upon termination, the Company repaid the amount outstanding under the former revolving credit facility, plus accrued and unpaid interest. NewMarket borrowed the entire $250 million available under the Term Loan Credit Agreement and approximately $465 million under the Revolving Credit Agreement to repay the amounts outstanding under the former revolving credit facility.

PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

FOR THE YEAR ENDED DECEMBER 31, 2023

(In thousands, except per-share amounts, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Historical | | Transaction

Accounting

Adjustments | | | | Pro Forma

Combined |

| | NewMarket | | AMPAC | | | Note | |

| Net sales | | $ | 2,698,419 | | | $ | 123,995 | | | $ | — | | | | | $ | 2,822,414 | |

| Cost of goods sold | | 1,925,906 | | | 54,788 | | | 37,435 | | | 4A-D | | 2,018,129 | |

| Gross profit | | 772,513 | | | 69,207 | | | (37,435) | | | | | 804,285 | |

| Selling, general, and administrative expenses | | 151,470 | | | 26,806 | | | (11,791) | | | 4E-H | | 166,485 | |

| Research, development, and testing expenses | | 137,998 | | | — | | | — | | | | | 137,998 | |

| Operating profit | | 483,045 | | | 42,401 | | | (25,644) | | | | | 499,802 | |

| Interest and financing expenses, net | | 37,359 | | | 39,127 | | | 5,779 | | | 4I | | 82,265 | |

| Other income (expense), net | | 43,276 | | | 119 | | | — | | | | | 43,395 | |

| Income before income tax expense | | 488,962 | | | 3,393 | | | (31,423) | | | | | 460,932 | |

| Income tax expense | | 100,098 | | | 112 | | | (7,605) | | | 4J | | 92,605 | |

| Net income | | $ | 388,864 | | | $ | 3,281 | | | $ | (23,818) | | | | | $ | 368,327 | |

| Earnings per share - basic and diluted | | $ | 40.44 | | | | | | | | | $ | 38.30 | |

| | | | | | | | | | |

| Weighted average shares outstanding - basic and diluted | | 9,583 | | | | | | | | | 9,583 | |

| | | | | | | | | | |

PRO FORMA CONDENSED COMBINED BALANCE SHEET

AS OF DECEMBER 31, 2023

(In thousands, except share amounts, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Historical | | Transaction

Accounting

Adjustments | | | | Pro Forma

Combined |

| | NewMarket | | AMPAC | | | Note | |

| ASSETS | | | | | | | | | | |

| Current assets: | | | | | | | | | | |

| Cash and cash equivalents | | $ | 111,936 | | | $ | 7,669 | | | $ | (11,474) | | | 4K | | $ | 108,131 | |

| Trade and other accounts receivable, net | | 432,349 | | | 46,330 | | | — | | | | | 478,679 | |

| Inventories | | 456,234 | | | 12,649 | | | 11,500 | | | 4L | | 480,383 | |

| Prepaid expenses and other current assets | | 39,051 | | | 8,500 | | | (6,500) | | | 4M | | 41,051 | |

| Total current assets | | 1,039,570 | | | 75,148 | | | (6,474) | | | | | 1,108,244 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Property, plant, and equipment, net | | 654,747 | | | 63,286 | | | 17,140 | | | 4N | | 735,173 | |

| Intangibles (net of amortization) and goodwill | | 124,642 | | | 374,216 | | | 297,368 | | | 4O | | 796,226 | |

| Prepaid pension cost | | 370,882 | | | — | | | — | | | | | 370,882 | |

| Operating lease right-of-use assets, net | | 70,823 | | | — | | | — | | | | | 70,823 | |

| | | | | | | | | | |

| Deferred charges and other assets | | 48,207 | | | 5,268 | | | 1,807 | | | 4P | | 55,282 | |

| Total assets | | $ | 2,308,871 | | | $ | 517,918 | | | $ | 309,841 | | | | | $ | 3,136,630 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | |

| Accounts payable | | $ | 231,137 | | | $ | 4,469 | | | $ | — | | | | | $ | 235,606 | |

| Accrued expenses | | 76,546 | | | 12,355 | | | (6,190) | | | 4Q | | 82,711 | |

| Dividends payable | | 19,212 | | | — | | | — | | | | | 19,212 | |

| Income taxes payable | | 6,131 | | | 5,044 | | | — | | | | | 11,175 | |

| Operating lease liabilities | | 15,074 | | | — | | | — | | | | | 15,074 | |

| Current portion of long-term debt | | 0 | | | 3,300 | | | (3,300) | | | 4R | | — | |

| Other current liabilities | | 16,064 | | | 15,930 | | | (14,000) | | | 4R | | 17,994 | |

| Total current liabilities | | 364,164 | | | 41,098 | | | (23,490) | | | | | 381,772 | |

| Long-term debt | | 643,622 | | | 310,200 | | | 379,800 | | | 4R | | 1,333,622 | |

| Operating lease liabilities - noncurrent | | 55,058 | | | — | | | — | | | | | 55,058 | |

| Other noncurrent liabilities | | 168,966 | | | 52,200 | | | 67,951 | | | 4S | | 289,117 | |

| Total liabilities | | 1,231,810 | | | 403,498 | | | 424,261 | | | | | 2,059,569 | |

| Shareholders' equity: | | | | | | | | | | |

| Common stock and paid-in capital | | 2,130 | | | 148,877 | | | (148,877) | | | 4T | | 2,130 | |

| Accumulated other comprehensive (loss) income | | (21,071) | | | 19,703 | | | (19,703) | | | 4U | | (21,071) | |

| Retained earnings | | 1,096,002 | | | (54,160) | | | 54,160 | | | 4V | | 1,096,002 | |

| Total shareholders' equity | | 1,077,061 | | | 114,420 | | | (114,420) | | | | | 1,077,061 | |

| Total liabilities and shareholders' equity | | $ | 2,308,871 | | | $ | 517,918 | | | $ | 309,841 | | | | | $ | 3,136,630 | |

1. Basis of Pro Forma Presentation

NewMarket's and AMPAC's audited historical financial statements were prepared in accordance with accounting principles generally accepted in the United States of America.

The accompanying unaudited pro forma condensed combined financial information was prepared using the acquisition method of accounting in accordance with ASC 805, as well as Article 11 of Regulation S-X, as amended by SEC Final Rule Release No. 33-10786, Amendments to Financial Disclosures About Acquired and Disposed Businesses and are based on the audited historical financial statements of NewMarket and AMPAC. The unaudited pro forma information has been prepared as if the AMPAC acquisition was completed as of January 1, 2023 in the case of the condensed combined statement of income and as of December 31, 2023 in the case of the condensed combined balance sheet.

As AMPAC's fiscal year-end is September 30 and within one quarter of the Company's December 31 fiscal year-end, the pro forma condensed combined statement of income for the year ended December 31, 2023 includes the Company's consolidated statement of income for the year ended December 31, 2023 and AMPAC's consolidated statement of operations for its fiscal year ended September 30, 2023.

The unaudited pro forma condensed combined financial information has been prepared for illustrative purposes only and is not necessarily indicative of the financial condition or results of operations of future periods or the financial condition or results of operations that would have been realized had the entities been a single entity as of or for the period presented.

Assumptions underlying the pro forma adjustments are described in Note 4, which should be read in conjunction with the unaudited pro forma condensed combined financial information. The transaction accounting adjustments are based on available information and assumptions that the Company's management believes are reasonable. These transaction accounting adjustments are estimates. Actual experience may differ from the estimates.

The acquisition is subject to closing adjustments and the purchase price valuation that have not yet been finalized. Accordingly, the pro forma adjustments are preliminary and have been made solely for the purpose of providing unaudited pro forma condensed combined financial information as required by SEC rules. Differences between these preliminary estimates and the final acquisition accounting may be material.

2. Cash Consideration

The cash consideration for the acquisition amounted to $700 million.

3. Preliminary Fair Value Allocation of Assets Acquired and Liabilities Assumed

We have initiated a purchase price valuation to determine the fair values of the tangible and intangible assets acquired and liabilities assumed and the amount of goodwill to be recognized as of the acquisition date. The amounts recorded for certain assets and liabilities are preliminary and are subject to change if additional information is obtained about facts that existed as of the acquisition date. These changes may be material. The final determination of the fair values of certain assets and liabilities will be completed within the measurement period of up to one year from the acquisition date.

A preliminary allocation of the purchase price is as follows (in thousands):

| | | | | | | | |

| Cash | | $ | 7,669 | |

| Trade and other accounts receivable, net | | 46,330 | |

| Inventories | | 24,149 | |

| Prepaid expenses and other current assets | | 2,000 | |

| Property, plant, and equipment | | 80,426 | |

| Goodwill | | 254,192 | |

| Intangible assets | | 417,392 | |

| Other assets | | 5,105 | |

| Accounts payable | | (4,469) | |

| Accrued expenses | | (6,165) | |

| Other current liabilities | | (1,930) | |

| Income taxes payable | | (5,044) | |

| Other noncurrent liabilities | | (15,158) | |

| Deferred tax liabilities | | (104,993) | |

| Fair value of net assets acquired | | $ | 699,504 | |

Identified property, plant, and equipment consisted of the following:

| | | | | | | | | | | | | | |

| | Fair Value (in thousands) | | Estimated Useful Lives (in years) |

| Land | | $ | 2,980 | | | |

| Land improvements | | 3,910 | | | 10 |

| Buildings | | 9,360 | | | 21 |

| Machinery and equipment | | 61,957 | | | 2-9 |

| Construction in progress | | 2,219 | | | |

| Total identified property, plant, and equipment | | $ | 80,426 | | | |

Identified intangible assets acquired consisted of the following:

| | | | | | | | | | | | | | |

| | Fair Value (in thousands) | | Estimated Useful Lives (in years) |

| Formulas and technology | | $ | 60,000 | | | 8 |

| Trademarks | | 35,000 | | | indefinite |

| Water rights | | 29,392 | | | indefinite |

| Customer base | | 293,000 | | | 17 |

| Total identified intangible assets | | $ | 417,392 | | | |