Form 6-K/A - Report of foreign issuer [Rules 13a-16 and 15d-16]: [Amend]

25 August 2023 - 1:39PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K/A

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or

15d-16 under

the Securities Exchange Act of 1934

For the month of August 2023

Commission File No. 000-54189

MITSUBISHI UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by

check mark whether the registrant files or

will file annual reports under cover of Form 20-F

or Form 40-F.

Form

20-F X Form

40-F

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE

INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM F-3 (NO. 333-273681) OF MITSUBISHI UFJ FINANCIAL GROUP, INC. AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION TO

THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED WITH OR FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION.

EXPLANATORY NOTE

This amendment is intended solely to correct the file number of our registration statement on Form F-3 referred to in the legend on the previously furnished

cover page. There are no changes to the risk-adjusted capital ratio information as disclosed in the original report on Form 6-K, dated August 14, 2023.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: August 25, 2023

|

|

|

| Mitsubishi UFJ Financial Group, Inc. |

|

|

| By: |

|

/s/ Toshinao Endo |

| Name: |

|

Toshinao Endo |

| Title: |

|

Managing Director, Head of Documentation &

Corporate Secretary Department, Corporate Administration

Division |

Mitsubishi UFJ Financial Group, Inc.(MUFG)

Risk-Adjusted Capital Ratio Based on the Basel 3 Standards for the First Quarter Ended June 30, 2023

Tokyo, August 14, 2023 — MUFG hereby announces the risk-adjusted capital ratio based on the Basel 3

standards for the first quarter ended June 30, 2023 as stated below.

|

|

|

|

|

|

|

|

|

|

|

| Mitsubishi UFJ Financial Group, Inc. (Consolidated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(in billions of yen) |

|

| |

|

As of

June 30, 2023

(A) |

|

|

Increase

(Decrease)

(A) - (B) |

|

|

As of

March 31, 2023

(B) |

|

| (1) Total capital ratio (4) / (7) |

|

|

14.08 |

% |

|

|

0.16 |

% |

|

|

13.91 |

% |

| (2) Tier 1 capital ratio (5) / (7) |

|

|

12.36 |

% |

|

|

0.31 |

% |

|

|

12.04 |

% |

| (3) Common Equity Tier 1 capital ratio (6) / (7) |

|

|

10.88 |

% |

|

|

0.11 |

% |

|

|

10.76 |

% |

| (4) Total capital |

|

|

18,229.3 |

|

|

|

1,063.2 |

|

|

|

17,166.1 |

|

| (5) Tier 1 capital |

|

|

16,009.1 |

|

|

|

1,145.3 |

|

|

|

14,863.7 |

|

| (6) Common Equity Tier 1 capital |

|

|

14,090.3 |

|

|

|

809.4 |

|

|

|

13,280.8 |

|

| (7) Risk weighted assets |

|

|

129,448.8 |

|

|

|

6,085.4 |

|

|

|

123,363.3 |

|

| (8) Required Capital (7)×8% |

|

|

10,355.9 |

|

|

|

486.8 |

|

|

|

9,869.0 |

|

|

|

|

|

|

|

|

|

|

|

|

| MUFG Bank, Ltd. (Consolidated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(in billions of yen) |

|

| |

|

As of

June 30, 2023

(A) |

|

|

Increase

(Decrease)

(A) - (B) |

|

|

As of

March 31, 2023

(B) |

|

| (1) Total capital ratio (4) / (7) |

|

|

12.74 |

% |

|

|

0.15 |

% |

|

|

12.58 |

% |

| (2) Tier 1 capital ratio (5) / (7) |

|

|

11.32 |

% |

|

|

0.28 |

% |

|

|

11.04 |

% |

| (3) Common Equity Tier 1 capital ratio (6) / (7) |

|

|

9.97 |

% |

|

|

0.07 |

% |

|

|

9.89 |

% |

| (4) Total capital |

|

|

15,025.3 |

|

|

|

817.5 |

|

|

|

14,207.8 |

|

| (5) Tier 1 capital |

|

|

13,362.0 |

|

|

|

892.8 |

|

|

|

12,469.2 |

|

| (6) Common Equity Tier 1 capital |

|

|

11,766.1 |

|

|

|

593.9 |

|

|

|

11,172.1 |

|

| (7) Risk weighted assets |

|

|

117,938.0 |

|

|

|

5,067.5 |

|

|

|

112,870.4 |

|

| (8) Required Capital (7)×8% |

|

|

9,435.0 |

|

|

|

405.4 |

|

|

|

9,029.6 |

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mitsubishi UFJ Trust and Banking Corporation (Consolidated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(in billions of yen) |

|

| |

|

As of

June 30, 2023

(A) |

|

|

Increase

(Decrease)

(A) - (B) |

|

|

As of

March 31, 2023

(B) |

|

| (1) Total capital ratio (4) / (7) |

|

|

19.56 |

% |

|

|

(1.11 |

%) |

|

|

20.67 |

% |

| (2) Tier 1 capital ratio (5) / (7) |

|

|

17.06 |

% |

|

|

(0.86 |

%) |

|

|

17.93 |

% |

| (3) Common Equity Tier 1 capital ratio (6) / (7) |

|

|

15.37 |

% |

|

|

(1.04 |

%) |

|

|

16.41 |

% |

| (4) Total capital |

|

|

2,110.3 |

|

|

|

68.8 |

|

|

|

2,041.5 |

|

| (5) Tier 1 capital |

|

|

1,841.2 |

|

|

|

70.3 |

|

|

|

1,770.9 |

|

| (6) Common Equity Tier 1 capital |

|

|

1,658.2 |

|

|

|

37.3 |

|

|

|

1,620.8 |

|

| (7) Risk weighted assets |

|

|

10,788.1 |

|

|

|

912.8 |

|

|

|

9,875.3 |

|

| (8) Required Capital (7)×8% |

|

|

863.0 |

|

|

|

73.0 |

|

|

|

790.0 |

|

|

|

|

|

|

|

|

|

|

|

|

| MUFG Bank, Ltd. (Non-Consolidated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(in billions of yen) |

|

| |

|

As of

June 30, 2023

(A) |

|

|

Increase

(Decrease)

(A) - (B) |

|

|

As of

March 31, 2023

(B) |

|

| (1) Total capital ratio (4) / (7) |

|

|

10.86 |

% |

|

|

0.14 |

% |

|

|

10.71 |

% |

| (2) Tier 1 capital ratio (5) / (7) |

|

|

9.59 |

% |

|

|

0.29 |

% |

|

|

9.30 |

% |

| (3) Common Equity Tier 1 capital ratio (6) / (7) |

|

|

8.17 |

% |

|

|

0.06 |

% |

|

|

8.11 |

% |

| (4) Total capital |

|

|

11,817.9 |

|

|

|

702.6 |

|

|

|

11,115.3 |

|

| (5) Tier 1 capital |

|

|

10,431.8 |

|

|

|

787.6 |

|

|

|

9,644.1 |

|

| (6) Common Equity Tier 1 capital |

|

|

8,887.6 |

|

|

|

477.4 |

|

|

|

8,410.2 |

|

| (7) Risk weighted assets |

|

|

108,751.4 |

|

|

|

5,063.7 |

|

|

|

103,687.7 |

|

| (8) Required Capital (7)×8% |

|

|

8,700.1 |

|

|

|

405.0 |

|

|

|

8,295.0 |

|

|

|

|

|

|

|

|

|

|

|

|

| Mitsubishi UFJ Trust and Banking Corporation

(Non-Consolidated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(in billions of yen) |

|

| |

|

As of

June 30, 2023

(A) |

|

|

Increase

(Decrease)

(A) - (B) |

|

|

As of

March 31, 2023

(B) |

|

| (1) Total capital ratio (4) / (7) |

|

|

18.49 |

% |

|

|

(1.10 |

%) |

|

|

19.60 |

% |

| (2) Tier 1 capital ratio (5) / (7) |

|

|

16.23 |

% |

|

|

(0.88 |

%) |

|

|

17.11 |

% |

| (3) Common Equity Tier 1 capital ratio (6) / (7) |

|

|

14.68 |

% |

|

|

(1.05 |

%) |

|

|

15.74 |

% |

| (4) Total capital |

|

|

2,189.8 |

|

|

|

58.8 |

|

|

|

2,131.0 |

|

| (5) Tier 1 capital |

|

|

1,921.5 |

|

|

|

60.4 |

|

|

|

1,861.1 |

|

| (6) Common Equity Tier 1 capital |

|

|

1,739.0 |

|

|

|

27.4 |

|

|

|

1,711.6 |

|

| (7) Risk weighted assets |

|

|

11,838.7 |

|

|

|

967.5 |

|

|

|

10,871.2 |

|

| (8) Required Capital (7)×8% |

|

|

947.1 |

|

|

|

77.4 |

|

|

|

869.6 |

|

2

Notes:

Risk-adjusted capital ratio of Mitsubishi UFJ Financial Group, Inc. is computed in accordance with the Notification of the

Financial Services Agency No.20, 2006.

Risk-adjusted capital ratio of MUFG Bank, Ltd. and Mitsubishi UFJ Trust and

Banking Corporation are computed in accordance with the Notification of the Financial Services Agency No.19, 2006.

-End-

About MUFG

Mitsubishi UFJ Financial Group, Inc. (MUFG)

is one of the world’s leading financial groups. Headquartered in Tokyo and with over 360 years of history, MUFG has a global network with approximately 2,000 locations in more than 50 countries. The Group has about 160,000 employees and offers

services including commercial banking, trust banking, securities, credit cards, consumer finance, asset management, and leasing. The Group aims to “be the world’s most trusted financial group” through close collaboration among our

operating companies and flexibly respond to all of the financial needs of our customers, serving society, and fostering shared and sustainable growth for a better world. MUFG’s shares trade on the Tokyo, Nagoya, and New York stock exchanges.

For more information, visit https://www.mufg.jp/english.

Press contact:

Taichi Nakanoshoya

Public Relations Division

Tokyo/Head Office

Mitsubishi UFJ Financial Group, Inc.

T +81-3-5218-1815

E taichi_nakanoshoya@mufg.jp

3

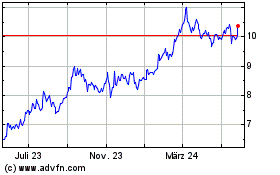

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

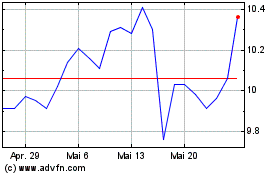

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024