UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 31)*

M.D.C.

HOLDINGS, INC. |

| (Name of Issuer) |

| |

Common

Stock, $0.01 Per Share |

| (Title of Class of Securities) |

| |

552676

108 |

| (CUSIP Number) |

| |

David D. Mandarich, 4350 S. Monaco St., Suite 500, Denver, CO 80237

(303) 773-1100 |

| (Name, Address and Telephone

Number of Person Authorized to Receive Notices and Communications) |

| |

January

17, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 552676 108 |

SCHEDULE 13D |

Page

2 of 5 |

| 1 |

NAME OF REPORTING PERSON

David D. Mandarich |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

6,029,022 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

6,029,022 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,029,022 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.0% (1) |

|

| 14 |

TYPE OF REPORTING PERSON

IN |

|

| (1) | Based on 75,593,479 shares of common stock, which consists of (a) 74,661,479 shares of common stock outstanding as of October 23, 2023, as reported in M.D.C. Holdings, Inc.'s Quarterly Report on Form 10-Q and filed with the Securities and Exchange Commission on October 26, 2023, plus (b) 932,000 shares issuable upon the exercise of stock options granted to Mr. Mandarich, which are exercisable within 60 days of this statement. |

| CUSIP No. 552676 108 |

SCHEDULE 13D |

Page

3 of 5 |

This Amendment No. 31 supplements and amends the Schedule 13D relating

to shares of common stock, par value $0.01 per share (the “Common Stock”), of M.D.C. Holdings, Inc. (the “Company”)

owned by David D. Mandarich (the “Reporting Person”). Only those items that are reported are hereby amended; all other items

reported in the previous amendments remain unchanged. Information given in response to each item shall be deemed incorporated by reference

in all other items as applicable.

Item 4. Purpose of Transaction

On January 17, the Company entered into an Agreement

and Plan of Merger (the “Merger Agreement”) with SH Residential Holdings, LLC, a Delaware limited liability company (“Parent”),

Clear Line, Inc., a Delaware corporation and wholly-owned subsidiary of Parent (“Merger Sub”), and, solely for the purposes

of Section 6.2, Section 6.17 and Section 9.15 of the Merger Agreement, Sekisui House, Ltd., a Japanese kabushiki kaisha, providing

for the merger of Merger Sub with and into the Company, with the Company surviving as a wholly-owned subsidiary of Parent (the “Merger”),

as described in further detail in the Company’s filings on Form 8-K filed with the SEC on January 18, 2024 and January 19, 2024.

In connection with the Company’s execution of the Merger Agreement,

on January 17, 2024, the Reporting Person, Mr. Larry Mizel, and certain of Mr. Larry Mizel’s affiliates and estate planning vehicles (the “Specified Company Stockholders”)

entered into a Voting Agreement (the “Voting Agreement”) with Parent, pursuant to which the Specified Company Stockholders

have agreed, among other things, to vote their shares in favor of the adoption of the Merger Agreement and the approval of the Merger

and any other matters that would reasonably be expected to facilitate the Merger and against, among other things, any other action, proposal

or transaction that is intended, or would reasonably be expected, to impede, interfere with, delay, postpone, discourage or prevent the

consummation of, or otherwise adversely affect, the Merger or any of the other transactions contemplated by the Merger Agreement or Voting

Agreement. The Voting Agreement also contains certain other restrictions on transfer of shares of Common Stock by such Specified Company

Stockholders. The Voting Agreement will automatically terminate upon certain events, including the termination of the Merger Agreement.

The foregoing description of the Voting Agreement is qualified in its entirety by reference to the full text of such agreement. A copy

of the Voting Agreement is filed as Exhibit 1 to this Amendment No. 31, and the information set forth in the Voting Agreement is incorporated

by reference herein.

Item 5. Interest in Securities

of the Issuer

| (a) | Mr. Mandarich beneficially owns an aggregate of 6,029,022 shares of Common Stock, representing approximately 8.0% of the outstanding

Common Stock of the Company. The ownership percentage set forth above is based on 75,593,479 shares of Common Stock, which consists of

(a) 74,661,479 shares of Common Stock outstanding as of October 23, 2023, as reported in the Company’s Quarterly Report on Form

10-Q and filed with the Securities and Exchange Commission on October 26, 2023, plus (b) 932,000 shares issuable upon the exercise of

stock options granted to Mr. Mandarich, which are exercisable within 60 days of this statement. |

| (b) | Mr. Mandarich has the: |

| (i) | Sole power to vote or direct the vote of 6,029,022 shares. This consists of 5,097,022 shares that he directly owns (including unvested

restricted stock granted under the Company’s equity incentive plans) and 932,000 shares issuable upon the exercise of stock options

granted under the Company's equity incentive plans. |

| (ii) | Shared power to vote or direct the vote of 0 shares. |

| CUSIP No. 552676 108 |

SCHEDULE 13D |

Page

4 of 5 |

| (iii) | Sole power to dispose or direct the disposition of 6,029,022 shares. This consists of the shares described in response to Item 5(b)(i)

above. |

| (iv) | Shared power to dispose or direct the disposition of 0 shares. |

Item 6. Contracts, Arrangements, Understandings

or Relationships with respect to Securities of the Issuer

The information set forth in Item 4 hereof is hereby incorporated by reference

into this Item 6, as applicable.

Item 7. Material to be filed as Exhibits

| CUSIP No. 552676 108 |

SCHEDULE 13D |

Page

5 of 5 |

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: January

18, 2024

| |

Signature: |

/s/ David D. Mandarich |

|

| |

Name: |

David D. Mandarich |

|

EXHIBIT

1

VOTING and support AGREEMENT

This

Voting and Support Agreement (this “Agreement”) is made and entered into as of January 17, 2024, by and

among SH Residential Holdings, LLC, a Delaware limited liability company (“Parent”), and each of the Persons set forth

on Schedule A hereto (each, a “Stockholder”, and collectively the “Stockholders”). Parent

and the Stockholders are each sometimes referred to herein as a “Party” and collectively as the “Parties”.

RECITALS

WHEREAS, concurrently with

the execution hereof, Parent, Clear Line, Inc., a Delaware corporation and a wholly owned Subsidiary of Parent (“Merger Sub”),

and M.D.C. Holdings, Inc., a Delaware corporation (the “Company”), are entering into an Agreement and Plan of Merger

(as the same may be amended from time to time, the “Merger Agreement”), pursuant to which Merger Sub will be merged

with and into the Company (the “Merger”), with the Company being the surviving corporation;

WHEREAS, as of the date

hereof, each Stockholder is the record or beneficial owner (as defined in Rule 13d-3 under the Exchange Act) of the number of shares of

common stock, par value $0.01 per share, of the Company (“Company Common Stock”), set forth opposite such Stockholder’s

name on Schedule A (all such shares of Company Common Stock, together with any shares of Company Common Stock or other voting equity

securities of the Company that are hereafter issued to or otherwise directly or indirectly acquired or beneficially owned (including in

connection with an Adjustment) by such Stockholder prior to the Expiration Time (the “After-Acquired Shares”), being

referred to herein as such Stockholder’s “Covered Shares”); and

WHEREAS, as a condition

to the willingness of Parent and Merger Sub to enter into the Merger Agreement, and as a material inducement and in consideration therefor,

each Stockholder has entered into this Agreement.

NOW, THEREFORE, in consideration

of the foregoing and the representations, warranties, covenants and agreements set forth herein, and other good and valuable consideration,

the receipt and sufficiency of which are acknowledged, the Parties, intending to be legally bound, agree as follows:

1.

Definitions. Capitalized terms used but not otherwise defined herein shall have the respective meanings ascribed

to such terms in the Merger Agreement. As used in this Agreement, the following terms have the meanings set forth below:

“Adjustment”

means any stock split, reverse stock split, stock dividend (including any dividend or distribution of equity interests convertible into

or exchangeable for shares of Company Common Stock), recapitalization, reclassification, combination, exchange of shares or other similar

event with respect to the capital stock of the Company.

“Adverse Proposal”

means: (i) any Acquisition Proposal; (ii) any change in the present capitalization of the Company or any amendment or other

change to the Company Governing Documents; (iii) any action, proposal or transaction that would reasonably be expected to result

in a breach of any covenant, agreement, representation or warranty or any other obligation of the

Company set forth in the Merger Agreement or

of any Stockholder contained in this Agreement; or (iv) any other action, proposal or transaction that is intended, or would reasonably

be expected, to impede, interfere with, delay, postpone, discourage or prevent the consummation of, or otherwise adversely affect, the

Merger, the other Transactions and the transactions contemplated by this Agreement.

“Controlled Affiliate”

means, with respect to any Person, any other Person that, directly or indirectly, through one or more intermediaries, controls such Person.

As used in this definition, the term “control” means the possession, directly or indirectly, of the power to direct or cause

the direction of the management and policies of an entity, whether through ownership of voting securities, voting equity, limited liability

company interests, general partner interests, or other voting interests, by contract or otherwise. Ownership of more than fifty percent

(50%) of the beneficial interests of an entity shall be conclusive evidence that control exists.

“Transfer”

means any direct or indirect (i) sale, tender, exchange, assignment, encumbrance, gift, hedge, pledge, hypothecation, disposition or other

transfer (by operation of Law or otherwise), voluntarily or involuntarily, or entry into any contract, option or other arrangement or

understanding with respect to any sale, tender, exchange, assignment, encumbrance, gift, hedge, pledge, hypothecation, disposition or

other transfer (by operation of Law or otherwise), of any Covered Shares (excluding, for the avoidance of doubt, any sale, tender, exchange,

assignment, encumbrance, gift, hedge, pledge, hypothecation, disposition or other transfer pursuant to this Agreement or the Merger Agreement)

or any right, title or interest therein; (ii) (x) deposit of any Covered Shares into a voting trust, (y) entry into a voting agreement

with respect to any Covered Shares (other than this Agreement) or (z) grant of any irrevocable or revocable proxy, corporate representative

appointment or power of attorney (or other consent or authorization) with respect to any Covered Shares; or (iii) agreement, arrangement,

understanding or commitment (whether or not in writing) to take any of the actions referred to in the foregoing sub-paragraphs (i) or

(ii); provided, however, that Transfer shall not include: (1) with respect to any Company Options held by a Stockholder

that expire on or prior to the termination of this Agreement, any transfer, sale or other disposition of any Covered Shares to the Company

as payment for the (A) exercise price of such Company Options and (B) taxes applicable to the exercise of such Company Options, (2) with

respect to any Company PSUs granted to a Stockholder, (A) any transfer for the net settlement of such Company PSUs settled in Covered

Shares (to pay any tax withholding obligations) or (B) any transfer for receipt upon settlement of such Company PSUs, and the sale of

a sufficient number of Covered Shares acquired upon settlement of such securities as would generate sales proceeds sufficient to pay the

aggregate taxes payable by the Stockholder as a result of such settlement, or (3) with respect to any Company RSUs granted to a Stockholder,

(A) any transfer for the net settlement of such Company RSUs settled in Covered Shares (to pay any tax withholding obligations) or (B)

any transfer for receipt upon settlement of such Company RSUs, and the sale of a sufficient number of Covered Shares acquired upon settlement

of such securities as would generate sales proceeds sufficient to pay the aggregate taxes payable by the Stockholder as a result of such

settlement.

2.

No Transfer; No Inconsistent Arrangements.

2.1

Each Stockholder agrees not to Transfer any of such Stockholder’s Covered Shares; provided, however, (i) that

such Stockholder may, (a) if such Stockholder is an individual, Transfer

any Covered Shares to any members of such Stockholder’s

immediate family, or to a trust solely for the benefit of such Stockholder or any member of such Stockholder’s immediate family,

(b) if such Stockholder is an individual, Transfer any Covered Shares by will, pursuant to the terms of any revocable trust that becomes

an irrevocable trust or under the laws of intestacy upon the death of such Stockholder, (c) if such Stockholder is Larry A. Mizel, Ari

Capital Partners, LLLP, CGM Capital LLLP and Boca Sawyer 22, LLC, collectively Transfer up to one million five hundred thousand (1,500,000)

of their Covered Shares, in the aggregate, to one or more charities, and (d) if such Stockholder is David D. Mandarich, Transfer up to

twenty percent (20%) of his Covered Shares as of the date hereof to the Mandarich Family Foundation, but in the case of the foregoing

clauses (a) and (b), only if all of the representations and warranties of such Stockholder would be true and correct upon such Transfer

(other than those set forth in Section 5.2 of this Agreement) and the transferees agree in writing, in a form reasonably satisfactory

to Parent, to be bound by the obligations set forth herein with respect to such Covered Shares as if they were a Stockholder hereunder,

with Parent named as an express third-party beneficiary of such agreements (any such Transfer, a “Permitted Transfer”);

and (ii) if any involuntary Transfer of any of such Stockholder’s Covered Shares shall occur (including a sale by such Stockholder’s

trustee in any bankruptcy, or a sale to a purchaser at any creditor’s or court sale), the transferee (which term, as used herein,

shall include any and all transferees and subsequent transferees of the initial transferee) shall, subject to applicable Law, take and

hold such Covered Shares subject to all of the restrictions, obligations, liabilities and rights under this Agreement, which shall continue

in full force and effect until the Expiration Time. Any action taken in violation of the immediately preceding sentence shall, to the

fullest extent permitted by Law, be null and void ab initio. To the extent any Covered Shares are transferred to any family

foundations of Larry A. Mizel or David D. Mandarich in compliance with this Section 2.1, nothing contained herein will be deemed

to require Larry A. Mizel, any individual executing this Agreement on behalf of an entity holding Covered Shares or David D. Mandarich,

in their capacities as directors or officers of such family foundations, to cause such family foundations to take or not take any actions

with respect to such Transferred Covered Shares.

2.2

Each Stockholder hereby authorizes and instructs the Company to cause the Company’s transfer agent or other registrar to

enter stop transfer instructions and implement stop transfer procedures with respect to all of the Covered Shares or other capital stock

or any securities convertible into or exercisable or exchangeable for Covered Shares or other capital stock of the Company owned or held

(of record or beneficially) by such Stockholder during the term of this Agreement. In the event that a Stockholder intends to undertake

a Permitted Transfer during the term of this Agreement of any of the Covered Shares, such Stockholder shall provide prior notice thereof

to the Company and Parent and shall authorize the Company to, or authorize the Company to instruct its transfer agent to, (i) lift any

stop transfer order in respect of the Covered Shares to be so Transferred in order to effect such Permitted Transfer only upon receipt

of certification by Parent and the Company that the written agreement to be entered into by the transferee agreeing to be bound by this

Agreement pursuant to Section 2.1 hereof (if required pursuant to such Section 2.1) is satisfactory to Parent and (ii) re-enter

any stop transfer order in respect of the Covered Shares to be so Transferred upon completion of the Permitted Transfer, except as to

any Covered Shares that are Transferred pursuant to Section 2.1(i)(c) for which no stop transfer order shall be re-entered.

2.3

Each Stockholder shall not, directly or indirectly, take any action that would make any representation or warranty of such Stockholder

contained herein untrue or incorrect or have the effect of preventing, impairing or materially delaying such Stockholder from performing

any of its obligations under this Agreement or that would, or would reasonably be expected to, have the effect of preventing, impairing

or materially delaying, the consummation of the Merger or the other Transactions or the performance by the Company of its obligations

under the Merger Agreement.

3.

Agreement to Vote. Each Stockholder irrevocably and unconditionally agrees that, at every meeting of the Company

Stockholders, however called, including any adjournment or postponement thereof, and in connection with any action proposed to be taken

by written consent of the Company Stockholders, such Stockholder shall, in each case, to the fullest extent that such Stockholder’s

Covered Shares are entitled to vote thereon: (a) appear at each such meeting or otherwise cause all such Covered Shares to be counted

as present thereat for the purpose of determining a quorum; and (b) be present (in person or by proxy) and vote (or cause to be voted),

or deliver (or cause to be delivered) a written consent with respect to, all such Covered Shares (i) in favor of (A) the adoption of the

Merger Agreement and approval of the Merger and the other Transactions and (B) any other matter that would reasonably be expected to facilitate

the Merger, including any proposal to adjourn or postpone any meeting of the Company Stockholders to a later date; and (ii) against any

Adverse Proposal. Each Stockholder shall retain at all times the right to vote such Stockholder’s Covered Shares in such Stockholder’s

sole discretion, and without any other limitation, on any matters other than those expressly set forth in this Section 3 that are

at any time or from time to time presented for consideration to the Company Stockholders generally. For the avoidance of doubt, the foregoing

commitments in this Section 3 apply to any Covered Shares held by any trust, limited partnership or other entity directly or indirectly

holding Covered Shares over which the applicable Stockholder exercises direct or indirect voting control (if any).

4.

Additional Covenants.

4.1

No Solicitation. Each Stockholder shall not, shall cause such Stockholder’s Controlled Affiliates not to, and shall

use reasonable best efforts to cause the Representatives of such Stockholder and such Stockholder’s Controlled Affiliates not to,

directly or indirectly: (i) solicit, initiate, or knowingly encourage or facilitate the submission or announcement of any Acquisition

Proposal; (ii) furnish any non-public information regarding the Company to any third party in connection with an Acquisition Proposal;

(iii) engage in or otherwise facilitate discussions or negotiations with any third party with respect to any Acquisition Proposal; (iv)

adopt, approve, endorse or recommend or publicly propose to adopt, approve endorse or recommend, any Acquisition Proposal or enter into

any letter of intent, support agreement or similar document, agreement, commitment or agreement in principle relating to or facilitating

an Acquisition Proposal; (v) become a member of a “group” (as defined in Section 13(d)(3) under the Exchange Act) with respect

to any voting securities of the Company for the purpose of opposing, discouraging or competing with or taking any actions inconsistent

with the transactions contemplated by this Agreement or the Merger Agreement or (vi) agree to do any of the foregoing. Each Stockholder

shall, and shall cause such Stockholder’s Controlled Affiliates and shall use reasonable best efforts to cause the Representatives

of such Stockholder and such Stockholder’s Controlled Affiliates to, immediately cease and cause to be terminated any existing solicitations

of, or discussions or negotiations with, any third party relating to any Acquisition Proposal.

Notwithstanding anything to the contrary set

forth in this Agreement, if and only if (i) the Company, to the extent permitted by Section 5.2 of the Merger Agreement, is participating

in discussions or negotiations with a Person who has submitted an Acquisition Proposal (such Person, an “Engaged Bidder”),

(ii) such Stockholder’s negotiations and discussions with such Engaged Bidder are in conjunction with the Company’s discussions

and negotiations with such Engaged Bidder and (iii) such Stockholder does not take any action that the Company would be prohibited from

taking pursuant to Section 5.2 of the Merger Agreement, each Stockholder may (x) participate in discussions and negotiations with such

Engaged Bidder and (y) privately (except as required by applicable Law) discuss and privately (except as required by applicable Law) confirm

to the Company and such Engaged Bidder the willingness of such Stockholder and such Stockholder’s Controlled Affiliates to sign

a voting agreement in connection with such Acquisition Proposal in the event of any termination of the Merger Agreement pursuant to Section

8.1(f) of the Merger Agreement. For purposes of this Section 4.1, “Acquisition Proposal” shall have the meaning ascribed

to such term in the Merger Agreement but shall also include any Transfer of any of such Stockholder’s Covered Shares other than

a Permitted Transfer.

4.2

Appraisal Rights. Each Stockholder irrevocably waives and agrees not to exercise any rights of appraisal or rights to dissent

from the Merger or the adoption of the Merger Agreement that such Stockholder may have under Section 262 of the DGCL and shall not permit

any such rights of appraisal or rights of dissent to be exercised with respect to any of such Stockholder’s Covered Shares.

4.3

Waiver of Certain Actions. Each Stockholder agrees not to commence or participate in, and to take all actions necessary

to opt out of any class in any class action with respect to, any claim, derivative or otherwise, against Parent, Merger Sub, the Company,

any of their respective affiliates or successors or any of their respective directors, managers or officers (a) challenging the validity

of, or seeking to enjoin or delay the operation of, any provision of this Agreement or the Merger Agreement (including any claim seeking

to enjoin or delay the consummation of the Merger) or (b) alleging a breach of any duty of the Company Board of Directors in connection

with the Merger Agreement, this Agreement, the Transactions or the transactions contemplated hereby.

4.4

Notice of Certain Events. Each Stockholder agrees to notify Parent of any development occurring after the date hereof that

causes, or that would reasonably be expected to cause, any material breach of any of the representations and warranties of such Stockholder

set forth in Section 5. Promptly upon the acquisition of any After-Acquired Shares, such Stockholder shall notify Parent of the

number of After-Acquired Shares so acquired; it being understood that any such shares shall be subject to the terms of this Agreement

as though owned by such Stockholder on the date hereof and the representation and warranties in Section 5 below shall be true and

correct as of the date that such After-Acquired Shares are acquired.

4.5

Documentation and Information. Each Stockholder shall not, and shall cause such Stockholder’s Controlled Affiliates

and shall use reasonable best efforts to cause the Representatives of such Stockholder and such Stockholder’s Controlled Affiliates

not to, make any public announcement or other communication to a third party regarding this Agreement, the Merger Agreement, the Transactions

or the transactions contemplated hereby without the prior written consent of Parent (such consent not to be unreasonably withheld, conditioned

or delayed)

except (i) as may be required by applicable

Law or by any listing agreement with or the listing rules of a national securities

exchange or trading market (provided that, to the extent legally permitted and reasonably practicable, such Stockholder shall provide

reasonable notice to Parent of any such disclosure and consider in good faith the reasonable comments of Parent with respect to such disclosure

and, if so requested by Parent, use reasonable commercial efforts to cooperate with Parent in obtaining confidential treatment with respect

to such disclosure), (ii) solely to the extent that such public announcement or other communication relates to any Proceedings between

the Parties, or between the Company, on the one hand, and Parent, Merger Sub or Guarantor, on the other hand, in each case, relating to

this Agreement or the Merger Agreement, or (iii) solely to the extent that such public announcement or other communication is consistent

with press releases, public disclosures or public statements made by Parent or the Company in compliance with the Merger Agreement and

does not include any material information not previously set forth in such press releases, public disclosures or public statements. Each

Stockholder consents to and authorizes the Company, Parent and Merger Sub to publish and disclose in all documents and schedules filed

with the SEC or any other Governmental Entity or applicable securities exchange, and any press release or other disclosure document that

the Company, Parent or Merger Sub reasonably determines to be necessary or advisable in connection with the Merger, the other Transactions

or any other transactions contemplated by this Agreement, such Stockholder’s identity and ownership of such Stockholder’s

Covered Shares, the existence of this Agreement and the nature of such Stockholder’s commitments and obligations under this Agreement,

and such Stockholder acknowledges that the Company, Parent and Merger Sub may file this Agreement or a form hereof with the SEC or any

other Governmental Entity or securities exchange. Each Stockholder agrees to promptly give Parent any information that is in such Stockholder’s

possession that Parent may reasonably request for the preparation of any such disclosure documents, and such Stockholder agrees to promptly

notify Parent of any required corrections with respect to any written information supplied by such Stockholder specifically for use in

any such disclosure document, if and to the extent that such Stockholder shall become aware that any such information shall have become

false or misleading in any material respect. Notwithstanding the foregoing, however, no Stockholder that is an entity shall have any obligation

to provide Parent with any non-public documentation pertaining to its ownership, governance, operations or business affairs, specifically

including any limited liability company agreement, partnership agreement, trust agreement or similar agreement that may govern such Stockholder

or any direct or indirect entity owners of such Stockholder.

5.

Representations and Warranties of Each Stockholder. Each Stockholder represents and warrants to Parent, as to such

Stockholder with respect to such Stockholder’s Covered Shares, on a several basis, that:

5.1

Due Organization; Authority.

(a)

If such Stockholder is not an individual, (i) such Stockholder is duly organized, validly existing and in good standing under the

Law of its jurisdiction of incorporation or organization, as applicable, (ii) such Stockholder has the requisite power and authority to

enter into and to perform its obligations under this Agreement, (iii) the execution and delivery of this Agreement by such Stockholder

and the performance of its obligations hereunder and the consummation of the transactions contemplated hereby have been duly authorized

by all necessary action on the part of such Stockholder, and (iv) no other proceedings on the part of such

Stockholder are necessary to authorize the

execution, delivery and performance of this Agreement by such Stockholder or to consummate the transactions contemplated hereby. If such

Stockholder is an individual, such Stockholder has the requisite legal capacity, right and authority to execute, deliver and perform such

Stockholder’s obligations under this Agreement and to consummate the transactions contemplated hereby.

(b)

This Agreement has been duly and validly executed and delivered by such Stockholder and, assuming the due authorization, execution

and delivery by Parent, constitutes a legal, valid and binding obligation of such Stockholder, enforceable against such Stockholder in

accordance with its terms, except as limited by Laws affecting the enforcement of creditors’ rights generally, by general equitable

principles or by the discretion of any Governmental Entity before which any Proceeding seeking enforcement may be brought.

(c)

If such Stockholder is married, and any of such Stockholder’s Covered Shares constitute community property or otherwise need

spousal or other approval for this Agreement to be legal, valid and binding, this Agreement has been duly and validly executed and delivered

by such Stockholder’s spouse and, assuming the due authorization, execution and delivery hereof by Parent, constitutes a legal,

valid and binding obligation of such Stockholder’s spouse, enforceable against such Stockholder’s spouse in accordance with

its terms, except as limited by Laws affecting the enforcement of creditors’ rights generally, by general equitable principles or

by the discretion of any Governmental Entity before which any Proceeding seeking enforcement may be brought.

5.2

Ownership of the Covered Shares; Voting Power. Such Stockholder is the record or beneficial owner (as defined in Rule 13d-3

under the Exchange Act) of all of such Stockholder’s Covered Shares as set forth on Schedule A. Such Stockholder has good

and marketable title to all of such Stockholder’s Covered Shares free and clear of any Liens in respect of such Covered Shares other

than those created by this Agreement or those imposed by applicable securities Law (collectively, “Permitted Liens”).

The Covered Shares listed on Schedule A opposite such Stockholder’s name constitute all of the shares of capital stock of

the Company or any other securities of the Company owned of record or beneficially by such Stockholder as of the date hereof. As of the

date hereof, such Stockholder has not entered into any agreement to Transfer any such Covered Shares. Such Stockholder has full voting

power, full power of disposition (except with respect to any shares set forth on Schedule A that constitute Company RSAs, which

are subject to a risk of forfeiture), full power to issue instructions with respect to the matters set forth herein and full power to

agree to all of the matters set forth in this Agreement, in each case with respect to all of such Stockholder’s Covered Shares.

None of such Stockholder’s Covered Shares are subject to any stockholders’ agreement, proxy, voting trust or other agreement,

arrangement or Lien with respect to the voting of such Covered Shares, except as expressly provided herein (including Permitted Liens).

5.3

Non-Contravention; Consents. Neither the execution and delivery of this Agreement by such Stockholder (or if applicable,

such Stockholder’s spouse) nor the consummation of the transactions contemplated hereby nor compliance by such Stockholder (or if

applicable, such Stockholder’s spouse) with any provisions herein will (a) if such Stockholder is not an individual, violate, contravene

or conflict with or result in any breach of any provision of the certificate of incorporation or bylaws or equivalent organizational documents

of such

Stockholder, (b) require any consent, approval,

authorization or permit of, or filing with or notification to, any Governmental Entity on the part of such Stockholder (or if applicable,

such Stockholder’s spouse), except for compliance with the applicable requirements of the Securities Act, the Exchange Act or any

other securities laws and the rules and regulations promulgated thereunder, (c) violate, conflict with, or result in a breach of or default

under any provisions of, or require any consent, waiver or approval under any of the terms, conditions or provisions of, any Contract

to which such Stockholder (or if applicable, such Stockholder’s spouse) is a party or by which such Stockholder (or if applicable,

such Stockholder’s spouse) or any of such Stockholder’s Covered Shares may be bound, (d) result in the creation or imposition

of any Lien (other than Permitted Liens or any Lien created by Parent or Merger Sub) on any of such Stockholder’s Covered Shares

or (e) violate any Law applicable to such Stockholder (or if applicable, such Stockholder’s spouse) or by which any of such Stockholder’s

Covered Shares are bound, except, in the case of each of clauses (c), (d) and (e), as would not, individually or in the aggregate, reasonably

be expected to prevent, impair or delay the consummation by such Stockholder of the transactions contemplated by this Agreement or otherwise

prevent, impair or delay such Stockholder’s ability to perform such Stockholder’s obligations hereunder.

5.4

No Legal Proceedings. There are no Proceedings pending against or, to the knowledge of such Stockholder, threatened against

or affecting such Stockholder or any of such Stockholder’s properties or assets (including any of such Stockholder’s Covered

Shares) that would, individually or in the aggregate, reasonably be expected to prevent, impair or delay the consummation by such Stockholder

of the transactions contemplated by this Agreement or otherwise prevent, impair or delay such Stockholder’s ability to perform its

obligations hereunder.

5.5

Opportunity to Review; Reliance. Such Stockholder has had the opportunity to review the Merger Agreement and this Agreement

with counsel of such Stockholder’s own choosing. Such Stockholder understands and acknowledges that Parent, Merger Sub and the Company

are entering into the Merger Agreement in reliance upon such Stockholder’s execution, delivery and performance of this Agreement.

6.

Termination. Unless earlier terminated by the written consent of Parent (in its sole and absolute discretion), this

Agreement shall terminate automatically and shall have no further force or effect as of the earliest to occur of the following (the “Expiration

Time”): (a) the Effective Time; (b) the date and time that the Merger Agreement is validly terminated in accordance with the

terms and provisions thereof; and (c) upon the entry by the Company without the prior written consent of such Stockholder into any amendment,

waiver or modification to the Merger Agreement that results in (i) a change to the form of consideration to be paid thereunder or (ii)

a decrease in the Merger Consideration. Upon termination of this Agreement, no Party shall have any further obligations or liabilities

under this Agreement; provided, however, that (x) nothing set forth in this Section 6 shall relieve any Party

from liability for fraud or any intentional breach of this Agreement prior to termination hereof and (y) the provisions of Section

7 shall survive any termination of this Agreement.

7.

Miscellaneous.

7.1

Severability. If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by rule

of Law or public policy, all other conditions and provisions of

this Agreement shall nevertheless remain in

full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner

adverse to any Party. Upon such determination that any term or other provision is invalid, illegal or incapable of being enforced, the

Parties shall negotiate in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible

in an acceptable manner to the end that the transactions contemplated hereby are fulfilled to the extent possible.

7.2

Assignment. This Agreement shall not be assigned by any of the Parties (whether by operation of Law or otherwise) without

the prior written consent of the other Parties. Subject to the preceding sentence, but without relieving any Party of any obligation hereunder,

this Agreement will be binding upon, inure to the benefit of and be enforceable by the Parties and their respective successors and assigns.

7.3

Amendment and Modification; Waiver. Any provision of this Agreement may be amended, modified, supplemented or waived if,

but only if, such amendment, modification, supplement or waiver is in writing and is signed, in the case of an amendment, modification

or supplement by each Party or, in the case of a waiver, by each Party against whom the waiver is to be effective. No failure or delay

by any Party to assert any of its rights under this Agreement or otherwise shall constitute a waiver of such rights.

7.4

Enforcement Remedies.

(a)

Except as otherwise expressly provided herein, any remedies herein expressly conferred upon a Party will be deemed cumulative with

and not exclusive of any other remedy conferred hereby, or by Law or equity upon such Party, and the exercise by a Party of any one remedy

will not preclude the exercise of any other remedy.

(b)

The Parties agree that irreparable injury will occur for which monetary damages, even if available, would not be an adequate remedy,

in the event that any of the provisions of this Agreement is not performed in accordance with its specific terms or is otherwise breached

(including by any Party failing to take such actions as are required of it hereunder in order to consummate this Agreement). It is agreed

that prior to the valid termination of this Agreement pursuant to Section 6, each Party shall be entitled to an injunction or injunctions

to prevent or remedy any breaches or threatened breaches of this Agreement by any other Party, to a decree or order of specific performance

specifically enforcing the terms and provisions of this Agreement and to any further equitable relief.

(c)

The Parties’ rights in this Section 7.4 are an integral part of this Agreement, without which none of the Parties

would have entered into this Agreement, and each Party hereby waives any objections to any remedy referred to in this Section 7.4

(on the basis that there is an adequate remedy at Law). For the avoidance of doubt, each Party agrees that there is not an adequate remedy

at Law for a breach of this Agreement by any Party. In the event any Party seeks any remedy referred to in this Section 7.4, such

Party shall not be required to obtain, furnish, post or provide any bond or other security in connection with or as a condition to obtaining

any such remedy and each Party irrevocably waives any right that it may have to require the obtaining, furnishing, posting or providing

of any such bond or other security.

7.5

Notices. All notices, consents and other communications hereunder shall be in writing and shall be given in the manner

described in Section 9.4 of the Merger Agreement, addressed as follows: (i) if to Parent, to the email addresses set forth in Section 9.4

of the Merger Agreement, and (ii) if to a Stockholder, to such Stockholder’s email address set forth on Schedule A hereto, or to

such other email address as such Party may hereafter specify for the purpose by notice to each other Party.

7.6

Governing Law; Jurisdiction.

(a)

This Agreement and any dispute, controversy or claim arising out of, relating to or in connection with this Agreement, the negotiation,

execution, existence, validity, enforceability or performance of this Agreement, or for the breach or alleged breach hereof (whether in

contract, in tort or otherwise) shall be governed by and construed and enforced in accordance with the Laws of the State of Delaware,

without giving effect to any choice of law or conflict of law provision or rule (whether of the State of Delaware or otherwise) that would

cause the application of the Laws of any other jurisdiction.

(b)

Each of the Parties hereby irrevocably and unconditionally submits to the exclusive jurisdiction of the Court of Chancery of the

State of Delaware, or, if (and only if) such court finds it lacks jurisdiction, the State or Federal courts of the United States of America

sitting in Delaware, and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Agreement

or the agreements delivered in connection herewith or the transactions contemplated hereby or thereby or for recognition or enforcement

of any judgment relating thereto, and each of the Parties hereby irrevocably and unconditionally (i) agrees not to commence any such action

or proceeding, except in the Court of Chancery of the State of Delaware, or, if (and only if) such court finds it lacks jurisdiction,

the other State or Federal courts of the United States of America sitting in Delaware, and any appellate court from any thereof, (ii)

agrees that any claim in respect of any such action or proceeding may be heard and determined in the Court of Chancery of the State of

Delaware, or, if (and only if) such court finds it lacks jurisdiction, the other State courts or the Federal courts of the United States

of America sitting in Delaware, and any appellate court from any thereof, (iii) waives, to the fullest extent such Party may legally and

effectively do so, any objection that such Party may now or hereafter have to the laying of venue of any such action or proceeding in

such courts, and (iv) waives, to the fullest extent permitted by Law, the defense of an inconvenient forum to the maintenance of such

action or proceeding in such courts. Each of the Parties agrees that a final, non-appealable judgment or determination of the courts described

in this Section 7.6 shall be conclusive and may be enforced in other jurisdictions and any court of competent jurisdiction by suit

on the judgment or in any other manner provided by applicable Law. Each Party irrevocably consents to service of process in the manner

provided for notices in Section 7.6(b). Nothing in this Agreement will affect the right of any Party to serve process in any other

manner permitted by applicable Law.

7.7

Waiver of Jury Trial. EACH PARTY HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT SUCH PARTY MAY HAVE TO A TRIAL

BY JURY IN RESPECT OF ANY LITIGATION DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT AND ANY OF THE AGREEMENTS DELIVERED

IN CONNECTION HEREWITH OR THE OTHER TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY. EACH PARTY CERTIFIES AND ACKNOWLEDGES THAT (A)

NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY

OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE SUCH

WAIVERS, (B) SUCH PARTY UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF SUCH WAIVERS, (C) SUCH PARTY MAKES SUCH WAIVERS VOLUNTARILY

AND (D) SUCH PARTY HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS

SECTION 7.7.

7.8

Entire Agreement; Third Party Beneficiaries.

(a)

This Agreement, together with the Merger Agreement (together with the Exhibits, Company Disclosure Letter, Parent Disclosure Letter

and the other documents delivered pursuant thereto) and the Confidentiality Agreement constitute the entire agreement among the Parties

with respect to the subject matter hereof and thereof and supersede all other prior agreements and understandings, both written and oral,

among the Parties or any of them with respect to the subject matter hereof and thereof.

(b)

Nothing in this Agreement, express or implied, is intended to confer upon any Person (other than the Parties) any rights or remedies

hereunder and the Parties agree that their respective representations, warranties and covenants set forth in this Agreement are solely

for the benefit of the other Parties in accordance with and subject to the terms of this Agreement.

7.9

Counterparts. This Agreement may be executed in multiple counterparts (including by an electronic signature, electronic

scan or electronic transmission in portable document format (.pdf), including (but not limited to) DocuSign, .tif, .gif, .jpg or similar

delivered by electronic mail, such delivery an “Electronic Delivery”), each of which will be deemed an original (and

will have the same binding legal effect as if it were the original signed version) but all of which together will be considered

one and the same agreement and will become effective when counterparts have been signed by each of the Parties and delivered to the other

Parties, it being understood that all Parties need not sign the same counterpart. No Party may raise the use of an Electronic Delivery

to deliver a signature, or the fact that any signature or agreement or instrument was transmitted or communicated through the use of an

Electronic Delivery, as a defense to the formation of a contract, and each Party forever waives any such defense, except to the extent

such defense relates to lack of authenticity.

7.10

Mutual Drafting; Interpretation.

(a)

Each Party has participated in the drafting of this Agreement, which each Party acknowledges is the result of extensive negotiations

between the Parties. If an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly

by the Parties, and no presumption or burden of proof shall arise favoring or disfavoring any Party by virtue of the authorship of any

provision. Headings of the articles and sections of this Agreement are for convenience of the Parties only and shall be given no substantive

or interpretative effect whatsoever. Except as otherwise indicated, all references in this Agreement to “Sections,” are intended

to refer to Sections of this Agreement. The schedule attached to this Agreement constitutes a part of this Agreement and is incorporated

in this Agreement for all purposes. No summary of this Agreement or any exhibit or schedule delivered herewith prepared

by or on behalf of any Party will affect the

meaning or interpretation of this Agreement or such exhibit or schedule, as applicable.

(b)

For purposes of this Agreement, whenever the context requires: the singular number shall include the plural, and vice versa; the

masculine gender shall include the feminine and neuter genders; the feminine gender shall include the masculine and neuter genders; and

the neuter gender shall include masculine and feminine genders. The words “include,” “includes” or “including”

mean “including without limitation,” and the words “hereof,” “hereby,” “herein,” “hereunder”

and similar terms refer to this Agreement as a whole and not any particular section in which such words appear. The words “shall”

and “will” have the same meaning. The phrase “to the extent” shall mean the degree to which a subject or other

thing extends, and such phrase shall not mean simply “if.” All references in this Agreement to “$” are intended

to refer to U.S. dollars. Unless otherwise specifically provided for herein, the term “or” shall not be deemed to be exclusive,

and shall be interpreted as “and/or”. Similarly, unless the context requires otherwise, the words “neither,” “nor,”

“any,” and “either” are not exclusive. The term “affiliates” shall have the meaning set forth in Rule

12b-2 of the Exchange Act. The phrases “the date of this Agreement,” “the date hereof,” “of even date herewith”

and terms of similar import, shall be deemed to refer to the date set forth in the preamble to this Agreement. If a term is defined as

one part of speech (such as a noun), it has a corresponding meaning when used in other grammatical forms or as another part of speech

(such as a verb). References to “writing” mean the representation or reproduction of words, symbols or other information in

a visible form by any method or combination of methods, whether in electronic form or otherwise, and including writings delivered by .pdf,

..tif, .gif, .jpg or similar attachment to email. “Written” will be construed in the same manner.

7.11

Capacity as Stockholder. No Person executing this Agreement who is or becomes an officer or director of the Company makes

any agreement or understanding herein in his or her capacity as such officer or director. Each Stockholder signs solely in his, her or

its capacity as the record or beneficial owner of such Stockholder’s Covered Shares. Nothing herein shall limit or affect any omissions

or actions taken by a Stockholder or any officer, director, employee, affiliate or Representative of a Stockholder in his or her capacity

as an officer, or director of the Company (including, for the avoidance of doubt, exercising his or her fiduciary duties). Notwithstanding

anything contained herein to the contrary, neither the Company, nor any of the Company Subsidiaries, shall constitute an affiliate or

“Controlled Affiliate” of any Stockholder for the purposes of this Agreement.

7.12

Expenses. All costs and expenses incurred in connection with this Agreement shall be paid by the Party incurring such cost

or expense. For avoidance of doubt, nothing in this Section 7.12 shall be interpreted as in any way limiting Parent’s right

to the Termination Fee in circumstances in which Parent is entitled to receive the Termination Fee pursuant to the Merger Agreement; provided,

however, Parent understands and acknowledges that the Company has agreed to pay all of the expenses of the Stockholders and their respective

affiliates, including attorneys’ fees, incurred by the Stockholders and their respective affiliates in the negotiation, preparation

and entry into this Agreement.

7.13

Further Assurances. Each Stockholder will execute and deliver, or cause to be executed and delivered, all further documents

and instruments and use such Stockholder’s

reasonable best efforts to take, or cause to

be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable under applicable Law, to perform such

Stockholder’s obligations under this Agreement.

7.14

Stockholder Obligations Several and Not Joint. Except if a Stockholder is an affiliate of another Stockholder, the obligations

of each Stockholder under this Agreement shall be several and not joint, and no Stockholder shall be liable for any breach of the terms

of this Agreement by any other Stockholder.

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties

have executed this Agreement as of the date first above written.

| SH RESIDENTIAL HOLDINGS, LLC |

|

| |

|

|

| By: |

/s/ Toru Tsuji |

|

| Name: |

Toru Tsuji |

|

| Title: |

CEO |

|

[Signature Page to Voting and Support Agreement]

IN WITNESS WHEREOF, the Parties have executed

this Agreement as of the date first above written.

| STOCKHOLDERS: |

|

| |

|

| /s/ Larry Mizel |

|

| Larry Mizel |

|

| |

|

|

| |

|

|

Ari capital partners, LLLP

|

|

| |

|

|

| By: |

CVentures, Inc., Its General Partner |

|

| |

|

|

| By: |

/s/ Carol Mizel |

|

| Name: |

Carol Mizel |

|

| Title: |

Senior Vice President |

|

| |

|

|

| |

|

|

Cascia Holdings, LLC |

|

| |

|

|

| By: |

/s/ Carol Mizel |

|

| Name: |

Carol Mizel |

|

| Title: |

Manager |

|

| |

|

|

| |

|

|

CGM Capital LLLP |

|

| |

|

|

| By: |

CVentures, Inc., Its General Partner |

|

| |

|

|

| By: |

/s/ Carol Mizel |

|

| Name: |

Carol Mizel |

|

| Title: |

Senior Vice President |

|

| |

|

|

|

|

|

Boca sawyer 22, LLC

|

|

| |

|

|

| By: |

/s/ Carol Mizel |

|

| Name: |

Carol Mizel |

|

| Title: |

Manager |

|

[Signature Page to Voting and Support Agreement]

M&G Growth, LLC

|

|

| |

|

|

| By: |

/s/ Carol Mizel |

|

| Name: |

Carol Mizel |

|

| Title: |

Manager |

|

| |

|

|

| |

|

|

| |

|

|

| /s/ David A. Mandarich |

|

| David A. Mandarich |

|

[Signature Page to Voting

and Support Agreement]

Schedule A

| Stockholder & Address |

|

Shares of

Company Common Stock |

|

Larry A. Mizel1

C/o CVentures, Inc.

4350 S Monaco St 5th Floor

Denver CO 80237

Attn: [*]

[*] |

|

115,712 |

| |

|

|

|

Ari Capital Partners,

LLLP2

C/o CVentures, Inc.

4350 S Monaco St 5th Floor

Denver CO 80237

Attn: [*]

[*] |

|

3,261,345 |

| |

|

|

|

Cascia Holdings, LLC3

C/o CVentures, Inc.

4350 S Monaco St 5th Floor

Denver CO 80237

Attn: [*]

[*] |

|

2,645,395 |

| |

|

|

|

CGM Capital LLLP4

C/o CVentures, Inc.

4350 S Monaco St 5th Floor

Denver CO 80237

Attn: [*]

[*] |

|

1,801,793 |

| 1 | | The shares held by Larry Mizel are all Company RSAs that remain subject to a substantial

risk of forfeiture. Larry Mizel also owns Company Options to purchase 1,665,280 shares of Company Common Stock, with 998,680 of those

Company Options being exercisable within 60 days. In addition, Larry Mizel was awarded 200,000 Company PSUs on July 14, 2021 (the “2021

Award Date”), with a performance period of January 1, 2021, through December 31, 2023, and 200,000 Company PSUs on August 23,

2023 (the “2023 Award Date”), with a performance period of January 1, 2023, through December 31, 2025. The Company PSUs subject

to the 2021 Award Date vested on January 1, 2023, and the Company PSUs subject to the 2023 Award Date vested on August 23, 2023. The

number of shares to be earned, issued and delivered with respect to the vested Company PSUs will be determined when the Compensation

Committee has certified that Larry Mizel has been in continuous employment with the Company from the applicable award date to the applicable

vesting date, the Company has filed its financial statements with the SEC for the applicable performance period, and the performance

goal has been satisfied. The number of shares of Company Common Stock that may be earned is subject to whether the holder meets Threshold,

Target or Maximum performance (50% of Company PSUs for Threshold, 100% of Company PSUs for Target and 200% of Company PSUs for Maximum).

The number of Company PSUs provided herein are based on Target performance. The performance goals are detailed in the applicable Grant

Agreement. |

| 2 | | Larry Mizel may be deemed to have beneficial ownership of the shares held by Ari Capital

Partners, LLLP. |

| 3 | | Larry Mizel may be deemed to have beneficial ownership of the shares held by Cascia Holdings,

LLC. Cascia Holdings, LLC has voting control over all of these shares, which control is exercised by the manager of Cascia Holdings,

LLC, but certain trusts have a 99% non-voting interest in Cascia Holdings, LLC in the aggregate. The manager of Cascia Holdings, LLC

is Larry Mizel’s spouse, Carol Mizel. |

| 4 | | Larry Mizel may be deemed to have beneficial ownership of the shares held by CGM Capital

LLLP. |

| Stockholder & Address |

|

Shares of

Company Common Stock |

|

Boca Sawyer 22, LLC5

C/o CVentures, Inc.

4350 S Monaco St 5th Floor

Denver CO 80237

Attn: [*]

[*] |

|

842,956 |

| |

|

|

|

M&G Growth, LLC6

C/o CVentures, Inc.

4350 S Monaco St 5th Floor

Denver CO 80237

Attn: [*]

[*] |

|

324,000 |

| |

|

|

|

David D. Mandarich7

C/o M.D.C. Holdings, Inc.

4350 S Monaco St 5th Floor

Denver CO 80237

[*] |

|

5,097,022 |

| 5 | | Larry Mizel may be deemed to have beneficial ownership of the shares held by Boca Sawyer

22, LLC. |

| 6 | | Larry Mizel may be deemed to have beneficial ownership of the shares held by M&G Growth,

LLC. M&G Growth, LLC has voting control over all of these shares, which control is exercised by the manager of M&G Growth, LLC,

but certain trusts have a non-voting 99.9% interest in M&G Growth, LLC. The manager of M&G Growth, LLC is Larry Mizel’s

spouse, Carol Mizel. |

| 7 | | The shares held by David Mandarich include 115,712 Company RSAs that remain subject to a

substantial risk of forfeiture. David Mandarich also owns Company Options to purchase 1,465,280 shares of Company Common Stock, with

932,000 of those Company Options being exercisable within 60 days. In addition, David Mandarich was awarded 200,000 Company PSUs on the

2021 Award Date with a performance period of January 1, 2021, through December 31, 2023, and 200,000 Company PSUs on the 2023 Award Date

with a performance period of January 1, 2023, through December 31, 2025. The Company PSUs subject to the 2021 Award Date vested on December

31, 2023, and the Company PSUs subject to the 2023 Award Date will vest, if at all, on January 1, 2025. The number of shares to be earned,

issued and delivered with respect to the vested Company PSUs will be determined when the Compensation Committee has certified that David

Mandarich has been in continuous employment with the Company from the applicable award date to the applicable Vesting Date, the Company

has filed its financial statements with the SEC for the applicable performance period, and the performance goal has been satisfied. The

number of shares of Company Common Stock that may be earned is subject to whether the holder meets Threshold, Target or Maximum performance

(50% of Company PSUs for Threshold, 100% of Company PSUs for Target and 200% of Company PSUs for Maximum). The number of Company PSUs

provided herein are based on Target performance. The performance goals are detailed in the applicable Grant Agreement. |

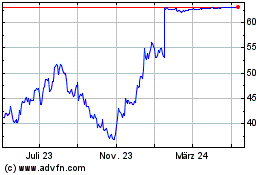

M D C (NYSE:MDC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

M D C (NYSE:MDC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024